Solomon's public offering results were manipulated; Polymarket predicts a trust crisis in the crypto market.

- 核心观点:Solomon公募涉嫌内幕操纵预测市场。

- 关键要素:

- 公募最后一小时募资突增至1亿美元。

- 交易员KimballDavies精准下注获利56万美元。

- 预测市场概率从1.6%瞬间跃升至99%。

- 市场影响:暴露预测市场内幕操纵风险。

- 时效性标注:短期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Golem ( @web3_golem )

Despite the recent spate of defaults in stablecoins, market enthusiasm for stablecoin protocols remains undiminished. On November 19th, Solomon Labs, a stablecoin protocol on Solana, announced the conclusion of its five-day public offering, raising over $102 million from 6,604 investors through MetaDao, making it the second-highest-funded project on MetaDao to date, second only to UmbraPrivacy.

In a sluggish market, it's usually cause for celebration that a project can secure substantial funding in the public market. However, Solomon Labs' success has left some players on Polymarket feeling rather disappointed.

This is all because there is a prediction on Polymarket called "Total commitments for the Solomon public sale on MetaDAO", where players can bet on the probability of "Solomon ultimately raising no more than how much money".

On the afternoon of November 18th, with less than 12 hours left before the fundraising ended, Solomon had only raised $7.25 million . As a result, some players were convinced that it would not be able to raise more than $40 million in the remaining time, so they bought "no" on Polymarket. Some even more conservative players bought "no" for "Solomon raising more than $100 million". The probability of this outcome remained at around 97% until 3 hours before the fundraising ended.

However, in the last hour or two before the fundraising ended, a large amount of funds suddenly poured into the Solomon public offering, raising the total amount raised to $100 million. The probability of "Solomon raising more than $100 million" on Polymarket also instantly jumped from 1.6% to 99%. The speed and timing were so precise that many Polymarket players did not have time to react and sell, ultimately losing 100% of their principal in their attempt to gain a 1% "investment return".

The probability of Solomon raising over $100 million surged at the last minute.

In the aftermath, Solomon officially stated that there were no insiders or behind-the-scenes transactions involved in the public offering. However, this explanation seemed somewhat weak, as the community discovered a Polymarket trader who had pre-bet "yes" on the low-probability outcome of Solomon's fundraising, and profited over $560,000 from it.

Insider trading by the project team or manipulation by large investors?

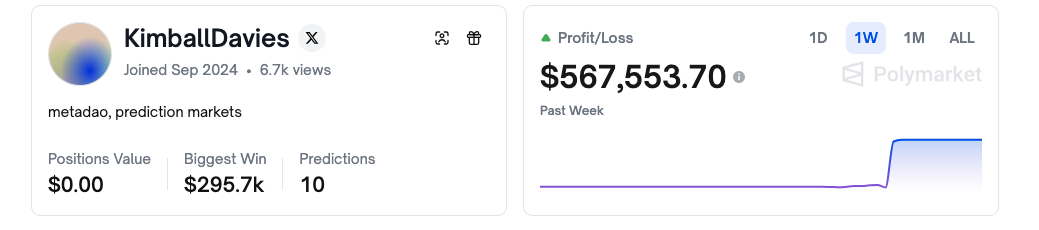

The trader, named KimballDavies, joined Polymarket in September 2024. His slogan is "metadao, prediction markets," which likely indicates that he specializes in predicting events related to metadao.

However, since joining, this trader has only placed bets on two events: one is buying $10 on September 25, 2024, on the prediction that "the Federal Reserve will cut interest rates by 50 basis points after November 2024"; the other is investing a total of $65,703.58 in the Solomon mutual fund event.

Insider trading by the project developer?

Starting November 17, Kimball Davies began buying "yes" in batches when "Solomon raised more than $40 million," and in the following two days, he also bought "yes" when it raised more than $60 million, $80 million, and $100 million.

This shows that the trader began planning the operation on November 19th as early as November 17th, and ultimately earned $567,554, nearly ten times the initial investment... Therefore, we reasonably suspect that KimballDavies had insider information.

What's even more intriguing is the ownership of this account. The prevailing speculation in the community is that the account belongs to the project team, who allegedly injected tens of millions of dollars at the last minute, all to earn the $500,000+ from Polymarket?

While such a possibility exists, it seems logically untenable upon closer examination. First, is $500,000 a mere pittance for a project launching a public offering of tokens? To pour tens of millions into a project with only $500,000 seems petty. Second, if this happens, anyone would first suspect the project team. To ruin the project's reputation for $500,000, thereby affecting community trust and potentially even negatively impacting future exchange listings, is simply not worth it.

Of course, there's also the possibility of internal team members placing bets privately. The project team might have a Plan B in place, where, given the limited public offering funds, they could inject a large amount of their own money to both further control the token supply and conduct a marketing campaign. Thus, the "intern" who knew about this plan secretly placed bets on all the low-probability events on Polymarket.

Large-scale manipulation is more likely

If we rule out the possibility of insider trading by the project team, then the large amount of funds injected into the Solomon public offering at the last minute could only be the work of large investors, or at least the work of their "underlings" who knew the information in advance.

These large investors may have already been involved in the Solomon public offering, but they noticed the predictions about the Solomon public offering funds on Polymarket. So, driven by the desire to make money or just for "fun," they decided to teach Polymarket players a lesson, letting small investors know that money can manipulate and predict market outcomes.

This isn't the first time large investors have manipulated the outcome of events on Polymarket. In July 2025, during a prediction contest about whether Ukrainian President Zelensky would wear a suit before July, even though mainstream media had reported that Zelensky wore a suit at a certain event, some UMA whales voted "no" in the final result vote, ultimately resulting in the winner being the trader who bet on him not wearing a suit. (Related reading: Polymarket embroiled in another truth controversy: What Zelensky wears will determine the ownership of $140 million )

Polymarket does not predict the truth about cryptography.

While there have been past cases of large-scale manipulation in prediction markets, the Solomon public offering prediction is the first event in the crypto market with significant allegations of insider trading. This event signals that as the number of crypto players and the amount of funds on Polymarket grow, it is becoming the perfect breeding ground for exploitation due to information asymmetry in the crypto market.

For example, betting on when a project will reach its final outcome (TGE) or what its FDV will be at TGE inherently presents an asymmetric advantage, because the project team and VCs already know the outcome and can easily manipulate it. The more funds in the prediction pool, the stronger their incentive to act maliciously.

In these events, Polymarket doesn't predict the truth; it only reflects human greed. For ordinary users like us, this event once again demonstrates the risks of end-of-day strategies. What seems like a foolproof investment scheme with a 99% success rate might be a carefully crafted trap waiting for you to walk right into it. (Related reading: 95% win rate, still losing money: I've stepped into the end-of-day "investment" trap for you )

In traditional financial markets, insider trading is subject to strict legal penalties upon discovery; in the crypto market, money laundering, insider trading, and market manipulation are gradually receiving regulatory intervention; however, in the rapidly growing prediction market sector, there are still few laws and regulations to regulate these wrongdoings. Even if someone were to come forward today claiming to have manipulated the Solomon public offering results, what can we do besides despising their shady dealings?

However, it is believed that in the future, countries will regulate the behavior of prediction markets more, and at that time, Polymarket may be able to predict the truth outside of public events.