Original Source: Mable , co-founder of Trends.fun

Original translation: Ismay, kkk, BlockBeats

Editor's Note: In this exclusive interview, Mable, co-founder of the social protocol Trends, spoke with Leonard, CEO of Aster, the hottest Perp DEX, offering a panoramic overview of their personal experiences and project strategies. From a technical position in a traditional investment bank to a blockchain entrepreneur, Leonard's journey traverses finance and Web 3. In this interview, he systematically recounts for the first time how Aster, starting with perpetual swaps, has grown into a comprehensive multi-chain trading platform; how they experimented with on-chain dark pool design, balancing privacy and transparency; and how they strike a balance between efficiency and fairness in token distribution, points programs, and buyback strategies.

In the interview, he candidly reviewed the lessons learned from the XPL incident and shared his thoughts on Aster Chain, its market maker initiative, and future on-chain governance. The interview not only showcases Aster's product philosophy and strategic layout, but also reflects the wisdom of Web 3 startups in balancing compliance, privacy, and market demand, providing readers with a valuable perspective on the development of the next generation of decentralized trading platforms.

The following is the full conversation:

Mable: Let’s start with your background. How did you get into crypto? What brought you to where you are today?

Leonard: It's a long story. I started out in banking technology. I was working in technology at a now-defunct Hong Kong investment bank. I initially focused on technical infrastructure, building high-frequency trading systems. Later, I transitioned to programming risk engines for the stock market, where I worked for about five years. After that, I entered the startup world and founded a business-to-business fintech lending platform in Asia. However, my first venture failed.

Mable: What year was it?

Leonard: Around 2015 or 2016, the concept of "Internet Plus" was incredibly popular in China. Simply adding "Internet" to anything made it a startup. Everyone wanted to disrupt the financial industry. But then regulatory pressure became overwhelming, and some scams ruined the industry, and it ultimately fizzled out.

During that process, we kept thinking about whether there were better ways to do this. That's when I discovered blockchain—around 2016, when Bitcoin had already existed and Ethereum was just emerging. I was initially drawn to it by ICOs and invested in a few. I made some money with the first one, thinking I was a genius. But I lost everything with the next few. But that's when I started to really get interested in technology.

We wondered if we could put all loan information on a blockchain. At the time, there was a debate about "permissioned" vs. "permissionless" blockchains. I remember IBM launching a project called Hyperledger, and I started learning about it, trying to build a loan platform based on it.

Of course, looking back now, we chose the wrong direction and should have chosen Ethereum. Later, I also tried to cooperate with game companies to release NFTs and tokens into games, but it was too early at that time, no one understood, and ultimately it didn't work out.

For about a year, I explored various avenues, ultimately landing at the DeFi project Injective Finance in 2019. There, I was exposed to numerous products and ideas. Later, dYdX launched, and we began to explore the possibility of building our own on-chain trading platform. Thus, the first prototype of Aster was born, which later evolved into Aster.

Crypto projects are constantly iterating through cycles: from dYdX, to GMX, to Hyperliquid. We've gone through all of these phases, constantly adjusting and trial-and-erroring until we create something the market truly needs.

Mable: So how do you define Aster now? And where do you hope it will be in one to three years?

Leonard: A year is a long time. If you had asked me this question two weeks ago, I might have given you a completely different answer. After all, in the crypto world, a year is a long time. Aster is often seen as a multi-chain trading platform, a multi-chain DEX. But in my opinion, we are no longer a traditional perp DEX.

Aster is often considered a Binance ecosystem project because we started with BNB Chain, with the help of CZ. However, we're no longer limited to BNB Chain. We also support Arbitrum, OP, Linea, and Solana, with plans to add more chains in the future.

We did start out as a perp, but in the past two weeks it was our spot trading product that attracted a large number of new users, because if people want to buy Aster tokens, they can only trade through the on-chain order book.

At the same time, we are also one of the largest providers of yield assets on BNB Chain, with products such as USDS and aUSDT, where users can earn income while trading.

So now we have grown from a simple perp project to a comprehensive multi-chain trading platform, with the goal of improving the efficiency of users' funds - you can deposit money to earn returns, and use these assets as collateral to participate in more strategies.

In the future, we hope to support more chains and more assets, and reconstruct all mainstream products and experiences on CEX on the chain, so as to create a complete and composable DEX product matrix.

Many people compare us to other projects, like dYdX or GMX. But our true competition isn't other DEXs, but CEXs themselves. We aspire to be the on-chain version of Binance. Ultimately, we hope to one day surpass Binance—our largest investor.

Within a year, we hope to replicate 80% of the CEX product experience, but reconstruct it entirely on-chain. Five years from now, I hope the entire DEX industry will surpass CEX, and we will be the leader.

Mable: There's actually a persistent narrative in the market that Binance is very supportive of Aster, even using it as a weapon against Hyperliquid. So if you had to describe Aster in one sentence, what is its core value proposition compared to CEXs or other DEXs?

Leonard: I think the most important point is that our entire infrastructure is built entirely on-chain, which gives us the fundamental advantages of "self-custody" and "transparency." This is the biggest difference between us and CEX.

Furthermore, as a DEX, we have greater flexibility in our governance model. CEXs are extremely inefficient when it comes to listing tokens or adjusting products due to their centralized processes, slow approvals, and complex risk control procedures. On-chain governance, on the other hand, can evolve continuously with the needs of the community and the market.

Projects like pump.fun you see today may have taken years to develop new models, but these ideas all originated from the community. Ultimately, the ones that survive are the ones with the best product designs that align with the market.

That’s the beauty of decentralization.

We have been building products in this direction since day one, so I believe that the on-chain trading platform will be able to find its way to adapt to the market more quickly.

Of course, from a startup's perspective, we're also more flexible and responsive. CEXs have more resources, but DEXs are closer to the community and more agile. For example, we're faster at launching new currencies and products.

Mable: So are you implying that the listing of new markets or new currencies in the future will be decided through governance voting?

Leonard: This is one of the directions we are seriously considering.

However, we also need to balance this. In the early stages of the project, for the sake of execution efficiency, we do retain a certain degree of centralized control to ensure that decisions can be implemented in a timely manner and maximize the benefits to the project and the community.

However, we are also "pragmatists". We know that in the future we will gradually transition towards decentralized governance. When the entire system becomes more mature and we find a clear business model, we will gradually release control and allow the community to participate in governance.

Mable: I totally agree. Gradual decentralization is a process. And it's true that early on, centralization is more efficient. In many projects today, a single address holds over 50% of the voting rights, making governance a mere formality.

Leonard: Yes, so we have to govern step by step.

Mable: We will talk about your "dark pool design" later, but I would like to ask a personal question first - besides Aster, which is your personal favorite DEX?

Leonard: This is an easy question. Of course it’s Hyperliquid.

I've actually tried almost every product. You could say these projects really ushered in a new era of orderbook-per-DEX. But the true OGs are projects like GMX, which laid the foundation for the subsequent LP model and market-making framework.

However, I think there are some interesting projects that are less well-known, such as Surf Protocol. I've tried it myself, and they also have a product with 1,000x leverage, just like ours, but they use a completely different profit distribution model—users only pay fees when they make money, which is quite interesting.

There's also JoJo on Base, I really like their UI. It's the kind that makes you think "Wow, that's cool" at first glance.

I feel like the entire perp product landscape is becoming increasingly homogenized. Everyone's scrambling to improve functionality. If you release a compelling feature, others will quickly copy it. After all, Web 3 is a world of open access, and the barrier to copying many things is relatively low. The core of competition, then, becomes "where do you specialize?" Some teams excel at high leverage, while others focus on oracle-driven limited partnership models. Ultimately, everyone has their own strengths, and it's hard to say who's better.

Aster's dark pool design

Mable: Let's talk about your dark pool design. Aster's hidden orders mean you can't see the direction or amount. So, is there any way for users to verify afterward that these orders were matched fairly? Do you provide some kind of public record?

Leonard: We do have the ability to conduct post-verification, such as through independent third-party audits. Our matching engine can take snapshots, and all transactions can be replayed for verification. However, there's currently no way to conduct public verification.

But this is a bit of a paradox in itself - if you can infer the contents of the transaction afterwards, then the hiding mechanism is meaningless. So we don’t really have a way for anyone to verify it publicly.

Of course, if anyone has a good solution, we'd love to collaborate. We're also constantly refining our product design. If anyone is working on a chain or feature related to private transactions, please contact us for collaboration. We have some ideas, but we haven't fully figured them out yet.

Mable: You designed the dark pool on the first day of going online. You must have a very strong judgment on this direction, right?

Leonard: In fact, we have been thinking about this issue from the beginning. In the TradFi world, the volume of dark pools and OTC far exceeds that of the public trading market.

Many people have asked us if we were to move this system onto a blockchain, and if so, would there be similar demands? This is actually quite a conflicting concept: blockchains are open, but financial transactions inherently favor privacy.

Later, a public exchange between CZ and James Wynn surfaced. James explained that he was being "liquidated" on Hyperliquid because transactions were public. CZ responded that on-chain transactions should be transparent. This debate inspired us.

We thought, this might be an opportunity. Everyone has this awareness, so why not take advantage of it? So we worked almost overnight on development and launched the feature in about a week and a half. CZ was also an advisor, and Yzi Labs was an investor, so we thought it was a good entry point and went for it.

After the launch, we did see some users trying it out, but honestly, the demand wasn't as strong as we expected. We later realized that if someone really cared about transaction privacy, they would probably still go to a CEX for more convenience.

But we haven't given up. We'll continue exploring and testing whether there are more suitable models for on-chain private transactions and OTC. Our goal is to "enable verification without leaking market signals." We're still in the experimental stages, but currently, retail investors don't have a strong preference for privacy.

Mable: This is similar to TradFi's dark pool; it primarily serves institutions, not ordinary traders. In other words, if you want this product to succeed, do you have to wait for more institutions to enter the market?

Leonard: That's right. The problem is that once institutions are involved, an entire regulatory and compliance framework becomes implicated. Our current anonymous, non-KYC (know your customer) model is a barrier to entry for most institutions.

We've also spoken with some institutions, and they've all expressed interest, but they're stuck at this point. So I think if you're thinking about starting a new Web 3 project, you really should consider the "permission mechanism" aspect.

Although we are not working on this yet, I do think that in some scenarios, adding a little bit of "permission control" layer may be the answer to resolving the conflict between privacy and compliance.

I guess that the next high-frequency Prop Trading funds may start testing the waters within 1 to 2 years.

Mable: Back to Aster's token distribution, we currently see on-chain that 96% of the supply is concentrated in a few addresses. Can you explain the structure of these wallets?

Leonard: I’ve also seen people discussing this online, but that’s not entirely accurate. We don’t control the tokens of all these addresses.

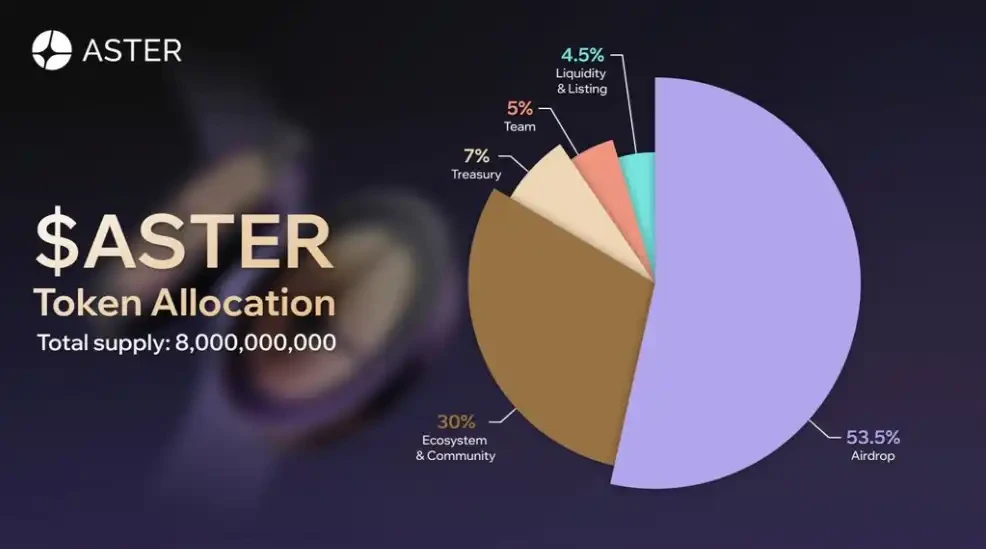

We do control a portion of it ourselves, but about 80% of the tokens are locked and can be viewed on the chain. The distribution is also very clear: 50% are airdrops, 8% of which are initial airdrops, and about 40% are sent directly to on-chain wallets. These are all verifiable.

Those largest wallet addresses are actually asset contract addresses, which are used by users to conduct spot transactions, so naturally there will be a lot of tokens stored there.

After we opened withdrawals, several large holders withdrew their tokens. We don't know who they are, but they chose not to sell directly on the exchange contract, but instead withdrew the tokens to their own addresses, suggesting they may be long-term holders.

I understand everyone’s concerns about the figure of “96% concentration”, but in fact at least 80% of the shares are verifiable and transparently locked on the chain.

Only about 10% is currently in circulation, including the user conversion share from APX. Our initial 1:1 swap with existing users accounted for about 10%, and the initial airdrop accounted for about 8%. There will be a linear release of tokens later, including a marketing budget, all of which is documented and verifiable on-chain.

The reason why the contract address looks like we control all the tokens is because most transactions occur in this contract, but in fact many tokens belong to users.

Mable: So Yzi Labs is your only private equity investor at the moment?

Leonard: Yes, but they are only a minority shareholder and their shareholding is not high. However, they have given us a lot of support.

Mable: Are their tokens locked? The community is quite concerned about this.

Leonard: We can't disclose the specific content of the agreement, but we can say that they don't have any intention of cashing out. They are not short of money, and they are not in a hurry to sell.

From TGE to now, our performance in the BNB ecosystem has proven the value of the project. Therefore, even without forced lock-up, they have no incentive to crash the market.

The tokens they receive come from only a small portion of the 5% team allocation, which is completely transparent and traceable on the blockchain, as they invest in equity, not the tokens themselves.

This percentage is also far lower than their actual investment. You can understand this as a very small incentive share. But precisely because the token's value has risen so significantly since its launch, even this tiny 5% now seems like a significant amount.

But considering the token ratio, I don't think there's much to worry about. And from a motivational perspective, there's little reason for them to sell their tokens right now. It's just that we have confidentiality obligations regarding the specific agreement, so we can't discuss it in detail.

What is the logic behind the points plan in the second phase?

Mable: Since we're talking about tokens, let's also talk about your Genesis Phase 2 points program. I remember you're still running the points program and have probably just entered the second cycle. Can you briefly explain the design logic?

Leonard: Of course. This round of points program actually started two weeks before TGE and lasted for a total of four weeks.

We just finished our third week, with one more week left. We will be distributing 4% of the total supply in this round, with the goal of distributing it as fairly and evenly as possible.

We particularly want to reward users who actually participate in trading. After all, this kind of activity will inevitably attract some users who are just there to earn points, so we are constantly optimizing the rules to ensure that genuine traders, loyal users, and long-term holders receive rewards.

Of course, we can't list every possible criterion, as someone would always find loopholes. However, for example, users who hold positions for a long time are often genuine traders. We also look at other behavioral data to filter out accounts that are clearly engaged in fraudulent activity, ensuring that rewards reach genuine users as much as possible.

This campaign was quite successful in terms of trading volume. After we announced the end date and total allocation for the points program, our trading volume skyrocketed, even surpassing other projects and becoming the top-ranked perp DEX by trading volume.

We have ranked first in daily trading volume for three or four consecutive days.

Mable: So in the third season, do you hope everyone will try other things, or does it not matter?

Leonard: Of course, we also hope that everyone will migrate their spot trading activities to our platform and tell us what features they really want. Since many people are currently testing it, we have received a lot of feedback. Although it may sound a bit harsh at times, we still take it seriously.

Because now we know what we want to do. So in the new season, we hope everyone will experience our spot products and tell us which assets you want to see online and what features you would like to see added.

Mable: However, the spot liquidity trading pairs probably won’t be as many other assets as those that can be traded on Aster, right?

Leonard: Yes, currently we only have some mainstream ones, such as BTC and ETH. We hope to cooperate with more issuance platforms to provide liquidity for early-stage projects. This is a direction we have tried and will continue to try, such as the asset generation process and the liquidity of early-stage assets.

As we've mentioned, one of the core aspects of Adventure Index is how to quickly list new assets. If we can also quickly provide liquidity for these assets, the entire process will be highly efficient, which is exactly what the market needs. Therefore, we will continue to advance this initiative across various projects.

Mable: Regarding the rewards for Season 2, will they be distributed at the end of Season 3? Or is there another arrangement?

Leonard: Our idea is this: after the second season, the points you can earn and the allocation will be clearly and transparently displayed to everyone. As for the specific distribution method, we are still designing it and considering what is the most appropriate one.

For example, we can't just consider new participants; existing token holders must also be considered. People are concerned that dumping 4% of rewards immediately into the market will cause a massive sell-off. Therefore, the project will certainly have some wiggle room in the release schedule. However, the exact amount you'll receive will be made transparent to everyone immediately after the end of Season 2.

Mable: So will there be an unlocking plan or something like that?

Leonard: We are indeed studying the possibility of doing so. We will design a plan based on the situation and will announce it soon - after all, there is only a week left, so everyone will know soon.

This is also a key point we are considering, how to find a balance between the interests of existing holders and the incentives for new users. So I think in the next two or three days, we will make a final decision and make an announcement.

Mable: I've seen some discussion in the community, but no one has given a clear answer, so I figured it would be best to ask you directly during the livestream. So, before entering Season 3, you haven't implemented any incentives for spot trading, right? So, what's the current trading volume distribution for perpetual swaps, spot contracts, and the high-risk products you just mentioned?

Leonard: Perpetual contracts still account for the vast majority, because the current market trading demand is basically concentrated in this area.

Over 90% of trading volume is in perpetual contracts, with over 80% of that concentrated in BTC perpetual contracts. So, looking at the distribution of trading volume, this is roughly the same.

Mable: What’s interesting is that BNB is not actually among them. I originally thought that BNB would at least have a similar share in perpetual trading as Ethereum.

Leonard: I think this is because Binance's products are already very mature for those who really want to trade BNB. In other markets, the demand for BNB is not that great, so the trading volume is relatively low.

Mable: I think I've asked enough questions about tokens. Let's talk about the XPL incident. I know some details might be off-limits, but to the extent you can share, could you please walk us through what happened? For example, a pricing error in the XPL perpetual index caused the price to spike to $4, causing losses for some users. Could you share your post-event review process?

Leonard: Regarding this experience, some very smart people on Twitter later summarized the problems. I think the biggest mistake we made was that it was stuck in the "pre-market mode" at the time.

If it were a regular perpetual contract, it would automatically track the correct index price, preventing price spikes or deviations from the market price. However, pre-market perpetual contracts inherently carry this risk—they rely solely on internal matching books for pricing, rather than open market prices. In other words, during the pre-market period, there's no external source of prices, and we can only derive prices from our internal order book. When adjusting our configuration, we mistakenly derived an incorrect price from our internal order book.

We quickly discovered the error and immediately switched it back to normal perpetual mode, restoring normal operations. It was our mistake, and we quickly made the decision to fully compensate affected users and shoulder the losses ourselves. There was no better solution at the time. This also serves as another reminder that pre-market products inherently carry higher risks.

We will implement several improvements in the future. First, even for pre-market perpetual swaps, we can obtain oracle prices through external pre-market markets, such as those from exchanges like Binance, rather than relying solely on internal matching books. If such a mechanism had been in place, this incident could have been completely avoided.

Of course, any pre-market market inevitably carries risks. If external price signals are lacking and liquidity is insufficient, similar price deviations are always possible. Therefore, we need to strike a balance between assessing our ability to manage this risk and determining market demand for the product. If the market truly demands it, we must enhance risk control measures to ensure system robustness and prevent the same mistakes from happening again.

Mable: Regarding oracles, I actually have a related question. I remember you're planning to launch tokenized stock products. So, where will the price oracles or data sources for these assets come from? Will you offer 24/7 trading?

Leonard: We currently use oracles like Python. Due to the limitations of the oracles themselves, we can't provide 24/7 service. For example, when data is unavailable, we can't provide prices continuously. We can use a pre-market approach, which means using our internal order book to derive prices when there are no oracle quotes.

The problem with this approach is that it restricts trading to a single price range. This effectively defeats the purpose – if volatility is limited to ±2%, people generally won’t be interested in trading. However, once volatility does occur, demand for trading is at its highest. However, strict risk controls prevent normal trading, posing a significant risk to users.

Therefore, we currently cannot offer tokenized stock trading services during after-hours trading hours. This is necessary unless we find better oracles that cover longer timeframes. For example, we are currently researching index-based assets whose futures are traded on multiple markets. Therefore, oracles can provide price data nearly 23 hours a day. For example, the Nasdaq index can be continuously updated through the futures market. For such assets, we may be able to offer near-24-hour trading. However, for single stocks, we are currently limited by the fact that oracles cannot provide price data 24/7.

Will Aster repurchase?

Mable: I remember someone mentioned in another interview that you might have a repurchase plan. So how often will such measures be carried out?

Leonard: I don't think we're willing to commit to a fixed timeline for now. We prefer to give the project owners or operators more autonomy in how they use their revenue. That being said, we do have buybacks and will invest a certain percentage of our revenue. The exact amount and frequency will be announced later. But one thing is for sure, we won't design it as a fixed, predictable mechanism. Compared to some other projects, we'll retain more flexibility so we can optimize our allocation based on revenue.

Mable: Yes, actually, different founders have very different views on this issue. For example, the founders of Pengu believe that buybacks aren't the best use of funds, but rather that they're done simply because of external expectations and pressure, and are considered industry practice. On the other hand, people like Pyth believe that all revenue should flow 100% back into the token, and this is their firm position. I know your answer doesn't represent Aster's final decision, but from a conceptual perspective, what are your thoughts on this execution logic?

Leonard: I'm a pragmatic person, and I think the best answer often lies somewhere in between. Extreme solutions aren't always suitable. Sometimes, using 100% of revenue for buybacks might be the optimal solution, but in other cases, setting aside a larger percentage for project development can be more beneficial.

Therefore, the key is to maintain flexibility. As we conduct one or two buybacks, the community will gradually build trust in our good faith and responsible use of funds. Ultimately, as the project matures, we can make the mechanism more automated and standardized. I have a background in traditional finance and have read extensively on the subject, so I tend to be rational and prudent in this regard.

Having read a lot of investment books in my youth, I understand why some people argue that buybacks aren't always the best option. Essentially, they're a bit like dividends. When an institution chooses to pay dividends, it usually means there's no better way to use the funds. For projects like ours, however, there are indeed ample opportunities to deploy capital in more valuable ways, such as investing in our team and partnering with investors to drive further growth.

Another crucial factor is the token price, which directly impacts the efficiency of buybacks. Using an automated algorithm to execute buybacks while prices are high can be counterproductive. While sometimes effective, it can often distort market expectations and drive up prices.

So I think two points are crucial:

First, the repurchase ratio and how much of the income should be used for repurchase should be flexibly adjusted according to the stage of the project, rather than being fixed.

Second, I believe 100% transparency isn't necessary at the execution level; otherwise, it could actually reduce efficiency. However, after the buyback is completed, all information must be publicly transparent and recorded on-chain for everyone to monitor. Otherwise, it becomes a gimmick: you announce a buyback, but no one knows where you're buying from or how much you're buying. That's meaningless.

Therefore, we need a certain degree of flexibility when executing; but afterwards, all data must be transparent and traceable to ensure that the outside world can clearly know what we have actually done.

Mable: So you might disclose something like this, for example, that you decided to use only 30% of revenue for buybacks this quarter, and explain why you needed to use the remaining funds for other purposes. This makes sense logically.

Leonard: Exactly, and we can adjust it at any time. If the community has strong feedback and makes good suggestions, we can definitely change it. It's precisely because we didn't set a fixed ratio at the beginning that we have this flexibility and can continuously optimize over time.

Mable: Yes, especially when your market capitalization is getting bigger and bigger, it’s impossible to satisfy everyone. You always have to find a balance. I believe you are already experiencing this situation.

Leonard: Indeed, we are growing very fast and are constantly learning.

Mable: I'd like to talk more about the product itself. I've reviewed your existing features, and you mentioned earlier that you hope to gradually offer more features and services similar to centralized exchanges. However, you already have grid trading. Why did you prioritize this feature?

Leonard: We actually launched this feature quite a while ago, back when we were testing the trading platform internally. It's clearly a very useful feature, especially for less experienced traders who only want to run a specific strategy. It's also great for the trading platform, as they were able to offer this feature from the start to ensure a better user experience.

It's not just about fee income; more importantly, it's about liquidity. Most retail investors, if they aren't given these tools, will simply place market orders and take advantage of the market price. But if you equip them with these tools, they'll trade with limit orders, allowing them to not only run strategies but also become liquidity providers. This is a win-win situation: retail investors can run strategies while also providing liquidity to the market. This is why we launched this feature early on, and why it's been maintained to this day, allowing it to become a well-established feature.

Mable: So what is your current trading user profile? I guess you also pay attention to data such as IP distribution.

Leonard: Previously, our IPs were mostly concentrated in Asia. Of course, we largely self-host this information, so we don't need to have complete information on every user. However, looking at overall IP usage, before TGE, our users were primarily from Asia. However, after TGE, we've clearly seen growing interest from the West. We can also see on Twitter that more and more users speaking English and European languages are discussing us. So, it's fair to say that our user base is shifting.

Mable: I heard that some external teams are using your API and data, and some have reported issues with the data format. Do you have any plans to improve this?

Leonard: Yes, we have received a lot of feedback in this regard. Our team is working on these issues almost around the clock. If we sometimes fail to respond in time, we are very sorry, but we are indeed gradually clearing up the technical debt. You can also join Discord at any time, or DM me directly, or contact us through our official Twitter account. In fact, after TGS, some developers took the initiative to contact us and put forward some very valuable technical improvement suggestions. For example, one of the problems that has been bothering us for a long time is the slow recharge speed of the Solana contract. Later, a developer took the initiative to offer help, and now a group has been formed to directly connect with our team to study solutions.

We're now releasing updates almost three times a day to ensure system improvements are implemented as quickly as possible. I think everyone will see significant improvements soon. If there's anything that bothers you, please let us know and we sincerely hope to fix it as soon as possible.

How to build Aster Chain?

Mable: Yes, if Solana needs anything else, we'll definitely help you out. I think this is similar to the situation with Arbitrum and other chains; everyone should be very interested in collaborating with you. Changing the subject, you mentioned Aster Chain in another interview. Can you tell us more about it? What role do you envision this chain playing in the future?

Leonard: We hope that all transactions on the chain can be transparent and verifiable, while also preserving a certain degree of privacy. This is our goal for Aster Chain.

Some competitors invest significant resources in building complete ecosystems on their own chains, but that's not where we want to focus our investment. We prefer to integrate with other chains and aggregate the credit of these transactions onto our own chain, making them verifiable to everyone. We're not saying that approach is bad; other projects are also doing an excellent job building ecosystems. Our focus is simply different—we're more focused on the transaction experience.

We hope to focus on providing a good trading environment and user experience for at least the next three to six months. Aster Chain's positioning is to provide transparency and verifiability, not to create another "universal chain" to attract everyone to build things on it. Frankly, I think there are already enough chains; we don't need another L1.

But we do need a better decentralized trading experience. That's why I believe Aster Chain's value lies. Of course, our strategy may adjust over time, and there may be future shifts, but for now, we must focus on building a better trading platform.

Mable: I understand. Just like Hyperliquid benefits from owning its own chain, being able to collect gas fees and also receive protocol revenue. I guess you had similar considerations when you started?

Leonard: Yes, I think in the long run, we may invest more in the chain itself. But in the short term, our focus remains on ensuring all trading functions are well implemented. After all, building a complete ecosystem is a massive and complex undertaking, and we don't want to be distracted right now. What we are best at, and what we should focus on, is building a trading platform with comprehensive functionality and a user experience close to that of centralized exchanges. As for the L1 ecosystem, that's something we can consider in the future.

Mable:Yeah, I mean, let's say a lot of your transactions are settled on Aster Chain, then you can basically get protocol revenue, and that revenue will not flow to other L1 or other EVM chains. I mean, is that the logic behind this?

Leonard: Two points. First, we currently run transactions on our own chain, but it's internal and not yet publicly available. It consumes gas, but it's not fully operational yet. We hope to make this information public so that everyone can run nodes and verify it. That's our goal. As for whether to build a complete ecosystem around it, that's not a priority right now. We may do that in the future, but it's not a priority right now. We'll consider that once we feel the platform is mature enough.

Mable:Do you have plans to become a market maker? Can anyone apply to join?

Leonard: We do have a market maker program. If you go to our website documentation, there's a Market Maker Program page with detailed information, including trading volume requirements, fees, and the incentive pool tokens they can earn. These tokens are separate from the other points system. Anyone interested can contact us directly via email. All the information is on this page.

Mable: Could you please share how many market makers you have at the moment? Or is it something you cannot disclose for the time being?

Leonard: I won't reveal the exact number, but we've already reached out to a lot of people, and quite a few have already joined. Active market makers are dynamic; they become more active due to high trading volume. If liquidity demand increases, more people will join.

Yes, they primarily provide margin trading, and they only make money when there's demand for liquidity. Over the past two weeks, trading volume has been incredibly high, and many people are willing to pay for high-quality trades. Every day, we receive numerous inquiries about joining the market maker program. People see market liquidity and realize they can make money by providing it, so demand is high.

Mable: Now you only have website and desktop versions. Will you develop a mobile app or distribute it through other front-ends?

Leonard: Actually, we do have a mobile version, but we may not have done enough publicity to let everyone know that we have a complete product.

Mable: Oh, really?

Leonard: Yes, we have an Android version, which is available for download on Google Play. The iOS version is still in the process of applying for listing on the App Store, but it is indeed available.

We're also collaborating with other wallets. For example, we're working with Trust Wallet and SafePal to help us build our front-ends. Just like Base, Base and Phantom have also done similar things. We'll soon be launching with Trust Wallet, allowing everyone to start transactions directly with Trust Wallet or SafePal. We're working with multiple partners, and we'd love for any wallet to collaborate with us on their front-ends.

Because we support multiple chains, users don't need to transfer assets across chains first. For example, on Solana, you can deposit directly. So if any listeners would like to work with us on the front-end, rather than on our behalf, please feel free to contact us. We're also looking for partners.

- 核心观点:Aster致力打造链上版币安。

- 关键要素:

- 从永续合约扩展至多链交易平台。

- 独创暗池设计平衡隐私与透明。

- 代币分配80%锁仓确保公平。

- 市场影响:推动DEX产品创新与CEX竞争。

- 时效性标注:中期影响