Gemini's first earnings report since its IPO: Revenue increased but profit declined, and stock price hit a record low.

- 核心观点:Gemini收入增长但亏损扩大。

- 关键要素:

- 净收入4977.5万美元,同比增长104.4%。

- 净亏损1.595亿美元,同比扩大76.9%。

- 运营支出1.71亿美元,同比增123.1%。

- 市场影响:股价创上市新低,引发盈利担忧。

- 时效性标注:短期影响

Original author: Eric, Foresight News

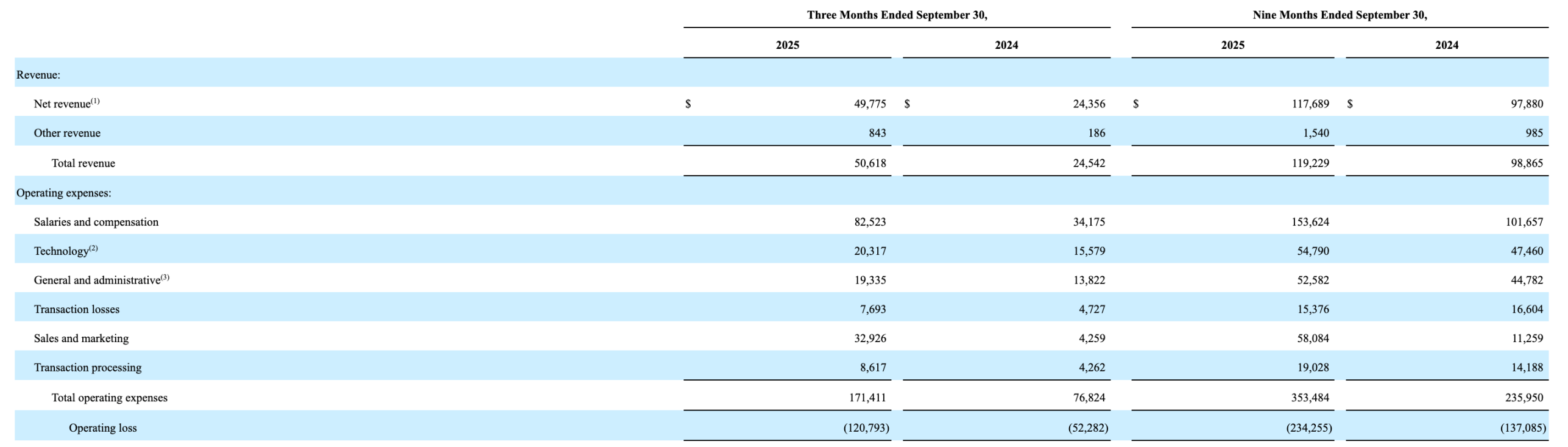

After the market closed on November 10th, US time, Gemini, which had recently gone public, released its first earnings report since its IPO. The report showed that Gemini's net revenue for the third quarter was $49.775 million, a year-on-year increase of 104.4% and a quarter-on-quarter increase of 51.8%, exceeding market expectations of $46.84 million. However, despite the significant revenue growth, net profit remained negative, with losses increasing by 76.9% year-on-year to $159.5 million, and earnings per share of -$6.67, significantly exceeding market expectations of -$0.767.

Gemini's stock price fell below $15 in after-hours trading, hitting a new low since its IPO, as investors worried about the company's widening losses. It has now fallen by two-thirds from its highest price.

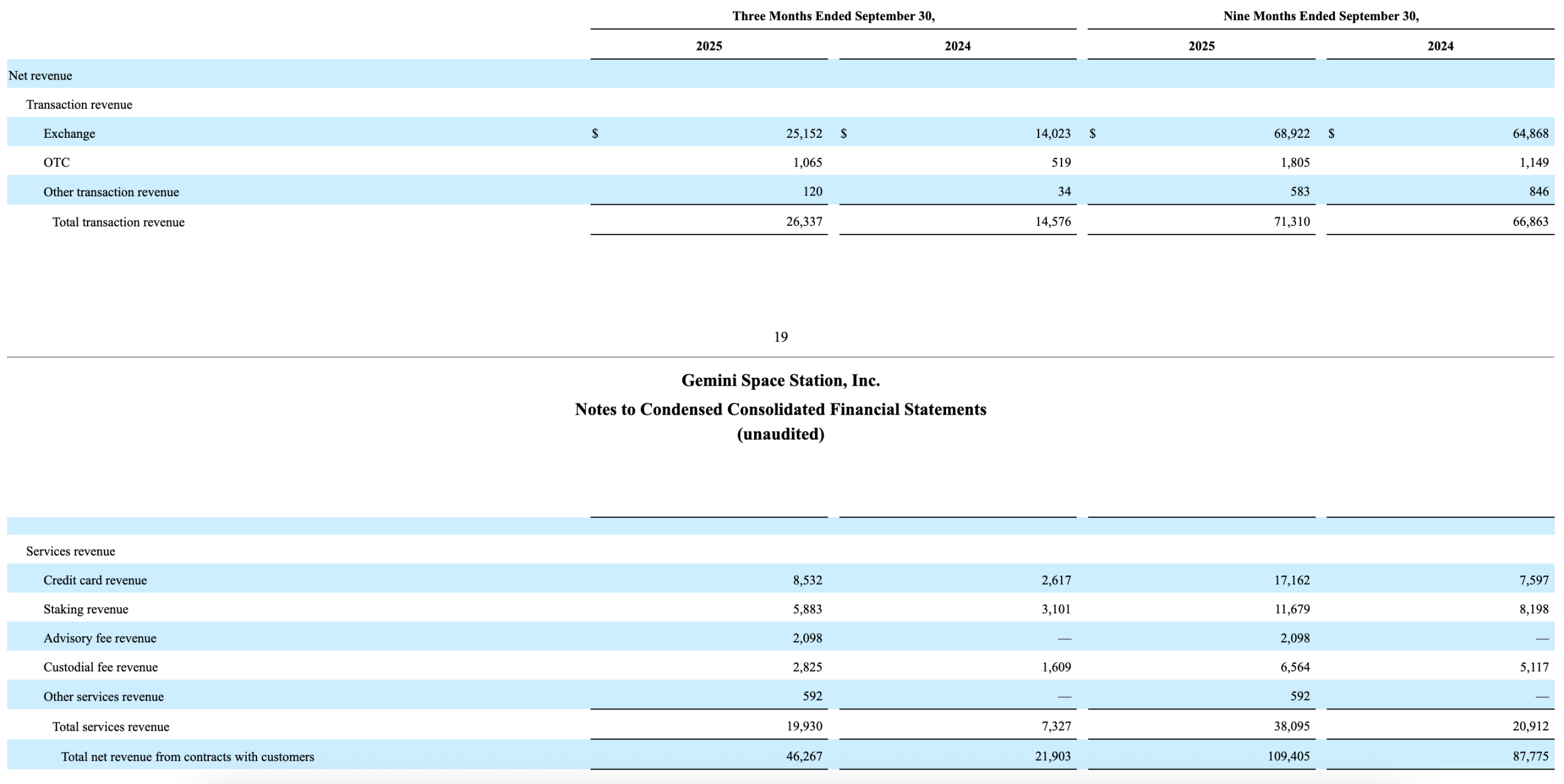

In terms of revenue, Gemini saw significant increases in both transaction and service revenue. In Q3, Gemini's transaction revenue reached $26.337 million, representing a year-over-year increase of over 80%. Total transaction volume on the Gemini platform reached $16.4 billion this quarter, a year-over-year increase of 144.8% and a quarter-over-quarter increase of 45.1%. Regarding service revenue, strong performance in credit cards, institutional staking, and custody businesses resulted in year-over-year revenue increases of 226%, 89.7%, and 75.6%, respectively.

According to data provided in the shareholder letter, Gemini credit card account openings have surpassed 100,000, with spending exceeding $350 million, more than doubling quarter-over-quarter; meanwhile, the platform's pledged assets valued at $741 million. Service revenue accounted for 39% of total revenue this quarter, compared to less than 30% a year ago.

While revenue increased, Gemini's operating costs also rose at a higher rate. In the third quarter, Gemini's operating expenses reached $171 million, an increase of 123.1% year-over-year, with sales and marketing expenses increasing nearly sevenfold year-over-year.

With operating expenses increasing at a faster rate than revenue growth, coupled with continued widening losses, Gemini's first report card since its IPO was dismal. To date, Gemini has yet to demonstrate its ability to generate its own revenue. Although some of the losses stemmed from IPO expenses, even considering EBITDA (earnings before interest, taxes, depreciation, and amortization), Gemini still suffered a loss of $52.4 million in the third quarter, a 3.4% increase year-over-year.

Increased revenue without increased profit is usually attributed to a problem with a company's operational capabilities. In fact, Gemini's IPO filing revealed a significant risk: as of June 30th of this year, Gemini's total borrowings were close to $1.4 billion, of which $1.28 billion was provided by an investment company owned by the two brothers who founded Gemini. Of this $1.28 billion, over $400 million could be converted into shares at a 20% discount to the IPO price. Gemini even explicitly stated that the IPO was solely for debt repayment.

Under these circumstances, Gemini's stock price decline after its IPO was entirely expected. If one had to find something to look forward to, it would be that its total liabilities have decreased by 9.2% to $1.685 billion since the end of last year. Its available cash has also increased by 118.6% year-on-year to $1.108 billion. If Gemini can achieve "decreased spending and increased revenue" after short-term investments, it could signify an improvement in the company's operating condition.