GIGGLE experienced a rollercoaster ride; whose responsibility is the sudden collapse of the BSC ecosystem?

- 核心观点:CZ声明引发BSC生态Meme币集体闪崩。

- 关键要素:

- 币安公告利好刺激GIGGLE暴涨60%。

- CZ澄清非官方代币致价格腰斩。

- 恐慌蔓延致BNB等生态代币跟跌。

- 市场影响:暴露BSC生态过度依赖中心化叙事风险。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

Amidst a continued market downturn, the BSC ecosystem suffered an even greater blow due to an unexpected emotional outburst.

On November 3rd at around 5 PM, GIGGlE, a meme token themed around the Giggle Academy charity education project endorsed by CZ, initially surged due to a positive announcement from Binance, but then plummeted due to CZ's statement, exhibiting an extremely dramatic "roller coaster" market trend in a short period. This also caused a short-term plunge in several other representative meme tokens in the BSC ecosystem, such as "4" and "Binance Life".

The Rise of Giggle

GIGGLE's development team is the BSC community team GiggleFund. Although the project is not directly related to the Giggle Academy team, it has keenly captured the hype opportunity when the latter donated on the open chain, and achieved a soft "binding" of community consensus by using "transaction fee donation" as a selling point.

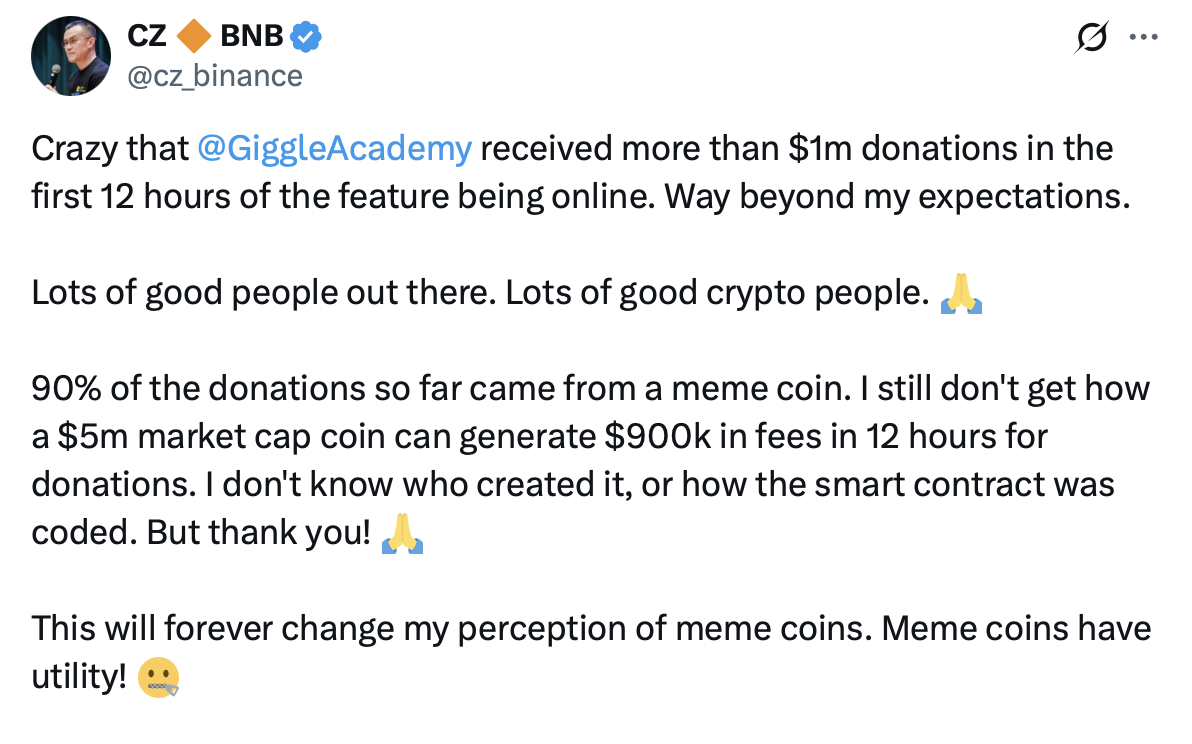

On September 21st, Giggle Academy announced it would begin accepting public donations in cryptocurrency to help more children access free, high-quality education. GiggleFund launched GIGGLE to coincide with this, announcing that all GIGGLE transaction fees would be donated to Giggle Academy. This excellent entry point led to a rapid surge in GIGGLE's popularity; within 12 hours of opening donations, Giggle Academy received over $1 million in donations, approximately 90% of which came from GIGGLE transaction fees. CZ specifically praised this move, stating that it "changed his view on Meme tokens, demonstrating their practical use," further solidifying GIGGLE's leading position in the BSC ecosystem.

While continuously contributing transaction fees to Giggle Academy (the latest figure is $11.2 million), GIGGLE also quickly established a secure platform – launching Alpha on October 3rd, perpetual contracts on October 9th, and spot trading on October 25th . Although Giggle Academy clarified on October 25th that it "has never issued any cryptocurrency, token, or smart contract address," the more explicit positive news of "spot trading" fueled a surge in community enthusiasm for GIGGLE – it briefly reached an all-time high of $313 that day, corresponding to a market capitalization of $313 million.

The rollercoaster market crashed the BSC ecosystem.

Following its listing on Binance Spot, and with the cooling of the Meme sector and the overall market, GIGGLE's popularity and price have experienced a sustained decline. During this period, GIGGLE holders began calling on the community for Binance to donate the transaction fees from GIGGLE spot and futures trading on its platform to continue the token's initial vision—which, of course, also included the holders' expectation that the market would interpret this as Binance reiterating its support for GIGGLE.

At 17:06 on November 3rd, the community's expectations were finally fulfilled—Binance officially announced that starting in December, 50% of the transaction fees generated from GIGGLE spot and margin trading will be donated to charitable projects supported by the Giggle Fund. Stimulated by this positive news, GIGGLE surged from around $70 to a high of $113.99, a short-term increase of over 60%.

However, the good times didn't last long. Perhaps to prevent excessive hype in the community, or perhaps to help Giggle Academy clarify its relationship, CZ suddenly posted at 17:46: "GIGGLE is not an official token issued by Giggle Academy. I don't know who issued it."

This blunt statement was quickly interpreted by the market as "GIGGLE has been abandoned," and panic ensued. GIGGLE's price began to plummet, not only quickly erasing previous gains but also falling as low as $56.21.

Worse still, many users rushed to buy at the moment Binance announced the news, and the sudden shift in sentiment led to many being trapped or even liquidated. Well-known on-chain trader 0xSun disclosed that he lost $980,000 as a result and expressed his disappointment with the BSC ecosystem; another prominent Chinese-language KOL, Lee Chan, also disclosed that he lost $426,000.

Immediately, disappointment and panic began to spread to other BSC ecosystem tokens. As of 22:40 on November 3rd, BNB was trading at 1018 USDT, a 24-hour decrease of 6.01%; BNB 4 was trading at 0.064 USDT, a 24-hour decrease of 23.66%; and Binance Life was trading at 0.154 USDT, a 24-hour decrease of 27.52%.

The market also experienced another round of decline in the evening...

Why did a single statement cause such a stir?

Just one month has passed since the BSC surge in early October. BSC is indeed an ecosystem full of wealth potential, but it can also be vulnerable to a stampede-like crash due to a single piece of "news".

This is clearly not a question that can be answered definitively in a few words. Looking back at this cycle, the industry's development seems to have taken a divergence. On the one hand, while the slogan of mainstreaming is constantly being chanted, institutions seem to be interested only in a very few assets such as BTC and ETH; on the other hand, affected by the lingering effects of "VC manipulation" and "insider trading," as well as new problems, old narratives have been repeatedly shattered, new narratives have failed to take over, retail investors have consistently failed to form a general consensus on the overall direction, and hot topics have always been fleeting.

Against this backdrop, rather than navigating a fragmented market, focusing on attention and liquidity has gradually become the primary path for new projects to break through. Leveraging the industry's largest user base and liquidity hub, Binance's importance in the entire industry chain is becoming increasingly apparent. Especially after Binance tightened its listing restrictions on other ecosystems like Solana and Base, and began openly and aggressively supporting BSC, Binance and BSC have become the central battleground for retail trading. CZ and He Yi, as key figures in this central battleground, are easily interpreted and amplified by the community as "divine pronouncements," leading to a larger-scale collective emotional impact.

In early October, BTC broke through its all-time high, and market sentiment was extremely positive, with retail investors full of imagination and confidence about the future. At that time, CZ and He Yi didn't even need to provide any explicit support; a mere mention was enough to ignite community sentiment and create phenomenal hit tokens like "Binance Life."

However, it wasn't just positive emotions that were amplified. After the epic liquidation on October 11th, market liquidity tightened rapidly, retail investors were highly tense, and the balance of power had shifted dramatically. Like CZ's comments regarding Giggle today, his intention might have simply been to make a statement, similar to Giggle Academy's official clarification on October 25th. However, the already tight liquidity in the market reacted directly, leading to a collective decline across the ecosystem.

From a broader perspective, today's unexpected flash crash of BSC is less a temporary loss of control over market sentiment and more a microcosm of the structural abnormalities in the entire industry.

When attention and liquidity become the only remaining anchors of value, the market's operating logic is no longer based on technology, products, or long-term beliefs, but rather on discourse power, social relationships, and speculative psychology. Under this distorted market structure, the cycle of reflexivity will always accelerate; rises will be glorified, while falls will be seen as betrayal —CZ may never have changed, but the image of CZ imagined in collective sentiment is never under control.