BTC has fallen below $100,000 again. Has the crypto market truly turned bearish?

- 核心观点:加密市场普跌,多重利空因素叠加。

- 关键要素:

- BTC、ETH现货ETF持续净流出。

- 美联储降息预期减弱,风险偏好下降。

- 长期持有者加速抛售,需求萎缩。

- 市场影响:市场情绪极度恐慌,短期承压明显。

- 时效性标注:短期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

The 43-day shutdown of the US federal government has ended , but the expected rebound failed to materialize—the crypto market instead experienced another pullback this morning.

According to OKX market data, BTC fell below the $100,000 mark, hitting a low of below $98,000, with a 24-hour drop of 3.01%, marking a new low since May 8th of this year; ETH fell below $3,200, hitting a low of around $3,150, with a 24-hour drop of 7.44%, SOL fell by 6.49%, and BNB fell by 4.07%.

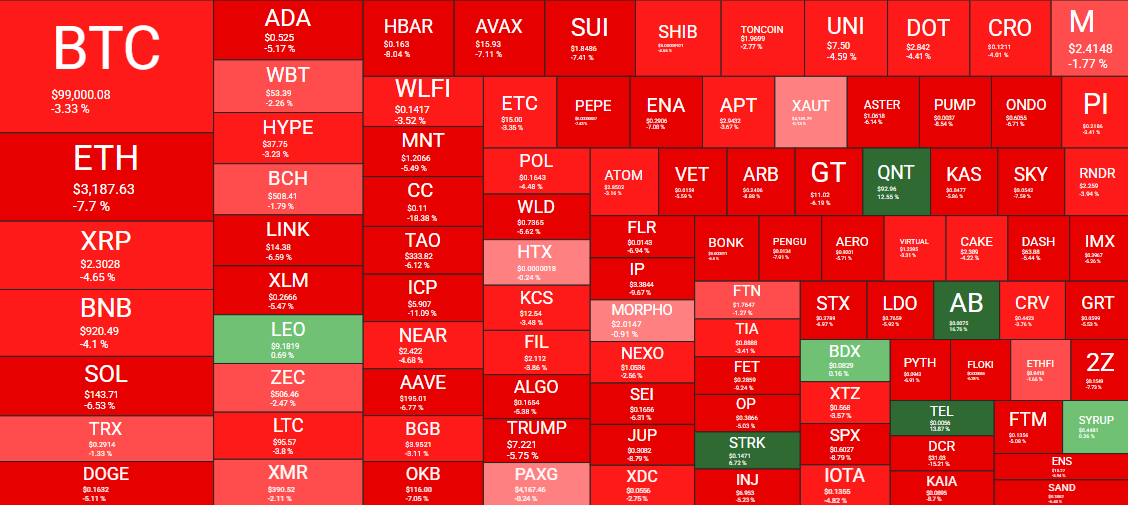

Apart from BTC, ETH, SOL, and BNB, the altcoin market continues to decline. According to data from Quantifycrypto , over 90% of the top 100 cryptocurrencies by market capitalization have been declining in the past 24 hours.

24-hour price change data for the top 100 cryptocurrencies by market capitalization

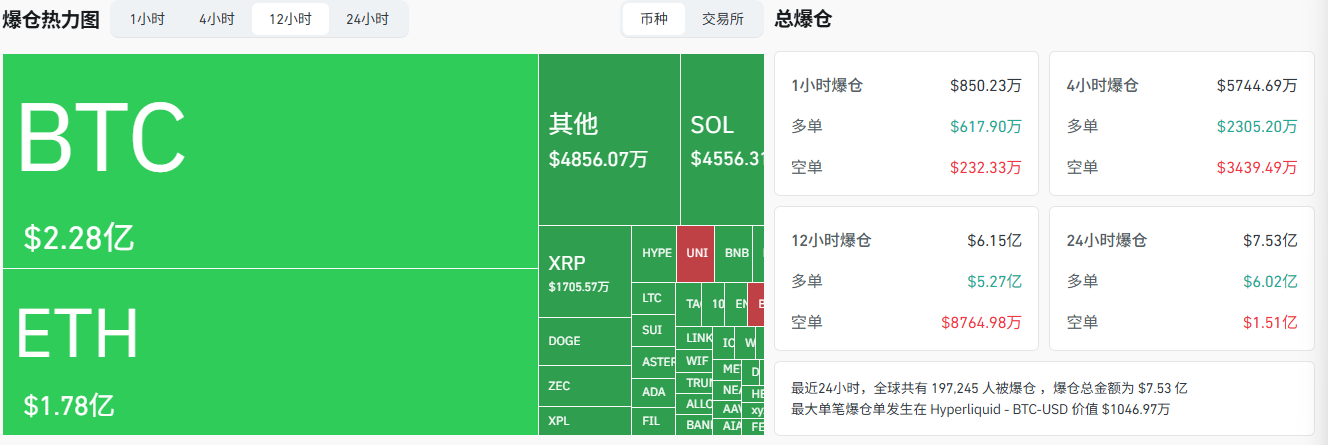

In the derivatives market, according to Coinglass data , the total liquidation amount across the network reached $615 million in the past 12 hours, of which long positions accounted for $527 million. BTC and ETH were the hardest hit by liquidations, amounting to $228 million and $178 million respectively.

Crypto derivatives market liquidation data

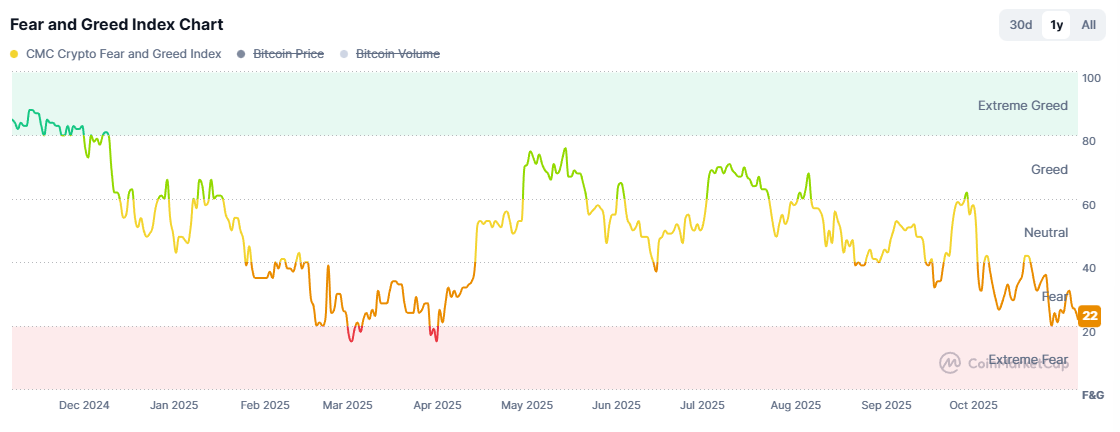

According to CoinMarketCap data , the Fear & Greed Index has continued to decline, remaining in a state of "extreme fear" for more than a week, with market sentiment plummeting to rock bottom.

Fear & Greed Index

Market sentiment continues to deteriorate, and investor morale is clearly unstable. What's the problem?

BTC and ETH spot ETFs have repeatedly shown net outflows.

Spot ETF data is an important indicator for observing market funds. According to SoSoValue data, since October 29th, BTC spot ETFs have experienced several large net outflows. Among them, the net outflow on November 4th reached as high as $577 million. Although there were brief net inflows on November 6th and November 11th (the net inflow of $1.15 million on November 10th is ignored for now), overall, funds have continued to flow out since November.

BTC spot ETF data

The recent performance of ETH spot ETFs has been even less optimistic. Data shows that since October 29, except for November 6 when there was a net inflow of funds (with a net outflow of 0 on November 10), there have been net outflows on all other days, with several single-day net outflows exceeding $100 million.

ETH spot ETF data

Expectations for a Fed rate cut have weakened.

The latest reports from the Federal Reserve's mouthpieces indicate that a serious division, rare in recent years, is emerging within the Federal Open Market Committee (FOMC), directly undermining market confidence in the future path of interest rate cuts and becoming a major reason for the recent continued weakening of risk appetite.

First, policymakers' views on the necessity of interest rate cuts have become divided—hawks emphasize that inflationary pressures still pose an upside risk and advocate for a pause in rate cuts; doves, on the other hand, worry about a sharp drop in job growth and believe that not continuing easing will drag down the economy. The government shutdown, which temporarily interrupted official economic data, further widened the differences between the two sides.

Secondly, differing judgments on the three core issues have created uncertainty regarding the policy outlook:

- Is tariff-induced inflation one-off or ongoing?

- Is the slowdown in employment due to weakening demand or insufficient labor supply?

- Does the current interest rate still have a "repressive" effect?

The lack of consensus on these three points also means that the conditions and pace of subsequent interest rate cuts have become unclear.

Finally, although the market had widely bet that the Federal Reserve would continue to cut interest rates in December, internal debate is now intense, with even Powell himself actively lowering market expectations at a press conference, indicating that the committee is in a state of "difficulty in reaching a consensus." Whether or not interest rates will continue to be cut in December now depends entirely on the data to be released, rather than on any predetermined path.

This is why the previously clear roadmap for interest rate cuts is becoming increasingly unclear. Policy uncertainty has led to a decline in risk appetite, becoming a major driver of recent weakening market sentiment, safe-haven flows, and pressure on crypto assets.

The DAT ( Crypto Treasury ) narrative may have already faded.

With regulations tightening across the board, the space for DAT (Data-Driven Acquisition) to survive is being squeezed.

According to Bloomberg, the three major stock exchanges in the Asia-Pacific region, including the Hong Kong Stock Exchange (HKEX), are resisting the trend of listed companies making cryptocurrency treasury (DAT) a core business. HKEX has recently questioned the strategic plans of at least five companies to transform into DAT companies, citing violations of regulations prohibiting the holding of large amounts of liquid assets. Exchanges in India and Australia have taken similar stances, creating greater obstacles for listed companies transforming into DAT companies.

The market may have already sensed the bubble forming in the corporate hoarding of currency.

At its most frenzied period in 2024, the so-called "DAT effect" became almost a guaranteed money-making game: any listed company that announced it was starting to allocate Bitcoin could instantly see its stock price surge, regardless of whether its main business was related to cryptocurrencies. As a result, more and more companies regarded "buying BTC, ETH, and SOL" as the cheapest and fastest way to manage market capitalization, and even "shell company"-style listed companies emerged with cryptocurrency hoarding as their primary narrative.

However, since the beginning of this summer, the market has clearly shown signs of fatigue. DAT companies no longer dare to loudly proclaim their blind buying, but instead have switched to more conservative narratives such as "governance optimization, asset diversification, and improvement of return structure," trying to convince the outside world that they are not betting on the market, but rather "systematically managing assets."

When the magic of "buying coins to drive up stock prices" fails, the era of DAT may be coming to an end ( for related content, see: The Turning Point of DAT? These 12 financial companies, representing mNav, have fallen below 1 ).

Market View

CryptoQuant: Bitcoin long-term holders' selling volume reaches its highest level this year, and demand is shrinking.

CryptoQuant reported on its X platform that long-term Bitcoin holders are accelerating their BTC sell-off, with approximately 815,000 BTC sold in the past 30 days, a new high since January 2024. Furthermore, this sell-off comes at a time of weak spot demand, reflected in net outflows from Bitcoin ETFs, a negative Coinbase price premium, and shrinking apparent demand.

Trader Nachi: Doesn't believe the market will see a substantial recovery before the end of the year.

According to a recent post by Binance trader Nachi, Bitcoin's rally after breaking through $100,000 was brief, followed by a rapid decline and a break below key support levels. The US stock market also lost upward momentum, primarily due to a decreased probability of a December rate cut and the government shutdown delaying policy and data releases. Investors are more inclined to lock in profits at year-end, and the market still has some downside potential after breaking through support.

Overall, market uncertainty persists in the short term, requiring a flexible approach. If short selling is not recommended, the safest strategy is to hold cash and wait for more suitable buying opportunities at lower prices. Based on the current situation, a substantial market recovery is unlikely before the end of the year.

Santiment: Retail investor sentiment has turned sharply pessimistic; BTC, ETH, and XRP may be nearing short-term bottom signals.

According to Santiment data, Bitcoin's bullish/bearish sentiment ratio has become unusually flat, Ethereum is only slightly positive, and XRP is at its most feared level of the year. Historically, when multiple large-cap assets simultaneously experience retail investor pessimism, it is often accompanied by the exit of weak hands and the formation of a short-term bottom.

On-chain metrics, Bitcoin's unrealized profit margin (NUP) has fallen to 0.476, approaching the range seen before several previous short-term rallies. The total market capitalization has currently dipped to approximately $3.47 trillion, but institutional allocation intentions remain cautiously bullish, with the latest survey showing that 61% of institutions plan to increase their exposure to crypto assets before the end of the year. Large holders are also accelerating their accumulation, and ETH exchange reserves have fallen to their lowest level since May 2024, reflecting a medium-term accumulation trend.

Yi Lihua: ETH's pullback to $3000-$3300 presents the "best buying opportunity."

Yi Lihua, founder of Liquid Capital (formerly LDCapital), posted on the X platform that the US stock and cryptocurrency markets have recently experienced a sharp decline due to weakening expectations of a December interest rate cut. However, his team still believes that the $3,000 to $3,300 range for ETH is the "optimal entry point." He mentioned that he had maintained his position when ETH fell to around $2,700, but the psychological pressure from the market correction led him to reduce leverage to mitigate risk before ETH fell below $3,000 in this round of trading. In this round of operations, he stated that he will focus on spot trading and will no longer use leverage. He plans to continue adding to his ETH position during subsequent adjustments and patiently wait for the market to change.