The final battle for payment begins: Plasma and WLFI both bet on PayFi debit cards to compete for stablecoin payment access

- 核心观点:PayFi赛道成加密行业新风口,潜力巨大。

- 关键要素:

- Plasma用户获万倍收益,市场反响热烈。

- WLFI将推借记卡,绑定Apple Pay支付。

- 稳定币市值破2950亿美元,创历史新高。

- 市场影响:推动稳定币支付应用普及,竞争加剧。

- 时效性标注:中期影响

Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

Plasma (XPL) unexpectedly made such a generous offer this time. Almost all users, whether participating in the public offering or making deposits, received substantial returns. Some even earned 11,000 XPL with a single unit of capital, achieving a remarkable "10,000x return." A few days ago, Plasma officially launched Plasma One, a stablecoin-native financial application, to a cautious market reaction. This time, the real money returns were clearly more sought after. Its investment in PayFi is also seen as a strategic move.

Coincidentally, WLFI co-founder Zak Folkman recently announced the upcoming launch of a debit card supporting Apple Pay and using the USD 1 stablecoin. With two major projects simultaneously launching the "PayFi U Card," what's the underlying motivation? Odaily Planet Daily will provide a brief analysis and discussion of this matter in this article.

When stablecoin projects follow the path of internet giants: PayFi will be carried out to the end

The launch of Plasma One signifies that Plasma, the public stablecoin blockchain backed by Tether and PayPal founder Peter Thiel, is expanding its reach far beyond the cryptocurrency market to encompass over 150 countries and regions worldwide. For a detailed introduction to Plasma One, we recommend reading "PayFi's Big Bang Arrives, XPL Launches Imminently: Does Plasma One's DNA Matter?"

Similarly, the launch of the debit card by WLFI also shows that this top-tier project, which promotes the concept of "Trump family crypto project", has great ambitions - they not only want to grab huge liquidity in the crypto market by issuing coins, but also intend to make achievements in stablecoin payments and transactions.

WLFI Lianchuang stated: Launching debit cards, not developing a public chain

Zak Folkman, co-founder of WLFI

At the recently concluded Korea Blockchain Week 2025 Impact Conference, World Liberty Financial co-founder Zak Folkman announced that the project will soon launch a debit card, allowing users to directly link the USD 1 stablecoin and the WLFI app to Apple Pay. Furthermore, Folkman described WLFI's upcoming retail app as "Venmo for credit cards x Robinhood for trading," combining traditional Web 2 peer-to-peer payment functionality with Robinhood-like trading elements.

At the same time, he emphasized that the WLFI team will not launch an independent public chain, but will maintain chain and technology neutrality.

It can be seen that despite the precedent set by stablecoin public chains such as TRON and BNB Chain, and the follow-up by Plasma, Stable 2 and Tether-supported stablecoin public chains, the WLFI team still has a clear understanding of its own capabilities and business scope.

Or perhaps, the WLFI core team understands that compared to building a brand new ecosystem from scratch, it is more appropriate to leverage their existing "resource advantages" to focus on "asset issuance and application". With the upcoming implementation of the US stablecoin regulatory bill "GENIUS Act", PayFi will be one of WLFI's next business priorities.

The intersection of crypto projects and internet companies: the golden age of payment applications

It is worth mentioning that Plasma and WLFI have successively announced that they will soon launch PayFi-related debit cards and financial applications, which is quite similar to the momentum of domestic Internet giants Alibaba using the Chinese New Year's lucky character collection to promote Alipay and Tencent using the Chinese New Year red envelopes to promote WeChat Pay. Both of them use payment scenarios to promote and popularize their own related businesses.

Of course, there are objective differences, such as:

1. Different business scope: Traditional internet giants’ businesses are concentrated on internet platforms and are more closely connected with the mainstream population; crypto projects’ businesses are relatively concentrated among the crypto crowd and require additional efforts to penetrate the crowd and radiate to a wider range of user groups.

2. Different payment currencies: The payment businesses of traditional internet giants are primarily focused on fiat currency transactions with upstream banks and downstream users. However, crypto projects need to deal with more complex business relationships, including the upstream traditional banking system and a complex network of card issuers. They also need to manage and balance the relationships and ecological closed loops between downstream individual users, institutional users, and various crypto protocols.

3. Different promotional scenarios: Traditional internet giants can leverage special events (such as Chinese New Year and holidays) to run promotions and provide payment incentives. However, crypto projects' payment services must consider both the economic returns demands of the crypto community and the high-frequency demands of everyday users, such as payments. Compared to internet-based promotions like giving out red envelopes and collecting lucky characters, crypto and mainstream users may prefer tangible "high-interest deposit" initiatives. This is why Plasma's TGE was so well-received by the market.

Of course, the above differences are also methods and potential opportunities that crypto projects can learn from, which also highlights the importance of payment applications in the Web 2 & Web 3 industries.

It's undeniable that, as crypto mainstreaming accelerates, payment applications incorporating stablecoins have become the undisputed "king-level track" in the crypto world due to their diverse scenarios, high-frequency demand, and vast user base. It's no exaggeration to say that whoever masters the PayFi scenario has found a new, highly competitive stablecoin distribution channel.

Stablecoin issuance hits new high, Plasma and WLFI target new stablecoin distribution channels

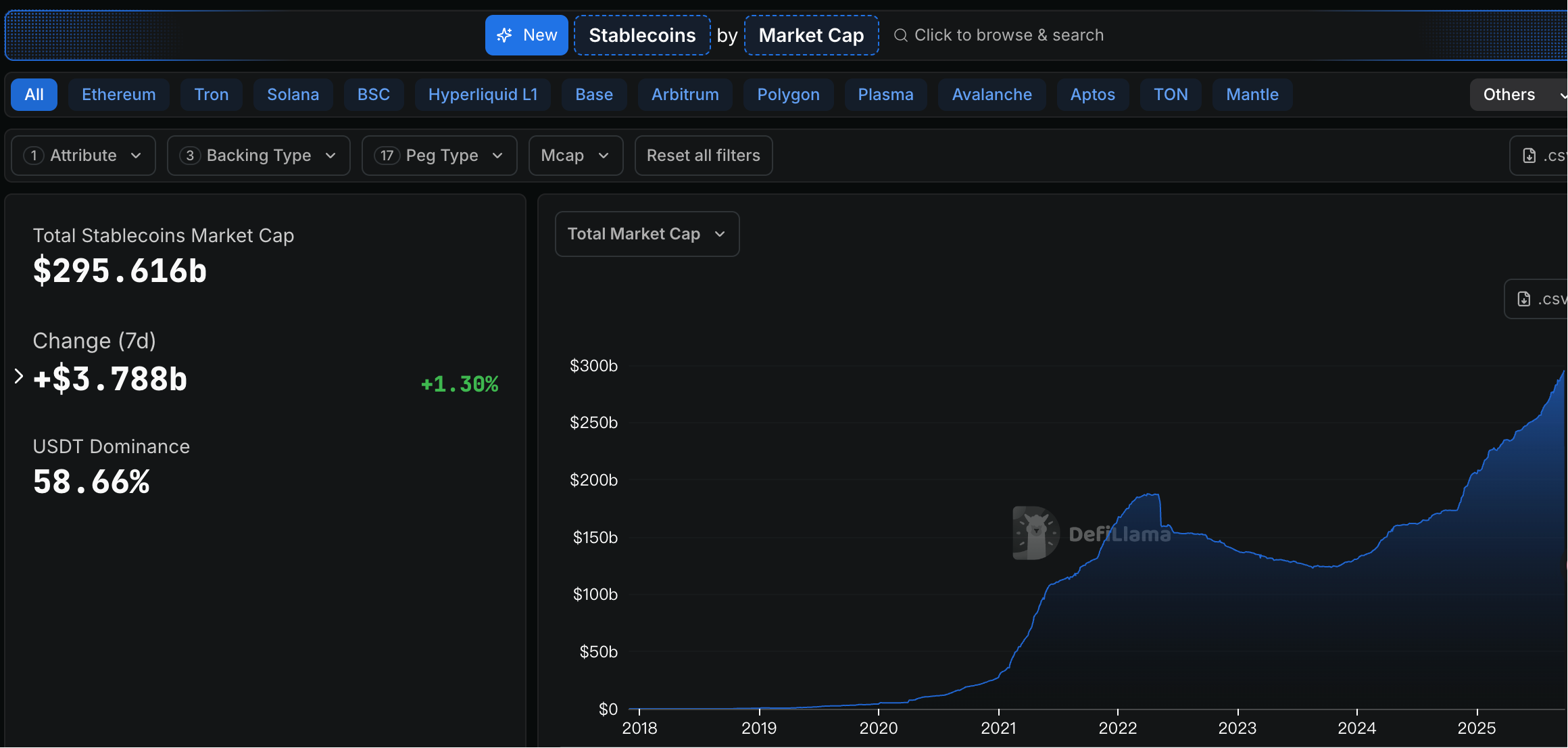

According to data from the DefiLlama website , the overall market value of stablecoins has exceeded US$295 billion, temporarily reported at US$295.616 billion, with a 7-day increase of 1.3%, continuing to set a new historical high.

At the same time, the supply of USDT on the Ethereum chain reached 80 billion US dollars, surpassing the Tron chain to regain its dominant position ; the issuance of Solana stablecoin exceeded 30 billion US dollars . From 2025 to the present, Circle has issued a total of 31 billion US dollars of USDC on the Solana chain.

After Circle's strong debut on the U.S. stock market as the "first stablecoin stock" and the passage of the U.S. stablecoin regulatory bill "GENIUS Act", the stablecoin track ushered in a wave of incremental growth - the number of stablecoin issuers increased sharply, followed by a steady increase in the issuance of stablecoins.

DefiLlama data

Not only that, crypto projects in the stablecoin track have also ushered in a large wave of competitors from traditional finance and the Internet.

Stablecoin issuance faces disruptors: 9 European banks plan to issue euro stablecoins, PayPal increases its investment in PYUSD, and internet infrastructure provider Cloudflare also joins the group.

Yesterday , nine European banks—ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International—announced the formation of a new company with plans to issue a Euro-denominated stablecoin regulated by MiCA in the second half of 2026. The company will apply for an electronic money institution license from the Dutch central bank, aiming to establish itself as the European digital payments standard and open it up to more banks. The stablecoin will support low-cost, near-real-time cross-border payments and digital asset settlement.

Global payments giant PayPal announced a partnership with decentralized finance platform Spark, aiming to expand on-chain liquidity for PayPal USD (PYUSD) from its current $100 million to $1 billion through decentralized finance lending. PYUSD, issued by Paxos and pegged to the US dollar, has been integrated into SparkLend, Spark's lending marketplace. This integration allows users to provide and borrow PYUSD, with liquidity backed by Spark's $8 billion stablecoin reserve. Within weeks of its launch, PYUSD deposits on SparkLend have exceeded $100 million.

Internet infrastructure company Cloudflare (NYSE: NET) announced plans to launch the NET Dollar, a U.S. dollar stablecoin designed to provide instant and secure transactions for AI-driven online activities. According to the company, the NET Dollar will modernize payment infrastructure by enabling transactions across currencies, regions, and time zones. The stablecoin is designed to enable programmatic operations, enabling AI agents to make instant payments based on predetermined conditions.

The fact that so many different players have joined the market shows how many people are interested in the stablecoin track, and this is naturally inseparable from the huge market size.

Citibank: Stablecoins may reach $4 trillion in 2030, and bank token trading volume may exceed $100 trillion

In its latest report , Citigroup raised its forecast for global stablecoin issuance in 2030 to $1.9 trillion under the baseline scenario, and up to $4 trillion under the bull market scenario, corresponding to an annual transaction volume of $200 trillion.

The report also points out that driven by businesses' demand for regulatory protection, the trading volume of bank tokens (such as tokenized deposits) may surpass stablecoins and is expected to exceed US$100 trillion by 2030. Citi believes that stablecoins, bank tokens, and central bank digital currencies (CBDCs) will coexist in the long term, jointly promoting the reshaping of financial infrastructure.

If this data is combined with Tether's 2024 performance, which projects an average daily trading volume of $45 billion, the stablecoin industry's average daily trading volume will reach at least $550 billion in 2030, a 12.22-fold increase compared to Tether's current daily trading volume. If Tether's 2024 net profit of $13.7 billion is used as a conservative estimate, the stablecoin industry's net profit will be at least $167.4 billion.

The track with profits of hundreds of billions is exactly why Plasma and WLFI are now focusing on the PayFi track, because it may give birth to the next trillion-dollar market opportunity.

Conclusion: PayFi may become the "Crown of Cryptocurrency", just like the social track of traditional Internet

Now, just like the social track that controls the traditional Internet traffic entrance, PayFi is becoming a "big crown" in the encryption industry.

At a time when the winner of the stablecoin payment market is still undecided, whoever can seize the entry point and attract more users in the PayFi field will establish the deepest foundation in the traditional financial field and the cryptocurrency market, and earn greater profits without any effort.

Before the emergence of the “killer app” in the PayFi track, even a strong company like Tether needs to compete for a “ticket for stablecoin payment” just like Alibaba and Tencent once bet on online payment.