The ORE flywheel logic with a monthly increase of 5000%: How does gambler's impulse create a deflationary narrative?

- 核心观点:ORE通过机制设计实现价格暴涨。

- 关键要素:

- 月涨幅5063%,市值达2亿美元。

- 采用链上彩票机制替代传统PoW。

- 10%手续费回购销毁代币制造通缩。

- 市场影响:推动Solana生态活跃与投机热潮。

- 时效性标注:短期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

ZEC's 137% monthly increase is no longer impressive; ORE's monthly increase is a staggering 5063%. This project, which surged from $10 to $540 and its market capitalization soared from $4 million to $200 million, entered the mainstream spotlight almost overnight. We can't help but ask, what kind of project is this, and what is the foundation of its explosive growth?

Project Origin: Transplanting the Bitcoin Spirit to Solana

ORE is a Proof-of-Work (PoW) mining protocol on the Solana blockchain. Its core concept is to transplant Bitcoin's "fair launch, no pre-mining, and no allocation mechanism" to the high-performance Solana network, creating true "digital gold." The project was developed anonymously by its founder, Hardhat Chad, and this anonymity, low profile, and idealism seem to align with the spirit of crypto fundamentalism .

ORE is not actually a new project launched this year, but rather a winning project from the 2024 Solana Renaissance Hackathon.

In April 2024, ORE first attempted to implement PoW mining on Solana. Theoretically, miners need to continuously submit hashes to compete for rewards; however, in a high TPS environment, this "unlimited submission" mechanism had disastrous consequences. In order to increase the winning rate, professional miners sent transactions frantically, and coupled with the fact that Solana was in the midst of a meme craze at the time, the double pressure caused severe network congestion.

ORE-related transactions once accounted for more than 25% of the Solana network's throughput, causing the network's transaction drop rate, latency, and failure rate to soar to 75% . As a result, just two weeks after its launch, on April 16, 2024, the project's founders announced a suspension of mining .

This failure, ironically, became a "turning point" for ORE. It realized that replicating Bitcoin-style fairness on a high-speed blockchain was impossible because the blockchain's computing power resources were not unlimited—therefore, ORE's second reboot was more like a rebirth of an economic game .

Gameplay Restructuring: From PoW to "On-Chain Lottery"

In August 2024, ORE was relaunched with version V2, and on October 22, it launched a brand new protocol. It completely abandoned the traditional PoW competition and turned to an on-chain lottery mechanism with "one round per minute" .

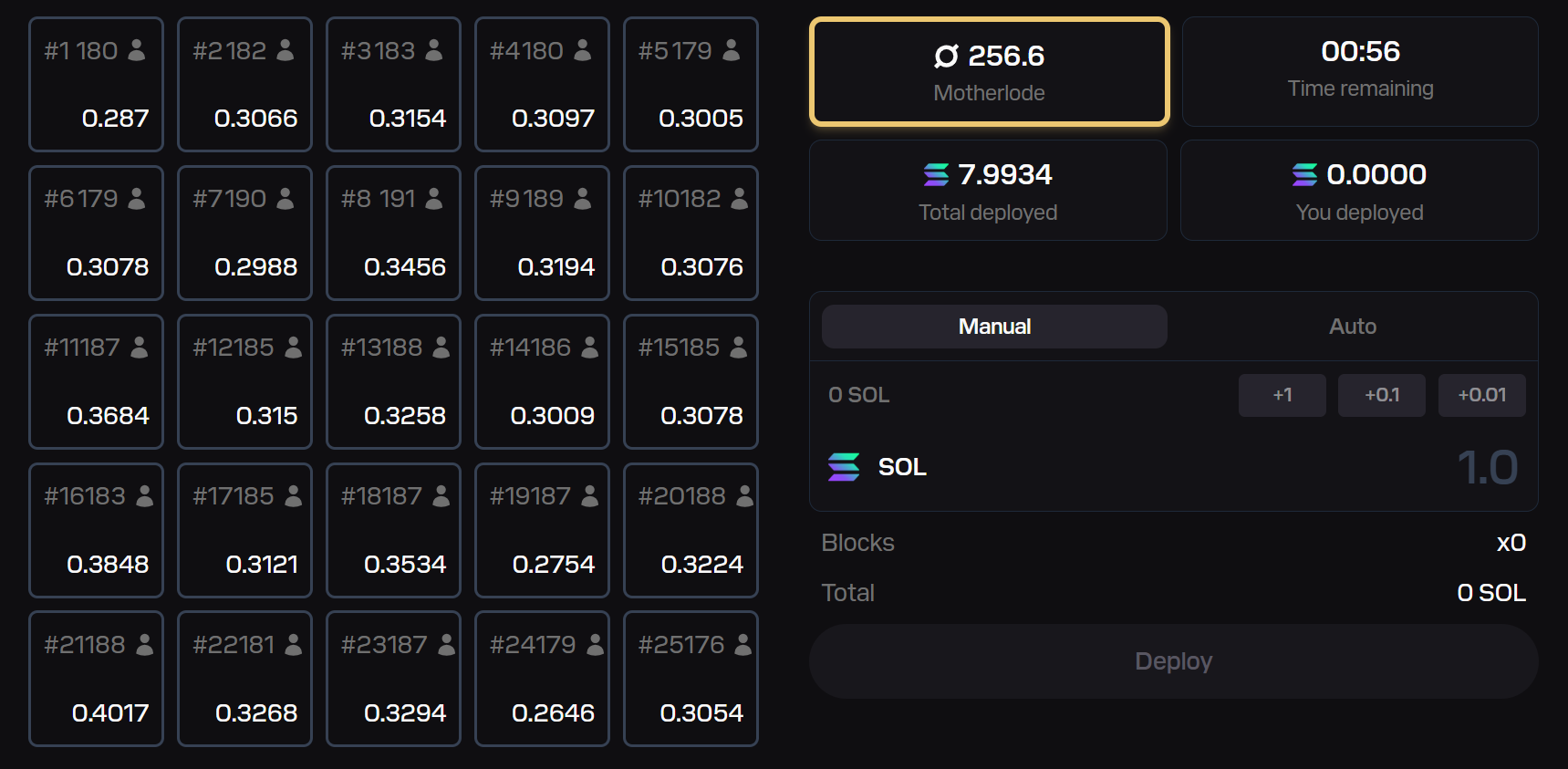

The basic gameplay involves a 5x5 grid with 25 squares . Miners wager SOL on each square, "prospecting" (occupying) space. Multiple squares can be claimed, and repetitions are allowed (minimum 0.1 SOL/square). At the end of each round, the system randomly selects a "winning square" using Solana's official VRF (verifiable random function). All miners on the winning square proportionally share the SOL from all the losing squares of that round plus 1 newly issued ORE. In approximately half of the rounds, the system will randomly select one miner through weighted averages to receive the entire +1 ORE, while the other winners only receive SOL.

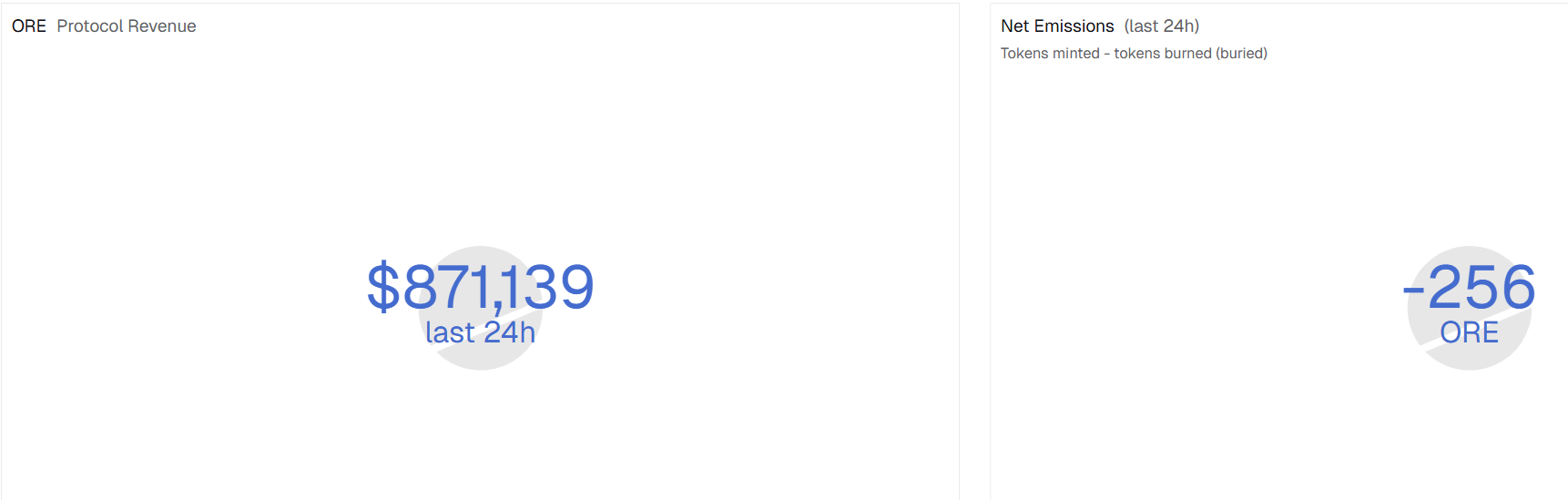

It is important to note that the agreement will charge a 10% fee on the total SOL bet in this round. This 10% will be used entirely to repurchase ORE from the market, with 90% burned directly and 10% distributed to ORE stakers to reward long-term holders.

In addition, the protocol adds the Motherlode feature . Each round of mining adds a fixed amount of +0.2 ORE to the Motherlode prize pool; there is a 1/625 chance (on average once every 3 rounds) to trigger Motherlode during the draw. If triggered, all miners of the winning tile share the entire prize pool proportionally based on their occupied space. If not triggered, it continues to accumulate (the current prize pool has accumulated 256 ORE, worth approximately $97,000 at the current price of $380).

Additionally, all mining rewards (ORE) are unclaimed by default. Therefore, a 10% fee is charged when claiming, and this fee is redistributed to other miners who did not claim. This means that the earlier you sell, the more you lose, and the later you sell, the more you earn .

Furthermore, if you hold ORE, you can stake it on the official website. The amount you stake determines your mining multiplier (betting weight), with a maximum of 2x, which strengthens the positive feedback of accumulating coins.

From a mechanistic perspective, ORE has implemented a multi-layered design at the behavioral finance level, combining "delayed gratification," "group incentives," and "deflationary narratives" to create a shared psychological loop between token holders and gamblers.

Token economics: deflation and scarcity narratives

The maximum supply of ORE tokens is 5 million, with a current circulating supply of 412,000 , representing approximately 8.2% of the total supply. All token minting is programmatically controlled by smart contracts on the Solana blockchain, with no pre-mining or pre-allocation, returning to Bitcoin's original vision of fair distribution. In an era of abundant supply, scarcity becomes a unique narrative weapon.

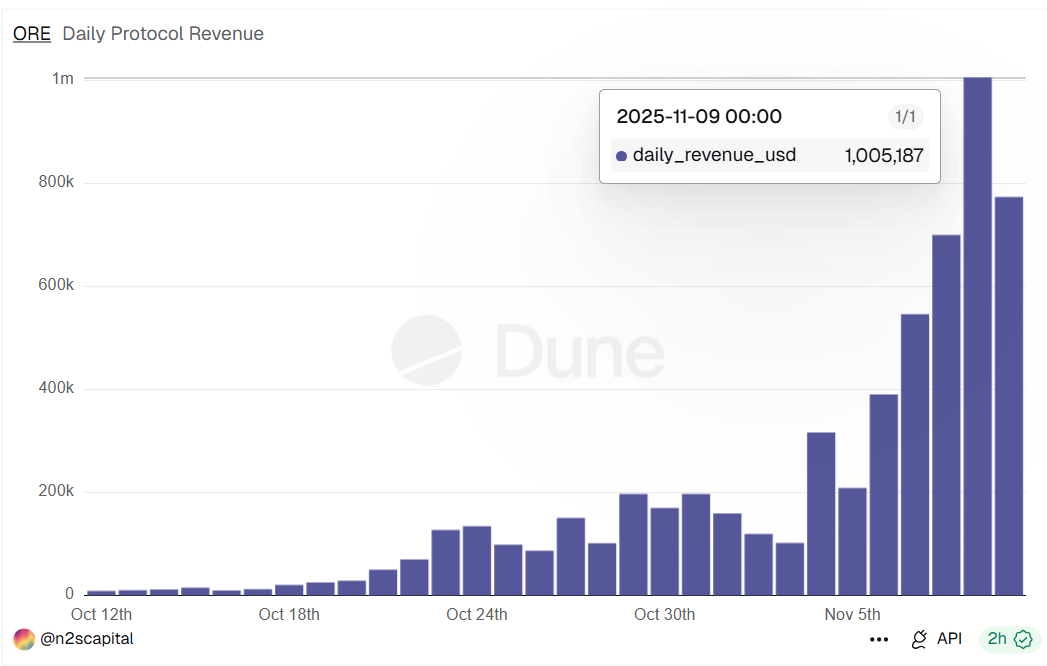

More importantly, 10% of the protocol's revenue is bought back and burned, creating a flywheel effect where "the more people play, the more money is burned, and the scarcer the resource becomes." According to Dune data , its revenue has been gradually increasing since the protocol's launch. On November 9th, it even ranked second on the Solana network's revenue chart, second only to Pump.fun, thanks to its record of earning millions of dollars in a single day.

We can see that in the past 24 hours, the ORE protocol's daily revenue was $870,000, and the net token supply (newly minted tokens - burned tokens) decreased by 256 tokens . Based on the current protocol revenue, the daily deflationary value of the tokens is approximately $97,000 .

This means that ORE has actually constructed a "deflationary internal circulation mechanism": the hotter the protocol, the stronger the speculation, the more buybacks, and the higher the price expectations—thus attracting more speculators to flock in. Deflation is no longer just a monetary attribute, but an emotion-driven price narrative .

Flywheel Model: Gambling, Deflation, and Ecosystem Integration

From an economic perspective, ORE is essentially a system that tightly binds together " gambler's impulse + deflationary expectations + Solana's inherent demand ".

The first step in the flywheel strategy is to ignite the "gambler's impulse." As we can see from the data above, ORE's protocol revenue suddenly surged after November 5th. The immediate trigger was the launch of its mobile application, Solana Mobile Seeker—users no longer needed a computer or command line; they could mine with a single click using their phones. This drastic drop in barriers led to explosive growth: the number of miners increased more than tenfold, and the betting amount per round soared from a few SOL to over sixty SOL.

As the number of miners increased, protocol revenue surged. According to the mechanism, 10% of each round of betting is allocated to buy back and burn ORE tokens in the market. With a total supply of only 5 million tokens and a circulating supply of less than 8%, hundreds of ORE tokens are burned daily, creating a strong expectation of scarcity. This is the second driving force of the flywheel: the consensus-building of the deflationary narrative. In the model of "the more people play, the more you burn, the scarcer it becomes," scarcity itself becomes the reason for participation.

The third driving force comes from ecosystem integration. All bets on ORE are denominated in SOL, meaning that every "bet" drives up the demand for SOL and on-chain activity. As transactions increase, Solana network fees and validator income rise in tandem, creating a positive feedback loop across the ecosystem. In a sense, ORE is not just an independent protocol, but an ecosystem accelerator amplified through "on-chain behavioral finance." This is precisely what the Solana ecosystem is currently hoping for.

Furthermore, the existence of Motherlode's prize pool and staking weighting mechanism further reinforces the positive feedback loop of speculation. The former provides the FOMO stimulus of "sudden big wins," while the latter rewards long-term holders with staking multipliers, thus suppressing short-term selling behavior both psychologically and in terms of returns . In this way, gambler's greed, deflationary belief, and ecosystem resonance intertwine to form a seemingly perfect closed loop.

Currently, ORE's daily revenue already surpasses most L1 tokens, but its circulating supply is only 8%. As long as miners are willing to bet on higher prices tomorrow using SOL, this flywheel will continue to accelerate. However, the allure of the flywheel is also its vulnerability. Because the ORE protocol itself does not generate value, it merely uses its mechanism to encourage participants to voluntarily "produce scarcity." But once large holders collectively take profits or Motherlode fails to trigger for an extended period, FOMO cools down, and the flywheel will collapse.

The story of ORE may be far from over. In a sense, ORE's surge is not only a victory for its mechanism, but also a victory for human nature. Under the narrative of "replicating the spirit of Bitcoin," it has constructed a complex system that integrates mining, lottery, deflation, and FOMO.

But like all flywheels driven by emotions, it can be exhilarating, but it can also collapse overnight.