The four-year cycle ends, and the new order of encryption has arrived

- 核心观点:加密货币进入机构主导、结构变革的新秩序。

- 关键要素:

- ETF推动资本从散户转向机构。

- 稳定币拓展支付与资本市场需求。

- RWA将实体经济资产引入链上。

- 市场影响:市场分化加剧,需精选价值项目。

- 时效性标注:长期影响。

Original author: Ignas

Original translation: Luffy, Foresight News

I strongly agree with Ray Dalio's "World Order Change" model because it forces you to look beyond the short term and see the bigger picture. The same applies to cryptocurrencies: don't get caught up in the daily drama of a particular cryptocurrency's one-day fluctuations; instead, focus on shifting long-term trends.

In today's crypto industry, not only is the narrative rapidly shifting, but the entire underlying order has also changed. The cryptocurrency market in 2025 will no longer resemble that of 2017 or 2021. Here's my interpretation of this "new order."

Large-scale capital rotation

The launch of the Bitcoin spot ETF was the first major turning point.

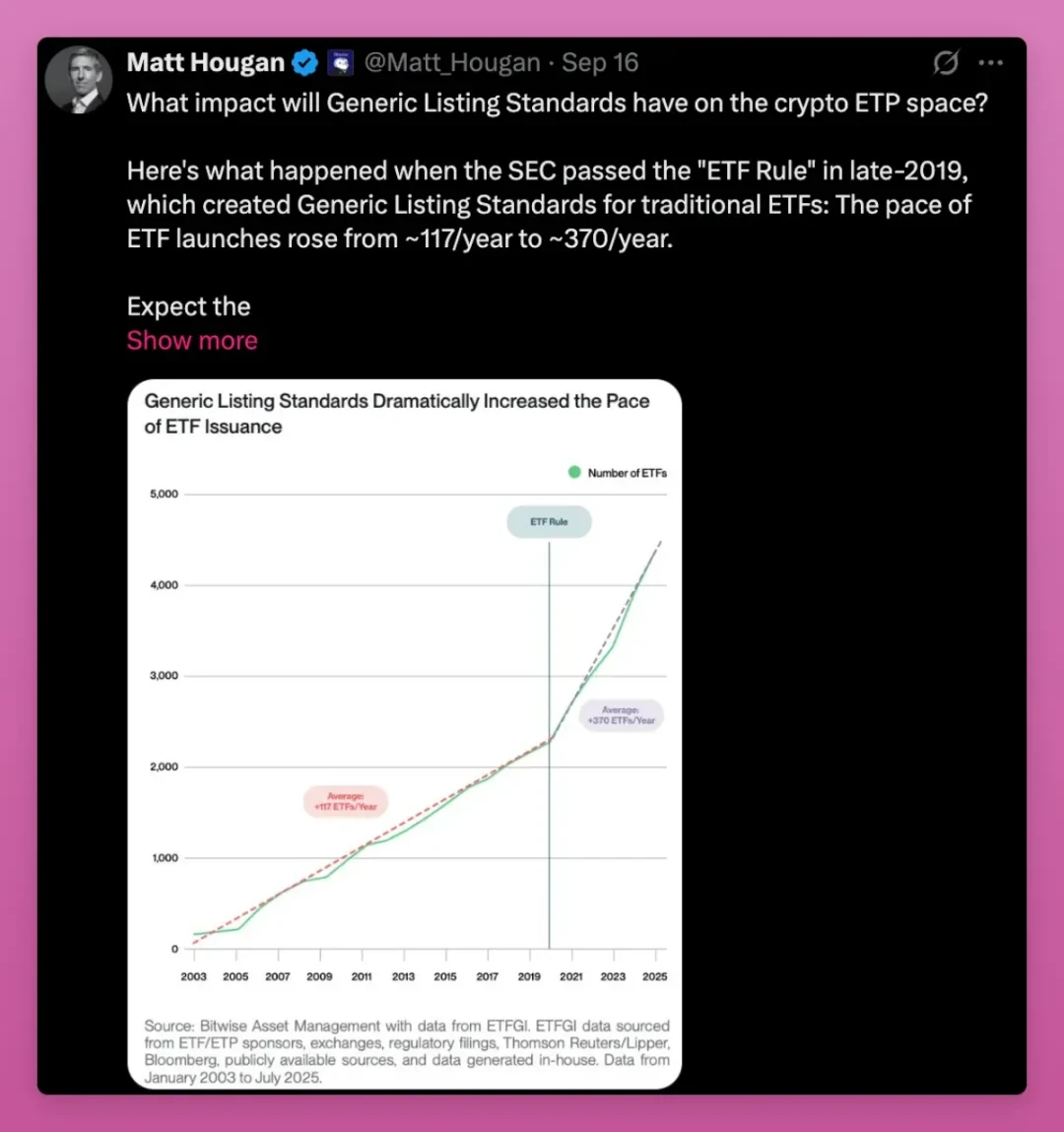

Just this month, the U.S. Securities and Exchange Commission (SEC) approved the "Universal Listing Standards for Commodity Exchange-Traded Products (ETPs)," which will accelerate the approval process for subsequent products and allow more crypto-asset ETPs to enter the market. Grayscale has already submitted an application under this new regulation.

The Bitcoin ETF set a record for the most successful ETF issuance in history; although the Ethereum ETF started slowly, its asset management scale has exceeded billions of US dollars even during the market downturn.

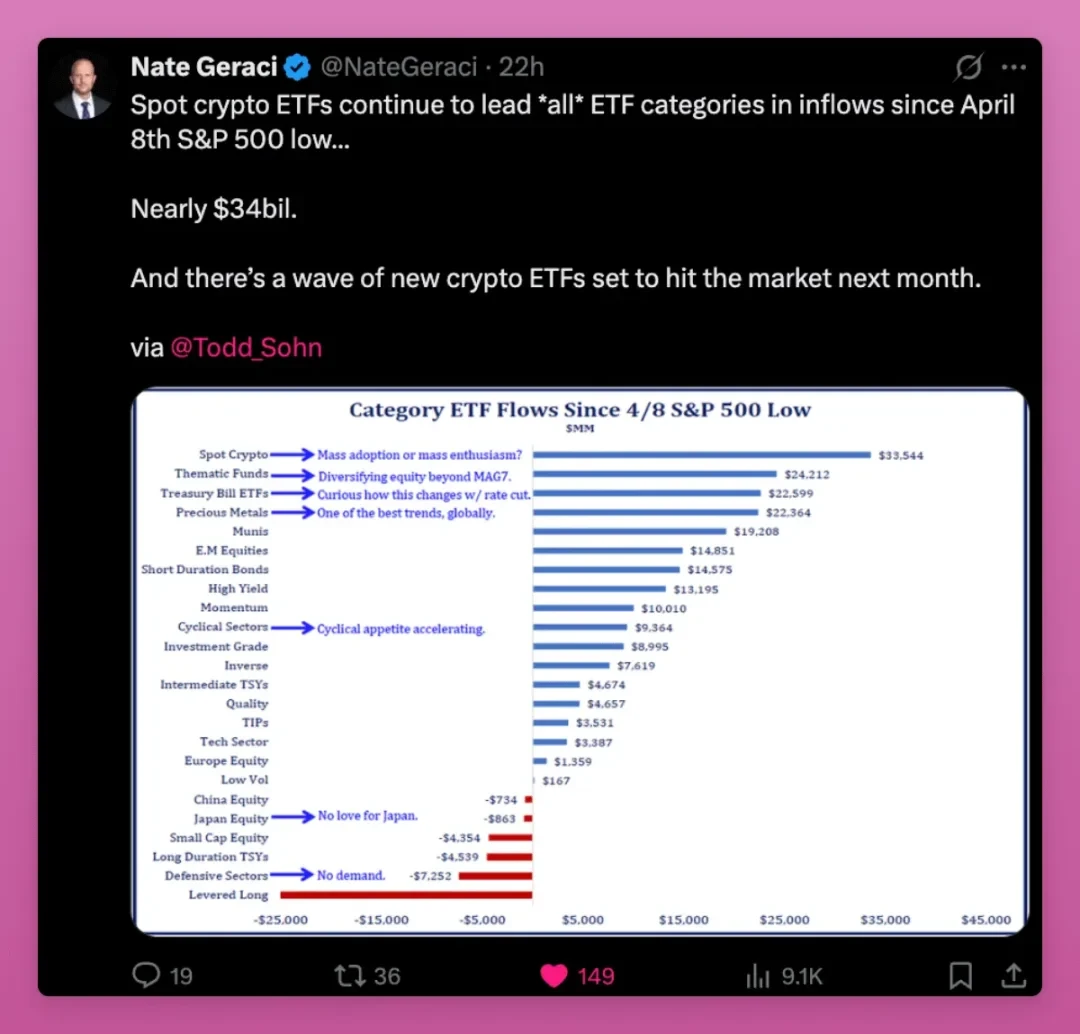

Since April 8, cryptocurrency spot ETFs have seen $34 billion in inflows, topping the list of all ETF categories, surpassing thematic ETFs, Treasury bond ETFs, and even precious metals ETFs.

Buyers of crypto ETFs include pension funds, investment advisors, and banks. Cryptocurrencies now appear alongside gold and the Nasdaq in discussions of asset allocation.

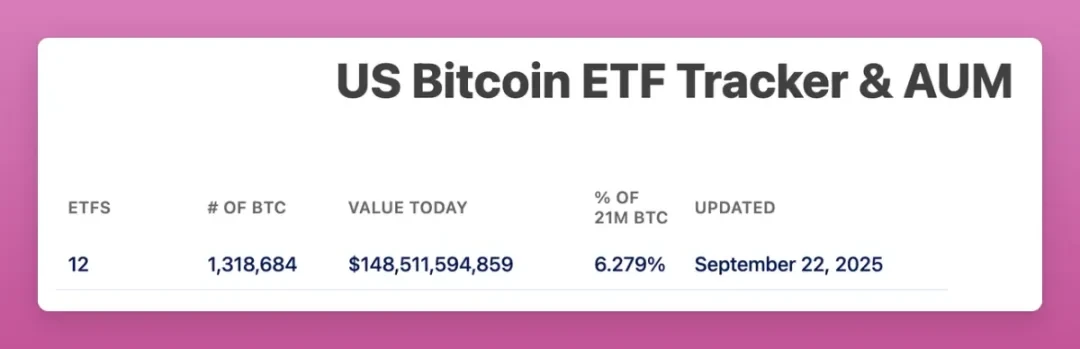

Bitcoin ETFs currently have $150 billion in assets under management and hold more than 6% of the total Bitcoin supply.

The Ethereum ETF holds 5.59% of the total Ethereum supply.

And all this took just over a year.

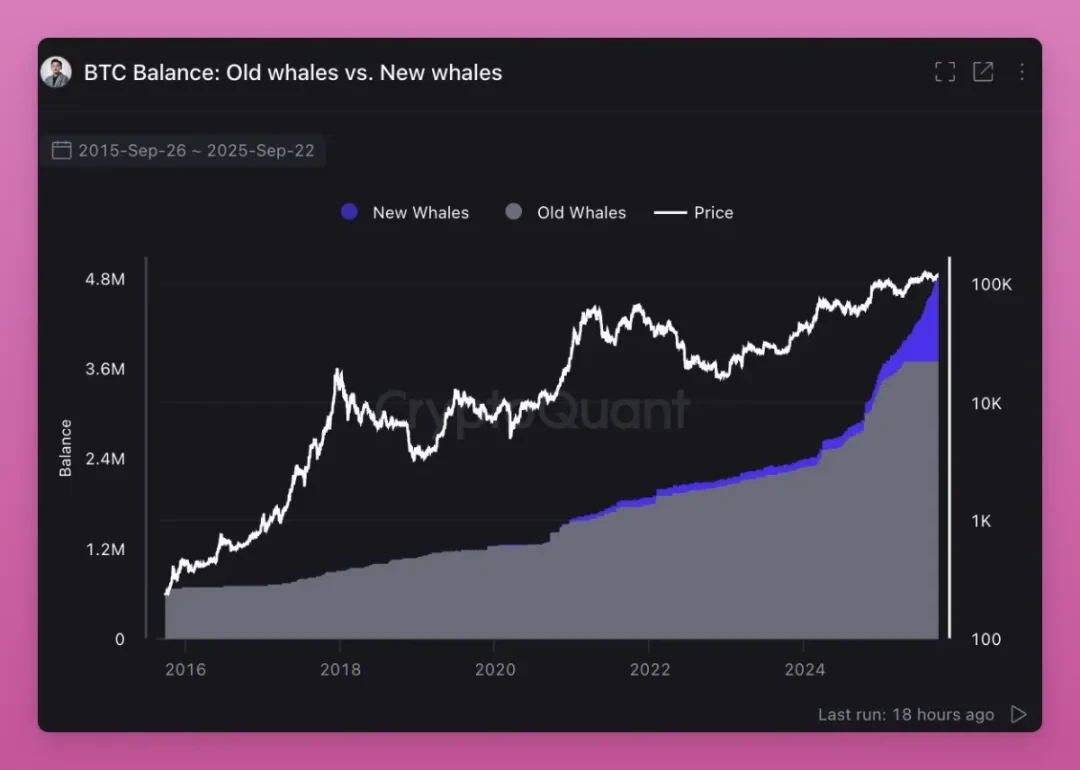

ETFs have become the primary buyers of Bitcoin and Ethereum, driving a shift in the ownership structure of crypto assets from retail investors to institutions. My past analysis shows that whales are continuing to increase their holdings, while retail investors are selling.

More critically, old whales are selling assets to new whales.

The holding structure is rotating: investors who believe in four-year cycles are selling, expecting history to repeat itself, but the current market is undergoing very different changes.

Retail investors who bought at the bottom are selling their assets to ETFs and institutional investors. This shift from retail to institutional investors not only pushes up the cost basis of crypto assets but also creates a solid price floor for future cycles, preventing new institutional holders from selling at small profits.

https://x.com/DefiIgnas/status/1970051841711894981

This is the massive capital rotation in cryptocurrencies: crypto assets are moving from speculative retail investors to long-term institutional investors .

The introduction of universal listing standards will usher in the next phase of this rotation.

Similar universal rules in the US stock market tripled ETF issuance in 2019. This trend is expected to repeat in the cryptocurrency sector: a large number of ETFs targeting assets such as SOL, HYPE, XRP, and DOGE will emerge in the future, providing retail investors with ample exit liquidity.

The big question remains: Can institutional buying offset retail sales?

If the macro environment remains stable, I believe that investors who are selling now because they believe in the four-year cycle will eventually have to buy back their assets at higher prices.

The era of comprehensive price increases has ended

In past crypto bull markets, assets often rise together. Bitcoin rises first, followed by Ethereum, and finally, other assets rise across the board. Small-cap coins surge because liquidity flows down the risk curve.

But this time is completely different, not all tokens will rise in sync.

Millions of tokens exist in the crypto market today, with new ones launching daily on the pump.fun platform. Creators are constantly shifting market attention away from older tokens and toward their own meme coins. While the supply of tokens has surged, retail investor attention hasn't grown at the same pace.

Since the cost of issuing new tokens is almost zero, liquidity is dispersed across a vast number of assets.

In the past, tokens with "low circulating stock and high fully diluted valuation (FDV)" were highly sought after, but now retail investors have learned their lesson and prefer tokens that "can create value, or at least have a strong cultural influence."

Ansem's point is valid: the pure speculative frenzy has peaked . The new mainstream is driven by revenue, and only revenue generation can achieve sustainable growth. Applications that demonstrate product-market fit (PMF) and generate fees will thrive, while the rest will struggle.

https://x.com/blknoiz 06/status/1970107553079079341

Two things stand out: the high fees users pay for speculation, and the efficiency of blockchain rails relative to traditional finance. The former has peaked, while the latter still has room to grow.

Murad added a key point that Ansem might have overlooked: Tokens that are still experiencing explosive growth today are often "newly launched, have unique models, and are not yet understood," but they need to be supported by a community of strong believers. I personally like these kinds of novelties (like my iPhone Air).

https://x.com/MustStopMurad/status/1970588655069622440

Cultural significance is key to whether a token lives or dies. A clear mission, even if it initially seems unrealistic, can sustain community vitality until user adoption snowballs. Pudgy Penguins, Punk NFTs, and some meme coins all fall into this category.

But not all novelty survives. Case studies like Runes and ERC-404 have reminded me how quickly novelty wears off. Many narratives can die before they even reach critical mass.

Putting all of this together, we can understand the logic of the new order: revenue filters out unreliable projects, and culture carries the misunderstood.

Both are equally important, but their paths of action are different. The ultimate winners will be the few tokens that have both revenue-generating potential and cultural influence.

Stablecoin order gives cryptocurrency credibility

In the early days, traders held USDT or USDC solely for the purpose of purchasing Bitcoin and altcoins. Back then, stablecoin inflows typically signaled a bullish outlook, as funds would eventually translate into spot buying, with 80% to 100% of stablecoin inflows used to purchase crypto assets.

Today, this logic has changed.

The use of stablecoins has expanded to scenarios such as "lending, payment, interest generation, asset library management, and airdrop arbitrage." Some funds no longer flow into the Bitcoin or Ethereum spot market , but they are still injecting vitality into the entire encryption system: the transaction volume of the underlying public chain (L1) and the second-layer network (L2) has increased, the liquidity of decentralized exchanges (DEX) has improved, the revenue of lending markets such as Fluid and Aave has increased, and the depth of the currency market in the entire ecosystem has deepened.

Payment-first underlying public chains (L1) are the latest trend:

- Tempo, jointly launched by Stripe and Paradigm, is designed for high-throughput stablecoin payments, supports Ethereum Virtual Machine (EVM) tools, and has a built-in native stablecoin automated market maker (AMM);

- Plasma is a Tether-backed L1 designed specifically for USDT, equipped with neo-banking features and payment cards for emerging markets.

These public chains are pushing stablecoins to move away from transactional attributes and integrate into the real economy. We are once again back to the narrative of blockchain being used for payments.

What this might mean (I'm still not sure, to be honest):

- Tempo: Stripe's vast distribution network will help popularize cryptocurrencies, but it may bypass the spot demand for Bitcoin or Ethereum. Tempo could ultimately become the PayPal of crypto, with massive capital flows but limited value transfer to public blockchains like Ethereum. It's unclear whether Tempo will issue a token (I believe it will) and how much of its fee revenue will flow back into cryptocurrencies.

- Plasma: Tether has established a dominant position in the stablecoin issuance space. By integrating a "public chain + issuer + application" approach, Plasma could potentially bring a significant portion of emerging market payment needs into a closed ecosystem, competing with the open internet championed by Ethereum and Solana. This has sparked a battle for USDT's default public chain, with Solana, Tron, and Ethereum L2 among the contenders. Tron carries the greatest risk of loss, while Ethereum itself isn't primarily focused on payments. However, if projects like Aave choose to deploy on Plasma, they pose significant risks to Ethereum.

- Base: The savior of Ethereum's Layer 2. Coinbase and Base are promoting stablecoin payments and USDC interest-bearing products through the Base app, continuously generating fee revenue for Ethereum and DeFi protocols. While the ecosystem remains fragmented, competition will drive further liquidity diffusion.

Regulation is also adapting to this trend. The GENIUS Act is pushing countries around the world to follow suit in regulating stablecoins. The US Commodity Futures Trading Commission (CFTC) recently allowed stablecoins to be used as tokenized collateral for derivatives, further fueling capital market demand for stablecoins beyond payment needs.

https://x.com/iampaulgrewal/status/1970581821177111034

Overall, stablecoins and new stablecoin-first public chains are giving credibility to cryptocurrencies.

Cryptocurrencies are no longer just a speculative casino, but have acquired geopolitical significance. Although speculation remains the primary use case, stablecoins have become the second largest application scenario in the crypto industry.

The future winners will be those public chains and applications that can capture stablecoin capital flows and convert them into sticky users and cash flow. The biggest unknown at the moment is whether new L1 chains like Tempo and Plasma can become leaders in value lock-in within the ecosystem, or whether Ethereum, Solana, L2, and Tron can successfully fight back.

The next major trading opportunity will come with the Plasma mainnet (launched on September 25th).

Digital Asset Treasury (DAT): New Leverage and IPO Alternatives for Non-ETF Tokens

Digital asset treasuries (DATs) worry me.

With every bull run, we find new ways to leverage tokens and drive up their prices . These methods can significantly increase price gains, far exceeding spot purchases. However, the deleveraging process is always brutal. When FTX collapsed, the forced sell-offs triggered by leverage in centralized finance (CeFi) devastated the entire market.

In this cycle, leverage risk may come from DAT: if DAT issues shares at a premium, borrows money and invests funds in tokens, it will amplify the upward gains; but once market sentiment turns, the same structure will exacerbate the decline.

Forced redemptions or a halt in share buybacks could trigger significant selling pressure. Therefore, while DATs have broadened access to crypto assets and brought in institutional capital, they have also added a new layer of systemic risk to the market.

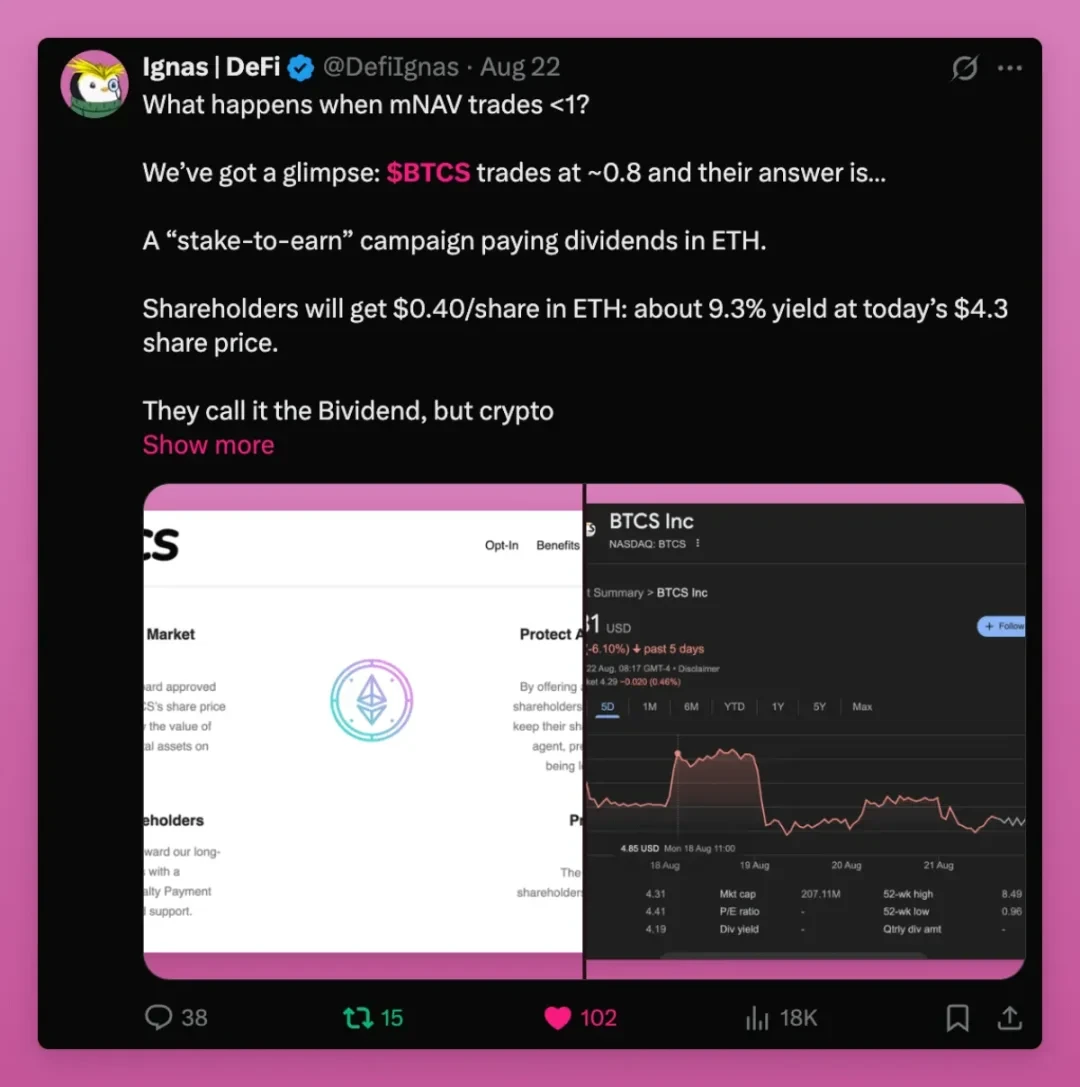

Recently, there have been cases where the market net asset value (mNAV) has exceeded 1. Simply put, DATs distribute Ethereum to shareholders, who are likely to sell this Ethereum. Even with a quasi-airdrop operation, BTCS (a DAT token) is still trading at only 0.74 times its market net asset value, which is not a good situation.

https://x.com/DefiIgnas/status/1958867508456194204

But on the other hand, DAT also builds a new bridge between the token economy and the stock market.

As Ethena founder G said: "One thing I worry about is that we have exhausted the 'crypto native capital' and cannot push altcoins to the peak of the previous cycle. Comparing the peak of the total market value of altcoins in the fourth quarter of 2021 and the fourth quarter of 2024, the difference between the two is not much (both are slightly less than 1.2 trillion US dollars); if the inflation factor is excluded, the peak of the two cycles is almost exactly the same. This may be the maximum amount of funds that global retail investors can invest in 'conceptual assets'."

This is where DAT comes in handy.

Retail capital may have reached its limit, but tokens with real businesses, real revenue, and real users now have access to a much larger stock market. The entire altcoin market is a fraction of the size of the global stock market, and DATs have opened the door for new capital to flow into the crypto space.

Not only that, since a few altcoin teams have the professional capabilities to issue DATs, DATs can also refocus market attention from millions of tokens to a few key assets.

G's other point is that the NAV premium arbitrage is not significant...it's actually a bullish signal.

https://x.com/gdog 97_/status/1948671788747300932

With the exception of Michael Saylor (founder of MicroStrategy), most DATs struggle to maintain a long-term premium to their net asset value. The true value of DATs lies not in the premium game but in access. Even maintaining a 1:1 net asset value with stable capital inflows is better than being completely cut off from the stock market.

ENA and even SOL's DAT have caused controversy, and they have been accused of being "tools for venture capital to cash out."

ENA is particularly risky, with significant venture capital investment behind it. However, considering the capital mismatch between private venture capital and secondary market liquidity, DATs are actually a bullish signal: venture capital can redeploy funds into other crypto assets after exiting through DATs.

This is crucial, as venture capitalists have suffered significant losses in this cycle due to their inability to exit their portfolios. By enabling exits and accessing new liquidity through DATs, they can re-fund innovative projects in the crypto industry and drive the industry forward.

Overall, DATs are beneficial to the crypto industry as a whole, especially for tokens that cannot be listed through ETFs. They allow projects with real users and revenue, such as Aave, Fluid, and Hype, to transfer asset exposure to the stock market.

While it is true that many DATs will ultimately fail and create spillover risks to the market, they also provide an IPO-style exit path for initial coin offerings (ICOs).

The Real Asset Tokenization (RWA) Revolution: On-chain Financial Life Becomes Possible

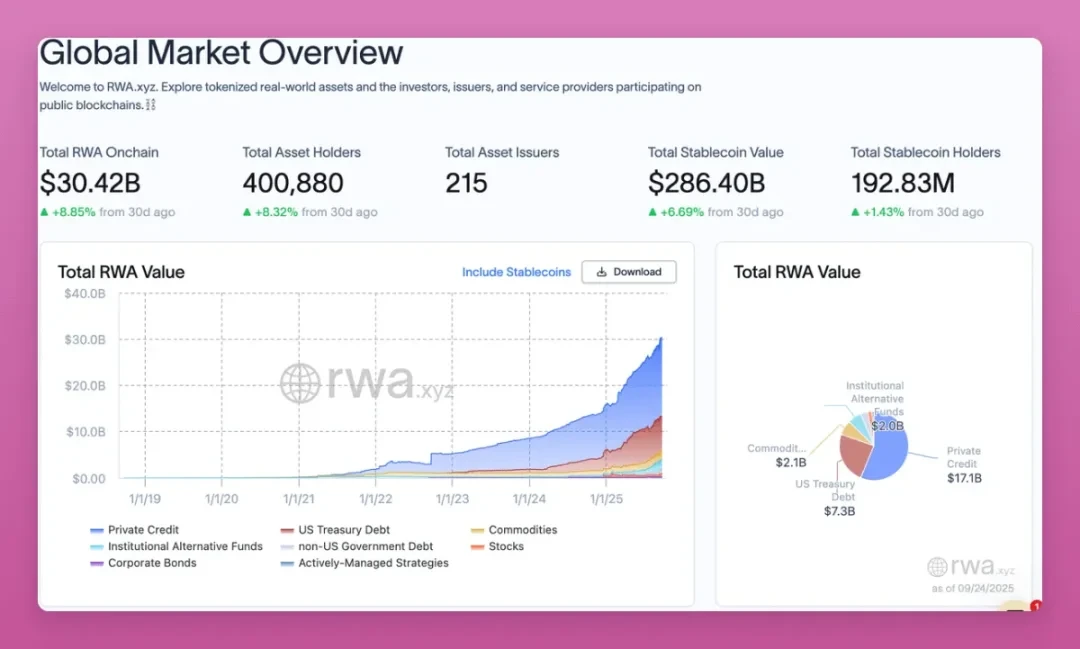

The RWA market has just surpassed $30 billion, having grown by nearly 9% in just one month, and the growth curve continues upward.

Now, government bonds, credit, commodities, and private equity have all been tokenized, and the escape velocity is rapidly increasing.

RWA has moved the global economy onto the blockchain, bringing about some major changes:

- In the past, investors had to convert crypto assets into fiat currency to purchase stocks or bonds. Now, they can operate the entire process on-chain, hold Bitcoin or stablecoins, convert them directly into on-chain government bonds or stocks, and control their assets themselves (self-custody).

- Decentralized finance (DeFi) has broken free from the Ponzi scheme, creating new revenue streams for DeFi and L1/L2 infrastructure.

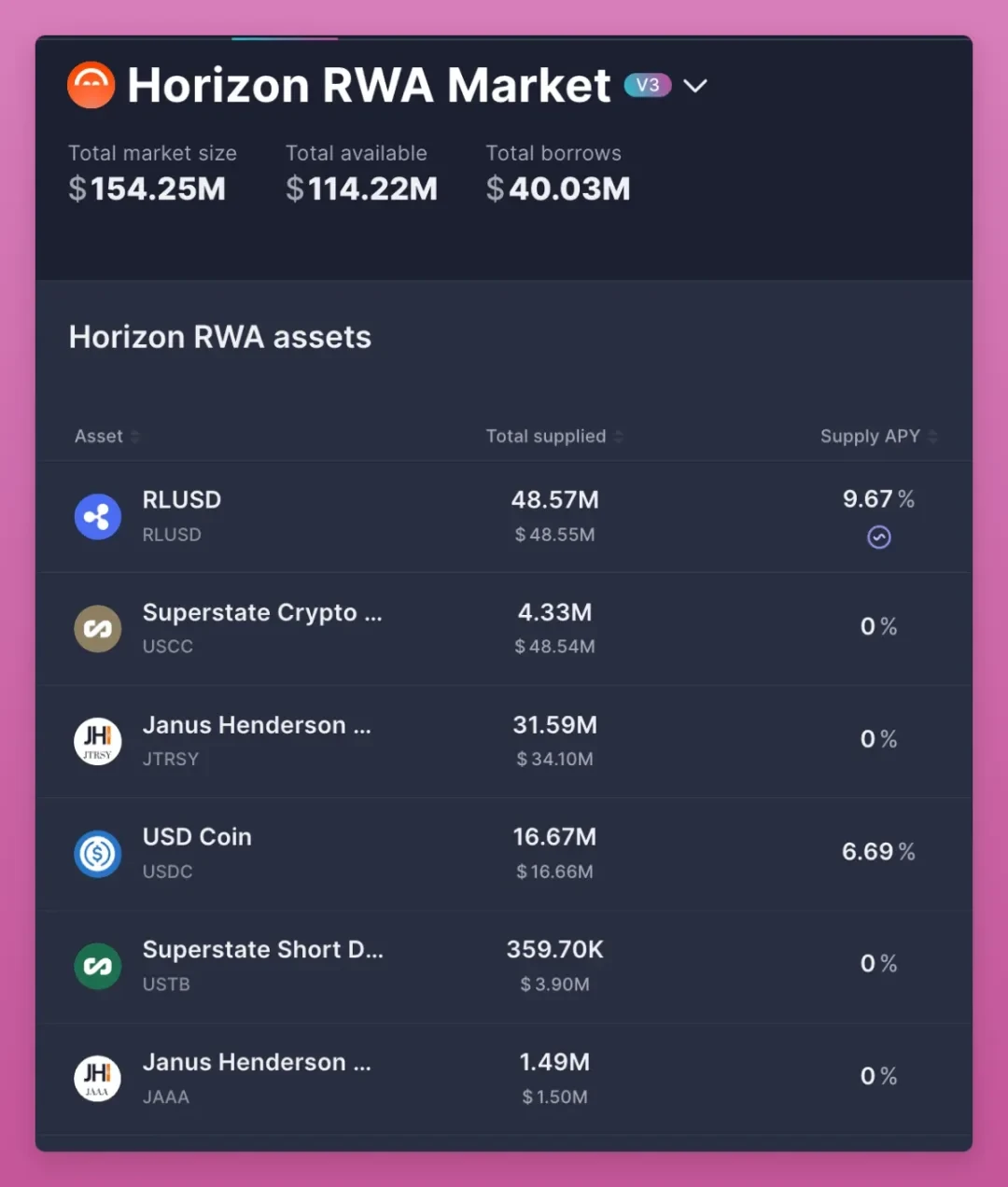

Aave’s Horizon protocol allows users to deposit tokenized assets backed by the S&P 500 index and use them as collateral for borrowing. Although the current value locked (TVL) is only $114 million, RWA is still in its early stages.

Traditional finance (TradFi) almost completely excludes retail investors from these opportunities.

RWA ultimately makes DeFi a true capital market. It establishes a benchmark interest rate based on government bonds and credit, and expands global coverage, allowing anyone to hold US Treasury bonds without going through a US bank.

BlackRock launched BUIDL and Franklin launched BENJI. These are not fringe projects, but bridges for trillions of dollars of capital to access crypto infrastructure.

Overall, RWA is the most important structural revolution in the current crypto industry. It connects DeFi with the real economy and builds the infrastructure for financial life across the entire chain.

The end of the four-year cycle?

The most important question for crypto natives is: Is the four-year cycle over? Many people around me are already selling, hoping for a repeat of the cycle. But I believe that with the advent of a new order in crypto, the four-year cycle will not repeat itself. This time, things are truly different.

I bet my own positions for the following reasons:

- ETFs transform Bitcoin and Ethereum into institutionally configurable assets;

- Stablecoins have become a geopolitical tool and are expanding into payment and capital markets.

- DAT opens up access to stock market capital for tokens that cannot issue ETFs, while allowing venture capital to exit and inject capital into new innovative projects;

- RWA brings the global economy to the blockchain and establishes a benchmark interest rate for DeFi.

Today’s crypto market is neither the casino of 2017 nor the frenzied bubble of 2021, but a new era of structure and adoption. Cryptocurrency is merging with traditional finance while retaining its core drivers of culture, speculation, and belief.

The next round of winners will not come from players who buy in across the board. Many tokens may still repeat their four-year cyclical crash, and investors must be selective.

The real winners are those projects that can adapt to macro and institutional changes while maintaining the influence of retail culture.

This is the new order of cryptocurrency.