Can you get Polymarket airdrops by using an AI agent to execute end-of-day strategies?

- 核心观点:Polymarket确认发币空投,用户需抓紧交互。

- 关键要素:

- 官方确认将发代币并进行空投。

- 90%用户投注低于100美元。

- AI代理可辅助无损交互策略。

- 市场影响:刺激用户参与交互,推动预测市场活跃。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author|Golem ( @web3_golem )

Polymarket has confirmed the launch of its token and airdrop. In a podcast interview on October 24th , Polymarket's Chief Marketing Officer, Matthew Modabber, stated, "There will be a token, and there will be airdrops. We could have launched the token at any time, but we wanted to go all the way. We want it to be a truly useful, durable, and forever-lasting token."

According to other sources, Polymarket will reopen to US users by the end of November and will issue its token in 2026.

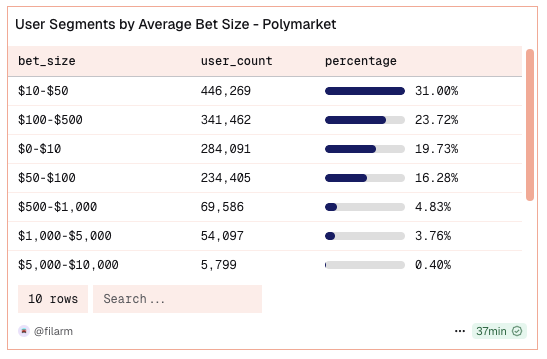

This means users have at most 3-4 months left to interact with Polymarket. Although there are rumors that Polymarket has already taken several snapshots, it's not too late to start interacting now. According to Dune data, over 90% of users wager less than $100, and whales wagering $5,000-$10,000 account for only 0.4%. Therefore, while Polymarket seems to have a huge user base, and strategies and tutorials for leveraging Polymarket are everywhere, the number of people actually putting in the effort to implement them may not be that many. Wages exceeding $500 can easily place you in the top 10%.

To avoid losing all their principal during Polymarket interactions ( statistics show that over 85% of Polymarket accounts are in negative balance), three main Polymarket strategies are currently popular, approaching "lossless volume manipulation." The first involves users finding a low-liquidity prediction event and using two wallets to repeatedly manipulate the volume. The second involves "end-of-day trading," trading only events with a high probability of over 95%. The third involves capturing arbitrage opportunities in multi-option markets where the combined probability is less than 100%.

However, all three strategies require a significant amount of time and effort to execute. Finding predictable events that meet the strategy's criteria is time-consuming, and even after finding suitable predictable events, the mechanical execution of trades still requires considerable effort. This is why, even with confirmed token issuance and a well-developed strategy, Polymarket's interaction appears relatively quiet. Ordinary players find it difficult to maintain consistent interaction, and these near-risk-free profit opportunities are gradually being monopolized by professional bots.

Utilizing AI agents to execute Polymarket's closing strategy

Considering these three Polymarket interaction strategies, the closing strategy is more suitable for most users, and there are already AI agents on the market that help users search for events on Polymarket with a probability of over 95% and trade autonomously. The following section will provide a detailed explanation using the Polymarket closing strategy agent launched by the AI agent infrastructure UnifAI as an example.

UnifAI is a platform that enables autonomous AI agents to perform on-chain and off-chain tasks within the Web3 ecosystem. The platform offers a variety of autonomous AI strategy agents, which users can easily copy and run for free. The Polymarket end-of-day strategy agent is one of its recently launched strategies, and according to platform data, 206 wallets are already running it.

How to run a Polymarket closing strategy agent

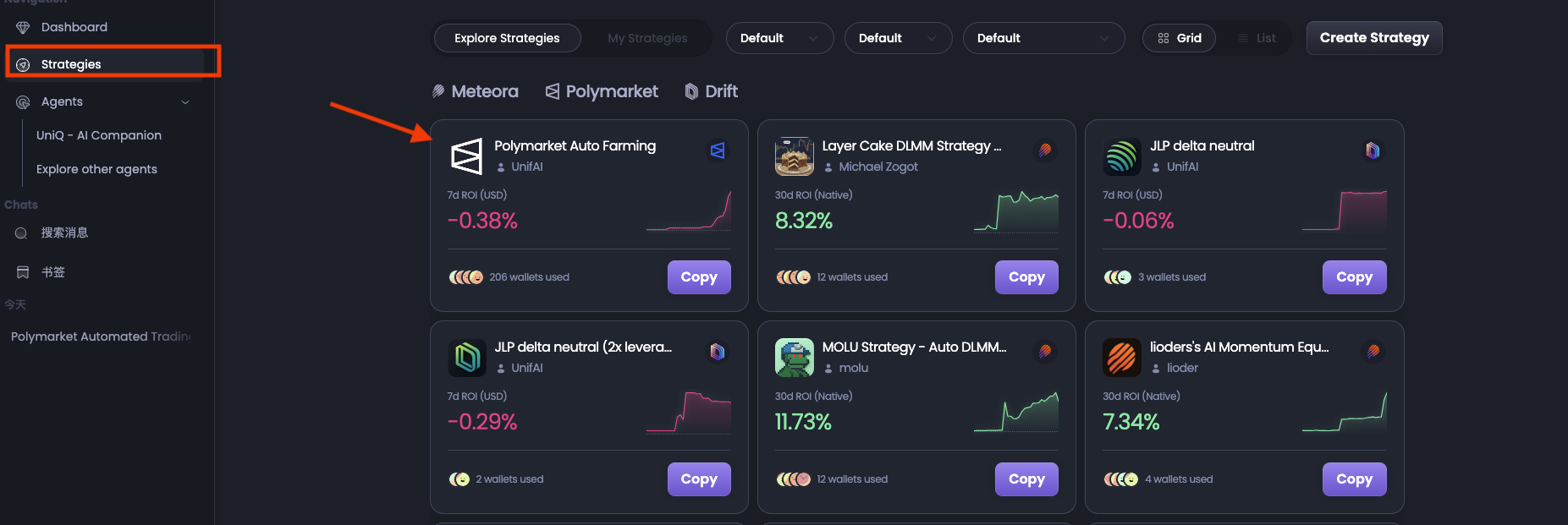

Running this strategy is simple. First, log in to the UnifAI website with your Telegram account, click "Strategies," and then click to enter the "Polymarket Auto Farming" strategy agent.

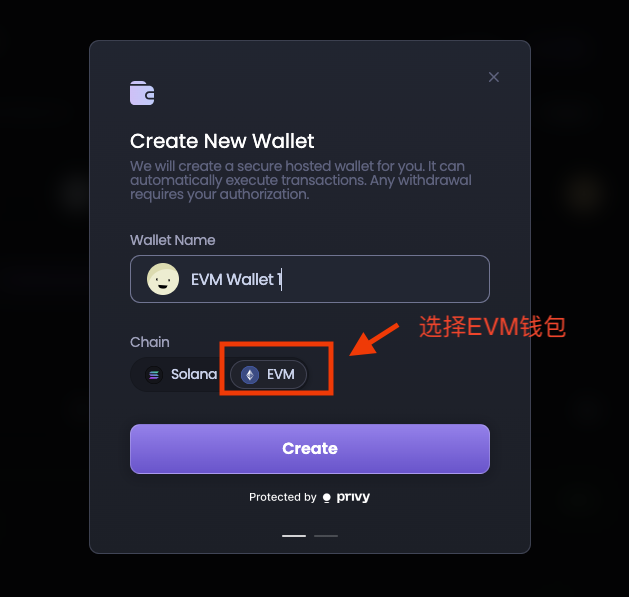

Then, under “Select Wallet,” click to create a new wallet. Note that because Polymarket runs on the Polygon network, an EVM wallet needs to be created. Also, wallets created through UnifAI are non-custodial wallets; users can export their private keys by clicking “Manage Wallet” in the upper right corner of the website.

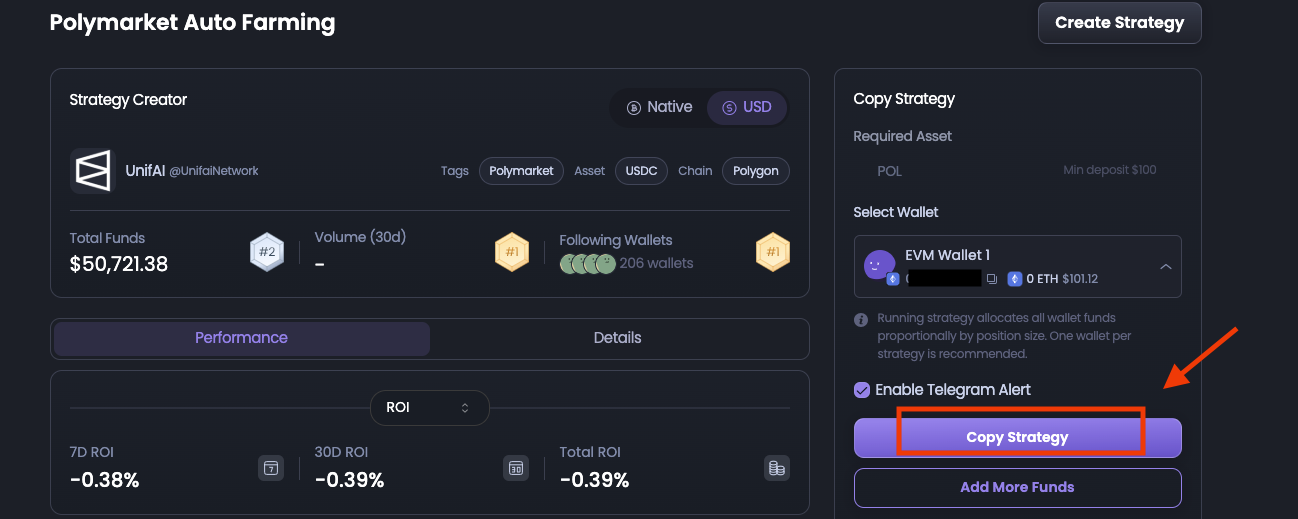

After the wallet is successfully created, you need to deposit at least 100 USDC and a small amount of POL as gas fees. Note that although UnifAI supports deposits via Ethereum, Base, BSC and Polygon, it is more convenient to use the Polygon network when running Polymarket's closing strategy agent. Users can directly transfer USDC and POL to the address via the Polygon network through exchanges.

Once the transfer is complete, click "Copy Strategy" and the agent will run automatically, searching for events with a probability greater than 95% in the Polymarket market and automatically buying them.

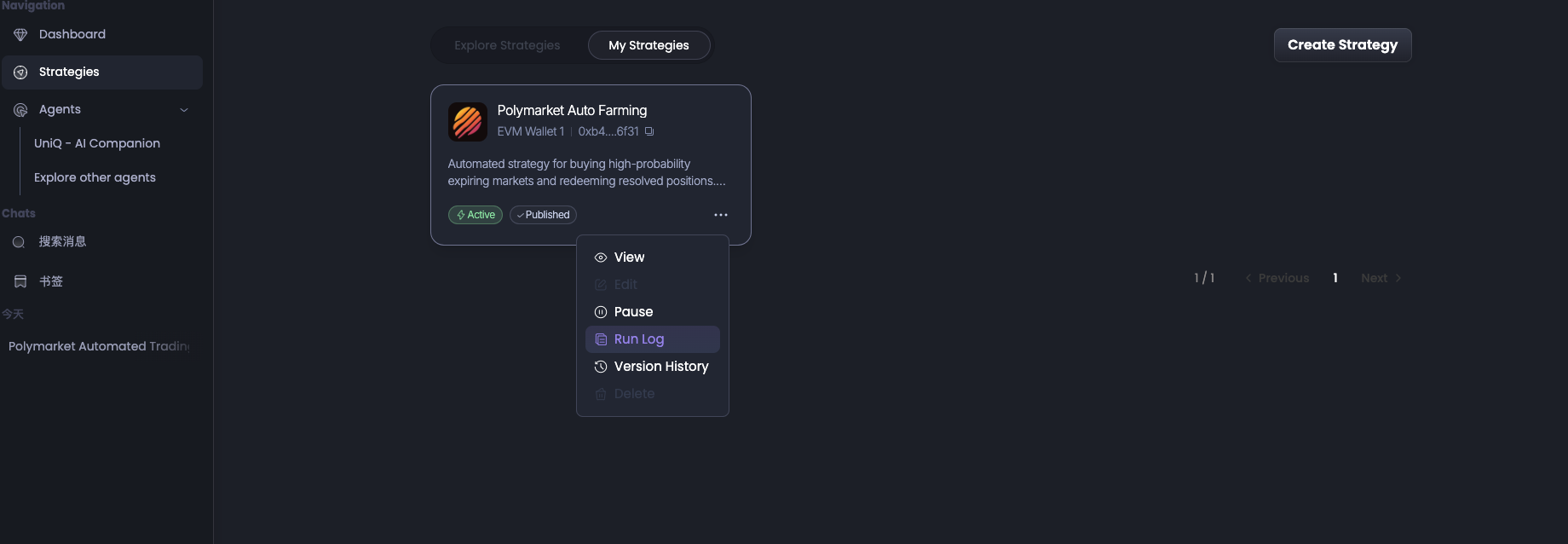

On the "Strategies" page, clicking "My Strategies" will display the currently running agents. Users can also choose to stop the strategy here, or click "Run Log" to view the strategy execution log.

Risk Warning

While end-of-day strategies are generally profitable, they can be susceptible to black swan events—events with a 95% probability of success may suddenly reverse or be manipulated by large investors. In such cases, users' funds could be wiped out. To address this, UnifAI employs a portfolio diversification mechanism, meaning it never bets its entire capital on a single event, thus mitigating some of the risk for users.

It's also worth noting that UnifAI's Polymarket end-of-game strategy agent has only been launched for two days and is not yet fully stable. Many users have reported betting errors in the community. The official response is that "too many new users have joined, Polymarket has reached its speed limit, and we are working hard to resolve this." Therefore, as a player, you can currently participate with a small amount of capital, or look for similar products on the market that are more stable. Those with technical skills can try writing their own program.

Can you get an airdrop by using an AI agent to interact with Polymarket?

Our main purpose in using AI agents to execute Polymarket end-of-day strategies is to achieve “lossless interaction” with Polymarket to obtain airdrops and save as much time and effort as possible. However, if Polymarket interaction using AI agents fails to obtain airdrop eligibility, then we are putting the cart before the horse.

Polymarket uses a built-in custodial wallet model. Users log in via wallet, email, or other methods, and the platform automatically generates a wallet associated with that wallet. Users need to deposit funds into this built-in wallet to trade, and private keys cannot be exported. Therefore, even if Polymarket airdrops snapshots, they are highly likely based on data from this built-in wallet.

However, when Agent A executed the Polymarket end-of-day strategy, it did not create a Polymarket account using the user's wallet. Users can verify this by exporting their UnifAI wallet private key and logging into Polymarket themselves. This has led the community to speculate that the UnifAI agent is using a "large fund model" and is not independently managing user wallet funds.

However, according to UnifAI community administrators, UnifAI's Polymarket end-of-day strategy agent directly uses user wallets to place bets. The reason why users cannot see the interaction when they log in to the Polymarket website is because "all third-party Polymarket accounts, from Telegram Bots to third-party market makers, directly use wallet interactions, rather than the Polymarket built-in wallet generated based on that address."

Whether the interaction addresses in this model will ultimately be included in the Polymarket airdrop is currently uncertain. However, if Polymarket ultimately only recognizes addresses with platform-built-in wallets and interaction data as "real users," it would be a significant loss for users employing this strategy. Therefore, those betting on airdrops can currently allocate a small amount of funds to AI proxies for Polymarket interactions, while primarily relying on manual airdrop farming.