Key Takeaways

- The global cryptocurrency market capitalization reached $4.01 trillion, down 10.09% from $4.46 trillion last week. As of press time, US ETFs had seen a cumulative net inflow of approximately $62.77 billion, with a net inflow of $2.71 billion for the week. US ETFs had seen a cumulative net inflow of approximately $14.91 billion, with a net inflow of $488 million for the week.

- The total market value of stablecoins is US$310 billion, of which USDT has a market value of US$179.4 billion, accounting for 57.87% of the total market value of stablecoins; followed by USDC with a market value of US$75.4 billion, accounting for 24.35% of the total market value of stablecoins; and DAI with a market value of US$5.36 billion, accounting for 1.73% of the total market value of stablecoins.

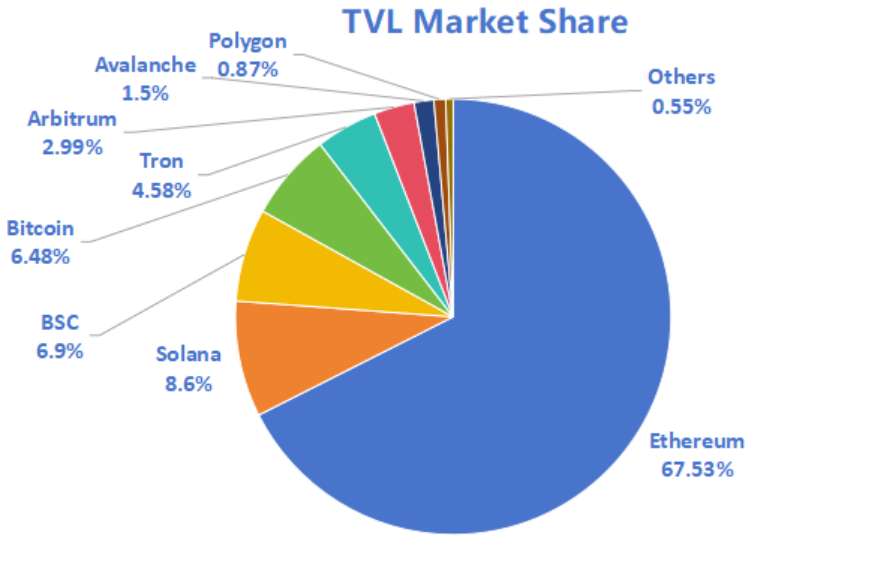

- According to DeFiLlama data, the total TVL of DeFi this week reached $157.4 billion, down 6.92% from $169.1 billion last week. Breaking down the TVL by public chain, the three chains with the highest TVL are Ethereum (67.53%), Solana (8.6%), and BNBChain (6.9%).

- Looking at on-chain data, daily transaction volume for all public chains, with the exception of Aptos, which saw a 27.2% decrease, rose this week. Ethereum saw a 91.15% increase, Solana rose 58.27%, BNBChain rose 58.12%, Toncoin rose 28.2%, and Sui rose 23.2%. Transaction fees fell 50% for Ethereum and Solana, while BNBChain, Toncoin, and Sui remained stable, and Aptos fell 33.3%. Daily active addresses saw Solana increase by 13.9%, BNBChain by 23.2%, Toncoin by 21.4%, and Aptos by 30.4%. Conversely, Ethereum fell 6.4% and Sui fell 16.7%. Judging from TVL, there was an overall downward trend this week, with only BNBChain rising by 1.9%. At the same time, Ethereum fell by 8.55%, Solana fell by 12.52%, Toncoin fell by 17.3%, Sui fell by 19.6%, and Aptos fell by 9.6%.

- Innovative projects to watch: Aborean is a DeFi protocol designed specifically for Abstract, aiming to improve capital efficiency; XSY is a DeFi protocol focused on building a digital synthetic dollar $UTY, aiming to unleash the value potential of the blockchain ecosystem in a structured and scalable manner; Punk.auction is a decentralized protocol built on Ethereum, designed to purchase and auction CryptoPunks through an automated mechanism.

Table of contents

Key Takeaways

1. Market Overview

1. Total cryptocurrency market capitalization/Bitcoin market capitalization ratio

2. Panic Index

3. ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange rates

5. Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance

2. Hot money trends this week

1. Top 5 VC and Meme Coins with the Most Gains This Week

2. New Project Insights

3. New Industry Trends

1. Major industry events this week

3. Important investment and financing events last week

4. Reference Links

1. Market Overview

1. Total cryptocurrency market capitalization/Bitcoin market capitalization ratio

The total market value of global cryptocurrencies is US$4.01 trillion, down 10.09% from US$4.46 trillion last week.

Data source: CryptoRank

Data as of October 12, 2025

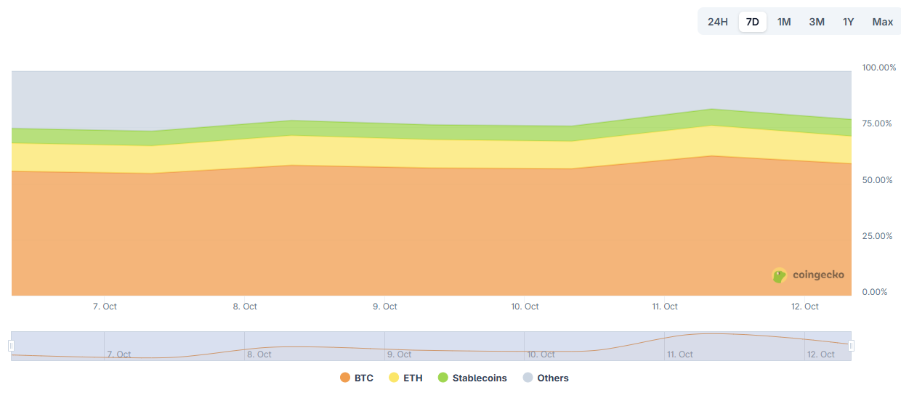

As of press time, Bitcoin’s market capitalization is $2.29 trillion, accounting for 57.2% of the total cryptocurrency market capitalization. Meanwhile, stablecoins’ market capitalization is $310 billion, accounting for 7.73% of the total cryptocurrency market capitalization.

Data source: coingeck

Data as of October 12, 2025

2. Panic Index

The cryptocurrency panic index is at 37, indicating panic.

Data source: coinglass

Data source: coinglass

Data as of October 12, 2025

3. ETF inflow and outflow data

As of press time, the U.S. Bitcoin spot ETF has accumulated a total net inflow of approximately US$62.77 billion, with a net inflow of US$2.71 billion this week; the U.S. Ethereum spot ETF has accumulated a total net inflow of approximately US$14.91 billion, with a net inflow of US$488 million this week.

Data source: sosovalue

Data source: sosovalue

Data as of October 12, 2025

4. ETH/BTC and ETH/USD exchange rates

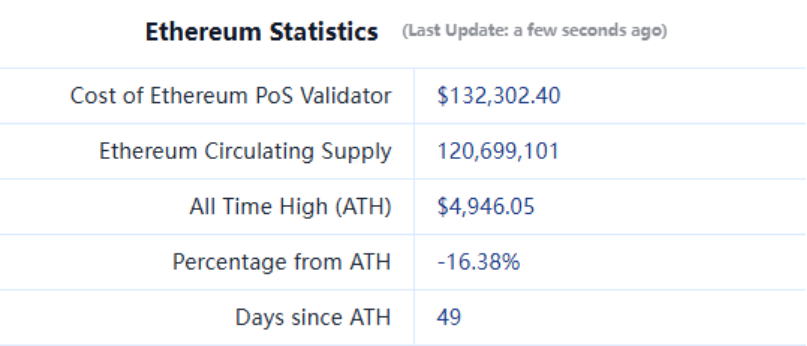

ETHUSD: The current price is $3,456, the historical high is $4,946, and it is down about 16.38% from the high.

ETHBTC: Currently at 0.035882, the historical high is 0.1238.

Data source: ratiogang

Data source: ratiogang

Data as of October 12, 2025

5. Decentralized Finance (DeFi)

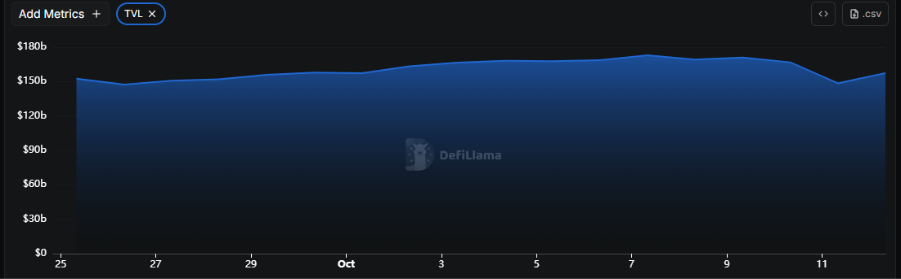

According to data from DeFiLlama, the total TVL of DeFi this week was US$157.4 billion, down 6.92% from US$169.1 billion last week.

Data source: defillama

Data source: defillama

Data as of October 12, 2025

Divided by public chains, the three public chains with the highest TVL are Ethereum chain accounting for 67.53%; Solana chain accounting for 8.6%; and BNBChain accounting for 6.9%.

Data source: CoinW Research Institute, defillama

Data source: CoinW Research Institute, defillama

Data as of October 12, 2025

6. On-chain data

Layer 1 related data

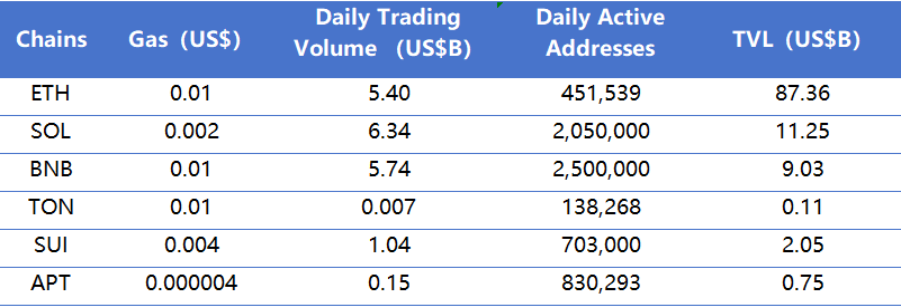

The main data of Layer 1 including ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspective of daily transaction volume, daily active addresses and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data source: CoinW Research Institute, defillama, Nansen

Data as of October 12, 2025

● Daily Trading Volume and Fees: Daily trading volume and fees are core indicators of public chain activity and user experience. Looking at daily trading volume, with the exception of Aptos, which saw a 27.2% decrease, all other public chains saw an upward trend this week. Ethereum saw the most significant increase, rising by approximately 91.15%, followed by Solana (58.27%), BNBChain (58.12%), Toncoin (28.2%), and Sui (23.2%). Regarding transaction fees, Ethereum and Solana saw a 50% decrease, while BNBChain, Toncoin, and Sui remained stable. Aptos saw a 33.3% decrease.

● Daily Active Addresses and TVL: Daily Active Addresses reflect the level of participation and user stickiness in a public chain ecosystem, while TVL reflects user trust in the platform. Daily Active Addresses showed significant fluctuations this week. Solana saw a 13.9% increase, BNBChain saw a 23.2% increase, Toncoin saw a 21.4% increase, and Aptos saw a 30.4% increase. Conversely, Ethereum saw a 6.4% decrease, and Sui saw a 16.7% decrease. TVL showed an overall downward trend this week, with BNBChain alone seeing a 1.9% increase. Meanwhile, Ethereum saw decreases of 8.55%, Solana 12.52%, Toncoin 17.3%, Sui 19.6%, and Aptos 9.6%.

Layer 2 Data

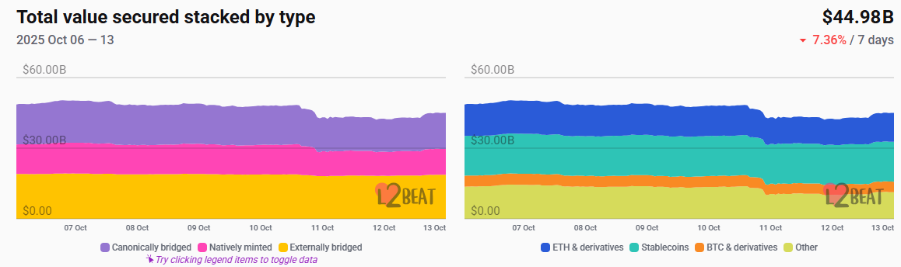

● According to L2 Beat data, the total TVL of Ethereum Layer 2 is US$44.98 billion, a decrease of 7.36% from US$47.88 billion last week.

Data source: L2Beat

Data source: L2Beat

Data as of October 12, 2025

- Base and Arbitrum occupy the top position with 38.26% and 35% market share respectively. This week, Base still ranks first in the TVL of Ethereum Layer 2.

Data source: footprint

Data source: footprint

Data as of October 12, 2025

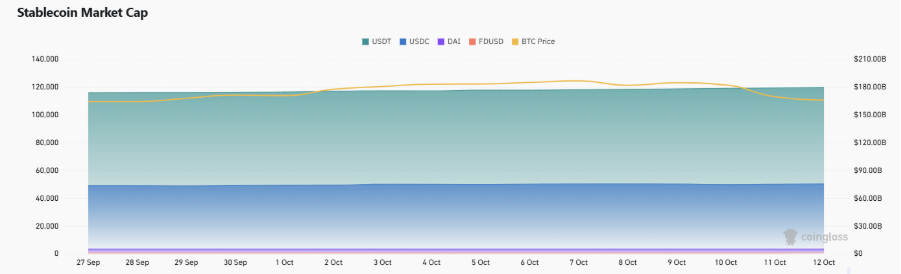

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $310 billion. USDT holds a market capitalization of $179.4 billion, accounting for 57.87% of the total stablecoin market capitalization. USDC holds a market capitalization of $75.4 billion, accounting for 24.35% of the total stablecoin market capitalization. DAI holds a market capitalization of $5.36 billion, accounting for 1.73% of the total stablecoin market capitalization.

Data source: CoinW Research Institute, Coinglass

Data source: CoinW Research Institute, Coinglass

Data as of October 12, 2025

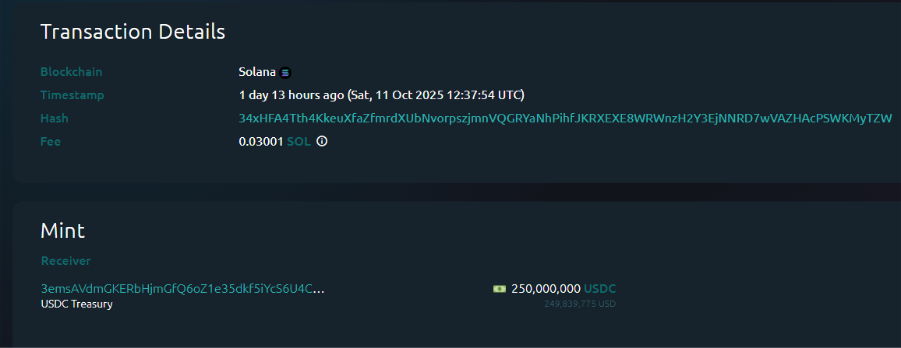

According to Whale Alert data, the Treasury issued a total of 2.65 billion USDC this week, and Tether Treasury issued a total of 1 billion USDT. The total amount of stablecoins issued this week was 3.65 billion, a decrease of about 9.65% from the total amount of stablecoins issued last week, which was 4.04 billion.

Data source: Whale Alert

Data as of October 12, 2025

2. Hot money trends this week

1. Top 5 VC and Meme Coins with the Most Gains This Week

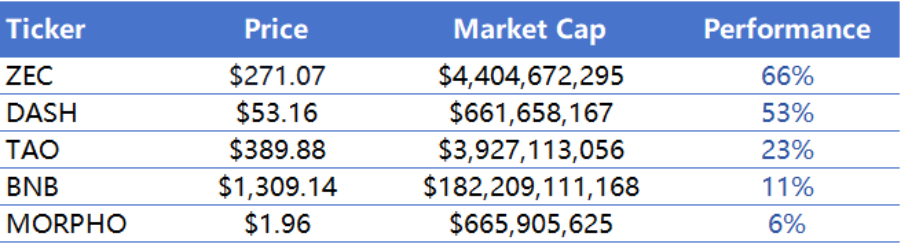

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data source: CoinW Research Institute, coinmarketcap

Data as of October 12, 2025

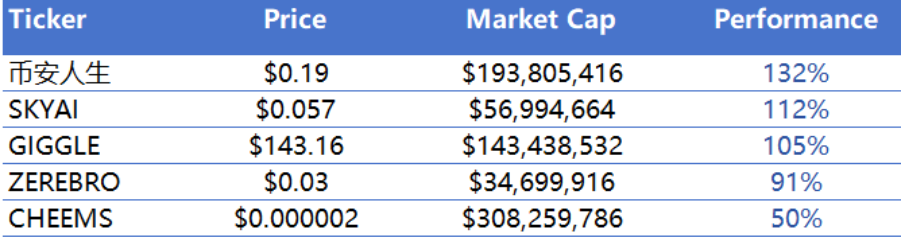

Top 5 Meme Coins with the Most Gains in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data source: CoinW Research Institute, coinmarketcap

Data as of October 12, 2025

2. New Project Insights

- Aborean is a DeFi protocol designed specifically for Abstract, aiming to improve capital efficiency. By integrating liquidity provision, governance mechanisms, and incentive structures, Aborean builds a flexible and robust liquidity infrastructure for the Abstract ecosystem.

- XSY is a DeFi protocol focused on building a digital synthetic USD (US$UTY), aiming to unlock the hidden value potential of the blockchain ecosystem in a structured and scalable manner. XSY focuses on innovative design of synthetic assets and stablecoin protocols, providing more efficient on-chain liquidity and capital utilization.

- Punk.auction is a decentralized protocol built on Ethereum that uses an automated mechanism to purchase and auction CryptoPunks. Its unique feature is that a portion of the token supply is destroyed during each transaction, creating a deflationary economic model.

3. New Industry Trends

1. Major industry events this week

- GitFish V 2, a platform focused on tokenizing and trading GitHub repositories, has launched on Solana. GitFish, which supports open source, states that each GitHub project can be converted into one gold coin, with more coins required to launch popular projects.

- The 9 Bit, a next-generation Web 3.5 gaming platform developed by The 9 Limited, has launched the Ultimate BitBox Treasure Box Event, with a total prize pool of 1,000 SOL. Participants can open a virtual treasure box to receive instant rewards, with the highest prize being 900 SOL. This event is an upgrade from the previous beta version and aims to improve the community incentive mechanism. Existing users will automatically be eligible to participate, while new users can participate by earning points by completing tasks.

- The second season of YZi Labs' incubation program Easy Residency was launched on October 6, covering the fields of Web 3, AI and biotechnology.

2. Big events happening next week

- Solana ecosystem liquidity protocol Meteora stated that the TGE time will not be postponed due to market changes, and TGE will still be carried out as planned on October 23.

- Aster has announced that the new Aster Phase 2 airdrop inquiry is now live, and users can still choose to claim the airdrop or receive a full refund of their S2 transaction fees. The deadline for selecting the claim option is October 13th, and the ASTER airdrop will be available on October 14th. Once the application for transaction fee refunds is open, they will be completed by October 16th.

- Fleek, an AI agent and virtual influencer platform, will hold its TGE on October 14. Fleek is known as the Shopify of the AI industry, supporting developers, creators, and brands to build and monetize AI agents and virtual humans on its platform.

- Intuition will conduct a TGE on October 15th. Intuition is a decentralized identity infrastructure that allows users to create proofs about any subject and store information in a way that is easy to navigate, query, and utilize by other applications.

- Novastro, the AI-powered RWA Layer 2 network, will hold its TGE on October 15th. Novastro.xyz is the online portal of the blockchain platform Novastro, dedicated to digitally managing real-world assets such as stocks and commodities.

3. Important investment and financing events last week

- Polymarket has completed a $2 billion strategic funding round, with a new valuation of approximately $9 billion, led by Intercontinental Exchange. Founded in 2018, Polymarket is a decentralized prediction market platform that allows users to trade based on real-world events and profit from their predictions. The platform reflects the market's consensus on the probability of future events through transaction prices, and utilizes Chainlink oracles to ensure the reliability of these prices. It has become one of the world's leading real-time prediction and information marketplaces. (October 7, 2025)

- Kalshi has completed a $300 million funding round, with a current valuation of approximately $5 billion. Investors include Andreessen Horowitz, Paradigm, Coinbase Ventures, and Sequoia Capital. Founded in 2019, Kalshi is a federally approved prediction market platform that allows users to trade contracts based on real-world events. It recently added native support for Solana and on-chain USDC, and partnered with Robinhood to launch a sports prediction market. (October 10, 2025)

- Galaxy Digital has completed a $460 million financing round, primarily to expand its global presence in digital asset trading, asset management, and investment banking. Founded by Mike Novogratz, Galaxy Digital, listed on NASDAQ: GLXY, operates across trading, asset management, principal investment, investment banking, and mining. The company is committed to providing comprehensive financial solutions across the entire digital asset ecosystem to institutional and high-net-worth clients. (October 10, 2025)

4. Reference Links

1. Aborean, https://x.com/AboreanFi

2. XSY, https://x.com/xsy_fi

3. Punk.auction, https://x.com/punkdotauction

4. Polymarket, https://x.com/Polymarket

5. Kalshi, https://x.com/Kalshi

6. Galaxy Digital, https://x.com/GalaxyHQ

- 核心观点:加密货币市场本周整体回调。

- 关键要素:

- 加密货币总市值跌10.09%。

- DeFi总TVL跌6.92%。

- 恐慌指数为37,显示恐慌。

- 市场影响:市场情绪偏谨慎,短期承压。

- 时效性标注:短期影响。