1. Project Introduction

MegaETH is a high-performance Ethereum Layer 2 built for the Web3 real-time interaction era, aiming to give Ethereum Web2-level computing and interactive experiences. It adopts a fully EVM-compatible execution environment and, through a self-developed high-concurrency architecture and parallel state management mechanism, advances on-chain response from second-level confirmation to millisecond-level interaction, achieving real-time transaction confirmation and a near-zero-latency on-chain experience. Simultaneously, MegaETH introduces a multi-threaded execution engine, an asynchronous scheduling system, and a low-latency consensus mechanism, breaking through the single-threaded bottleneck at the architectural level and significantly reducing gas costs and interaction latency.

MegaETH's core vision is to become Ethereum's performance engine. Without sacrificing Ethereum's security and ecosystem compatibility, it aims to split the execution layer into independent and horizontally scalable high-performance computing layers, allowing Ethereum's native assets and applications to directly inherit this computing power advantage. MegaETH believes that future public chains will not be isolated ecosystems but will evolve into interconnected computing networks. Ethereum, as the settlement and value layer, needs a performance acceleration layer capable of supporting real-time applications and high-density interactions to drive ecosystem upgrades. Therefore, MegaETH's goal is to propel Ethereum from an asset and value settlement layer to a general-purpose real-time computing and interaction layer, becoming the infrastructure for next-generation on-chain applications.

2. Market Dynamics

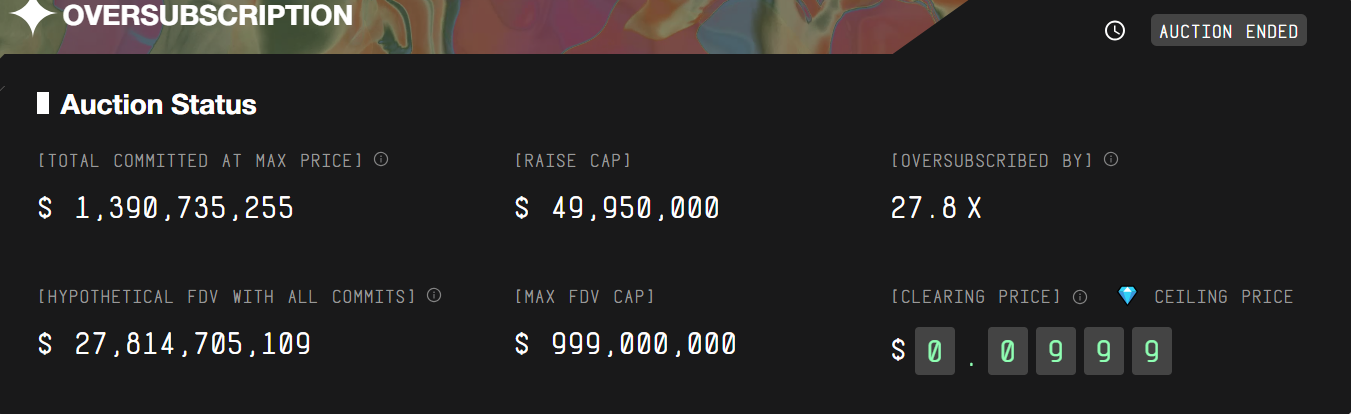

The MegaETH public offering phase has concluded, with overall enthusiasm significantly exceeding expectations. The final subscription size was approximately $1.39 billion, representing an oversubscription of 27.8 times. The offering was completed on Echo's Sonar platform. Of the total 10 billion tokens supplied, 500 million were auctioned off in USDT, representing 5% of the total supply. The entry threshold was set at a minimum of $2,650 and a maximum of $186,282. This offering adopted a British auction model, where the price started at a predetermined low price and increased until a unified market price was reached, at which point all successful bidders settled at the same price. In this round, the starting price was $0.0001 per token (corresponding to a FDV of $1 million), and a maximum cap of $0.0999 per token (corresponding to a FDV of $999 million) was set. Participants submit their bids at the highest price they are willing to pay, but the final price is not determined by individual bids, but rather by the combined market demand. All successful bidders receive tokens at this uniform price (in this round, MegaETH refunded participants who bid below $999 million FDV). Therefore, the user's final cost depends on the final transaction price, not the price ceiling of their individual bids, making the mechanism closer to a uniform price auction than continuous bidding.

It's important to note that the British auction mechanism in traditional finance is often used for high-value, scarce assets that are difficult to price accurately, such as antiques and artworks. Its reserve price is typically determined based on professional valuation, historical transaction prices, and independent assessment models, while the higher price is gradually increased through open bidding. The bidding process is transparent, participants are experienced and possess pricing capabilities, thus achieving price discovery and relatively fair allocation, and effectively preventing manipulation. However, in the crypto market, due to the lack of a mature valuation framework for token assets and the fact that issuers usually pre-set price ranges, investors may find it difficult to gain a clear understanding of the overall valuation and risk level of the project during the subscription phase, leading to information asymmetry. Under these conditions, the effectiveness of the British auction mechanism in the crypto context may differ from that in traditional finance; its price formation process may be more influenced by participant expectations, narrative-driven factors, and market sentiment. MegaETH's choice of the British auction is not only a financing method but also a narrative strategy, a user psychological game mechanism, and a capital efficiency tool. Overall, the subscription enthusiasm and capital structure of MegaETH reflect that high-performance Ethereum execution layers are becoming the focus of capital investment, and MegaETH, as a representative project in this field, has begun to enter a phase of accelerated capital and user awareness.

Source: sale.megaeth

3. Team Background

MegaETH's team possesses both strong underlying technical capabilities and extensive experience within the Ethereum ecosystem. Founding members have expertise in distributed systems research, engineering implementation, and business deployment. Co-founder and CEO Shuyao Kong entered the blockchain industry early on, previously serving as Global Business Development Director at ConsenSys, and is a graduate of Harvard Business School, possessing in-depth knowledge of the Ethereum ecosystem and the global Web3 industry landscape. The technical team also boasts strong academic backgrounds and practical skills. Co-founder Yilong Li holds a PhD from Stanford University, while CTO Lei Yang holds a PhD from MIT, focusing on underlying technologies such as distributed systems, consensus mechanisms, and synchronization algorithms—key to building a high-performance execution layer. Overall, the team combines theoretical depth with industry experience, providing MegaETH with reliable engineering implementation capabilities for its high-performance roadmap.

Since 2024, MegaETH has raised approximately $30 million in funding. In June 2024, it completed a $20 million seed round led by leading funds such as Dragonfly, with participation from Figment Capital, Robot Ventures, Big Brain Holdings, and other industry leaders, including Vitalik Buterin, Joseph Lubin, Sreeram Kannan, and Cobie. In December 2024, it raised another $10 million through a community round, further strengthening its user and community connection.

4. Token Information

MegaETH's native token is $MEGA, with a total supply of 10 billion. The token uses a KPI-driven distribution mechanism, meaning token release is linked to the network's actual growth data. A new round of token release is triggered when the network reaches specific performance and ecosystem goals. The token distribution structure is as follows:

- The KPI reward pool accounts for approximately 53% of the total reward pool, and only staking users can participate. The staking period is between 10 and 30 days, with longer staking periods resulting in higher reward weighting. Based on network metrics, performance-based staking rewards are distributed over time.

- Other investors and early-stage investors accounted for approximately 24.7%, including institutional investors (approximately 14.7%), Echo round investors (approximately 5%), Fluff buyers (approximately 2.5%), and the Sonar rewards pool (approximately 2.5%).

- The team and consultants account for approximately 9.5% of the total, with a one-year lock-up period, and the shares are gradually unlocked in a linear fashion over three years.

- The foundation and the ecosystem reserve account for approximately 7.5% of the fund, which is used for ecosystem development, strategic cooperation, and the maintenance of the sustainability of agreements.

- The public offering accounts for approximately 5%, and all tokens will be distributed to the purchasers; the issuer will not directly retain any assets.

5. Competitive Landscape

As the Layer 2 competition accelerates into a phase of differentiation at the execution layer, MegaETH has chosen a performance-first approach. Its goal is not to engage in price wars or subsidy wars with traditional general-purpose Layer 2s, but rather to gain an advantage in high concurrency, low latency, and real-time applications. With the increasing density of on-chain transactions and interactions, new application models such as real-time order books, high-frequency DeFi, and AI agents are gradually entering the validation phase, providing a compelling narrative and demand for high-performance Layer 2s. MegaETH has already attracted early investment from multiple projects across various sectors, and its ecosystem development pace is faster than other projects at the same stage. It is expected to be the first to successfully establish a growth curve characterized by high performance, high-value applications, user activity, and capital accumulation. If this flywheel turns smoothly, MegaETH has the potential to become a representative project of high-performance execution layers within the Ethereum ecosystem, providing the computing power and real-time interaction foundation for the large-scale deployment of Web3 applications in the next stage.

It's important to note that MegaETH is still in its early stages, and the long-term stability of the mainnet, its execution performance, and its long-term compatibility with the Ethereum mainnet all require time to verify. Furthermore, the token has not yet been TGE'd, leaving future market pricing and liquidity release uncertain. In addition, the performance-for-speed architecture places higher demands on security, the barrier to entry for node participation, and the degree of network decentralization. If ecosystem growth fails to keep pace, performance cannot be consistently delivered, or competitors with more differentiated performance approaches emerge in the market, MegaETH's period of dominance may be shortened.

- 核心观点:MegaETH旨在打造高性能以太坊Layer2。

- 关键要素:

- 采用并行架构,实现毫秒级交易确认。

- 公募超额认购27.8倍,融资热度高。

- 团队技术背景强,获3000万美元融资。

- 市场影响:推动高性能Layer2成为资本新焦点。

- 时效性标注:中期影响