A brutal lesson in market prediction: A star trader missed a single line of text, and his $500,000 profit vanished.

Last week, the most talked-about topic globally was the "end of the US government shutdown." After all, global capital markets were watching the US move closely, as the timing of reopening would indicate potential policy changes.

On Polymarket, the largest prediction market, the trading volume for topics related to "when the government will reopen" exceeds $100 million, demonstrating the market's high level of attention. Interestingly, however, many people who predicted the outcome correctly still lost money.

Let's rewind to November 12th. On that day, a series of positive news emerged: first, a White House press conference conveyed optimistic signals, indicating that "the government shutdown is very likely to end on Wednesday evening (November 12th)." Then, on the evening of the 12th, President Trump officially signed the bill ending the shutdown, broadcast live on television.

This kind of definitive event, like other political events, immediately triggered a strong market reaction: the price of Yes shares on Polymarket, which were "closing on November 12th," soared, reaching a high of $0.97. In the logic of prediction markets, this means that the market consensus believes there is a 97% certainty that this event will occur. Because the highest possible price is $1, or 100% probability, buying at $0.97 only yields a final 3% profit, but this 3% is a risk-free, guaranteed win because the event has already been confirmed.

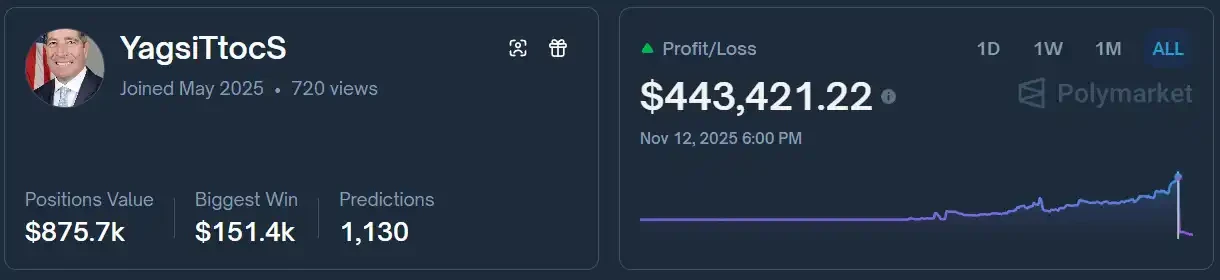

The biggest investor in this buying frenzy was a trader named YagsiTtocS (formerly known as Halfapound). He was a star figure in the Polymarket political sector, and from August to November 12, he accumulated nearly $400,000 in profits by participating in more than 1,000 different markets, with a steadily rising profit curve and almost no losses.

(According to Polymarket's personal page, his historical trading profit curve was excellent as of 6 PM on November 12th, with no significant drawdowns.)

Looking at his previous trading logic, you'll find that, in addition to arbitrage, he is very good at quickly buying large amounts of stock when major, high-certainty news events occur.

According to YagsiTtocS, the confirmation of the government's reopening date on the 12th perfectly aligned with his trading logic. Therefore, he invested over $500,000 at an average price of approximately $0.60, heavily betting on Yes. After Trump signed the bill, the price of Yes rose to $0.97. In his view, the gamble was over, and all that remained was to wait for the system to automatically settle his profits. He even continued to buy at higher prices at this point, believing that this was no longer a risky, subjective transaction, but rather a "zero-risk, short-term, high-interest investment."

Near midnight: An incomprehensible plot twist

However, the story takes a sharp turn for the worse from here.

After 10 p.m. that night, and after Trump signed the bill and all news outlets reported on the end of the shutdown, a strange thing happened in the market: the price of "Yes" fell instead of rising. This meant that some people believed the market would settle for "No" on the 12th!

This has left many people confused: the president has signed it and the news has reported it, so why do some people still think the shutdown on the 12th "won't end"?

The answer lies hidden in the "market rules" that many traders overlook.

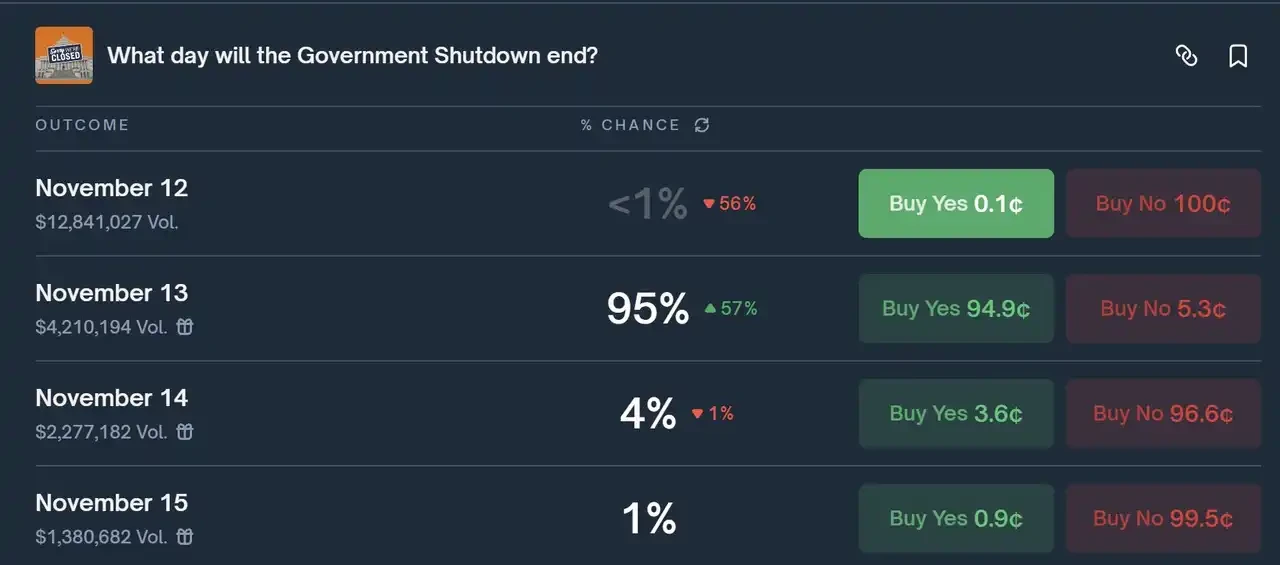

Polymarket's settlements for each market do not rely on what we generally consider "facts," but rather on a single, clearly defined official source of information. For the market on "When will the government shutdown end?", the rules explicitly state that the final decision-maker is not the president's signature, nor any news headline, but rather the "Government Operations Status" published on the website of the Office of Personnel Management (OPM).

The image above is a screenshot from Polymarket. This market operates on the date (Eastern Time) when the OPM website first announced the end of the federal government shutdown. Details are as follows:

The date of the OPM announcement shall prevail, not the actual date of resumption of work (for example: if the announcement of resumption of work on November 11 is made on November 10, then this market determines the date of resumption of work as November 10).

Even partial shutdowns count as shutdowns;

All status determinations are based on the operational status page on the OPM official website (https://www.opm.gov/policy-data-oversight/snow-dismissal-procedures/current-status/).

Simply put: the market will only have a settlement result if the OPM website says "the government has opened up"; if it doesn't say so, even if the president says so, it's invalid under Polymarket's rules.

Due to delays in government processes, the status of the OPM website was not updated immediately after Trump signed the bill.

The constraints of rules and the breakdown of emotions

At this moment, the most agonizing person was YagsiTtocS. With only one hour left until midnight, his $500,000 hung on that thin line of the rule.

When the date jumped from the 12th to the 13th, the OPM website remained normal. However, the price of Yes on Polymarket for the corresponding 12th had already collapsed, plummeting from $0.97 to below $0.05. YagsiTtocS seemed unable to accept this fact: in the early hours of the 13th, he continued to buy Yes shares for the 12th, which were already destined to go to zero, at prices ranging from $0.05 to $0.30. This was no longer a strategy, but a "gambler's" act driven by anger, resentment, and wishful thinking, attempting to fight against the cold rules by constantly "averaging down" his costs, which ultimately amplified his losses.

When the final market settlement was completed, YagsiTtocS's losses in this market exceeded $500,000, making him the biggest loser among traders in this market. This trade not only wiped out all his historical profits but also brought his total paper losses to over $150,000, causing him to fall from the top of the platform's profit rankings to outside the top one million.

The winners who understand the rules

On the other side of this tragedy stood a trader named sargallot. Compared to the star power of YagsiTtocS, he was previously unremarkable, averaging only around $200 per trade. Before November 12th, his total profit was less than $100. However, this seemingly ordinary trader, relying on a completely different trading method from YagsiTtocS, became the biggest winner in this market, reaping profits exceeding $100,000.

The secret to sargallot's success is simple: read the rules carefully.

He realized that this market wasn't betting on "when the shutdown would actually end," but rather "when the OPM website would update its status," and he also anticipated the possibility of administrative delays. So, on the evening of the 12th, when everyone was celebrating the news and driving the price of No. 1 down to $0.07, he calmly bought a large amount. When the OPM website failed to update in the early hours of the 13th, at 00:02, he sold all his shares at $0.99, exchanging a tiny cost for an astonishing return.

One gamble, two outcomes. A star trader loses everything because of a "correct prediction," while an unknown trader makes a fortune because of "understanding the rules." This $500,000 may well be the cruelest and most fundamental lesson this market has to offer.

- 核心观点:预测市场规则比事件本身更重要。

- 关键要素:

- Polymarket结算以OPM官网为准。

- 明星交易员忽视规则亏损50万美元。

- 普通交易员因熟悉规则获利超十万。

- 市场影响:警示投资者需深度理解平台规则。

- 时效性标注:长期影响