A review of companies whose mNav has fallen below 1: What is the future of DAT?

- 核心观点:DAT公司面临币价下跌与财务困境。

- 关键要素:

- 多家公司mNav跌破1,市值低于持仓。

- Strategy等公司债务高企,融资受阻。

- 部分公司已出售加密货币偿还债务。

- 市场影响:DAT抛售加密货币或引发市场抛压。

- 时效性标注:中期影响。

Original article by Odaily Planet Daily ( @OdailyChina )

Author|CryptoLeo ( @LeoAndCrypto )

2025 was a booming year for DAT (Digital Treasury) cryptocurrencies. Since Strategy began implementing its crypto treasury strategy, many companies have joined the fray, with over 200 DAT companies currently operating, covering dozens of different cryptocurrencies. In July alone, DAT funding reached $6.2 billion. We've indeed seen many companies transforming themselves into crypto treasury companies when profitability was difficult to achieve, initially driving up stock prices and market capitalization, with many proclaiming DAT as the future. But is DAT a trap or the future?

With the recent decline in BTC/ETH, even falling below the purchase cost of many financial companies, it means that the BTC/ETH purchased by these companies has turned into a loss-making situation. This may cause public concern to some extent, leading to a drop in its market value.

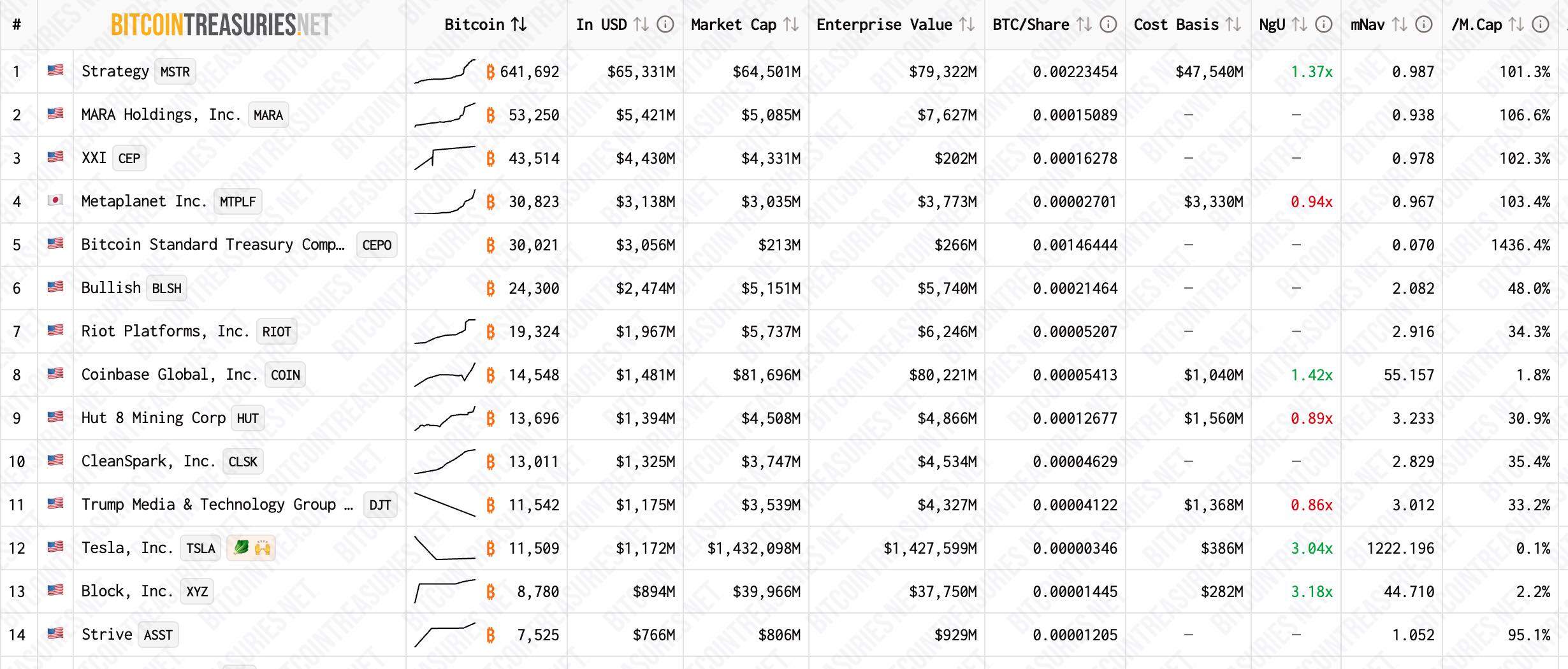

Yesterday I saw a "horrifying" data point showing that the mNav of many DAT companies has fallen below 1 (except for some mining companies, exchanges and early investors, most crypto treasury companies' mNav is below 1), including Strategy, the "founding giant of the treasury concept".

mNav (market capitalization to the value of cryptocurrency holdings) is a data point that is of great interest to crypto treasury companies. Odaily Planet Daily will be listing a batch of BTC/ETH treasury companies whose mNav has now fallen below 1.

mNav drops below 1 BTC Treasury

Strategy

Data: Strategy currently holds 641,692 BTC, with a holding value of $65.04 billion. The company's market capitalization is $63.67 billion, and the mNav is currently at 0.979.

Recent developments : They have not stopped increasing their holdings, but have shifted from large-scale purchases to smaller-scale purchases of BTC.

Metaplanet

Data: Metaplanet currently holds 30,823 BTC, with a holding value of $3.124 billion. The company's market capitalization is $3.024 billion, and the mNav is currently at 0.968.

Recent developments : A strategically planned financing round, using its Bitcoin holdings as collateral to raise $100 million, with the funds intended for additional BTC purchases and stock buybacks.

The Smarter Web Company

Data: The Smarter Web Company currently holds 2,664 BTC, with a holding value of $270 million. The company's market capitalization is $221 million, and the mNav is currently at 0.783.

Recent developments : Currently raising $360,000 in funding, and may continue to increase its holdings.

Semler Scientific

Data: Semler Scientific currently holds 5,048 BTC, with a holding value of $512 million. The company's market capitalization is $3.74 billion, and mNav is currently at $0.73.

Recent Developments : Stock Merger. Semler Scientific and Strive announced an all-stock merger, which will result in Semler holding over 10,900 BTC.

Empery Digital

Data: Empery Digital currently holds 4,081 BTC, with a holding value of $414 million. The company's market capitalization is $246 million, and the mNav is currently at 0.595.

Recent developments: Efforts to improve mNav; Q3 financial report indicated that approximately $80 million in stock buybacks had been executed.

Sequans Communications

Data: Sequans Communications currently holds 2,264 BTC, with a holding value of $229 million. The company's market capitalization is $166 million, and the mNav is currently at 0.73.

Recent Developments: Debt Reduction and Continued Long-Term BTC Buying Strategy. The company sold 970 Bitcoins to redeem approximately 50% of its convertible bonds, reducing its total debt from $189 million to $94.5 million.

mNav drops below 1 for ETH treasury

Bitmine Immersion Tech

Data: Currently, there are 3.529 million ETH in holdings, with a holding value of $12.07 billion. The company's market capitalization is $11.43 billion, and mNav is temporarily reported at 0.946.

Recent moves: Unlimited ammunition, continuing to accumulate 24,007 ETH.

SharpLink Gaming

Data: Currently, there are 859,400 ETH in holdings, with a holding value of $2.94 billion. The company's market capitalization is $2.28 billion, and mNav is temporarily at 0.84.

Recent activity: Increased holdings by 19,271 ETH.

The Ether Machine

Data: Currently, there are 496,700 ETH in holdings, with a holding value of $1.7 billion. The company's market capitalization is $171 million, and the mNav is currently at 0.08 (it has never reached 1).

Recent developments: Plans to go public through a merger with Dynamix.

BTCS Inc.

Data: Currently, there are 70,000 ETH in holdings, with a holding value of $239 million. The company's market capitalization is $143 million, and mNav is currently at 0.6.

Recent developments: Dividends and bonuses were distributed to shareholders in the form of ETH.

FG Nexus

Data: Currently, there are 50,000 ETH in holdings, with a holding value of $173.5 million. The company's market capitalization is $142 million, and mNav is currently at 0.82.

Recent developments: Expanding its European user base, it is now listed on the Deutsche Börse stock exchange under the ticker symbol "LU51".

ETHZilla

Data: Currently, there are 93,790 ETH in holdings, with a holding value of $320 million. The company's market capitalization is $277.3 million, and mNav is temporarily reported at 0.86.

Recent moves: Attempt to boost mNav by selling $40 million worth of ETH to buy back company stock (but unsuccessful).

Will a race to the bottom in cryptocurrency prices and the circulating shares of treasury companies lead to a sell-off of BTC/ETH to keep operations afloat?

DAT is essentially a cyclical compounding process of financing and buying cryptocurrencies, achieving high valuations to continue issuing bonds/stocks to buy even more cryptocurrencies. This metric presupposes "holding for profit," but if the cryptocurrency price falls after purchase, it in turn affects the stock price, turning into a race between the cryptocurrency price and the circulating stock price. Debt repayment and financing difficulties are the two major "pain points" facing DAT companies. In the future, they may inevitably face the need to sell cryptocurrencies to repay some debts, and the treasury selling cryptocurrencies to maintain operations is the biggest concern.

For companies with strong financing capabilities and sufficient scale, this issue may not be a concern in the short term. For example, Strategy, whose CEO Saylor has repeatedly emphasized that he will never sell BTC, and which possesses strong financing capabilities and prudent capital structure management in the capital markets, may not be a major concern in the short term. While Strategy continues to accumulate BTC in small amounts, in the medium to long term, if BTC enters a bear market or debt nears maturity, coupled with S&P's previous B- rating of Strategy (which S&P considers a "junk" company with extremely high default risk), the rating could have a long-term impact, affecting Strategy's stock price and financing capabilities, increasing the probability of selling Bitcoin to repay debt. Although the current BTC bull-bear cycle is not a four-year cycle, we can temporarily disregard the scenario of BTC prices falling below $90,000 during a bear market.

Previously, crypto analyst Willy Woo also stated:

Michael Saylor's Strategy (MSTR) will not need to sell a portion of its Bitcoin reserves to pay off debt in the event of the next major cryptocurrency market downturn. Strategy's debt primarily consists of convertible senior notes. The company has the option to repay maturing convertible debt with cash, common stock, or a combination of both. Approximately $1.01 billion of Strategy's debt matures on September 15, 2027. To avoid needing to sell Bitcoin to pay off debt, Strategy's stock must trade at a price above $183.19. He added that this price roughly equates to a Bitcoin price of around $91,502, assuming an mNAV of 1.

Saylor may not need to worry about Strategy's BTC sale for the time being, but it's not so good for many companies with limited liquidity, high debt, and weak financing capabilities. Selling Bitcoin to repay debt is not an isolated case. Sequans Communications, the US-listed semiconductor company mentioned earlier, also redeemed about 50% of its convertible bonds in early November by selling 970 Bitcoins, reducing the company's total debt from $189 million to $94.5 million and its debt-to-net-equity ratio from 55% to 39%.

Ethereum treasury company ETHZilla also sold $40 million worth of ETH for stock buybacks at the end of October this year, hoping to bring its mNAV back above 1. However, the problem is that its stock price has fallen even faster than the token (ETH). As mentioned earlier, the sale of DAT tokens affects its stock price. Currently, ETHZilla has a market capitalization of $266.6 million, ETH holdings worth $322.2 million, and an mNav of 0.82, which has not yet returned to 1.

Reality shows that TradeFi, this "big buyer," has little demand for these DAT stocks. Even if cryptocurrencies rebound at the end of the year, without TradeFi's support, DAT stocks may still not perform well, and the return of mNav to above 1 remains a distant prospect. The longer DAT companies continue to trade at low mNav levels, the more desperate their shareholders will become, ultimately leading to a forced sell-off of their cryptocurrencies or a discounted acquisition. They control a large supply of BTC and ETH, and every sale could create significant selling pressure on mainstream cryptocurrencies and altcoins.

Currently, very few DAT companies have successfully replicated Strategy's success. Ultimately, DAT may be acquired by Saylor or Tom Lee, leading to a further centralization of cryptocurrency holdings. Whether it's selling off cryptocurrency or being acquired, it won't benefit any of us who are trading cryptocurrencies.

During the writing of this article, Tom Lee retweeted a post stating that top institutions, including Ark, BlackRock, Vanguard Group, and JP Morgan, had bought BitMine stock. This offered some reassurance to those of us worried about DAT. If DAT can hold on for a while until its stock gradually returns to TradeFi's portfolio, DAT's future remains promising. It's difficult to predict how long "a while" it will take for Wall Street giants to accept DAT stock; we can only hope that President Trump will publicly announce some measures that are beneficial to crypto DAT.