Original author: OneShotBug

Original Source: Investor Sixpence

October 2025 is the U.S. stock market earnings season, and the key word is: "far exceeding expectations."

October 2025 is the U.S. stock market earnings season, and the key word is: "far exceeding expectations."

JPMorgan Chase and Goldman Sachs' latest quarterly earnings reports, two of Wall Street's most prominent banks, easily surpassed analyst expectations. JPMorgan Chase's third-quarter revenue grew 9% to $47.12 billion, far exceeding the expected $45.4 billion; Goldman Sachs' third-quarter revenue grew 20% to $15.18 billion, far exceeding the market's $14.1 billion forecast. Many US stock market participants saw satisfactory returns as a result. The recent decline and subsequent rise in US stocks, driven by factors such as trade conflicts, has provided investors with more room for maneuver.

However, although the U.S. stock market is full of investment opportunities, ordinary investors from mainland China have once again been shut out: in September, platforms such as Tudou and Hutong announced their complete closure. Unless they have overseas permanent residency, mainland Chinese users will no longer be able to open an account freely.

So, how should ordinary investors in mainland China participate in the U.S. stock investment market now?

My answer is: Bitget.

Recently, Bitget Exchange announced support for trading hundreds of RWA (Real-Warnings Authorization) US stock tokens, with no overseas ID or complex account opening process required, and entry points as low as $30. These stock tokens include well-known US stocks such as Apple, Tesla, Microsoft, and Nvidia. These tokens are held in regulated US custodians, their prices are pegged to the actual stock, and they are available for trading 24/7.

This means: Investing globally no longer requires a cross-border identity, only a Bitget account is required.

This is driven by their "UEX" concept—Universal Exchange. With a comprehensive range of assets, Bitget is reshaping the boundaries of "exchange." From on-chain assets and real-world assets (RWA) to AI-powered trading experiences, Bitget has built a unified platform that breaks down the barriers between traditional finance and crypto assets.

The real question we should ask is: if there is such an entrance that integrates the world's high-quality assets in your hands, how many reasons do you need to continue opening an account in the traditional way?

Bitget UEX: A faster, cheaper, and more user-friendly channel for US stocks

In the past, investing in well-known US stocks like Apple, Nvidia, and Tesla required opening an account through platforms like Futu and Tiger, and providing proof of overseas identification. Now, Bitget, a UEX, is offering two more flexible and lower-threshold alternatives.

1. US stock perpetual contracts

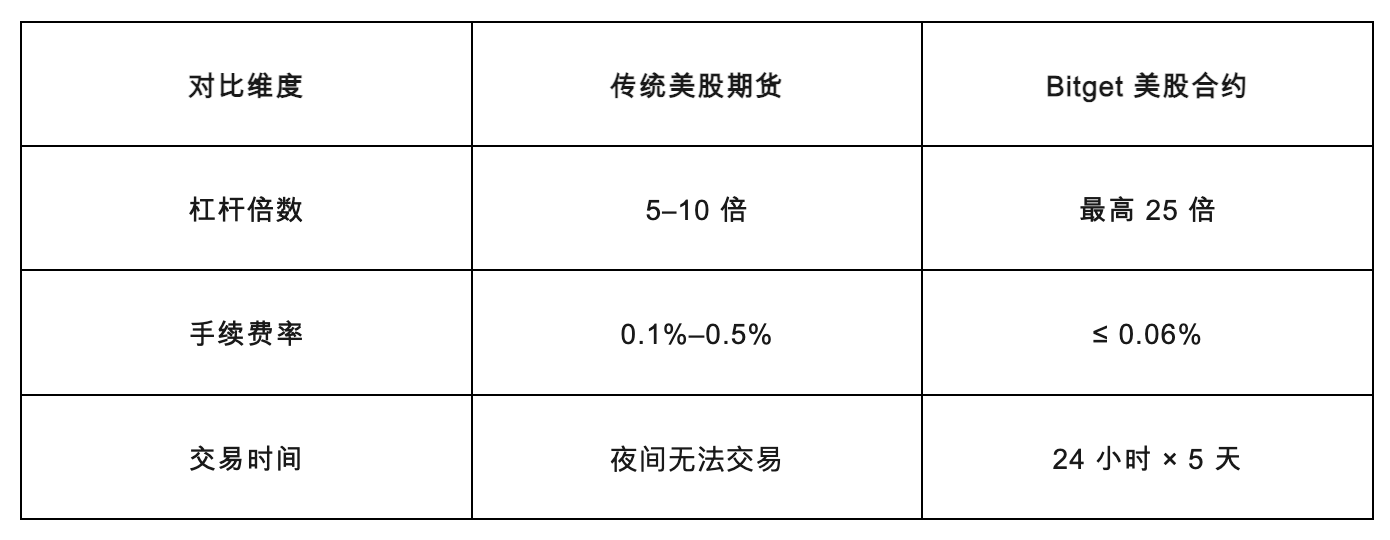

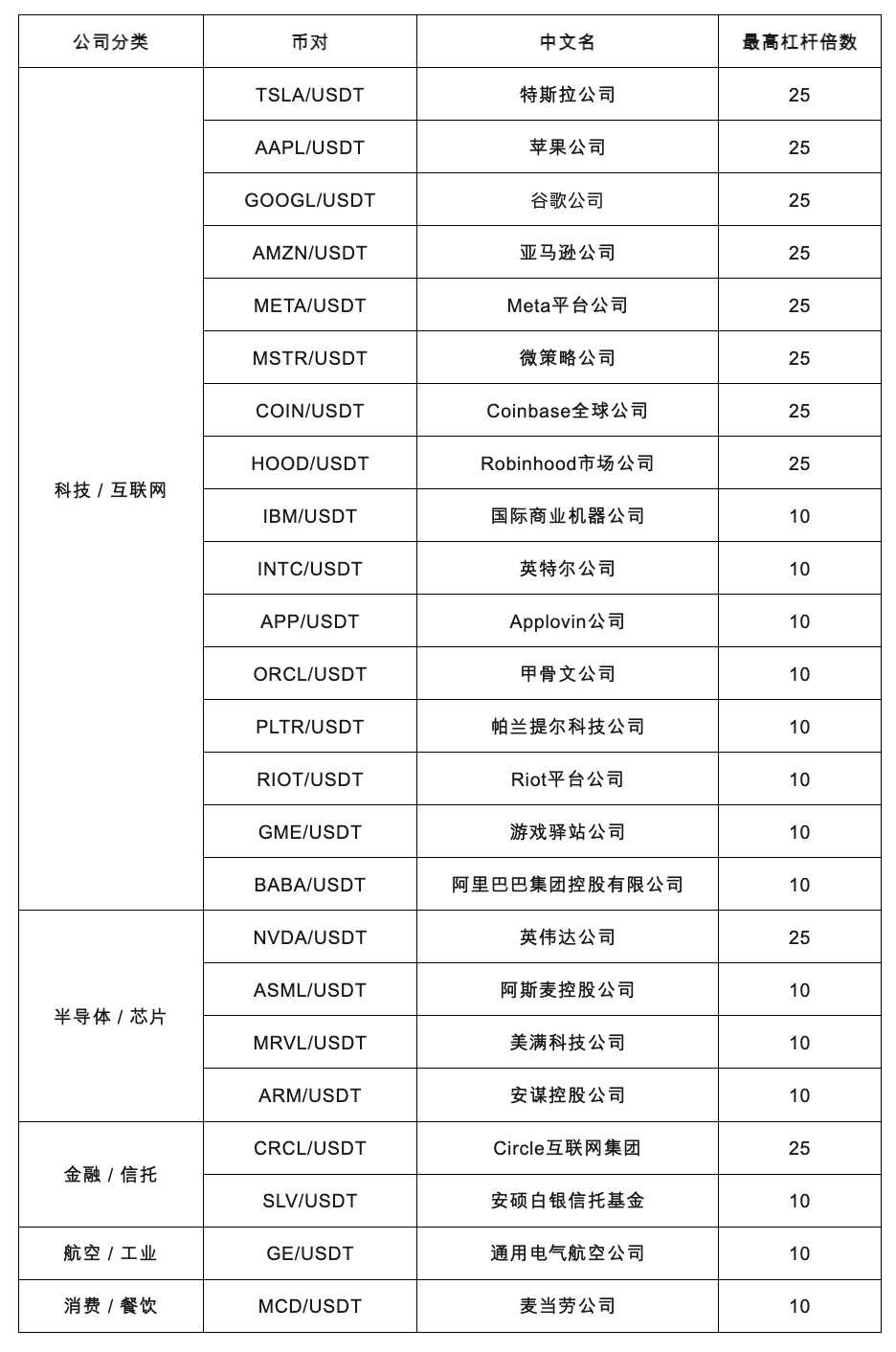

Users simply download the Bitget app and deposit USDT into their contract account to access the "Stocks - Contracts" section, where they can trade 25 U-denominated US stock perpetual contracts across popular sectors like technology, chips, aviation, finance, and consumer goods. This trading method not only offers a low barrier to entry but also offers flexibility unmatched by traditional platforms:

Other advantages include:

- Only need mobile phone number or email address to register and trade

- Open a position with $1

- Flexible leverage, stop-profit and stop-loss settings to facilitate different market strategies

-Risk control guarantee: Dynamically adjust the leverage ratio for different targets to ensure transaction security and liquidity

Current available products include:

2. RWA US Stock Token (Coin-Share)

If you prefer long-term holding of US stocks, Bitget has also partnered with Ondo Finance to launch a batch of on-chain versions of US stock assets, including stocks of hundreds of well-known companies such as Apple, Tesla, Microsoft, Amazon, and Nvidia, as well as mainstream index funds. You can trade US stock tokens through the stock section on the Bitget App homepage - Stock Tokens.

All assets are held in custody by a regulated US custodian. Tokens reflect underlying asset price fluctuations and dividend yields, with a minimum investment of $30. All assets are denominated in US dollars and trade 24/5, providing users with a convenient experience that surpasses traditional brokerages and banks.

You can think of it as a combination of "U.S. Stock Connect + Crypto Account" - a new generation of cross-border financial management method that truly maps global assets.

For most investors who have opened accounts with Futu and Tiger but are now blocked, Bitget's two methods provide a real choice: use the method you are familiar with to invest in the global market with more free tools.

Invest in US stocks with Bitget, and use AI to achieve intelligent analysis and strategy assistance

Many people assume that investing in crypto assets requires knowledge of blockchain, wallet operations, and even coding. Bitget is striving to break this misconception by making the complexities accessible. Here's how to execute trading instructions like sending WeChat messages, and how the system intelligently selects the most efficient and cost-effective path.

1. AI assistant GetAgent: Analyze targets and place orders through WeChat chat

To place an order on a traditional trading platform, users need to:

-Select market type (spot/contract)

-Select trading pair

-Set price and quantity

- Place buy and sell orders

-Manage positions, take profit and stop loss, etc.

This entire process is not only cumbersome, but also discourages a large number of new users.

Bitget's GetAgent completely reshapes the trading experience. All you need is one sentence:

“Help me buy Nvidia with $100.” “I want to short Tesla with $50, 5x leverage.”

The implementation mechanism behind this is very complex, including:

- Intent recognition (what asset the user wants to trade, long or short)

- Asset matching (which market and which product is best)

-Automatic order placement and matching (calling intelligent routing algorithm)

- Risk control testing (whether leverage/position requirements are met)

- Order execution feedback (confirmed user)

But all of this is just a matter of words in the eyes of users.

This makes transactions truly "conversational" and "humanized", rather than an operating interface with high technical barriers.

2. Smart Routing: Efficient Transactions and Optimized Fees

Bitget also integrates smart routing in the background. When trading assets, the platform will:

- Estimate the optimal path (for example, if you want to buy a new coin on the Base chain, it will determine whether it is most cost-effective to first exchange USDT for ETH and then exchange ETH for the coin)

- Estimate gas fees and slippage to automatically execute the most economical path

-Integrate multiple on-chain DEX liquidity pools to optimize prices

This means that users no longer need to understand the on-chain mechanism, gas fee logic, and bridging process themselves, but instead get an almost CEX-level operational experience, but it is completed on the chain.

UEX: Not just a US stock trading platform, but a gateway to global assets

If Bitget offers a combination of "US stock contracts + US stock tokens", then the real question it wants to solve is: Why are you still using tools from ten years ago to invest in the current market?

Traditional investors have long been accustomed to managing different assets on multiple platforms and accounts:

-Use brokerage firms to speculate in US stocks;

- Go to the bank to allocate gold;

- Buy some crypto assets on an exchange;

-Return to the spreadsheet to do asset allocation and summary.

The fragmentation of all this not only keeps the investment threshold high, but also makes it costly, inefficient and has a poor experience for ordinary investors when switching between different markets.

Similar problems have also arisen in the cryptocurrency world. UEX is a future-oriented solution, whether it is TradFi (traditional finance), CeFi (centralized finance in the cryptocurrency world), or DeFi (decentralized finance in the cryptocurrency world).

You'll find that many cryptocurrency exchanges, including CEXs (centralized exchanges) and DEXs (decentralized exchanges), are experimenting with RWA-like products and on-chain integration products. The overall industry trend is towards the encryption of traditional assets and the controllability of on-chain assets. Bitget simply achieved a closed loop and defined the direction earlier.

Just like the iPhone was already in practice before the word "smartphone" was born; UEX may be the prototype of the future "super application platform" in crypto finance.

Risks, Challenges and Future Forecasts

Of course, UEX is not a panacea. To truly become an industry standard, it still faces many practical problems:

1. Regulatory challenges are the biggest variable

Although Bitget introduced U.S. stock assets through tokenization and claimed that they were managed by a "U.S. compliant custodian," there are still differences in the regulatory compliance standards for RWA assets in different countries around the world.

In particular, for platforms that provide quasi-securities trading services, will the SEC and other regulatory bodies further define them as "brokerage dealers" in the future? Will they require additional licenses? These questions remain unresolved.

If Bitget wants to become a "global asset circulation center", it must continue to invest in compliance - this will determine whether UEX can go far.

2. User education and conversion still takes time

To many traditional users, the idea that "a single exchange can trade traditional financial assets like US stocks, cryptocurrencies, and on-chain assets" sounds like a scam. Getting users to accept this super-asset aggregation model will take time.

Bitget still has work to do in this area, such as:

- Strengthen the output of educational content

- Provide introductory product packages (such as a "Beginner Asset Allocation Portfolio")

- Launch new features such as fixed investment tools and low-risk portfolio simulation trading

How far do we have to go on the road to panoramic transactions?

With the arrival of US stock earnings season, the market focus has once again shifted to technology and financial sectors, with investors oscillating between valuations and earnings expectations. Bitget's "UEX" concept offers a new investment perspective in this market environment: making investing in high-quality global assets more convenient and exploring how to break down the barriers between traditional investment methods and crypto finance.

This is not only an innovation for the trading platform, but also a challenge to the entire industry - how to break the limitations of traditional finance and provide a truly open investment space in an era of highly interconnected information and increasingly globalized asset flows.

As traditional brokerage firms tighten their barriers to entry, exchanges become more competitive, and user experience bottlenecks emerge frequently, Bitget has given its own answer: breaking asset isolation; integrating technology, AI, and wallets; and transforming the complexity of finance into simple operations.

Will all trading platforms, whether traditional finance or crypto asset exchanges, become “UEX-ized” in the future? Perhaps.

But what is more worth asking is: when assets can truly flow freely, is your investment thinking ready to break out of the boundaries of the old era?

- 核心观点:Bitget提供便捷美股投资通道。

- 关键要素:

- 支持RWA美股代币交易。

- 无需海外身份低门槛入场。

- 集成AI助手简化操作。

- 市场影响:降低全球资产投资门槛。

- 时效性标注:中期影响