Data Analysis: In-depth comparison of new token and contract data from the top ten major exchanges

- 核心观点:交易所新币策略决定收益风险特征。

- 关键要素:

- 高频上币平台黑马多但破发率高。

- 精选上币平台收益稳健波动小。

- 合约联动加速价格回归理性。

- 市场影响:引导投资者根据风险偏好选择交易平台。

- 时效性标注:中期影响

After a temporary recovery in the crypto market in the third quarter of 2025, new coin listings have once again become a hot topic for speculative investors and hot money. A recent surge in projects, such as World Liberty Financial (WLFI), a token associated with the Trump family, has sparked widespread market debate over whether new coin offerings are still worth investing in. In the current environment, investors are divided on whether to maintain a short-term, "sell at the market open" mentality or adopt a more long-term strategy. To address this debate, this article attempts to analyze the differences in new coin listing performance and derivatives trading across the top ten major exchanges through quantitative data comparisons, using both spot and futures trading metrics, to provide investors with a more comprehensive framework.

First, we analyzed data from the top ten exchanges—Binance, Upbit, OKX, Bybit, KuCoin, Gate, LBank, Bitget, MEXC, and HTX (formerly Huobi)—on the launch and performance of new tokens on these platforms from August to mid-September 2025. By comparing the cadence of new token launches on each platform, price fluctuations over different periods after listing, and trends in contract trading volume over the same period, we aim to assess:

- Listing cadence and new coin performance: Which exchanges have the most new coins and launch them most frequently? How do the gains and losses of new coins vary across platforms? Which platforms are most likely to see a "profit effect"?

- Contract trading activity: Which exchanges have seen the fastest growth in derivatives trading volume and increased market share? How do the various platforms differ in their strategies for new coin-related contracts (e.g., how quickly they launch new coin contracts and the breadth of contract product coverage)?

- Spot-contract linkage: Does the platform's token issuance and contract support form a closed loop? How do new token spot prices and contract trading interact?

- Future trends: As exchanges are increasingly developing their own chains (e.g., Binance’s BNB chain, Bybit’s Mantle, etc.), how will the “new coin-contract-on-chain ecosystem” interact and what kind of closed-loop effect will be formed?

Through the above analysis, we strive to sort out the differences in the performance of new coin strategies of major exchanges in the current market, as well as the underlying reasons behind these differences.

Comparison of new spot coin listings

Overview of coin listing rhythm and quantity

During the new coin craze around August 2025, different exchanges showed significant divergence in the number and frequency of coin listings. According to statistics, the number of new tokens listed on each platform in the past six weeks (roughly from early August to mid-September) is as follows:

- Binance, a global leader, prioritizes quality and compliance, and is relatively conservative in its new coin listings. Having listed approximately 13-14 new coins since August, Binance maintains a restrained approach, preferring to screen projects through mechanisms like Launchpad/Seed Tags before opening them for trading.

- OKX — Optimizing quantity over quantity. OKX only listed approximately six new coins between August and mid-September. The platform maintains its traditionally cautious approach, selecting only a few high-quality projects for listing to maintain overall market order.

- Bybit — A strict selection of projects, with a moderate but steady pace. Bybit launched approximately 14 new tokens in the past two months, averaging approximately two per week, continuing the steady pace of one token every two to three days in the first half of the year. Bybit favors listing high-profile projects like memes and new public chain ecosystems, which account for approximately 70% of its listings.

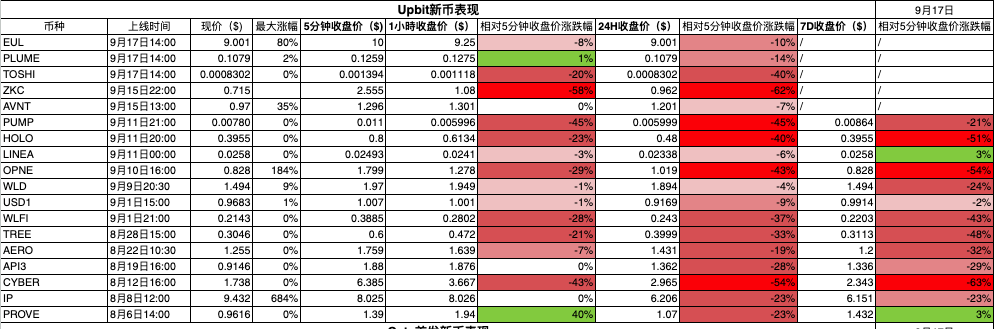

- Upbit — Focused on the Korean market, it selectively lists well-known cryptocurrencies. During the statistical period, Upbit added approximately 18 new trading pairs, many of which were globally well-known or popular in South Korea (e.g., WLD, API 3, and CYBER, which have a history of trading on other platforms). Upbit rarely launches new projects, preferring to list them retroactively.

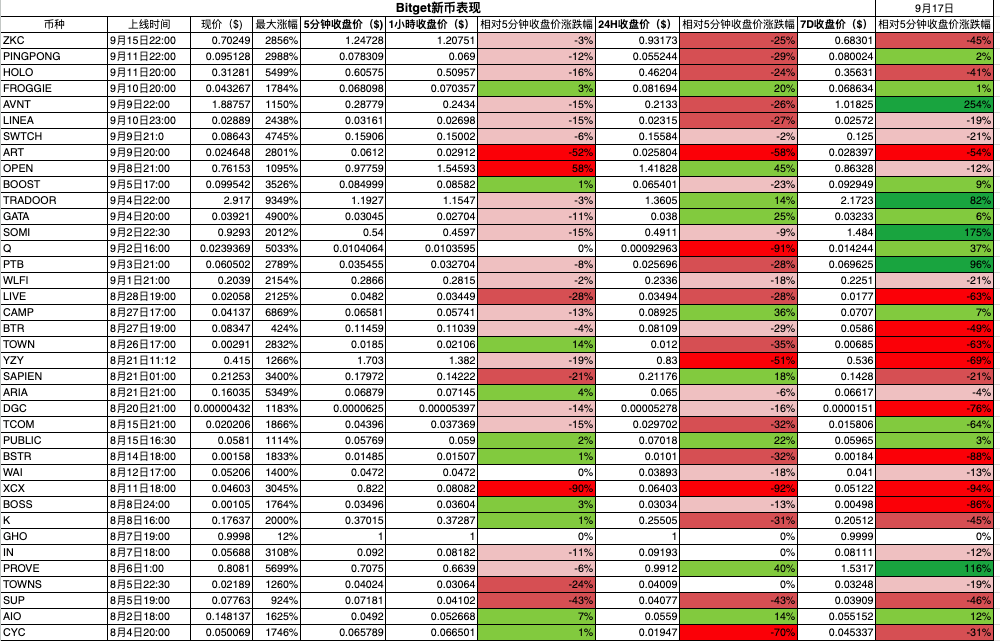

- Bitget — Driven by both spot and futures trading, the number of new tokens listed is moderate to high. Bitget is expected to launch around 20-30 new tokens during this period (exact data to be provided), with a frequency of approximately 4-5 new tokens per week.

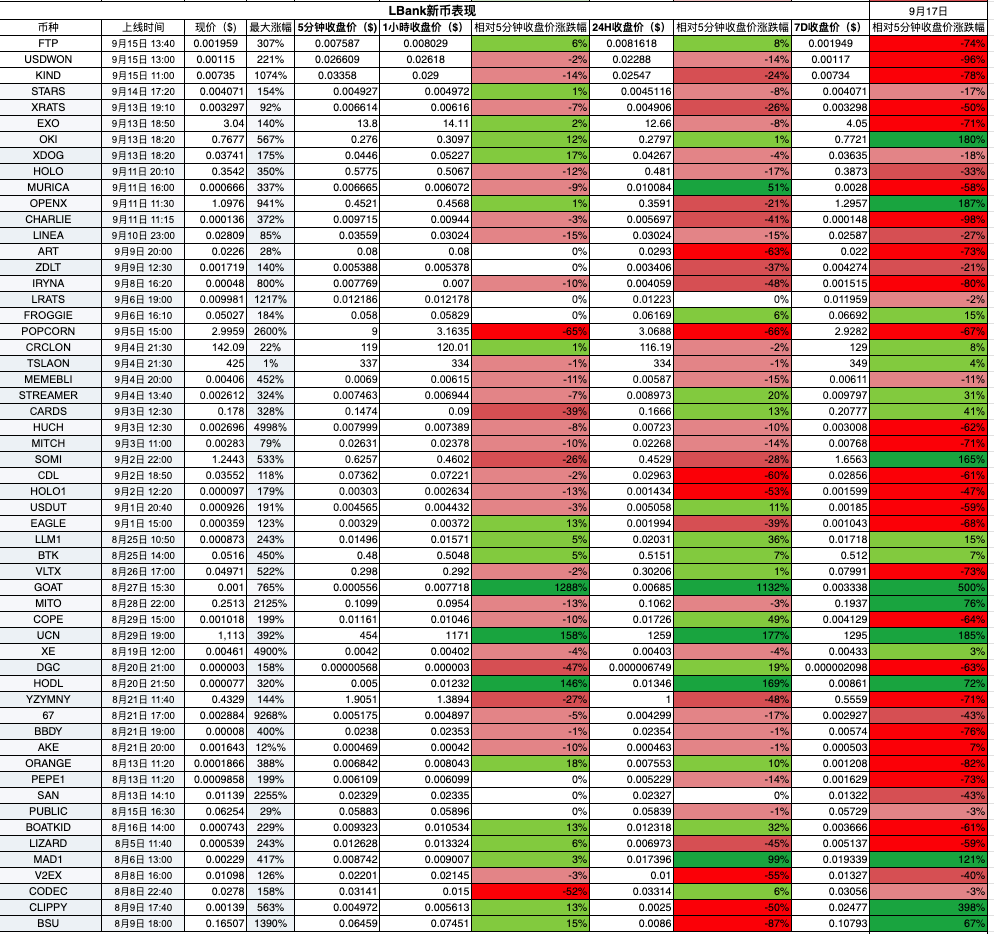

- LBank—The largest number of new tokens, with a machine-gun-like frequency of listings. According to incomplete statistics, LBank launched dozens, even hundreds, of new tokens during this period, continuing the frenetic pace of "2-3 new tokens per day" seen in the first half of the year. This high frequency of new token launches provided the market with numerous opportunities for trial and error, but the quality of projects varied widely, with significant price fluctuations within seven days. (Previously, 90% of projects in the May-June sample experienced significant price fluctuations within a week.)

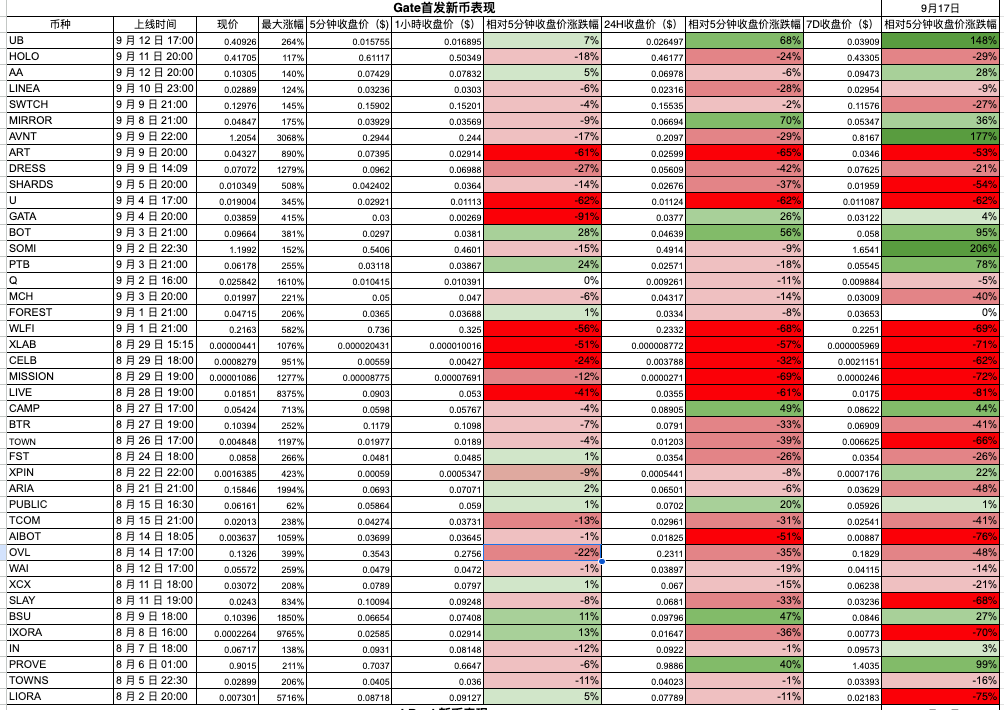

- Gate — Second only to LBank in terms of frequency of coin listings, Gate boasts a daily release of new coins, ranking first in terms of number of new listings. Since August, Gate has launched over 40 new coins simultaneously or for the first time, exceeding the number of first-tier platforms expanding into the European and American markets during the same period. Gate maintains a consistent "one coin per day" listing frequency, providing ample opportunities for short-term investors. However, due to the large number of projects and limited market making depth, some tokens have experienced significant volatility and deep drawdowns since listing.

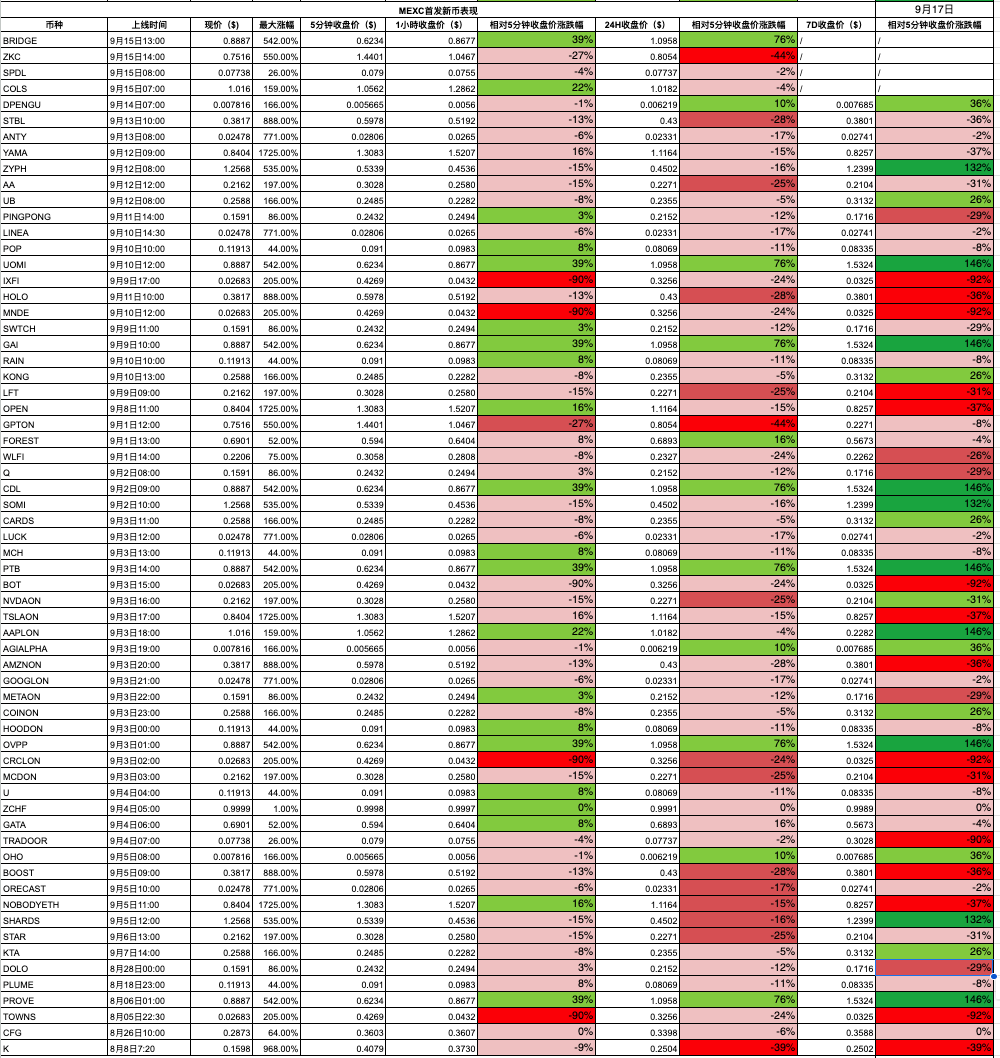

- MEXC—a fast-paced coin listing platform with a diverse portfolio. During the statistical period, MEXC launched over 60 new tokens, surpassing even Gate and ranking among the highest. MEXC is known for its aggressive approach to listing a wide variety of small-cap, trending themes, practically guaranteeing listings wherever there's a buzz. While this aggressive strategy creates opportunities for explosive growth, it also results in inconsistent quality and highly polarized short-term performance for new tokens.

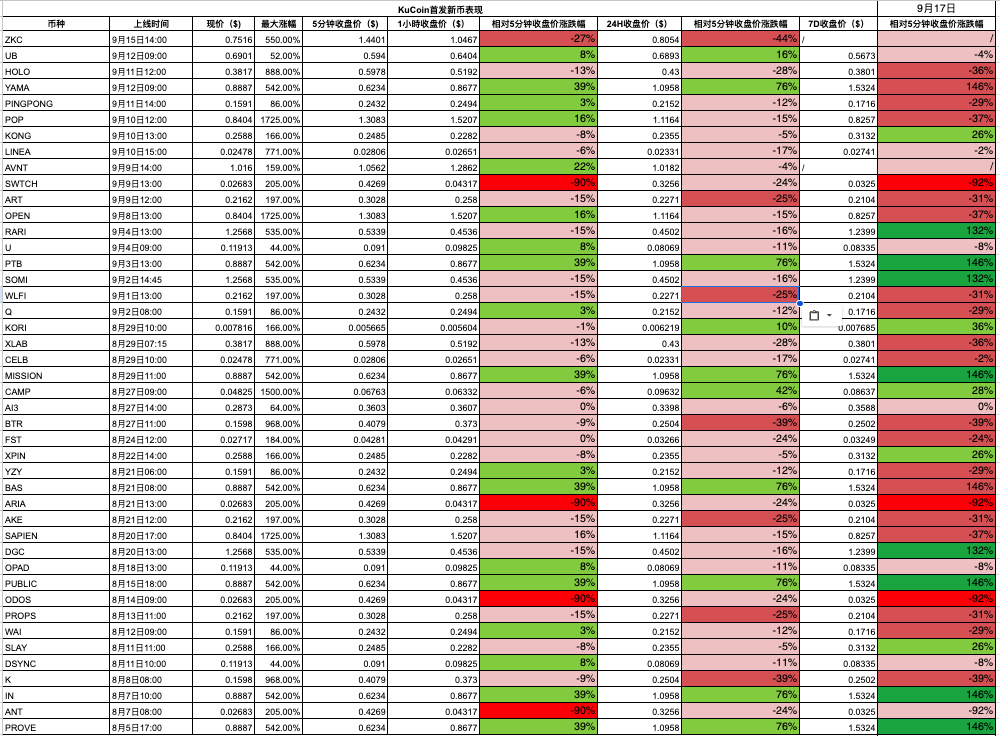

- KuCoin—Actively following market trends, the number of new coins has increased significantly. KuCoin has listed approximately 44 new coins in recent months, with an average of one new project added daily. Compared to its previously restrained listing strategy, KuCoin has recently significantly accelerated its pace, now listing popular public chain ecosystem coins and GameFi/Meme coins. This frequent listing allows KuCoin users to keep up with market trends, but it also requires users to be able to quickly capture market trends.

- HTX (Huobi) — Attempting to revive its coin listing business, HTX has a moderate number of listings. HTX launched approximately 11 new coins in August. While HTX has seen some improvement in recent months compared to its sluggish listing performance at the beginning of the year, its overall listing volume remains far less than that of high-volume platforms like LBank and Gate. As a long-established exchange, HTX currently prioritizes compliance and quality in its coin listings, strategically preferring to follow the mainstream rather than lead trends.

In summary, the pace of new coin listings shows a polarized pattern: platforms like LBank, Gate, MEXC, and KuCoin attract market attention through frequent listings, casting a wide net to create short-term opportunities; while Binance, OKX, and Upbit strictly control the number of coins they list to maintain a stable ecosystem. Bitget and Bybit fall somewhere in between, maintaining a certain level of listings while increasing market participation through derivatives tools. This divergence reflects the different development strategies of exchanges: some platforms attract speculative traffic by launching a large number of new coins, while others cultivate a solid reputation by carefully selecting projects.

Comparison of overall performance of new coins

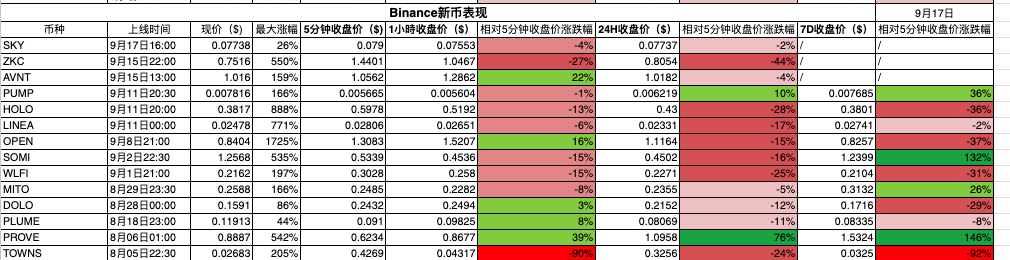

In addition to the number of listed coins, the price performance of new coins after listing is a key indicator for evaluating the "listing effect" of each exchange. We compared the price fluctuations of new coins on various platforms over different time periods (5 minutes, 1 hour, 24 hours, and 7 days) to observe which exchanges have the most significant increases in new coin prices and which platforms have a higher proportion of coins breaking their IPO price (declining after listing).

According to the provided data statistics, the performance distribution of new coins on various exchanges within one week of listing is roughly as follows:

Binance: Overall stable, with a few gains and most pullbacks

As a leading cryptocurrency exchange, Binance often lists high-profile new coins, leading to relatively rational speculation. A weekly analysis shows that approximately 36% of new coins listed on Binance rose, while 64% fell, similar to KuCoin's performance. Extreme drawdowns (a drop of more than 50%) accounted for less than 10%, demonstrating Binance's commitment to quality control and minimizing the risk of project failures.

The fluctuation of most currencies within 7 days was within +/-30%, and the fluctuation was relatively convergent.

- WLFI fell back after nearly doubling in price on Binance, with a weekly drop of about 30%;

- Although Linea surged on the first day, it quickly fell back and returned to almost the issue price within a week (a drop of about 2%).

- Overall, there are not many miracles of getting rich quickly, and there are also very few tragic cases of people losing their money in half.

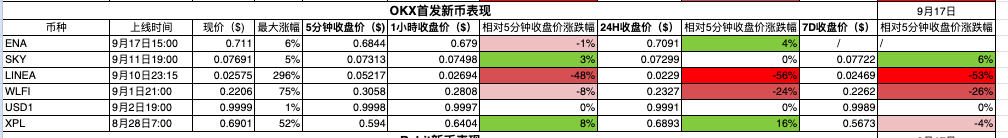

OKX: Volatility is controlled, and the profit effect is highly concentrated.

OKX has a limited sample size due to its small number of listed coins. Of the six new coins, only one saw a weekly gain, while the rest all declined. Some projects experienced a weekly retracement of over 90%, dragging the average return into negative territory.

- Looking at the 24-hour period, the first-day fluctuations of OKX new coins were relatively mild, with the median close to flat.

- Data from the 7th revealed a divergence: some high-quality projects continued to rise steadily within a week, such as RESOLV, which rose nearly 49% in the 24 hours after its launch in May and June, but most projects gave up almost all of their gains within a week.

- The overall volatility of new coins on OKX is lower than that on other platforms, and there are rarely crazy surges or plunges, but the profit effect is highly concentrated: if you miss out on a few strong coins, the rest of the projects will be almost unprofitable.

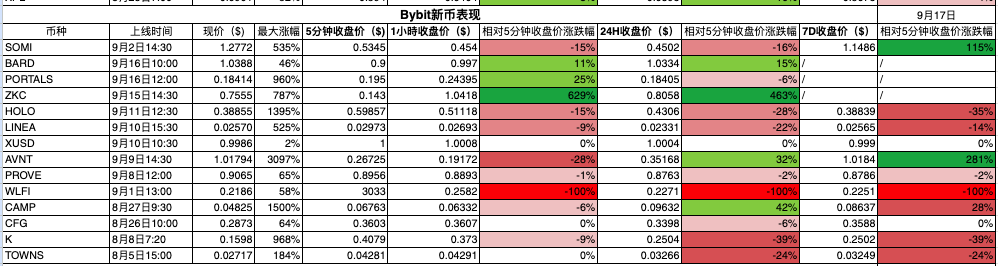

Bybit: “Stopwatch Market” is obvious, with profits and losses polarized

Bybit's new coin performance is characterized by large volatility on the first day, followed by overall weakness. Statistics show that only approximately 27% of the listed coins maintained prices above their initial listing price seven days later, while nearly 30% experienced declines exceeding 50% in the first week, with over 70% experiencing overall declines. Most tokens tend to peak within minutes of opening, followed by a step-by-step decline. For example, Homecoin rebounded nearly 30% from its 5-minute price within 24 hours, but failed to maintain its gains. Similarly, BDXN's 5-minute price of 0.1404 USDT plummeted to just 0.0441 USDT a week later, a 68.6% drop.

Bybit occasionally has some standout "dark horses," such as Avantis (AVNT), which surged over 30-fold on its first day, becoming one of the few examples to achieve positive average returns. However, overall, Bybit's new coin returns are highly dependent on individual star projects, with the vast majority of coins experiencing negative performance after seven days. Investors who miss out on the first-day surge face difficulties in achieving positive returns later on.

Upbit: More declines than increases, focusing on stability

Because Upbit primarily lists new coins based on "follow-up" strategies, their performance on Upbit is relatively flat, often after the frenzy in other markets has passed. Data shows that only about 15% of new coins listed on Upbit saw gains over the week, while over 80% ultimately declined. Approximately 23% of these coins lost more than half their value in the first seven days, indicating that some previously hyped overseas coins experienced a compensatory decline after entering the Korean market. For example, Worldcoin (WLD) surged and then retreated on its day of listing on Upbit, dropping over 20% in the week. Linea, with its opening price close to the market's fair value, remained essentially flat with a slight increase in the first seven days. Both the average and median returns of new coins on Upbit were negative (with a median decline of approximately -25%), indicating that most coins on the platform did not experience significant growth. For conservative Korean investors, this performance, while lacking in excitement, presents a relatively manageable risk profile.

Bitget: First-day sell-offs were common, with a few strong holdings supporting the average

The statistical scope covers 38 new coins during the sample period.

- The 7-day price increase relative to the 5-minute price accounts for about 34%, and the decline of ≥50% accounts for 24%. The deep decline is significantly smaller than LBank, but the overall elasticity is also more limited.

- The 7-day average change was about -6.7%, with a median of -19%; the 24-hour average was -16%, with a median of -20.5%, indicating a common path of "opening high - giving back on the same day - weakening during the week".

- Projects with a doubling of the 7-day dimension (≥+100%) accounted for 7.9%, and those with ≥+300% accounted for 0%.

Representative strong performers include AVNT (+254%), SOMI (+175%), and PROVE (+116%); however, tail drawdowns should not be underestimated, such as XCX (-94%), BSTR (-88%), and BOSS (-86%). Overall, Bitget's 24-hour median drawdown is deeper and its 7-day median negative values are more concentrated, suggesting a pattern of "a few strong performers driving up the average while the majority of underlying assets weaken with the trend." For traders, missing out on a few strong performers can make subsequent positive returns more difficult.

LBank: Frequent coin listings = higher discovery rate, leading the industry in “dark horse density”

During the sample period, 56 new coins were included. LBank, relying on a “machine gun”-style listing and sufficient initial liquidity, brought significant early price discovery efficiency:

- The 7-day dimension saw an increase of approximately 34%, of which doubling (≥+100%) accounted for 12.5% and ≥+300% accounted for 3.6%. The density of dark horse stocks ranked first among the same echelon platforms;

- The 7-day average return is approximately +1.5%, and the 24-hour average return is approximately +16%, indicating that there is a considerable short-term cashing window on the first day.

Representative strong performers include GOAT (+500%), CLIPPY (+398%), and OPENX (+187%), demonstrating the platform's ability to capture emerging themes and small-cap stocks. It's important to note that LBank's broad coverage also means a longer "long tail" of returns: the 7-day median is approximately -36.5%, and approximately 43% of stocks experienced a weekly decline of 50% or more. Therefore, a more trader-friendly approach is to view LBank as a new coin discovery engine that follows a "sample selection - grab the first wave - disciplined profit-taking" strategy: strict position and risk control are used to maximize the returns of dark horse stocks and mitigate long-tail drawdowns, effectively translating the platform's high hit rate into a strategic win rate.

Gate: Explosive market and deep decline risks coexist

Gate, with the largest number of listed coins, has the largest sample size. Statistics show that while approximately 30% of newly listed coins continue to rise relative to their first-day prices within seven days, over 70% decline. Approximately 30% of these coins even see their prices halved (drop by over 50%) within a week, representing the steepest decline among all platforms. This is due to Gate's relatively weak market-making capabilities, making price fluctuations easily amplified by single-point capital.

However, Gate has also contributed to some of the most dramatic price increases in the market: Avantis (AVNT), for example, saw its value soar over 30-fold on its first day, creating a short-term myth, only to quickly fall. Overall, Gate-listed new coins exhibit the greatest volatility—some often experience astonishing price increases on their first day, but often experience subsequent plunges.

MEXC: The income distribution is right-leaning, with a prominent peak increase

As another frequently listed platform, MEXC's overall performance for new tokens is somewhat similar to Gate's: approximately 30% of projects saw an increase from their listing price one week later, while 70% saw a decrease. Of these, approximately 10% experienced a deep, nearly 50% retracement. MEXC is characterized by its frequent instances of extreme price increases: the largest increase during the statistical period occurred in the IXORA project, the first MEXC-listed project, which saw a peak surge of nearly 98 times its issue price, an outrageous figure. This suggests, on the one hand, that MEXC attracts high-risk speculative funds willing to speculate on small-cap tokens; on the other hand, it also suggests that most projects quickly rationalize after the initial hype, with prices falling or even breaking their issue price. The average 7-day return of new MEXC tokens is slightly positive (inflated by extreme values), but the median is negative, indicating a weak performance for most tokens.

KuCoin: Overall stable, with moderate explosive power

Approximately 36% of new coins listed on KuCoin closed higher within a week, while 64% closed lower, slightly outperforming platforms like Gate and MEXC. Less than 10% of projects experienced a drawdown exceeding 50%, indicating relatively few significant declines. On average, new coins listed on KuCoin experienced a slight positive return (approximately +15%) over the first day's price over the seven-day period, with a median of approximately -8%. This suggests that a few large gains have driven the average higher, while the majority experienced modest declines. KuCoin rarely sees dramatic increases of dozens of times, with peak gains generally ranging from 5-20 times. The top performers are often carefully selected projects (such as social Fi and games) that are trending. Overall, the performance of new coins on KuCoin has been characterized by a moderate to bullish trend: neither extreme get-rich-quick schemes nor sustained price drops have been observed. Investors who capitalize on this opportunity have the potential to generate steady returns.

Looking horizontally at the overall return distribution of new coins in the week following their listing, platforms with high listing frequency, such as LBank, Gate, and MEXC, exhibit a right-skewed pattern of "highs and lows": a few coins experience legendary gains of dozens of times, while many more projects quickly fall below their IPO price, resulting in a significant polarization in investor gains and losses. In contrast, leading exchanges like Binance and OKX, due to their stringent listing screening procedures, experience more moderate and convergent performance for new coins: drastic increases are rare, while sharp declines are also relatively rare, with the majority of coins maintaining manageable gains and losses. Bybit and Bitget exhibit both characteristics: star coins experiencing a single-day increase of dozens of times, as well as numerous common coins experiencing quiet declines. Their new coin return distribution exhibits a "long tail," with extreme values driving up the average, while median returns are low or even negative. This suggests that investors who speculate on new coins on these platforms require the ability to select individual cases.

Analysis of the performance distribution characteristics of new coins

Combining the above data, we can further summarize the distribution characteristics of new coins on each platform:

- Concentration of Growth: This refers to the degree to which profits are primarily concentrated in a few new coins. Bybit and Bitget have the highest concentration of new coin growth—the surge in one or two projects contributes the majority of overall returns, while the majority of other coins experience limited or even negative growth. Due to the small number of projects on OKX, the rise or fall of a single coin has a significant impact on the overall performance, exhibiting a concentrated pattern. Conversely, LBank and Gate's growth is relatively evenly distributed. While there are individual cases of high absolute returns, the overall contribution of each coin is dispersed due to the large number of projects. Binance and KuCoin fall in the middle: neither extremely concentrated in one or two coins, nor completely evenly distributed. Strong coins contribute to overall returns to a certain extent, but they do not dominate.

- The percentage of new coins that close higher on their first day or week: This metric reflects the "break-even rate" of new coins. Upbit has the lowest percentage of break-evens, less than 20%, indicating that most new coins in the Korean won market fail to achieve gains. OKX and Bybit also have relatively low break-even rates, around 20-30%. Platforms like Gate, MEXC, Binance, and KuCoin have slightly higher break-even rates, ranging from 30-40%. LBank's data is missing, but historical data suggests it's likely around 30%. This means that breaking even (declining in the first week) is the norm for new coins on most platforms, with break-evens becoming the exception. Only by locking in profits early in the launch period can investors ensure their profits are secure.

- Deep Drawdown Rate: We consider a 7-day drop of more than 50% relative to the 5-minute closing price to be a "deep drawdown" (a halving). Gate saw the highest weekly drop in approximately 31% of its new coins, the highest in our sample. This confirms the risk of liquidity disruptions associated with Gate's frequent listings, with subsequent day-after-day price drops frequently occurring. Upbit followed closely behind, with approximately 23% of new coins experiencing a halving within the week, likely due to a compensatory decline in the value of popular overseas coins listed in South Korea. Bybit saw approximately 9% of projects experiencing a halving, while Binance and KuCoin saw less than 10%, MEXC around 10%, and LBank and Bitget estimated to be in the 10-20% range. The situation on OKX remains unclear, but at least extreme cases have occurred. Overall, platforms like Gate and Upbit present higher risks, with nearly a quarter of new coins experiencing a rapid halving. Binance and KuCoin, on the other hand, experienced relatively mild declines, with only around 10% experiencing a deep drop.

Through the above analysis, the performance of new tokens on different exchanges is clearly differentiated: platforms with frequent listings present both opportunities and risks, with overall returns depending on whether one can capitalize on a small number of rapidly surging tokens. Low-frequency, selective platforms, while offering fewer opportunities for quick gains, also have lower average drawdowns, with returns more concentrated in the middle. For the average investor, investing in new projects on frequently listing platforms requires more cautious stop-loss and profit-taking strategies. However, participating in popular listings on leading platforms offers more manageable risks, but avoid excessively high returns.

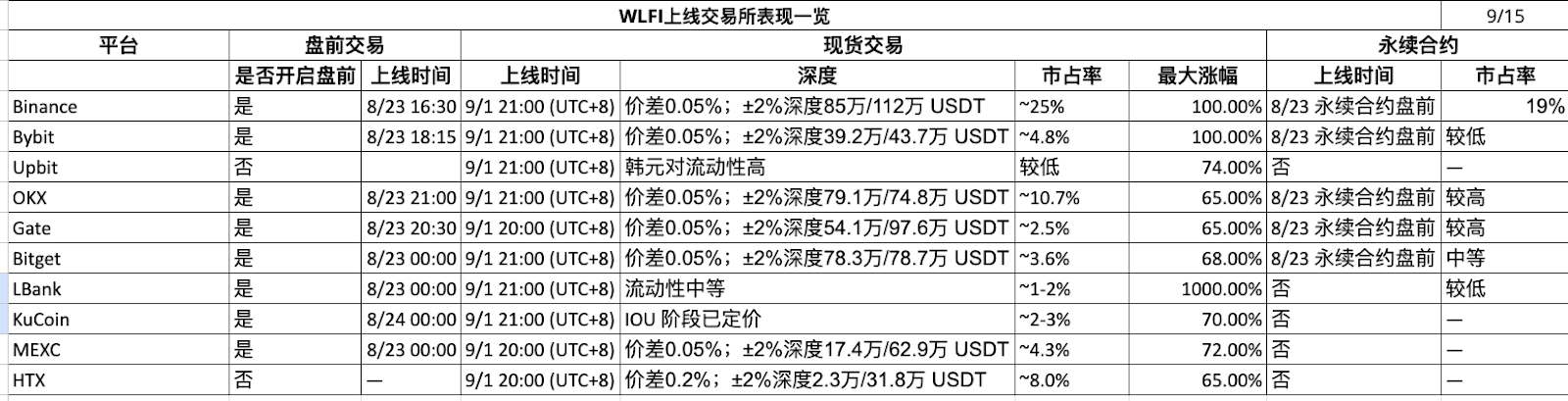

WLFI: Trump Concept Coin’s Multi-Platform Performance

Project Overview: WLFI (World Liberty Financial) has garnered significant attention due to its alleged backing from the family of former US President Trump, earning it the nickname "Trump Coin." Around September 1st, numerous exchanges, including Binance, HTX, KuCoin, Bybit, and LBank, announced their listings, creating a near-global simultaneous listing. Binance even tagged it with a rare "Seed Tag" to indicate high risk. Bybit launched its exclusive "Token Splash" airdrop event, while LBank offered a special trading compensation offer. This large-scale, multi-platform simultaneous launch is rare in recent years, making WLFI an excellent benchmark for testing the user structure and investment strategies of different exchanges.

Project Overview: WLFI (World Liberty Financial) has garnered significant attention due to its alleged backing from the family of former US President Trump, earning it the nickname "Trump Coin." Around September 1st, numerous exchanges, including Binance, HTX, KuCoin, Bybit, and LBank, announced their listings, creating a near-global simultaneous listing. Binance even tagged it with a rare "Seed Tag" to indicate high risk. Bybit launched its exclusive "Token Splash" airdrop event, while LBank offered a special trading compensation offer. This large-scale, multi-platform simultaneous launch is rare in recent years, making WLFI an excellent benchmark for testing the user structure and investment strategies of different exchanges.

First-day price trajectory: WLFI's opening price and subsequent fluctuations on various platforms showed significant differences. Overall, the first day experienced a "high-open-low" trend - that is, it rose sharply in the early trading and then quickly fell back, but the extent of the rise varied across different exchanges:

- On KuCoin, HTX, and Binance, WLFI opened at a relatively low price, prompting buying to nearly double its price, with the largest increase reaching approximately 1.97 times (+97%). For example, within minutes of Binance's opening on September 1st, WLFI surged from approximately 0.15 USDT to around 0.30 USDT before encountering resistance and falling back. An hour later, the gains narrowed, and by the 24-hour closing price, it had retraced only 34% of the opening price. Seven days later, it had fallen approximately 30% below the issue price. KuCoin and HTX's performance mirrored that of Binance, with both experiencing a near-doubling rally, but failing to hold onto the gains, closing roughly around the opening price.

- On OKX and MEXC, WLFI opened at a relatively high price, without any significant upward movement. Instead, the opening price became the highest price of the day (i.e., a "diving" trend). This resulted in its maximum increase of only approximately +0.75 times (i.e., 25% lower than the opening price) [30†first column] - in other words, WLFI did not have any upward range on these two platforms, peaked at the opening, and then fluctuated downward. The closing price on the first day fell by more than 20% from the opening price, and was still down by about 26% a week later, showing weak performance [30†first column]. This situation suggests that on platforms such as OKX and MEXC, there may be more aggressive buy orders that pushed up the opening price of WLFI, making it unable to rise further.

- On Bybit, WLFI's first-day performance was even more unique. Because Bybit launched an airdrop event simultaneously with its launch, many users received free WLFI tokens, which released some selling pressure. At the opening, WLFI's price quickly plummeted (opening high), with the maximum increase being only 0.58 times, before plummeting significantly [30†WLFI-Bybit]. According to data, WLFI's 5-minute closing price on Bybit was approximately 0.3033 USDT, but it fell to 0.2582 an hour later and 0.2271 USDT after 24 hours, both below the opening price. Seven days later, it was still down approximately 30% [30†WLFI-Bybit]. While Bybit's airdrop strategy increased trading volume, it also led to heavy selling pressure at the opening, resulting in a relatively weak first-day performance.

- On Upbit (South Korean market), WLFI also underperformed on its first day. Upbit users showed limited interest in this overseas political-themed coin, and the opening price immediately became a high point (reportedly, the "maximum increase" was recorded as 0% [30†WLFI-Upbit]). WLFI's price subsequently continued to decline, dropping approximately 37% in 24 hours and still down over 43% from the opening price a week later [30†WLFI-Upbit]. This suggests that the Korean market lacked the momentum to chase WLFI's upward momentum—possibly due to the regulatory environment or investor preferences, which favored a wait-and-see approach rather than enthusiastic speculation. Additionally, it may be because by the time WLFI launched on Upbit, global prices had already been driven up and then retreated on other platforms, leaving the Korean won market lacking an independent market trend.

Liquidity and Trading Volume: The trading volume and liquidity distribution across various platforms upon WLFI's launch also reflected differences in user demographics. Binance, the world's largest exchange, led the WLFI/USDT trading pair by a significant margin on its first day, demonstrating ample buy/sell order book depth and a relatively stable price equilibrium. KuCoin and MEXC, with their large concentration of speculators, also experience high short-term trading activity, with dramatic intra-second candlestick chart fluctuations. However, their depth is inferior to Binance's, making them susceptible to large orders driving up and crashing the market. On Bybit, due to its airdrop, a massive influx of sell orders immediately after the market opened, creating significant pressure to absorb buy orders. However, this also subsequently attracted significant bargain-hunting activity, maintaining high trading volume. On Upbit, while trading volume for the Korean won pair was lower than that of the US dollar market, it still ranked among the top daily trading pairs in South Korea, demonstrating continued interest. Overall, WLFI's liquidity is more concentrated on large exchanges, resulting in more orderly pricing, while smaller exchanges experience active trading but volatile fluctuations.

Analysis of differences in launch strategies and user structure: From the WLFI case, we can see that the differences in the launch strategies of various exchanges in new coins have a significant impact on price trends:

- Binance's "seed" tagging didn't involve any additional promotions, attracting a more rational user base. This led to a relatively mild and orderly price trend. Its user base is primarily comprised of global professional investors, who are wary of politically motivated tokens. Consequently, despite a slight surge in WLFI, the price quickly returned to a more rational level.

- Bybit used an airdrop spree to stimulate trading volume, with its users primarily comprised of derivatives and airdrop enthusiasts. The influx of free chips, coupled with Bybit users' tendency to trade short-term, led to an artificially high opening price for WLFI on Bybit and heavy selling pressure, resulting in a high opening and a low closing. This suggests a high proportion of speculators within Bybit's user base, and the platform's strategy reinforces this short-term trading atmosphere.

- Upbit users are primarily Korean retail investors with a relatively conservative investment style and a lack of emotional attachment to non-Korean products. Despite the global hype surrounding WLFI, Korean investors have remained restrained, avoiding a frenzy. This reflects regional market preferences: Korean users prefer domestic concepts or mainstream global currencies, with relatively limited interest in coins related to US politics. Furthermore, Upbit lacks a futures market for short-selling arbitrage, requiring users to trade only in spot trading. Consequently, after prices on other platforms fell, the Korean won also fell, lacking support.

- To mitigate the risks of first-minute pricing deviations and abnormal matching, LBank often implements a pre-market price protection mechanism and platform-level compensation plan upon new coin launches. These mechanisms set protection thresholds for the opening quote range, order size, and matching anomalies, initiating a rollback and compensation process once triggered. This combination helps mitigate extreme slippage in sentiment coins like WLFI, improves the predictability of early price discovery, and bolsters retail investor confidence in participating in initial public offerings. Consequently, short-term "surges" are somewhat suppressed, resulting in a more controlled opening curve and a more stable trading experience.

- KuCoin, MEXC, HTX, and other platforms attract a large number of international retail investors and speculative capital, who are highly sensitive to novel concepts. KuCoin's community, in particular, excels at short-term speculation, willing to buy at low prices to drive up prices. This is why WLFI, on KuCoin, saw a nearly 200% increase in value. However, precisely because this type of capital is quick to enter and exit, they quickly sell off after the gains are achieved, causing the price to fall. These platforms' launch strategies are essentially to cast a wide net to cater to the market, lacking additional risk control measures. The performance of new tokens is driven entirely by market sentiment, resulting in wild fluctuations.

Overall, WLFI's performance on various exchanges is "different," with different answers to the same question: the same project, but different platforms' varying user structures (rational vs. speculative, local vs. international) and supporting strategies (whether airdrops are used, risk warnings), leads to vastly different market performances. Some platforms saw WLFI double in value, while others saw little change and continued to decline. This clearly demonstrates that the ecological characteristics of an exchange shape the trading fate of a new coin. Exchanges serve as both the issuance venue and price discoverer for new coins, and different "audiences" determine the direction of the performance.

Summary: Cross-platform insights into ICOs

Through the WLFI case, we can summarize some general patterns in the cross-platform performance of new coins:

- The user base determines the intensity of hype: platforms favoring speculation (such as LBank, MEXC, and Gate) tend to drive exaggerated gains in sentiment-based coins, but may also experience greater selling pressure on fundamental-based coins. Conservative and rational users (such as Upbit and some Binance users) are less enthusiastic about theme-based coins and have a certain preference for value-based coins.

- Synchronous listings narrow price gaps: When multiple exchanges list a new coin simultaneously, price discovery is expedited, and arbitrage quickly eliminates price differences across platforms. Performance differences between exchanges are more reflected in fluctuations and details rather than price trends.

- Platform strategies influence short-term trends: The strategies employed by exchanges (such as airdrops, trading competitions, and guaranteed trading payouts) can influence supply and demand in the initial stages of a new coin's listing. For example, airdrops increase selling pressure, trading competitions stimulate trading volume and amplify volatility, and guaranteed trading payouts can discourage blindly chasing rising prices. These factors are reflected in the first-day K-line chart.

- Contract tools accelerate price recovery: Platforms offering coin futures/perpetual contracts often see spot prices return to normal levels faster. This is because short-selling mechanisms allow price bubbles to burst more quickly. This is particularly evident after a surge in coin prices—where short selling is available, the upward trend is likely to peak sooner.

- Regional markets have their own rhythms: Even when local exchanges (such as Upbit) list global coins, they will still reflect the unique reaction patterns of local investors. Coins that have been hyped in international markets may not necessarily be popular in their home markets, and vice versa. This reminds us to pay attention to the impact of the market environment in which the exchange operates on the performance of new coins.

In short, the performance differences of new tokens between exchanges are shaped by a combination of factors: investor composition and platform systems. The same new token can have vastly different outcomes depending on where it's traded. While simultaneous listings on multiple platforms have become a trend for project developers, coordinating the pace of launches and leveraging the strengths of each platform is a skill in itself. For investors, understanding these differences helps them choose the right time and place to participate—the exchange they buy on and the exchange they sell on can impact their ultimate returns. This is precisely the significance of our in-depth cross-platform comparisons.

Contract data comparison

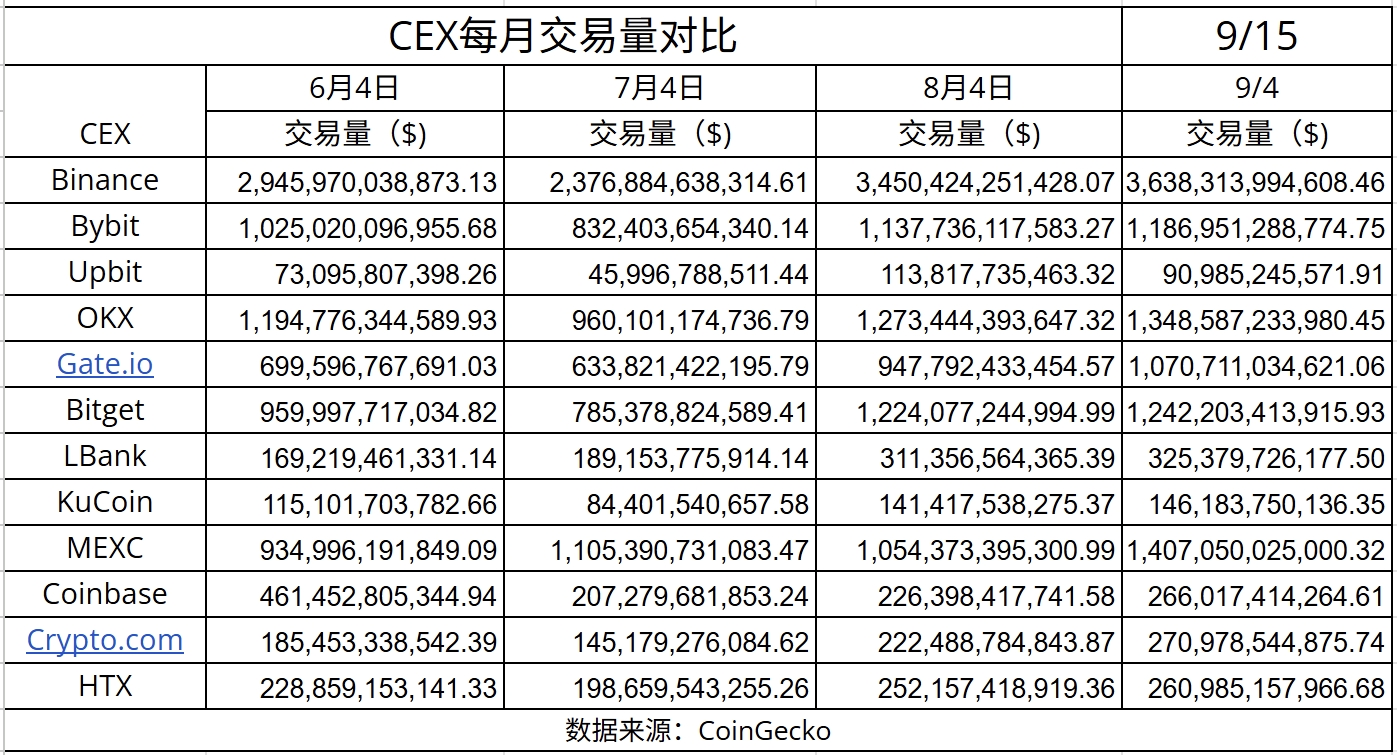

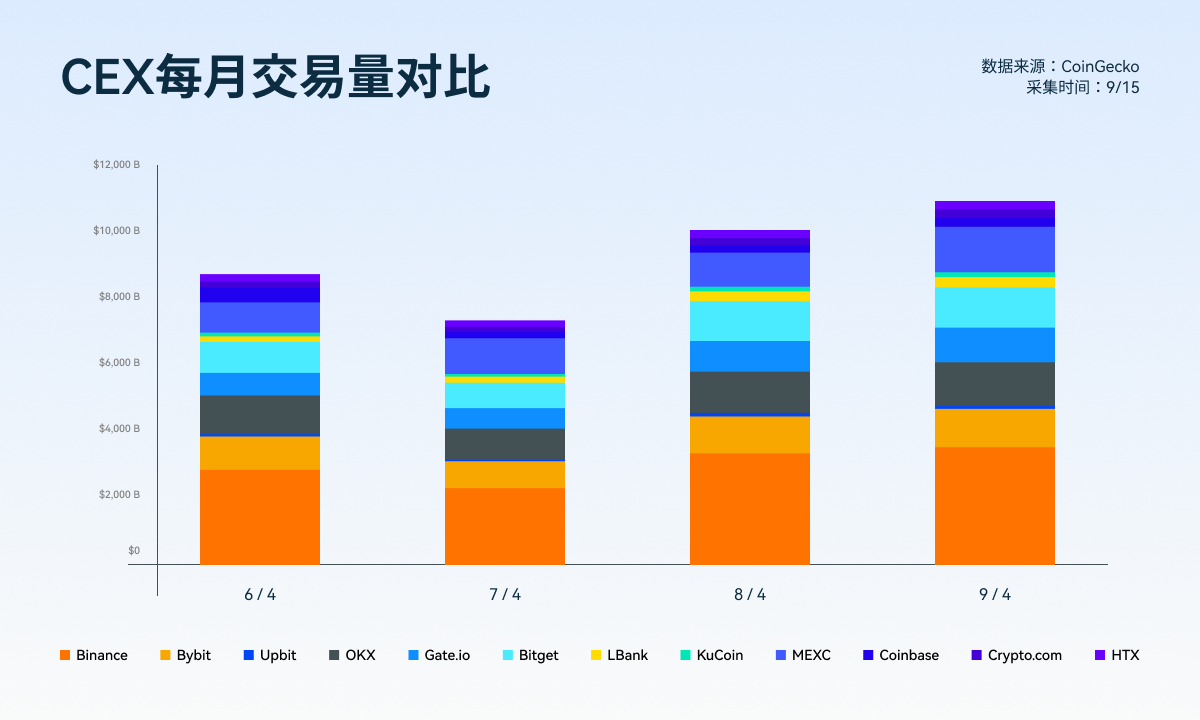

While the spot market for new tokens is certainly eye-catching, competition and changes in the futures market offer a better reflection of exchanges' strategic priorities. In August 2025, as the market rebounded, significant divergence in derivatives trading volume emerged among major exchanges. Using the metrics in the "Exchange Data Comparison" table, we conducted a comparative analysis of futures trading on the top ten platforms, providing insights into the changing landscape from trading volume, growth trends, to currency coverage.

Total trading volume and derivatives share

First, let's look at overall trading volume and the proportion of derivatives trading. Based on 24-hour trading volume data from Coingecko in early September 2025, a comparison of spot and derivatives trading on various platforms is as follows (the percentage of derivatives trading in the total volume is in brackets):

- Binance: Spot trading volume is approximately $735.6 billion, and USD derivatives volume is approximately $2.90 trillion, totaling $3.64 trillion per 24 hours, with derivatives accounting for approximately 80%. As the industry leader, Binance's futures trading volume is far ahead, approximately four times that of spot trading.

- Bybit: Spot trading volume is approximately 126.9 billion, and derivatives volume is approximately 1.06 trillion, totaling 1.187 trillion, with derivatives accounting for approximately 89%. Since its inception, Bybit has positioned itself as a contract specialist, with its contract volume approaching nine times that of the leading spot exchanges.

- OKX: Spot trading is approximately RMB 114 billion, derivatives are approximately RMB 1.234 trillion, totaling RMB 1.348 trillion, with derivatives accounting for approximately 92%.

- Gate: Spot trading is approximately 129.2 billion, derivatives are approximately 941.5 billion, totaling 1.0708 trillion, with derivatives accounting for approximately 88%.

- Bitget: Spot trading is approximately 131.6 billion, derivatives are approximately 1.1106 trillion, totaling 1.2422 trillion, with derivatives accounting for approximately 89%.

- MEXC: Spot trading is approximately 128.5 billion, derivatives are approximately 1.2785 trillion, totaling 1.4070 trillion, with derivatives accounting for approximately 90.8%.

- LBank: Spot trading volume was approximately 108.4 billion yuan, and derivatives trading volume was approximately 216.9 billion yuan, totaling 325.3 billion yuan. Derivatives trading accounted for approximately 66.7%. LBank's derivatives trading volume was relatively low among the sample, at only about two-thirds.

- HTX (Huobi): Spot trading volume is approximately 107.3 billion, and derivatives trading volume is approximately 153.6 billion, totaling 260.9 billion. Derivatives trading accounts for approximately 58.8%. HTX has the lowest derivatives trading volume in this comparison, at less than 60%.

- KuCoin: Spot trading volume is approximately 53.7 billion yuan, and derivatives volume is approximately 92.4 billion yuan, totaling 146.2 billion yuan. Derivatives account for only 63% of the total. KuCoin's derivatives portfolio is significantly lower than that of the aforementioned platforms. This indicates that KuCoin's users still primarily focus on spot trading, with futures trading lagging behind. While KuCoin also offers perpetual contracts, the variety and depth may not be comparable to first-tier platforms, and user stickiness in its derivatives offerings needs to be improved.

- Upbit: Spot volume is approximately US$9.1 billion, with no derivatives trading.

The above comparison demonstrates that, with the exception of a few platforms (KuCoin, LBank, and Upbit), derivatives dominate the trading volume structure of most exchanges. This is particularly true for emerging or second-tier platforms like OKX, Bybit, Bitget, Gate, and MEXC, where futures/perpetual swaps account for 85-90% or even more of their trading volume, demonstrating their success in driving platform scale through contract products. This is driven by user preferences and platform strategies: younger traders prefer high leverage and high volatility, and these platforms are happy to offer a wide range of contract products to cater to this demand. Meanwhile, despite Binance's substantial spot trading base, its derivatives volume remains nearly four times that of its spot trading volume, accounting for 80% of its total, demonstrating that even leading platforms rely heavily on the contract market.

KuCoin, LBank, and HTX are in a transitional state: their derivatives businesses still lag significantly behind their spot trading counterparts, accounting for around 60%. This may reflect either a late start in the contract trading business (e.g., LBank, which only recently launched futures), a user base dominated by conservative investors (e.g., HTX's traditional users are accustomed to spot trading), or a lack of competitiveness in their contract products (e.g., KuCoin's futures market depth and product variety have yet to fully develop). As the industry develops, these platforms with relatively low market share will likely focus on expanding their derivatives market share if they want to increase their total trading volume.

Contract trading volume trends and market share changes

To observe trading volume trends, we compared data from early June and early September 2025 and calculated the quarterly rate of change in total trading volume for each exchange. This can reveal which platforms have experienced rapid growth in recent quarters and which have been relatively stagnant:

- LBank: Quarterly trading volume increased by a staggering +92.3%, the fastest growth in the sample. This impressive growth suggests that LBank implemented an aggressive strategy to expand its contract business in Q3, perhaps by aggressively launching contracts for popular tokens and implementing contract incentive programs, which led to a surge in trading volume. Furthermore, many smaller tokens saw strong trading activity in Q3, with LBank leading the way in new listings. The surge in trading volume for these new tokens also contributed to the overall volume.

- Gate: Quarterly volume increased by approximately +53.0%. As a long-established alt-exchange, Gate reached new heights in trading volume in Q3, with growth primarily driven by derivatives (+62% quarter-over-quarter). This growth is due to Gate's ability to capitalize on the market trends and launch numerous perpetual contracts for new tokens.

- MEXC: Quarterly growth of approximately +50.5%. MEXC continued its rapid growth in Q3, solidifying its "dark horse" status. The significant growth in its derivatives offerings, in particular, has brought it close to matching OKX in terms of derivatives volume.

- Bitget: Quarterly growth of approximately +29.4%. Bitget maintained steady growth.

- KuCoin: Quarterly growth was approximately +27.0%. KuCoin's total trading volume growth was primarily driven by increases in its spot trading (a surge in spot trading was driven by the numerous new coin listings in Q3). Derivatives also saw some improvement, but the magnitude was modest.

- Upbit: Quarterly growth of approximately +24.5% (spot trading only). Upbit's trading volume naturally rebounded by nearly a quarter, benefiting from the overall market recovery in Q3 and the inflow of funds from South Korea. This growth rate is similar to Binance's, indicating that Upbit generally followed the broader market and did not perform exceptionally well.

- Binance: Quarterly growth was approximately 23.5%. As the exchange with the largest base, Binance's 23% quarter-over-quarter growth is impressive. This is primarily due to the rebound in trading sentiment in Q3, which saw both top cryptocurrencies and some smaller cryptocurrencies surge in volume on Binance. Binance has not made any major strategic adjustments, and even reduced some high-risk products under US regulatory pressure. Therefore, its growth generally represents the broader market average. In terms of market share, Binance experienced a slight decline (due to the higher growth of mid-sized exchanges), but it still firmly holds the leading position.

- Bybit: Quarterly growth was approximately +15.8%. Bybit's growth lagged behind the industry average. This may be due to several factors: first, Binance and other platforms have lost some users (e.g., users have left Binance after regional bans); second, Bybit's Q3 activity was mediocre; despite the high number of new coin listings, their contribution to trading volume was limited; and third, its derivatives market share was eroded by newcomers such as Bitget and MEXC. This 15.8% growth puts Bybit at risk of being approached or even surpassed by Bitget in the rankings, resulting in a slight decline in market share. This is a warning sign for Bybit, once the second-largest contract trading platform. Bybit needs to refocus on product and marketing to regain rapid growth.

- HTX: Quarterly growth of approximately +14.0%. HTX also saw modest growth. Amidst internal and external challenges, Huobi's user base struggled to expand significantly, with the increase in trading volume primarily driven by a slight increase in activity among existing users. This 14% growth rate further marginalized HTX in the rankings, leading to a continued decline in market share.

- OKX: Quarterly growth was only approximately 12.9%. OKX's growth was the slowest, almost stagnant. This was surprising, given OKX's recent overseas expansion and new product launches. However, data shows that its trading volume growth was far slower than that of its competitors. This may be due to OKX's high base, making incremental growth difficult; it may also reflect a slowdown in user growth, particularly due to missed opportunities in the emerging altcoin and derivatives markets.

The above trends indicate that the biggest market share winners in Q3 were mid-sized platforms such as LBank, Gate, MEXC, and Bitget. These platforms expanded at rates exceeding 50%, or even nearly doubling, capturing a larger share of the trading volume pie. Meanwhile, traditional large exchanges such as Binance, OKX, Huobi, and Bybit lagged behind, suffering a relative loss of market share. This is likely due to the fact that Q3's market share was primarily focused on small-coin speculation and derivatives—the very areas where second- and third-tier platforms excel. Conversely, large exchanges, due to compliance and strategic constraints, were unable to delve deeper into many high-risk, high-return sectors, resulting in limited growth. Whether this market share shift remains stable in the long term will depend on the performance of these exchanges once the bull market fully begins. However, in volatile markets, small and flexible platforms have demonstrated greater driving force.

Differences in trading volume structure and currency coverage

Besides the spot/contract ratio, trading volume structure can also be compared based on the internal structure of contracts: for example, the ratio of perpetual contracts to delivery contracts, the ratio of mainstream and altcoin contracts, and the number of underlying assets. These factors reflect the focus and depth of an exchange's contract trading.

- Looking at perpetual swaps vs. delivery futures, nearly all platforms mentioned prioritize perpetual swaps, accounting for the vast majority of trading volume. Delivery futures (fixed-term contracts) are only offered by a few full-service platforms like Binance and OKX, and while they account for a significant portion, they are also becoming increasingly marginalized compared to perpetual swaps. Therefore, we can focus on the perpetual swap comparison.

- Mainstream Coins vs. Altcoins: Contract volume on leading exchanges like Binance and OKX remains highly concentrated in mainstream coins like BTC and ETH. For example, BTC/USDT and ETH/USDT perpetual swaps on Binance Futures likely account for over 50% of trading volume. Correspondingly, while smaller coin contracts offer a wide variety of products, the trading volume per unit is limited. Platforms like MEXC and Gate, attracting traders of smaller coins, have more diversified contract trading across a wide range of altcoins. For example, a new perpetual swap on MEXC can generate hundreds of millions of dollars in daily trading volume, yet it's not even listed on Binance. On Gate, perpetual swaps for coins with relatively low market capitalizations like PEPE once led the market. This demonstrates that leading platforms succeed by leveraging their depth in major coins, while second-tier platforms rely on their breadth in smaller coins.

- Number of Contracts: Binance currently offers over 150 USDT-margined perpetual contracts and dozens of coin-margined contracts. OKX offers approximately 200 contracts, including many DeFi and popular projects. Bybit also offers over 150 contracts. MEXC, on the other hand, claims to offer over 250 perpetual contracts, covering nearly all of its listed spot altcoins. Gate also offers around 200 contracts. KuCoin's contract offering is relatively limited, at just over 100. LBank's contract offerings are very limited, likely covering only a few dozen mainstream coins and some popular altcoins. Upbit offers no contracts. Explanation of the differences in product variety: MEXC and Gate, in an effort to attract users, have added a large number of contracts for smaller coins to offer speculators; Binance is more cautious with its smaller coin contracts, limiting their offerings to a relatively limited number. Bitget and Bybit fall in between, offering a large number of contracts for new coins, but they are selective (for example, Bitget will select contracts based on popularity, but may not offer them as fully as MEXC).

- Trading Tools and Features: Beyond quantity, futures trading also differs in detailed features. For example, in terms of leverage, Binance and OKX offer up to 125x leverage on mainstream cryptocurrencies, while smaller cryptocurrencies are generally capped at 20-50x. MEXC and other platforms sometimes offer high leverage on smaller cryptocurrencies to attract gamblers. Regarding liquidity, platforms like Binance have a large team of market makers to ensure depth and minimize slippage, while smaller platforms may have thin liquidity on some contracts, making them susceptible to market manipulation and liquidation. Funding rates and the strength of insurance funds also serve as key differences. Overall, leading platforms offer greater expertise and stability in the futures market, while emerging platforms prioritize aggressiveness and flexibility, potentially sacrificing some stability.

- Hot Spot Tracking: Strategically, some exchanges are keen to chase market trends. For example, the aforementioned MEXC and Gate will list perpetual futures contracts as soon as a new coin becomes popular, allowing users to trade in both directions. For example, when the Friend.tech concept became popular this year, related coins like BLUR had futures trading on these platforms, attracting large volumes of users. Bitget and Bybit also follow hot spots, but they are slightly more cautious, typically ensuring that spot products are listed and have basic liquidity before opening futures contracts. Other exchanges focus on mainstream markets and avoid listing unpopular futures contracts. Typical examples include Coinbase (which only offers BTC and ETH futures, which are not within the scope of this discussion) and OKX (which relatively avoids indiscriminately listing futures on micro-coins). Binance falls somewhere in between: selectively participating in hot spots, such as when PEPE was extremely popular, Binance made an exception and listed perpetual futures contracts, but most altcoins do not.

The result of these differences is that user stickiness for futures trading varies across exchanges. Users interested in speculating on smaller coins are often active on platforms like Gate, MEXC, and Bitget, as they flock to platforms where new products are available. Meanwhile, funds investing in large-volume mainstream coin futures tend to favor platforms like Binance and OKX for their depth, reliability, and low slippage. In the short and medium term, when the market for smaller coins is booming, contract volume on smaller platforms surges. When the market returns to a more rational state and large funds prioritize BTC, the dominance of leading platforms reasserts itself. These two models are not mutually exclusive. Many exchanges attempt to "grasp both ends"—promoting smaller coin futures while maintaining a strong market for larger coins. For example, Bybit and Bitget employ this strategy, boasting a large number of alt-perpetual futures contracts while competing with Binance for depth in major currencies. This all-around approach requires both resources and technology investment, as well as market dominance. Currently, Binance remains the recognized leader in comprehensive futures trading, but other platforms are overtaking in specific areas through differentiation.

Summary of performance comparison between new coins and futures contracts

Through the above comprehensive comparison of spot coin and futures trading, we can draw several key conclusions:

(1) Platforms with the strongest explosive power for new coins: If we judge heroes by their explosive power, LBank, Gate, MEXC, and other platforms have the strongest short-term explosive power for new coins—assuming investors can choose the right "rocket." However, it should be emphasized that the high returns of these platforms are accompanied by high break-even rates and deep drawdowns, with their ups and downs far greater than those of the top exchanges.

(2) Platforms with the best overall performance of new coins: From the perspective of most projects being able to achieve relatively stable returns, Binance and KuCoin's new coins have performed relatively well overall. Binance's new coin break-even rate is lower than average, with few tragic cases of halving, making it less likely for investors to step on mines; while KuCoin has about one-third of its projects closing higher in the week, with average and median returns ranking among the top in the sample (average +15%, median only -8%). Although OKX has a small number of listed coins, the few new coins it lists, with the exception of one or two, have not experienced dramatic drops, and their performance is relatively stable. Upbit, as it mostly follows mainstream coins, has not seen much growth, but it has the advantage of controllable risks. In general, from the perspective of stable profitability, Binance and KuCoin are slightly better, followed by Bitget/Bybit (because their averages are pulled up by extreme values and their medians are low), and Gate/MEXC is the most challenging (with polarized profits and losses). Of course, the "best overall" here is from the perspective of risk control. Aggressive investors may pay more attention to the "explosive power ranking" mentioned above.

(3) Platforms with the fastest increase in contract transaction share: From a quarterly perspective, LBank, MEXC, and Gate are the three platforms with the fastest increase in contract transaction share and scale. LBank's contract volume doubled month-on-month, and its derivatives share increased from about 55% to nearly 67%, indicating that it has successfully converted a large number of spot users into contract trading users. MEXC and Gate's derivatives share was already high, and each increased by about 5 percentage points, consolidating their dominant position in high-leverage trading. Bitget and KuCoin also increased by about 4 percentage points each, indicating that the importance of the derivatives sector has further increased. On the contrary, the derivatives share of OKX and Bybit remained basically the same, while Binance increased slightly but the change was not significant (due to the large base). HTX remained almost unchanged, still hovering around 60%. In general, the contract share of small and medium-sized platforms generally increased faster. These platforms clearly tended to focus on contracts to drive growth in Q3; due to the base and positioning reasons, the share of the leading platforms changed little, but the absolute volume was also increasing. It can be foreseen that with the rise of these up-and-coming companies, the contract market will become more diversified and will no longer be dominated by a few leading companies.

(4) Closed-loop effect of new coin quantity and contract support: From our analysis, we can see that some exchanges have formed a closed-loop ecosystem of "new coin spot + supporting contracts", while others have not yet fully connected. Typical examples include Bitget, LBank, Gate, and MEXC. They are among the top in terms of the number of listed coins, and they also provide contract trading for almost every hot coin. This closed-loop linkage between spot and contract trading has the following advantages: users can complete spot trading and leveraged trading of new coins on the same platform without switching to other platforms, which naturally increases transaction stickiness and trading volume. For example, if a user sees that new coin X is rising well on LBank, he can first open a spot position, then immediately open a contract to increase leverage and go long, and then close the spot position after making a profit - the entire process is completed within LBank. For exchanges, new coins bring spot traffic, and contracts further amplify trading volume. The two complement each other. Platforms like Binance and OKX, however, have been slower to achieve a closed-loop system: they list few or only a few new coins, and for many new coins, they don't have spot trading, let alone futures (or wait until the price stabilizes before launching futures). This forces some users to look elsewhere to trade futures for smaller coins. Binance has experimented with launching futures simultaneously with its Launchpad projects (such as the ARB futures after the airdrop), but the overall pace has been more conservative. KuCoin and HTX have listed some new coins but haven't provided corresponding futures contracts in a timely manner. Users seeking leverage have been forced to look elsewhere, resulting in capital outflows. Overall, platforms that have achieved a coin-to-futures integration reaped significant benefits in Q3, benefiting both trading volume and user retention; platforms that haven't yet achieved a closed-loop system have missed out on some of their trading potential.

(5) Matching user returns with platform strategies: By comparing different platforms, we also found that the profit prospects that investors can obtain on different exchanges are consistent with the strategic positioning of the platform: on high-risk, high-return platforms (such as the aforementioned LBank, MEXC, etc.), the short-term returns of new coins may be huge but generally unsustainable, which is suitable for players who are good at short-term speculation and quick entry and exit; on stable platforms (Binance, OKX, etc.), although the opportunities for new coins are few, they are relatively stable, which is suitable for investors who prefer lower volatility. Similarly, in contract trading, aggressive platforms provide more small-coin contracts and higher leverage, which means that profits may double or even tenfold, and losses may return to the pre-liberation era overnight; stable platforms mainly promote mainstream currency contracts, and the market volatility is relatively controllable. This risk-return matching reflects that the ecology of each exchange has formed a certain "temperament": users will make choices based on their own risk preferences, and over time, this choice will strengthen the platform's strategic direction. For example, people who are willing to bet on the new coins to get rich quickly flock to LBank/Gate, and in turn, these platforms are more willing to list various new coins, thus forming a cycle. For investors, when trading new coins or contracts, they should also fully consider the platform attributes and regard it as part of their investment portfolio: make quick money on one platform and make a stable allocation on another platform to achieve a balance between returns and risks.

Extension: The trend of ecological linkage of exchanges building their own chains

Beyond discussing new coins and futures contracts, we also need to consider a broader trend: exchanges building their own public chains or layer-two ecosystems, and the potential for synergy between these and new coin and futures contracts. Currently, many leading exchanges are developing their own blockchains, such as Binance's BNB Chain, Bybit's Mantle Network, and Coinbase's Base Network (also an Ethereum layer-two). Furthermore, while not developed by exchanges, emerging layer-two platforms like ZKSync are also worth considering due to their partnerships with multiple exchanges (e.g., Bitget Wallet integrates the ZKSync ecosystem). By comparing these strategies, we can explore how the future closed loop of "new coin-contract-on-chain ecosystem" will emerge.

Overview of current exchange chain strategies:

- Binance: Early on, it launched the independent public chain BNB Chain (formerly BSC), which flourished its ecosystem. In 2023, it launched opBNB as an Ethereum-compatible second-layer, hoping to improve performance and attract developers. Binance's strategy is to build its own on-chain empire, particularly in this market wave. It leverages the Binance Alpha points system to attract retail investors and, at the same time, encourage projects to list their tokens. This creates a unique, win-win model: retail investors provide data, Binance Alpha acts as a bridge, and projects receive unlimited funding. Furthermore, it leverages stronger capital and the DAT model to reshape new capital, thereby driving BNB's value and on-chain trading volume. This closed loop will then be achieved by listing corresponding project tokens on centralized exchanges.

- Bybit/Mantle: Bybit leverages Mantle as an extension of its ecosystem: on one hand, it allows Bybit users to participate in Mantle-based projects (e.g., offering Mantle ecosystem project launchpads, staking, and airdrop rewards); on the other hand, it quickly lists outstanding new project tokens on Mantle on Bybit's spot and futures platforms. This allows Bybit users to enjoy on-chain benefits (such as early mining airdrops) while conveniently trading and cashing out on the exchange, creating a synergy between on- and off-exchange trading. The more Mantle prospers, the more Bybit benefits.

- OKX: OKX has gained maximum market exposure by relying on a combination of strong market manipulation and X Layer promotion. Currently, both of its two token assets have achieved impressive market performance and have also made a comeback. However, the continued popularity remains to be seen, and everything will be left to time.

- Coinbase/Base: Coinbase has attracted a large number of users to its wallet and services through Base. Although Base has not yet launched a token, the prosperity of projects on the chain will eventually flow back to the Coinbase exchange. Coinbase has already tasted the sweetness of Base, and other exchanges are naturally following suit. The Base chain may launch a token in the near future, further igniting the network.

Future linkage closed loop outlook

The synergy between new coins, contracts, and the on-chain ecosystem can be imagined as follows: An exchange incubates a new project A on its own chain. Project A issues a token to attract the community on-chain, with the price discovered through the on-chain DEX. The exchange notices Project A's popularity, lists its token on a centralized platform, and launches contract trading for Project A. The centralized exchange provides Project A with significant liquidity and higher prices, attracting more people to participate in Project A's ecosystem applications (such as yield farming). Project A's ecosystem flourishes, on-chain transaction fees rise, and the value of the chain's native token (such as BNB or MNT) increases, further benefiting the exchange's finances. Furthermore, exchanges may offer special treatment to projects launched on their chains, such as direct listing channels, additional trading pairs, and increased margin requirements for contracts, to encourage them to choose their chain. This creates a situation where the strong become stronger: projects within the exchange's ecosystem are more likely to succeed, and this success feeds back into the ecosystem. Other projects, seeing this demonstration effect, are also willing to join the chain's ecosystem.

For users, this interconnected closed loop means more opportunities and greater convenience. In the past, to pursue a new project, users had to participate in IDOs/airdrops, then trade on a decentralized exchange (DEX), and finally wait for the centralized exchange to launch—a tedious process. In the future, if exchanges integrate on-chain and off-chain, users can participate in early-stage on-chain projects directly on the exchange platform (for example, by directly integrating the launchpad with the on-chain issuance). Once the project tokens arrive, they can trade them within the exchange. When they want to use on-chain applications, the exchange provides a cross-chain bridge. This one-stop experience will significantly lower the barrier to entry and attract mainstream capital to the previously complex world of on-chain.

Of course, achieving this closed loop presents challenges: project quality control, regulatory risks, and technical stability. If exchanges, in the interest of ecosystem prosperity, relax their vetting of on-chain projects, fraudulent projects could emerge to defraud users, in turn damaging the exchange's reputation. If a large number of tokens on a self-built chain are traded on the exchange, regulators may raise concerns about price manipulation and profiteering, leading to increased scrutiny. Furthermore, both on-chain protocol security and exchange system security require dual safeguards; otherwise, a failure in one link could ripple through the entire system (e.g., a chain hack could lead to a sharp drop in the exchange's token price). Therefore, exchanges must strike a balance between openness and security.

Judging from current progress, Binance and Coinbase have taken a solid step toward this closed-loop approach. Binance, through the Binance Alpha + USD 1 combination, has successfully achieved significant growth across multiple assets, with the underlying message of "contracts first, spot trading later" becoming a market trend. It is foreseeable that blockchain integration will no longer be just a marketing gimmick but an integral part of the CEX business. "New coin, contract, on-chain" will truly merge: exchanges will serve as trading venues, blockchain network operators, and investors in new projects. This could usher in a more closed-loop cryptoeconomic system.

The crypto trading industry in 2025 is undergoing profound changes on multiple fronts. New coin launches are booming, competition in derivatives is fierce, and exchanges are increasingly cross-bordering into blockchain. Against this backdrop, investors face both greater opportunities and challenges. This article, through an in-depth analysis of new coin and contract data from the top ten exchanges, hopes to help readers understand the strengths and weaknesses of different platforms. Before chasing the next 100x coin or opening the next highly leveraged contract, choosing an exchange that suits your strategy and risk profile is undoubtedly the foundation for success. At the same time, we should also recognize the accelerating convergence of centralized exchanges and on-chain ecosystems. Future investment opportunities will no longer be limited to isolated platforms, but rather reside in the synergies between on-chain and off-chain. Once formed, the closed loop of "new coin, contract, and on-chain ecosystem" will foster new growth drivers and wealth creation, redefining the rules of the game in the crypto market. Let us wait and see how this trend evolves, constantly learning and adapting in practice, and seizing the opportunities presented by this era.