x402 Protocol: Deconstructing the On-Chain Payment Revolution of the AI Agent Economy

- 核心观点:x402协议解决AI Agent支付难题。

- 关键要素:

- 基于HTTP 402标准实现链上微支付。

- 通过中间人实现链无感交互。

- 支持EIP-3009实现低延迟支付。

- 市场影响:推动AI与加密经济深度融合。

- 时效性标注:长期影响

Original author: @BlazingKevin_, the Researcher at Blockbooster

x402 Protocol – The Pivot for Agent Payments

1.1 The Payment Dilemma Faced by AgentFi

Against the backdrop of rapid development in artificial intelligence (AI), the large-scale application of agents is inevitable. However, when these agents attempt to interact with the traditional financial system, they face two insurmountable structural barriers that significantly limit the realization of AgentFi :

- Lack of identity and sovereignty issues : Since the agent lacks legal or natural person status, it cannot open accounts in traditional banks or payment systems (such as Stripe). This forces all economic activities of AI to rely on human intervention, such as complex API key settings, transaction authorization, and payment type restrictions, thus depriving it of autonomy.

- Economic friction in micropayments : Agent economic activities are inherently high-frequency and small-value. For example, the value of each API call or AI service request might be only $0.01 or $0.05. In the current payment environment, a transaction fee of $0.30 or even higher might be required for a $0.01 payment, making this model completely economically unfeasible.

Solution for 1.2 x402: A2A On-Chain Payment Gateway

The x402 protocol is designed to systematically resolve all the aforementioned frictions. It provides an on-chain payment gateway specifically designed for agent-to-agent (A2A) value transfers.

Its core workflow is based on the HTTP 402 "Payment Required" standard and extends it to the blockchain:

- Request : When the client (Agent A) requests a service from the server (Agent B), Agent B returns a 402 payment request, explicitly requesting a small fee (e.g., 0.01 USDC).

- Payment : After receiving the 402 request, Agent A independently sends 0.01 USDC to Agent B's address via the blockchain.

- Verification and Settlement : The on-chain transaction is confirmed within seconds. Agent B immediately provides services to Agent A after verifying the successful payment.

The revolutionary aspect of this process is that it completes the entire process of payment, clearing, and settlement in a matter of seconds, without any human intervention, and with negligible transaction costs .

Furthermore, this "pay-per-use" micropayment model is equally attractive to human users, offering a fairer and more efficient way to exchange value that breaks away from the traditional "registration/subscription" system.

1.3 The core of x402: An architecture design based on "simplicity"

The strength of the x402 protocol lies in its minimalist design philosophy.

It focuses on solving only one core problem: the "verifiability" of payments between the buyer (client) and the seller (server) .

It must be clarified that x402 is not a completely new, all-encompassing foundational protocol. Its role is that of a "cryptographic-native extension tool" to the AP2 standard, which is driven by giants like Google. The AP2 protocol defines the macro-level standards for "trusted interoperability" between agents and API service providers (such as the use of Mandates for authorization and Verifiable Credentials (VCs)), while x402 provides a plug-and-play "payment method" adapted to crypto assets.

This design significantly lowers the barrier to adoption: developers or service sellers don't need to understand the complex workings of blockchain . They simply need to create a wallet, integrate a few lines of code, and monetize their services to agents or human users worldwide.

1.4 Implementation of "Verifiability": Seamless Chain Interaction

The simplicity of x402 is further reflected in its verification mechanism. When the buyer's agent initiates an HTTP 402 request, the seller (server) does not even need to run a node or access the blockchain to verify whether the transaction has been completed.

The server outsources the verification process to a third-party service called a "Facilitator." This facilitator monitors the on-chain state and notifies the server upon transaction confirmation. This allows for virtually seamless interaction between buyers and sellers, further reducing integration complexity.

1.5 Why is "simplicity" the tipping point?

The "Crypto x AI Agent" narrative, while a grand one, has long been a hot topic in the market, but it has failed to generate widespread adoption. The fundamental problem lies in the fact that the previous AI Agent narrative (such as Defai) was too complex .

This narrative attempts to achieve a one-step solution, allowing agents to directly manage users' private keys and autonomously schedule a series of complex DeFi transactions. However, due to the dual challenges of a lack of unified standards and extremely high implementation difficulty, this narrative ultimately failed to materialize.

The emergence of the x402 provides a crucial "fulcrum" for this predicament .

What Crypto x AI Agent previously lacked was a sufficiently simple and low-level foundation. x402, as an extremely simple payment protocol standard , perfectly fulfills this role.

- Because it's simple, it's easy to integrate : any Web2 or Web3 developer can adopt it without any barriers.

- Because of its simplicity, it possesses the strongest composability : a standardized payment layer can spawn a vast ecosystem, including but not limited to: diversified intermediary services, efficient on-chain data indexers, and an infinite number of application scenarios ranging from Meme coin payments to real-world RWA services.

The core role and workflow of the Facilitator (intermediary)

In the x402 protocol architecture, the middleman is the core of its "simplicity," playing a key role as an "on-chain payment coordinator" and a "technical abstraction layer."

Its fundamental value lies in its complete encapsulation of all the complexities involved in the blockchain within the payment process. This includes a series of operations such as wallet management, private key signing, gas fee estimation, transaction construction, on-chain broadcasting, and state verification.

Thanks to the intermediary, neither the client nor the server needs to interact directly with the blockchain . They can complete a full on-chain value settlement simply through standard HTTP requests, thus achieving a smooth and seamless payment experience.

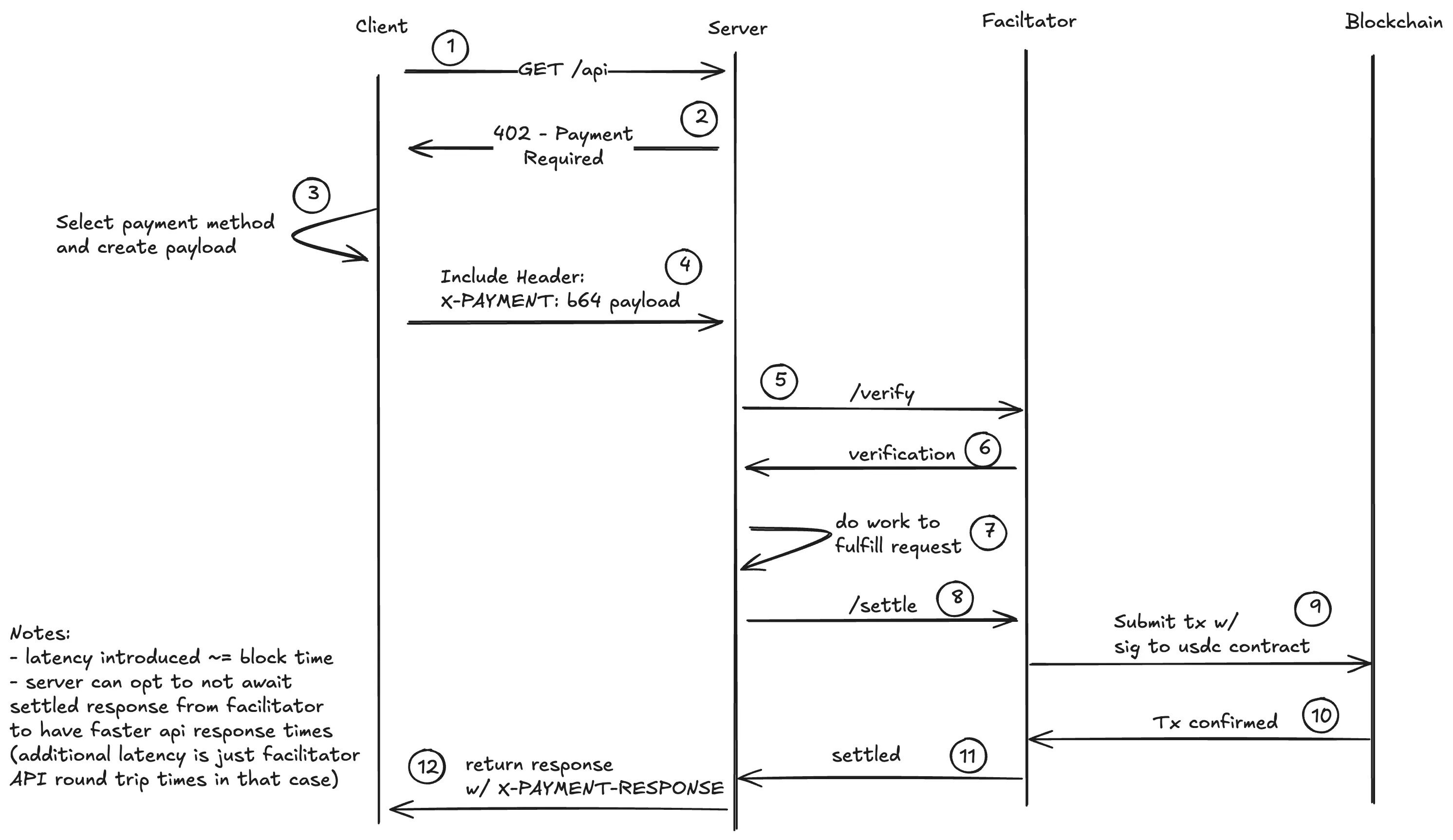

2.1 x402 Architecture and Interaction Flow

The x402 workflow consists of four key roles:

- Client : This refers to the Agent or the user's browser that initiates the request.

- Server : A website that provides APIs or content, i.e., the "seller".

- Intermediary : A third-party service that handles on-chain verification and settlement.

- Blockchain : The ultimate value settlement layer (e.g., Base Chain).

Its core interaction process can be broken down into the following key stages:

Phase 1: Payment Challenges

- The client sends a standard service request (GET /api) to the server.

- The server identifies the resource as a paid item and returns a 402 - Payment Required status code, initiating a payment challenge to the client.

Phase Two: Signing of Payment Intent

- Upon receiving a 402 challenge, the client does not immediately construct or send an on-chain transaction .

- Instead, it creates a "payment credential" locally that conforms to the EIP-3009 specification . This is essentially a signed "payment commitment" (similar to a signed check) authorizing a specific party to transfer a specific amount in the future.

- The client places this credential in the HTTP request header (X-PAYMENT) and sends another request to the server.

Phase Three: The Key Bifurcation in Verification and Settlement This is the ingenious design of the x402 protocol, where the process branches out:

- Verification : After receiving this "payment credential," the server does not verify it itself . Instead, it forwards the credential to a middleman, which initiates a /verify API request. The middleman is responsible for checking the validity of the signature, account balance, etc., and confirming to the server: "This credential is valid and can be cashed."

At this point, the server faces a critical decision:

- Path A: Synchronous Settlement. After receiving "verification passed," the server chooses to wait for the funds to be fully credited to its account. It instructs the intermediary to execute a /settle (settlement) request. The intermediary then broadcasts the credential to the blockchain, awaiting block confirmation. Only when the intermediary finally notifies the server that "the money has arrived" will the server return the requested data to the client.

- Drawback : The delay in the entire process is tied to the blockchain's block generation time, which can last for several seconds, severely impacting the user experience.

- Path B: Asynchronous Settlement. This is the core mechanism by which x402 achieves a low-latency experience . After receiving the "verification passed" confirmation from the intermediary, the server no longer waits . It immediately returns the data to the client , while simultaneously "asynchronously" instructing the intermediary to complete the subsequent settlement process in the background.

2.2 The Transfer of Trust: The Delicate Balance of x402

In path B, the server makes a crucial trade-off: it chooses to trust the intermediary's "verification," equating it with a guarantee of future "settlement."

In this way, the server transfers the risk of delay caused by "waiting for blockchain confirmation" to the intermediary . In exchange, the client experiences almost no blockchain latency; the only perceived latency is the round-trip time (in milliseconds) between the server and the intermediary's two API calls.

2.3 Underlying Technology: The Key Role of EIP-3009

All of this is possible thanks to the Ethereum EIP-3009 standard. This standard allows users (or agents) to authorize a one-time signature , which an intermediary can then use to "pull" funds in the future without requiring further client intervention. Currently, the USDC contract on the Base chain is the primary asset supporting this functionality, making it the preferred settlement network for the x402 protocol.

Current Market Landscape of "Middlemen"

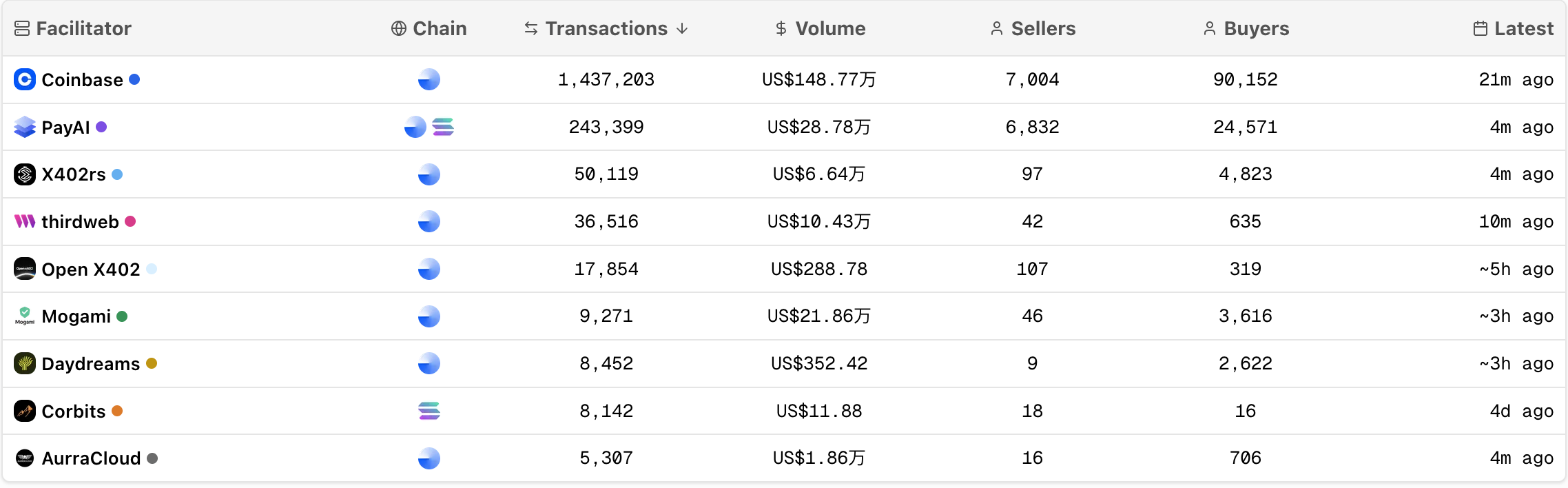

The simplicity of the x402 protocol shifts its core complexity (and value) to the role of the "middleman." Currently, the market has initially formed four main players, each with their own strategic positioning and business model revealing different trade-offs and dependencies.

2.4 Coinbase: Defining Standards with Subsidies

As the creator of the x402 protocol, Coinbase operates the official intermediary service and dominated the market in its early stages.

- Market data : Its platform has processed over 1.4 million transactions, with a total transaction value of approximately $1.48 million.

- Ecosystem scale : It has attracted 7,000 sellers and more than 90,000 buyers, forming the largest user base to date.

- Core Strategy : Coinbase's developer platform currently employs a completely free subsidy policy . While this strategy has rapidly captured market share and promoted its standard, it has also made the early development of the x402 ecosystem highly dependent on Coinbase's continued financial support . The strategic intent is to deeply bind early adopters of the x402 protocol to the Base chain through this typical approach of subsidizing infrastructure.

2.5 PayAI: Seeking a Differentiated Breakthrough in the Ecosystem

PayAI positions itself as one of Coinbase's main competitors, holding approximately 13% market share. It attempts to gain market share through "differentiated competition."

- Strategic Positioning : The project's stated slogan is "Solana First, Multi-Chain x402 Coordinator." However, a noteworthy reality is that its current transaction activity still primarily occurs on the Base chain , and its "Solana First" strategy has not yet been reflected in the data.

- PayAI's core strategy : It attempts to build an "agent commerce" ecosystem that transcends payments themselves. Its planned product matrix (such as the "Freelance AI" marketplace) demonstrates its intention to package scenarios with payments . Whether this model can truly build a self-sufficient closed loop, rather than becoming another form of dependence on Coinbase subsidies, remains to be seen.

2.6 ThirdWeb: A tool provider that "commodifies" standards

For thirdweb, x402 is not its core business, but rather a functional "plugin" that it has adopted as a trend.

- Platform positioning : thirdweb is a full-stack Web3 development platform that provides a wide range of SDKs and APIs.

- Core strategy : Instead of competing on x402 as a separate track, the platform quickly "commoditized" it , packaging it into its "Payments" product line as a value-added feature for its existing developer base.

- Market Role : This strategy indicates that ThirdWeb focuses on acting as a tool service provider . Therefore, its resource investment and focus on the x402 track itself are relatively limited, making it unlikely to become a dominant player in the protocol ecosystem.

2.7 x402.rs : Open Source and "Trustless" Infrastructure

x402.rs is an independent, open-source protocol implementation built on the Rust language, positioned as a neutral technology option independent of the protocol initiator .

- Core value proposition : Its main value lies in providing a “ fully open and auditable implementation ,” which contrasts sharply with other intermediaries that operate as closed-source, managed services.

- Product and Positioning : x402.rs ' core product is a self-hosted middleman. This allows any developer or company to deploy and run their own middleman service, thus gaining complete control over their infrastructure and eliminating reliance on third parties . It is not positioned as a SaaS platform, but rather as an infrastructure building block , focusing on providing high-performance middleware for backend developers (especially those using the Rust stack).

- Market Implications : Therefore, the official public instances of x402.rs seen on the intermediary leaderboard are merely one example of how the project operates. The true market value of x402.rs lies in its promotion of decentralization and developer autonomy , providing a crucial alternative to Coinbase custody for tech teams that wish to censor, self-host, and freely modify their payment infrastructure.

Analogy and Market Implications of the x402 Issuance Mechanism

3.1 x402 Asset Issuance Mechanism: On-Chain Data and Off-Chain Interpretation Rights

Recent market buzz generated by the x402 protocol (such as $PING) shares significant structural similarities in its asset launchpad mechanism with Bitcoin's inscription mechanism. Its core operating logic can be summarized as follows: utilizing a public blockchain as an "immutable data ledger," while relying on an off-chain "indexer" to assign specific meaning to this data .

- The operational logic of inscriptions : A user sends a transaction to the Bitcoin mainnet. The Bitcoin network itself is only responsible for recording the transaction and does not deduce whether it constitutes an "inscription." The Ordinals protocol , as a third-party indexer, acts as a "state interpreter." It scans all on-chain data and, according to its custom rules (such as "first come, first served"), determines which transactions are valid inscriptions, thereby constructing the BRC-20 state off-chain.

- The operating logic of $PING : This model uses almost the same architecture. Users send USDC to a specific address on the Base chain. From the perspective of the Base chain and the x402 protocol, this is just a standard ERC-20 transfer. What truly gives this transaction the meaning of "Mint" is the x402scan indexer . It scans all USDC transfers to a specific address and, according to its own defined rules (e.g., 1 USDC = 5000 $PING), confirms which are "valid Mints" in the off-chain database, and ultimately distributes the tokens through the contract.

3.2 The potential impact of the x402 narrative on the competitive landscape of CEXs

The rise of the x402 protocol presents a strategic opportunity for CEXs and their ecosystems to reshape the influence of on-chain narratives . This judgment is based on the following three points:

- The hierarchy and persistence of the narrative: The strategic significance of x402 from the application layer to the protocol layer lies in the fact that it is not an application layer hotspot (like inscriptions), but rather a "protocol layer revival" of the core internet protocol HTTP 402 on the modern blockchain settlement layer. It aims to solve the "infrastructure layer problem" of autonomous, real-time settlement in the agent economy. For CEXs, this presents a strategic opportunity: shifting from supporting "applications" to defining "standards" is a crucial step in their evolution from traffic platforms to infrastructure providers.

- The Strategic Gap for Indexers: The Struggle for "Data Interpretation Rights" Indexers are the "data interpreters" of the Crypto ecosystem. Currently, x402scan operates as a centralized entity with its own issued token, facing systemic conflicts of interest and centralized risks. This creates a clear strategic entry point for centralized exchanges (CEXs): providing a more neutral and open "public good" type indexer. This move aims to build technological trust and an ecosystem moat, with strategic value far exceeding simple capital subsidies.

- Positioning itself in the long-term race: The "settlement bus" of the agent economy . MEME assets (such as $PING) merely validated the market hype surrounding x402. Its true long-term value lies in providing a missing "autonomous procurement protocol" for the integration of AI and Crypto. In the future machine-to-machine (M2M) economy, agents will need x402 to autonomously and frequently procure "computing resources" and "data." Therefore, x402 is positioned as the "settlement bus" for this highly certain long-term trend, with extremely high strategic potential.

Future Landscape and Rotation Prospects for the X402 Track

The emergence of the x402 protocol acted as a catalyst, injecting new narratives and capital into the long-dormant AI Agent sector. Based on the current market structure, we can deduce several key sub-sectors that may experience future rotation.

4.1 AI Launchpad

The x402 protocol is currently widely interpreted by the market as a novel " asset issuance primitive " rather than a simple payment tool. This interpretation provides an excellent opportunity for existing AI Agent platforms in the Base ecosystem (such as Virtuals and Clanker) to return to the center stage.

These platforms, having accumulated substantial user consensus, project resources, and a developer base during the AI Agent boom a year ago, now need a fresh and compelling narrative to revitalize their ecosystems. The "issuance-as-payment" model enabled by the x402 protocol perfectly aligns with the core business logic of these launchpads. Therefore, it is foreseeable that these "native AI issuance platforms" will become the main force most likely to enter the market in the next phase and leverage their existing advantages to compete for market share.

4.2 Indexer

If x402 follows the development path of inscriptions, then the next focus of market competition will inevitably shift from "issuing assets" to "defining the rules for asset issuance" —that is, the struggle for the right to speak on indexers.

The indexer is the sole arbiter of which payment is a valid Mint. If Launchpad chooses not to rely on x402scan, but instead builds its own indexer and defines a completely new and potentially more attractive issuance mechanism, it will quickly capture the market with its existing brand and user base.

4.3 Intermediaries

The middleman role is central to the current narrative, but this positioning presents a strategic duality :

- For the Crypto-Native market : the technological barriers to entry for the intermediary role are not high . Any indexer or agent payment application can (and is very likely) choose to run its own intermediary service to control the entire technology stack and value chain. From this perspective, the moat for this role is limited, and its narrative popularity is likely to be phased .

- For the Web2 adoption market , the dynamics are completely reversed. When traditional Web2 companies seek to integrate crypto payments, they never build their own infrastructure; instead, they choose the market leaders, the most trusted, and the most compliant providers. In this area, Coinbase possesses a near-monopoly structural advantage due to its brand, regulatory standing, and deep integration with the Base Chain.

4.4 The Public Blockchain Debate and the Completeness of the Ecosystem Stack

The competition for x402 will ultimately evolve into a competition between public blockchain ecosystems, and the core of this competition is the depth of technological adaptation .

- Contract Adaptation Challenges : x402's low-latency "pull" payments heavily rely on support for the EIP-3009 standard. Implementing and embedding this standard quickly and securely on other EVM-compatible chains is a long and arduous process, presenting significant engineering and security challenges.

- The "Empty Shell" Protocol and Systems Engineering : The x402 protocol itself is merely a standard, an "empty shell." Its true power lies in the entire supporting ecosystem behind it. Coinbase has undertaken a long-term, systematic approach to connecting the upstream and downstream of x402, including:

- Protocol layer : MCP (Connectivity), A2A (Multi-Model Collaboration), AP2 (Macro Standard), EIP-3009 (Payment Primitives), etc.

- Infrastructure : native wallet services, trading markets.

- Application layer : Specific scenarios built based on the x402 standard.

About BlockBooster

BlockBooster is an Asian Web3 venture capital studio backed by OKX Ventures and other top institutions, dedicated to being a trusted partner for outstanding entrepreneurs. We connect Web3 projects with the real world through strategic investment and in-depth incubation, helping high-quality startups grow.

Disclaimer

This article/blog is for informational purposes only and represents the author's personal views, not the position of BlockBooster. This article is not intended to provide: (i) investment advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries extremely high risk, with significant price volatility and the possibility of becoming worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your own financial situation. For specific questions, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general informational purposes only. Reasonable care has been taken in compiling these data and charts, but we are not responsible for any factual errors or omissions expressed herein.