Analysis of the USDX De-pegging Crisis: Structural Risks and Future Development Path of Delta-Neutral Stablecoins

- 核心观点:USDX脱锚暴露合成稳定币结构性风险。

- 关键要素:

- 创始人关联地址异常操作引发恐慌。

- Delta中性策略存在黑箱操作缺陷。

- 缺乏透明审计与有效风控机制。

- 市场影响:削弱市场对合成稳定币信任。

- 时效性标注:中期影响

USDX, a synthetic stablecoin issued by Stables Labs using a Delta-neutral strategy, suddenly and drastically de-pegged on November 6th, plummeting from $1 to below $0.60, a drop of over 40%. The trigger was unusual activity from an address directly linked to the project's founder, Flex Yang—ignoring annualized borrowing interest rates as high as 800%, it frantically borrowed all stablecoins (USDT, USDC, USD1, etc.) that could be used as collateral with USDX and sUSDX on DeFi platforms like Euler and Lista DAO, and immediately transferred the funds to centralized exchanges like Binance. When no more loans were available, the address dumped large amounts of USDX on PancakeSwap to obtain USDT, this reckless "escape" triggering market panic.

The USDX de-pegging incident exposed the structural risks of synthetic stablecoins—its Delta-neutral strategy was executed off-chain by centralized exchanges, creating an opaque "black box" operation, and the expansion of the strategy to altcoins further amplified the risk. Unlike USDe, which quickly recovered after a brief de-pegging, USDX lacks transparent proof of reserves and third-party audits, and the project team has yet to provide a clear explanation for the de-pegging. This incident once again demonstrates that in the complex protocol nesting and leveraged environment of the DeFi field, stablecoin projects lacking transparency and regulatory compliance are highly susceptible to trust crises in extreme market conditions, ultimately leading to insolvency and user losses.

Analysis of the Reasons for USDX Stablecoin De-pegging

Direct triggering factors

Abnormal activity at the founder's associated address: A wallet address directly linked to Stables Labs founder Flex Yang (starting with 0x50de) exhibited clear "exodus" behavior starting in late October. This address began receiving USDT from an address starting with 0x246a (directly flagged as Flex Yang by Arkham) from late July and transferring it to Binance. More critically, this address disregarded annualized borrowing rates as high as 800%, aggressively borrowing stablecoins (USDT, USDC, USD1, etc.) from multiple DeFi platforms such as Euler, Lista DAO, and Silo, and immediately transferring them to centralized exchanges like Binance. When no more stablecoins could be borrowed, the address dumped large amounts of USDX on PancakeSwap for USDT, a cost-insensitive operation that triggered market panic. This behavior clearly violates normal business logic—no rational investor would be willing to pay such exorbitant borrowing costs unless facing an urgent liquidity crisis.

Market liquidity depletion and its chain reaction: Abnormal operations led to the complete emptying of all assets in the DeFi market that could be collateralized with USDX/sUSDX, including USDT, YUSD, USD1, and even WBNB and BTCB in the Re7 Labs Cluster on Euler. Borrowing rates on Lista DAO using sUSDX as collateral to borrow USDT in the vault surged to over 800%, and if borrowers continue to default, these rates will continue to rise until forced liquidation. USDX liquidity pools on DEXs like PancakeSwap experienced severe skew. Although the Stables Labs project's multisignature address removed nearly $20 million in liquidity from PancakeSwap two days prior and then added another $10 million, it still couldn't stop the liquidity crisis from spreading. Large sell orders caused significant slippage due to insufficient liquidity, further accelerating the de-pegging process.

Fundamental structural problems

The inherent flaws and amplified risks of Delta-neutral strategies: USDX employs a Delta-neutral hedging strategy similar to Ethena, but expands its scope from Bitcoin and Ethereum to altcoins. While this can amplify returns in bull markets, it also significantly increases risk exposure. In extreme market conditions such as the "10.11 crash," this strategy is prone to ADL (automatic leverage) or hedging failure, leading to losses on collateralized assets. As the xUSD collapse case demonstrates, Delta-neutral strategies suffer losses on collateralized assets due to ADL in extreme market conditions. The risks accumulated from entrusting funds to third parties for off-chain operations and using cyclical leverage strategies ultimately erupted after third-party losses approached $100 million. USDX's problem is that it not only inherits the inherent risks of this strategy but also further amplifies the risk factor by extending it to altcoins.

The opaque "black box" operation and information asymmetry: USDX's hedging strategy is primarily executed off-chain on centralized exchanges, creating a severe information asymmetry. Although the official website shows over $680 million in reserve assets (with Binance accounting for the majority), the authenticity of this data cannot be verified due to the opacity of centralized exchanges. In stark contrast to Ethena's USDe, which regularly discloses third-party reserve verification and maintains a collateral ratio above 120%, USDX lacks regular third-party audits and a real-time reserve verification mechanism. This "black box" operation means that apart from the project team, no one knows the actual asset status and hedging effectiveness. When market anomalies occur, investors can only make decisions based on speculation and panic.

Governance Structure Deficiencies and Risk Control Failure: Stables Labs' governance structure suffers from significant flaws. The project entrusts substantial funds to third parties for off-chain operations, but lacks effective oversight and risk control mechanisms. While the use of cyclical leverage can improve capital efficiency under normal market conditions, it can also amplify losses in extreme situations. When third-party operations incur losses, these risks quickly spread throughout the entire system. More seriously, key project decisions appear to be highly centralized in the hands of the founders. When addresses associated with the founders begin to engage in abnormal activities, the entire project's reputation and stability suffer a fatal blow. This centralized governance structure contradicts the principles of decentralized finance and lacks effective checks and balances.

Systemic risk factors

Complex Nesting and Risk Transmission Among DeFi Protocols: USDX is widely used as collateral for DeFi protocols, forming a complex risk transmission network with multiple protocols. Of particular note is that Re7 Capital and MEV Capital simultaneously established markets for both USDX and the previously defunct xUSD. This high degree of correlation means that when one project encounters problems, the risk quickly spreads to related projects. The overlapping leverage between protocols makes it difficult to accurately assess the true risk exposure. For example, crvUSD can use a stablecoin issued with crvUSD as its underlying asset to issue crvUSD. This complex nesting structure makes it difficult to calculate exactly how many layers of leverage a basic underlying asset has been leveraged, even if all information is publicly transparent on-chain. When USDX began to de-peg, all DeFi strategies and lending positions using it as collateral were impacted, creating a systemic chain reaction.

Market Confidence Crisis and Panic Contagion: Given the recent collapse of xUSD due to the failure of its Delta-neutral strategy, a crisis of confidence already existed in the market regarding stablecoins employing similar models. The USDX de-pegging incident occurred at an extremely sensitive time, when investors' awareness of the risks associated with these "synthetic stablecoins" had significantly increased. The unusual behavior of the founder's associated addresses further exacerbated market panic, especially after it was discovered that Flex Yang was not only the founder of Stables Labs but also a former founder of Babel Finance and HOPE; his negative historical record amplified the crisis of confidence. The project team's lack of timely and transparent crisis communication, and the failure to provide a clear explanation to date, has allowed the crisis of confidence to continue to fester and spread throughout the entire DeFi ecosystem.

Regulatory Environment and Compliance Risks: Compared to traditional stablecoins USDT and USDC, synthetic stablecoins like USDX face significant disadvantages in terms of regulatory compliance. Traditional stablecoin issuers like Circle actively embrace regulation, undergoing regular audits and disclosing their reserve asset composition, which has built a strong reputation among institutional investors. While USDX claims to be a MiCA-compliant stablecoin issuer, its actual operating model deviates considerably from traditional stablecoins, resembling more of a structured financial product. In an increasingly stringent regulatory environment, this ambiguous positioning increases the project's compliance risks and limits its acceptance in the institutional market.

Market microstructure analysis

Imbalance in Liquidity Provision Mechanisms and Incentives: USDX's liquidity across various DEXs primarily relies on project-based liquidity provision and external liquidity providers. When market anomalies occur, external liquidity providers often quickly withdraw liquidity to avoid losses, leading to a sharp contraction in liquidity. While project teams attempt to stabilize prices by adjusting liquidity, these efforts are often insufficient in the face of large-scale sell-offs. The flawed design of the liquidity incentive mechanism results in liquidity being most scarce when it is most needed, creating a vicious cycle.

Arbitrage Mechanism Failure and Price Discovery Distortion: Normally, when USDX deviates from its pegged price, arbitrageurs profit by buying low-priced USDX and redeeming an equivalent amount in US dollars. This arbitrage activity helps the price revert to its original value. However, when the market questions the underlying assets of USDX, arbitrageurs fear the redemption mechanism may fail and are therefore unwilling to participate in arbitrage activities. This causes the normal price discovery mechanism to fail, and the price of USDX reflects market panic more than its intrinsic value. Abnormal operations by the founder's associated addresses further distort price signals, making it impossible for the market to accurately assess the true value of USDX.

What is Delta neutral stablecoin?

Definition of Delta neutral stablecoins

Delta Neutral Stablecoin is an innovative stablecoin based on a decentralized reserve protocol (DRP) that maintains value stability through a Delta neutral hedging strategy. Its core idea is to ensure that the overall value of the reserve pool is unaffected by fluctuations in the price of the underlying asset, thereby guaranteeing a 1:1 peg between the stablecoin and the US dollar. This solves the problem of insufficient reserves caused by collateral price fluctuations in traditional DRP stablecoins.

Operating Mechanism: Triple Income Combination

Delta, a neutral stablecoin, employs a "triple yield source" model: holding spot crypto assets such as BTC/ETH, simultaneously shorting an equivalent amount of coin-margined perpetual contracts, and obtaining stable on-chain yields through staking and other methods. By offsetting the +1 Delta from spot holdings with the -1 Delta from shorting perpetual contracts, the overall portfolio achieves Delta=0, ensuring that the USD value of the reserve pool remains stable regardless of crypto asset price fluctuations.

Core profit mechanism: Capital rate arbitrage

Delta's core profit driver for its neutral stablecoin is "funding rate arbitrage," a mechanism unique to perpetual contracts. When the number of long positions exceeds the number of short positions, long positions must pay funding rates to short positions to maintain the balance between the spot and contract prices. Historical data shows that funding rates are positive most of the time. Statistical validation has shown that this strategy has achieved a stable annualized return of 7%-10% in all historical years, providing stablecoin holders with an additional source of income.

Two main implementation routes

Route 1: Direct Hedging Mode (UXD, Pika, Ethena, USDX)

The direct hedging model is the most intuitive way to achieve Delta neutrality, with the protocol acting as a professional arbitrage trader. When users mint stablecoins, the protocol uses the received funds to purchase an equivalent amount of spot crypto assets (such as BTC or ETH) and simultaneously opens an equivalent short perpetual contract position on a centralized or decentralized derivatives exchange, forming a perfect Delta-neutral combination. Taking Ethena as an example, when a user deposits 1000 USDC, the protocol will purchase $1000 worth of spot ETH and open an equivalent short contract. Regardless of whether the ETH price rises or falls, the spot gains and contract losses completely offset each other, but the protocol continues to receive funding fee income to distribute to users. The advantage of this model is its simplicity, transparency, and ease of understanding for users. However, the challenges lie in the need for a professional risk management team, and the fact that hedging operations primarily rely on external exchanges, posing counterparty risk and ADL (automatic deleveraging) risk.

Route 2: Built-in Derivatives Market Model (Angle Protocol, Liquity V2)

The built-in derivatives market model is more complex and innovative. The protocol itself is a derivatives trading platform, independent of external exchanges for hedging. Users can open long positions within the protocol to gain price exposure, while the protocol, as the counterparty, naturally forms short positions, thus achieving overall Delta neutrality. Taking Angle Protocol as an example, when users want to gain BTC price exposure, they deposit margin into the protocol and open long contracts. The margin collected by the protocol is used to support the issuance of stablecoins, while the short risk borne by the protocol is hedged by the users' long position losses—when the BTC price falls, the margin losses of long users are replenished to the protocol's reserves, maintaining the stability of the stablecoin. The advantages of this model are complete decentralization, independence from external exchanges, and better composability. However, the challenge lies in the need for sufficient user participation to form a balanced long-short ratio, and the higher complexity of the protocol design, requiring sophisticated risk parameter adjustment mechanisms.

Advantages and disadvantages of Delta neutral stablecoins

Main advantages

High Yield: The biggest advantage of Delta neutral stablecoins is their ability to provide stable returns to holders. Historical data shows that through funding rate arbitrage, annualized returns can reach 7%-15%, far exceeding the zero returns of traditional stablecoins and bank deposit rates. For example, Ethena's USDe has even achieved annualized returns exceeding 20% during bull markets, providing DeFi users with an attractive source of passive income.

High capital efficiency: Compared to CDP models like MakerDAO that require 150%-200% overcollateralization, Delta neutral stablecoins can theoretically achieve a 1:1 or near-1:1 collateralization ratio, significantly improving capital utilization efficiency. Users do not need to lock up large amounts of excess assets to obtain stablecoins, freeing up more liquidity for other DeFi activities.

Decentralization: In particular, the built-in derivatives market model operates entirely on-chain, without relying on centralized institutions for issuance or redemption, aligning with the core principles of DeFi decentralization. Users can participate without KYC or geographical restrictions, enjoying true financial freedom.

Main disadvantages

Complex Risk Exposure: Delta neutral stablecoins face multiple complex risks. The most significant is ADL (Automatic Downsizing) risk, where exchanges may force liquidation in extreme market conditions, rendering hedging ineffective. Funding rate reversal risk, while rare, can lead to continuous losses. Other risks include liquidity risk, basis risk, and operational risk. The USDX de-pegging event is a typical example of these overlapping risks.

Centralization Dependence: Direct hedging heavily relies on centralized exchanges to execute hedging operations, which exposes the platform to counterparty risk, regulatory risk, and single point of failure. If the primary hedging platform experiences problems (such as the FTX collapse), the entire Delta neutrality mechanism may fail. Even decentralized, built-in derivatives models often require external dependencies such as oracles.

Liquidity and Size Limitations: The size of the Delta neutral stablecoin is limited by the liquidity of the derivatives market. As the project grows, it will require larger short positions in the derivatives market, but the market capacity is limited, which may lead to increased slippage and hedging costs. Furthermore, in extreme market conditions, a liquidity crunch in the derivatives market may prevent hedging operations from being executed properly.

Governance and Transparency Risks: The complexity of Delta's neutral strategy makes it difficult for ordinary users to understand and monitor the protocol's operation. Key decisions such as risk parameter settings and hedging strategy adjustments are often controlled by a small number of team members, posing a risk of centralized governance. Furthermore, especially in the direct hedging model, most operations are conducted off-chain, lacking real-time transparency.

Unstable Returns: Although funding rates have historically been mostly positive, they are highly volatile and can remain negative for extended periods. During bear markets or periods of extreme market pessimism, funding rates may turn negative, causing Delta-neutral strategies to incur losses rather than gains, thus impacting the sustainability of stablecoins.

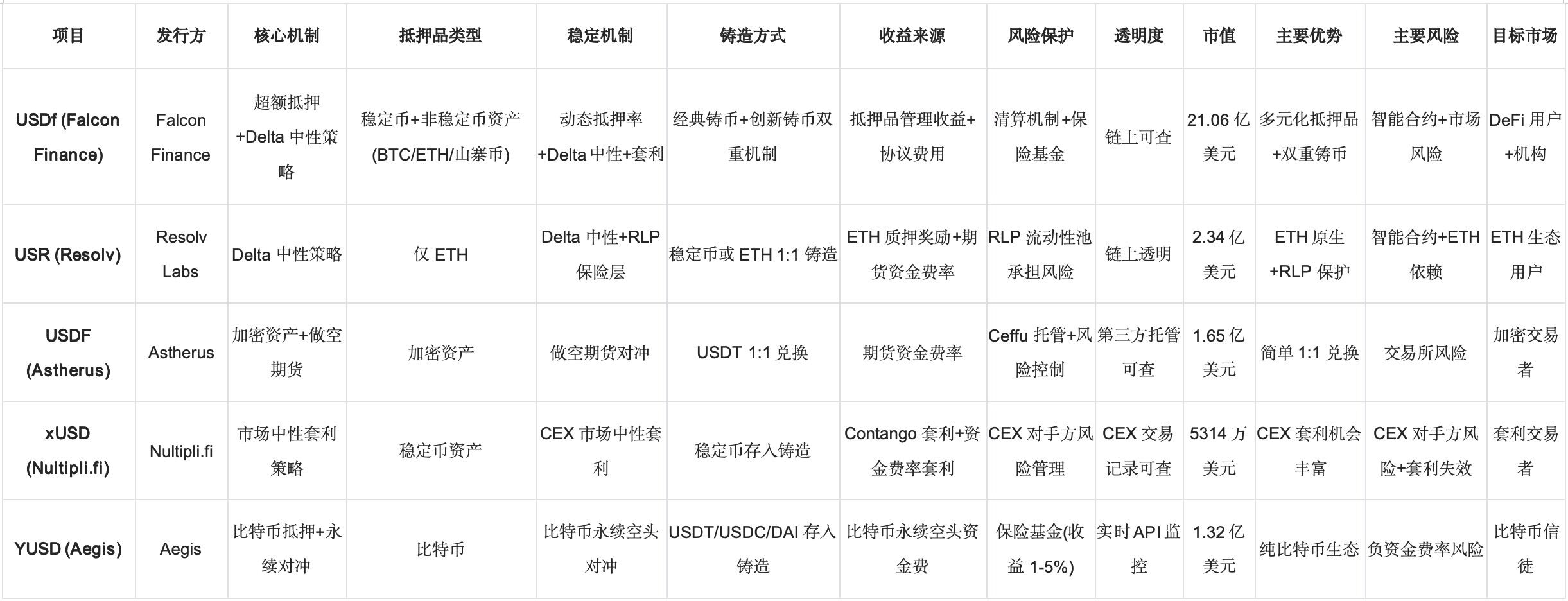

Delta's main neutral stablecoin projects

The value of the acquired assets is over $50 million.

The merits of USDX stablecoin operations and innovation

Given USDX's positive market response in the early stages, its relatively active ecosystem cooperation and multi-chain expansion, and its merits in operation, maintenance, and innovation, we will conduct an in-depth study from the following aspects.

- Stability maintenance and risk management

- Multi-chain scaling and liquidity optimization

- Revenue sharing incentive mechanism

- Ecological bridging and community-driven

Summarize

The USDX de-pegging crisis is not merely an isolated case of project failure, but a concentrated manifestation of the structural challenges facing the entire Delta-neutral stablecoin sector. From a direct triggering perspective, the abnormal operations of the founder-linked addresses exposed the centralized flaws in project governance and the failure of the risk control system. From a root cause analysis, the inherently complex risk exposure of the Delta-neutral strategy, the opaque off-chain operation model, and the complex nested relationships between DeFi protocols collectively constitute a fragile risk transmission network. Especially during the sensitive period following the xUSD collapse, the market's trust in these "synthetic stablecoins" was already weak, and the USDX incident further exacerbated investors' skepticism towards the entire Delta-neutral stablecoin model. This event once again proves that the pursuit of high returns coupled with a lack of transparency, decentralized governance, and effective risk control mechanisms ultimately leads to a systemic trust crisis.

Despite numerous challenges, Delta-neutral stablecoins still hold immense potential as a significant direction for DeFi innovation, with the key being finding a balance between profitability and security. Successful projects require several core elements: first, establishing transparent proof-of-reserve and real-time monitoring mechanisms to allow users to verify the protocol's true status; second, implementing an effective decentralized governance structure to prevent excessive concentration of key decisions in the hands of a few; and third, establishing a multi-layered risk management system, including insurance funds, emergency pause mechanisms, and progressive risk exposure management. From a technical perspective, the built-in derivatives market model offers better decentralization and composability compared to direct hedging, but it needs to address liquidity guidance and user education issues.