WLFI is about to open for trading. Understanding the ecosystem and valuation structure in one article

- 核心观点:WLFI 将政治叙事与金融工程结合,打造加密政治结构体。

- 关键要素:

- 公募两轮募资5.5亿美元,首轮回报或超867%。

- 稳定币USD1流通市值突破21亿美元,增速最快。

- ALT 5战略配售锚定WLFI估值0.2美元。

- 市场影响:或重塑加密市场政治叙事与资本模型。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3 )

The crypto market is about to usher in a new variable that deserves close attention.

World Liberty Financial (WLFI) official X once said that the goal is to open token trading at the end of August.

As an unprecedented experiment in combining "political narrative and financial engineering," WLFI has captivated American crypto investors and the market since the second half of 2024. Now, with the team fully locked up, public offerings unlocked in batches, and the TGE approaching, it's necessary to reexamine the project's current valuation logic, the on-chain performance of its stablecoin, USD1, and WLFI's capital investments and layout within the external ecosystem.

Based on these signals, the next stage of WLFI may not just be a "tradable governance coin", but a "crypto-political structure" that benchmarks TRUMP, imitates the MSTR model, and is bound to the USD1 multi-chain path.

How to Anchor Valuations: ALT 5, Justin Sun, DWF Labs, and Multiple Rounds of Price Gambling

In October 2024, WLFI launched its first public offering at a price of $0.015, raising a total of $300 million. A second round, launched on Trump's inauguration day in January 2025, raised an additional $250 million at a price of $0.05. These two rounds attracted over 150,000 users across multiple markets, including North America, Asia, and Europe, making it one of the most popular initial fundraising events from late 2024 to early 2025.

During the fundraising phase, the project adopted a "freeze circulation, bet on the future" strategy, making tokens untradable and limited to governance participation. While this mechanism was initially met with market skepticism, subsequent market performance has proven to be effective in filtering out speculative activity and fostering a more cohesive community structure. The community governance proposal was officially approved on July 17th of this year, followed by an official announcement on the 19th that the TGE might launch around the end of August. (This timeframe is an estimate, not a specific date; the original document stated it would be completed within 6-8 weeks from the date of the announcement.)

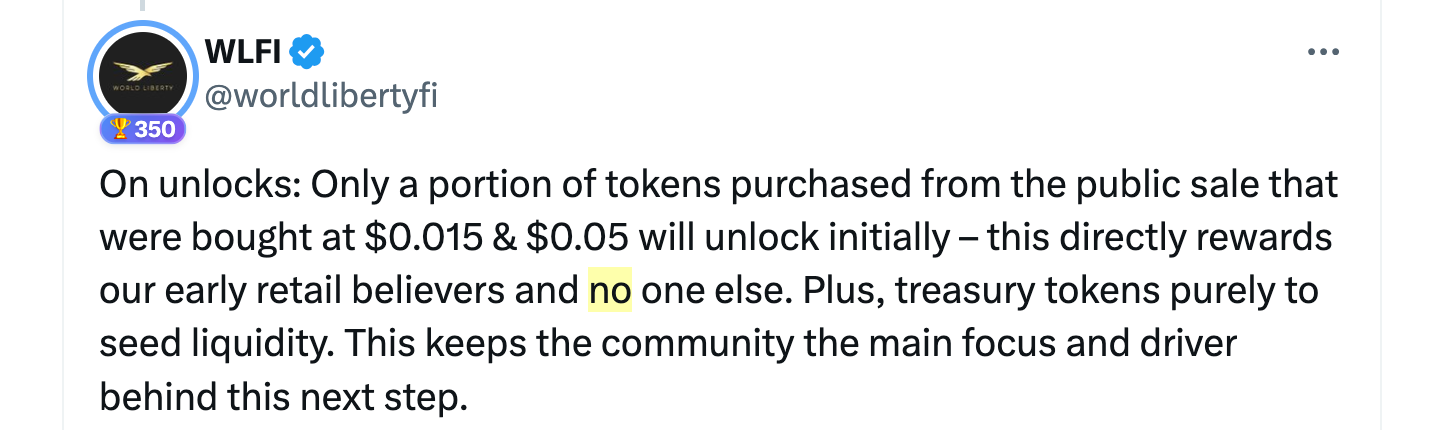

According to official statements and on-chain data, only early public offering round shares will be partially unlocked, while the core team, consultants, and strategic investors will all be locked in. The future unlocking rhythm will be determined by community voting.

On this basis, a review of over-the-counter trading data since July shows that WLFI's trading price has fluctuated between US$0.8 and US$1 (source: LBank Pro-Market data) , and the predicted probability of "FDV exceeding US$13 billion after TGE" on the prediction market Polymarket is as high as 74% ( data from August 14 ) . If compared with this FDV level, the return on first-round investors may exceed 867%.

Public information also shows that DWF Labs, Web 3 Port, and Aqua 1 Fund all made significant investments in strategic rounds. Among them, Justin Sun purchased 300 million WLFI tokens through Tron DAO in November of last year at a low price, even below the $0.015 cost of the public round, becoming one of the largest independent holders. This influx of capital not only enhances WLFI's institutional credibility but also lays a foundation for the subsequent market performance of the token after it is unlocked.

This previously unlisted governance token achieved its first off-chain valuation of $0.20 following a strategic placement by ALT 5 Sigma . According to the transaction structure, ALT 5 will issue 200 million new shares, half of which will be used directly for a token swap with the WLFI project. Based on a consideration of $1.5 billion, this gives each WLFI a book value of $0.20.

More importantly, this round of transactions carries with it even more political and financial signals. ALT 5 is not only a capital infusion provider but also a key component of WLFI's governance structure. Trump family member Eric Trump, WLFI CEO Zach Witkoff, and COO Zak Folkman have all joined ALT 5's board of directors. ALT 5 also plans to incorporate WLFI into its crypto treasury assets, building a new capital model known as a "decentralized corporate reserve."

It can be said that this move by ALT 5 not only provides a valuation anchor for WLFI, but also establishes it as the "political capital anchor" of the Web 3 world.

Stablecoin USD1: From on-chain depegging testing to the expansion of the points program

USD1, which is highly tied to WLFI, is also evolving rapidly.

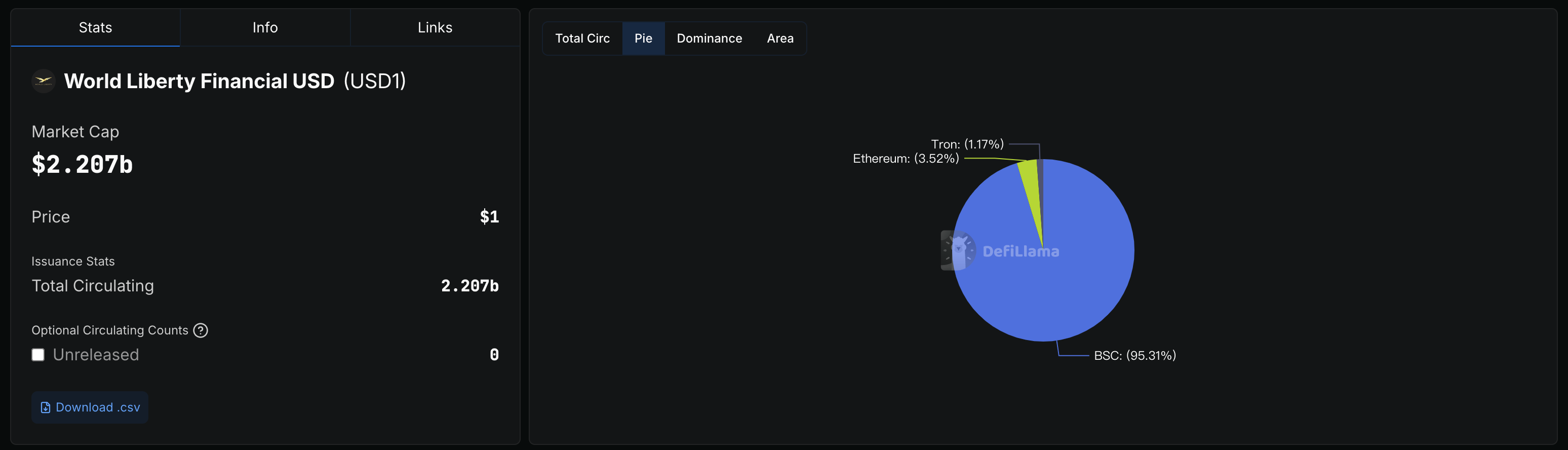

USD1 is WLFI's core stablecoin offering. Its structure is pegged 1:1 to the US dollar, with reserves consisting of US Treasury bonds and US dollar cash, and custodian BitGo Trust Company. This model is similar to USDC, but its market expansion strategy leans more towards centralized platform integration and off-chain resource injection. Since its official launch in March of this year, USD1 has rapidly gained market share thanks to its fiat currency reserve backing, BitGo custody, security audit certification, and the backing of the Trump family. In just two months, its circulating market capitalization exceeded US$2.1 billion, making it the fastest-growing newcomer in the current stablecoin landscape.

In terms of on-chain distribution, USD1 is primarily distributed on the BNB Chain , with approximately 90% of its token circulation occurring there. USD1 has also achieved compatibility with Ethereum and Polygon through the Chainlink CCIP and has also launched on the Tron chain. USD1 is currently integrated into trading pairs on exchanges such as Binance, HTX, and MEXC, and supports staking, lending, and redemption through protocols such as ListaDAO, StakeStone, and Falcon Finance.

However, the resulting high-frequency usage also exposed potential liquidity vulnerabilities. On July 29th, following the conclusion of the IKA Launchpad event on the Gate platform, USD1 experienced a temporary depegging due to a massive redemption of $200 million, sending its price plummeting to 0.9934 USDT. This sell-off, triggered by this massive redemption, was seen as a passive stress test for USD1 in the face of real market conditions. (See: "Can Trump's USD1 Remain Stable After Depegging Before Mass Adoption?" )

Fortunately, the price subsequently stabilized at 0.9984 and remained stable. On August 7th, the project team also announced the USD1 Points Program , which will provide users with points incentives through trading, holding, staking, and other behaviors. The program launched simultaneously with several major exchanges, including OKX, and plans to integrate the WLFI App and native on-chain DeFi projects to further strengthen the stablecoin's user stickiness and on-chain application layer.

However, the situation on the blockchain ecosystem is not optimistic. USD1 trading volume within the Binance ecosystem is currently limited. Previously, meme coins like BUILDon, usd1doge, and wlfidoge experienced gains ranging from several to dozens of times before disappearing, lacking any sustained momentum or a "leading effect." Whether the on-chain ecosystem can continue to thrive in the future will likely require further details of the points program.

But this cannot affect one fact: USD1 is no longer just "a subsidiary stablecoin of WLFI", but has gradually become the on-chain unit of account and fund intermediary of Trump's narrative.

Ecological expansion: Multiple rounds of foreign investment and asset acquisition under the treasury strategy

Rather than simply telling a story, WLFI is more adept at using money to justify its claims. The WLFI project has consistently emphasized the "encrypted treasury model" and has adopted a multi-dimensional expansion strategy in practice.

In the first half of 2025, WLFI has invested in or announced investments in the following projects:

- A strategic investment of US$10 million in Falcon Finance, with USD1 becoming its official collateral asset;

- A $6 million investment was pledged to Vaulta (formerly EOS) to promote the launch of its Web3 banking module in the United States;

- Purchased $6 million in Vaulta A and EOS through DEXs such as Pancake and exSat;

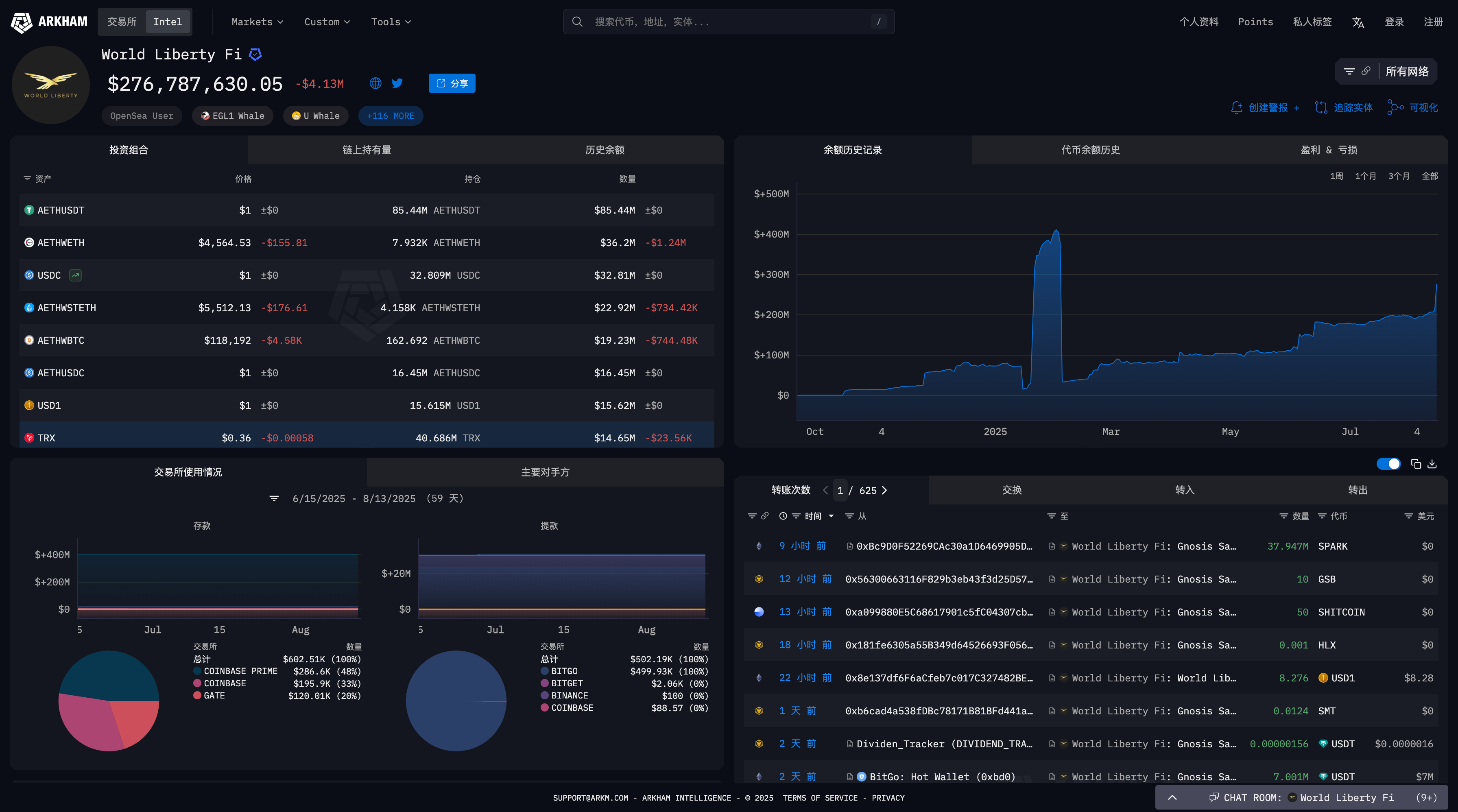

- Actively purchase mainstream crypto assets such as LINK, TRX, AAVE, SEI, AVAX, MNT, ENA, ONDO, MOVE, etc., with a total expenditure of over US$40 million.

Some of these assets (such as TRX, LINK, and AAVE) are included in WLFI's strategic treasury asset reserves to support the issuance of stablecoins and the construction of financial instruments.

A more significant step is WLFI's reverse capital injection into Alt 5. The project secured a seat on Alt 5's board through a token-for-equity swap and is driving the restructuring of its crypto asset management business around WLFI. This approach serves both as a valuation anchor and as a community governance signal.

According to co-founder Zak Folkman, three US-listed companies have expressed their willingness to consider including WLFI in their asset reserves. He pointed out: "We are trying to replicate Michael Saylor's path, but taking a stablecoin-led approach."

What is more noteworthy is that most of these investments revolve around the actual circulation and payment scenarios of USD1, directly consolidating its position as a stablecoin intermediary.

The crypto experiment of political capital is still in progress

From the "non-tradable" governance setting to the high anticipation for the upcoming TGE, from the rapid increase in the stablecoin USD1 to the ecosystem's wide-ranging capital layout, from the investor structure of Justin Sun, DWF Labs, and Aqua Fund to the speculative game on Polymarket where users bet on its FDV exceeding 13 billion... the underlying logic of this series of actions is clear:

WLFI is trying to transform political brand power into crypto-financial flows and build a complete closed loop from treasury mechanism, stablecoin issuance, scenario construction to community governance.

In the short term, the market will continue to compete around nodes such as TGE, unlocking ratio, and exchange debut. In the long run, whether this "crypto experiment from Trump" can continue to win market trust and withstand extreme volatility depends on whether it can truly achieve a high degree of coupling between political narrative and financial engineering.

The ecosystem built by WLFI is clearly not a single DeFi project, but rather a "scenario-based expression" of embedded political capital mechanisms in the Web 3 world. This is driven not only by the personal brand influence of the Trump family but also by the broader context of the new US administration's shifting attitude toward the crypto industry (e.g., the GENIUS Act). Therefore, WLFI isn't building a purely on-chain model like "anonymous community self-governance," but rather a cross-chain, cross-sector governance experiment.

If Polygon is a Web 3 model of India's political, business and technological collusion, then WLFI is an integrated exercise in "American-style crypto-nationalism."

However, we must also be aware of the risks : the circulation of tokens is extremely uneven (large investors hold highly concentrated positions); the project parties are intensive in strategic investment and have a large asset risk exposure; the stablecoin USD1 is still in the early stages of on-chain development and has not yet passed the test of large market capitalization stability; while political labels can bring attention, they may also amplify regulatory pressure.

Whether WLFI can truly break through simple political traffic and establish financial inertia in the future still depends on two core paths: first , whether USD1 can truly form a mainstream payment and settlement network on the chain ; second, whether the market circulation mechanism after TGE is stable and sustainable.

Conclusion: WLFI is destined to be more than just a token

World Liberty Financial currently stands at a trifecta of policy shifts, narrative transformation, and market recovery. It carries the burden of transforming American political influence into on-chain order, while also facing questions about how decentralized autonomy can be taken over by real-world capital.

Can WLFI become the next Trump? Can it emulate MSTR and become a paradigm for corporate treasury encryption? Can it break the curse of "political crypto = sentimental market capitalization" and ultimately achieve long-term financial compounding potential?

Whether you believe it or not, the era of WLFI is about to begin.