On October 31, 2025, Coinbase released its Q3 financial report. This report came at just the right time, injecting a strong boost into the liquidity-deficient crypto industry.

Total revenue reached $1.87 billion, a 55% year-over-year increase and a 25% quarter-over-quarter increase. Net income was $433 million, compared to only $75.5 million in the same period last year. Earnings per share were $1.50, exceeding analysts' expectations by 45%. Wall Street analysts applauded, and JP Morgan upgraded its rating to "overweight" last week with a target price of $404.

While many anticipated poor liquidity and lower-than-expected trading volume in the cryptocurrency market in the third quarter, Coinbase delivered a perfect performance, with consumer trading volume surging to $59 billion, a 37% increase from the previous quarter. Retail trading revenue reached $844 million.

In addition, Coinbase has been consistently increasing its Bitcoin holdings. Through weekly fixed-amount investments, it has added $299 million to its Bitcoin holdings this quarter. As of now, its total Bitcoin holdings have reached 14,548.

"Everything can be traded" is central to the next phase of our development, CEO Brain Armstrong said during the company's earnings call. In addition, Coinbase is integrating prediction markets, tokenized stocks, and other products into its platform.

Behind the trend of everything being tradable, Coinbase is no longer just a guardian of cryptocurrencies; it is transforming into a "crypto-Apple ecosystem" that connects people and capital.

What ambitions does Coinbase have behind this acquisition of 14,548 BTC?

Wall Street applauds the turnaround: Base x USDC transforms from a side hustle into a cash cow.

Looking back from 2023 to the present, the stock price of Coinbase, the first cryptocurrency stock, has been like a roller coaster, climbing from a low of $30 to over $300 today. This is not due to luck, but to its two-pronged approach: Base and USDC.

These two were originally "side jobs," but now they have become cash cows, and Wall Street's praise for the turnaround came swiftly and directly.

COIN Price Chart | Source: Tradingview

First, let's talk about JP Morgan's rating being upgraded to "overweight".

On October 24, analyst Kenneth Worthington stated in a report that "Coinbase is undervalued, with the potential value of the Base token at $12-34 billion."

Base is an Ethereum Layer 2 network incubated by Coinbase. When it was launched in 2023, it was just a "low-fee testbed" but has now become a star.

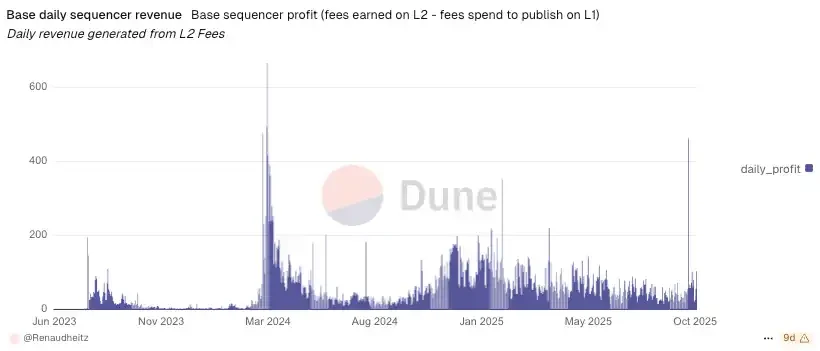

Where does this money come from? As an Optimistic Rollup, Base requires each transaction to be packaged onto the blockchain using a single sequencer and scale effect. Although the fees are low (averaging $0.01 per transaction), the scale effect is terrifying—daily transaction volume has exceeded 5 million multiple times, double that of the mainnet. The sequencer model makes fee revenue a strong source of cash flow.

Base sorter revenue | Image source: Dune

Coinbase transferred all these fees to its own escrow account, citing "security and auditing" reasons, but the community criticized this as "centralized leeching." Management responded in the earnings call that they would explore ecosystem revenue sharing in the future, such as returning a portion of the fees to developers or users, creating a positive feedback loop.

Even more anticipated is the potential native token of Base.

JP Morgan predicts that if Base issues its native token, its market capitalization could reach tens of billions of dollars.

What can the token do? It incentivizes usage flexibility, allowing holders to participate in governance, stake to earn fee revenue, and even use it for gas fee discounts. With millions of daily active users and huge revenue elasticity, if the token is successfully implemented, Base can quickly transform from a "cost center" into a "profit engine."

Looking at USDC, this stablecoin is a joint venture between Coinbase and Circle.

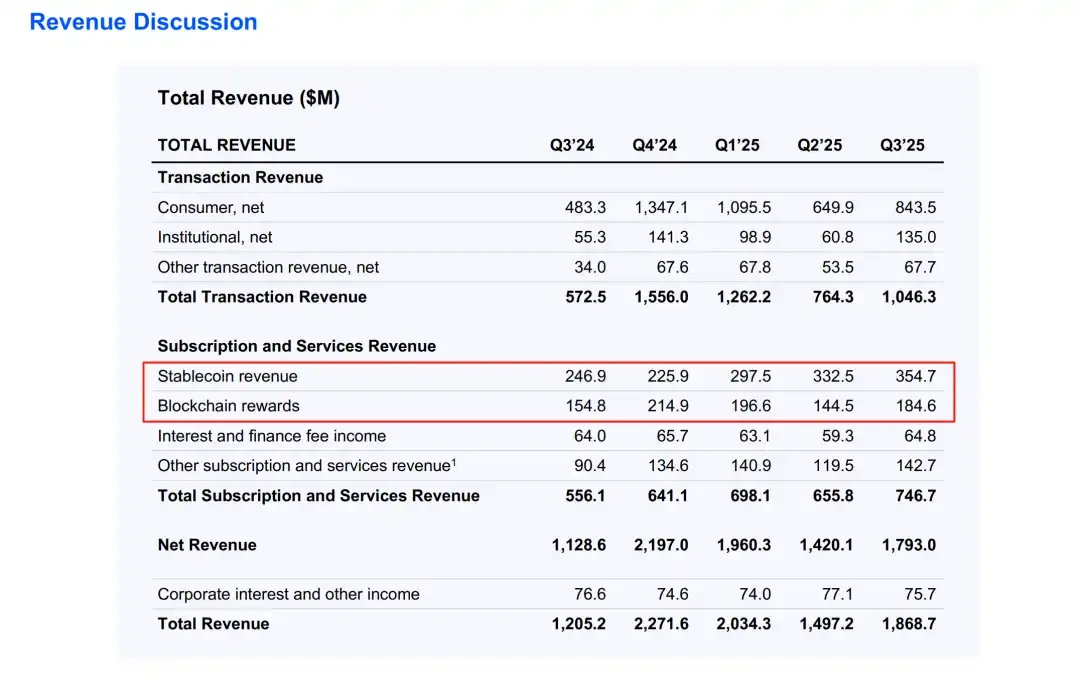

The Q3 financial report shows that USDC's market capitalization reached a record high of $74 billion. The average USDC balance on the Coinbase platform was $15 billion, a 9% increase quarter-over-quarter. The average USDC balance outside the platform was $53 billion, a 12% increase quarter-over-quarter. Stablecoin revenue was $355 million, a 7% increase quarter-over-quarter.

Stablecoin revenue and blockchain revenue | Image source: Coinbase

Its revenue sources are diverse, including interest rate spreads (USDC reserves invest in US Treasury bonds, earning a yield of 4-5%), custody fees (Coinbase Prime provides institutional custody, taking a 0.1-0.2% commission), clearing fees (cross-border transfer fees), and merchant revenue sharing (integrated into e-commerce platforms such as Shopify, taking a 1% commission).

Why is USDC so profitable?

Because it has penetrated merchants and cross-border settlements. Management revealed that USDC has a 15% penetration rate in cross-border payments, especially in emerging markets such as Latin America and Southeast Asia, where users use it to avoid foreign exchange fluctuations. For example, after Remitly and Wise integrated USDC, transfer costs decreased by 30%, and Coinbase also benefited from this.

More importantly, USDC is transforming from a "store of value" into a "payment medium." Sell-side analysts have mentioned that Coinbase may expand its distribution, such as issuing L2-specific USDC variants or deeply integrating it with DeFi protocols. Timeline? Management says "we'll see in the first half of next year."

The synergy between Coinbase and USDC is its killer feature. Coinbase uses USDC as its native gas fee, resulting in transaction costs as low as $0.001, attracting the DeFi and NFT ecosystems. The essence of Wall Street's praise is seeing Coinbase shift from "volatility dependence" to "stable rental income."

In the past, transaction revenue accounted for 80%, which would be halved during a bear market; now, subscription services account for 40%, showing strong counter-cyclical resilience.

Of course, risks still exist.

Regulation is a double-edged sword – the SEC is scrutinizing stablecoins more and more strictly, and Base's centralized sequencer may also attract attacks from "decentralization fundamentalists".

But judging from the financial report, the management is full of confidence: "We are not betting on the market, we are building infrastructure." Coinbase is taking a steady and ambitious path from a side business to a cash cow.

Empire continues to expand

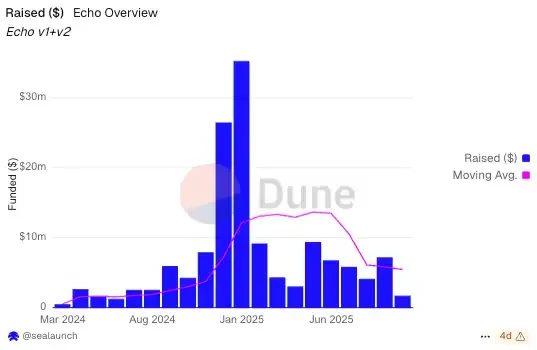

Coinbase's expansion resembles the Roman Empire, proceeding step by step, from exchange to custody, and then to the primary market. The most eye-catching acquisition in its Q3 earnings report was the $375 million acquisition of the Echo blockchain funding platform on October 21st.

From issuance and listing to trading and custody, Coinbase uses six anchors to secure its ecosystem, pushing itself towards becoming a "crypto version of Apple." Developers come and don't want to leave, institutions come and can't leave, and users can't live without it.

Let's start with the technological infrastructure, the cornerstone of the Coinbase empire.

Base Chain is not another Layer 2, but rather Coinbase's "iOS," compatible with the Ethereum ecosystem, but with its core controlled by Coinbase itself.

Leading protocols like Aave and Uniswap have already joined, but Coinbase's value lies in its "app store" attributes. Through the acquisition of Spindl (an on-chain advertising attribution tool), Coinbase can track user origins and conversion rates, similar to the App Store's recommendation mechanism, thus controlling traffic distribution. Developers wanting to acquire customers? They must use Spindl; Coinbase uses this information to decide who appears on the featured list.

The acquisition of IronFish addresses a privacy shortcoming. Under intense regulatory scrutiny, Base integrates zero-knowledge proofs, balancing compliance and user privacy, and emulating Apple's privacy protection strategy. More importantly, Base directly connects to Coinbase's 100 million users, allowing developers to reach a massive user base immediately upon launch—an advantage that Arbitrum or Polygon struggles to match.

The capital formation system is the second pillar, and the acquisition of Echo is the main event.

Echo is an on-chain capital succession platform founded by renowned crypto trader Cobie, and it also operates the Sonar public offering tool. Echo has helped over 300 projects raise more than $200 million, such as Plasma's XPL token sale.

Why did Coinbase choose it?

Because primary issuance is Crypto's "upstream source of funding." Traditional VC models are closed, making it difficult for retail investors to participate; Echo allows projects to raise funds directly from the community, encompassing both private and public sales. The acquisition price of $375 million (cash + stock) is a drop in the ocean compared to Coinbase's $70 billion market capitalization, but its strategic value is enormous, filling Coinbase's gap in "capital formation."

Echo fundraising trend chart | Source: Dune

The integration roadmap is taking shape. Echo will be embedded in the Coinbase ecosystem, using Coinbase's compliance framework (KYC/AML) for issuance approval, Coinbase's transparent ledger for disclosure, Coinbase Exchange for secondary market making, and Prime for custody. The initial offerings will focus on crypto tokens, with a target size of $1 billion in Q1 of next year.

For institutions, Coinbase is launching a settlement toolkit, real-time clearing, and data API; for developers, Sonar will upgrade to support privacy-enhanced fundraising (zero-knowledge proofs to avoid sensitive disclosures). The on-chain crowdfunding platform founded by KOL Cobie has raised $51 million and completed 131 transactions. The rapid growth of its first project, Ethena's USDe stablecoin, demonstrates its potential.

Echo's Sonar tool allows founders to self-manage token sales, reviving the 2017 ICO model, but things are different now—it's protected by the GENIUS Act, with a clear regulatory framework. Coinbase has officially stated that it started with cryptocurrency token sales and will expand to tokenized securities and real-world assets (RWA).

This ambitious goal extends beyond Crypto; it envisions the financialization of everything, including stocks, real estate, and artwork, all issued on the blockchain.

The puzzle is completed by the acquisition of Liquifi, which provides full lifecycle management of tokens—issuance, allocation, locking, and liquidity. Echo manages "who can raise funds," while Liquifi manages "how to operate and maintain," forming a closed loop.

The institutional market is the third pillar. The Deribit acquisition was a milestone in crypto history, acquiring the world's largest derivatives exchange for $2.9 billion, with institutional clients accounting for 70% and daily trading volume in the billions. Coinbase, which previously focused on retail and had a weak derivatives market, has now addressed this weakness, significantly increasing options depth and futures liquidity.

This aligns with Goldman Sachs' dual approach of investment banking and retail banking. Institutions are not just trading; they are also becoming seed users of Base/USDC. Management revealed that after the Deribit integration, the cross-selling rate reached 40%, with institutions expanding from derivatives to custody and clearing.

Retail access is the fourth pillar. Coinbase credit cards are not a payment tool, but rather the "final link" in the ecosystem.

Partnering with AmEx, positioned as a high-end platform, with users averaging $3,000 in monthly spending, above average. Offering 2-4% Bitcoin cashback, pegged to platform assets, with high holdings and proportions.

At a deeper level, data and consumer habits are used for targeted marketing, recommending NFTs or DeFi. This model creates a closed-loop effect: users earn cashback by swiping their cards, then invest that cashback in a base to earn even higher cashback, further stimulating more consumption. With regulatory support, this bridges fiat currency and cryptocurrencies, lowering the barrier to entry.

Content ecosystem is the fifth pillar. On October 20th, Coinbase spent $25 million to acquire NFTs and relaunch the UpOnly podcast—a show about bull market gods, hosted by Cobie/Ledger. This is no coincidence, as it belongs to the Cobie ecosystem, the same as Echo.

This is a strategic cultural positioning, with UpOnly disseminating its philosophy and products to enhance community influence. Coinbase's decision not to control advertising or content creation, purely as a community tribute, has sparked considerable discussion. Combined with Echo, this forms a dual-engine model of "content + capital," with podcasts showcasing projects and Echo securing follow-up funding. Future expansion will target an Apple TV+-style service, with content becoming the engine of user engagement.

Regulatory barriers form the sixth pillar. Coinbase is domestically listed, regulated by the SEC, and holds licenses in multiple states. Following the GENIUS Act, its stock price rose 30%, highlighting USDC's compliance advantages. It attracts traditional institutions, partners with JPMorgan, and facilitates the conversion of Chase points to crypto. These high barriers create significant competition—Binance/OKX face pressure offshore, making it difficult for new entrants to overcome. Similar to the App Store's review process, it's stringent in the short term but prioritizes quality in the long term.

These pillars are not isolated, but form a closed loop: developers use Echo/Liquifi for funding, deploy on Base, acquire customers with Spindl, gain exposure through UpOnly, facilitate institutional Deribit transactions, use Prime custody, facilitate retail credit card spending, and optimize data loops.

Coinbase isn't just buying companies; it's weaving a web—from issuance to trading, from technology to culture—to build a crypto "Apple empire."

Planning for the next era

If Base and USDC are the cash cows of today, then the x402 Foundation is Coinbase's big bet on the future.

Imagine an HTTP code that has been dormant for 30 years suddenly coming to life and becoming a bridge connecting humans with the machine economy.

This is not science fiction, but a real event that unfolded on September 23. Coinbase and Cloudflare joined forces to establish the x402 Foundation, while Google's AP2 protocol followed closely behind, transforming the HTTP 402 "Payment Required" status code into a machine-native payment process.

The story begins with a clear access path. In Coinbase's ecosystem, Base acts like an efficient tollbooth manager, responsible for low-fee settlements, requiring only $0.001 per transaction; USDC plays the role of a frictionless universal currency, avoiding "roadblocks" in exchange rates; and Custody, as the "guardian" of institutional-grade security, handles all accounting.

At the heart of the protocol is the revival of the HTTP 402, a piece of code that had been idle for many years, now transformed into a "highway" for AI payments. Imagine an AI agent crawling Cloudflare's CDN data and encountering a 402 response along the way. It doesn't stop; instead, it automatically initiates a USDC payment, confirms it instantly, and continues to retrieve content, all without human intervention.

The lineup of partners is truly star-studded, with the first batch of partners including Google (with AP2), Adyen, PayPal, Mastercard, and developer platforms such as Etsy and Now.

The pilot phase has begun, with Cloudflare's Agents SDK being the first to integrate x402 and is currently privately testing the "pay per crawl" mode—AI crawlers voraciously access massive amounts of pages, with fees settled daily.

Google's AP2 extends x402 to support mixed payments using credit cards and stablecoins, with the first B2B procurement pilots launched on the Cloud Marketplace, involving Intuit and Salesforce.

Coinbase acts as the “bridge architect” for Crypto: x402 settles through Base, while AP2’s Mandates (digital contracts) act as smart sentinels, ensuring that every step of authorization and auditing is watertight.

Why does AI need this "payment script"? Because AI agents are about to "learn to spend money for you".

Currently, AI like ChatGPT is still in the era of human ordering and payment, but in the future, they will make purchases or subscribe to services autonomously, requiring a reliable payment framework.

AP2's Intent/Cart Mandates act like a "plot twist" to prevent fraud, allowing users to pre-sign a budget, agents to generate shopping carts, and the entire process is traceable.

x402 brings Crypto's instant settlement "climax" by using stablecoins to bypass bank delays. Gartner predicts that the AI payments market will surge to one trillion dollars by 2030, with Crypto accounting for 10% of that.

For Coinbase, the result of this story is that Base benefits from the low-fee advantage.

end

Ten years ago, Coinbase started by facilitating human transactions and even raised funds in China, braving wind and rain.

Ten years later, it's more like laying an underground network: Base manages settlements, which are low-cost and efficient; USDC manages clearing, ensuring stable circulation; Echo manages issuance, securing a position upstream; and x402 connects to "machines that spend money" at the remote end.

This Q3 earnings report is a milestone, with total revenue of $1.87 billion and net profit of $433 million, but behind the numbers lies an empire blueprint—from volatility dependence to stable rent collection; from exchange to full-stack hub.

The future of crypto isn't about betting on prices, it's about building infrastructure. Coinbase's ambition is like Rome's road network, connecting everything. In the next decade, when AI agents are everywhere, Coinbase may already be the "Federal Reserve of the digital economy."

But don't forget, imperial expansion always has its frontiers—regulation, competition, and black swan events. Investors, hold on tight; this show has only just begun.

- 核心观点:Coinbase Q3财报超预期,转型基础设施服务商。

- 关键要素:

- 总营收18.7亿美元,净利润4.33亿美元。

- Base链和USDC稳定币成新增长引擎。

- 战略收购完善生态,布局AI支付。

- 市场影响:提振行业信心,推动加密服务多元化。

- 时效性标注:中期影响