Solana has recently strengthened, but who holds the funds?

- 核心观点:机构持仓推动SOL价格上涨。

- 关键要素:

- 质押率高达66.9%,卖压有限。

- 17家公司财库储备1711万枚SOL。

- ETP持仓占总供给约1.73%。

- 市场影响:增强价格支撑,吸引更多资金流入。

- 时效性标注:中期影响。

Original author: Biteye

SOL has strengthened recently, with the reason being that many listed companies have been buying continuously. The treasury reserves have reached 17.112 million pieces, which has directly pushed up the price!

Just as Bitcoin ETF and Ethereum ETF have rewritten the funding landscape, Solana is also experiencing its own “holding reshuffle.”

We have previously analyzed the holding structure of Ethereum. This is the second analysis of the holdings of mainstream currencies.

Who are Ethereum’s “financial backers”? Do ordinary people still have a chance?

01 Why is it important to study the holding institutions?

The crypto market moves at a fast pace, so who is buying? How much? Who is selling? Where is the selling pressure concentrated?

Which funds are locked up for a long time and which funds may flow out at any time?

These issues determine the price elasticity of the token and the room for ups and downs in the next cycle.

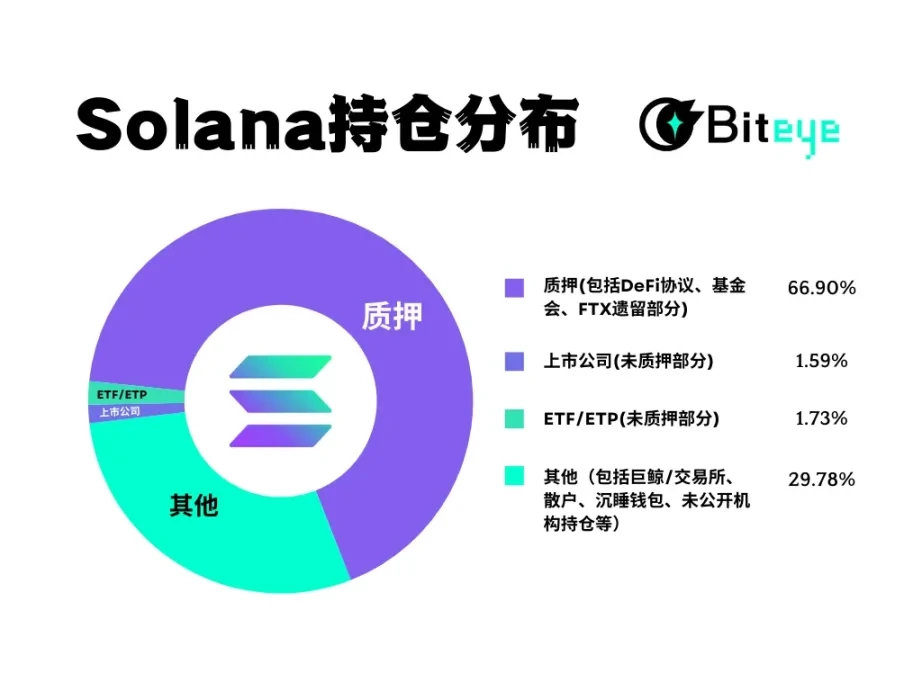

02 Pledge, accounting for about 66.9%

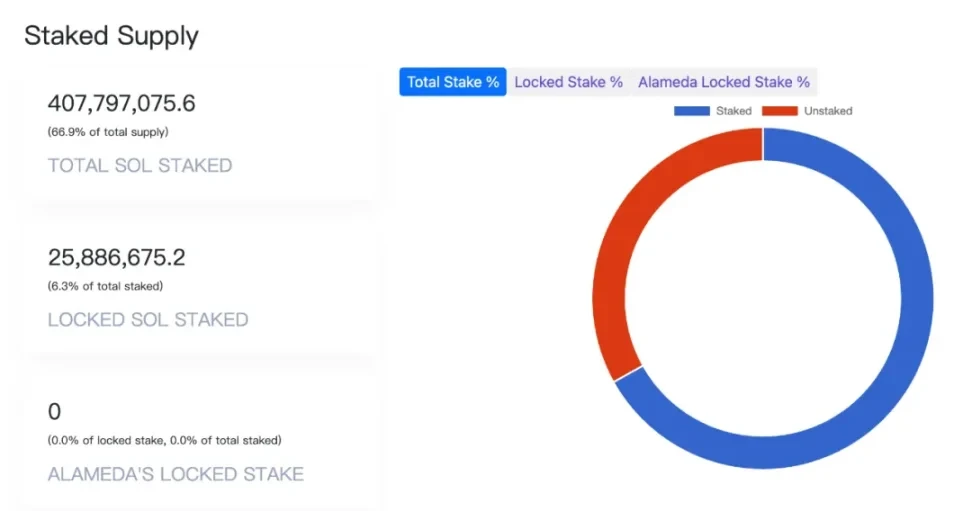

Data from the Solana compass shows that the total supply of SOL is 610 million.

As of September 16th, approximately 408 million SOL tokens have been staked on the Solana network, representing 66.9% of the total supply. This is essentially a massive pool comprised of staking by retail investors, DeFi protocols, public company treasury stakes, foundations, and institutional whales.

In comparison, ETH’s staking rate is only 40%. This makes SOL one of the mainstream public chains with the highest staking rates in the crypto market, which means limited selling pressure and strong price support.

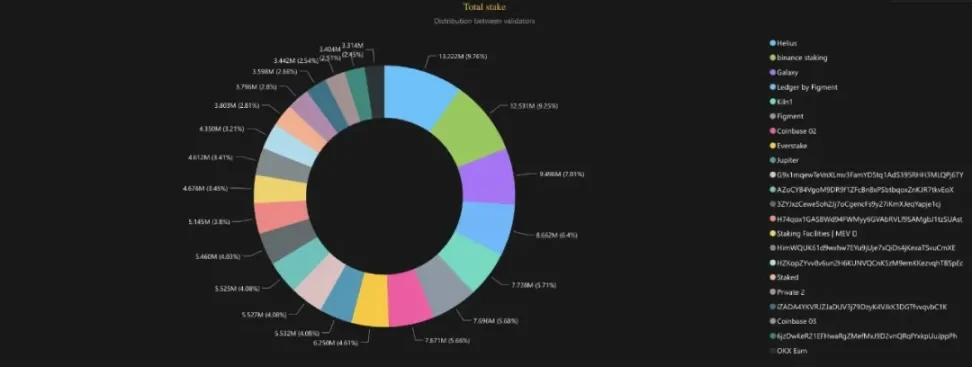

1. Analysis of the concentration of pledge patterns:

There are also some interesting points in the staking validator landscape. According to everstake data:

- The top three validators, Helius, Binance Staking, and Galaxy, collectively control over 26%, with Helius alone holding 13.22 million SOL (9.76%).

- Next are Ledger by Figment, Kiln, Coinbase, Everstake and other nodes, each with a share in the 3–6% range.

This means that Solana's staking structure presents a "top concentration + long tail dispersion" pattern: large institutional nodes have a significant influence, but overall it still maintains a certain level of decentralization, avoiding being completely dominated by a single force.

⚠️ Note: The data in the pie chart below mainly shows the distribution of top validators, and does not equal the total amount of 408 million SOL staked in the entire network.

2. DeFi Protocols

According to DeFiLlama data, the Solana network's total TVL is approximately 52.89 million SOL. However, it's important to note that a significant portion of this volume comes from LST derivatives (such as JitoSOL, mSOL, and bSOL), not just SOL. This data also overlaps with the 66.9% staked volume across the entire network and represents an independent increase in locked-in tokens.

3. Foundation

The SOL held by the Solana Foundation and Solana Labs is mainly placed in the staking account, that is, included in the 408 million SOL staked, the specific proportion of which is unknown.

4. FTX, Alameda

The special thing about SOL is that it has a "historical legacy disk", which is the chips of FTX and Alameda.

During the early stages of Solana's ecosystem development from 2020 to 2022, FTX and Alameda were among the most important supporters, purchasing and holding large amounts of Solana. Following the FTX collapse in November 2022, these assets were placed into custody and included in the liquidation process. Their future unlocking, auctions, and even over-the-counter trading will impact the supply and demand balance of Solana.

Since November 2023, FTX and Alameda related staking addresses have redeemed and transferred a total of 8.98 million SOL

Currently, approximately 4.18 million SOL (0.69%) are still staked on the chain and will be unlocked in installments until 2028.

This part is seen by the market as potential selling pressure, which may cause price fluctuations.

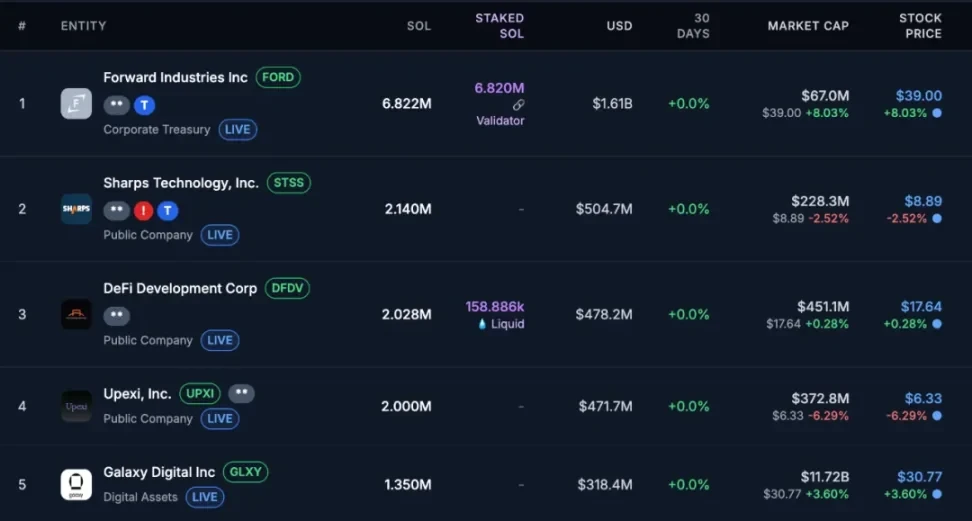

03 Listed companies, accounting for approximately 1.59% (unpledged portion)

According to data from Strategic SOL Reserve (as of September 16), there are currently 17 entities that have established SOL treasury reserves, totaling 17.112 million SOL, accounting for 2.8% of the current total supply.

Among these holdings, the amount of SOL pledged is approximately 7.4 million SOL, accounting for approximately 1.2% of the total supply.

Top holdings:

- Forward Industries (FORD): 6.822 million SOLs, approximately $1.63 billion

- Sharps Technology (STSS): 2.14 million SOL, approximately $510 million

- DeFi Development Corp (DFDV): 2.028 million SOL, approximately $480 million

- Upexi (UPXI): 2 million SOL, approximately $470 million

- Galaxy Digital: 1.35 million SOL, approximately $320 million

In the total plate split, this part only counts the unstaked 9.71 million SOL (about 1.59%) to avoid double counting with the entire network staking.

04 ETF/ETP, accounting for approximately 1.73% (unpledged portion)

ETPs (Exchange-Traded Products) are essentially fund shares listed on an exchange. The following ETPs directly purchase and hold SOL spot, then issue corresponding shares for circulation on the exchange.

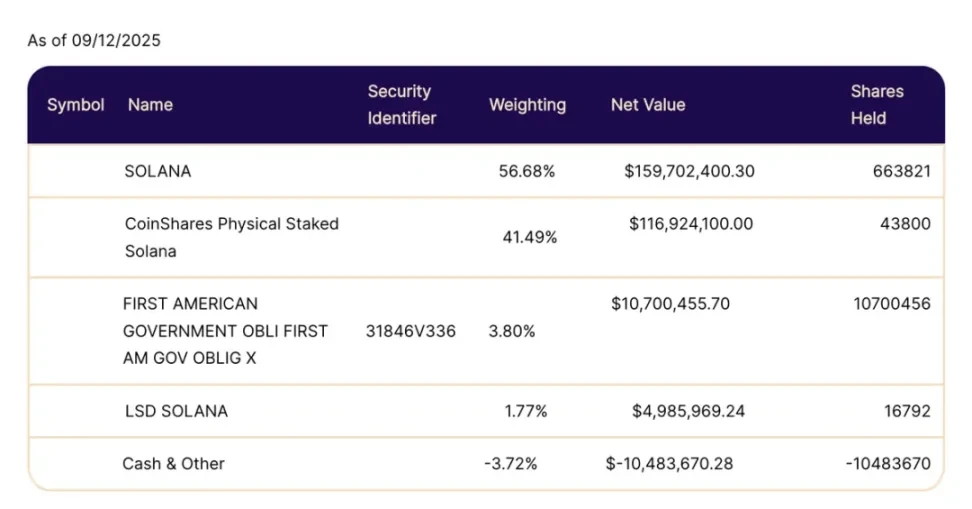

1. 21 Shares ASOL has a market capitalization of approximately US$1.53 billion

2. CoinShares SLNC has a market capitalization of approximately $699 million

Based on the estimated range of $200-$260, the corresponding holdings are approximately 8.57-11.15 million SOL, accounting for 1.41%-1.83% of the total supply.

While traditional spot SOL ETFs are still awaiting regulatory approval, the REX-Osprey SOL + Staking ETF (SSK) was launched in July 2025, becoming the first ETF in the United States to combine SOL spot with on-chain staking returns.

As of mid-September, the fund had approximately $274 million in assets, of which approximately 56.7% was in spot SOL. Based on an estimated price range of $200–$260, this corresponds to approximately 598,000–777,000 SOL.

In total, the three parties hold approximately 9.17 million to 11.92 million SOL in spot trading, accounting for 1.50% to 1.96% of the total supply, with an average of approximately 1.73%. The nature of this part of funds is more long-term and stable.

05 Others, accounting for 29.78%

1. Whales/Exchanges

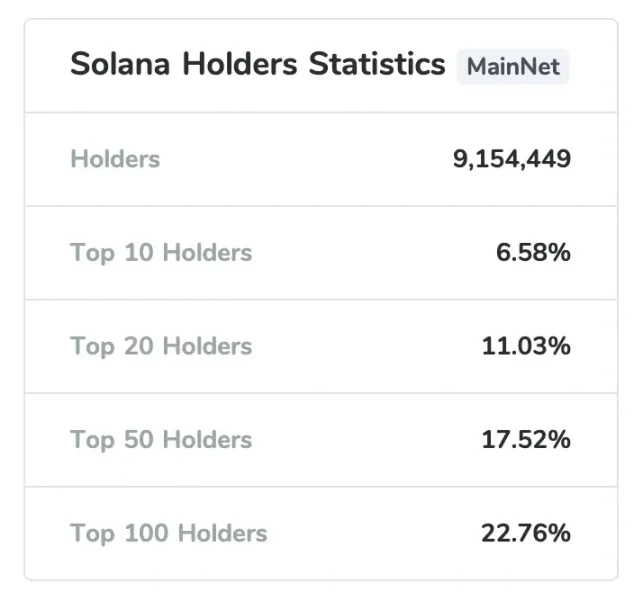

According to CoinCarp Rich List data (as of September 16th), a single whale address holds over 5 million SOL (approximately 1% of the total supply). Overall, Solana currently has approximately 9.15 million addresses, with the top 100 holding only 22.8% of the total supply. This shows limited concentration at the top, with the majority of holdings distributed among long-tail users, staking pools, and exchanges.

It’s important to note that whale addresses aren’t necessarily all retail investors; they include early-stage VCs, exchanges, dormant wallets, and more. Furthermore, there’s overlap between whale holdings and staked assets, with many whales already having staked their holdings.

2. Retail investors

Dispersed but large in number, it is the basic foundation of the market

3. Undisclosed institutions

Some funds or venture capitals hold shares but are not included in the financial statements

06 Government Holdings

As of now, there is no publicly disclosed government or sovereign fund that directly holds SOL.

07 Celebrity Calls for a Warehouse

Beyond the money, there's also the narrative. Who's calling for more SOL?

Bitwise’s Chief Investment Officer, Matt Hougan, recently emphasized in an article that Solana is in a critical window of ETP approval and the rise of corporate SOL vaults, a combination that has historically led to significant price increases for Bitcoin and Ethereum.

Former Goldman Sachs executive Raoul Pal @RaoulGMI called Solana's "long-term structure stupidly bullish," expressing his long-term bullish view on SOL.

Well-known cryptocurrency trader Ansem @blknoiz 06 recently expressed bullish views on the fact that "if the Treasury Company's funds are invested in Solana DeFi, it will be extremely beneficial."

Helius Labs CEO Mert Mumtaz is betting Solana will rise 150% over the next five years, arguing that any short-term price action is just noise.

👉 From the perspective of holding structure to the narrative level, SOL has entered the stage of "institutional buying driven + market bullishness". Combined with the Hyperliquid liquidation chart, the current price is $238:

The first target: $250-275 - the first short position liquidation area above, once broken through, it may trigger a short-term acceleration.

The second target level: $275-315 - the area with the most concentrated short positions, which may lead to a stronger short squeeze after breaking through.

As ETFs/ETPs and treasury companies resonate, market expectations for Solana will also be reshaped. If capital flows continue, it is possible that Solana will hit the $300-$400 range in a bull market.