Chen Yizhou, who brought Renren.com to its knees, turned around and invested in the first crypto bank in the United States.

- 核心观点:SoFi成为首家加密银行。

- 关键要素:

- 2022年获全国性银行牌照。

- 2025年重启加密货币交易。

- 存款两年增长18倍。

- 市场影响:开创银行与加密融合新模式。

- 时效性标注:长期影响

Original author: Sleepy.txt

In November, US fintech giant SoFi announced that it would fully open cryptocurrency trading to all retail customers. This comes just three years after it obtained a national banking license in the United States. Now, it has become the first truly "crypto bank" in the US and is even preparing to launch a dollar-denominated stablecoin in 2026.

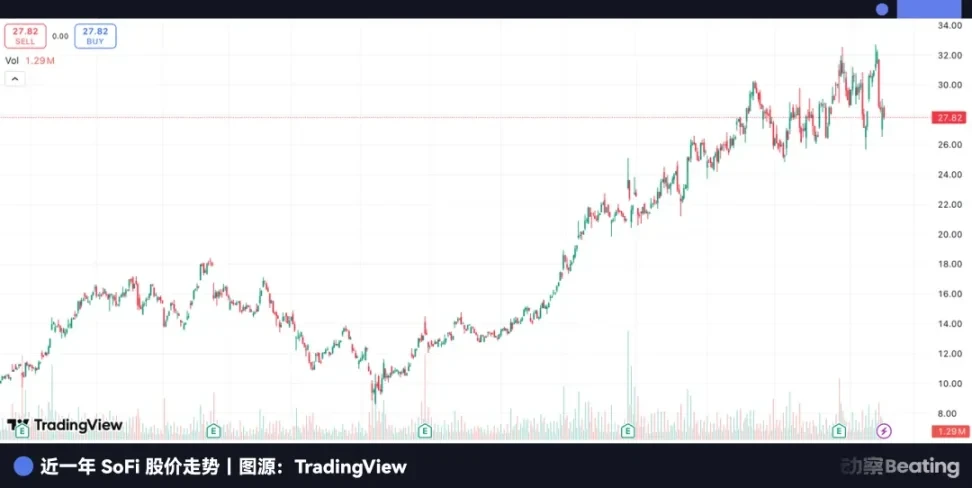

On the day the news was announced, SoFi's stock price soared to a record high, with a market capitalization of $38.9 billion, representing a year-to-date increase of 116%.

Chen Yizhou, CEO of Xiaonei.com (later renamed Renren.com), was one of SoFi's earliest investors. In 2011, he met SoFi's founder through an introduction at Stanford University, and after talking for less than five minutes, he decided to invest $4 million.

Later, in a speech recalling this investment, he said, "I didn't know about P2P lending at the time. I thought it was a great thing."

SoFi has pieced together a story of two seemingly unrelated elements: a traditional financial license and a highly sensitive crypto business. Before it, traditional Wall Street banks dared not touch cryptocurrencies, while crypto giants like Coinbase couldn't obtain banking licenses. SoFi became the unique outlier, straddling the intersection.

But if you rewind the timeline, you'll find that its starting point wasn't cool at all. It wasn't a tech company or a crypto company, but rather, like that generation of P2P platforms in China, it started with the most traditional "matchmaking lending." Only a little over a decade later, they've taken completely different paths.

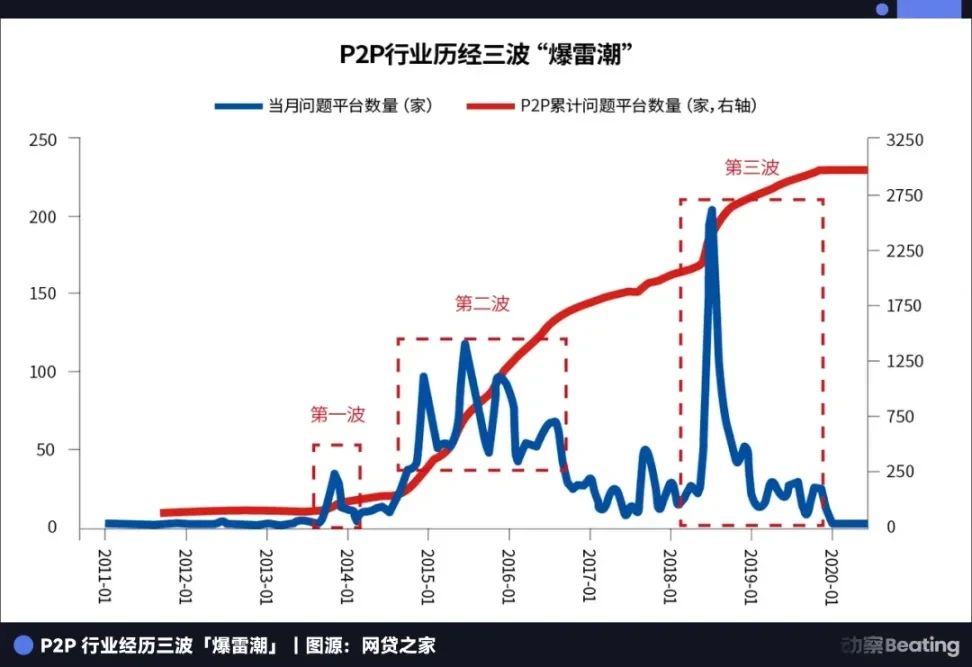

Across the ocean, China's P2P lending industry is now history. From over 5,000 companies at its peak, none survived. The bubble of an era finally burst, leaving behind hundreds of billions of yuan in bad debts and countless broken families.

Both are P2P platforms, so why did one die out while the other was reborn and even evolved into a new species called "crypto bank"?

Two genes in P2P

Because their underlying genes are completely different.

The essence of China's P2P model is a business of "traffic + high-interest loans". It involves offline street canvassing and online customer acquisition, with high interest rates and short cycles. The platform does not look at long-term credit and does not need to manage customer relationships.

SoFi, on the other hand, is a completely different species. In 2011, when P2P platforms were springing up like mushrooms after rain in China, SoFi was also born in a classroom at Stanford Business School. Four MBA students, together with alumni, raised $2 million, and their first business was lending $50,000 each to 40 students for their tuition.

SoFi's initial story was incredibly simple: to solve real lending needs on campuses. Their first customer was their own classmate. This allowed SoFi to bypass the most difficult hurdle—risk control—from the very beginning.

It targets the highest-credit-rated individuals in the US: students from prestigious universities. These individuals have promising future incomes and extremely low default rates. More importantly, SoFi stands for "Social Finance," and its earliest lending relationships came from alumni networks. Borrowing money from fellow students is essentially a form of credit based on acquaintances; alumni status serves as the most natural guarantee.

Unlike Chinese P2P lending platforms that often offer annualized interest rates of over 20%, SoFi has kept its interest rates lower than those of government and private institutions from day one. It doesn't aim for high interest rate spreads; instead, it focuses on attracting the best young people to its system, building a long-term business that can last ten or twenty years. Student loans are just the beginning; what follows are mortgages, investments, and insurance—a complete financial lifecycle.

The essence of Chinese P2P lending is transactions, one-off deals; the essence of SoFi is services, a steady and long-term approach.

It was during that period that a group of investors willing to bet on "atypical finance" began to emerge.

Chen Yizhou, who runs Xiaonei.com, invested in this "Xiaonei Loan" company.

This well-timed move helped him avoid the high interest rates and financial pools that later plagued China's P2P lending industry, and instead he bet on a financial services company with an elite club vibe.

This investment also inspired another Chinese investor. Zhou Yahui, founder of Kunlun Tech, was deeply inspired after seeing Chen Yizhou's investment in SoFi and decided to invest in the Chinese local company Qufenqi. Zhou Yahui later called Chen Yizhou his "mentor." However, Qufenqi took a different path, entering the campus loan market with high interest rates, and ultimately became embroiled in huge controversy and regulatory storms.

Just three years after Chen Yizhou invested in SoFi, in the fourth quarter of 2014, Renren.com launched its own campus loan product, "Renren Fenqi" (Renren Installment). This time, Chen Yizhou was no longer the investor who "didn't understand P2P," but a shrewd operator. Renren Fenqi provided installment loans to students, charging installment repayment fees and interest, while simultaneously launching "Renren Licai" (Renren Wealth Management) as a P2P wealth management platform.

Since then, China's P2P lending industry has been on a roll. Student loans were just the entry point; it quickly expanded to cash loans, consumer loans, and asset-backed investment products. High interest rates, capital pools, and guaranteed returns became the mainstream practices. Renren Fenqi's decision to exit student consumer loans in May 2016 and shift to installment loans for used car dealers, in a sense, was a quiet exit before the industry truly spiraled out of control.

2018 was a watershed year for this industry.

China's P2P lending industry experienced explosive growth amidst regulatory vacuum and exorbitant interest rates, only to collapse en masse in 2010, with platforms shutting down, assets evaporating, and a rapid transition to a complete liquidation. By November 2020, the liquidation of Chinese P2P platforms was complete, and all major players in the industry had been liquidated.

As the industry was being liquidated, the person who first bet on SoFi was also putting an end to that investment. Chen Yizhou, through a series of insider transactions, spun off Renren's SoFi shares into companies he controlled, and then resold them at low prices to buyers including SoftBank. Minority shareholders were furious, New York courts intervened, and litigation lasted for years.

To many, this means SoFi is nothing more than a bargaining chip that can be easily disposed of, a footnote to the end of the P2P era. But at the same time, SoFi's management is solving another problem: transforming itself from "an object of regulation" into "a part of the regulatory system."

At that time, everyone thought that the destiny of FinTech was to disrupt banks, but SoFi, as a FinTech company, did the opposite and chose to become a bank.

A life-or-death decision: from P2P lending to banking

In July 2020, when the entire FinTech community was talking about decentralization, cryptocurrencies, and disrupting banks, SoFi made a decision that surprised everyone: it formally submitted an application to the Office of the Comptroller of the Currency (OCC) in the United States to seek a nationwide banking license.

At the time, this was a step backward in history. A star company labeled as a technology innovator turned around and embraced the most traditional, regulated, and least cool identity.

But there are always moments in business history when everyone is rushing in one direction, and the person who turns back either misjudged the situation or saw further ahead.

Why does SoFi do this? From its very first loan, the company has acted more like a bank than a matchmaking platform. It values long-term relationships, risk control, and the entire customer lifecycle, rather than one-off interest income.

More importantly, a banking license means much more to a financial company than just "compliance." On the surface, it means being able to accept public deposits, issue more types of loans, and enjoy the protection of the Federal Deposit Insurance Corporation (FDIC); but the real power of the license lies in its ability to drive down the overall cost of funding.

The cost of capital is a perpetual pain point for FinTech companies.

Before obtaining a banking license, SoFi must rely on external financing and bond issuance, which is costly and unstable. With a license, it can absorb large-scale savings deposits like all traditional banks. The cost of this money is typically only 1% to 3%, while the cost of financing in the capital market is often 5% to 8% or even higher.

Under the scale effect of finance, this seemingly small cost difference can be magnified infinitely, directly determining a company's profitability and expansion speed.

SoFi's decision is essentially a strategic exchange; they chose to embrace regulation in exchange for a genuine source of funding from the banking industry—a pool of funds with infinitely lower costs.

The essence of finance is a game of money; whoever can obtain more money at a lower cost has the ultimate pricing power.

After a long wait and review process of a year and a half, on January 18, 2022, the OCC and the Federal Reserve finally gave their approval. SoFi became the first major fintech company in U.S. history to obtain a full banking license.

SoFi was able to obtain this coveted license precisely because it spent ten years proving to regulators that it was not a "barbarian." Its business model is robust, its risk control record is excellent, and from the regulators' perspective, it is a "trustworthy innovator." Its competitors, whether aggressive crypto companies or slow-moving traditional banks, have all followed the path SoFi has taken.

But this victory did not come without a price.

A regulatory document from September of the same year clearly stated that after obtaining the license, SoFi was prohibited from conducting any cryptocurrency-related services without further approval. In other words, SoFi had to abandon its then-booming crypto business. From a regulatory perspective, a true bank must prioritize stability and cannot seek both a license and a booming trend.

The moment SoFi complied with the shutdown order, it was actually sending a signal to regulators that it was willing to conform to banking standards.

It's worth noting that SoFi had already launched crypto trading in early 2020, allowing users to buy and sell mainstream cryptocurrencies such as Bitcoin and Ethereum on its platform. While this business was small in scale, it represented SoFi's foray into the emerging financial sector.

2021 also coincided with a golden age for cryptocurrencies, with Bitcoin surging from $29,000 to a new high of $69,000 that year. That year, competitors like Coinbase and Robinhood made a fortune from crypto trading. SoFi, however, surrendered before dawn.

What was Chen Yizhou doing at the critical moment when SoFi was making drastic sacrifices for a banking license?

In October 2021, a New York court seized $560 million in assets belonging to his private company, OPI, on charges of "asset stripping." Under immense pressure, he ultimately chose to settle with minority shareholders, paying at least $300 million in compensation.

On one side, a company is betting on the future, using the safest and least attractive method to secure long-term growth; on the other side, those who were the first to bet on it are settling old scores and being forced to withdraw.

The birth of crypto banks

SoFi chose a less advantageous, more difficult, but also more stable path: first becoming a regulatory-approved bank, and then pursuing its desired innovations. This strategic patience is what sets it apart from most FinTech companies.

So, where does it really want to go?

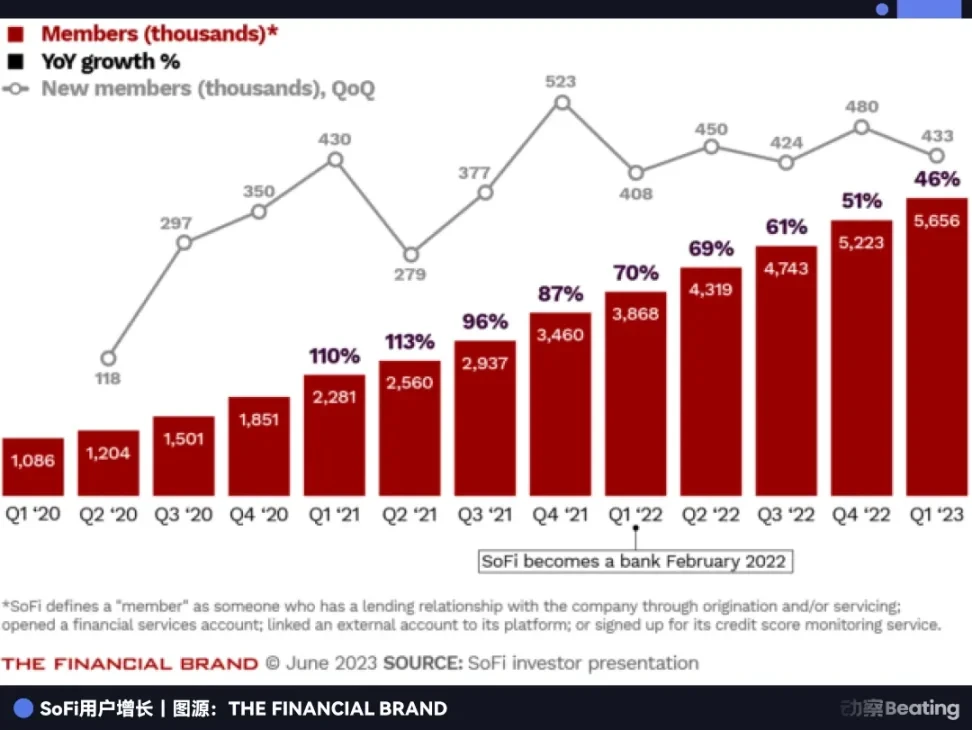

After obtaining a banking license, SoFi's business model underwent a fundamental transformation. The most direct change was the explosive growth in deposit volume.

With deposit rates far exceeding the market average, SoFi attracted a large number of users. These continuous, low-cost deposits provided ample ammunition for its lending business.

Financial data clearly demonstrates this change: deposits surged from $1.2 billion in the first quarter of 2022 to $21.6 billion by the end of 2024, an 18-fold increase in two years. It grew from a large-scale wealth management platform into a mid-sized national bank. By the third quarter of 2025, the company's net income reached $962 million, representing a year-over-year increase of nearly 38%.

The lowest cost is the highest barrier to entry. While other FinTech companies are still struggling with expensive financing, SoFi already possesses a "money-printing machine" on par with traditional banks. In just two years, it has completed the leap from platform to bank, completely leaving all competitors behind.

What truly reshapes the industry landscape is the authority granted by licenses. Without licenses, crypto services are merely incremental additions to FinTech; with licenses, the same services are incorporated into the banking system, becoming formal services within the compliance framework. These represent two entirely different forms of power.

On November 11, 2025, SoFi dropped a bombshell on the market, announcing that it would reopen its cryptocurrency trading services to its retail customers after a nearly three-year hiatus.

This means that SoFi has become the first and only financial institution in U.S. history to possess both a national banking license and the ability to offer mainstream cryptocurrency trading.

SoFi is essentially creating a completely new financial species. It combines the stability and low-cost funding of traditional banks with the flexibility of FinTech and the imagination brought by crypto businesses. For users, it's more like a "one-stop financial supermarket," where savings, loans, stock purchases, and cryptocurrency investments can all be completed within a single app.

Its innovation lies not in inventing anything new, but in combining the seemingly opposing systems of banking and encryption into a self-consistent whole. Wall Street analysts have been lavish in their praise, believing that SoFi is currently demonstrating the closest possible combination of FinTech to its ultimate form.

Looking back from this perspective, the decision to abandon the encryption business in 2022 was actually a well-thought-out strategic retreat. At that time, it relinquished short-term growth, but in return gained a trump card that was scarcest in the entire industry. And when it returned to the table in 2025, no one could rival it.

Anti-consensus

Traditional Wall Street banks generally have depressed stock prices, with price-to-earnings ratios hovering between 10 and 15 for years. SoFi, however, boasts a price-to-earnings ratio as high as 56.69, meaning the market is valuing it as a technology company rather than a bank.

This is SoFi's greatest achievement: it is a bank, yet it doesn't operate like one.

Over the past fifteen years, the grand narrative of the entire FinTech industry has been to disrupt traditional banking with technology. Coinbase talked about enabling everyone to trade cryptocurrencies; Robinhood talked about a zero-commission transaction revolution; Stripe talked about making payments extremely seamless.

But SoFi tells a completely different story. It says that we should first become a bank, and then use that bank identity to do things that others cannot do.

Looking back three years later, the "compromises" and "surrenders" of 2022 were precisely the most radical innovations.

SoFi's story has reached its climax, but it's far from over. Now that SoFi is the only "crypto bank," where will its next battleground be? Will it continue to expand its lending scale, deepen its crypto business, or leverage its unique identity to unlock possibilities we can't yet predict?

This company started as a P2P platform, squeezed its way forward amidst regulatory cracks, and now stands in a position that no one in the industry ever imagined.

In the beginning, no one would have associated SoFi with the words "crypto banking"; and in 2025, no one could have predicted its next fifteen years.