In-depth analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX (3)

- 核心观点:Lighter公测上线,积分机制驱动增长。

- 关键要素:

- 主网上线,TGE预计Q4进行。

- 积分机制防女巫,促裂变增长。

- 零手续费交易,LLP收益依赖对手损益。

- 市场影响:增强Perp DEX赛道竞争格局。

- 时效性标注:短期影响

Lighter - Don't trust—verify

This generation of Perp DEX is fundamentally different from the "GMX, DYDX" generation of Perp DEX. Since it is still Perp DEX, the title will still use Perp DEX to discuss it.

Lighter is a Perp dex invested by a16z , a well-known American venture capital firm. It is based on Ethereum's ZK Rollup and also uses the order book (CLOB) model.

In an AMA at the end of August, the team outlined some of Lighter's future plans. For example, they will be launching RWA derivatives and pre-launch perps (the development volume for these two products is lower than the spot market, and they are planned to launch nearly simultaneously). Points Season 1 (private beta) is coming to an end, and the points distribution rules during this phase have been intentionally kept private to prevent cheating. More specific guidance will be provided in Season 2 (after the public beta). Furthermore, as we enter the next phase, we will periodically disclose some notable investors and their contributions. Most importantly, the TGE remains on track, with an expected launch date of Q4 this year.

Today (October 3, 2025), after eight months of private beta, the Lighter public mainnet officially launched. However, we haven't seen the release of RWA perps, pre-launch perps, or Spot, leading us to wonder if the TGE will be delayed. My guess is that Spot and TGE will launch simultaneously, with RWA perps and pre-launch perps launching during the public beta.

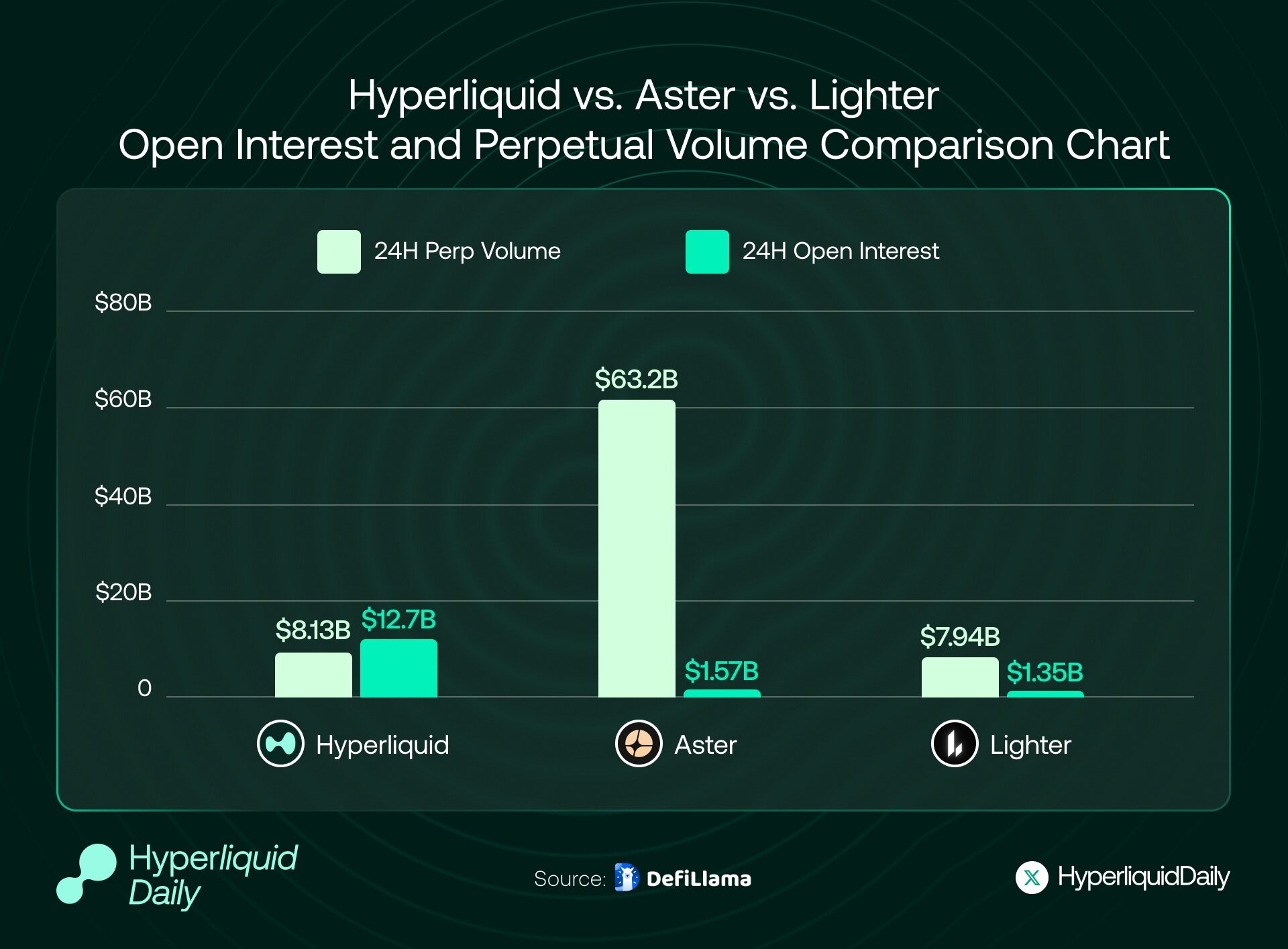

The above chart shows 24-hour Perp dex data from October 1, 2025. Hyperliquid, Aster, and Lighter occupy the top three positions in terms of trading volume and OI. The Volume/OI ratio shows that Hyperliquid's is less than 1 (a significant number of users holding positions overnight indicates a healthier market), indicating a high proportion of real trading volume and users. Lighter's is around 6, which is in the middle of the pack. Aster's is around 40, the highest, indicating significant volume manipulation and a surge in the new season.

The first two TGEs were very successful, and it remains to be seen whether Lighter will be the next " epic big hair " after Hyperliquid and Aster, but community expectations are very high.

Lighter user growth flywheel and points incentive mechanism design

Lighter's growth logic revolves around the two core elements of " invitation to start cooling + points-driven fission ".

During its cold start phase (lasting eight months), Lighter employed a closed beta test strategy, allowing only users with invitation codes to register. (Open beta launched today, and users with more than 50 weekly points will receive three invitation codes .) Invitation codes were difficult to obtain, requiring existing users to accumulate a certain amount of trading volume or points to unlock a limited number of invitation codes. For each new user successfully invited, the inviter received an additional 10% of the invitee's points. This design increased the cost of bulk registration of smurf accounts, effectively curbed Sybil attacks, and created a market hunger through the scarcity of invitation codes. Over-the-counter trading of invitation codes and points even occurred within the community, further exacerbating users' fear of disappearance. A fixed weekly distribution of 250,000 points was allocated, with a limited number and no inflation.

The organic combination of cold start, fission, anti-sybil attack and airdrop incentives builds a self-reinforcing growth flywheel: expected airdrop → accumulating points through transactions → unlocking invitation codes → fission propagation → community expansion → increased point value → attracting users again.

Combined with some tips from the official

- Small capital (< $10k) scoring strategy

- Target selection: Choose targets with low OI and low trading volume (official reminder), which makes it easier for the trading volume/position to be " seen " by the points model without increasing slippage.

- Order placement method: Focus on placing small, frequent limit orders to reduce impact costs and avoid "unstrategic order waterfalls."

- Risks: Low liquidity means higher risk of slippage and margin calls - it is best to use leverage ≤5x, reserve a buffer of about 2 times the maintenance margin, strictly set take-profit and stop-loss, and strictly control liquidation (the 1% notional principal liquidation fee is very "painful").

- Sub-accounts: Used to isolate strategies/risk control (not to replicate multiple accounts). Official instructions state that sub-accounts are included in statistics, but will be reset to zero after a Sybil check. Do not abuse them with multiple accounts.

- Medium/large funds (≥ $10k–$1m) and semi-automatic/quantitative

- API transactions: Generate a key, claim an API role in Discord, and execute using low-impact methods such as TWAP/VWAP;

- Control the order-to-fill ratio and order cancellation rate (for example, a cancellation rate of ≤70% is used as an internal red line) to avoid being misused by the system as wash trading/HFT.

- Fees and Identity: For accounts with a market-making/HFT trading style, calculate the marginal return based on a 0.02%/0.002% cost. For accounts with a mid-term/trend-oriented trading style, try to maintain retail-level (0% commission) characteristics (low frequency, low order cancellations, high transaction percentage, and long holding periods).

- Hedging and Risk: Directional hedging/basis trading can be conducted on other exchanges to achieve "normal trading" rather than self-dealing; any cross-trading/same-account counterparty behavior may be considered wash trading.

- User Public Pools Points and Capital Efficiency

- Passive Participants: DeFi farmers looking to contribute and earn points (the latest policy requires 50 points before receiving a 25% share) should prioritize user-created pools (as LLP pools operated by the protocol do not count towards points). Screening criteria include historical drawdown, net asset value curve, maximum holdings, win rate over the past 30 days, and average holding period.

- Active traders: Building your own user pool can expand both the scale of funds and the source of points. However, you must invest your own funds, disclose your strategy rules and risk control lines, and establish credibility; avoid taking excessive risks just to "rush for points."

Based on my own experience of brushing for a few weeks, I have summarized some speculations about real trading points (anti-brush volume). Here are three points (not necessarily correct, welcome to discuss):

1. Formula: f = ( actual transaction volume × maker quality × OI-hours × price influence negative reward ). If any one of these is 0, all are 0.

2. Multiplier: Market making within key depth zones (e.g., within 1 bp) is weighted; the longer the net position is held, the higher the weight (to encourage genuine risk-taking).

3. Eliminate: short-term arbitrage with the same account/IP/device, extremely high cancellation ratio, and “self-trading” loops with net OI ≈ 0

Try to avoid two extremes: high volume multiplied by OI-hours, opening and closing positions in seconds, and low volume multiplied by high OI-hours, hedging positions. The final product is not very large (just a guess).

Public funding pool

The public funding pool includes the protocol public funding pool and the user agreement public funding pool. There is nothing special about it and it is similar to Hyperliqyid.

Regarding LLP, Lighter implements a zero-fee policy for regular traders (both Maker and Taker fees are 0), aiming to profit from high-frequency traders. As of today's public beta, regular user transactions remain completely free, with only funding fees being charged for settlement between long and short positions.

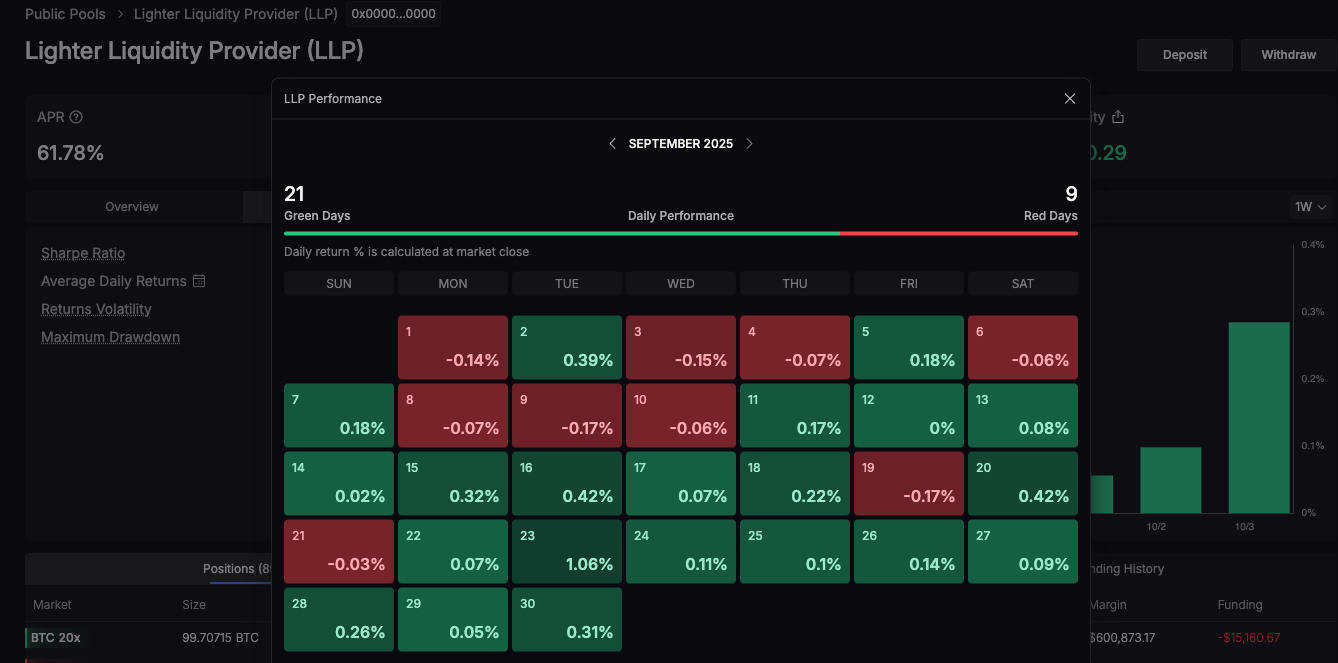

In this model, LLP's revenue primarily comes from market-making profits and losses and liquidation proceeds: when the LP pool acts as the counterparty, if the majority of traders suffer losses, the corresponding profits and losses go to the LLP. The LLP APR is currently around 60% (for example, in September, there were 21 days with positive returns and 9 days with negative returns).

At the same time, LLPs may charge fees or retain margin during liquidation. Lighter's liquidation mechanism stipulates that some forced liquidations will be matched at a "zero price." If a transaction is executed at a better price, a liquidation fee of up to 1% will be charged to the LLP. Therefore, whenever forced liquidation or liquidation occurs, the LLP acts as an insurance fund, generating income from liquidation fees. Furthermore, as a counterparty, the LLP also earns funding fees (funding fees paid by the counterparty flow to the LP) and spread profit. Due to the zero transaction fees in the early stages, the Lighter platform has limited stable revenue sources, and LLP profits are largely dependent on market fluctuations and traders' profits and losses. Overall, Lighter LLP currently generates income for LPs through counterparty profits and losses, funding fees, and liquidation fees, and will introduce a partial fee sharing mechanism in the future.

In addition, after the public beta started today, the threshold of the public fund pool LLP was raised from "0 points can also save 25%" to "must get 50 points before saving 25% ", which maintained a high APR to a certain extent and protected the interests of early users from being diluted by the impact.

The user public fund pool is similar to Hyperliquid's, similar to a secondary fund and copy trading system, with fund managers and lead traders receiving a 20-30% commission. The difference is that participating in the user public fund pool earns points, while LLP does not. However, the risks are also higher than LLP, so caution is advised.

Since Lighter hasn't yet launched its token, user retention currently relies primarily on points incentives and community engagement. "Zero-fee transactions" remains one of Lighter's biggest selling points. As someone who is optimistic about Lighter and intends to hold Lighter tokens long-term, I offer some advice for Lighter users in the post-TGE era. First, consider Aster's approach. They launched a second airdrop immediately after the initial airdrop to build momentum, successfully retaining some users into the second phase. Lighter could also consider reserving a portion of tokens after the token launch to reward users who consistently trade (for example, based on monthly or quarterly trading volume or active days) to smooth out the post-airdrop lull in activity. Second, at the same time as the TGE, introduce VIP-style tiers and fee discounts. Taking a cue from Hyperliquid (which launched a bit late), establish user tiers based on token holdings or trading volume. For example, those who hold a certain number of platform tokens or reach a certain trading volume threshold in the past 30 days can upgrade to a VIP tier, enjoying fee discounts, priority customer service, and beta testing privileges. On the one hand, this encourages users to hold coins ( not sell tokens ), and on the other hand, it prompts high-end users to continue trading in order to maintain discounts, forming a retention closed loop.

Overall, Lighter's technical integration of ZK ensures fairness, its product offers affordable zero transaction fees, and its points system is poised for growth. It will undoubtedly secure a spot in the PerpDex market. Furthermore, as announced in the AMA at the end of August, Lighter will periodically disclose some prominent investors in the next phase. Today marks the official launch of its public beta, and the official Twitter account has received endorsements from several Ethereum ecosystem founders, including EigenLayer. Furthermore, news indicates that Founders Fund and Arthur Hayes have participated in the investment.

Finally, let’s talk about Lighter and the “endgame of Ethereum”

Unlike HyperLiquid, which built its own L1 and full suite of protocols, Lighter will be natively composable with Ethereum's L2. For example, Lighter will tokenize LLP on the mainnet and collaborate with protocols like Aave, offering a low-cost, low-latency, and verifiable execution environment. This ecosystem will follow an "Ethereum composable" path, enabling faster integration into mainstream DeFi rather than a closed-loop, self-built ecosystem.

Lighter = the "verifiable exchange" on Ethereum's endgame. It integrates two of the most sensitive aspects of an exchange—price-time matching and liquidation—into ZK proofs, while handing over asset custody, state, and data availability to Ethereum. With the gradual implementation of 4844→Danksharding, (e)PBS, and (potential) native Rollups, Lighter's advantages in cost, censorship resistance, and trust minimization will increasingly resemble "protocol-level features." This is its structural, synergistic relationship with Ethereum's endgame.

If Binance is behind Aster, then Ethereum is behind Lighter.

For details about edgeX, please refer to the next article: "In-depth Analysis of Perp dex: Hyperliquid, Aster, Lighter, edgeX (4)"

(The above is just my personal opinion, not investment advice. Please point out any errors.)