Original article by Alex Liu, Foresight News

DeFi actuaries are one step ahead, but DWF Labs is even more powerful?

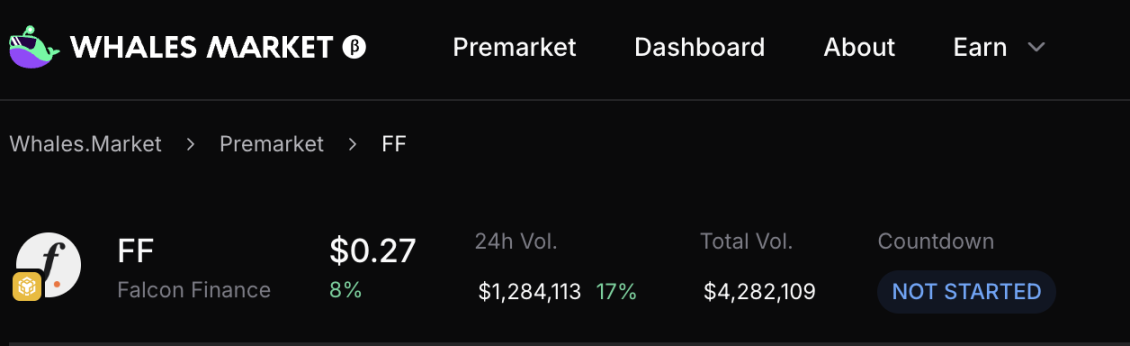

FF price trend after listing on Binance Alpha

On the evening of September 29th, Falcon Finance's FF token officially launched, listing on major exchanges including Binance, OKX, Upbit, Bitget, and Bybit. As a project incubated by market maker DWF, FF's price has exhibited a "high opening, low closing" trend since its launch . Why is this happening?

Opening high

Based on FF's opening price of $0.60 on Binance Alpha, its FDV (Fully Distributed Market Value) is $6 billion. Looking at project fundamentals, Falcon Finance's synthetic USD stablecoin, USDf, has a supply of $1.9 billion, while leading sector project Ethena has a stablecoin supply exceeding 16 billion, and its ENA token has an FDV of $8.4 billion.

In comparison, FF is relatively overvalued. For reference, the pre-market market previously priced FF at around $0.27.

Why did FF open at such a high price?

Where does the selling pressure come from?

The token price opened high and then fell, indicating selling pressure. With such a high opening price, Falcon Finance claims in its token economics that 7% of the token is allocated for a points airdrop. Is it the airdrop recipients' eagerness to sell their tokens that caused the price to drop?

In fact, Falcon Finance didn't allow users to query the number of tokens allocated until the airdrop was open. When claims finally opened after a delay of about an hour, participants discovered that the number of tokens they could claim was less than a quarter of the 7% airdrop percentage . Officials offered no explanation for this.

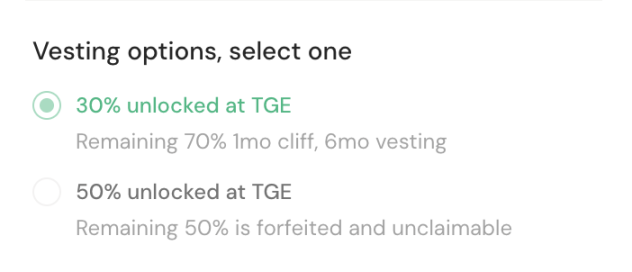

In addition, all participants are required to lock up their tokens . If you choose to claim 50% of your tokens, the remaining 50% will be forfeited. If you choose to claim 30%, the remaining 70% will be locked up for one month and then released linearly over six months. Furthermore, participants with less than 5 million points (equivalent to approximately $100 USD in tokens) are ineligible to claim.

As a result of these factors, Falcon Points participants were able to sell only one-tenth of their expected airdrop tokens. According to on-chain data, the actual number of airdropped tokens claimed for the points portion was less than 40 million, or approximately 0.4% of the total token supply.

461.9 million tokens remain in the contract address with an initial balance of 500 million tokens

The official initial circulating supply of the token is 23.4%. The combined Buidlpad public sale and Binance airdrop account for less than 5% of the token supply, raising questions about the source of the token sell-off .

Reflection on transparency

Because Falcon Finance claimed to airdrop 7% of points in the first quarter, but actually airdropped less than 2%, the transparency issue caused users to lose trust in its second quarter airdrop. Pendle YT, which is used to obtain points through leverage, fell from 15% to 12% in a short period of time (due to the underlying returns, the expected valuation of points dropped significantly), causing users who had arranged Falcon Finance's second quarter in advance to be trapped.

Whether retail or large investors, those participating in stablecoin projects generally seek transparent rules and predictable returns. If Falcon Finance fails to address this, it risks losing a significant number of users and creating a trust rift that will be even more difficult to bridge .

Comparison with ENA

As a control group, Ethena’s points activities are more transparent.

Ethena airdropped 5% of its total token supply in the first quarter and will now airdrop 3.5% in the fourth quarter. Falcon airdropped less than 2% in the first quarter. The top 2,000 Ethena users are required to lock up half of their tokens, while retail users are required to unlock all their tokens. Falcon users are required to lock up their tokens.

Ethena publishes the daily number of newly added points and total points. Due to the transparency of its rules and data, the airdrop returns for each season can be clearly calculated before token issuance. While the Falcon points black box attracted a large number of DeFi players to calculate their gains, the project ultimately failed to adhere to the rules.

From the perspective of peace of mind and fairness, it is recommended that large investors participate in Ethena for stablecoin management.

Disclaimer: The author of this article participated in the FF token application and also participated in the Ethena ecosystem. Some of the content is personal experience.

- 核心观点:FF代币高开低走因透明度不足。

- 关键要素:

- 开盘价0.6美元,FDV达60亿高估。

- 空投比例7%实际不足2%,强制锁仓。

- 透明度差致用户信任流失,积分估值跌。

- 市场影响:削弱用户对项目方信任,影响参与意愿。

- 时效性标注:短期影响