If the X402 is widely adopted, which businesses and projects will be the most profitable?

- 核心观点:x402协议价值捕获在接口与分发渠道。

- 关键要素:

- Coinbase掌控完整技术栈与闭环。

- API卖方可通过兼容获取新收入。

- 浏览器等接口层主导支付集成。

- 市场影响:重塑互联网微支付生态。

- 时效性标注:长期影响。

Original author: Yash Agarwal, founder of SendAI

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

The x402 protocol is generating a lot of buzz, with a16z even calling it a new market that could reach $30 trillion.

As someone who has been following the protocol since its inception, I began to think about a more practical question: if it really has that much potential, who will be the biggest value capturer?

I will no longer explain the technical details of the x402, but instead want to explore its value capture mechanism and potential adoption path from a more pragmatic perspective.

The core functionality of x402 is simple: it allows any API call to become a payment. In other words, any button click can be a "micro-transaction".

x402 is not a new technology. All of its functions can be achieved through blockchain transactions, and all blockchain limitations (such as gas fees and wallet interactions) also apply to x402 transactions.

However, as a standard protocol, it is indeed very powerful—because it is compatible with HTTPS, making the payment experience across the entire internet more "user-friendly".

Like other payment systems, x402 has four main types of participants:

- API seller (supply side);

- API buyer (demand side);

- Facilitators;

- Infrastructure (chains and tokens);

API seller (supply side)

API sellers are generally divided into two categories:

(1) First/secondary sellers (e.g., Switchboard selling its own pricing data);

(2) Third-party sellers (e.g., selling Helius' RPC services through proxies or API wrappers);

In the first scenario, once market demand is large enough, they will have a direct incentive to make their APIs x402 compatible—because it will allow them to access a completely new market. For example, websites like The New York Times could easily convert their webpages to x402 compatible, requiring crawlers or AI agents to pay upon access, which would bring them new revenue streams. Similarly, commercial platforms like Airbnb could choose to be x402 compatible, allowing AI agents like Perplexity to make payments via USDC, while the agents themselves would automatically earn commissions on the same transaction.

In the second scenario, they are more likely to evolve into an "API marketplace"—encapsulating various APIs and providing users with convenient payment methods. Their business model involves arbitrage between costs and fees (for example, a monthly cost of $20, with a charge of $0.0001 per call).

In the short term, facilitators also have an incentive to move toward the API market in order to attract users and solve the cold start problem (such as @corbits_dev).

The seller's direct market opportunity is to modify their API or website to be x402 compatible, leveraging network effects to gain additional revenue and traffic.

API Buyer (Demand Side)

API buyers are the users or consumers of the API—usually AI agents.

As long as a user or agent has a wallet, they can pay for any API via x402. However, this is also the hardest part to get started in the entire supply chain. It's fair to say there's almost no real demand at present (most transactions are just spam test transactions).

There are two ways to stimulate demand:

- The seller sells data only via x402 (e.g., a news website only allows web crawlers to access data via x402 payment).

- There are plenty of APIs available for proxies or applications to easily access via x402;

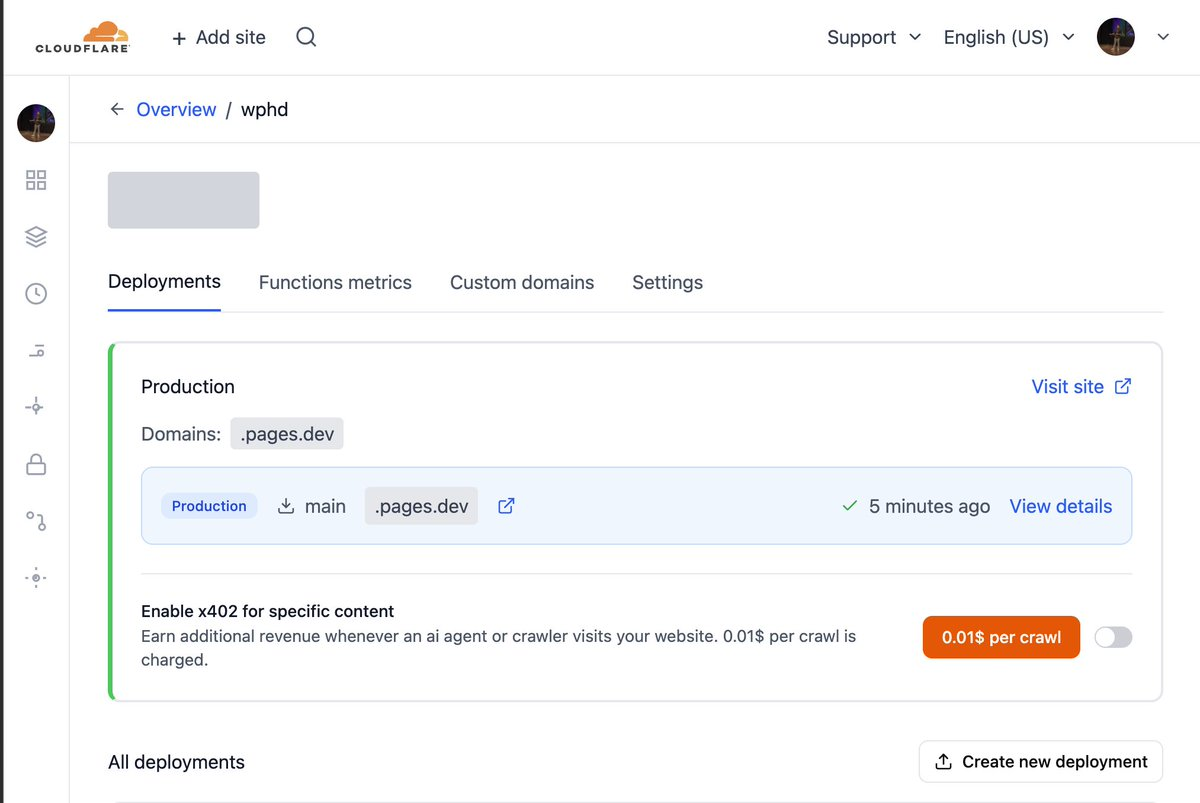

In my view, one of the biggest potential drivers is Cloudflare—a partner of the x402 Foundation and very interested in the pay-per-crawl model. Cloudflare is the world's largest content delivery network provider, deeply involved in the distribution of internet traffic (covering APIs, content, and services). They could simply provide a switch to enable x402 for specific content, allowing developers to earn additional revenue through traffic.

I suspect that Cloudflare may initially partner exclusively with Coinbase or Base, using their own stablecoin, NET Dollar, as the payment method.

Agentic commerce platforms like ChatGPT and Shopify could certainly become one of the biggest drivers of demand for x402.

It's important to note that many people believe x402 enables "walletless payments," but this is a misunderstanding. x402 isn't magic—it still requires a wallet and blockchain transactions with gas fees, but these processes are abstracted and hidden, or can be batch-settled off-chain as "API credits."

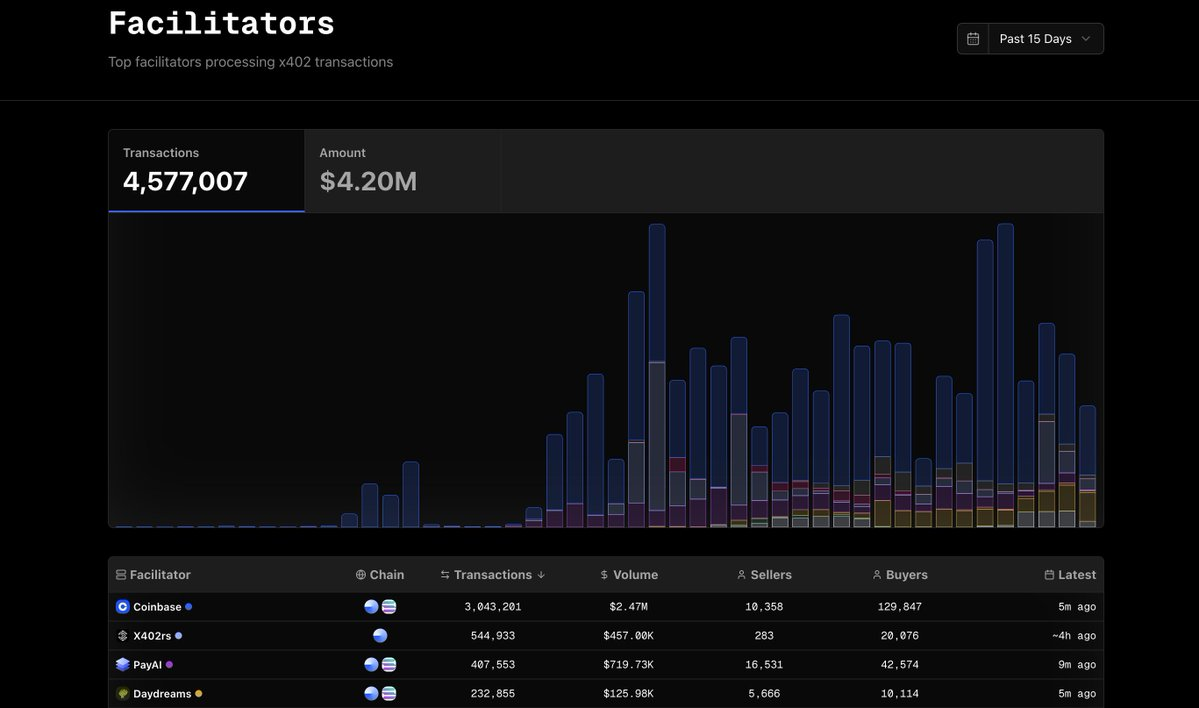

Facilitators

Like Visa or MasterCard, intermediaries need to route payments between API buyers and sellers. They typically charge between 0 and 25 basis points (most even 0%) – but this can eventually turn into a “price war” because there are virtually no barriers to entry for setting up a new intermediary.

Visa and MasterCard possess strong network moats, but the middleman in x402 has virtually no moat—because the underlying blockchain itself is the one that reaps the network effects . Large players like Cloudflare or Google can launch their own Facilitator on any blockchain (such as Solana or Base) in just one day because they have already mastered the interface layer.

Larger entities, such as Coinbase, tend to make intermediaries completely free and open-source in order to drive ecosystem adoption, thereby squeezing all profit margins in the short term.

Infrastructure (chain and tokens)

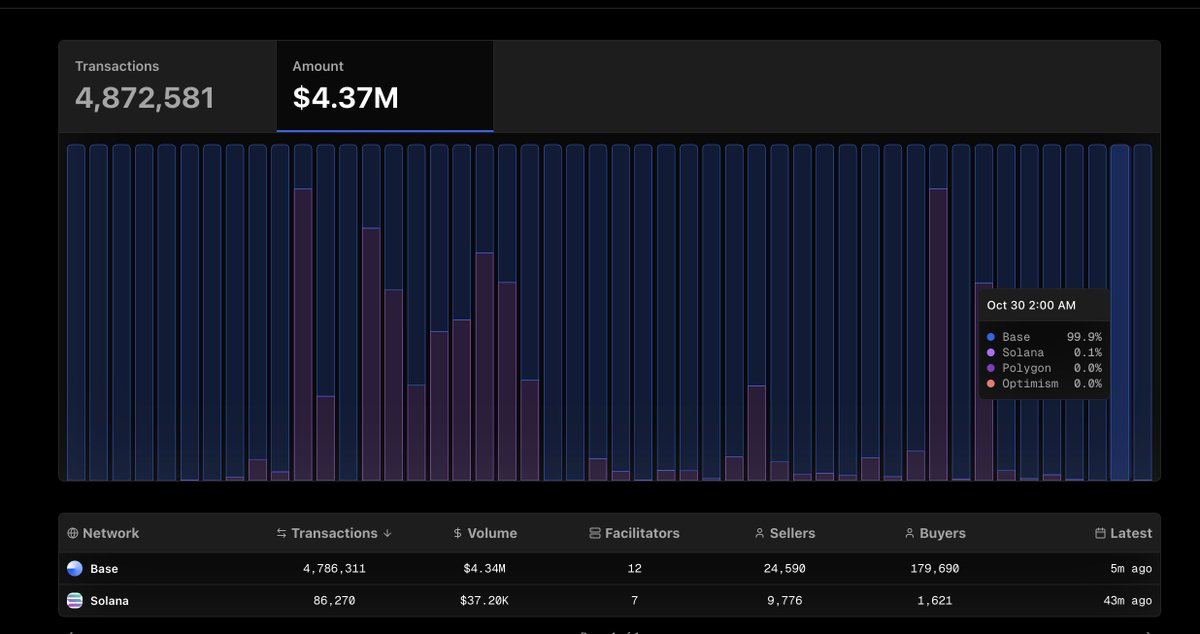

Since x402 is Coinbase's "own child," Base and USDC will always be the number one blockchain and number one stablecoin.

However, every chain is actively promoting the adoption of x402, including Solana, which is currently hosting an x402 hackathon. Every stablecoin project and public chain is vying for dominance in x402, as this will directly increase the chain's "on-chain GDP" —including the total value locked (TVL) of stablecoins and the number of transactions, because more and more micropayments will occur on that chain.

For example, we can observe that some stablecoin public chains (such as Tempo and Arc) are attempting to deeply integrate x402 into enterprise-level development tools. In my view, public chains, tokens, and wallets will ultimately capture the most value within the entire x402 technology stack.

The reason Coinbase and Brian Armstrong are so aggressively promoting x402 is because Coinbase effectively controls the entire x402 technology stack:

- Facilitator: Coinbase;

- Chain: Base;

- Stablecoin: USDC;

- Wallets: Base App and Coinbase embedded wallet;

Coinbase can directly market this entire system to businesses such as Cloudflare or Vercel—providing end-to-end commercial solutions on top of an open-source license.

Almost all large enterprises (such as Stripe) want to have their own x402-like protocols or run x402 payment systems on their own blockchains (such as Tempo).

Furthermore, large-scale micropayments are currently not economically feasible on blockchains such as Solana or Base. For example, on Solana, any payment below $0.10 is not economically viable due to the existence of base and priority fees—because payment transactions compete for block space with speculative transactions (such as meme coin exchanges).

I personally really like Tempo's design, which features a dedicated payment lane for payment transactions. It's foreseeable that as x402 adoption increases, there will be payment sidechains, application chains, or rollups specifically designed for x402 micropayments.

Interfaces and Wallets: Capturing Value

There are no secrets here. Whoever controls the distribution channels and interfaces can capture the most value—this includes various platforms, markets, AI chat applications, AI browsers, and so on.

In the internet world, browsers capture the most attention, thus becoming the most natural and promising entity to deeply integrate with x402 and dominate the wallet layer.

Imagine if Chrome had a native wallet; every click in the browser could potentially become an x402 payment. Any API, simply by being whitelisted for security, could become a payment-triggering API call. They could even charge a 0.05% fee on each transaction, and users would willingly pay for the convenience.

However, x402's biggest competitor is actually Stripe. For example, ChatGPT, the largest consumer AI application, has announced a partnership with Stripe to enable e-commerce functionality. Stripe has its own Agentic Commerce Protocol, which allows transactions to be completed on existing credit card payment networks via shared payment tokens.

x402 and Dynamic Resource Pricing

While x402 excels in static pricing (e.g., "$0.001 per API call"), it has yet to demonstrate the most powerful potential of blockchain—creating a market for everything.

In my view, the unique advantage of the x402 lies in its ability to empower the "resource market," which can include:

- Data or results (such as prices or news articles)

- Computational or reasoning ability;

- Specific operations (such as booking a flight);

- Complex tasks (such as customizing a chair);

- Priority services (such as time slots or bandwidth reservations).

Historically, the essence of markets lies in their ability to solve the problem of information coordination—prices naturally reflect the relationship between supply and demand.

Imagine a future where you can tell an AI agent, "Customize a chair for me according to these specifications for $500." The agent will then automatically coordinate multiple individuals and systems to find timber, hire carpenters, and arrange delivery—all autonomously, solving the "resource coordination problem" directly at the machine level.

Thanks to LLM and AI agents, for the first time we have machines capable of reasoning and negotiating throughout the supply chain. This will enable ultimate financialization—every resource and action can be dynamically priced, with agents seamlessly trading and paying each other in the background. While x402 itself doesn't directly handle dynamic pricing, blockchains like Solana can achieve this—by creating permissionless markets.

In the future, Airbnb prices may no longer need to be set by the hosts themselves, but will be automatically determined by market demand – this is the future we are moving towards.

The Future Path of x402

I love the standard protocol, and I love x402 and the endless possibilities it brings, but there is no doubt that x402 is currently being heavily hyped.

If you're buying so-called "x402 tokens," I can say with certainty that 99% of them are worthless. I'm relatively pessimistic in the short term, but extremely optimistic about the future of x402 in the long term: it is very likely to become the foundational protocol for the Agentic Web and one of the native features of future crypto networks.

x402 reminds me of Solana Blinks—back then, every click triggered a Solana transaction request, but unfortunately, Blinks ultimately failed to achieve widespread adoption. This time, however, giant Coinbase is leading the way. If all this succeeds, we will completely reshape the internet payment system.

In short, within the x402 technology stack, the party that controls the interface, distribution channels (as well as assets and blockchain) will capture the most value. Coinbase is heavily promoting x402 precisely because it possesses a complete closed loop from top to bottom.