Decoding CZ’s “Call”: How to predict the next selected Binance portfolio?

- 核心观点:CZ推文通过筛选生态协同项目引发市场关注。

- 关键要素:

- SFP因CZ转发推文单日暴涨60%。

- 被投项目需与币安生态深度协同互补。

- 筛选标准为长期迭代与业务落地能力。

- 市场影响:推动市场重估币安系生态项目价值。

- 时效性标注:短期影响

How much power can a tweet have?

The answer is: to instantly increase the value of a token with a market capitalization of over $200 million by 60%.

This is the power of CZ. On September 24th, CZ retweeted SafePal's native integration with Aster, adding the comment: "SafePal is also part of our portfolio. We invested early, right after Trust Wallet." The price of SFP skyrocketed.

This is not an isolated case. In addition to the eye-catching Aster, CZ recently mentioned several projects invested by YZi Labs (formerly Binance Labs), all of which produced a significant order-calling effect.

If you look at these portfolios together, you will find that there is a very clear main thread behind them.

1. The correct way to open the Binance investment landscape

"SafePal is also a portfolio, btw. Invested way back."

CZ's words have also led many people to summarize an intuitive screening method, which is to go back to the coin issuance projects that YZi Labs has invested in, and there is a high probability that the next skyrocketing target will be discovered.

This logic sounds correct, but in practice, it is like "looking for a needle in a haystack". The reason is simple - Binance's investment portfolio is extremely large.

First, we need to understand Binance's investment strategy. The full acquisition of Trust Wallet in July 2018 marked the beginning of Binance's expansion, marking the evolution of its strategy from a single CEX to an ecosystem. Since then, Binance has gradually developed three major "investment levers" covering the entire project lifecycle:

- Incubator model (MVB, YZi Labs incubation program): casts a wide net to cover a large number of startup teams and early-stage potential projects, and then invests in some projects after final screening. The amount is relatively small, mainly incubating from 0 to 1;

- YZi Labs (VC Direct Investment): Targets mature growth-stage projects, offers higher precision and larger investment amounts, and aims to provide in-depth resource integration.

- Exchange-listed tokens (Alpha listing or new coin listing): focusing on mature projects, providing top-tier liquidity and market exposure;

It is through the combination of these three paths that Binance has almost covered the project layout of different stages and different tracks, and achieved a staggered layout covering the entire life cycle of different projects (early incubation, investment support, and listing and trading). Among them, direct investment in YZi Labs is the core of the mid- and early-stage ecological construction.

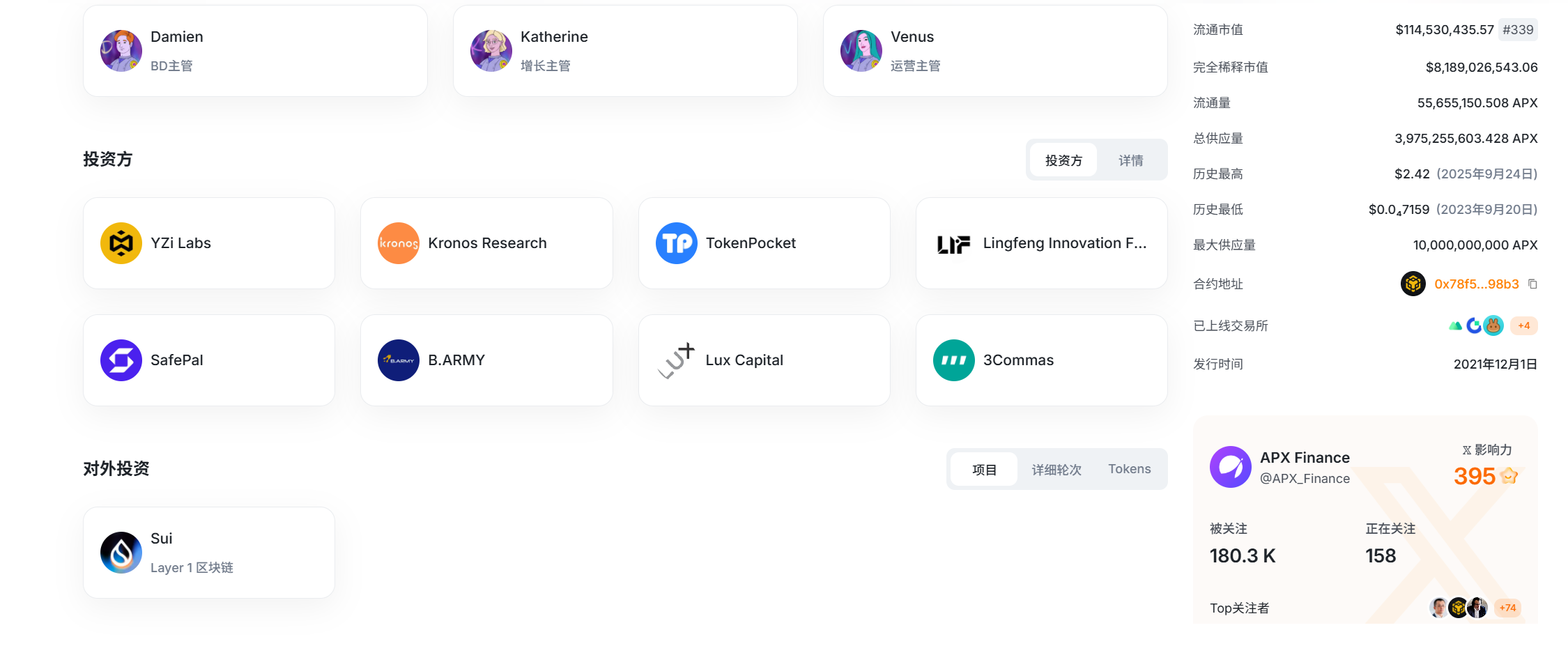

But the problem is that according to third-party statistics from the data platform Messari, YZi Labs (Binance Labs) has invested in (or laid out) more than 300 projects since its establishment. Obviously, simply using "having been invested in" as a screening criterion is basically equivalent to casting a wide net with no eyes, which is meaningless.

So, what is the real screening logic?

From the three cases recently mentioned by CZ, namely Aster, Sign, and SafePal, we can already identify some commonalities. They all meet several core characteristics:

- First, there's the high degree of ecological synergy with Binance. For example, Aster, as a prep DEX, completes the on-chain derivatives puzzle, alleviating pressure on Hyperliquid. SafePal, through its integration strategy closely aligned with Binance's product line, naturally achieves ecological complementarity between "custodial CEX & non-custodial wallet."

- Secondly, there must be a clear and sustained implementation cadence: Whether it's Aster (21 years), Sign (20 years), or SafePal (18 years), these projects are not new stars, but "veterans" who have persisted from 2018 to 2021, continuously promoting iteration and expansion over a long period of time;

This is also the key to interpreting CZ’s order logic.

2. Following the Map, CZ’s “Call Order” Logic

If you carefully review CZ's activity over the past few months, you'll find that his calls weren't impulsive; they were actually deliberate. By analysing his timeline, you can clearly see a clear, logical, and progressive pattern:

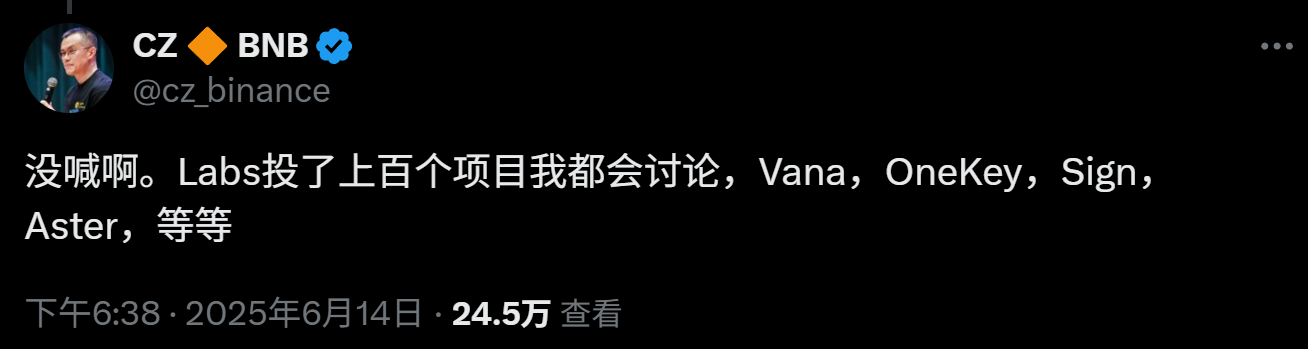

- On June 14, when CZ responded to the community's questioning about his "calling out Aster," he named a number of projects he had invested in, including Vana, OneKey, Sign, Aster, etc., laying the groundwork for the future.

- From June to September, CZ publicly mentioned or interacted with Aster several times, continuously injecting attention into it;

- On September 23, CZ specifically retweeted Sign, emphasizing its identity as a YZi Labs portfolio and revealing that he had personally acted as a matchmaker for it;

- On September 24th, it was SafePal's turn. CZ not only mentioned it by name, but also emphasized the early and strategic nature of the investment - "We invested in it a long time ago, right after Trust Wallet."

Aster, Sign, SafePal, Vana, and OneKey, without exception, are all portfolio ecosystem projects that can deeply collaborate with Binance's core business to deliver a "combination punch."

This indirectly shows that CZ’s “calls” are by no means random, but are a conscious attempt to guide the market and refocus its attention on those “old-school doers” who are deeply tied to the Binance ecosystem.

Taking SafePal as an example, if you understand its multiple identities in the Binance landscape, you can understand the tricks behind these "calls".

In Binance's wallet portfolio, many people may be more familiar with Trust Wallet, or OneKey, which recently received investment this year. However, to some extent, Trust Wallet is an established team that was acquired midway, OneKey is a newcomer that received investment later, and SafePal is truly Binance's first (hardware) wallet project that was invested in and incubated from scratch.

In September 2018, Binance acquired Trust Wallet and immediately included SafePal as the only wallet brand in Binance Labs' first incubator program. The investment was completed at the end of the year, while SafePal did not officially launch its first hardware wallet, the S1, until the first half of the following year.

In other words, before the product was officially launched, SafePal was already regarded by Binance as an important chess piece to occupy a position in the hardware wallet track. For this reason, in the context that Binance has never developed its own hardware wallet, SafePal remains the hardware wallet option with the most special strategic position and the deepest binding in its ecosystem.

In addition to hardware, its App wallet has almost become an extension of the Binance product matrix, almost replicating the core trading and asset management functions:

- CEX layer: The mini program integrates Binance's spot, leverage, contract, and wealth management portals, serving as a backup for the main site's core trading and asset management functions. Users can directly access the Binance app within the app to complete authorized login and trade.

- Trading layer: Swap (supports direct use of Binance main site liquidity), native support for BNB Chain and Aster, and gas-free transfer of BNB Chain stablecoins;

- Asset Management Layer: Financial management (natively supports Binance Earn), NFT, and DeFi modules are all directly connected to the BNB Chain ecosystem;

- Fiat Deposit Layer: Integrates Binance Connect fiat deposit and withdrawal channels, with built-in fiat purchase and U-pay support;

- Transfer layer: You can directly call up the Binance app to complete transfers from the currency details page in the app, without having to copy and paste the wallet address.

Note: Binance Mini Program for SafePal Wallet

Many old investors should have the impression that when Binance checked users in some countries/regions in 2021, the combination of SafePal + Binance DApp once became a "safe haven" for many users. This deeply bound synergistic relationship is probably one of the core reasons why CZ mentioned SafePal.

Therefore, when we expand this line of logic, we will find that CZ’s orders are not just casual calls. They are not just simple invested projects. What they point to are actually "ecological puzzle" projects that can work together with Binance's core product matrix.

3. Revaluation: Becoming a "Jigsaw Puzzle" Screening Game

So why is the value of these "ecological puzzles" worthy of re-evaluation by the market?

First of all, they both fill gaps in the Binance ecosystem:

- Aster is a key investment by Binance in the on-chain derivatives market, designed to address the competitive landscape of CEX/DEX and counteract emerging rivals such as Hyperliquid.

- Sign positions itself in the RWA narrative, laying a key foundation for Binance in the emerging on-chain RWA market;

- SafePal, through dual access points of hardware and apps, covers Binance's core trading and asset management scenarios, becoming the non-custodial wallet portfolio closest to its core business.

In their respective fields, they are not short-term narrative products of following hot trends, but exist as functional plug-ins in the Binance ecosystem, and to some extent are an irreplaceable part of its strategic puzzle.

Secondly, these projects have demonstrated long-term viability and have experienced complete bull and bear cycles, continuing to iterate and expand even when the market is cold. It is this BUIDL spirit that allows their narratives to not rely on short-term emotions, but to continuously build moats through product and ecological synergy.

Because of this, the market value of these projects is often seriously mismatched with their actual ecological niche, and CZ’s orders are often an external catalyst, pushing the market to begin to re-examine their true value.

There is also a very convincing special signal that many people have not noticed: SafePal itself is an early investor in APX Finance (the predecessor of Aster), and the tweet retweeted by CZ this time was precisely the release of SafePal as "the first wallet with native built-in integration of Aster."

This is a very interesting trend, indicating that CZ also agrees that high-quality "sub-projects" within the Binance ecosystem should work together to form a "1+1>2" matrix effect.

In addition, SafePal's most notable move this year is its deep integration with the compliant Swiss bank Fiat 24, allowing users to open bank accounts and apply for Mastercards directly within their wallets, creating a convenient channel for crypto assets to enter daily consumption (further reading: " Use U to Spend, a Nanny-Level Tutorial on Registration and Use of SafePal Mastercard ").

From investment to usage scenarios, this is the best footnote to what CZ calls the value of the ecological puzzle.

Final Thoughts

In other words, the real screening logic behind CZ's "call" for Binance portfolios is that you not only have to be able to "survive" in a bear market, but you also have to proactively prove that you can expand and capture new value in the large ecological pool of Binance.

Therefore, predicting the next lucky person to be named is essentially about finding wealth-creating factors that complement the Binance ecosystem and are truly worthy of attention.