With the tariff threat temporarily lifted, is the bull market coming back?

- 核心观点:中美关税磋商进展推动加密市场普涨。

- 关键要素:

- BTC突破11.5万美元,24小时涨3.02%。

- 加密总市值回升至3.984万亿美元。

- 巨鲸持有超3亿美元多单未止盈。

- 市场影响:市场情绪转暖,空头大量爆仓。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

As tariff negotiations between China and the United States have made new progress, crypto market sentiment has rapidly heated up.

From last night to this morning, the market saw another significant surge. OKX market data (data as of 9:30 AM) shows that BTC broke through 115,000 USDT, reaching a high of 115,590 USDT, a 24-hour increase of 3.02%. ETH approached 4,200 USDT, reaching a high of 4,194.84 USDT, a 24-hour increase of 5.88%. Sol (SOL) reclaimed the 200 USDT mark, reaching a high of 205.09 USDT, a 24-hour increase of 5.58%.

Besides BTC, ETH, and SOL, the altcoin market has finally seen some decent recovery, with some tokens seeing impressive gains. For example, the consistently strong ZEC reached 368 USDT, a 30.03% 24-hour increase. Favored by the renewed interest in AI, VIRTUAL reached 1.5761 USDT, a 22.25% 24-hour increase. Popular protocols like PUMP, PENDLE, and ENA also performed well, with 24-hour gains of 17.64%, 10.06%, and 9.22%, respectively.

Driven by the overall upward market, the total cryptocurrency market capitalization has rebounded rapidly. Coingecko data shows that the total cryptocurrency market capitalization has returned to $3.984 trillion, a 24-hour increase of 3.5%, just shy of the $4 trillion mark. Panic among cryptocurrency users has also significantly subsided, with the Fear and Greed Index reaching 51 today, shifting from "panic" to "neutral."

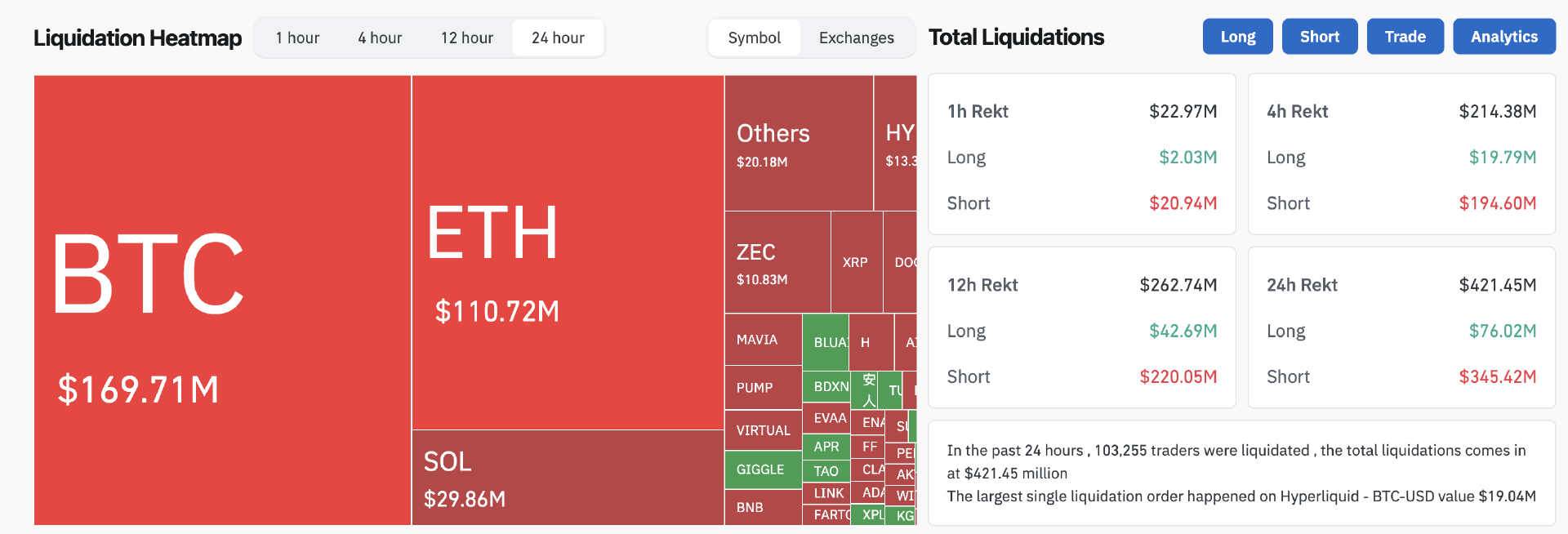

In derivatives trading,Coinglass data shows that over the past 24 hours, the entire network saw $421 million in liquidations, the vast majority of which were short positions, totaling $345 million. By currency, BTC saw $169.7 million in liquidations, while ETH saw $110.7 million in liquidations.

Tariff clouds temporarily lifted

From the news perspective, the most direct reason for the rapid recovery of the market is undoubtedly the new results achieved in the consultations between China and the United States on tariff conflicts.

From October 25 to 26, the Chinese side's chief negotiator for China-US economic and trade consultations, Vice Premier He Lifeng, and his US counterparts, US Treasury Secretary Jeffrey Bessant and Trade Representative Greer, held China-US economic and trade consultations in Kuala Lumpur.

Li Chenggang, China's international trade negotiator and vice minister of the Ministry of Commerce, told Chinese and foreign media reporters after the consultations that the two sides had reached a preliminary consensus on properly resolving a number of important economic and trade issues of mutual concern, and would carry out their respective domestic approval procedures in the next step.

Following the talks, U.S. Treasury Secretary Jeffrey Bessant stated in an interview with U.S. media that the two sides reached a "very substantive framework agreement" after two days of talks in Kuala Lumpur, laying the groundwork for a meeting between the two leaders. The U.S. side is "no longer considering" imposing 100% tariffs on China. U.S. Trade Representative Greer also stated at a press conference that the U.S.-China trade negotiations were productive, covering a wide range of issues. The two sides are discussing the final details of a trade agreement proposal, which is almost ready for submission to the two leaders for review.

Since Trump suddenly opened fire again on the issue of tariffs earlier this month, a dark cloud has always hung over the cryptocurrency market and even the global financial market. On October 11, the market suffered a historic plunge (see " 1011 Horror Night: The Crypto Market Plummeted Instantly, and $20 Billion Was Wiped Out " for details). As the relevant contradictions gradually ease, the market will naturally warm up. Having said that, this seems to be Trump's classic "raise high and put down lightly" strategy, but a major transfer of wealth has been completed in one move .

This week's focus: interest rate decision

The focus of the market this week will undoubtedly be the Federal Reserve's interest rate decision on Thursday morning . At 2:00 am Beijing time on October 30 (Thursday), the Federal Reserve FOMC will announce the interest rate decision and a summary of economic expectations; then at 2:30 pm, Federal Reserve Chairman Powell will hold a monetary policy press conference.

Last Friday, the U.S. Bureau of Labor Statistics released September's headline and core inflation figures, both lower than expected, paving the way for the Federal Reserve to further implement interest rate cuts. The unadjusted consumer price index (CPI) for September was 3% annualized, a slight increase from 2.9% the previous month, the highest since January 2025, but slightly below the consensus forecast of 3.1%. The seasonally adjusted CPI for September was 0.3% monthly, below both the consensus forecast and the previous reading of 0.4%. The unadjusted core CPI for September was 3% annualized, below both the consensus forecast and the previous reading of 3.1%. The seasonally adjusted core CPI for September was 0.2% monthly, also below both the consensus forecast and the previous reading of 0.3%.

Following the release of the CPI data, traders increased their bets that the Federal Reserve will cut interest rates twice more this year. Data from the CME "FedWatch" indicator indicates a 97.3% probability of a 25 basis point rate cut in October, with a 2.7% probability of maintaining interest rates. The probability of a cumulative 50 basis point rate cut in December is 95.5%.

"Insider" whale movements: continue to be bullish

Putting aside all the traditional influencing factors with uncertainty and abstracting the market trend into a very simple problem, the individual with the most say recently is undoubtedly the whale with a 100% winning rate since the big drop on October 11 (see " How is the whale with a 100% winning rate made? Revealing the true identity of the "Trump insider"" for details ).

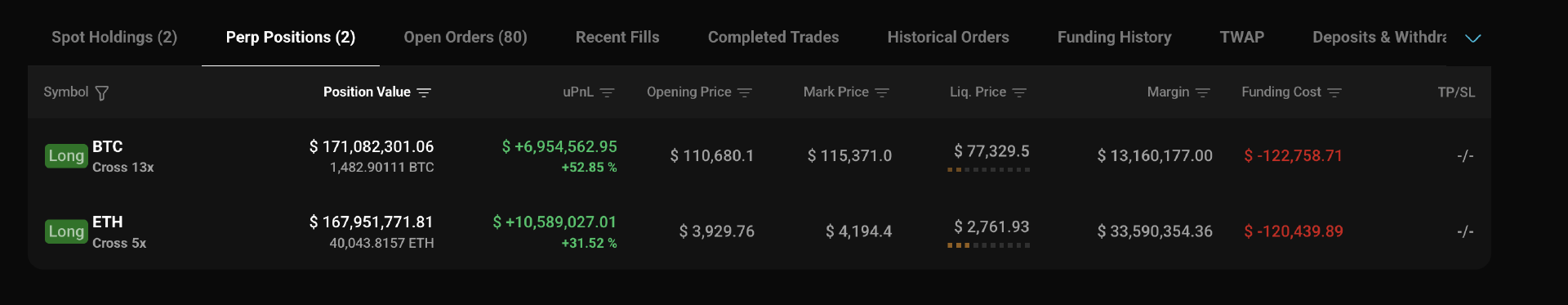

HyperBot data shows that the "100% Win Rate Whale from October 11th to Date" currently holds a 13x BTC long position and a 5x ETH long position, resulting in a profit of approximately $17.54 million. The whale has not yet taken profits, and even added an additional 1,868 ETH long position three hours ago. Currently, the whale's total holdings are valued at approximately $339 million, including approximately $171 million in BTC long positions, opened at $110,680, and approximately $168 million in ETH long positions, opened at $3,929.

Clearly, the whale is still bullish. Whether it's based on insider information or technical analysis, keeping up with the whale's pace in the short term may be the best solution to the current market situation.