The era of permanent quantitative easing by the Federal Reserve is approaching. Where are the opportunities for ordinary people?

- 核心观点:美联储将被迫重启量化宽松政策。

- 关键要素:

- 银行准备金已低于GDP的10%警戒线。

- 逆回购工具(RRP)余额耗尽,失去缓冲。

- SOFR与EFFR利差扩大,显示流动性紧张。

- 市场影响:推动资金流向黄金、比特币等抗通胀资产。

- 时效性标注:中期影响

Original text from James Lavish

Compiled by Odaily Planet Daily Golem ( @web3_golem )

"The Federal Reserve may stop shrinking its balance sheet in the coming months," a statement by Federal Reserve Chairman Powell last week sparked market speculation. The implicit signal behind this statement is that " quantitative tightening (QT) is about to turn into quantitative easing (QE), and the pace will be faster than most people expect ."

But is this merely a symbolic move by the Fed, or is it of extraordinary significance? Most importantly, what is Powell hinting at regarding the current state of the financial system? This article will delve into the Fed's liquidity strategy, the similarities and differences between the liquidity crisis we face today and that of 2019, and why the Fed will embark on a permanent quantitative easing (QE) policy.

Liquidity crisis looms

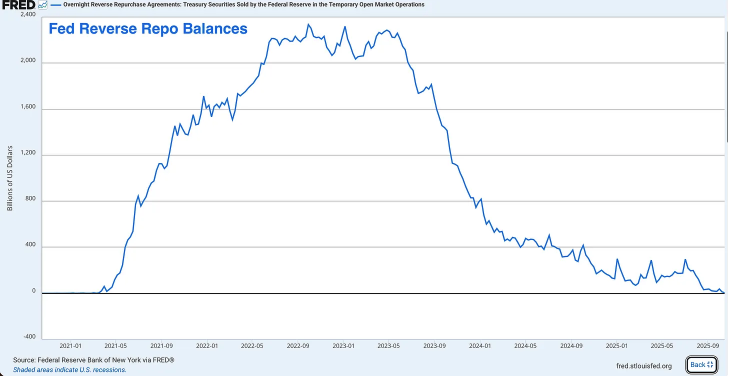

The reverse repurchase facility (RRP) has expired

The RRP used to be a giant excess liquidity piggy bank, peaking at around $2.4 trillion in 2022, but it is now essentially empty. As of this week, the RRP had only a few billion dollars left, down more than 99% from its peak.

Although originally created as a tool to help the Federal Reserve manage short-term interest rates, over the past few years the RRP has become a release valve for excess liquidity and a shock absorber for the entire financial system.

During the pandemic, the Federal Reserve and the Treasury injected trillions of dollars into the financial system, all of which ended up in RRPs via money market funds. Then, in a clever sleight of hand, Treasury Secretary Janet Yellen devised a way to drain the RRPs by issuing attractive short-term Treasury bills.

Money market funds pulled their cash out of RRP (earning the Fed’s RRP rate) and into buying higher-yielding Treasury bills. This allowed the Treasury to finance the government’s massive deficit without flooding the market with long-term Treasury bonds.

This was a brilliant strategy before the RRP ran out, but it no longer works.

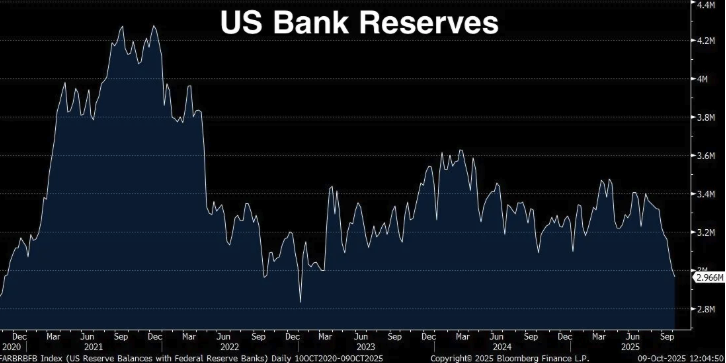

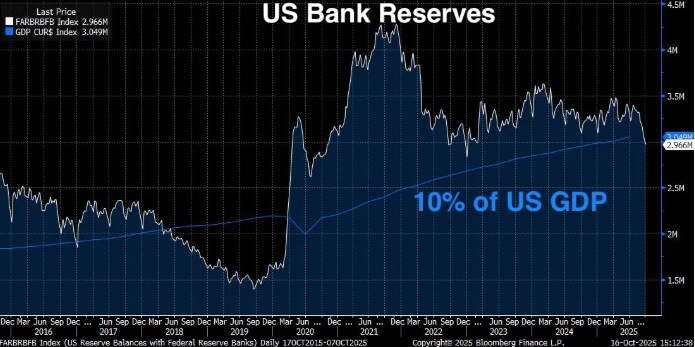

Bank reserves are at level 2 alert

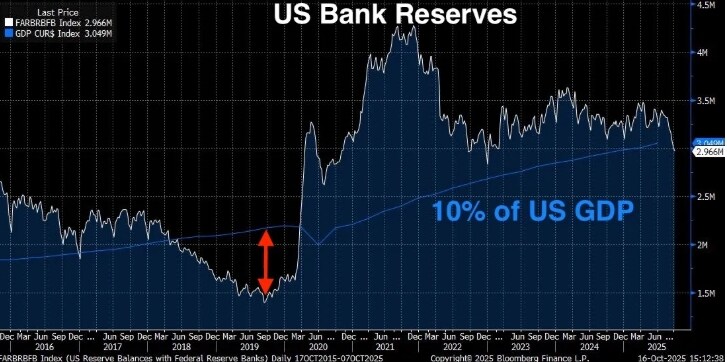

Bank reserves have fallen to $2.9 trillion, representing a $1.3 trillion decline since their peak in September 2021. Powell has explicitly stated that the Fed becomes nervous when bank reserves fall below 10-11% of GDP. The 10% threshold isn't an arbitrary number; it's based on extensive Fed research, surveys of banks, and the actual experience of September 2019 (more on that disaster later).

So where are we now?

- Current bank reserves: $2.96 trillion (as of last week)

- Current US GDP: $30.486 trillion (Q2 2025)

- Reserves as a percentage of GDP: 9.71%

Bank reserves are currently below the 10% minimum level determined by the Federal Reserve as "adequate reserves" (i.e., a level at which the financial system can function smoothly). According to the Fed, to ensure smooth market functioning, reserves should be maintained between $2.8 trillion and $3.4 trillion. However, considering GDP has reached $30.5 trillion, a 10% threshold would mean that reserves should ideally exceed $3.05 trillion.

Our reserves are currently at $2.96 trillion. In short, we are in danger. And since the RRP is essentially depleted, the Fed has no buffer left.

In January of this year, bank reserves were approximately $3.4 trillion, RRP was approximately $600 billion, and total liquidity was approximately $4 trillion, meaning that in less than a year, total system liquidity has fallen by more than $1 trillion. To make matters worse, the Federal Reserve is still conducting quantitative tightening at a rate of $25 billion per month.

This time will be worse than 2019

Some might be tempted to think that we encountered a similar situation in 2019, when reserves fell to $1.5 trillion, but everything turned out fine, and that this time will be the same. But the truth may be that the liquidity crisis we face this time will be worse than in 2019.

In 2019, reserves fell to $1.5 trillion, or about 7% of GDP (GDP was then about $21.4 trillion). The financial system was paralyzed, the repo market exploded, and the Federal Reserve panicked and began printing money. Bank reserves currently stand at 9.71% of GDP. While this is below the 10% threshold for adequate reserves outlined by Powell, it is still higher than in 2019. So why has the situation worsened?

There are three reasons:

- The absolute size of the financial system has increased. The banking system is larger, its balance sheets are larger, and the amount of reserves needed to keep the system running smoothly has also increased. The 7% level in 2019 triggered a crisis; now, at 9.71% of GDP, reserves are already showing signs of stress, and this pressure point is likely to worsen as reserve levels decline.

- We no longer have the RRP buffer . In 2019, the RRP was almost non-existent, but in the post-pandemic era, the financial system had become accustomed to this additional liquidity buffer. Now that it's gone, the financial system must readjust to operate without it.

- Regulatory requirements have become stricter . Following the 2008 financial crisis and the more recent regional banking crisis in 2023, banks are facing stricter liquidity requirements. They need to hold more high-quality liquid assets (HQLA) to meet regulations such as the liquidity coverage ratio (LCR). Bank reserves are the highest-quality liquid assets. As reserves decline, banks approach their regulatory minimums. When they do, they begin to take defensive actions, such as reducing lending, hoarding liquidity, and raising the overnight funding rate (SOFR).

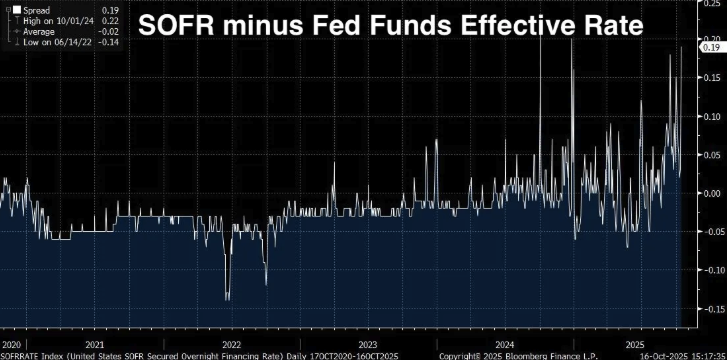

SOFR spreads are widening

If the buildup of bank reserves and the depletion of RRPs are just a few of the “stop signals” we encounter as we head towards a liquidity crisis, then we will next see the real “flashing red lights” ahead.

SOFR/effective fed funds rate spread

SOFR (Secured Overnight Financing Rate) is the interest rate that financial institutions pay to borrow cash overnight using U.S. Treasuries as collateral. It replaced the London Interbank Offered Rate (LIBOR) as the primary benchmark for short-term interest rates and is calculated based on actual transactions in the U.S. Treasury repurchase agreement (repo) market, which has a daily trading volume of approximately $1 trillion.

The effective federal funds rate (EFFR) is the interest rate banks pay on unsecured overnight loaned reserve balances. Under normal circumstances, these two rates trade very closely (within a few basis points). They are both overnight rates, both indexed to Federal Reserve policy, and both reflect short-term funding conditions.

When everything is normal, they are almost identical, but when SOFR starts to rise significantly above EFFR, it raises red flags. This means that secured loans (i.e., loans backed by U.S. Treasuries) suddenly become more expensive than unsecured loans between banks.

Normally, lending against rock-solid collateral like Treasuries should cost less, not more. So when the opposite happens, it signals trouble in the system, like tight reserves or shrinking balance sheet space.

When SOFR is higher than EFFR, it’s like the bank is saying, “I’d rather extend you unsecured loans at a lower rate than accept your U.S. Treasury collateral at a higher rate.” This doesn’t happen in a healthy, liquid market; it only happens when liquidity starts to dry up.

Interest rate differentials are structurally widening

The spread has been widening steadily from 2024 to 2025 and is currently at 0.19 (19 basis points). This may not sound like much, but in the world of overnight funding, it is a lot.

The average spread between 2020 and 2022 was approximately -0.02, reaching a low of -0.14 on June 14, 2022. However, on October 1, 2024, the spread peaked at 0.22, and is currently at 0.19. The shift from negative to positive spreads is not a short-term spike, but a structural change, signaling excessively tight market conditions.

Why SOFR Spreads Matter

The SOFR/EFFR spread is a real-time market signal. It's not a lagging indicator like GDP, or a survey like consumer confidence. It's the actual money being borrowed and lent in the world's largest and most liquid funding market.

When the spread continues to widen, it means:

- Banks don’t have excess reserves to lend freely. If they do, they will arbitrage it by lending at a higher rate in the SOFR market, thereby offsetting the spread.

- The Fed's open market operations have been insufficient. The Fed maintains a Standing Repurchase Facility (SRF), designed to prevent funding stress by allowing banks to borrow U.S. Treasuries at a fixed rate. Despite the existence of this facility, SOFR is trading at a high level, suggesting that demand for reserves is outstripping the Fed's supply.

- Year-end pressures are intensifying. Banks face additional balance sheet scrutiny and regulatory reporting requirements at quarter and year-end. These pressures are now spilling over into the regular trading day, suggesting that reserve requirements are too low.

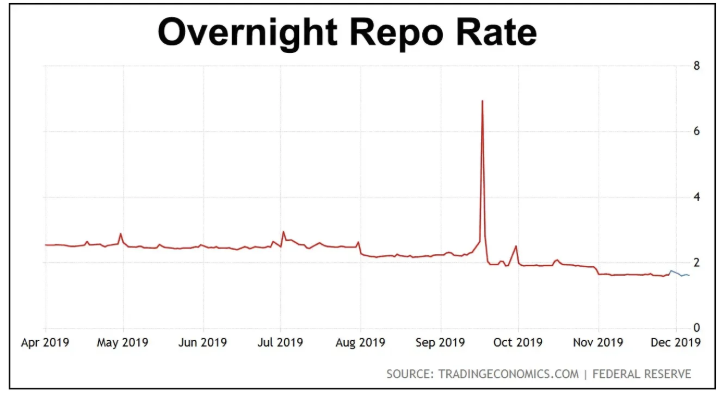

- We are only one step away from a 2019-style crisis. We are currently seeing a structural rise, but we are not seeing a panic (yet). In September 2019, the overnight repo rate did not rise gradually but rather jumped from 2% to 10% almost overnight.

The Fed is well aware of what this means; the SOFR spread is one of the key indicators monitored daily by the New York Fed's trading desk. They know what happened the last time the spread widened this much, and they also know what will happen if they don't act.

Will the repo crisis reappear in September 2019?

September 17, 2019. For anyone following Federal Reserve policy, it should be a date to remember. That morning, the overnight repo rate (the rate at which banks borrow money overnight using U.S. Treasury bonds as collateral) suddenly soared from around 2% to 10%.

The Fed’s target rate at the time was 2.00-2.25%, and the repo rate jumped to five times the Fed’s policy rate in a matter of hours, all because bank reserves had fallen so low.

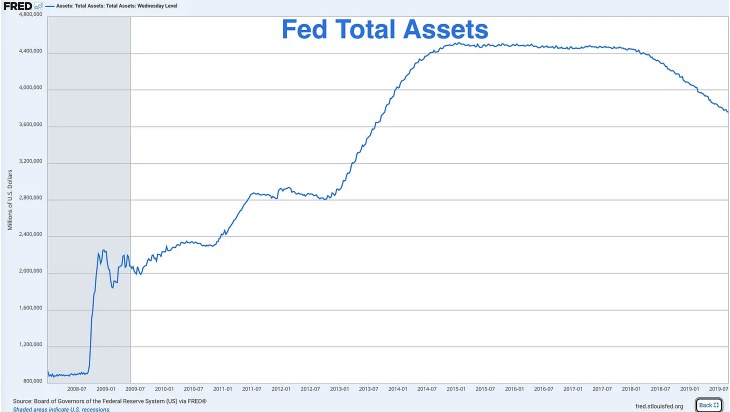

After the financial crisis, the Fed expanded its balance sheet from less than $1 trillion to over $4.5 trillion through various quantitative easing programs. But starting in 2017, they began implementing quantitative tightening, shrinking their balance sheet by allowing bonds to mature without reinvesting them.

By September 2019, reserves had fallen to about $1.5 trillion, or about 7% of GDP at the time (which was about $21.4 trillion). The Fed naively thought this was fine, but they were proven wrong.

Several fatal factors came together at that time, causing the overnight repo rate to soar:

- Corporate Income Tax Payments – Mid-September is a key corporate income tax deadline. Companies are withdrawing reserves from the banking system to pay the U.S. government, temporarily draining liquidity.

- Treasury Settlement – A large Treasury auction just settled, removing additional reserves from the system.

- No buffer – Unlike today (before the RRP was depleted), in 2019, reserves were the only source of liquidity.

- Regulatory restrictions – Post-2008 regulations mean banks are more reluctant to lend out reserves, even if interest rates increase, because they need to maintain a certain ratio.

The Fed's Remedy: Pre-COVID-19 Quantitative Easing

The Fed was understandably panicked, and within hours they announced emergency repo operations, injecting tens of billions of dollars into overnight funding markets. Over the next few weeks, they began to rescue the market:

- Conducting daily repo operations adds hundreds of billions of dollars of temporary liquidity to the market.

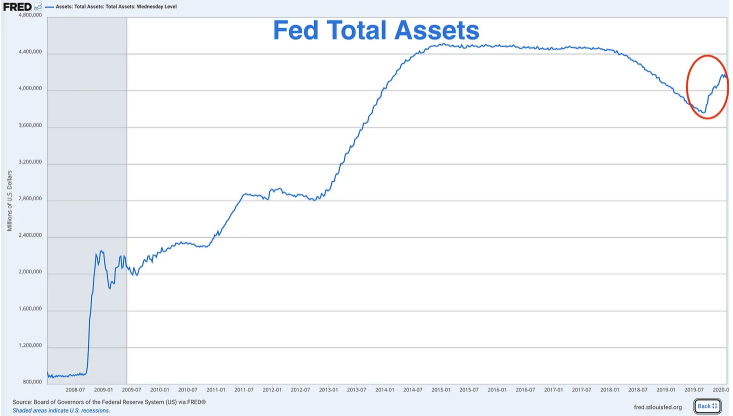

- Announced that it would begin purchasing U.S. Treasury bonds again (i.e., expand its balance sheet).

- It ended quantitative tightening several months ahead of schedule and started quantitative easing in October 2019.

The Federal Reserve’s total assets began to rise at the end of 2019 thanks to quantitative easing, and the printing press began to start.

But all this happened in the first six months of the COVID-19 lockdown. Therefore, the Fed restarted quantitative easing not because of the pandemic, not because of a recession, and not because of a financial crisis in the traditional sense, but because bank reserves were too low and the "plumbing" of the financial system was broken.

Now the Fed is once again faced with the problem of low bank reserves, and we are only in the early stages of the crisis.

Differences between today and the 2019 crisis

But there are some differences between today and 2019 that are making the crisis worse:

- The Treasury needs to issue more bonds

In 2019, the federal deficit was about $1 trillion per year—high by historical standards but manageable. Today, it's over $2 trillion per year, with no end in sight. The Treasury must issue massive amounts of bonds to finance the government, and every dollar of debt issued potentially drains liquidity from the banking system.

- The Fed's balance sheet is much larger than expected

When the repo crisis erupted in 2019, the Fed's balance sheet was approximately $3.8 trillion. Today, even after $2 trillion in quantitative tightening (QT), it's still around $6.9 trillion. The Fed should have "normalized" its balance sheet to pre-crisis levels. But they can't do that now because every time they try, they run into the same problem: insufficient reserves.

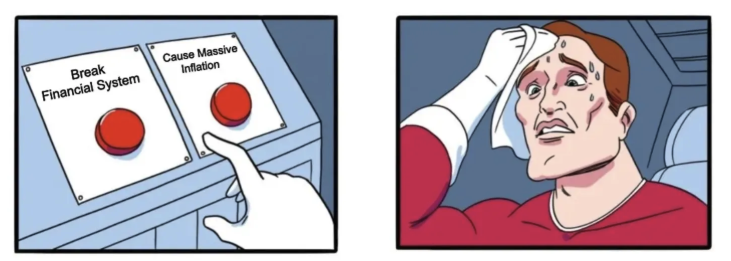

The Fed has essentially put itself into permanent QE. They can't reduce it much without breaking the system, and they can't maintain it at the current level without fueling inflation.

- Higher reserve levels cause cracks in the system

In 2019, at the onset of the crisis, reserves reached 7% of GDP. Now, at 9.7%, we're seeing warning signs. This suggests the financial system now requires a higher reserve base to function smoothly. The economy, banking system, and leverage ratios are all larger, and regulatory requirements are stricter, so the required buffers are also larger.

If 7% of GDP broke the system in 2019, and we are already facing 9.7% today, how much lower can this number fall before the system collapses?

The Fed has already sent a signal

Powell's statement that the Fed "may stop shrinking its balance sheet in the coming months" was not a casual remark; it was a carefully considered signal. The Fed is preparing for a policy shift, trying to avoid being caught off guard like in 2019 and having to make panicked, emergency adjustments.

This time, they want to act like they are in control. But control is an illusion, and the outcome is the same: quantitative tightening is ending and quantitative easing is coming.

The only question now is: will they wait for the truth to come out, or will they strike first?

The Federal Reserve must implement quantitative easing (QE)

We already know that the US economy is in crisis, with extremely low reserves, RRPs being emptied out, and SOFR spreads widening, and that the situation is worse than in 2019. Now, let's delve into why the Fed is so concerned about reserve levels and what will happen if this liquidity crisis becomes serious.

When reserve requirements fall below 10-11% of GDP, banks begin to exhibit stressed behaviors, including:

- Less willing to lend reserves to other banks overnight

- Stockpiling liquidity to meet unexpected demand

- Charging higher interest rates on short-term loans (SOFR spreads)

- Reduce lending to the real economy

- Balance sheets become more defensive

With the reserve requirement ratio now at 9.71% of GDP, the monetary transmission mechanism may have begun to collapse.

The scars of the 2023 banking crisis

The Federal Reserve and regulators were deeply troubled by the regional banking crisis of March 2023. The collapse of banks like Silicon Valley Bank and First Republic Bank was attributed to poor liquidity management. Their long-term bond holdings lost value due to rising interest rates, and when depositors withdrew their funds, the banks were unable to replace the outflows without selling these bonds, resulting in massive losses.

The crisis was ultimately prevented by the Federal Reserve's intervention and the launch of the Bank Term Funding Program (BTFP), which allowed banks to borrow against their insolvent bonds at face value.

The crisis is still fresh today, and if you imagine trying to reduce the overall supply of reserves (through quantitative tightening) while banks are still scarred, regulatory scrutiny is intense, and interest rates are already below the 10% threshold, you can understand why Powell is already talking about ending quantitative tightening.

The Fed has to move forward

With GDP currently at $30.5 trillion and a growth rate of approximately 2-3% per year, if GDP grows by 3% this year, that would mean approximately $900 billion in additional output. If the Fed wants to maintain reserves at around 10% of GDP, then reserves would need to increase by approximately $90 billion per year to keep pace.

Instead, the Fed has been shrinking reserves by about $300 billion per year ($25 billion per month x 12). Even if the Fed stopped quantitative tightening today and stabilized reserves at $2.96 trillion, the ratio of reserves to GDP would still decline over time, from 9.7% to 9.5%, then to 9.2%, or even lower.

To keep the ratio stable (or get it back above 10%), the Fed has two options:

- Reserve growth is in line with GDP (moderate quantitative easing)

- Let the ratio gradually decrease until a breakout occurs

There is no third option. In short, the Fed is like a rat trapped in a hamster wheel and has to move forward.

The Federal Reserve will formally announce the end of quantitative tightening at its December or January FOMC meeting. They will describe it as a "technical adjustment to maintain ample reserves" rather than a policy shift. If another significant drawdown of reserves occurs before the end of the year, the Fed may be forced to issue an emergency statement, as it did in 2019.

The Fed always overshoots

The federal government is running an annual deficit of over $2 trillion, and the Treasury needs to issue massive amounts of bonds. With the RRP drying up, where will the money come from? There simply isn't enough private demand to absorb $2 trillion in annual bonds unless yields soar. If banks use their reserves to buy Treasury bonds, this will further deplete reserves, exacerbating the problem.

This forces the Fed to once again become the buyer of last resort. Moreover, with GDP growing at 2-3% per year, reserves would need to increase by $60-90 billion per year to maintain the current ratio.

Looking back at the period from 2008 to 2014, the Fed’s quantitative easing policy was not restrained. They conducted three rounds of quantitative easing and one reverse operation, and their balance sheet increased from $900 billion to $4.5 trillion.

If you look at 2019-2020, they restarted their balance sheet expansion ($60 billion a month in Treasury purchases) in October 2019. Then COVID hit, and they launched another aggressive expansion, adding $5 trillion in a matter of months.

When the Fed turns to easing policy, they always overshoot. So when this quantitative tightening cycle ends, don’t expect a gentle and gradual quantitative easing from the Fed; expect a deluge of expansion.

The Fed may purchase $60 billion to $100 billion in U.S. Treasuries each month to "maintain ample reserves and ensure smooth market functioning."

What should we do?

When central banks start printing money without restraint, we have only one rational response, which is to hold assets that they cannot print: gold and Bitcoin.

The market has already incorporated quantitative easing into gold pricing, causing it to skyrocket. In January 2025, the price of gold was approximately $2,500. Today, it has risen by over 70%, trading above $4,000 per ounce. Smart investors aren't waiting for the Fed to announce quantitative easing; they've already started buying in.

Besides gold, Bitcoin is also the best asset to deal with the coming quantitative easing tsunami.

Bitcoin is the first truly scarce digital asset, with a total supply fixed at 21 million. Although the Federal Reserve can print an unlimited amount of US dollars, neither the Federal Reserve, the government, businesses, nor miners can print more Bitcoin.

At the same time, Bitcoin has even greater room for growth than gold for the following reasons:

- It is harder to make money with Bitcoin than with gold.

- The supply of gold increases annually through mining, at a rate of approximately 1.5-2% per year. The scarcity of gold is relative, not absolute. The supply of Bitcoin grows at a fixed decreasing rate (halved every four years) and will reach an absolute peak of 21 million around 2140. After that, no more Bitcoin will be issued, and this will remain the case forever.

- Bitcoin is the most difficult currency to make money from in human history.

- Bitcoin follows gold and has a multiplier effect. Currently, Bitcoin's performance is significantly "lagging" gold, but historically, when gold continues to rise due to concerns about monetary policy, Bitcoin will eventually catch up and often exceed gold's percentage gains.

- Bitcoin allows you to completely escape the sovereign debt Ponzi scheme. Gold protects you from inflation, but Bitcoin does much more than that. It exists entirely outside the system. It cannot be confiscated (if properly stored), devalued, or manipulated by central banks.

In summary, I hope your investment behavior will be more wise after understanding the reasons why the Federal Reserve is about to shift from quantitative tightening to quantitative easing, the liquidity situation, and why Bitcoin and gold are assets worth holding during the upcoming period of monetary expansion.