JustLend DAO, the core DeFi protocol of the TRON ecosystem, has reached a milestone with the successful completion of the first large-scale destruction of JST, marking the official entry of JST from "full circulation distribution" into a new stage of development of "sustainable deflation."

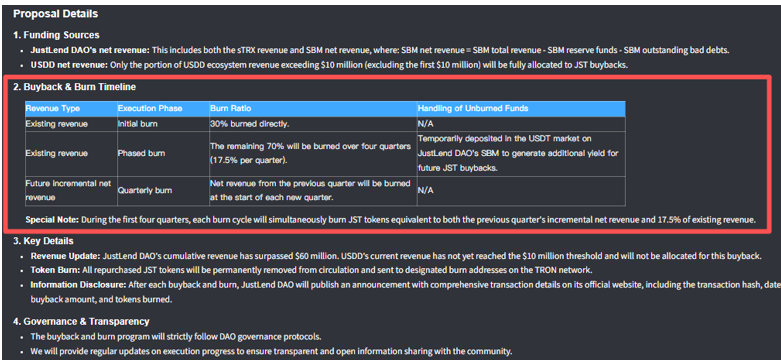

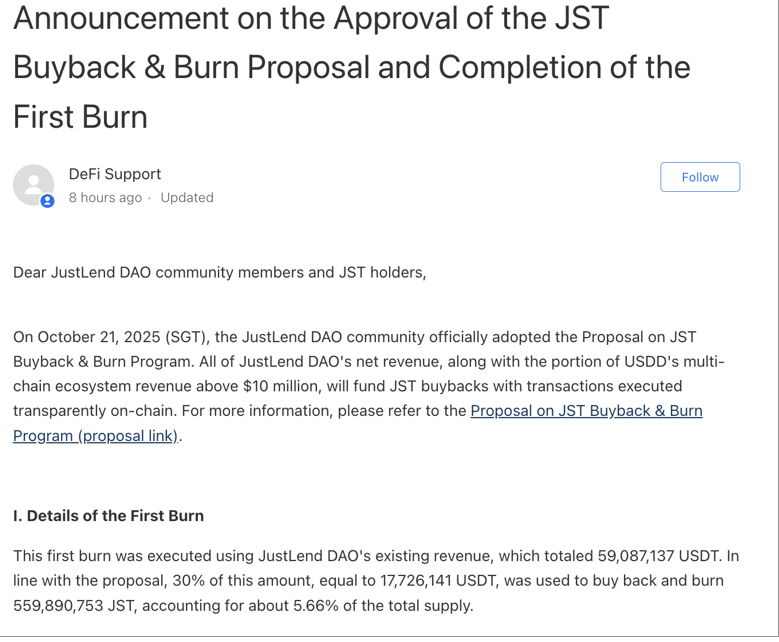

According to the latest destruction announcement, JustLend DAO has withdrawn more than 59 million USDT from its existing earnings, with 30% of this amount destroyed for the first time. The number of JST destroyed is as high as 560 million, accounting for 5.6% of the total supply of JST. The remaining 70% of the existing earnings will be carried out in four quarters and have been deposited in JustLend DAO's SBM USDT lending market for interest.

In the first round, 5.6% of the total supply was directly destroyed. Such a strong opening move instantly ignited the enthusiasm of the crypto community and triggered a positive response from the market.

Crucially, this buyback and burn is far from a short-term stimulus; rather, it marks the beginning of JST's long-term deflationary model, built on the ecosystem's real returns. From the approximately $60 million in existing earnings from JustLend DAO, to the continued injection of incremental earnings from its multi-chain ecosystem with USDD, to the value support provided by the JUST ecosystem's entire supply chain, JST is gradually forming a positive cycle: "ecosystem profits drive deflation, deflation increases scarcity, scarcity drives value, and value feeds back into the ecosystem." As ecosystem details continue to be finalized, the long-term value and growth potential inherent in JST are becoming increasingly clear.

The buyback and destruction will be carried out in batches and in an orderly manner: 5.6% of the total supply will be destroyed in the first round, and there is still more than 41 million US dollars of proceeds to be destroyed

The newly launched buyback and burn mechanism for JST demonstrates unique competitiveness. It doesn't rely on short-term, one-time fiscal subsidies, but rather is rooted in the real business profitability of JustLendDAO and USDD, two key ecosystem pillars. By directly linking JST's value to ecosystem returns and employing a clever design that prioritizes existing returns and fuels incremental returns, JST establishes a clear, sustainable, long-term deflationary loop, fundamentally different from the short-lived, short-term buybacks often seen in the crypto market.

From the perspective of funding sources, the source of JST repurchase funds is transparent and highly sustainable. It precisely focuses on the profitability of the two core components of the JUST ecosystem, "JustLend DAO and USDD". There is no risk of "taking money from one pocket to fill another", which fundamentally guarantees the stability of the deflation mechanism.

Specifically, the funds will be divided into two categories: the current and future net income of JustLend DAO, covering both existing and future incremental revenue; and the incremental revenue generated by the USDD multi-chain ecosystem once profits exceed $10 million. Both categories of funds will be invested in JST repurchases and permanently destroyed. This design deeply aligns the value of JST with the profitability of JustLend DAO (TRON's core lending protocol) and USDD (TRON's second-largest stablecoin), creating a virtuous cycle of "a more prosperous ecosystem leads to higher business profitability, which in turn leads to stronger deflation," laying a solid foundation for the long-term value growth of JST.

According to the previous proposal announcement, the JustLend DAO platform has accumulated approximately US$60 million in existing stock earnings, which will be fully injected into JST repurchase and destruction in batches; and the USDD ecosystem will have to wait until its profits exceed the US$10 million threshold before its incremental earnings will be added to the repurchase and destruction queue, reserving additional momentum for long-term deflation.

During the destruction phase, JST adopted a gradual approach of "orderly phased release of existing stock, and continuous and steady injection of incremental stock." This strategy effectively avoids short-term market speculation caused by a one-time large-scale destruction, ensures the impact of short-term deflation, and leaves room for compound growth during the long-term reduction process.

In terms of existing funds, the JustLend DAO platform has withdrawn over 59 million USDT in profits. According to the destruction announcement, this portion of funds was burned at a pace of "30% as the first batch of funds + 70% gradually destroyed quarterly."

At present, the first batch of JST destruction has been successfully completed. According to TRONSCAN data, 30% of JustLend DAO's current income has been successfully destroyed, corresponding to the destruction of approximately 560 million JST, accounting for more than 5.6% of the total supply of JST.

This wiped out more than 5.6% of the total supply, a move rarely seen among many crypto projects, fully demonstrating the team and community's firm determination to drive the long-term value growth of JST.

The remaining 70% of JustLend DAO's outstanding earnings will be used to repurchase and burn JST in batches over the next four quarters at a rate of 17.5% per quarter until the fourth quarter of 2026. Currently, this portion of funds is deposited in the form of jUSDT in the USDT market on JustLnd DAO's SBM to generate interest, and subsequent earnings will be used to repurchase and burn JST.

In terms of incremental funding, JustLend DAO's quarterly net revenue will be fully incorporated into the buyback pool. Once USDD profits exceed the $10 million threshold, its incremental earnings will also be injected into the buyback pool. This means that as the scale of the dual ecosystem businesses (e.g., JustLend DAO's lending TVL and USDD's circulating supply) continues to expand, JST's deflationary momentum will continue to strengthen, completely eliminating the problem of "lack of subsequent momentum."

Subsequent quarterly buyback and destruction will be handled by the JustLend Grants DAO, with clear and unambiguous rules: During the first four quarters, "JustLend DAO's incremental net income from the previous quarter + 17.5% of existing gains" will be destroyed at the beginning of each quarter. This "small-amount, high-frequency" operation model ensures the sustainability of deflation while smoothing market expectations, laying the foundation for long-term deflation of JST.

In addition to executing buybacks and burns, Grants DAO itself serves as the JST incentive and ecosystem empowerment organization led by the JustLend DAO community. Its core mission is to empower developers, contributors, and all ecosystem-building projects through diverse means while maintaining market stability. As a core booster of the ecosystem, it injects JUST ecosystem reserves and partner funds into the Grants Pool, benefiting all participants—JST holders, voters, liquidity providers, and more. Currently, the Grants DAO treasury holds approximately $130 million in reserves, providing a solid foundation for the long-term development of the JustLend DAO ecosystem.

The implementation of this deflationary closed loop marks JST's official transition from a "fully circulated token" to a "continuously shrinking value asset." The initial destruction of over 5.6% of the total supply is just the beginning. With the gradual release of existing funds and the continued injection of incremental funds, the cumulative proportion of destroyed tokens in the total supply will exceed 20%.

JustLendDAO and USDD's two major ecological benefits work together to increase the value of JST

Of course, the value growth of JST does not rely solely on the single logic of deflation, but is also rooted in the deep support of the "full-link value closed loop" of the entire JUST ecosystem - the synergistic profit empowerment of the two core components of JustLend DAO and USDD not only provides continuous capital replenishment for the deflation mechanism, but also builds a complete transformation path from "deflation and volume reduction" to "value enhancement".

As the core DeFi system of the TRON ecosystem, JUST has built a complex service system of "lending + staking + energy leasing" around the core lending protocol JustLend DAO. It has also expanded its comprehensive DeFi product matrix, including the stablecoin USDD and the cross-chain JustCrypto. This provides a system-level ecological guarantee for JST to achieve the transformation from "implementing a deflationary mechanism" to "substantial value enhancement."

JustLend DAO, a core pillar of the JUST ecosystem, has already completed its strategic upgrade from a single lending protocol to a comprehensive service platform, evolving into a multi-functional DeFi platform integrating a lending market (SBM), liquidity staking (sTRX), and energy leasing. This means that JustLend DAO's profitability isn't solely reliant on lending, but rather a multi-tiered revenue structure built through diverse businesses. This significantly enhances its risk resilience and growth potential, surpassing similar protocols. This diverse profit model and stable market position ensure that JST's deflationary "funding pool" will remain continuously replenished.

These are clearly demonstrated by JustLend DAO's operational data. As of October 21st, the platform's total locked-in value (TVL) exceeded $7.62 billion, with 477,000 users, firmly placing it at the top of the TRON ecosystem's DeFi protocol rankings. Even within the global lending landscape, JustLend DAO, leveraging its single-chain deployment advantages, has consistently ranked among the top four in terms of TVL, firmly establishing itself as a leading lending DeFi protocol.

In terms of profitability, the viability of JustLend DAO's business model has been fully validated by long-term operational data. According to the disclosed data from the destruction, JustLend DAO's platform withdrawals generated approximately $59 million in cumulative revenue. Furthermore, according to DeFiLlama data, capture fees in Q3 of this year approached $2 million, with average daily revenue exceeding $20,000 and maintaining a steady growth trend. This profitability level means that even without considering existing funds, incremental revenue alone can support a monthly repurchase volume of nearly $6 million, providing sustainable funding for JST's long-term deflation and providing a "bottom line" for long-term deflation.

Meanwhile, USDD, the decentralized stablecoin launched by JUST, serves as the "second profit engine" of JST's deflationary mechanism. According to the mechanism's design, when USDD's multi-chain ecosystem profits exceed the $10 million threshold, the excess profits will be directed into the JST repurchase fund pool.

As the second-largest stablecoin in the TRON ecosystem, USDD is rapidly advancing toward the $10 million profit threshold through diversified profit models, including interest income from overcollateralized assets and cross-chain transfer fees. USDD has now been deployed across multiple chains, including TRON and other major public chains like Ethereum and BNB Chain, with a circulation volume exceeding $450 million. This indicates that as USDD's circulation expands, its application scenarios will expand from a basic transaction medium to DeFi collateral and payment tools, potentially becoming a significant source of deflationary funds for JST.

Looking at the overall scale of the JUST ecosystem, its total locked-in value (TVL) has reached $12.2 billion, directly accounting for 46% of the total locked-in value of the TRON network. This means that nearly half of all assets on the TRON chain have chosen to be deposited in the JUST ecosystem. This overwhelming scale is no accident and directly demonstrates the market's high trust and widespread recognition of the JUST ecosystem. It also demonstrates its core ability to "continuously generate large-scale, stable returns." In the future, every lending operation, staking activity, and cross-chain transaction within the ecosystem will ultimately be converted into actual returns for JustLend DAO or USDD. These returns will directly serve as the core funding pool for the JST buyback and destruction, building a solid financial foundation for the deflationary mechanism.

Even more exciting is that the JUST ecosystem's growth momentum hasn't slowed, but continues to strengthen. JustLend DAO and USDD are both accelerating their business expansion. Their TVL and market share are steadily climbing, and their corresponding revenue will also expand. This will undoubtedly inject stronger financial support into JST's deflationary mechanism, ultimately forming a virtuous cycle of "ecosystem prosperity → revenue growth → accelerated deflation → value enhancement," providing a solid foundation for JST's long-term value growth.

The resonance between deflation mechanism and ecological benefits opens a new channel for JST value growth

With the official implementation of the first round of JST buybacks and burns, its large-scale deflationary process has fully begun. Currently, JST's deflationary mechanism resonates with the positive cycles of the JustLend DAO and USDD ecosystems, mutually reinforcing each other. This combined force is expected to directly propel JST into a new round of price increases.

JST tokens achieved 100% circulation in Q2 2023, with the total supply remaining constant at 9.9 billion, eliminating any future selling pressure. This feature means that each buyback and burn represents a true reduction in the "actual circulating supply," rather than a nominal adjustment. This creates a pure and direct deflationary effect.

In terms of the intensity of the destruction, the initial destruction of approximately 560 million JST has reduced the total supply by over 5.6%. With the continued implementation of subsequent quarterly buybacks, the cumulative deflation rate will approach 20% based solely on JustLend DAO's current revenue. The continued reduction in the circulating supply will significantly increase token scarcity, thereby providing strong support for the JST price.

It is particularly worth mentioning that the high proportion of JST burns is particularly prominent in the industry. The current market value of JST is only about $300 million, while the $60 million in accumulated earnings on the JustLend DAO platform alone is equivalent to 20% of the former's market value. Compared with similar tokens in the crypto market, most buyback and burn plans account for less than 5% of the funds (for example, Aave's buyback funds announced in March this year were only $24 million).

The destruction of over 20% of JST is considered an industry benchmark. Crucially, this percentage does not yet factor in future incremental revenue. As JustLend DAO and the USDD ecosystem grow in profitability, the deflationary effect will be further amplified.

Looking further at the product fundamentals, as TRON founder Justin Sun previously pointed out, the product support logic behind JST has undergone a fundamental change. It is not a single lending tool, but a comprehensive DeFi platform that integrates multiple functions such as "lending (benchmarked against Aave), stablecoins (benchmarked against MakerDAO), and staking (benchmarked against Lido)." It is equivalent to concentrating the core competitiveness of three types of leading products in the industry into one, and its fundamental strength far exceeds that of similar single protocols.

In particular, JustLend DAO, which serves as the core support of JST and is a long-established DeFi protocol launched in 2020, has achieved significant breakthroughs in its business by relying on its long-term accumulation: from the initial single lending, it has gradually expanded to staking, energy leasing and GasFree innovative functions, building a diversified income structure, and simultaneously improving risk resistance and profit potential; in terms of safe operations, it has always maintained a stable operating record of zero safety accidents, and this reliability is particularly rare in the industry.

At the same time, JustLend DAO also relies on the complete TRON ecosystem for strong support - including core resources such as the world's largest USDT circulation center and a user base of over 340 million. These advantages not only provide underlying guarantees and value amplification space for its diversified business, but will also continue to be transformed into the core value support of the JST token, consolidating its long-term growth foundation.

While most crypto projects are obsessed with short-term gains and market trends, JST has established a long-term deflationary logic through its buy-back and burn mechanism. Leveraging the dual profit engines of JustLend DAO and USDD, coupled with the comprehensive support of the JUST ecosystem, JST has forged a differentiated development path centered on value-driven growth, creating a stark contrast to the market's short-term profit-seeking behavior.

- 核心观点:JST启动长期通缩模型提升价值。

- 关键要素:

- 首轮销毁5.6亿枚JST,占总量5.6%。

- 依托JustLend DAO 6000万美元存量收益。

- 未来USDD生态收益将注入回购资金池。

- 市场影响:增强代币稀缺性,推动价值增长。

- 时效性标注:长期影响