RWA Weekly Report | RWA Asset Holders Add Over 20,000 in a Single Week; Bitwise to Launch Solana Staking ETF BSOL Today (October 22-28)

- 核心观点:RWA市场持续增长,链上总价值创新高。

- 关键要素:

- RWA链上总价值达350亿美元,周涨2.52%。

- 资产持有者增至51.2万,周增4.08%。

- 私人信贷占比超50%,美债增长3.61%。

- 市场影响:推动机构资金流入,加速资产代币化进程。

- 时效性标注:中期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

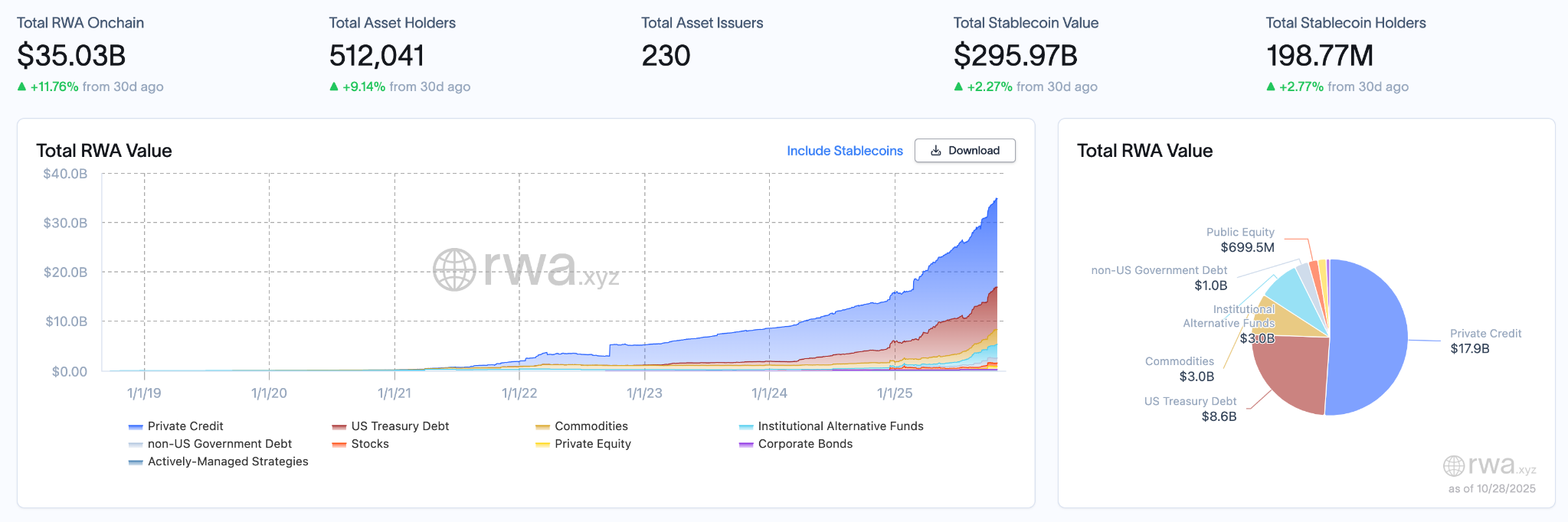

RWA Sector Market Performance

As of October 28, 2025, the total value of RWA on-chain reached $35.03 billion, an increase of $860 million from $34.17 billion on October 21, a weekly increase of 2.52%. The total market capitalization of on-chain assets increased for the fifth consecutive week, setting new all-time highs. The total number of asset holders increased from 491,951 to 512,041, with 20,090 new holders added in a single week, a 4.08% increase. This was the most significant week of user growth in the past four weeks, indicating a significant increase in activity. The number of asset issuers increased from 226 to 230, with 4 new issuers. Regarding stablecoins, the total market capitalization was $295.97 billion, a slight decrease of $120 million, or 0.04%, from $296.09 billion the previous week. This was a minimal change, indicating a period of sideways trading. The number of stablecoin holders increased from 197.00 million to 198.77 million, an increase of approximately 1.87 million, or 0.95%, and the user base maintained steady growth.

From an asset perspective, private credit grew steadily from $1.74 billion to $1.79 billion, an increase of $50 million, or 2.87%, maintaining its share of the total. US Treasury bonds also saw a rise, increasing from $830 million to $860 million, an increase of $30 million, or approximately 3.61%. Amidst the correction in US Treasury yields, on-chain allocation demand has rebounded. Commodity assets declined from $3.1 billion to $3 billion, a slight decrease of $100 million, or 3.23%, making them a relatively weak sector this week. Institutional alternative funds rose from $2.8 billion to $3 billion, an increase of $200 million, or 7.14%. Institutional funds remain focused on non-standard strategies. Public equity reached $699.5 million (due to system statistical adjustments, displayed numerically). Non-US government debt remained at $1 billion, unchanged for now, with limited overall impact.

Trend analysis (compared to last week )

This week, the RWA market continued its upward trend with internal divergence. While total market capitalization and user numbers continued to climb, performance varied across asset classes. Private credit, US Treasury bonds, and alternative funds performed reliably, providing fundamental support for the market. In contrast, commodities and public equity assets experienced a period of correction, reflecting a short-term rebalancing of risk and return. The number of asset issuers rebounded to 230 this week, indicating a stabilizing market structure while still maintaining room for expansion.

Review of key events

Bitwise to Launch Solana Staking ETF BSOL Today

Cointelegraph published on the X platform that Bitwise will launch its Solana Staking ETF (BSOL) today, which is the first ETP in the United States with 100% spot SOL exposure.

Hong Kong's first Solana spot ETF is listed, with an initial issuance of HK$21.29 million

Hong Kong’s first Solana spot ETF, the ChinaAMC Solana ETF, has officially been listed on the Hong Kong Stock Exchange, becoming the third category of cryptocurrency spot ETF approved by the Securities and Futures Commission of Hong Kong, following Bitcoin and Ethereum.

According to SoSoValue data, the trading volume on the first day of listing was HK$11.39 million, with a total net asset value of HK$21.29 million, equivalent to approximately 13,461 SOL. The HKD counter closed at a -0.60% discount, indicating strong selling pressure. This first-day trading volume was approximately half the trading volume of the Ethereum spot ETF listed in Hong Kong on April 30, 2024 (when three products were listed simultaneously).

The ChinaAMC Solana ETF, issued by ChinaAMC (Hong Kong), was approved by the Hong Kong Securities and Futures Commission on October 22. Its features include:

- Support cash or physical redemption

- Solana is not supported to provide additional income through staking

- Management fee rate 0.99%

- Multi-currency transactions: Supports Hong Kong dollar (code 3460), RMB (code 83460), and US dollar (code 9460) transactions

Aave Labs acquires Stable Finance to expand consumer access to on-chain savings

Aave Labs, the company behind the DeFi project Aave, announced it has acquired Stable Finance, a San Francisco-based startup dedicated to simplifying on-chain savings for everyday users. Terms of the transaction were not disclosed. The move brings Stable's founder, Mario Baxter Cabrera, and his engineering team to Aave Labs, where they will assist in developing new consumer-focused DeFi products. Cabrera will join as Director of Product.

Aave Labs founder Stani Kulechov stated that the acquisition reinforces the company's goal of integrating "on-chain finance into everyday finance." Stable's technology will be integrated into future Aave Labs products, with its existing applications gradually phased out. This acquisition marks Aave's third talent-focused transaction, following its acquisitions of Sonar in 2022 and Family in 2023, and aims to continuously expand its product design capabilities.

Documents indicate that Ant Group has applied to register several trademarks in Hong Kong related to virtual assets, stablecoins, and blockchain, including "ANTCOIN." Industry insiders believe this move may be an early stage in its development of fintech and Web3 businesses, aiming to expand into new business areas beyond traditional payment systems. (Hong Kong Economic Times)

Fireblocks, an enterprise-level digital asset custody platform, announced the acquisition of Web3 development platform Dynamic to accelerate the implementation of on-chain applications for fintech and corporate clients.

Dynamic provides on-chain account and wallet infrastructure to numerous industry institutions, including Kraken, Zerohash, Magic Eden, Lighter, and Ondo Finance, supporting over 50 million on-chain accounts to date. With this acquisition, Fireblocks will for the first time offer a complete product stack from institutional custody to end-user wallets, encompassing custody, settlement, user onboarding, wallet integration, and fund transfers, enabling businesses to launch secure and compliant on-chain products within days.

"For the past seven years, we've provided secure custody and settlement infrastructure to the world's largest banks and exchanges," said Michael Shaulov, CEO of Fireblocks. "Now, combined with Dynamic's consumer-grade wallet and multi-chain access capabilities, we've created the industry's first secure, scalable platform that covers the entire chain."

Dynamic co-founder and CEO Itai Turbahn added that the team's vision is to enable businesses to "access Web3 functions as easily as accessing Twilio and Plaid," and that this integration will help more teams quickly launch on-chain services in areas such as payments, yield farming, stablecoins, and embedded wallets. (citybiz)

Coinbase acquires crypto fundraising platform Echo for $375 million, founded by Cobie

Coinbase announced that it has acquired the crypto fundraising platform Echo for approximately US$375 million. The platform was founded by Cobie, a well-known figure in the crypto industry, and focuses on on-chain capital raising.

To date, Echo has helped approximately 300 projects raise over $200 million through direct funding from its community. Following the acquisition, Echo will temporarily operate as an independent brand, while its core product, Sonar (which supports both private and public token sales), will be integrated into the Coinbase platform.

Coinbase stated that the acquisition aims to build a "full-stack solution" for crypto fundraising, providing entrepreneurs with financing tools closely aligned with their user base and opening up access to early-stage projects for investors. The company also plans to expand Echo's infrastructure to tokenized securities and real-world assets (RWAs). This acquisition aligns with Coinbase's earlier acquisition of token management platform LiquiFi.

In addition, the deal reportedly includes $25 million to relaunch Cobie's podcast, UpOnly. (Coindesk)

Hot Project Dynamics

Ondo Finance (ONDO)

One sentence introduction:

Ondo Finance is a decentralized finance protocol focused on the tokenization of structured financial products and real-world assets. Its goal is to provide users with fixed-income products, such as tokenized U.S. Treasury bonds and other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its ONDO token is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Latest News:

On October 20, Ondo Finance announced on the X platform that more than 90 million wallets now support tokenized stock and ETF trading. In addition, its subsidiary Ondo Global Markets has also obtained support from Blockchain․.com and will provide trading services for more than 100 tokenized stocks and ETFs to global users.

Ondo Finance previously wrote to the U.S. Securities and Exchange Commission (SEC ) calling for a delay or rejection of Nasdaq’s proposed tokenized securities trading plan. Ondo argued that the plan could give large institutions an unfair advantage because it relies on undisclosed settlement details.

In the letter, Ondo stated that without clarity on how the Depository Trust Company (DTC) would handle blockchain settlement, it would be difficult for regulators and investors to fairly assess the proposal. While supporting the development of security tokenization, Ondo advocated for approval after the DTC had finalized its systems to ensure market fairness and transparency.

MyStonks (STONKS)

One sentence introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing and trading RWAs, such as US stocks, on-chain. The platform partners with Fidelity to achieve 1:1 physical custody and token issuance. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks is committed to bridging the gap between TradFi and DeFi, providing users with a highly liquid, low-barrier-to-entry on-chain investment platform for US stocks, and building the "Nasdaq of the crypto world."

Previous news:

On September 16th, the MyStonks platform officially launched Hong Kong stock futures trading . Users can trade directly with USDT/USDC using their wallets, with up to 20x leverage. This launch includes a number of high-quality Hong Kong stocks, including Guotai Junan International (1788.HK), BYD Co., Ltd. (1211.HK), Xiaomi Group (1810.HK), Mixue Group (2097.HK), Meituan (3690.HK), Tencent Holdings (700.HK), Pop Mart (9992.HK), JD.com (9618.HK), and SMIC (981.HK). These stocks cover a variety of industries, including technology, automotive, retail, internet, and semiconductors, meeting users' diverse asset allocation needs.

On September 25th, the MyStonks platform announced a brand upgrade , officially changing its domain name to msx.com, marking its entry into a new era of global fintech. This upgrade not only simplifies access but also demonstrates its transformation from a meme-based platform to a professional international financial brand, demonstrating its commitment to digital financial innovation and global expansion. The msx.com team stated that it will continue to prioritize users, drive technological innovation, and enhance the security and efficiency of digital financial services.

Related links

Sort out the latest insights and market data for the RWA sector.

Understanding the TreeGraph Public Chain, a World-Class Public Chain

A relatively basic article that introduces the Conflux chain and its current development status.

Correctly Understanding Regulation: The Compliance Development Path of the RWA Industry in China

Correctly understanding the core intent of regulatory policies and exploring innovation within a compliance framework are key to the sustainable development of the RWA industry in China. Regulation is not intended to prohibit business operations, but rather to guide financial innovation to better serve the real economy and prevent systemic financial risks. Only by adhering to the principle of "shifting from virtual to real" can RWA find a suitable development path in China.