Original author: Max@IOSG

Source: IOSG Ventures

TL;DR

- Retail investing in traditional finance (tradfi) has gone mobile (zero commission + app user experience), and this trend is spreading to the cryptocurrency field - retail users are looking for a fast, familiar, low-friction mobile native trading experience.

- Hyperliquid's technology stack (HyperEVM + CoreWriter + builder code) significantly lowers the development threshold for mobile front-ends, while taking into account the execution efficiency of CEX-like and the advantages of DEX (self-custody, fast coin listing, and fewer geographical/KYC restrictions).

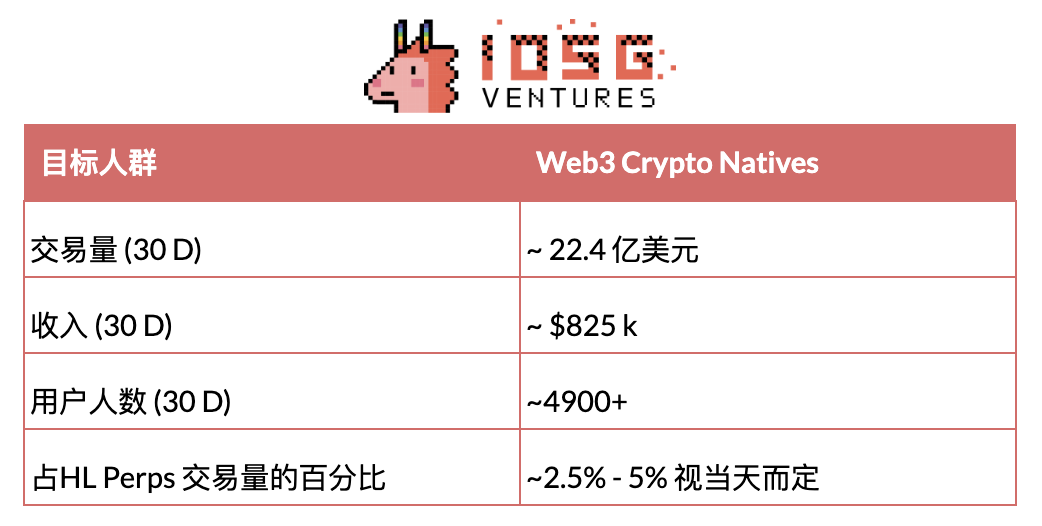

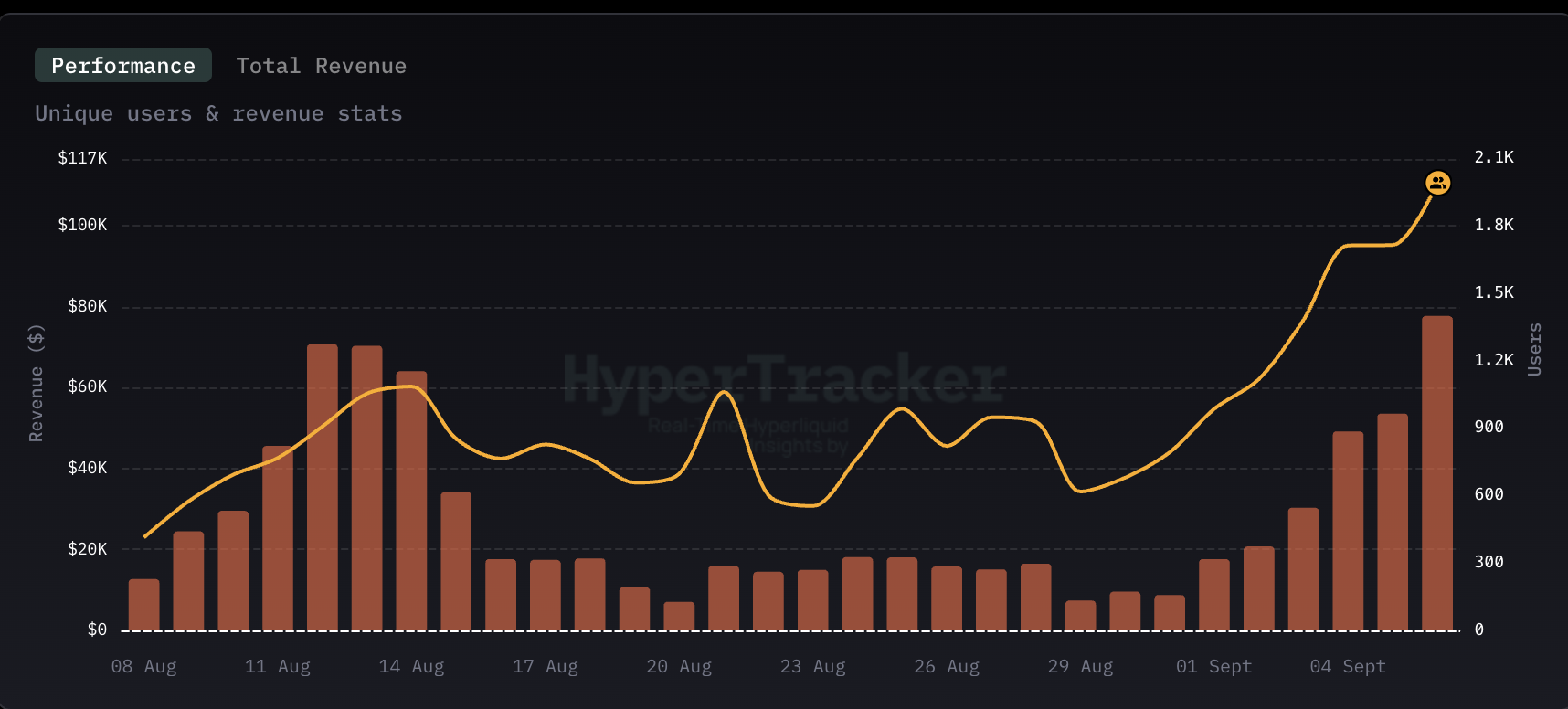

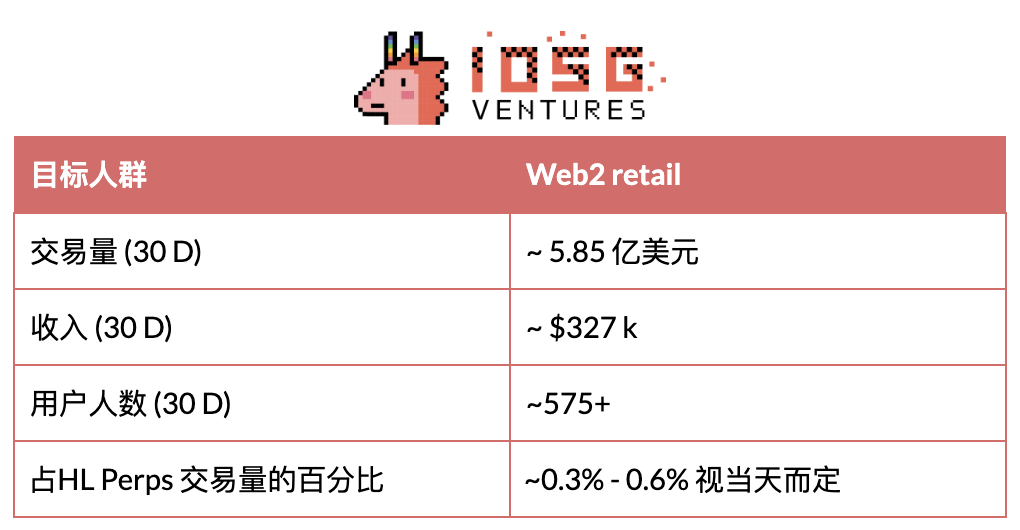

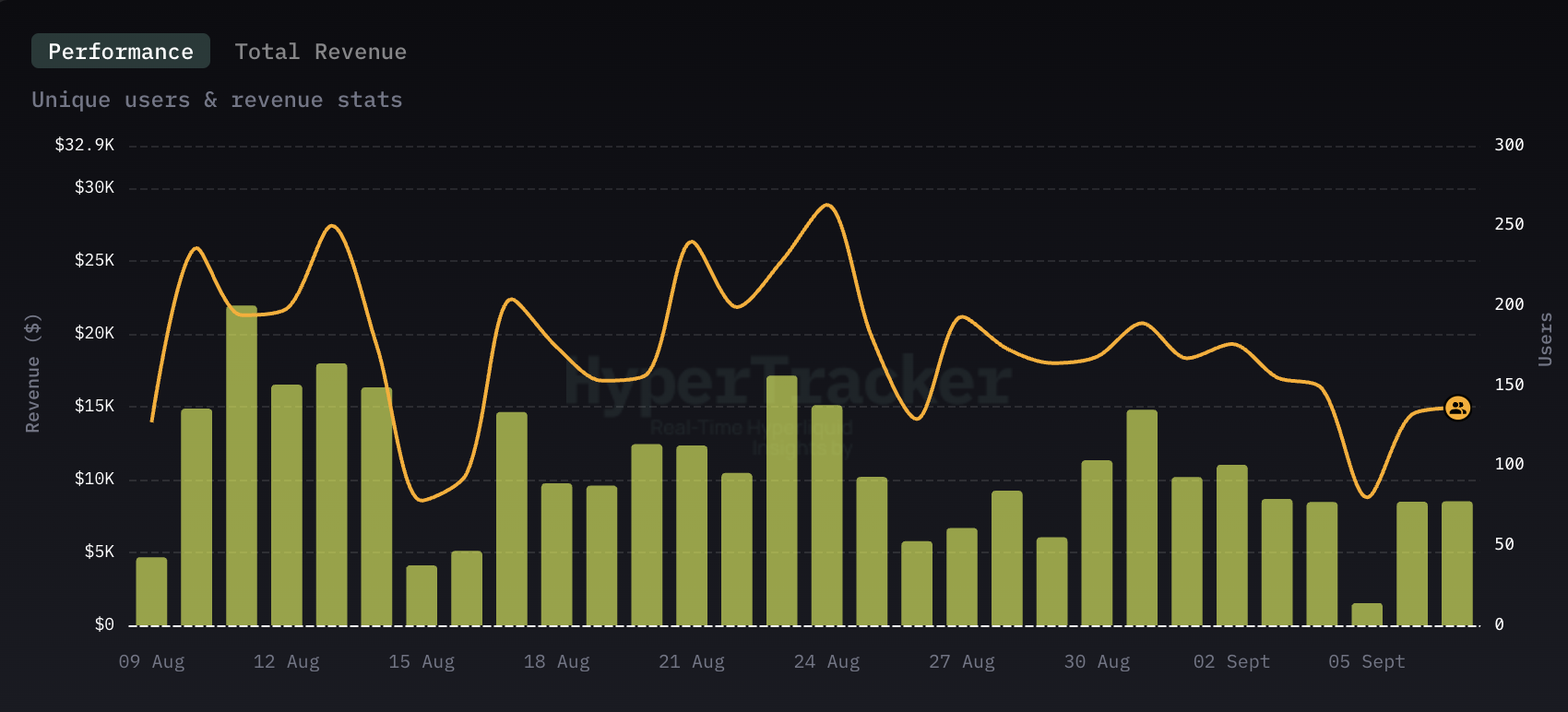

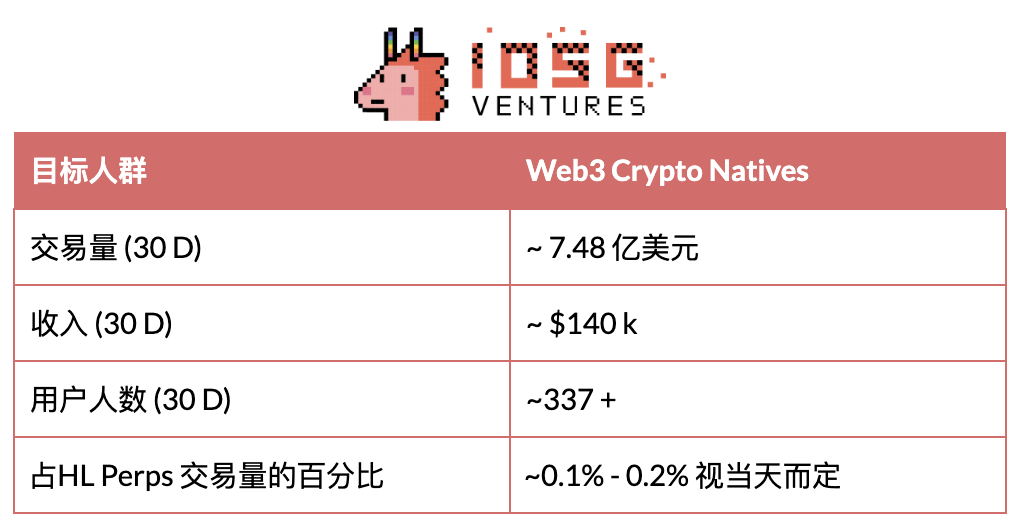

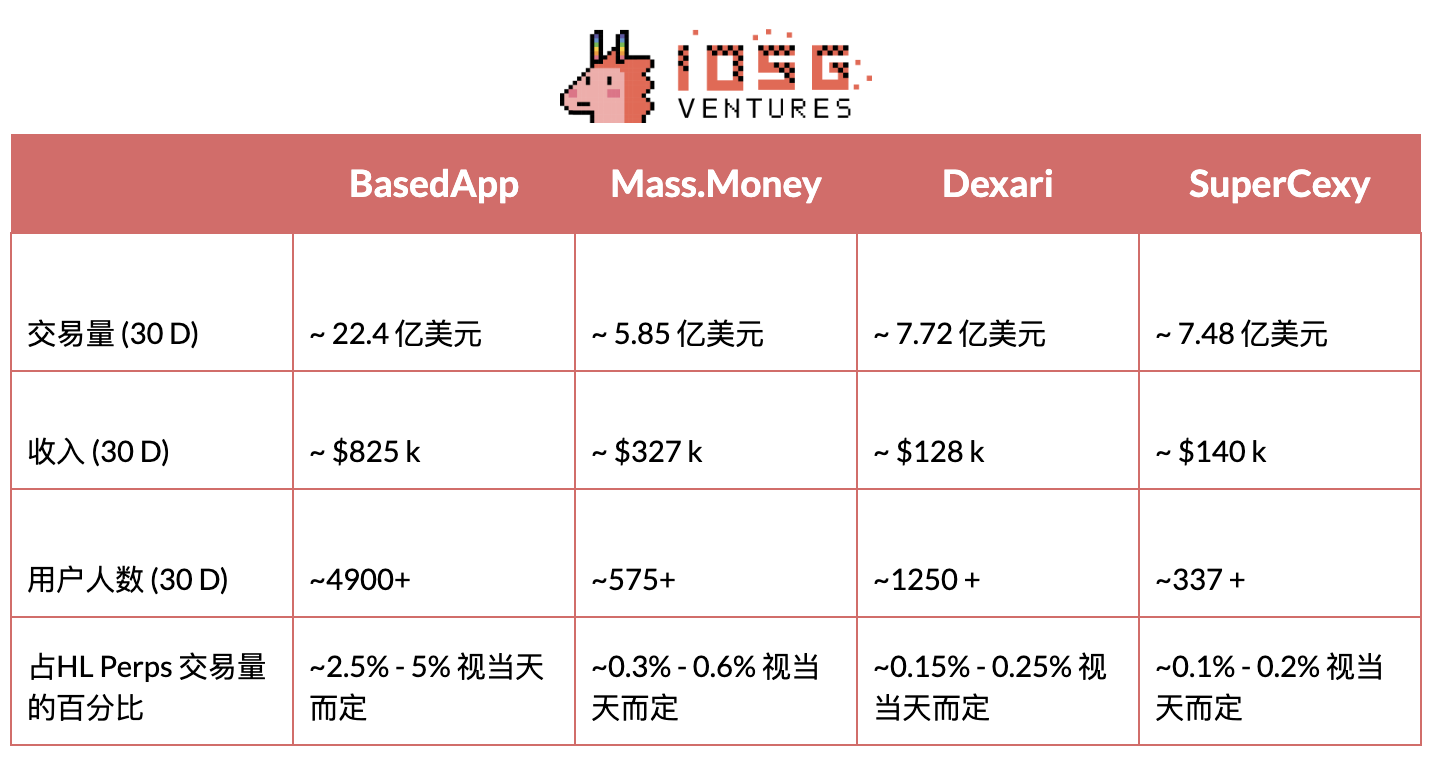

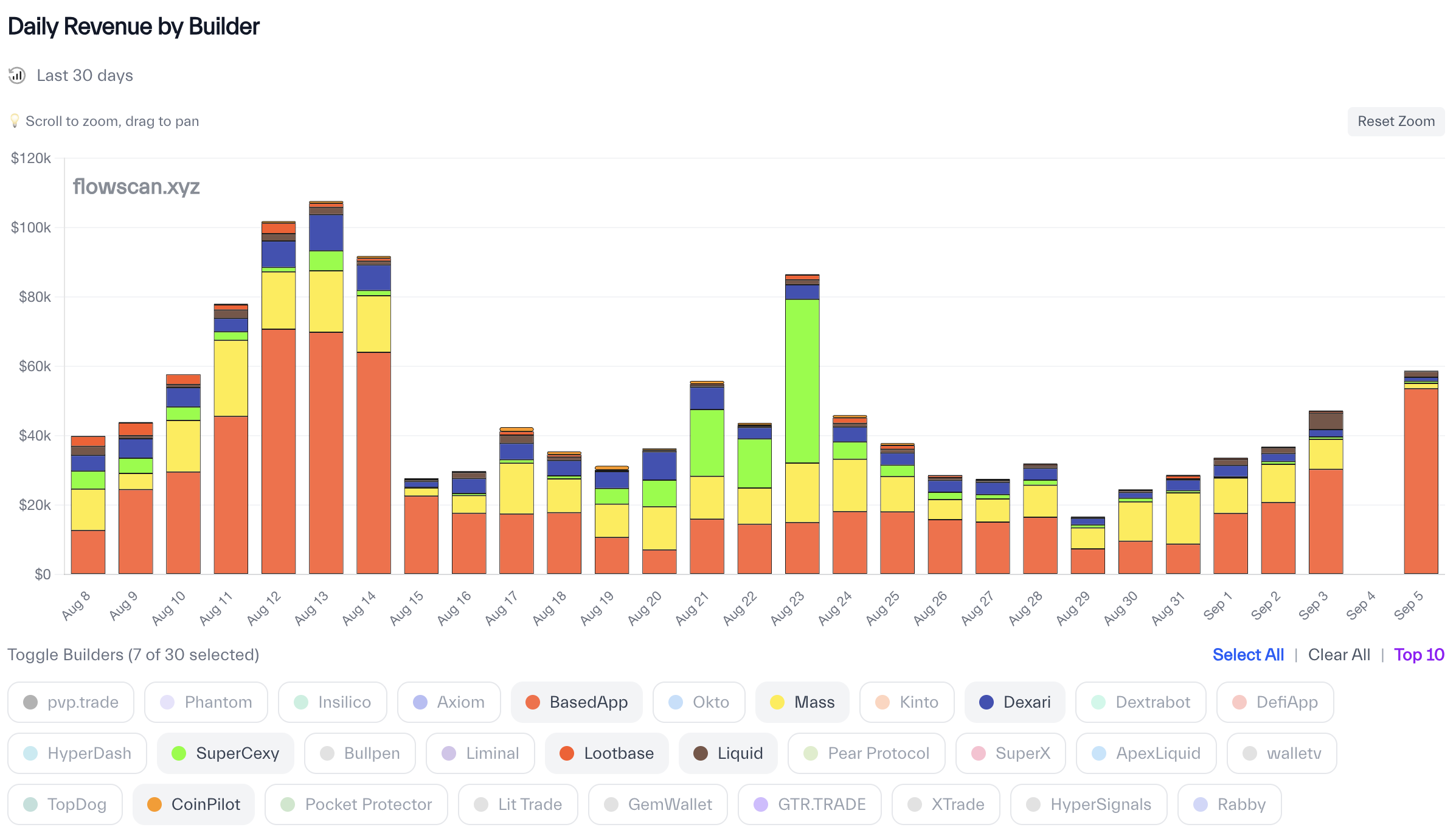

- A wave of native mobile apps built on HL has begun: BasedApp, Mass.Money, Dexari, and Supercexy. These apps generate an average daily trading volume of $50,000 USD (with a monthly recurring revenue of $1.5 million USD), representing approximately 3-6% of HL perpetual contract trading volume, and target diverse user groups (crypto-native users, Web2 retail users, and professional traders).

- Why now? Hyper-speculation and the creator content cycle have increased retail users’ risk appetite; mobile apps have shortened user onboarding time, simplified the complexity of crypto, and added sticky features (copy trading, fiat currency deposits, card payments, money markets, and income tools).

Core arguments:

- Crypto mobile trading fronts benefit from strong tailwinds from Web 2 mass adoption and retail activity.

- For the cryptocurrency market to grow in scale and transaction volume, it needs to provide more crypto-native mobile applications for mainstream Web 2 consumers.

- Compared to the Web 3 business model, this field has real sustainable scale revenue characteristics and extremely low marginal cost of expansion.

The past few months have seen a significant increase in the number of mobile trading and DeFi applications targeting retail consumers, many of which are built on Hyperliquid's infrastructure. This article aims to delve deeper into this vertical, analyzing the applications currently dominating the market and providing relevant insights.

background

Overall, retail investor participation in traditional investments has grown dramatically over the past decade. This trend began in 2019, when several major US brokerages reduced stock trading commissions to zero to compete with Robinhood, significantly reducing trading costs for small accounts. The 2020 pandemic accelerated this process: lockdowns, stimulus checks, and continuously optimized mobile experiences brought millions of new investors into the market. By 2022, the Federal Reserve's Survey of Consumer Finances showed a significant increase in stock market participation—58% of US households owned stocks directly or indirectly, and direct ownership jumped from 15% to 21%, the largest increase on record.

Retail trading continues to play a significant role in daily market activity: it currently accounts for 20-30% of US stock trading volume, far exceeding pre-pandemic levels. This phenomenon is not limited to the United States but is also evident globally: the number of investment accounts in India has surged from tens of millions pre-pandemic to over 200 million by 2025. Investment channels are also continuing to expand—ETF inflows reached a record high in 2024-2025, and the popularity of fractional share trading and mobile brokerage services has provided retail investors with more convenient investment tools. The cost impact of zero commissions, the access impact of mobile trading applications, and the liquidity impact of ETFs have collectively driven retail investors to enter the public markets on a large scale, making consumer-grade investment applications a significant structural force in the market.

Mobile Trading App

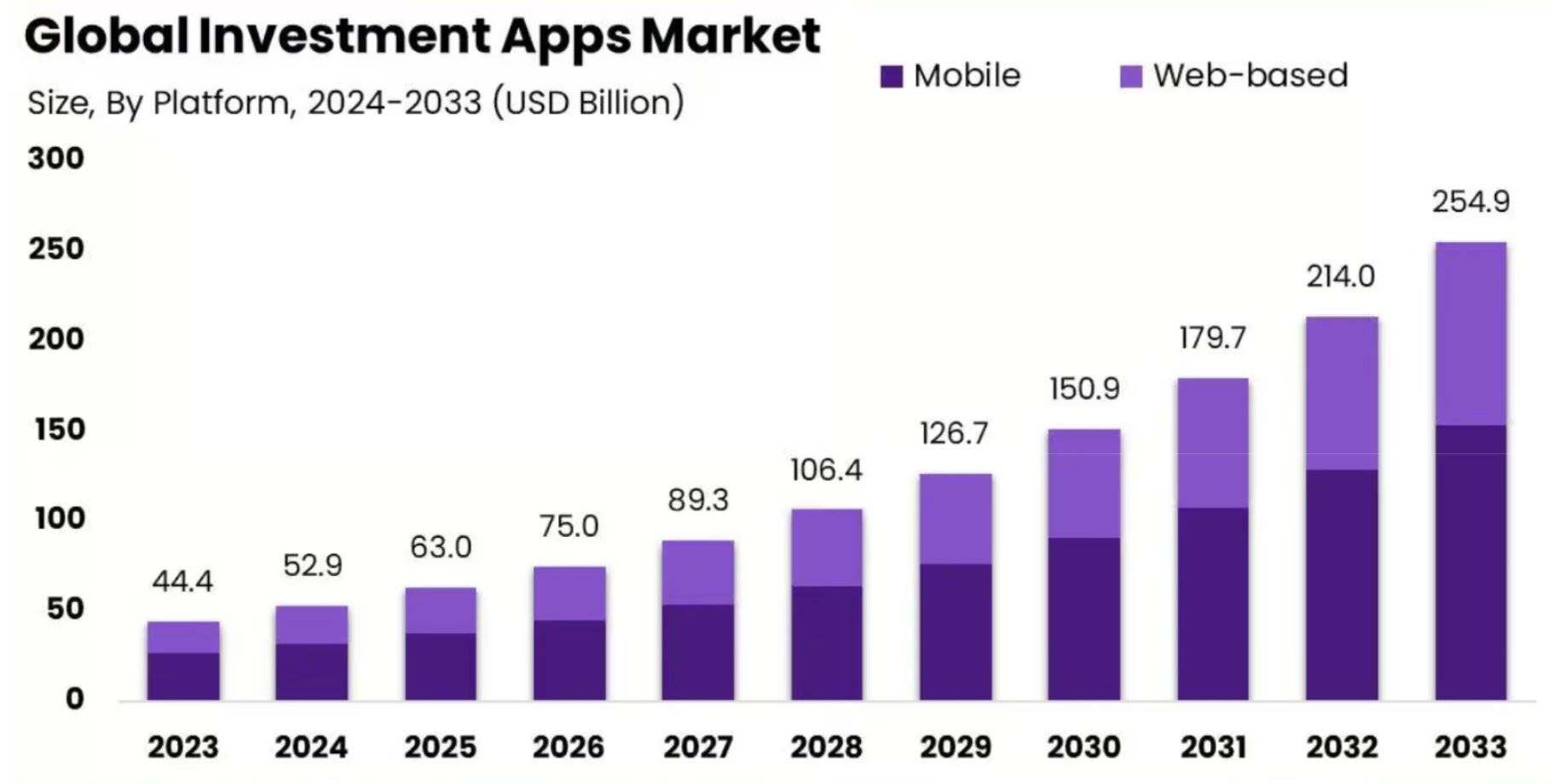

Since 2021, the mobile trading app vertical within the retail trading market has continued to expand, driven by the increasing penetration of mobile devices and the rise of a new generation of independent decision-making investors. The global investment app market is projected to reach approximately $254.9 billion by 2033, growing at a compound annual growth rate (CAGR) of 19.1%.

Why are mobile trading apps so popular among retail investors? The main reasons can be summarized into two dimensions:

#Socially driven (everything is gamified and gambling-like)

Contemporary social culture is dominated by dopamine loops, gamification mechanisms, and hyper-speculative behavior. The rise of the creator economy and short-form video platforms like TikTok and YouTube Shorts has reshaped user behavior, driving a demand for instant gratification. Mobile trading apps perfectly fit this need on multiple levels.

On the social media front, communities like Wall Street Bets on platforms like Reddit are flooded with users showcasing massive gains and losses. Single-day gains and losses exceeding $100,000 have become normalized, and retail users are becoming increasingly desensitized to such sums. Many users separate their Robinhood account funds from real money, viewing their portfolios as mere chips in a game. Coupled with rising living costs, a widening wealth gap, and negative sentiment surrounding "involution," many working-class individuals believe the only way to achieve the American Dream is through "hyper-speculation"—taking extreme risks for outsized returns.

Mobile trading apps have successfully capitalized on this social and cultural trend. By offering short-term options, leveraged products, instant execution, and a gamified interface, these apps have successfully lured users away from casinos and into the stock market. Users can simultaneously experience the dopamine rush, gaming thrills, and speculative trading experiences all on a single mobile device.

#Application Features

Mobile trading apps have significantly improved their features across multiple dimensions. Onboarding, they have condensed the account opening process from days of tedious paperwork to a near-instant online experience. All user processes, from identity verification to trade execution, are integrated into a single interface, enabling users to fully manage their portfolios.

By removing friction points from traditional brokerage models and incorporating new value propositions like fractional share purchases and recurring investments, these platforms lower both the financial and cognitive barriers to entry. By incorporating familiar consumer design language from mainstream apps, they shorten the trading decision-making process, while personalized features like curated target lists and portfolio performance analysis maintain user engagement.

Furthermore, post-investment features like detailed performance reporting and automated tax filing make the experience more akin to a full-service financial application, enabling users to complete all operations, rather than a simple trading terminal. On the social side, content elements further lower the barrier to use by providing an easily shareable interface, fostering social engagement and incentives (e.g., usage driven by the WSB forum). These characteristics collectively explain why mobile platforms have become the default investment channel and a persistent driver of retail market participation.

How does this impact the cryptocurrency industry?

The mobile-first application trend has extended from traditional finance/Web 2 markets to the Web 3 field.

The surge in cryptocurrency wallet app usage over the past five years demonstrates market demand for mobile-native crypto products. Since trading and earning are inherent features of cryptocurrencies, perpetual swaps and DeFi are naturally the first areas to be transformed in this "mobile" era.

With the rise of Hyperliquid since the end of 2024 and the launch of its modular high-performance trading infrastructure, many mobile perpetual contract DEX transactions and DeFi front-end products began to be built on HL infrastructure and flooded into the market.

Why Hyperliquid and DEX?

From a developer's perspective, HyperEVM's infrastructure is highly attractive due to the powerful tools it provides. CoreWriter and precompiled contracts allow smart contracts on HyperEVM to interact directly with HyperCore perpetual contract positions, enabling unique use cases and near-instant execution. Builder Code provides a clear incentive layer for developers, enabling them to earn a share of transaction fees when users trade through their front-ends. These features not only lower the barrier to entry for development but also make HyperEVM one of the most developer-friendly platforms, attracting top teams and talent. This is why 99% of mobile crypto trading front-ends are built on Hyperliquid.

As for why DEXs? Traders are generally drawn to their structural advantages: broader access by eliminating KYC and jurisdictional restrictions, faster coin listings and a wider selection of tokens, and the ability to manage funds autonomously. Previously, CEXs attracted retail users because they significantly reduced the complexity of market participation: offering multiple trading markets within a single, mature web application, instant execution, low slippage, and high liquidity, along with integrated support features like wallet management, stable returns, and fiat currency access. However, this required users to assume significant counterparty risk and forgo the right to self-custody their assets.

Hyperliquid is the platform that perfectly integrates all of these. This on-chain decentralized exchange combines the structural advantages of a DEX perpetual contract platform with the liquidity, execution efficiency, and overall user experience of a CEX. This makes it the ideal liquidity infrastructure for building mobile crypto trading applications.

So how does all this relate to mobile wallet transactions?

Thanks to the availability of this modular, high-performance architecture, the development costs of building a mobile trading front-end have become extremely low - this is why a large number of related applications have begun to emerge on the market.

Most mobile trading front-ends currently offer similar functionality centered around perpetual contract trading, but some are beginning to go beyond perpetual contracts to offer users a wider range of ancillary products. Generally speaking, these apps generally offer the following features:

- Fiat currency deposit channels: Supports credit/debit cards, bank transfers, Apple Pay, Google Pay, Venmo and other deposit methods

- Investment strategy tools: Provide fixed investment plans, stop-loss and take-profit functions, and early access to new tokens

- Money Market Integration: One-Stop Access to DeFi Lending Protocols

- Earn interest: Earn income through automatic compounding vaults

- Dapp Explorer: Search and connect to emerging decentralized applications

- Debit/Credit Card Services: Directly use self-managed funds for spending

These features are made possible by the Hyperliquid infrastructure, which greatly simplifies the development of the main perpetual contract product, allowing the team to focus on innovation in other derivative areas. Due to the modular nature of the entire ecosystem, most HL-based projects can easily achieve parallel development in multiple areas. The rich functionality offered by many applications is primarily due to: 1. The low development threshold of the Hypercore builder code; 2. The high willingness to integrate with other protocols.

In addition, major applications are competing mainly in terms of user experience/interface design and social brand building. The most promising representatives in the market include:

#Basedapp

Currently, Based App is the most popular and fastest-growing mobile trading front-end application in the market. In addition to offering perpetual contracts and spot trading, the platform also innovatively offers debit/credit card solutions directly connected to users' trading wallets, supporting payment needs in everyday scenarios. Its long-term goal is to transform into an emerging digital bank similar to Etherfi.

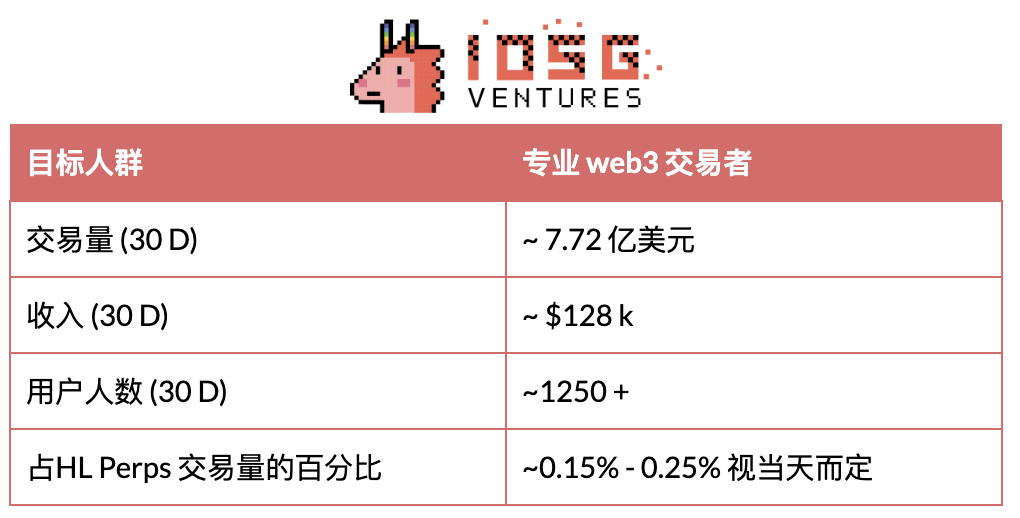

#Mass.Money

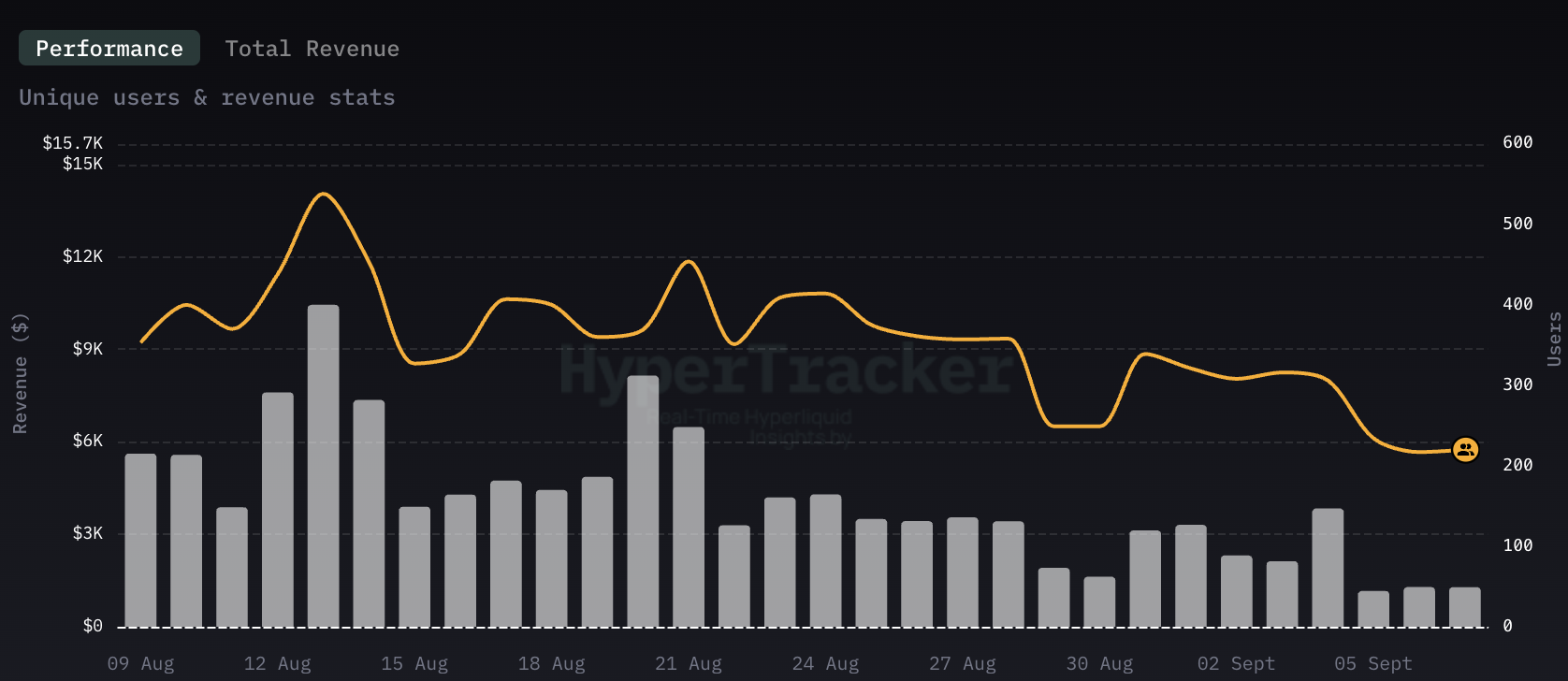

Following closely behind in the mobile trading front-end competition is Mass.money. Unlike Based Apps, this platform focuses more on the Web 2 retail user base, a positioning fully reflected in its product design: in addition to standard HL perpetual contracts and spot trading, it also integrates Apple Pay deposit channels, social copy trading functionality, DeFi money market access, and cross-chain EVM spot exchange, among other full-featured services. Its interface design deeply incorporates gamification elements, drawing heavily on the design language of Web 2 consumer applications.

However, due to their higher fee model and broader product portfolio, their revenue per user and transaction volume are significantly higher than BasedApp.

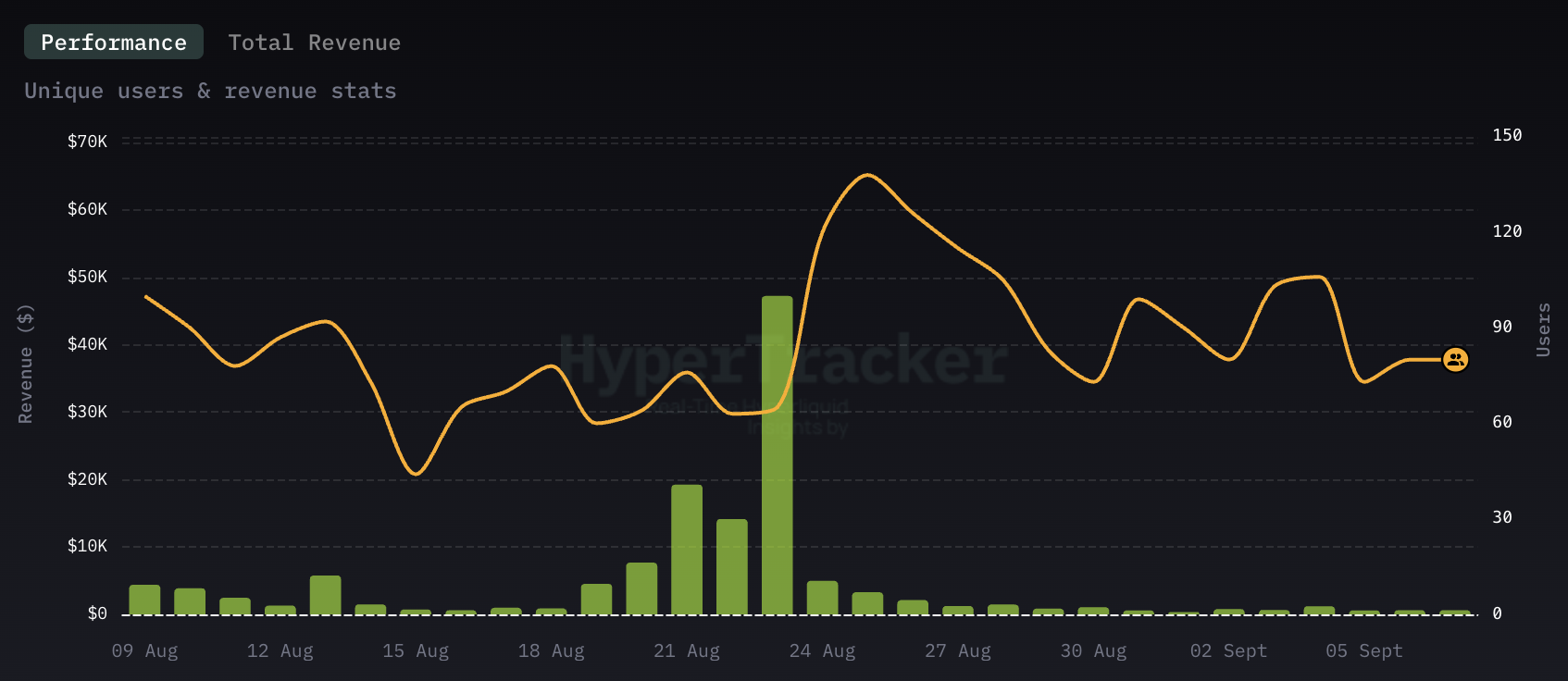

#Dexari

Following closely behind Mass.money is Dexari, a mobile trading front-end designed for professional traders, focusing purely on trading functionality. Key product features include HL perpetual contracts and spot trading, with a user experience and interface design focused on asset discovery, analytical tools, and execution efficiency. Their goal is to become the Axiom (professional trading benchmark) of mobile trading front-ends.

#Supercexy

Last but not least, Supercexy. This platform has opted for a purely mobile-first approach and is also optimizing its web-based perpetual contract DEX trading experience, aiming to provide a CEX-like experience, but built entirely on Hyperliquid infrastructure. With DeFi staking functionality and money market access integrated into its product suite, the app primarily serves Web 3 native traders.

Comprehensive perspective

Overall Overview

Overall, the combined average daily revenue for all relevant mobile trading frontends (including some not mentioned here) is approximately $50,000, equivalent to approximately $1.5 million in monthly recurring revenue (MRR). These apps account for approximately 3%-6% of Hyperliquid's total perpetual contract volume. For reference, Hyperliquid's HLP vault accounts for approximately 5%.

Hyperliquid Mobile Trading Front-End Revenue

Summarize

Core Viewpoint

1. Cryptocurrency mobile trading frontends benefit from strong tailwinds from the Web 2 crowd and retail activity

The trend of hyper-speculativeness in society has fundamentally altered retail consumer behavior. As evidenced by the growth of Polymarket and Kalshi, most users in the current environment adopt high-risk strategies. With speculative demand at an all-time high, mobile trading apps are the product form most directly benefiting. As mentioned earlier, traditional financial mobile apps like Robinhood, Wealthsimple, and TD Ameritrade have seen significant increases in user growth and adoption, primarily due to their low barriers to entry and their willingness to promote short-term, highly leveraged, and gambling-like products. Clearly, retail users need easy ways to gain risk exposure and allocate capital, and mobile trading apps are the most logical solution.

Mobile cryptocurrency trading apps are fundamentally no different and can similarly benefit from this consumer behavior if they effectively build product discoverability. Robinhood, Wealthsimple, and Revolut, all integrating crypto products into their apps, are a testament to this. Despite charging significantly higher fees, these traditional financial apps have seen significant adoption of crypto products within their apps, demonstrating a strong demand among retail users for convenient mobile access to the crypto market. Without dedicated mobile crypto trading apps, the Web 3 market will cede significant value capture opportunities to Web 2 competitors.

2. For the cryptocurrency market to achieve growth in scale and transaction volume, it needs to provide more crypto-native mobile applications for mainstream Web 2 consumers.

There has been virtually no new retail inflows since 2023. The total stablecoin market capitalization is only about 25% above its 2021 all-time high, a dismal four-year growth rate for any sector—and this is happening against the backdrop of the most favorable regulatory environment for stablecoins and strong presidential support for the crypto industry.

The market needs solutions to attract new retail liquidity, but significant barriers to new retail capital entry remain unaddressed. The primary obstacles are: first, the public's perception of complex operational processes for participating in the crypto market; second, a lack of accessible applications that truly understand the needs of Web 2 users. Web 2 retail users don't use complex wallets or transfer funds across multiple chains. They need products packaged in a familiar format, offering easy onboarding and a user-friendly experience, similar to accounts offered by Robinhood or Wealthsimple.

Cryptocurrency mobile trading front-ends are the solution—they package products in traditional financial formats familiar to Web 2 users, fundamentally removing the cognitive barrier to entry and lowering the barrier to participation. This is the only effective way for cryptocurrencies to break through Web 3 circles and gain mainstream exposure.

3. A real revenue model with sustainable economies of scale and very low expansion costs compared to Web 3 business models

Mobile cryptocurrency trading frontends mark the beginning of a new generation of applications in the Web 3 market—a more sustainable and compliant path to development. Unlike previous traditional crypto products (whether infrastructure or DApps), most projects haven't focused on scaling or revenue generation because these weren't core incentives. Most founders' North Star metric was acquiring initial users at any cost, no matter how inefficient or extractive their growth funnels were. They then raised venture capital, locked up tokens through over-the-counter sales, or waited out vesting periods without improving their products. Examples include Story Protocol ($IP), Blast, and Sei Network ($SEI).

Crypto mobile trading frontends take the opposite approach: leveraging existing infrastructure to optimize scale, prioritizing revenue generation and raising capital later. By acting as aggregators of diverse products and employing a base fee structure, these frontends possess the structural advantage of integrating across multiple verticals at minimal cost, while simultaneously focusing on the user experience interface to drive user acquisition and retention. This combination means revenue generation from day one, with continued exponential growth over time. The end result is a more sustainable, real-world commercial and value layer for Web 3, replacing the extractive model of the past. This will bring growing credibility to the entire Web 3 industry.

- 核心观点:加密移动应用是吸引Web2用户的关键。

- 关键要素:

- Hyperliquid技术栈降低开发门槛。

- 移动应用简化加密操作提升体验。

- 日均交易量达5万美元显潜力。

- 市场影响:推动加密市场扩大用户和交易规模。

- 时效性标注:中期影响。