The key to the bear-bull transition: the second S-shaped growth curve

- 核心观点:市场正从流动性扩张转向结构性整合。

- 关键要素:

- 永续DEX主导,Hyperliquid提供流动性。

- 预测市场作为信息衍生品兴起。

- AI协议通过Web2场景扩大收入。

- 市场影响:风险资产重新定价,收益率取代叙事驱动。

- 时效性标注:中期影响

Written by arndxt

Compiled by AididiaoJP, Foresight News

Liquidity expansion remains the dominant macro narrative.

Recession signals lag and structural inflation is sticky.

The policy rate is above neutral but below the tightening threshold.

Markets are pricing in a soft landing, but the real adjustment is institutional: from cheap liquidity to disciplined productivity.

The second curve is not periodic.

It is about structural normalization of finance through yields, labor, and credibility within real constraints.

Cycle Conversion

The Token2049 Singapore conference marked a turning point from speculative expansion to structural consolidation.

Markets are repricing risk, moving away from narrative-driven liquidity and toward income-supported yield data.

Key shifts:

- Perpetual decentralized exchanges maintain their dominance, with Hyperliquid ensuring liquidity at web scale.

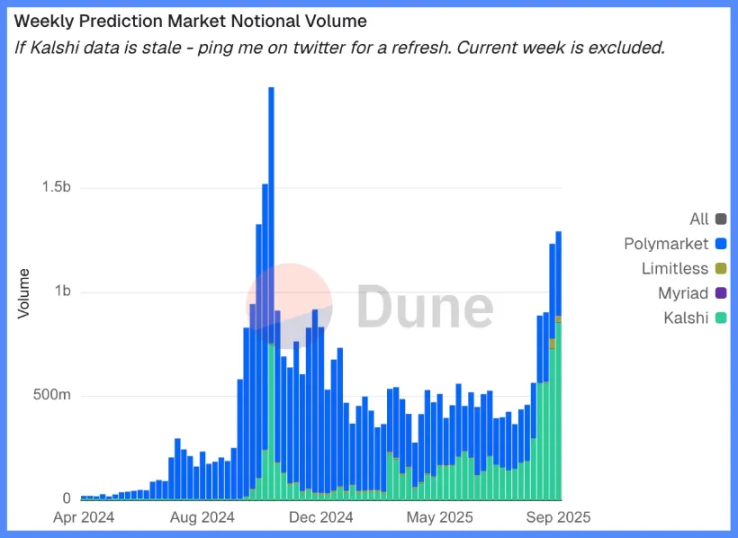

- Prediction markets are emerging as a functional derivative of information flows.

- AI-related protocols with real Web2 application scenarios are quietly expanding their revenue.

- Restaking and DATs have peaked; liquidity fragmentation is evident.

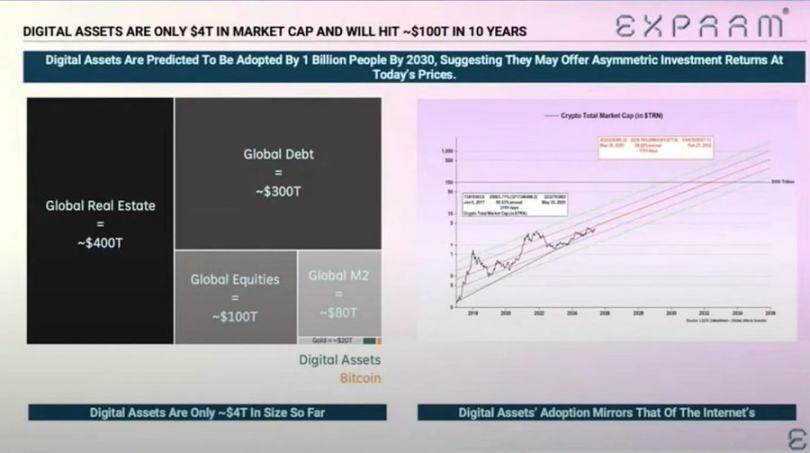

Macroeconomic system: currency devaluation, demographic structure, liquidity

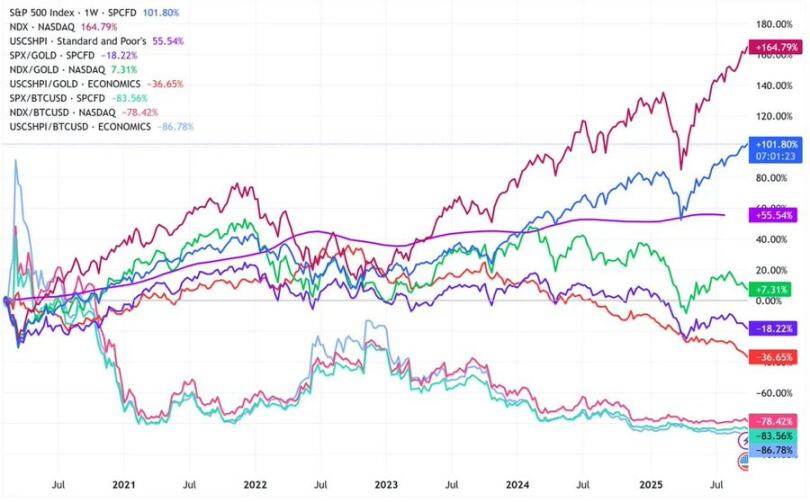

Asset inflation reflects currency depreciation, not organic growth.

When liquidity expands, duration assets outperform.

When liquidity shrinks, leverage and valuations are compressed.

Three structural drivers:

- Currency devaluation: Repaying sovereign debt requires continued balance sheet expansion.

- Demographic structure: An aging population reduces productivity and increases dependence on mobility.

- Liquidity pipeline: Global aggregate liquidity, the sum of central bank and banking system reserves, has tracked the performance of 90% of risky assets since 2009.

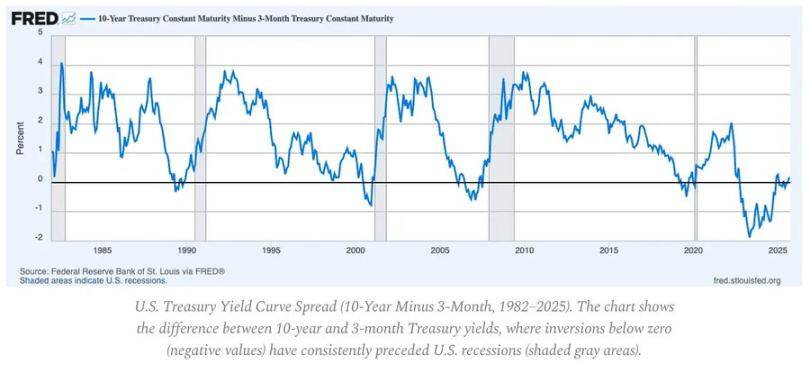

Recession Risk: Lagging Data, Leading Signals

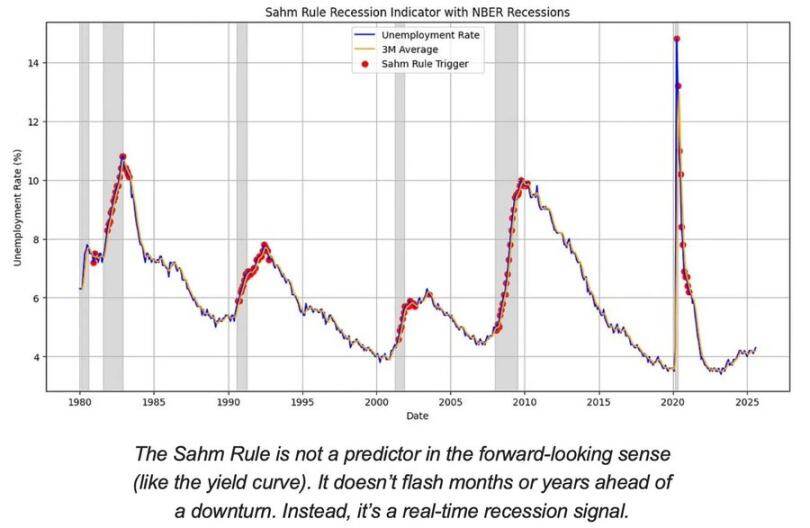

Mainstream recession indicators are lagging.

CPI, unemployment rate and Sam's Rule are not confirmed until after the economic downturn begins.

The United States is in the late stages of the economic cycle, not in a recession.

The likelihood of a soft landing remains higher than the risk of a hard landing, but policy timing is a constraining factor.

Leading indicators:

- An inverted yield curve remains the clearest leading signal.

- Credit spreads are contained, suggesting no imminent systemic stress.

- The labor market is gradually cooling; employment remains tight across the cycle.

Inflation Dynamics: The Last Mile Problem

Goods disinflation is complete; services inflation and wage stickiness now anchor the headline CPI around 3%.

This “last mile” is the most complex phase of disinflation since the 1980s.

- Commodity deflation is now offsetting some of the impact of CPI.

- Wage growth of close to 4% kept services inflation elevated.

- Housing inflation is measured with a lag; real market rents have cooled.

Policy implications:

- The Fed faces a trade-off between credibility and growth.

- Cutting rates too soon risks reacceleration; keeping them in place for too long risks over-tightening.

- The equilibrium outcome is that the new inflation floor is closer to 3%, not 2%.

Macrostructure

Three long-term inflation anchors remain:

- Deglobalization: Supply chain diversification increases transition costs.

- Energy transition: Capital-intensive low-carbon activities increase short-term input costs.

- Demographics: Structural labor shortages lead to persistent wage rigidities.

These limit the Fed's ability to achieve normalization without higher nominal growth or higher equilibrium inflation.