Weekly trading volume exceeds Hyperliquid. Evidence of Aster's wash trading is as follows.

Original article from DeFi Warhol

Compiled by Odaily Planet Daily Golem ( @web3_golem )

Editor's Note: This morning, according to DeFiLlama data, Aster's perpetual swap trading volume exceeded $100 billion over the past seven days, surpassing Hyperliquid ($64.634 billion) and Lighter ($56.105 billion), ranking first among all perpetual swap DEXs. Furthermore, Aster's fee revenue reached $39.56 million over the past seven days, surpassing UniSwap ($28.95 million), Jupiter ($27.76 million), and Hyperliquid ($21.26 million), ranking third among all protocol fees in the network, behind only Tether and Circle.

Aster's impressive performance not only kept its price strong but also reignited the prep DEX market, creating a buzz around the DEX-versus-CEX, Aster-versus-Hyperliquid narrative. However, regarding Aster's surge in trading volume over just a few days, DeFi researcher Warhol believes this isn't organic growth, but rather artificial hype, wash trading, and orchestrated manipulation. Below, he explains his judgment based on data, arguing that true prep DEX adoption hasn't arrived yet and that everything is simply premeditated hype. Odaily has compiled the full text below.

Why pay attention to this matter

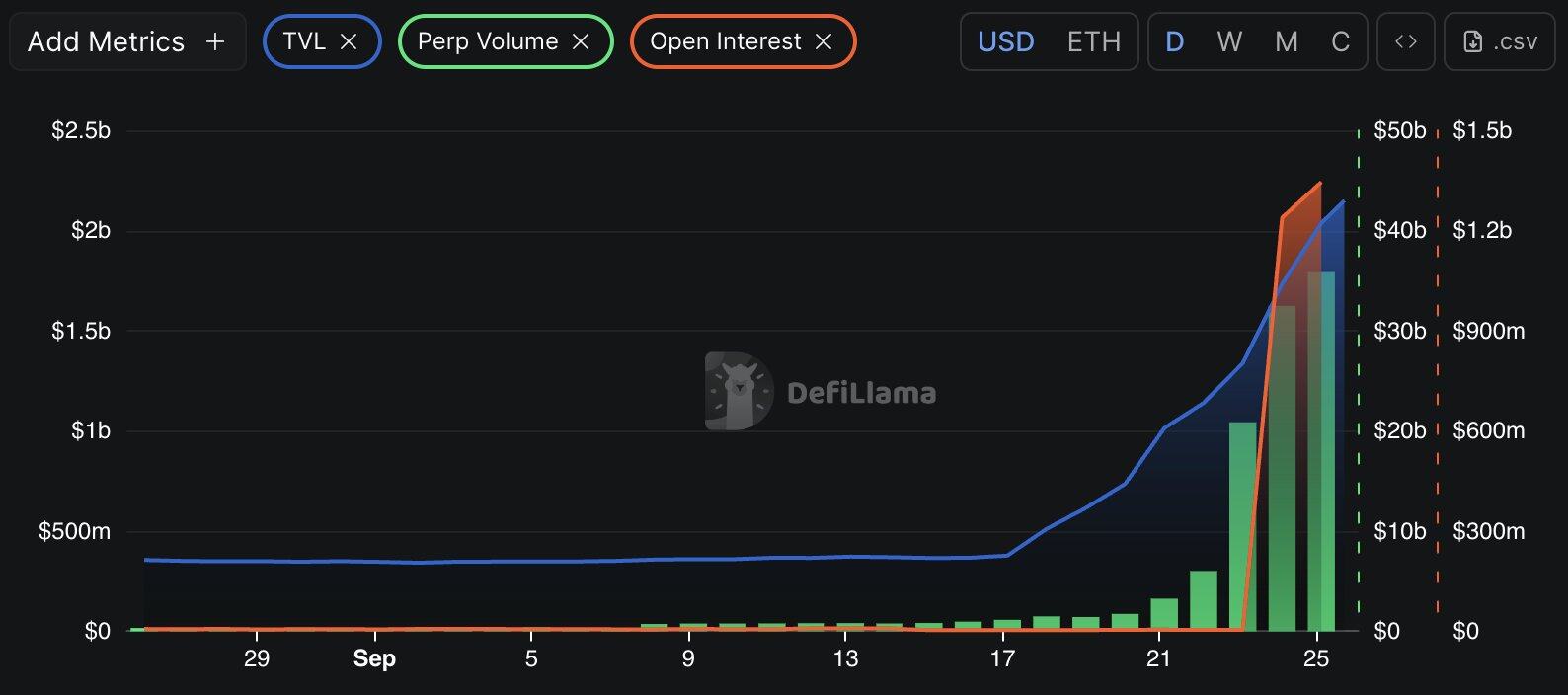

I became suspicious immediately when Aster’s daily trading volume jumped from $1 billion to $20 billion in just 7 days (September 16-23, 2025). This 20x growth rate exceeded all other DeFi growth stories I have studied.

Meanwhile, Aster’s open interest (OI) surged approximately 33x (from $3.7 million to $1.3 billion on September 24th), and its TVL soared approximately 500% in 30 days. In contrast, Hyperliquid’s metrics over the same period showed a stable, organic pattern.

The scale, timing, and speed of Aster’s growth prompted me to explore whether we were seeing genuine frenzy of adoption or artificial manipulation.

Abnormal trading volume

September 17

Volume: $1.1 billion

TVL: $378 million

OI: $3.62 million

September 24

Trading volume: $32 billion

TVL: $1.7 billion

OI: $1.2 billion

In contrast, Hyperliquid maintained a relatively stable trading volume pattern during the same period. The stability of Hyperliquid’s trading volume highlights the potential for human factors behind Aster’s surge in trading volume.

Reasonable transaction volume growth typically follows a user adoption curve and is associated with fundamental improvements to the underlying protocol, but neither is sufficient to explain the rapid growth exhibited by Aster.

Whale transfers and wash trading patterns

In the past 7 days, Aster had 156 large transfers of more than US$10 million, with an average transfer size of US$45.2 million , significantly higher than typical DeFi transaction patterns.

FalconX executed eight transfers totaling $680.4 million within a six-hour period on September 25. Analysis of transfer patterns revealed coordinated activity between the exchange and an unknown wallet, coinciding with a surge in Aster’s trading volume .

In a three-hour period on September 24th, Binance transferred a total of $877.67 million in USDT to Aave, preceding a surge in Aster trading volume. This temporal correlation, combined with the systematic nature of the transfers, suggests an orchestrated liquidity manipulation at Aster aimed at inflating trading metrics.

Fee and revenue structure

DeFiLlama’s data confirms my suspicions:

- Aster 24-hour costs: $12.03 million

- Aster 30-day cost: $27.9 million

- Aster TVL: $2.2 billion

This means Aster's daily fee-to-TVL ratio is approximately 0.55% , roughly 14 times higher than Hyperliquid's ratio of approximately 0.04%. However, only 59% of these fees are converted into net revenue, compared to Hyperliquid's efficiency of around 99%. This suggests that fees are being recycled through artificial trading rather than generating sustainable revenue from real traders.

Points system

In addition, Aster has introduced a points system, where points are awarded based on trading activity and volume. This is important because it introduces a direct incentive to increase trading volume.

This gave wash traders another reason to recycle fees by generating rewards through points, effectively legitimizing circular trading under the guise of user loyalty. The timing of the points system's introduction coincided with the peak of Aster's suspicious trading volume growth, suggesting that Aster was intent on prolonging and legitimizing its manipulation activities.

in conclusion

Aster's growth was not organic. Within seven days, its daily trading volume increased 20x, its open interest surged 33x, and its daily fees reached $12 million, yet its revenue conversion rate was low . Furthermore, Aster's heavy reliance on BSC and cross-chain wash trading, coupled with a points system that amplified the incentive for manipulation , led to the conclusion that this was an organized manipulation campaign rather than a true prep DEX adoption initiative.

- 核心观点:Aster交易量暴涨系人为操纵非真实增长。

- 关键要素:

- 7天交易量激增20倍至320亿美元。

- 巨鲸协同转账与交易量峰值高度吻合。

- 费用/TVL比率异常高但收入转化率仅59%。

- 市场影响:暴露DEX数据造假风险,引发监管关注。

- 时效性标注:短期影响