Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3)

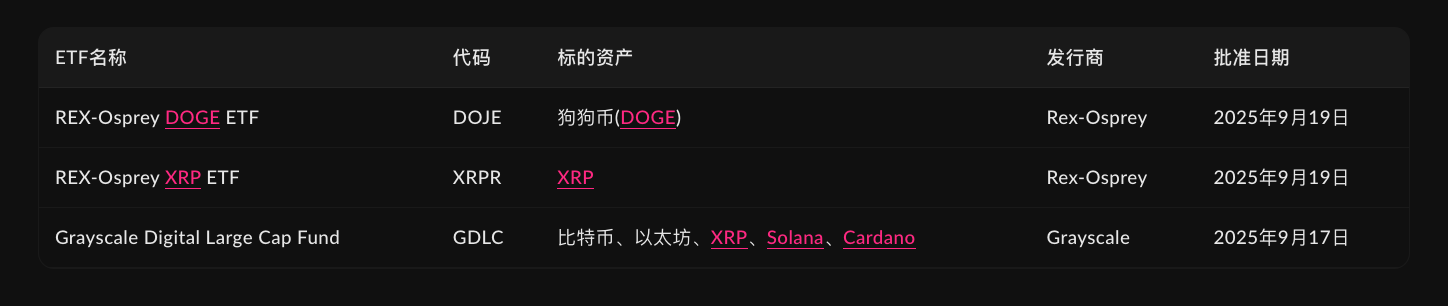

On September 18, DOGE and XRP spot ETFs were listed on the CBOE exchange, officially becoming the first altcoin ETFs to be approved after BTC and ETH. This means that they are no longer at the stage of "possible approval" but have entered the real trading market as compliant financial products.

Meanwhile, Grayscale's multi-asset ETF, "GDLC," was listed on NYSE Arca on September 19th. The product tracks the CoinDesk 5 Index, covering BTC, ETH, XRP, SOL, and ADA. Meanwhile, the highly anticipated BlackRock ETH collateralized ETF has again had its approval postponed by the SEC, with the final decision date extended to October 30th. Regulators stated that further evaluation of its collateralization mechanism and investor protection measures is required.

A wave of ETF listings is quietly taking shape.

However, despite the growing interest, market understanding of key information, such as which listings have been approved, which are still under review, and the approval progress and thresholds, remains fragmented. More importantly, with the SEC's implementation of "Generic Listing Standards," the approval model has shifted from a case-by-case approach to a standardized process, reshaping the issuance path, asset screening logic, and market ecosystem. In this rapidly evolving environment, fragmented "flash news" information is no longer sufficient to support comprehensive investor decision-making.

Based on this, Odaily Planet Daily will systematically sort out and respond to the following four core questions in this article: What is the actual progress of various types of crypto ETFs? Has the compliance channel been truly established? What substantial liquidity and awareness improvements will assets gain after being included in ETFs? What are the views of industry experts on the evolution of this trend?

Who's already listed? Who's still vying for the top? A table explains the current crypto ETF landscape.

For a long time, the term "crypto ETF" was largely reserved for Bitcoin and Ethereum. However, with the loosening of regulatory barriers and rising industry demand, we are already seeing a comprehensive expansion of ETF products in terms of quantity, types, and asset coverage starting in the second half of 2025.

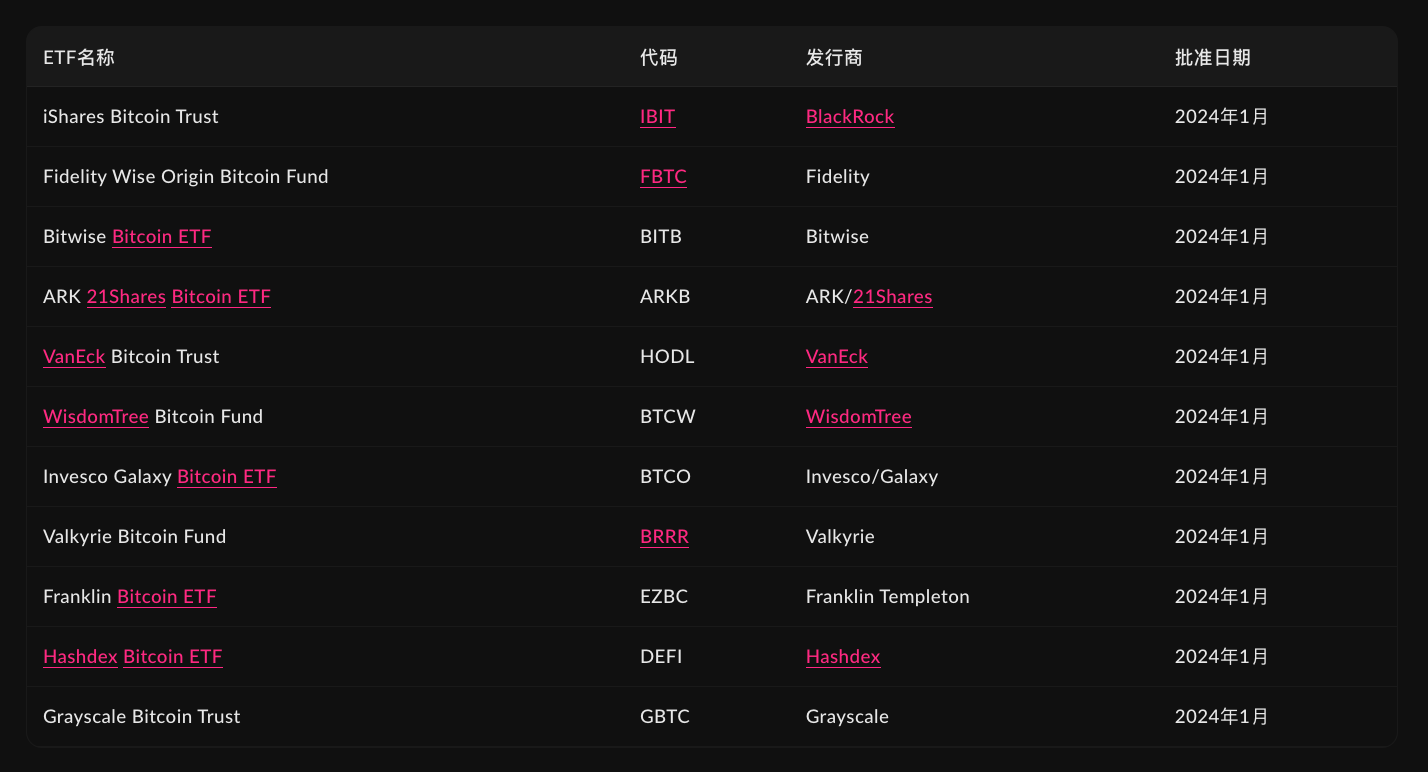

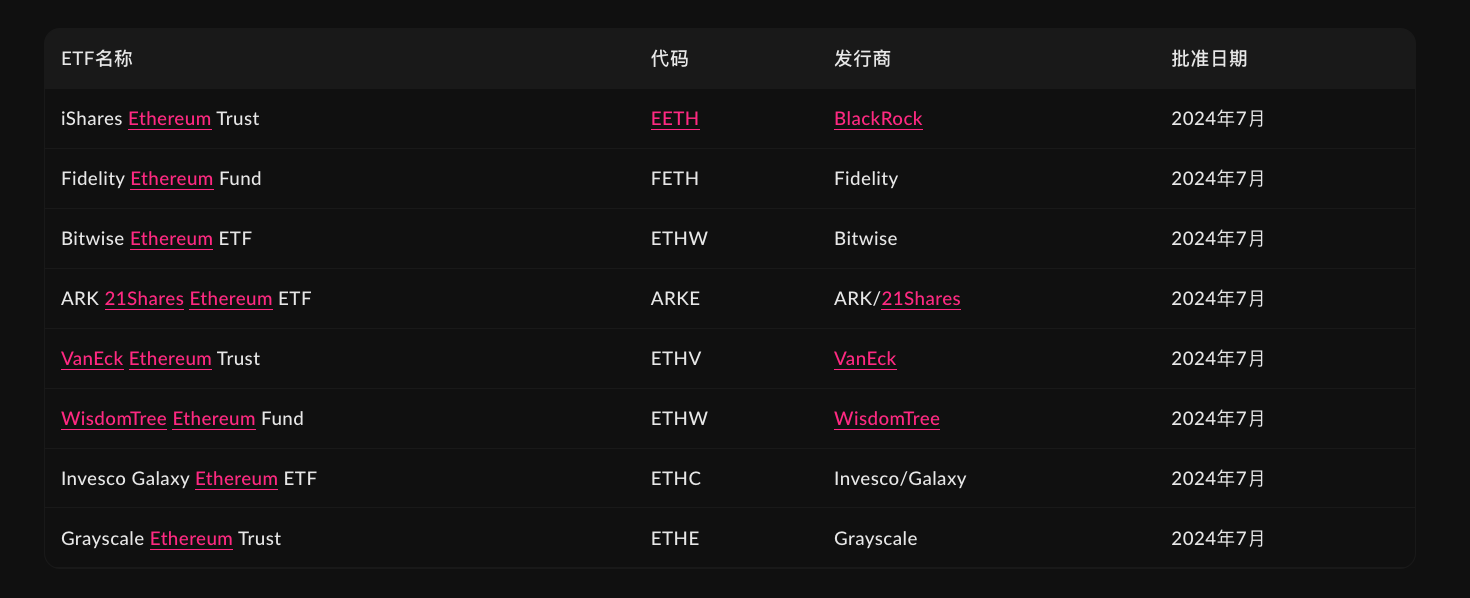

According to SEC public filings, as of September 25, 2025 , the following crypto ETFs have been officially approved for listing on the U.S. stock market:

Bitcoin spot ETFs (11 in total):

Ethereum spot ETFs (8 in total):

Newly approved spot crypto ETFs (3 in total):

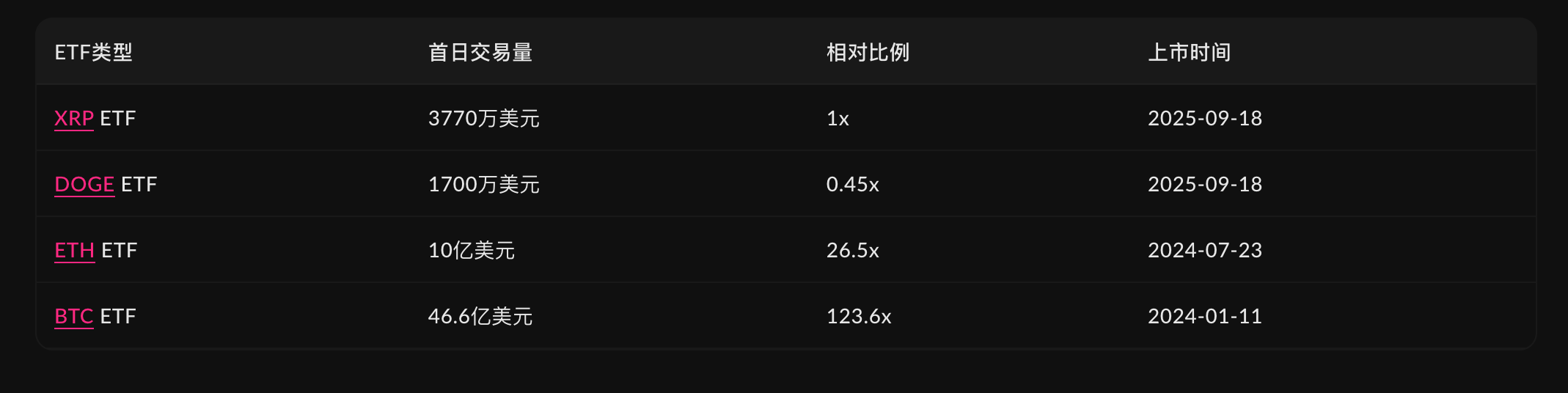

As pioneers, BTC and ETH have established advantages in funding and scale. DOGE and XRP, however, are the first altcoin ETFs approved under the universal standard, demonstrating the feasibility of the new system. Debut data shows that DOGE's first-day trading volume was approximately $12 million, and XRP's was approximately $37.7 million, for a total of $54.7 million. While this figure may not compare to the historic debut of the BTC ETF, it is significantly higher than the average debut value of new US stock ETFs, demonstrating that DOGE and XRP possess strong liquidity in the traditional secondary market.

Products currently in the "queue" are more worth observing. Data shows that the ETFs currently in the S-1 review process include:

These products have two things in common:

- Most of them meet the DCM futures listing requirement of six months under the "General Standard" . For example, SOL, LINK, DOT, and AVAX all have continuous futures trading records on compliant exchanges such as Coinbase.

- The issuer concentration is high, and leading asset management companies such as Grayscale and VanEck are expanding their product line matrix , rapidly deploying from single BTC/ETH to altcoins and combination ETFs.

At the same time, some currencies such as SHIB and XLM have also been launched for futures trading, but the issuers have not yet officially submitted S-1. They may become the next batch of target assets in the "application queue" .

“Universal Listing Standards” Open the Institutional Gate to Crypto ETFs

On September 17, the U.S. Securities and Exchange Commission (SEC) approved the "Universal Listing Standards for Commodity Trust Units", which is the most structural adjustment to the crypto ETP/ETF approval process since the launch of the Bitcoin spot ETF in 2024.

Under the old framework , any spot crypto ETF listing had to pass two hurdles simultaneously:

- The exchange filed a 19b-4 rule change to persuade the SEC to modify/exempt existing trading rules;

- The issuer submits an S-1 registration statement and undergoes a disclosure/structural compliance review.

Both steps are indispensable, and each step may be rejected, which has led to approval cycles of 6-8 months (such as Ethereum).

Under the new regulations , if a product meets the unified "universal listing standards," exchanges no longer need to submit a 19b-4 filing on a case-by-case basis, allowing it to proceed directly to the S-1 review process . The SEC will no longer exercise individual discretion over each product, but will remain responsible for the review and validation of the S-1 . This not only shortens the process but also reflects a shift in regulatory philosophy: from " whether to allow " to " how to regulate ." In other words, the ETF listing process has shifted from "temporary approval" to " proactive compliance according to standards ."

There are three compliance paths. Which assets can take this “fast lane”?

If any of the following conditions are met, the general standard can be applied and 19b-4 can be omitted (S-1 review is still required):

Path 1|ISG Regulatory Collaboration Path : The underlying commodity has available cross-market surveillance sharing arrangements in ISG (Intermarket Surveillance Group) member markets (emphasis on monitoring/sharing , not "spot performance").

Path 2 | CFTC/Futures Path (Most Common) : The underlying commodity must have a continuous trading record of 6 months or more on a CFTC-regulated DCM (Designated Contract Market) , and a fully shared surveillance agreement (CSSA) must be established between exchanges. This is crucial for altcoins. For example, DCMs like Coinbase Derivatives have listed futures on various platforms, including SOL, DOT, LINK, AVAX, SHIB, and HBAR. Assets that meet the "6-month futures history + shared surveillance agreement" requirement qualify for the Fast Track (but still require full S-1 disclosure and approval).

Path 3 | "40% NAV" Precedent Path : If an ETP listed on a national securities exchange already holds a commodity with a NAV of ≥40% , similar commodity trusts can follow this precedent and apply a common listing , minimizing case-by-case rule changes. This path is rarely used directly, but it provides a reference and convenience in certain structures.

The most obvious result is that the approval cycle is significantly shortened: the new framework reduces the shortest effective window from 6-8 months from submission to implementation to as fast as 75 days to complete the entire process (based on the S-1 review and supplementary document progress , not a guaranteed time limit).

If a cryptoasset “becomes an ETF,” what exactly does it gain?

Many people's understanding of the word "ETF" still remains at the level of "enabling more people to buy", but the institutional dividends it brings to crypto assets are far more than imagined.

First, there's the leap in compliance and accessibility . The ETF's shell brings it into the catalogs of national exchanges like the NYSE and Cboe. Brokerage firms can list it, investment advisors can allocate it, and mainstream platforms like Robinhood and Fidelity can "buy it with one click." This shift from a "token on the blockchain" to a "product in your securities account" is a transformation in its identity.

This is followed by an influx of real money . Bitcoin's experience proves this—cumulative net inflows exceed $57 billion; Ethereum has also recorded positive net inflows for several consecutive weeks since August. DOGE and XRP, while still relatively small, have at least paved the way for altcoins to become ETFs : DOGE's first-day trading volume was approximately $12 million, and this wasn't simply driven by headlines.

Another significant benefit of cryptocurrency ETFs is that they open the door to institutional capital . For strictly regulated institutions like pension funds, insurance companies, and fund-of-funds (FOFs), compliance is paramount. Consequently, ETFs have become a key entry point for these investors to invest in crypto assets; without this compliant vehicle, this long-term capital would be virtually unable to enter the market.

Finally, there's the "anchor" of market microstructure . After an ETF is listed, its price no longer solely follows the fluctuations of the native crypto market; it is constantly "calibrated" by subscription and redemption mechanisms, market making, and arbitrage funds. While daily fluctuations are often compressed, structural events can also amplify the impact of feedback loops—this is both a source of order and a price.

In a word : Becoming L1 may be a narrative pass, but becoming an ETF is the entry ticket into the compliance system .

There are large differences in the market

In this "new ETF cycle" triggered by the SEC's policy shift, different participants have offered vastly different interpretations and predictions from their own perspectives (Odaily Note: The following opinions are extracted and summarized, not the original sentences) :

Eric Balchunas (Bloomberg ETF Analyst):

The SEC's approval of universal listing standards paves the way for spot ETFs for approximately 12-15 tokens . Balchunas noted that the new rules allow tokens whose underlying assets have futures listed on Coinbase to be directly listed as spot ETFs under the Securities Act of 1933, significantly streamlining the approval process. He observed a swift market response, with the Meme Coin ETF (DOJE) boasting over $6 million in trading volume on its first day, far exceeding the typically under $1 million trading volume of similar new ETFs. This demonstrates strong investor demand for innovative crypto products and signals the accelerating integration of cryptocurrencies into the mainstream financial system.

Matt Hougan (Chief Investment Officer, Bitwise):

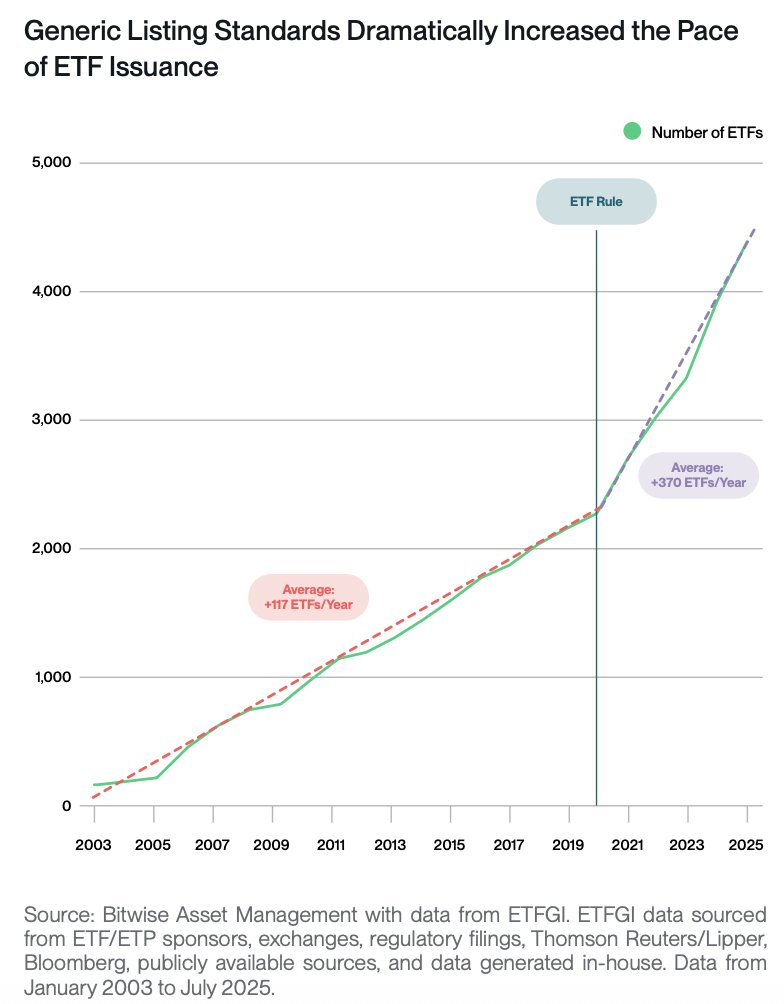

The SEC's approval of universal listing standards for cryptocurrency ETPs will trigger explosive market growth. Hougan likened this regulatory breakthrough to the 2019 "ETF Rule" for traditional ETFs, which surged annual ETF issuance from 117 to 370. He predicts a repeat of this trajectory in the cryptocurrency sector: standardized approval processes will significantly accelerate time to market, driving the emergence of innovative crypto asset allocation tools (such as thematic multi-token funds). Investors should be prepared for the industry's rapid growth.

James Seyffart, Bloomberg ETF analyst:

The U.S. SEC's approval of universal listing standards for cryptocurrency exchange-traded products (ETPs) marks a regulatory milestone. The establishment of this "long-awaited framework" means the approval process will be standardized and streamlined.

Seyffart predicts this will trigger a wave of cryptocurrency ETFs . He anticipates the market will "start racing" within weeks , with the first products potentially arriving as early as October. These new products will push boundaries, encompassing diverse assets never before considered investment targets. Examples include ETFs holding Dogecoin and Trump-related tokens like MEME, as well as multi-cryptocurrency asset funds focused on specific themes like "tokenization."

Under the new regulations, the primary listing criterion for cryptocurrency ETFs is that the underlying assets must have a futures market history of at least six months on a regulated exchange, such as Coinbase. However, cryptocurrency ETF products that do not meet this framework can still seek approval through the traditional individual application process. This move removes barriers between issuers and investors, paving the way for wider mainstream adoption of cryptocurrencies.

Caroline A. Crenshaw, Commissioner of the U.S. Securities and Exchange Commission:

This decision improperly shifts the review responsibility that should have been borne by the Commission to the exchanges, substantially weakening investor protection.

She emphasized that digital asset ETPs are extremely novel and undertested financial products. Their underlying cryptocurrency spot markets present unique risks of manipulation and fraud, and they lack the regulatory safeguards of traditional securities markets. Approving them for listing under simplified listing standards means they don't have to undergo the SEC's individual case review and public comment process, thus circumventing the key requirements of the Securities Exchange Act to prevent fraudulent and manipulative practices and protect investors.

Commissioner Crenshaw further noted that this move would further blur the important distinction between ETPs under the Securities Act of 1933 and the strictly regulated ETFs under the Investment Company Act of 1940, potentially leading investors to mistakenly believe that these products enjoy the same protections when, in fact, they are not subject to key provisions such as independent board oversight and review and examination by the SEC's Division of Investment Management. He reiterated that the SEC's core mission is to protect investors, not to provide a fast track to market for untested, high-risk products.

Conclusion

From BTC and ETH to DOGE, XRP, and the multi-asset GDLC, crypto assets are rapidly entering the core of traditional finance through the compliant path of ETFs. Compliance is gradually replacing market interest as the new screening criterion, while disclosure mechanisms and liquidity depth are also beginning to replace the stage previously dominated by emotions and narratives.

As process barriers gradually break down, key questions emerge: Which assets can withstand the liquidity fluctuations caused by subscriptions and redemptions? Who can establish a robust market-making mechanism? And which products can stand the test of time?

The answer is no longer written in white papers or short-term market value fluctuations, but is engraved in calm and hard-core real-world indicators such as futures data, secondary market depth and compliance disclosure.

ETFs are not the end, but the beginning of the institutionalized, layered evolution of crypto assets. This journey has only just begun.

Recommended reading: "US SEC approves 'universal listing standards', crypto ETFs are expected to explode"

- 核心观点:SEC新规推动加密ETF进入标准化审批新阶段。

- 关键要素:

- DOGE、XRP现货ETF已正式上市交易。

- 通用上市标准简化审批,最快75天完成。

- 需满足期货交易满6个月等合规条件。

- 市场影响:加速更多山寨币ETF上市,吸引机构资金。

- 时效性标注:中期影响