a16z: Arcade Token, the most undervalued token type.

- 核心观点:街机代币是稳定可控的区块链经济原语。

- 关键要素:

- 价格稳定机制抑制投机。

- 支持动态定价与用户激励。

- 链上互操作性创造网络效应。

- 市场影响:推动数字经济创新与用户增长。

- 时效性标注:中期影响

Original author: a16z

Original translation by Blockunicorn

We recently compiled a new, comprehensive classification system for token types, including network tokens, collectible tokens, and meme tokens. Of the seven types we identified, arcade tokens are the least known and most undervalued: tokens with relatively stable value within a specific software or product ecosystem, typically managed by the issuer (such as a company).

Essentially, arcade tokens are blockchain-based assets, similar to familiar assets such as frequent flyer miles, credit card points, and in-game digital coins. What they have in common is that they are currencies that circulate and underpin the market economy: for example, frequent flyer miles and reward points can enhance brand loyalty and can be used to purchase airline tickets and upgrades; digital coins allow you to buy and sell items in video games.

While businesses have been using such assets for decades, almost all previous use cases have been confined to centralized databases, limiting ownership, transferability, and user choice. Arcade tokens, on the other hand, are based on public blockchains. Their openness, interoperability, and composability give them a host of new market design advantages.

This article aims to answer the most common questions we receive about arcade tokens: what they are, what their purpose is, why they are valuable, how developers use them, the design trade-offs involved, and the opportunities they present.

What are arcade tokens?

From a technical perspective, arcade tokens are essentially digital currencies used within their associated application ecosystem—their supply and demand are flexibly managed to maintain price stability. You can think of them primarily as currencies within the digital economy.

So, where does the term "arcade token" come from? Whether you've been to an arcade or not, you're probably familiar with the concept: you walk in, exchange cash for tokens (usually physical tokens), and then use those tokens to play a few rounds of Galaga, GatorPanic, or other games you like. These tokens allow you to participate in the arcade's economy.

The arcade analogy clearly illustrates how these tokens work: arcade tokens possess relatively stable value within their respective economic systems—whether within a single service or across multiple services. This relative stability of arcade token value distinguishes them from other types of tokens, such as those whose value derives from underlying assets (e.g., asset-backed or collectible tokens), decentralized network market operations (e.g., network tokens), or speculative investments in specific entities (e.g., company-backed or security tokens).

Despite their comical name, arcade tokens are powerful programmable economic primitives—key to opening up new frontiers in the design space of cryptocurrencies.

What isn't an arcade token?

To reiterate, the most fundamental difference between arcade tokens and other types of tokens is that arcade tokens are not intended for investment or speculation. Unlike the typical expectation of investment returns through purchasing network tokens or security tokens, arcade tokens are for consumption.

Arcade tokens are sometimes referred to as "utility tokens" because they are designed to provide practical functionality. We avoid using this label because it implies that other types of tokens lack utility, which is not the case. (For more information, please see our "Token Definition" article.) Other names for arcade tokens include "points" (although in everyday language, this usually means that the relevant records are kept on a private ledger rather than a public blockchain) and "loyalty tokens" (this refers to only one specific application).

This does not mean that the value of arcade tokens will never change—as we explain below, the price of purchasing arcade tokens may fluctuate slightly over time. However, arcade tokens are typically supplied indefinitely at their current price, and they do not offer, promise, or imply financial returns. This means they are generally not suitable as investment products and are therefore usually not governed by U.S. securities laws.

This does not mean that the value of arcade tokens will never change—as we will elaborate below, the purchase price of arcade tokens may fluctuate slightly over time. However, arcade tokens are typically supplied indefinitely at their current price, and they do not offer, promise, or imply any financial returns. This means they are generally not suitable as investment products and are therefore usually not governed by U.S. securities laws.

What are the uses of arcade tokens? Why should developers consider using them?

Arcade tokens enable developers to print and distribute value in the digital economy. Crucially, this ability to create and distribute value can incentivize user behavior, foster early growth, and generate network effects—without relying on external capital or speculative demand.

The logic is simple and applies perfectly to the arcade example: if you run an arcade, you'd want to control the supply of tokens, ensuring it matches customer demand. For instance, if the number of customers doubles one day, issuing roughly twice the number of tokens might be more helpful, allowing all customers to play the games they want (assuming no capacity limitations, of course). Since enough tokens can be issued, why turn away customers?

You may also need to be able to adjust prices: if you make significant improvements to the arcade itself—such as doubling the number of games, introducing more advanced and feature-rich machines, or offering more generous prizes—you might be able to increase the price per token. In short, you need the flexibility to control your economic system to better balance supply and demand (and, more importantly, to demonstrate the value of your arcade to customers).

Beyond optimizing daily operations, this economic control also helps build long-term relationships with your most loyal customers. For example, you can award reward tokens to your most active players. More importantly, having some tokens left in people's pockets at the end of the day incentivizes them to return to your arcade, where they can use those tokens.

More formally, arcade token support:

- Dynamic pricing and promotions: Arcade token issuers can adjust the token price, the purchase price denominated in tokens, or both. This allows them to offer discounts on goods or services during periods of low demand or reward spending during peak periods.

- Network effects: Similar to airline miles and credit card points, users who acquire or hold tokens are more likely to remain loyal to a brand. The value of this established user base motivates merchants, developers, and other service providers to collaborate more, thereby increasing user value—this is a typical platform network effect.

- Incentives and loyalty rewards: Arcade token issuers can offer rewards and other benefits to customers who complete specified actions. They can also use their issuance rights to reward network participants when they accept or redeem tokens. All of this reinforces the network effects described earlier.

- Economic control: Arcade token issuers can burn tokens upon redemption, track liabilities on-chain, and implement monetary policy similar to that of a central bank—while keeping supply and pricing within a predictable range.

How do arcade tokens work?

Economic Dynamics Analysis

Arcade tokens differ from other types of tokens in their economic dynamics. Instead of granting holders ownership of the underlying ecosystem, arcade tokens grant them access to or use of specific applications or services; crucially, their market value is designed to be programmatically capped. This doesn't mean arcade tokens must be pegged to fiat currencies like stablecoins; it simply means issuers can use mechanisms to set a price floor, and often more importantly, a price ceiling.

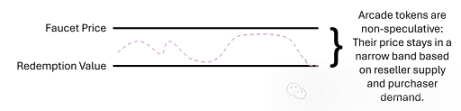

Arcade tokens are typically purchased freely at a pre-set price. Think of the token vending machines in the arcades along the waterfront: you walk up, insert a dollar, and the machine gives you four tokens, each worth 25 cents. These vending machines, often called "faucets" or "valves," effectively set a price cap that the market value should never exceed. Therefore, arcade tokens have no investment value: they are for consumption, not speculation.

The value of a token can be assessed based on its redeemable value through any "consumption mechanism" (i.e., the mechanism by which the token is withdrawn from circulation). In arcade games, the "consumption mechanism" refers to the game's "coin slot"—the one where you need to insert a coin to play. If playing a game requires one token, then its value should be 25 cents. Alternatively, the arcade can set a buyback price slightly lower than the token's initial price; this way, the issuer can guarantee to always buy back these 25-cent tokens at a price of 20 cents each. This sets a price floor, and the token price should not fall below this floor.

Consider the impact of these parameters on the market: If you knew you could always buy the same token from a tap (or vending machine) for a quarter of the price, would you still spend a dollar to buy a token worth 25 cents from a speculator? Absolutely not—it simply doesn't make sense! (Or rather, it's simply not worth it.) Someone moving to another city might stand outside an arcade trying to sell their remaining 25-cent tokens for 22 cents each, but no one would buy them for more than 25 cents. Therefore, while some people might choose to sell their arcade tokens at a discount (e.g., if they were leaving the ecosystem altogether), the price of the token should remain relatively stable at any given point in time.

All these non-speculative factors make arcade tokens particularly suitable as the basis for a controlled market economy. It's important to note that this doesn't depend on whether the use of arcade tokens is narrow (limited to a single application or service) or broader—they are simply a result of the "faucet/exchange" design of arcade tokens. (Continuing with the arcade example: even if the local grocery store owner is a video game enthusiast and chooses to accept tokens for local arcade games instead of cash, there's no reason to pay more than 25 cents per token if you can simply walk into the arcade and buy them for 25 cents.)

Why not just accept stablecoins as a payment method?

Arcade tokens conceptually overlap with stablecoins—both aim to facilitate economic transactions while maintaining a relatively stable value. However, arcade tokens offer developers greater flexibility. Issuers can print arcade tokens on demand (although they still need to track the "shadow" value of these tokens on their balance sheets—the value at the time of redemption). Issuers can then use these tokens to fund and subsidize users, developers, and other network participants. Furthermore, these tokens incentivize participants to remain within a specific economic system rather than diverting funds elsewhere. (There's a reason airlines issue "mileage" instead of direct cash rewards to frequent flyers; these miles must be used to purchase future flights.)

Arcade tokens also offer developers more monetization options. Issuers can sell tokens directly to users (at a fixed or dynamic price), package them into subscription packages, or distribute them through promotional campaigns. When a partner network agrees to accept a particular arcade token, they can establish cross-promotion and affiliate marketing models—strategies that can expand the reach of each partner without external funding.

Crucially, arcade tokens also allow issuers to exercise fine-grained control over the flow of value within the economic system:

- Restrict portability (e.g., only within the application or between whitelisted addresses).

- Set depreciation or expiration dates (to encourage timely use and reduce hoarding), and

- Linking redemption to specific goods or services (aligning utility with economic intent).

These characteristics help strengthen the value of the token as a medium of exchange rather than a speculative asset, and can be encoded through on-chain programming. In short: Arcade tokens can help drive growth, encourage user participation and management of the internal economy, while giving its maintainers a degree of control.

The power of interoperability

As we have already described, arcade tokens issued on public blockchains are similar to loyalty points or airline miles—but they have one key difference: they are on-chain, which means they can be open, interoperable, and composable.

Unlike traditional loyalty systems that confine value within a closed ecosystem, blockchain-based arcade tokens can be shared, accepted, and exchanged among multiple participants without permission—theoretically even among competitors. Portability is a major advantage: in this model, users can transfer loyalty to different services, and status can be easily transferred (e.g., unlike the cumbersome "tier matching" process used by airlines today). This portability encourages market participants to compete on product and service quality rather than simply pursuing user lock-in, and can transform decentralized loyalty programs into public goods.

To date, the $FLY token issued by Blackbird, founded by Resy and Eater, is arguably one of the best examples of an on-chain arcade token. This token creates a loyalty program for restaurants similar to Starbucks Rewards or McDonald's membership programs. This may sound familiar, but it's unique: the same token can be used at multiple different restaurants. Customers earn tokens by making purchases at restaurants within the Blackbird network, which can then be redeemed for discounts and other offers at any participating restaurant. Because the underlying protocol is based on blockchain, all of this can be done without direct interaction between restaurants. Just as a single restaurant's rewards program can enhance customer loyalty, $FLY can simultaneously boost loyalty across the entire restaurant network.

Consumers benefit from broader usability; businesses benefit from the network effects of sharing.

The result is cooperative competition (rather than traditional competition): for example, both your local coffee shop and Starbucks could benefit from accepting the same token. While it might seem like neither coffee shop wanted this at first glance, a shared membership program enabled by arcade tokens can actually benefit both. Arcade tokens allow the experiences at Starbucks and the local coffee shop to complement each other, so patronizing either one provides added value for both. For example, if one shop offers a free mocha with arcade tokens, the value a customer receives when buying coffee at either shop increases. Such offers can enhance customer loyalty to the coffee chain network and encourage customers to allocate a larger proportion of their budget to coffee.

This cooperative competition generates a larger overall surplus for the network, which can be distributed proportionally to each supplier's sales. In other words, instead of competing for a share of the pie, it's better to make the pie bigger.

Design trade-offs (and opportunities)

Arcade tokens are not suitable for all projects. They are unsuitable in situations that require speculative assets. For example, a single-layer blockchain network with its own network token typically can function without arcade tokens.

However, for many projects—especially those with a consumer-centric economic model or those integrated with the physical world—arcade tokens can be a highly attractive option. They offer the following advantages:

- Price stability is achieved through price ceiling and floor mechanisms and by controlling the amount issued.

- Ease of use: Intuitive and consistent value helps users understand their consumption patterns.

- Accounting clarity: Their cost on the balance sheet is the opportunity cost they can exchange for—no more, no less.

- Control: Issuers can manage them in a manner similar to that of a central bank.

We've also seen arcade tokens gradually become a complement or precursor to network tokens. Blackbird's $FLY token allows users to redeem it at any partner restaurant, with this redemption managed by a specially constructed blockchain layer powered by network tokens. For example, a decentralized computing network can use network tokens to secure and incentivize computing providers while simultaneously using arcade tokens to build network effects among its user base. Alternatively, a marketplace platform can use arcade tokens to drive user engagement and then gradually introduce network tokens as its operating protocol becomes decentralized. In these cases, arcade tokens can serve as an introductory pathway, catalyzing early demand and helping the network achieve initial user growth before it transitions to a more decentralized system in the long term.

Regulatory Outlook

An early example of arcade tokens is Quarters, from the blockchain-based gaming platform PocketfulofQuarters. Players can use Quarters tokens to acquire features and rewards in participating games. Regarding the view that arcade tokens are not investment assets, PocketfulofQuarters received a no-objection letter from the U.S. Securities and Exchange Commission (SEC) in July 2019. The SEC stated in the letter that they recognize people using Quarters solely for gaming and not for speculation or investment.

Despite this positive precedent, Quarters' no-objection letter and the regulatory mechanisms in many states remain flawed. For example, they are skeptical of interoperability, viewing it as a loophole rather than a feature. Their reasoning stems from the flawed view that interoperability, once established, automatically makes assets easier to trade, thus giving them the characteristics of financial instruments. This view ignores the fact that trading demand still depends on whether an asset has speculative upside potential—something we explained earlier that arcade tokens typically lack. Meanwhile, interoperability is one of the most exciting advantages of on-chain arcade tokens, offering numerous benefits to consumers, including reduced transaction friction and increased choice.

Clever design can alleviate regulatory concerns. Arcade tokens don't need to be confined to closed networks. Features such as price caps, faucet-sink models, and redemption mechanisms linked to usage allow issuers to programmatically curb speculative activity. Consumers also benefit from interoperability, as it enhances user experience, fosters competition, and creates broader network effects—ultimately driving innovation and delivering greater value to users without relying on financial speculation.

While arcade tokens are not suitable for all scenarios, they are a crucial component in the evolution of crypto networks. Just as stablecoins have ushered in new business models and network tokens have enabled decentralized value sharing and governance, arcade tokens can also drive the development of the digital economy on a large scale.

As regulatory policies become clearer, we expect more developers and users to recognize the advantages of arcade tokens, as more projects (including those not native to cryptocurrencies) will explore their uses.