CZ has built a position in ASTER. Will this shake Hyperliquid's position?

- 核心观点:赵长鹏首次公开买入并喊单ASTER。

- 关键要素:

- 个人买入209万枚,价值超190万美元。

- ASTER价格1小时暴涨近30%。

- 项目由其孵化,定位多链Perp DEX。

- 市场影响:提振BNB Chain生态与Perp DEX竞争。

- 时效性标注:短期影响。

Original author : 1912212.eth, Foresight News

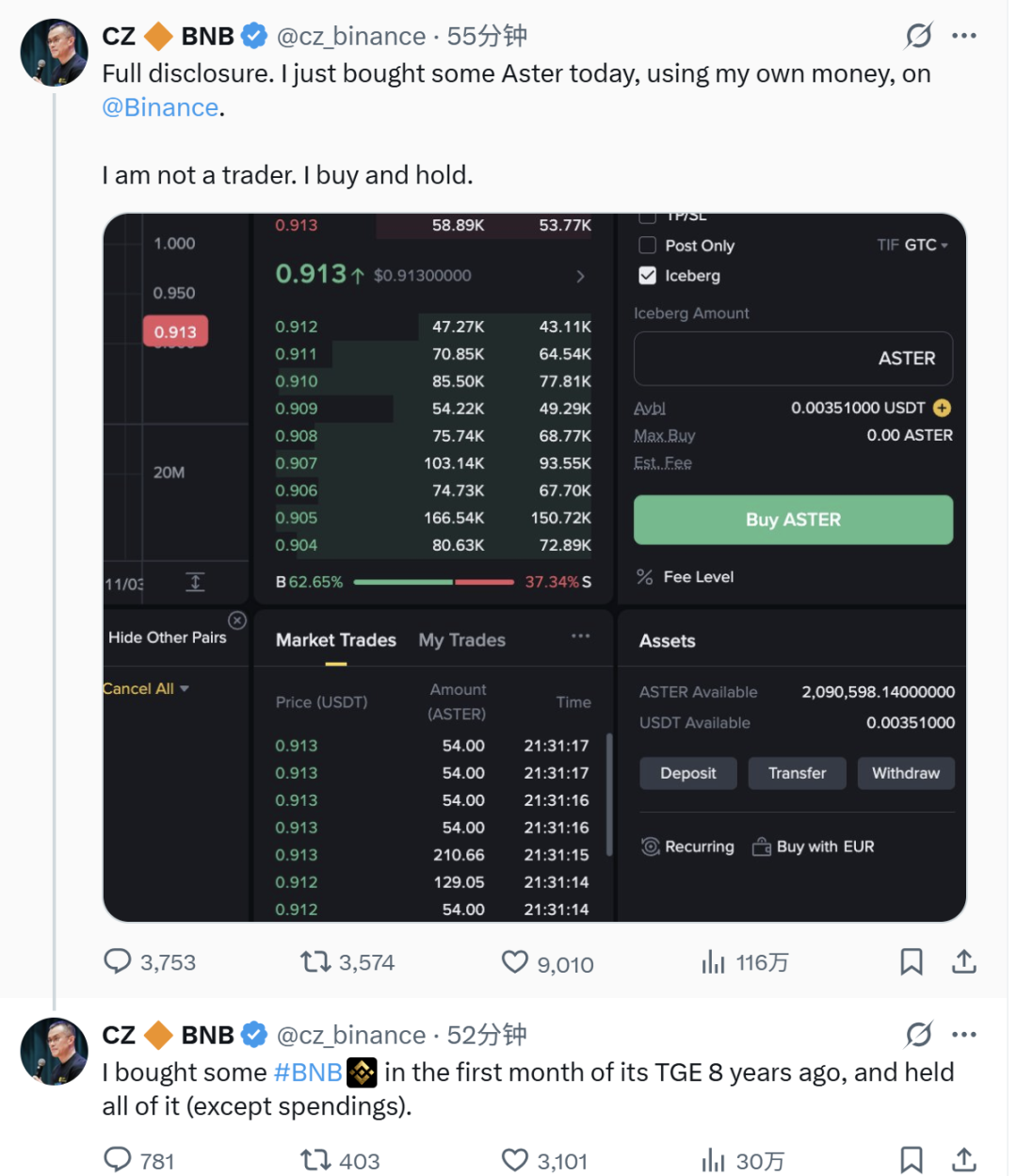

On the evening of November 2, Zhao Changpeng announced that he had used his own money to purchase 2.09 million Aster tokens. He then followed up with a series of meaningful tweets, saying, "Eight years ago, I bought some BNB in the first month of TGE and have held them ever since (except for the portion used for consumption)."

ASTER quickly rose from $0.90 to around $1.25, a nearly 30% increase in one hour.

This wasn't a casual statement from Changpeng Zhao; it was the first time he had publicly and directly endorsed a specific cryptocurrency. Prior to this, while he had mentioned the Aster project multiple times in posts praising its innovation, he had never disclosed his personal holdings or purchasing activity. This purchase signifies Changpeng Zhao's strong endorsement of Aster.

Regarding the specific transaction details, according to Zhao Changpeng's publicly available Binance account records, the average price was locked at $0.913, with a total value exceeding $1.9 million. Zhao Changpeng emphasized that he is not a trader but a long-term holder, which is consistent with his consistent investment style—not frequently trading after purchase, but focusing on the long-term value of projects.

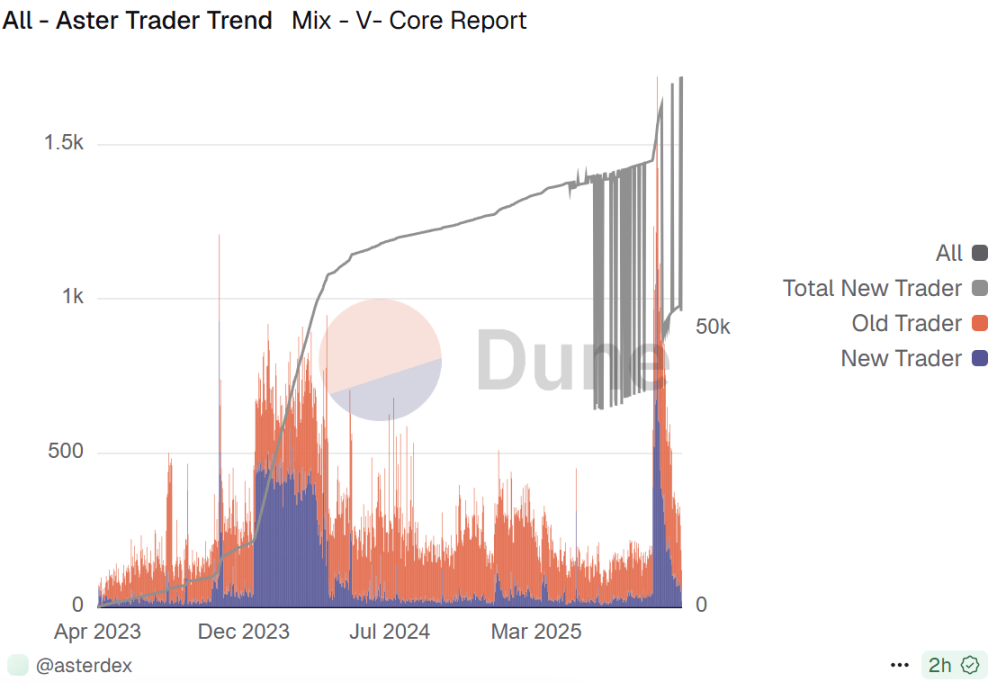

From a timeline perspective, this purchase occurred shortly after Aster's token listing, during a period of market volatility. Changpeng Zhao's move to build a position led to a surge in trading volume. Aster's market capitalization rebounded to above $2 billion.

The final battle against Hyperliquild?

Back in September, Changpeng Zhao (Zhao Changpeng) interacted with Aster-related content multiple times, praising its Hidden Order feature, noting that it was implemented in just 18 days, much faster than over 30 similar projects. He also retweeted Aster posts, emphasizing its multi-chain support and low-fee advantages, driving the growth of the BNB Chain ecosystem. However, these were all project-level comments, with no disclosure of personal investment. It wasn't until November 2nd that his open investment was revealed.

Zhao Changpeng's purchase of Aster shares was not a spur-of-the-moment decision, but a well-thought-out strategic move.

Since leaving his position as CEO of Binance, Changpeng Zhao has shifted his focus to investment and ecosystem building. His company, YZi Labs, is a key backer of Aster, and the Aster DEX, incubated by YZi Labs, focuses on next-generation Perp DEX innovation. Zhao's purchase of Aster shares is tantamount to voting for his own project with real money, sending a signal to the market that Aster is not a short-term speculative investment, but rather a long-term potential infrastructure.

Aster positions itself as a multi-chain Perp DEX, supporting platforms like BNB Chain. Its core selling point is Hidden Orders—large orders are only made public after matching, preventing front-end manipulation and attacks. Aster addresses a pain point of traditional DEXs, such as the vulnerability of publicly available order books to manipulation by competitors like Hyperliquid.

Zhao Changpeng's endorsements are essentially aimed at "driving traffic" to the BNB Chain ecosystem, increasing liquidity into BNB Chain and stimulating gas fees and DeFi activity. According to the latest data from Dune, Aster currently has over 5.314 million users, a total TVL exceeding $1.256 billion, and a staggering total transaction volume of $2.9 trillion. From September to October this year, a large number of new users flooded in, with daily increases even surpassing those seen during the bull market of early 2024.

The Perp DEX market is highly competitive, with Aster standing out due to its low fees, tokenized stocks, dark pool trading, and grid trading. When Changpeng Zhao bought in, rumors circulated that he had sold $30 million worth of ASTER shares (later denied), which only highlighted his determination to defeat Hyperliquild in the perpetual contract DEX arena.

Over the past few years, whether it's Pancake, wallet products, or Alpha, Binance wasn't initially the leader, but it always managed to maintain a close competition, or even surpass it later on. This has led the market to wonder if Aster can challenge Perp DEX's leading position.

Perhaps the real battle of derivatives is yet to come.

Can on-chain buybacks save the large unlocks in November?

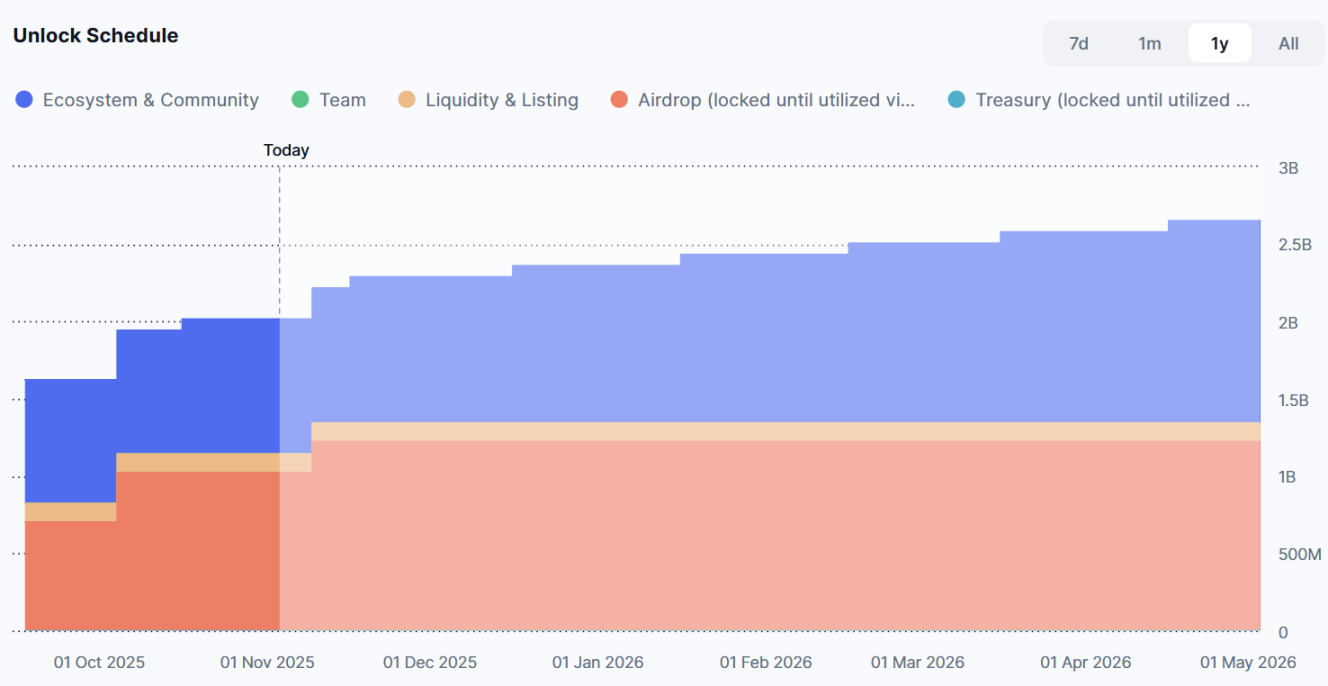

Aster's token economic model is designed for gradual release, with a total supply of 8 billion tokens. In November, Aster will experience two cliff unlocks.

According to Binance App data, approximately 200 million ASTER tokens (representing 2.5% of the total supply) were unlocked on November 10, worth approximately $240 million (at current prices); on November 17, approximately 72.73 million ASTER tokens (representing 0.91% of the total supply) were unlocked, worth approximately $87.276 million.

The market is experiencing a liquidity crunch, and the selling pressure from S3 tokens and token unlocking have led to a wait-and-see attitude among market investors.

On October 30th, Aster officially announced that its S3 buyback is completely transparent and 100% executed on-chain, with tokens being purchased daily from the open market until the cumulative amount reaches the target range of 70%–80% of transaction fees during the S3 period. ASTER's S3 phase will last 35 days, ending on November 9th. Furthermore, the S3 airdrop will launch after all buybacks are completed, prioritizing the distribution of tokens from the buyback address; any shortfall will be unlocked from the airdrop allocation pool to ensure full distribution.

According to the latest data from DefiLlama, Aster's average daily transaction fees have been around $1.93 million recently. Based on this, the daily repurchase amount has been between $1.35 million and $1.54 million recently.

On October 31, the official announcement stated that 50% of all its buyback funds (including S2 and S3) would be burned through a public buyback address to reduce supply and solidify ASTER's long-term value. The remaining 50% would flow back to a locked airdrop address, thereby reducing circulating supply and reserving more for future airdrops to reward genuine Aster users and long-term holders.

The official buyback force continues to support its price. Perhaps when market liquidity is ample and the market improves, and the popularity of derivatives returns, the impact of its unlocking and selling pressure may be reduced.