CEX breaks through the current impasse: How can the X402 protocol usher in a new cycle in the crypto industry?

- 核心观点:X402协议推动AI自主支付成为新经济引擎。

- 关键要素:

- AI代理技术突破实现自主决策支付。

- 稳定币与链上结算提供价值载体。

- 开放标准低门槛实现多链兼容。

- 市场影响:催生30万亿美元代理支付新经济层。

- 时效性标注:长期影响

X402: From a Sleeping Symbol to a 30 Trillion Core

In the history of internet development, the HTTP 402 "Payment Required" status code remained dormant for 30 years, failing to break through the conceptual level due to a lack of suitable technological environment and business scenarios. Until May 6, 2025, when Coinbase activated this standard and launched the X402 protocol, enabling AI to achieve autonomous on-chain payments, it leaped from a technical community experiment to a core engine of the crypto capital market within just a few months. This also marks the beginning of the internet's return from a traffic-driven economy to a value-driven internet. Against the backdrop of AI agents, stablecoins, and on-chain settlement, a new economic layer surrounding payments is taking shape. The a16z 2025 Crypto Report predicts that the value of agent payment transactions will reach $30 trillion by 2030, and X402, as an open standard, is at the heart of this wave.

The rise of X402 is no accident. First, it benefits from the maturity of the technological ecosystem, which provides fertile ground for its application. Breakthroughs in AI agent technology have enabled machines to make decisions by autonomously identifying needs and assessing value, no longer just passive tools that execute instructions. On-chain settlement technology enables trustworthy transactions without intermediaries, solving the trust problem of value transfer. Stablecoins such as USDC provide a value carrier for cross-scenario circulation, effectively avoiding the price volatility risk of cryptocurrencies.

Building on this, X402's technical design also addresses industry pain points. As an open standard, it has achieved multi-chain integration with Base, Polygon, Solana, and other chains to solve cross-chain payment compatibility issues. Its low-barrier feature of "enabling USDC instant settlement with one line of code" significantly reduces the cost of integration for developers. The "transaction as identity verification" mechanism eliminates the dependence on traditional account systems and perfectly adapts to the anonymity and efficiency requirements of machine interaction, making it stand out among similar solutions.

Capital Resonance: From Meme Pre-launch to Ecosystem Pricing

X402's explosive growth was not a linear increase driven by technology, but rather a synergistic effect of capital and ecosystem, which enabled it to make a rapid leap from "proof of concept" to "value consensus".

The initial surge originated from the meme asset PING, which attracted hundreds of thousands of addresses with its "1 USDC minting 5000 tokens" mechanism. This speculative frenzy unexpectedly enabled performance stress testing of the protocol, publicly validating the high concurrency and low cost of the X402 protocol. After the initial hype, funds quickly rotated to functional assets with infrastructure value, such as PayAI, which acts as a multi-chain facilitator and at one point accounted for over 14% of the X402 ecosystem's trading volume. Capital logic is transitioning from "experimentation" to "pricing," pushing exchanges to the forefront of narrative resource competition.

At this stage, the location of the trading platform directly determines the entry route of funds. For investors, the platform that can take over the ecosystem assets earliest and most comprehensively means faster price discovery, lower entry and exit costs, and a stronger wealth effect.

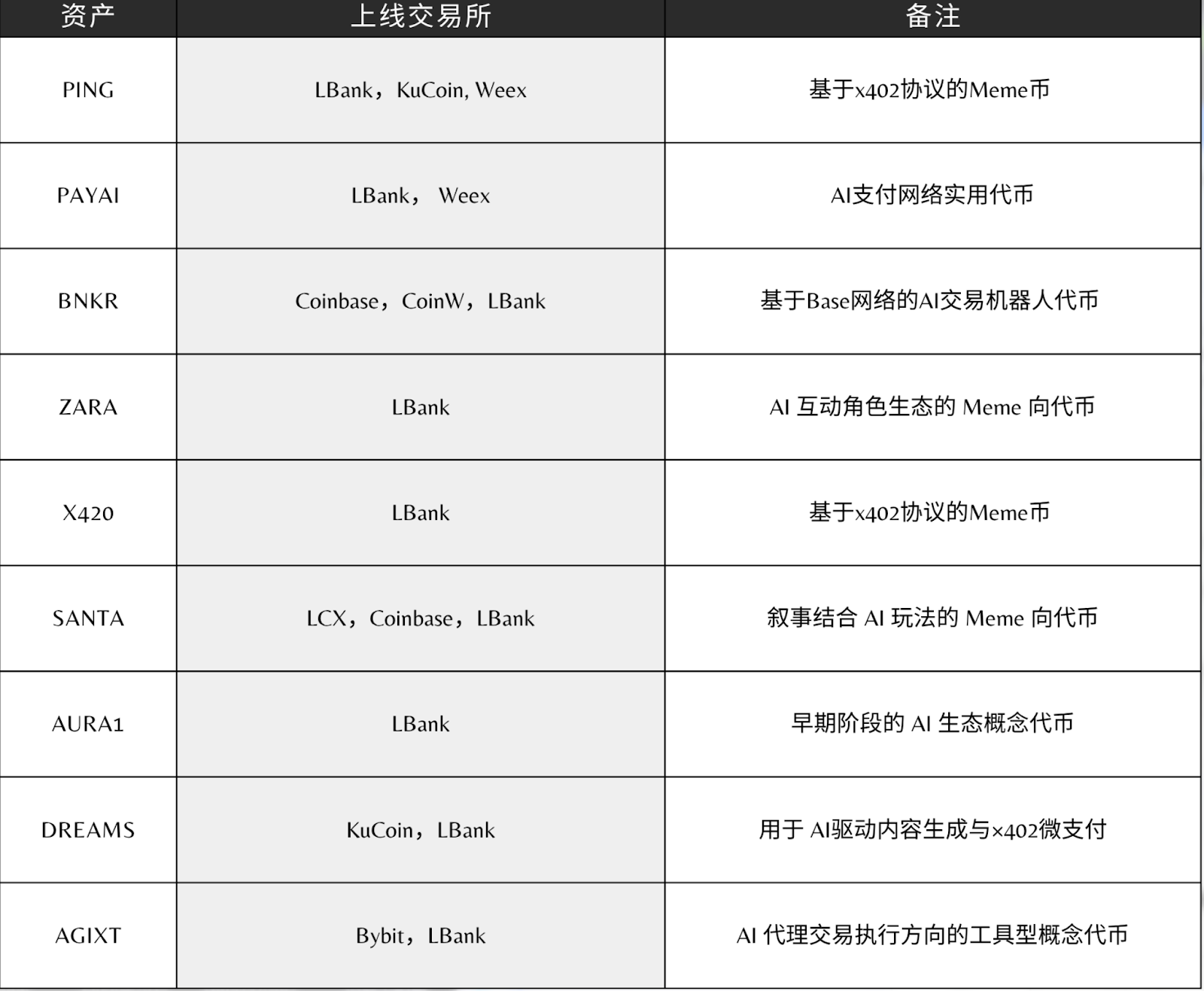

Data shows that in mid-October, when the X402 sector was at its peak, LBank accounted for over 27% of the daily trading volume within the X402 ecosystem, becoming one of the most concentrated entry points for capital flow in this narrative. The related assets listed on the platform performed exceptionally well, including PING (maximum increase of 989%), PAYAI (875%), BNKR (654%), ZARA (347%), X420 (291%), SANTA (250%), AURA1 (240%), AGIXT (213%), DREAMS (198%), and DIRA (155%). The ten core projects achieved an average maximum increase of approximately 421%, significantly outperforming the overall market performance, making LBank a preferred channel for investors in early-stage narrative positioning.

For project teams, the ability to quickly establish trading depth and community attention in the early stages of their lifecycle will determine the speed of their network effect expansion. Listing on LBank not only signifies global liquidity coverage but also represents a path to gain stronger pricing power during periods of heightened market sentiment.

From an industry competition perspective, speed is reshaping rankings and weightings. The ability to keenly identify narrative turning points, rapidly launch new products to achieve ecosystem coverage, and maintain long-term, deep support is becoming a new differentiator between platforms. Looking at timelines and asset performance, LBank is at the forefront of seizing the speed dividend in this trend, and its ability to absorb these opportunities has become a crucial indicator of the X402 ecosystem's acceleration.

Risks, regulations, and unknown boundaries

The rapid rise of X402 has also been accompanied by risks and controversies, but it is precisely these "undefined areas" that constitute the innovation space and speculative frontier of the new cycle.

Security challenges have already emerged: In October, the third-party application x402bridge suffered a loss of $17,000 USDC due to a private key leak, exposing the shortcomings of insufficient security awareness among developers in the early stages of the ecosystem. Furthermore, the risks associated with AI-driven autonomous payments are even more alarming; malicious injection could induce AI to initiate unauthorized payments, and vulnerabilities such as infinite spending loops have not yet been fully resolved. In response, Coinbase has improved its protection system by publishing core security standards, promoting the "least trust model," and implementing self-custody deployments; however, full adaptation of security capabilities will still take time.

The regulatory gray areas bring greater uncertainty. Do AI agents possess legal entity status? Does automated on-chain transaction require a financial license? How can small, high-frequency payments meet anti-money laundering and KYC requirements? These questions remain unanswered. However, as industry analysts have stated, "Every area yet to be defined by regulators is the frontier of speculation in a new cycle." This uncertainty, in turn, provides room for market imagination and forces the industry to explore compliance pathways.

From HTTP to X402: The Starting Point of the New Wealth Narrative

The shift from HTTP to X402 essentially represents the evolution of the internet from an "information transmission layer" to a "value settlement layer." Thirty years ago, HTTP defined the rules for information flow, giving rise to the golden age of the traffic economy; today, X402 is defining the logic of value flow, driving AI agents to become new economic agents.

The alliance between Coinbase and Cloudflare is just the beginning; exchanges, stablecoin issuers, and AI companies are all finding their place on this track.

X402 is a technological revolution, but more importantly, it's the engine of a financial narrative. It transforms on-chain traffic into cash flow and AI applications into assets. On the edge of a new cycle, LBank's early positioning and high liquidity make it the first platform in this narrative to capture the "wealth effect."

This new cycle, spearheaded by X402, is not only a narrative revolution in the crypto industry, but also an inevitable shift in the digital economy from "traffic is king" to "value is fundamental." Just as the DeFi summer of 2020 redefined financial services, this time, the combination of AI and payments is ushering in a broader era of autonomous economy.