Tether’s next chapter: From offshore issuance to global compliance infrastructure ambition

- 核心观点:USDT主导地位面临竞争与监管挑战。

- 关键要素:

- USDT市场份额从80%降至约60%。

- 波场主导高频支付,以太坊拓展零售应用。

- 推出USDT 0和Plasma扩展多链分发。

- 市场影响:推动稳定币向合规与多链化发展。

- 时效性标注:中期影响

Originally Posted by Tanay Ved

Original translation: AididiaoJP, Foresight News

Key Takeaways:

- Tether remains the global leader in stablecoins, providing access to the US dollar in emerging markets and driving demand for US Treasuries through its reserves.

- USDT’s dominance is declining as new regulations and competitive dynamics reshape the stablecoin market, creating differentiation in compliance and revenue distribution.

- The roles of Ethereum and Tron in USDT activity are evolving, with Tron maintaining its lead in high-frequency, low-cost payments, while Ethereum's declining fees and increased liquidity are driving broader retail and settlement applications.

- Emerging corridors present new growth opportunities, and USDT 0 and stablecoin-focused networks like Plasma are expanding Tether’s distribution to more networks and use cases like payments.

introduction

Tether's USDT is the undisputed leader in global stablecoins today, commanding approximately 60% of the roughly $300 billion market. Once primarily a trading tool, USDT's significance has expanded beyond the cryptocurrency market, becoming a key channel for emerging economies to access US dollars and holding growing geopolitical importance within the US market. Meanwhile, Tether has become one of the most profitable companies in the industry, generating billions of dollars in quarterly profits and in the midst of a $20 billion capital raise that could make it one of the most valuable private companies in the world.

However, as regulation and growing competition reshape the stablecoin landscape, Tether's next chapter hinges on its ability to maintain its network effects and extend its long-term dominance. Building on our recent observations of the post-GENIUS Act stablecoin landscape, we examine Tether's market position as it balances its dominant present with an increasingly competitive future. We explore how USDT's market share has evolved, how its activity varies across blockchains, and how emerging corridors will shape its role in the next phase of stablecoin growth.

Tether’s Market Position and Importance

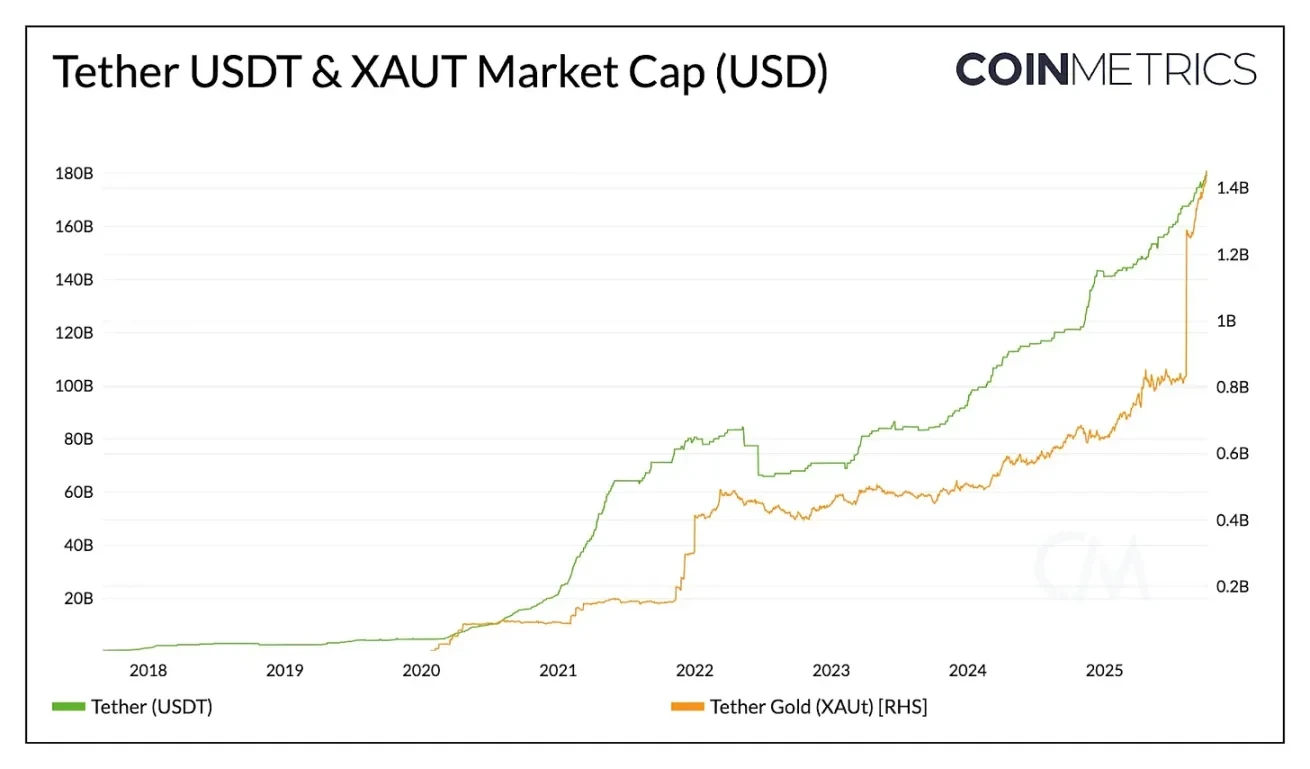

With $178 billion in circulation, Tether's USDT is the largest stablecoin by a significant margin (approximately 2.4 times larger than Circle's USDC and approximately 3.6 times larger than all other stablecoins combined). Its size and liquidity make it a valuable tool for protecting savings, providing economic stability, and facilitating transactions, particularly in regions with limited banking infrastructure or in countries where local currency inflation exceeds 5%.

Source: Coin Metrics Network Data Pro

In addition to the US dollar, Tether also offers tokenized gold exposure through XAUt, whose market capitalization has grown to over $1.4 billion as demand for alternative stores of value rises. Tether appears to be expanding this dual strategy, seeking a $200 million funding round with Antalpha Platform to establish a digital asset treasury that will acquire Tether's XAUt tokens. With further investments in Bitcoin and gold mining, Tether is moving towards integrating different forms of value storage.

Market share and growth pressure

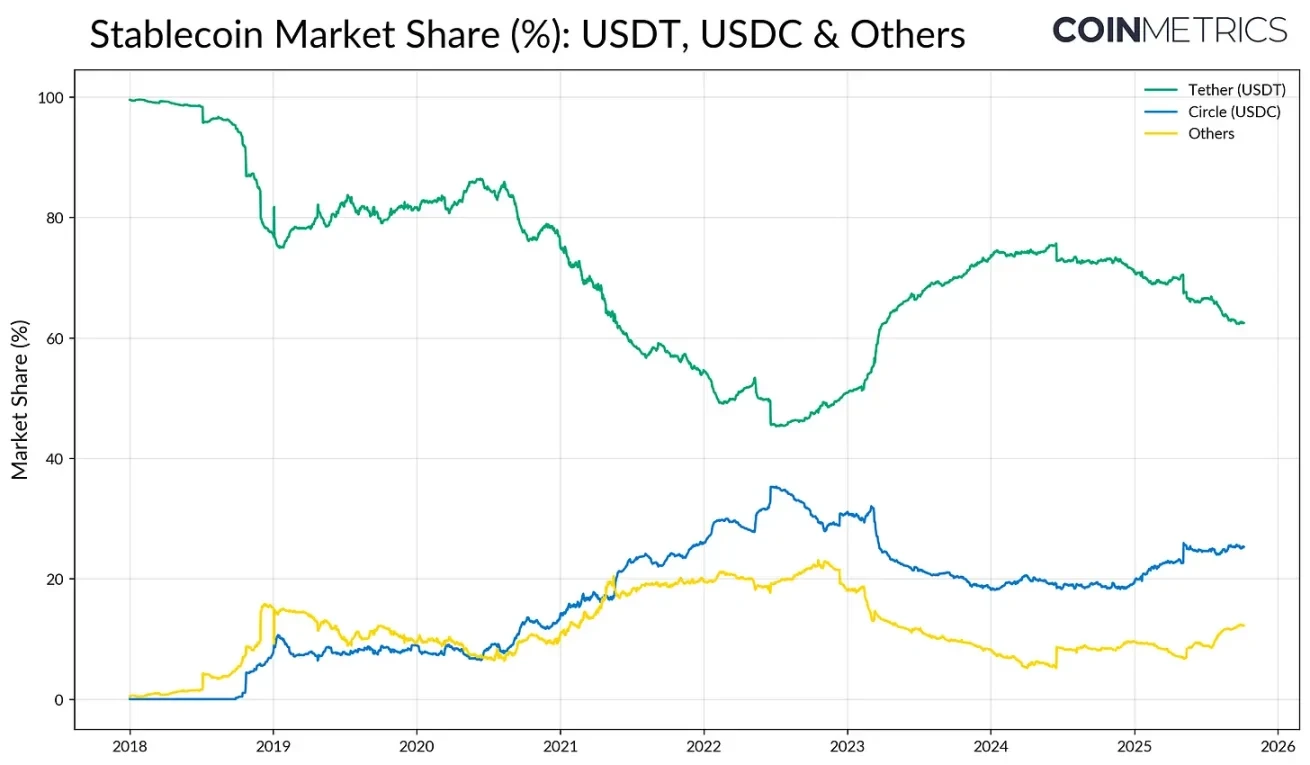

USDT's first-mover advantage and deep liquidity on exchanges have endowed it with a powerful "network effect." In the early stages of the industry, USDT's market share exceeded 80%. The rise of USDC and BUSD subsequently reduced its dominance to closer to 50%. The collapse of Silicon Valley Bank (SVB) in 2023 quickly reversed this trend, with capital fleeing competing issuers. However, since 2024, and with the impending passage of the GENIUS Act in 2025, USDT's share has shown signs of pressure again.

Source: Coin Metrics Network Data Pro

Circle's USDC is gradually regaining its footing, driven by regulatory momentum onshore, while "other" stablecoins, primarily interest-bearing alternatives such as Ethena's USDe, Sky's USDS, and tokenized money market funds, are gaining market share. The market currently appears to be in a transitional period, with USDT continuing to lead in liquidity and adoption, but facing increasing competition from existing payment networks and yield-distributing alternatives entering the market.

The road to profitability and compliance

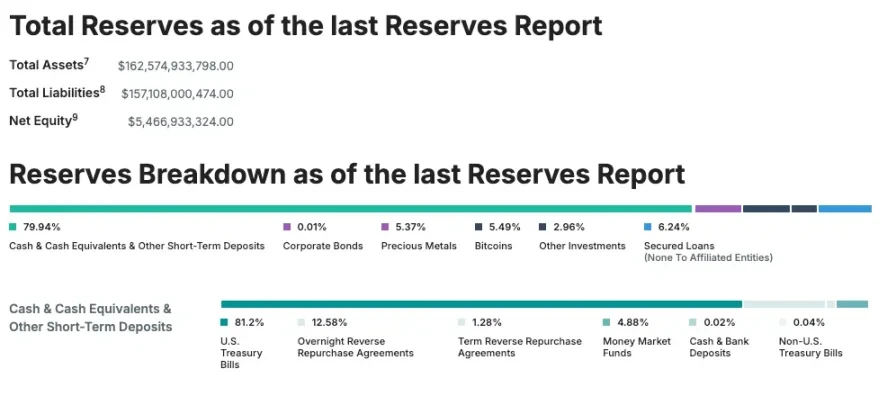

Despite increasing competition, Tether remains the most profitable stablecoin issuer, generating $4.9 billion in net profits in the second quarter of 2025. This is driven by its $127 billion in U.S. Treasury reserves, making it one of the world's largest holders of U.S. government debt. However, Tether has historically been an offshore issuer based in El Salvador, with some of its reserves consisting of non-compliant assets such as precious metals, Bitcoin, and secured loans. To address this issue, Tether plans to launch USAT, a fully compliant stablecoin established in the United States, to strengthen its domestic growth strategy and its role in addressing U.S. debt demand.

Source: Tether Transparency (Assurance Report as of June 30)

How USDT flows between different blockchains

Having established Tether's market position as the issuer, it's crucial to understand how USDT flows across blockchains and the channels that support its transfer and settlement. The circulation of USDT is shaped by the capabilities of each network, influencing the types of activity and user groups that dominate on each chain. USDT usage reflects this diverse range of activity, with the vast majority of issuance concentrated on Ethereum and Tron.

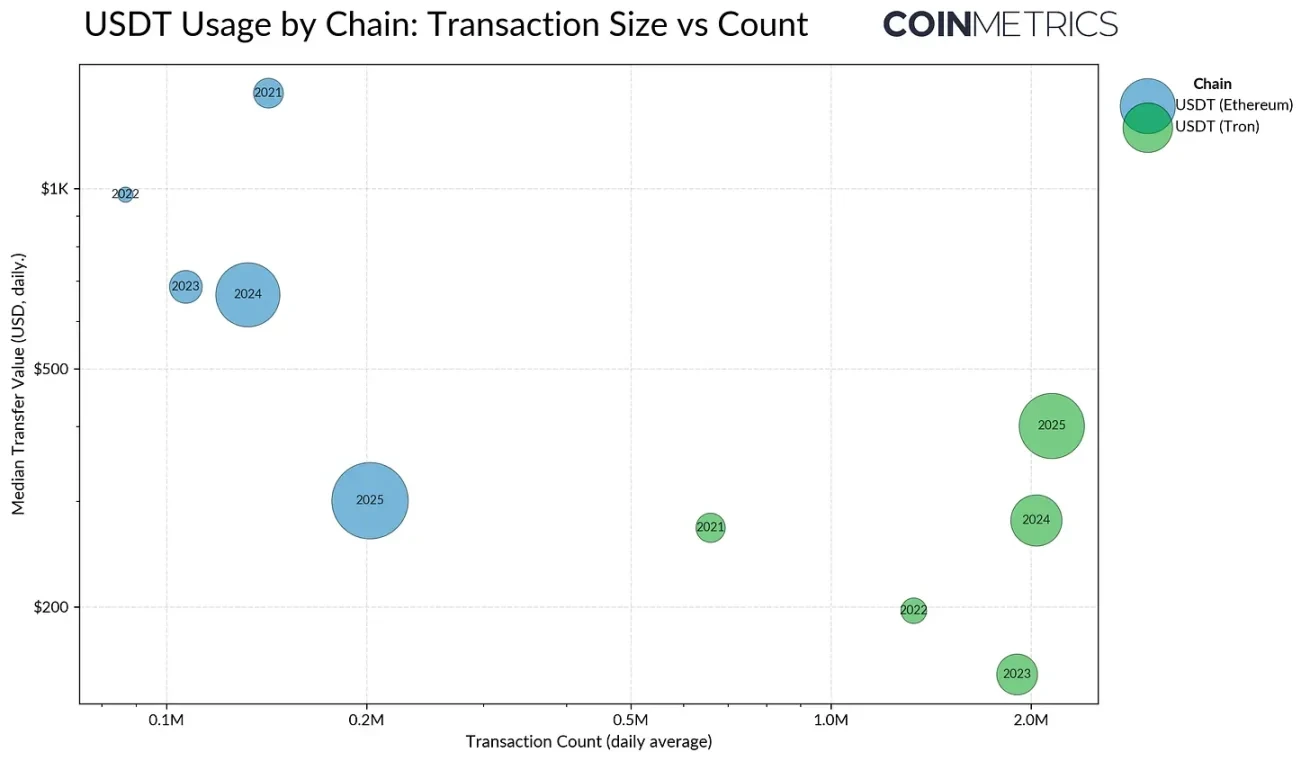

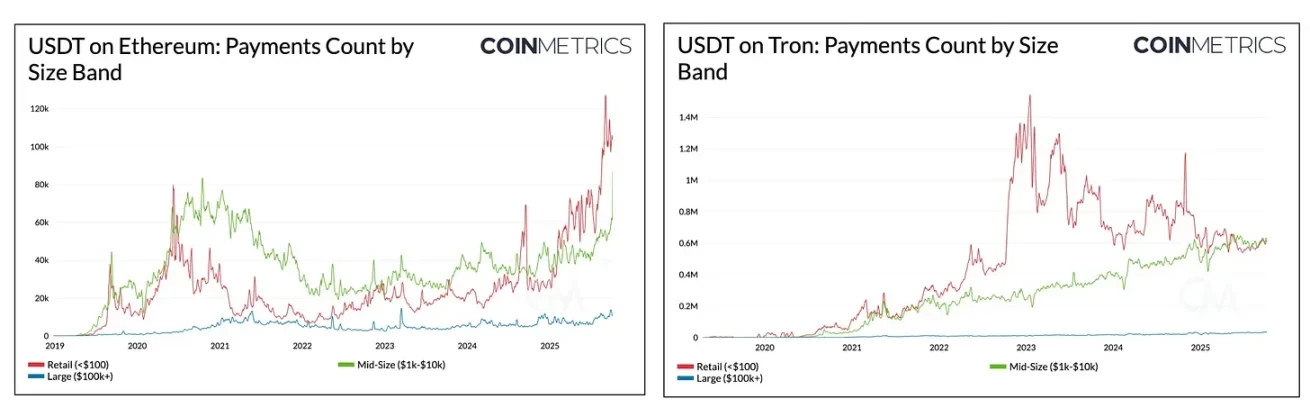

Tron has historically served as a primary access point for users in emerging markets, favored for its low fees and fast settlement times. With an average daily transaction volume exceeding 2.3 million in 2025, Tron appears to be a highly sticky network for USDT transfers, supporting a sustained, high-speed flow of small-value, payment-like activity. This model aligns with its use in retail and remittance payments, where cost-effectiveness and accessibility are paramount.

Source: Coin Metrics Network Data Pro

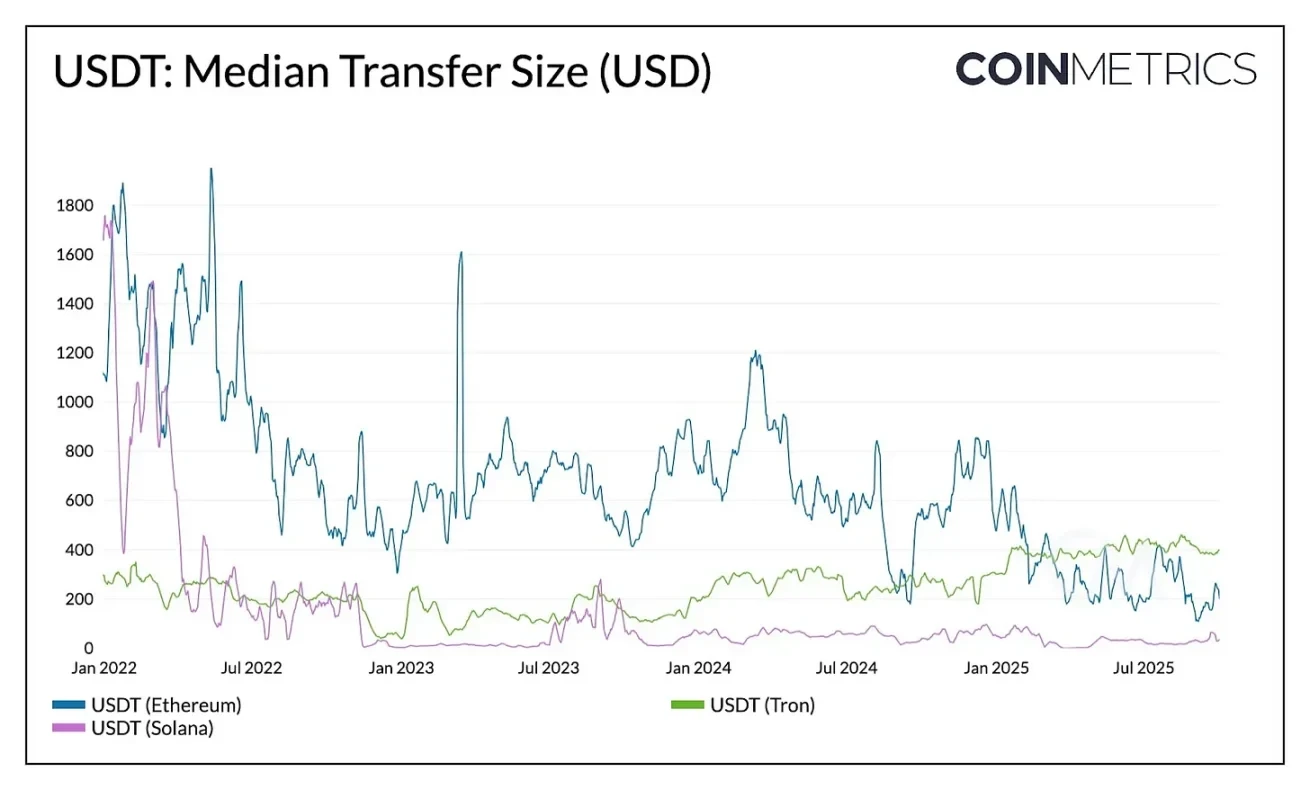

In contrast, Ethereum has traditionally carried greater value, lower-frequency transfers, reflecting its role as a settlement and liquidity hub for DeFi and institutional activity. However, this dynamic is changing.

Following the Dencun and Pectra upgrades, Ethereum's average transaction fee has fallen below $1, enabling a greater frequency of small transfers. The median transaction amount on Ethereum has fallen from over $1,000 in 2023 to approximately $240 in mid-2025, while the median amount on Tron has increased. This dynamic has brought Ethereum closer to the type of activity once exclusive to Tron.

Source: Coin Metrics Network Data Pro

This behavioral shift also coincided with a redistribution of supply. In August 2025, the USDT supply on Ethereum ($96 billion) surpassed the supply on Tron ($78 billion), demonstrating that lower fees and deeper liquidity were attracting activity back to Ethereum.

Source: Coin Metrics Network Data Pro (USDT on Ethereum, USDT on Tron)

This trend is also evident in the composition of USDT payments across blockchains. On Tron, as medium-sized flows gain momentum, the gap between retail payments and medium-sized transfers has narrowed. On Ethereum, since 2024, the number of retail (<$100) and medium-sized (1,000-10,000) payments has grown dramatically, while large-value transfers ($100,000-1,000,000) have remained stable. This suggests that USDT usage is diversifying towards smaller-scale activities as the network becomes more accessible.

Expanding USDT’s dominance through emerging channels

USDT’s evolution on chains like Tron and Ethereum highlights how settlement speed, cost, and liquidity shape user behavior. Looking ahead, Tether is strategically expanding its reach through new distribution channels and settlement layers.

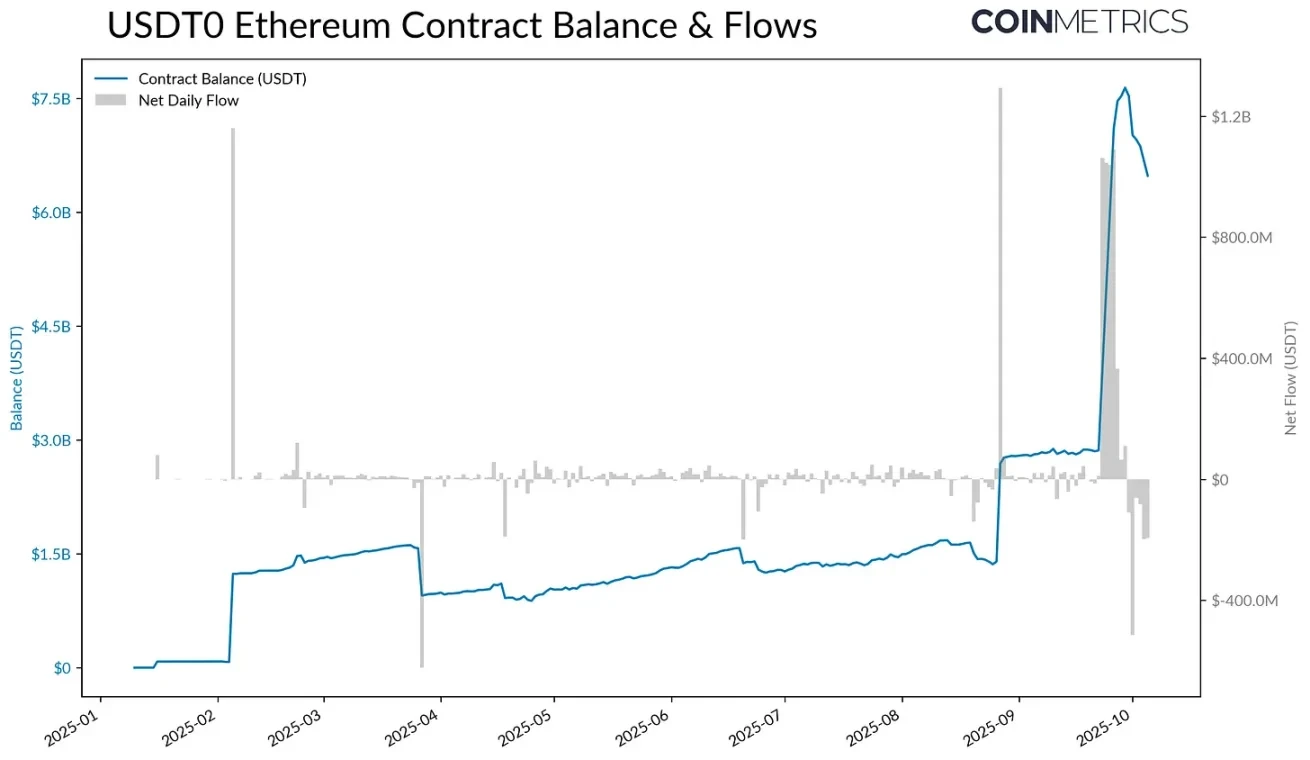

For example, USDT 0, launched based on LayerZero's fully homogenous token (OFT) standard, achieves seamless cross-chain transfers and maintains 1:1 endorsement by locking USDT on Ethereum and minting an equal amount of tokens on the target chain.

Source: Coin Metrics ATLAS

Following the September 25th launch of Plasma, a Layer-1 blockchain optimized for stablecoins, the USDT supply locked in the USDT 0 Ethereum contract surged from $2.8 billion to $7.7 billion. With zero-fee USDT transfers, stablecoin-as-gas, and a high-throughput design, Plasma quickly attracted over $6 billion in USDT 0 supply, which currently stands at approximately $4.2 billion.

While its long-term sustainability will depend on adoption for payments and savings use cases, Plasma represents a new class of complementary channels for USDT, similar to how Tron and Ethereum serve different activities today. Together, USDT 0 and Plasma illustrate how Tether can expand its distribution to a broader set of networks that can support a variety of needs, from high-value settlements to payments, DeFi, and retail activities.

in conclusion

As stablecoins become global payment infrastructure, Tether's next chapter will unfold against a backdrop of intensifying competition and growing regulatory clarity. Its ability to maintain its dominant position will depend on its ability to evolve from an offshore issuer to a multi-chain, compliant infrastructure provider without diminishing its core strengths in liquidity and distribution. The emergence of full-chain USDT and dedicated stablecoin networks like Plasma portends a more diversified future for settlement and payments. Whether Tether expands its network effect or loses ground to competitors will ultimately define the next phase of the industry's evolution.