Can you really make money just by participating in IPOs? A roundup of 8 hottest IPO projects recently.

- 核心观点:多个知名项目近期集中进行代币公开销售。

- 关键要素:

- Monad完成2.25亿美元融资,估值30亿。

- HumidiFi十月交易额达359亿美元。

- BOB旨在结合比特币安全与以太坊功能。

- 市场影响:为市场注入新流动性,推动生态发展。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

Monad participates in coinbase exchange IPOs

Project Overview

Developed over two years by the Pyth and Solana teams, Monad is a high-performance L1 public blockchain compatible with Ethereum. According to its official documentation, Monad defines itself as a high-performance L1 blockchain compatible with the EVM using a PoS mechanism. It aims to pioneer new paradigms of public blockchain possibilities through the pipelined execution of Ethereum transactions. Its key innovations include MonadDB (a database specifically designed for Ethereum state access) and Optimistic parallel execution (ensuring high TPS with minimal overhead).

On the evening of April 9, 2024, Monad Labs announced the completion of a $225 million funding round at a $3 billion valuation, led by Paradigm, with participation from Electric Capital and Greenoaks, among others. As one of the most watched projects in the Layer 1 space, Monad, focusing on the concept of "Parallel EVM," aims to introduce a parallel processing-based execution layer scaling solution, significantly improving network execution efficiency while maintaining 100% compatibility with all EVM byte characters.

Participation Guidelines and Details

How to participate: Register a Coinbase exchange account and complete KYC verification. Based on feedback, mainland China users can complete KYC verification using their passport and Hong Kong address . Specific details are as follows:

- Subscription period: 9:00 AM on November 17, 2025 to 9:00 PM on November 22, 2025 (ET).

- IPO price: $0.025.

- Minimum investment amount: US$100.

- Maximum investment amount: US$10,000.

Infinex launches IPO on the Sonar platform

Project Overview

Infinex is a decentralized finance (DeFi) platform launched in April 2024 by Synthetix founder Kain Warwick. The project aims to break down the boundaries between CeFi and DeFi, providing a seamless user experience similar to centralized exchanges while maintaining the non-custodial nature and security of decentralized services.

Participation Guidelines and Details

Infinex founder Kain stated that the Time Event (TGE) is expected to take place between late December and early January, with a pre-sale of "Sonar" to be launched prior to TGE. All Infinex tokens will be 100% allocated to Patron NFT holders, with plans to subsequently transform Patron NFTs into the PFP series and reduce the total supply to 25,000 to 50,000 tokens through a synthesis mechanism.

In addition, Kain stated that regarding the token TGE, the team has decided to voluntarily lock up 20% of the total token supply for another 12 months, and release it linearly over 12 months after unlocking, to ensure that liquidity is not obtained prematurely before product-market fit is achieved.

HumidiFi launches on Jupiter DTF platform

Project Overview

HumidiFi is a dark pool trading platform. Dark pool trading platforms (DMMs) are a type of automated market maker that has recently emerged in the Solana ecosystem. Unlike mainstream DEXs such as Uniswap, they operate in the background, usually without an official website, and do not support users to provide liquidity to earn transaction fees. They mainly rely on the anonymous creator's own funds and route and match transactions through aggregators such as Jupiter.

According to DefiLlama data, HumidiFi's total transaction volume in October reached $35.9 billion, surpassing Meteora ($34 billion) and Raydium ($22.7 billion) to become the decentralized trading platform with the largest transaction volume on the Solana chain.

Participation Guidelines and Details

On October 30, Jupiter announced on its X platform that its first ICO project on its DTF platform will be HumidiFi.

Dark pool DEX HumidiFi will become the first new offering project on the Jupiter DTF platform.

According to feedback, this initial public offering (IPO) will be divided into three phases: the whitelist phase, the JUP token staker phase, and the public sale phase on a first-come, first-served basis. The payment method is SOL/USDC.

BOB participates in IPOs on the CoinList platform.

Project Overview

BOB is an abbreviation for "Build on Bitcoin," an L2 technology stack designed to support Bitcoin DeFi innovation and ecosystem development. It not only inherits Bitcoin's PoW security and supports the Bitcoin ecosystem, including Ordinals, Lightning, and Nostr, but is also fully compatible with the EVM.

Bitcoin's security mechanisms are being incorporated into DeFi innovations within the Ethereum ecosystem. The BOB network aims to bring Bitcoin to the center of DeFi activity, releasing a large amount of Bitcoin liquidity that was previously dormant on-chain. BOB provides a DeFi platform that combines Bitcoin's security with Ethereum's functionality, primarily in the following three aspects:

- Bitcoin-based security: BOB is integrated with Babylon, and the Bitcoin Secure Network (BSN) provides security support for cross-chain operations and on-chain activities. Users can participate in Bitcoin staking through BSN, enhancing asset security throughout the cross-chain process.

- Ethereum-compatible DeFi functionality: As a rollup within the Ethereum ecosystem, BOB supports low-cost, fast transaction execution, while also integrating with decentralized exchanges, lending protocols, NFTs, and blockchain games to provide users with diverse on-chain services.

- Trustless BTC deposit method: With the help of the BitVM bridge, users can deposit BTC directly from the Bitcoin main chain into BOB without relying on third-party custodian institutions, further enhancing the trustlessness of the operation.

In summary, BOB builds the security of DeFi interactions directly on the Bitcoin network, avoiding reliance on intermediaries and providing a different path option in current Layer 2 solutions.

According to ROOTDATA , at the end of March 2024, BOB announced the completion of a $10 million seed round of financing, led by Castle Island Ventures, with participation from Coinbase Ventures, Mechanism Ventures, Bankless Ventures, CMS Ventures and UTXO Management, as well as some angel investors.

Participation Guidelines and Details

The BOB token sale is currently underway on the CoinList platform and will end at 1:00 AM Beijing time on November 14th . The token sale link is: https://gobob.xyz/sale .

The total supply of BOB tokens is 10 billion, with this public sale accounting for 4% (400 million tokens). The subscription limit for a single account is $500,000 to $250,000. This token sale on the CoinList platform is divided into the following:

- General Public round: Raised $230 million FDV, with 20% vesting upon TGE, and linear vesting over 12 months, i.e., 6.67% vesting per month;

- BOB Community Member round: raised $165 million FDV, with linear vesting over 12 months, or 8.33% vesting per month.

Immunefi participates in coinlist IPOs.

Project Overview

Immunefi is a Web3 bug bounty platform where participants typically independently explore and report vulnerabilities in exchange for rewards. The platform has recently launched Magnus, an AI-powered security platform designed to address the inefficiencies of current on-chain security measures and the inevitable occurrence of large-scale breaches if the system remains unchanged. Magnus uses artificial intelligence to automate security operations across various aspects, including vulnerability scanning, auditing, bug bounty programs, on-chain monitoring, and firewalls.

Participation Guidelines and Details

According to official information, Immunefi will launch its initial public offering (IPO) on the CoinList platform at 1:00 AM Beijing time on November 13th . Details are as follows:

- IPO price: $0.01337 (fundraising at $133.7 million FDV);

- Unlock status: 100% unlocked during TGE;

- Minimum investment amount: US$100;

- Payment currencies for new share subscriptions: USDT, USDC.

Makina participates in IPOs on the Legion platform.

Project Overview

Makina is a programmable DeFi platform that helps professional DeFi capital allocators deploy complex multi-chain yield strategies on non-custodial, transparent, and fully automated infrastructure. According to DefiLlama data, Makina's TVL has surpassed $100 million.

Participation Guidelines and Details

Currently, the only confirmed information is that Makina is the next new offering project on the Legion platform ; specific details will be announced by the official X account.

FlyingTulip participates in IPOs on the Impossible platform.

Project Overview

FlyingTulip is a one-stop DeFi platform launched by Andre Cronje, which includes multiple functions such as trading, liquidity pools, and lending. It can centralize spot, leveraged, and perpetual transactions in a single AMM protocol, eliminating the need to store them in different protocols and thus solving the problem of liquidity fragmentation.

The official claim is that this product offers the following advantages compared to other DEX protocols: a 42% reduction in impermanent loss, a 9x increase in LP returns, and an 85% improvement in capital efficiency ( for more related content, please read: The man who understands DeFi best brings his new project FlyingTulip ).

Participation Guidelines and Details

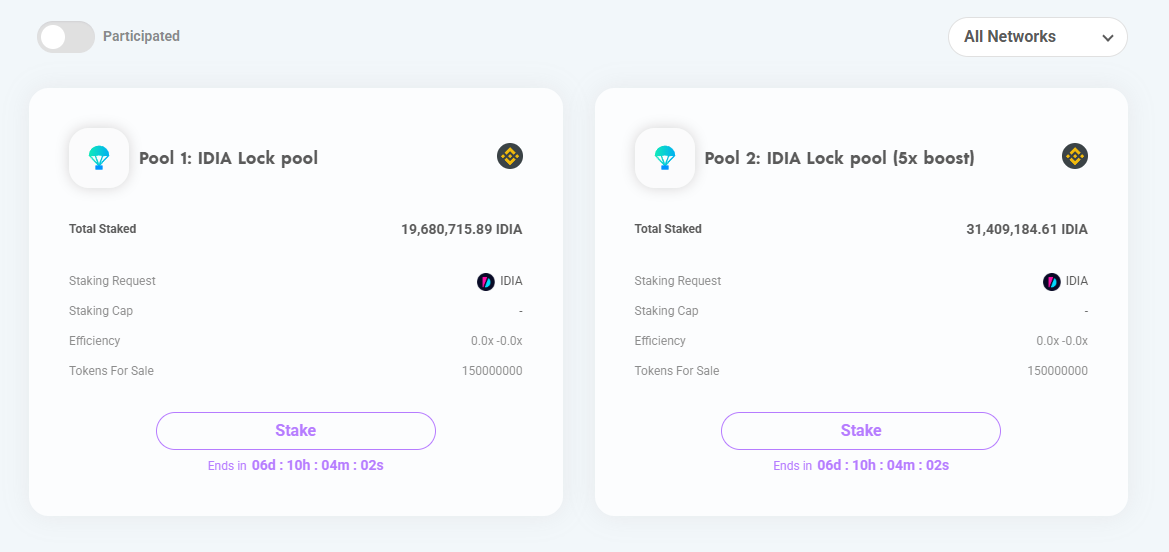

According to official information, FlyingTulip is currently launching its initial public offering (IPO) on the Impossible platform . Users need to stake IDIA tokens to obtain token shares. The event ends at 3 PM Beijing time on November 17th (participation link: https://app.impossible.finance/launchpad/project/168 ).

Two staking pools participated in the FlyingTulip initial public offering.

Brevis may launch an IPO on the Buidlpad platform.

Project Overview

Brevis is an off-chain computing engine built on zero-knowledge proofs, positioned as an "infinite computing layer for Web 3 and everything." Simply put, Brevis makes smart contracts "smarter," shifting from passive execution to active computation, saving computational costs and improving efficiency. This, in turn, facilitates user interaction with the protocol, asset accumulation, and increases protocol adoption. Brevis has recently generated significant community discussion due to Vitalik Buterin's endorsement.

Brevis completed a $7.5 million seed round of funding last November, led by Polychain and Yzi Labs (for a detailed introduction to Brevis, see: Brevis Unveiled: Favored by Vitalik, Raising $7.5 Million, How Does Off-Chain Computing Engine Unlock a New Ethereum Paradigm? ).

Participation Guidelines and Details

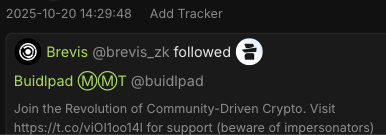

According to community speculation, Brevis may launch its IPO on the Buidlpad platform , for the following reasons:

1. Brevis This project is invested in by the crypto venture capital firm Nomad Capital. Nomad Capital's founder, Erick Z ( @ErickNomad ), is also the founder of the Buidlpad platform.

2. The official Brevis account followed the official Buidlpad account on October 20.

In addition, Brevis users can still participate in the second phase of interactive tasks to win token airdrops ( for details, please see: A Step-by-Step Guide to Participating in the Second Phase of Brevis Tasks ).