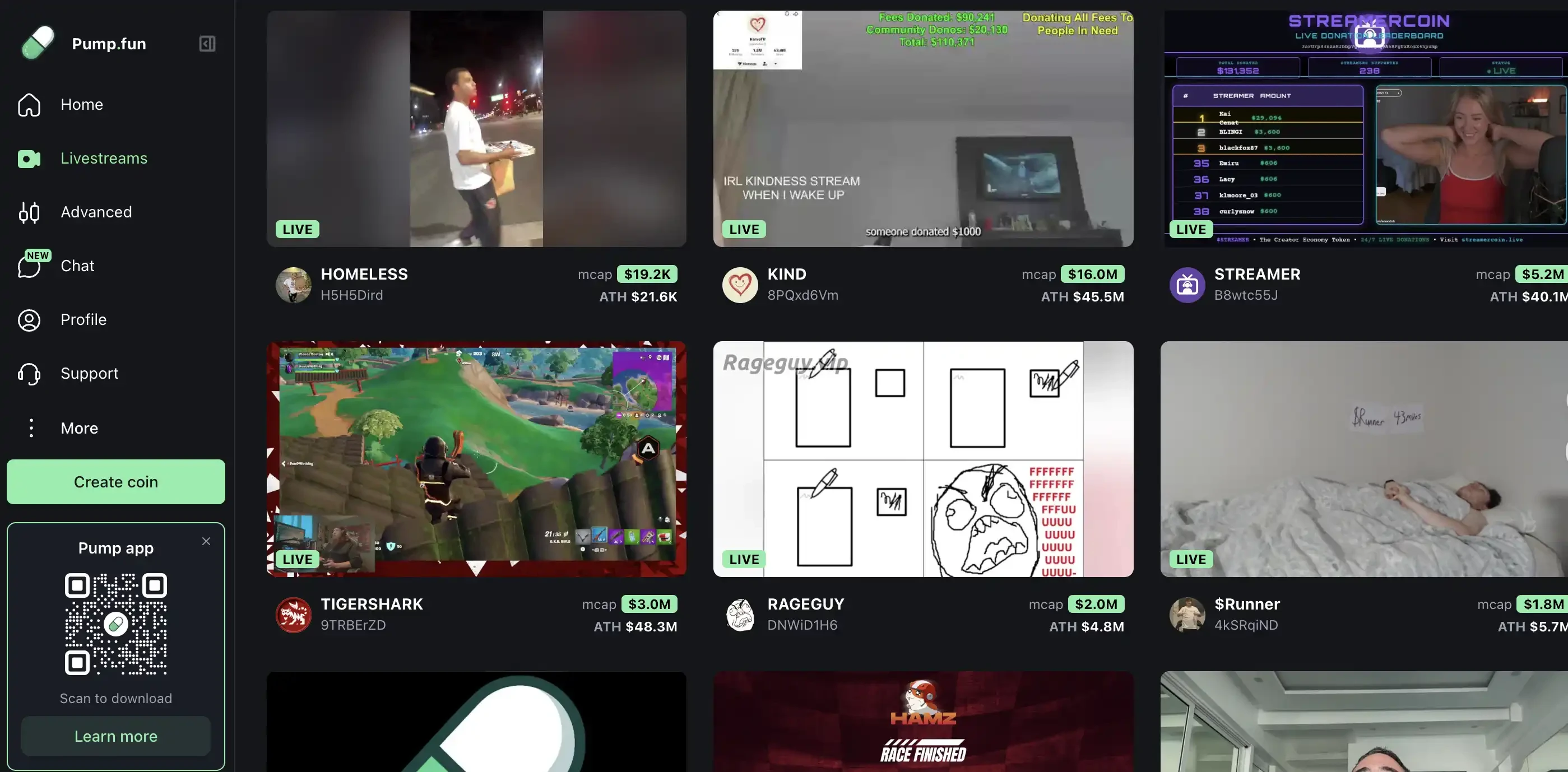

Alon's first interview after PumpFun's crazy live broadcast went viral again

- 核心观点:Pump.fun通过直播功能实现爆发式增长。

- 关键要素:

- 日收入跃居DeFi协议第三。

- 单日向创作者分发超400万美元。

- 执行9730万美元代币回购策略。

- 市场影响:推动创作者经济与代币化结合新范式。

- 时效性标注:短期影响

In September, Pump.fun staged the return of the gods.

After a long period of intense competition in the Solana launch platform race, Pump.fun was plagued by controversy and skepticism. But in September, everything changed. Pump.fun and its founder, Alon, declared in a strikingly violent manner: "We're back, and stronger than ever."

For two consecutive days, Pump.fun's daily revenue surpassed Hyperliquid, ranking third among all DeFi protocols, behind only the money-printing machines Tether and Circle. This success stems from the launch of Pump.fun's "Project Ascend," a core upgrade on September 2nd that's friendly to livestream creators. Some users claim that a single Pump.fun livestream can generate revenue equivalent to a month's worth of YouTube revenue, prompting a surge in enthusiasm among creators for the livestreaming feature.

On September 15th alone, the platform distributed over $4 million in cash to creators. Within a week, creators' total revenue reached $19.3 million. Just how formidable is this "revenue flywheel effect"? On that very day, 21,000 new livestream tokens were issued. According to real-time data from GMGN, the number of tokens in Pump.fun's "graduated" livestreaming section with a market capitalization exceeding $1 million has reached 39. And that's not all. While Pump.fun is frantically distributing funds to creators, it's also executing an aggressive token buyback strategy—spending $97.3 million on repurchasing PUMP tokens since mid-July, directly removing 6.67% of the circulating supply.

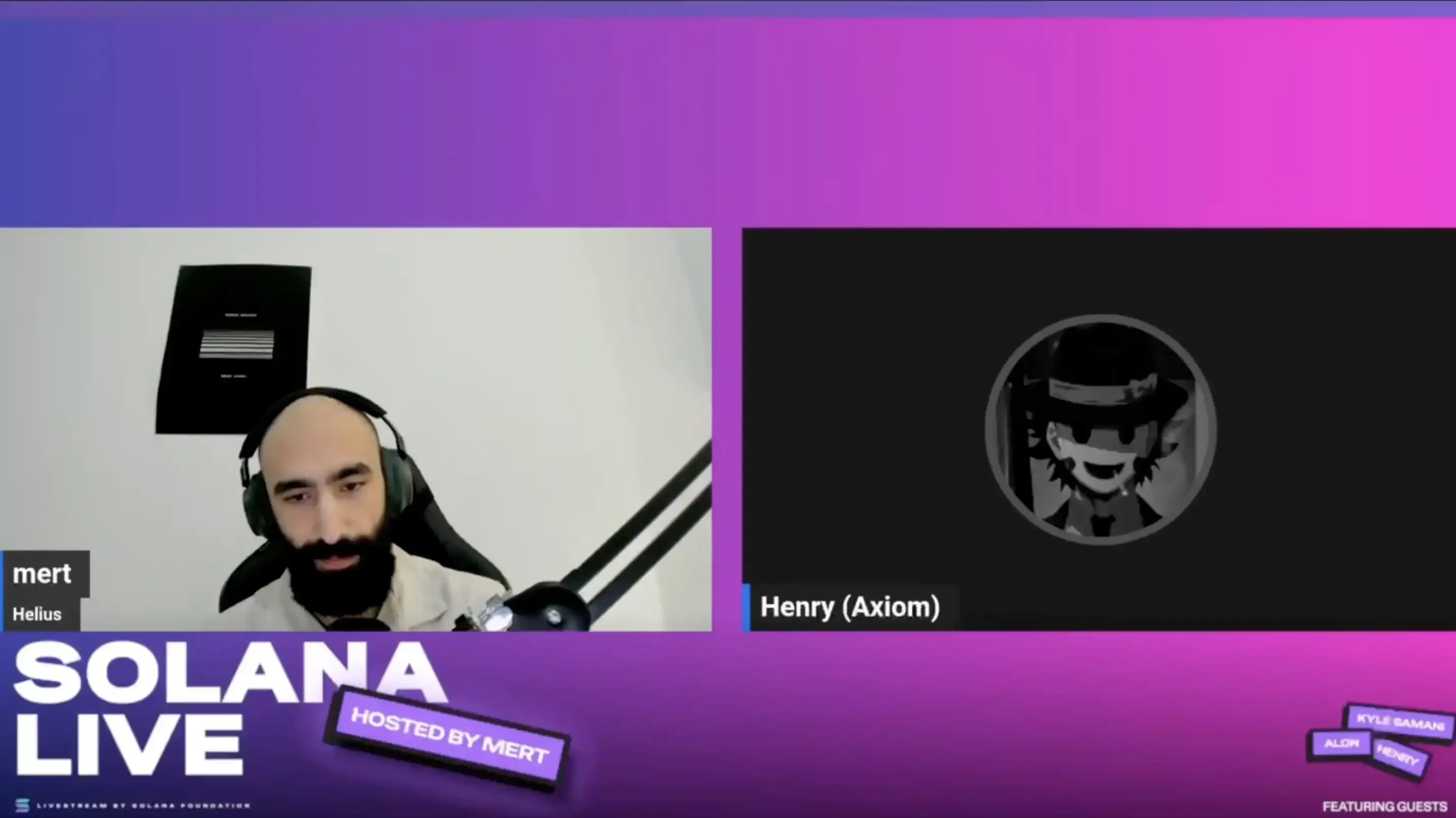

Just after Pump.fun reignited the livestreaming scene, Alon's latest interview took place on last night's Solana Alive. Hosted by Mert from Helius, he also featured Axiom founder Henry Zhang and Multicoin partner Kyle Samani. BlockBeats has compiled a transcript of the Solana Alive episode:

Host: Hello everyone, welcome to the second episode of Solana Alive, and the first hosted by a bald guy. I'm Mert from Helius. Today I'll be chatting with three guests: Alon, Henry Zhang, and Kyle Samani. First, let's welcome our first guest, Alon.

Alon's first interview after PumpFun's crazy live broadcast went viral again

Alon (Founder of Pump.fun): Mert, how are you?

Host (Mert): I'm fine. You must be a very busy person. How have you been these days?

Alon: It's been completely crazy. I mean, you know, we've said this publicly at X, the last four or five days have been absolutely crazy since live streaming has taken off. But it makes me even more optimistic because, you know, the vision that we've been painting for years is slowly but surely coming to fruition.

Host: I'd really like to get straight to the point about that vision. I'd like to hear how you describe the future of PumpFun. But before that, let's take a look at what's happened over the past few days. You've been making a lot of noise lately with your livestreams and creator rewards. Could you please explain what's been going on for those who aren't familiar with the situation?

Alon: Absolutely. About two weeks ago, PumpFun made a significant change to the protocol, allowing people to earn more Creator Rewards than ever before. Creator Rewards are essentially a way to align the interests of creators with their fans and the people who trade their tokens. For example, every time a transaction occurs—whether it's a buy or sell—a small percentage goes to the creator. We call this update Project Ascend.

With this update, creator fees increased tenfold. People are slowly realizing this can be a very good source of income for them as creators. We relaunched a livestreaming platform back in May, and people are using it more and more. Then, four or five days ago, it completely took off.

To give you a comparative perspective, take the number of concurrent live streaming channels. PumpFun is currently roughly 20% of Kick, the second-largest live streaming platform globally. A few days ago, I tweeted that we were only 10% of Kick, but now we're 20%. This growth is truly exponential, and it shows no signs of slowing down.

Host: That's crazy. Wow, this has all happened so quickly. What's driving it? Was there a particular moment where it took off, or did a bunch of creators come in and realize they could actually make a good living from this and find interesting content? What's really driving this?

Alon: There are indeed some creators who have had viral moments—to be honest, there are too many to list. But I think the real trigger was the realization that tokenization is an incredibly powerful tool that can take creators from zero to one hundred. Because they no longer have to wait for audience growth, funding, or advertising revenue to make money from brands, right?

As you know, on other platforms, like Web 2 platforms, it often takes months or even years to start earning money. On PumpFun, however, you can earn money instantly, with no middlemen and no censorship. Audiences are also directly motivated to seek out early creators because the earlier they discover them, the more likely they are to earn money. This is a huge difference in platform incentives. It's particularly friendly to small and medium-sized creators.

This applies not only to streamers, but also to Meme Coin communities, artists, startups, and anyone who needs attention and capital. The PumpFun platform is more efficient in this regard than anywhere else on the internet.

Host: Very cool. So what are your thoughts on this? For example, in live streaming, everyone knows there's the giant Twitch; in short-form video, there's Kick, Instagram Reels, and even X Video—all vying for attention. Do you see PumpFun as directly competing with these platforms, or is it an entirely new category, combining finance and entertainment to create something that hasn't existed before?

Alon: Yes, I do believe it's something completely new. It attracts a group of people who might not create on other platforms. But it's also undoubtedly competing with the largest platforms on the internet. And it provides a better platform and better service for all users. That's why we're seeing PumpFun grow at an unprecedented rate.

Host: Was this all part of your vision from the beginning, or did you discover it gradually as you observed how people used MemeCoin and organized communities around it?

Alon: Of course, PumpFun has had a vision from the beginning, which is to break through the pure crypto circle and expand the application of tokenization to all places that can change the world. As we build, we see more and more user behavior, and these user behaviors make us decide what to build.

Take live streaming, for example. People had actually been experimenting with live streaming for over a year, even before we officially launched our platform. We noticed this behavior early on. So, overall, we observe user behavior every day and pay closer attention to traders than anyone else. When we see spontaneous behavior from users and creators, we adapt, which allows us to shape our strategy in the medium term. But in the long term, our vision remains unwavering: to make tokenization a superior alternative, ultimately disrupting today's social media giants.

Host: Wow, "disrupt the social media giants"—that's a very ambitious and exciting goal, I love it. So let's talk about that. You mentioned the word "vision" a few times. What exactly is that vision? For example, during your weekly stand-up meetings at PumpFun headquarters, how do you encourage the team? How do you tell new members, "This is our mission?"

Alon: That's a great question. Our vision is to revolutionize the way creators create and interact with their audiences. We believe everyone is a trader, and everyone can benefit from being a trader. Whether it's finding the next big streamer, the next big startup, or the next meme coin, we can provide more value to everyone through a blockchain-based tokenized rail.

So viewers can earn money with their skills while supporting their favorite creators. And creators—whether they're startups, meme coins, or streamers—can monetize instantly, without middlemen or censorship. This is the direction we're heading. We're working hard to build this every day.

Host: Very cool. I was reading the comments, and they're all hilarious. One said "Alon + Elon = Megazord," and I have no idea what that means.

Alon: Haha, I don’t know either.

Host: Some people say "Alon is a god," and some say "Alon is the new Zuckerberg." These are quite interesting comments. What are your thoughts? Do you want to challenge Meta someday, like Instagram?

Alon: I'm flattered. I certainly think it's not absurd to say we're already competing with giants like Kick and Twitch. Just a few weeks or months ago, people were saying it was impossible, and now it's happening every day. I don't want to overhype it, but I've certainly spoken with some of the biggest names in Web 2, and they're starting to take notice of us, PumpFun, our creators, and the buzz around us. I believe we can not only compete, but we can win.

Host (Mert): As a founder, I have to ask, did you "see it all coming" before you took the first step? I just saw an interview or podcast with your co-founder, so I followed him, and I found out that he actually messaged me in 2023, and basically asked: "Shit coins?" I was like, what the hell, I didn't see that coming. But now you guys, I don't know the exact number, but you're probably one of the top three or five fastest-growing "revenue growth" tech companies in history. First of all, that's really exaggerated. But did you see it coming? Do you feel like the opportunity was always there? What has the journey been like from day one to now?

Alon: That's a good question. I definitely didn't, we didn't—we anticipated it would come this soon. But looking back now, it all makes sense.

From day one, we believed this market would be enormous. From day one, we were extremely bullish on on-chain transactions. Before that, we were working on NFTs, and we were incredibly bullish on them. Later, we entered the Solana token market, and we were equally bullish from day one.

So we saw the difference between this and other areas very early on. Especially in the early days, many people thought these were just meme coins, just jokes, with no chance of becoming sustainable or meaningful. But we always knew there was something here. This further fueled our ambition to prove all the doubters wrong.

Host: Has Solana helped you accelerate your business growth? For example, has it allowed you to focus more on your product? I remember you were on another platform before, right?

Alon: Exactly. Before we arrived at PumpFun, which everyone knows and loves, we experimented with a bunch of different ideas on Ethereum-based chains. This is all public information, by the way. We've always been "building in public." You can go back and look at my early tweets and stuff.

A large part of our success is indeed due to Solana. We have a large number of traders, high activity, many excellent ecosystem projects, and of course, an underlying blockchain that can handle this load, as well as a great user experience—all of which have undoubtedly contributed to the platform's rapid growth.

And it's not just that. When we first started PumpFun, we came to Solana because there was already some activity on Solana for so-called meme coins. But we stayed and plan to stay here because the infrastructure has become so good.

Host: I have to ask, you've made incredible amounts of money in a very short period of time, and you're still young. How do you ensure this doesn't disrupt your brain's reward circuitry? What still drives you? In a sense, you've achieved financial freedom. What keeps you so passionate about building what you're building every day?

Alon: Of course, if we weren't mission-driven, if we weren't driven by this ambition to basically change the world and have a huge impact, we definitely wouldn't be here today. Even very successful startups have very, very difficult moments in their journey - I haven't seen any that have been smooth sailing.

We've had a lot of moments where we felt like we were on the verge of breaking, and there were times when we could have just called it quits and been successful for the rest of our lives. But that's not the path we want to take. We want to keep building and make it bigger than ever. Yeah, I mean, at the end of the day, it's all about truly creating impact, not about money or fame or status or anything like that.

Host: I have to give you guys a pat on the back. You've taken a lot of flak—less now, let's say, since the token price has "turned green"—but you've also taken a ton of hate. I've never seen so much negativity on Twitter for so long, for a whole year. Of course, there's also a lot of love, so perhaps polarization is a more accurate word. How do you deal with that? Do you really care? Does it affect you? Or are you so resolute that it doesn't matter? What's Alon's mindset?

Alon: That's a good question. I think there are two points.

First, if it weren't for the user's voice, I wouldn't care that much. User feedback is really, really important. So if a user is disappointed, it does affect me because the entire team and I want to provide the absolute best for our users—especially the traders who make this possible.

Second, you need to have conviction in what you're doing. I mean, especially... let's talk about live streaming, which has really taken off recently. Even the smartest people in the space had serious doubts about whether we were on the right track. But within just a few days, I saw them completely flip from bearish to bullish. And we had that conviction from the beginning. This is just one example of how adhering to strong principles and believing in yourself and your ideas pays off.

So even if you receive a lot of hate, no matter what the reason, if you know what you're doing is good, that it will improve the ecosystem and the world, then there's no reason to be discouraged by what a group of people say on Twitter or elsewhere. Ultimately, people are short-sighted, and today's platform algorithms actually encourage negativity. So the key is to talk to users, to the people who truly matter in this industry, to take their feedback seriously, while remaining true to our principles and continuing to maintain our faith.

Host: Very well said, my friend. Okay, let me ask two final quick questions. You're clearly promoting live streaming, and it seems to be progressing well. Could you offer some advice to creators? I want to be a live streamer when I grow up, or at least try. What advice do you have for creators who want to start a live stream? For example, what niches should they focus on, what strategies should they use, and how should they get started?

Alon: That's a great question. I think at a high level, it all comes down to preparation and, well, not being afraid to iterate, trying to incorporate all the feedback from the community and working hard to improve. I think if you're small and just starting out, you actually have a lot of opportunities to "shoot for the goal." That's why I always say it's worth trying to create your own token or something similar.

But if you already have an audience, it's worth reaching out to someone like me, or anyone with a PumpFun badge, to chat with our team and get a better understanding of how this whole thing works. Because "issuing a token" is definitely a very different thing. You know, live streaming on PumpFun is very different from other places, and while that has its benefits, you need to respect that, you need to respect the traders on our platform, and you need to take some necessary precautions.

Host: Yes, so please make this more specific and give some examples?

Alon: For example, when you launch a token, make sure you're very honest with people about your intentions and be transparent about your plans. If you have the resources, are ready, and have a livestream schedule, be transparent about it. If you don't, be honest and transparent, and don't over-hype or over-promise.

Those things might not seem like a big deal, especially if you're coming from another space, like Web 2, where these things are actually encouraged. But in crypto, things work very differently, and they can ultimately cause harm. So we're taking this very, very seriously. One of the big things we've been doing over the past few days is proactively reaching out to creators and guiding them to make sure they're proceeding in the right way, so that all creators—not just streamers, but whether it's Meme Coin, ICM projects, or anyone else—can maximize their chances of success.

Host: Great. Okay, last question. What's the name of your chat group? — Haha, just kidding, don't answer. Let me turn to something more positive: What's one piece of entrepreneurial advice you'd give to entrepreneurs who want to follow the same path after seeing what you've accomplished?

Alon: It's hard to boil it down to just one thing. I would say always, always act with the highest standards of integrity, while also shipping fast and breaking things. It's not one thing, it's two things, right? (Laughs) Always act with the highest standards of integrity, while also iterating quickly, experimenting, and trying everything. At some point, something will "stick." That's what happened with us: we had a bunch of ideas that no one really cared about. Until, at some point, we came to Solana, and it became incredibly successful.

Host: Awesome. Thank you so much for your time and what you're doing. And I'm really looking forward to what you're going to build next, my friend. Awesome, thank you so much, Alon, and thank you all for joining us today.

With less than 10 employees, Axiom has set a new record for fastest-growing revenue

Host (Mert): Very cool! I hope you found this useful and informative. I really enjoyed my presentation on quantified energy (laughs). I think we'll have Henry up soon. Oh, well, the featured speaker is already here. Henry, how are you, brother?

Henry (founder of Axiom): I'm fine, how about you?

Host: I'm fine, too. I wanted to ask, have you ever been on a podcast or livestream before? You seem hard to get a date with.

Henry: No, this is my first time.

Host: Oh, wow, I'm honored, and Solana Channel is honored to have you give us your first public appearance. You're the founder and CEO of Axiom. Axiom is the fastest-growing company in the history of YC (Y Combinator), the accelerator that has incubated companies like Stripe, Coinbase, and Airbnb.

So, first, tell us a little bit about yourself. Not many people really know Axiom's founder, at least not personally. What brought you to where you are today? What experiences have brought you here?

Henry: Well, I think it goes something like this: I started trading crypto on my own during my senior year of high school. Then, in college, I met Preston E., who was also a computer science student, and we were roommates. So, we often worked on small projects on our own, because the class material wasn't that interesting. We'd always been interested in fintech and finding an edge in trading, whether that was creating our own tools or providing alpha to other traders.

After a few small personal projects, we interned at a large company for a while, and then we started Axiom. I actually started by following Ansem's coin trading, and then I thought, maybe we can make something better than Photon. So that's how it started.

Host: So you were working at a big company at the time, and you were also using various trading robots and applications on the market, and then you basically said, "Actually, I think we can do better," is that right?

Henry: Yeah, I was using Dex Screener and it was terrible. So I looked for alternatives and the only one I found was Photon. So we thought: we can do better.

Host: So what was the execution process like? Because I guess you know, a lot of people see a crappy website and say, "Damn, I can do better." But the crazy part is actually the process between the idea and the actual implementation. So how did you go from the idea to applying to YC to launching your first product? What was that process like?

Henry: We worked incredibly hard, literally, 16-hour days for months on end. Many people don't know this, but we released a version 1 back then. It wasn't very successful, with a ton of issues. In short, the product wasn't good enough. So we applied to YC, and thanks to Tom, our partner at YC, he saw our vision.

I think our ambition and vision have grown during this process. While we're still primarily focused on meme coins, we want to expand into a broader product in the future. The YC experience was fantastic, and it gave me a lot of insight into entrepreneurship. For us, it was a completely different experience from that of a typical AI company, as there were only five crypto-related companies in that batch, and we were the only consumer-facing crypto application.

YC forced us all to live in one house and really dive in. The difference between V1 and V2 was that we took a step back and interviewed a lot of deal makers, asking them what they were missing and what features they would like to see.

Host: Interesting, wow. I want to talk about the vision and the future, but before that, I saw a job posting for Axiom, and one of the requirements seemed to be living in an apartment with you guys? Is it in Texas or somewhere in the US? So, are we actually going to live under the same roof and work together? Is that a requirement?

Henry: Yes, that's right. I think nothing beats being in the same room. Even in an office, the commute can diminish that feeling. So our job postings are straightforward, but we also offer high compensation that matches the intensity of the work required.

Host: Well, I'm not a professional trader myself. I occasionally trade long on SOL, but generally I don't trade much. I'm curious, because there are all kinds of trading terminals, trading apps, and Telegram bots out there. You were a latecomer, but you quickly outpaced many of your competitors, and you managed to stay very under the radar until everyone could no longer ignore you. How do you think you achieved this? In such a crowded market, how do you stand out? What problems did you solve that others didn't realize, but that traders are very grateful for?

Henry: That's a good question. I think what sets us apart from other teams is that I'm a very strong believer that you don't necessarily need a super unique insight or idea.

While many accelerators and incubators suggest you need this, I believe what's more important, especially in the trading world, or indeed in many other fields, is execution. We're incredibly focused on execution. Another often-overlooked quality is taste. For example, in the early days, many people struggled with our UI and complained a lot. But over time, everyone sees our design decisions becoming the standard, and there's a reason for that.

Host: That's very interesting. We'll have Kyle come up and talk about this later. It's actually very similar to what Ford said: "If I had asked my customers what they wanted, they would have said faster horses." You're essentially saying: We're going to introduce a completely new user experience, even if it takes some getting used to at first. That's very cool. So, how would you describe Axiom? For example, to someone who doesn't know much about crypto, how would you introduce it? Would you say, "We let you trade any asset on Solana, and cross-chain is possible in the future," or something else?

Henry: That's the term we're using now. And because of job postings and a very strong headhunter, we now have more engineers and can expand into other areas. You'll see us in other areas soon.

Host: Very interesting. Next question: Today, you can trade almost any asset on Solana. What's your vision? When you talk to the team about the roadmap, or talk to new employees about the next one to three years, how do you describe how big the company will be? Do you want to be Robinhood, or define a new category?

Henry: Yeah, that's pretty much the same approach as Robinhood. A lot of what we're trying to do is similar to Robinhood's thesis. The difference is: some teams just follow where the revenue comes from, but we're really serious about this goal. Sure, right now it's mainly meme coins, but people trade a lot more. To become a true "one-stop shop," where users can safely store all their assets and have a seamless experience, we need to support a wider range of assets.

Host: Okay, let me ask another question I'm personally curious about, which the audience might not find particularly relevant. If you have any questions, please post them in the chatroom and we'll select them. You just said that you were the only consumer crypto app in your YC batch. Back then, most were AI, right? And about a year and a half ago, Jason famously tweeted, "If you're in crypto, switch to AI." In Silicon Valley, crypto is harder to justify than AI, in my experience, probably because I have zero risk appetite (laughs). What are your thoughts? What opportunities do you think crypto offers for the next generation of founders, users, and traders?

Henry: I think this is a classic answer: Crypto and DeFi offer opportunities far beyond the existing financial system. We're on Solana because it has the ecosystem we're looking for. We're also collaborating with highly advanced teams like Helius and Solana Research Labs, and we're very optimistic about Solana's future roadmap. The short answer is: it's a massive opportunity, because those who succeed can redefine the user experience of the financial system.

Host: That's very inspiring. Okay, I'd like to ask you some startup-related questions, but before that, I want to ask you something personal. You guys made money incredibly quickly, probably faster than PumpFun or Hyperliquid. Back then, you were just a few engineers working tirelessly in your Texas apartment. Did you really anticipate the success you've achieved today? Or were you surprised?

Henry: Well, I don't think any founder would say, "We're definitely going to be the fastest-growing company." Some might say that, but actually achieving it is a completely different matter. Honestly, for us, we were skeptical at times. But after launching the product and receiving overwhelming user feedback, we realized this thing could really be huge. Since then, we've adhered to one principle: whenever something new comes out, we want to be the first to offer traders an advantage, allowing them to trade in that new category. Looking back, that's not surprising, but it certainly was at the time.

Host: I also asked Alon and Toly: You've made so much money so quickly, whereas many people in history have made quick bucks and then gone rogue, even crashing the industry. Clearly, you're not doing anything like over-issuing stablecoins. But the question is, what drives you when you wake up every morning? Money is no longer an issue, so what else do you want to change?

Henry: For me, the driving force is creating a better trading experience. I see this as a massive opportunity, much like the CEO of Robinhood—he could have stopped expanding, but he obviously didn't. The reason is simple: whoever can execute best and control the distribution channels will capture this massive opportunity. Another key consideration for me is being the first company to define this experience.

Host: Okay, let me ask another question about the team. How many people are there in your team now?

Henry: Less than 10, including the new recruits, probably almost 10.

Host: It's crazy that they've achieved this with less than 10 people. So how did you recruit them? You can't just post a job posting and get them done, right?

Henry: Our approach has always been extremely resource-intensive and manual. When I had limited funding, I would personally search for independent developers on Discord and Reddit. Now, we do cold research on LinkedIn. For example, we focus on Solana developers and their open source contributions. We also maintain a large recruitment funnel. We've also established a strong headhunting agency, and most of our new hires come from there.

Host: It sounds like you're the type who keeps things to yourself when you see something that doesn't sit well with you until you personally address it. What do you think are the most common mistakes that founders make in the crypto space?

Henry: I think it's an over-focus on "marketing." Many people, especially after raising funding, want to buy an insurance network and spend money on influencers and agents. But if the product is bad, this is basically useless. I've seen this happen countless times. My point is: a good product will market itself. Users will truly love it, and then they'll want to tell their friends, "Wow, you didn't use this? I have to recommend it to you." That's the attitude a founder should have.

Host: That's a great point. This is especially important in the consumer-facing space, where people spread the word. Okay, last question. There are many of your loyal users watching your livestreams here. What can they expect in the coming months?

Henry: We will improve performance globally to achieve the absolute best. We've heard our users' feedback and are working hard to improve. We'll also be quicker to follow emerging trends, such as the recent Pump CCM. Furthermore, another branch of our team is working on other asset classes, and we'll see some cool collaborations in the future, bringing new trading experiences to our users.

Host: That's so cool. Henry, thank you so much for choosing this place for your first public appearance. You guys are doing great, keep it up.

Henry: Thanks, Mert, it's great to talk to you.

Multicoin’s $1.65 billion SOL DAT staked

Host (Mert): Guys, all of these guests are younger than me, but way more successful, which is not good for my ego (laughs). Kyle, are you here? Kyle, long time no see, my friend. How's it going? How's it going, man? How does it feel to see these young founders making more money than you?

Kyle Samani (Multicoin Managing Partner): Oh, man, I'm doing some soul searching right now.

Host: Now, our guest is Mr. Kyle Samani. A little background for our audience: I just had Kyle on my podcast two days ago on Sunday, so I've already asked many of the questions you're about to ask. I'll try to add some new ones. But, Kyle, you're the chairman of the new Treasury Company DAT (Treasury Type Company), ticker symbol FORD. Let's first fill in the blanks: What is it? What does it do? Why do it? Why are you doing this?

Kyle: Hi everyone, I'm Kyle from Multicoin. I'm in Washington, D.C., meeting with members of Congress over the next few days. I recently became Chairman of Ford Industries. Ford Industries is a public company listed on the Nasdaq under the ticker symbol FORD, FORD. Yes, it sounds just like that car company.

Over the past few months, I've gotten to know Ford Industries' management, and they recognized an opportunity to collaborate with Jump, Galaxy, and us at Multicoin to build a leading treasury strategy for Solana and digital assets. So, we came together and raised $1.65 billion in a matter of weeks. We announced the deal last week, and the closing took place last week. The funds have now been injected into the company, and we've already used them to purchase some Solana tokens. Of course, we have many more plans.

Host: Okay, let's talk about those plans. You're in DC right now, and I'd like to talk about what's going on there later. Some people in the chatroom are talking about "Samani mode" and "Saylor mode," which is quite interesting. What are your plans? What are you going to do? What does the future hold for Solana and Ford?

Kyle: Solana's future is essentially the dream Anatoly had back in 2017 and 2018. Back then, we called it a "decentralized NASDAQ." But in hindsight, that was a bit of a backward-looking statement. The concept has now evolved into what we call ICM (Internet Capital Markets).

I believe the internet capital market is a grand vision, one that's more imaginative, more future-oriented, and better captures the excitement this technology represents. What is an internet capital market? It's a global, unified ledger, available 24/7, permissionless, and programmable. All you need is a phone and an internet connection, and you can trade any asset from any piece of software. Essentially, it brings the inherent properties of the internet to finance. For the past 30-40 years in the software era, finance has existed in a strange little bubble: operating for a limited time, unlike the rest of the internet; financial software systems were strictly regulated and controlled. But it turns out that with cryptography and permissionless consensus, we can bring these inherent properties of the internet to all forms of capital flow, financial flows, value flows, and transactions.

This is Solana's vision, and Ford Industries hopes to play its part in moving this forward. I believe the most important thing Ford Industries can do is truly build the future. About six or seven weeks ago, SEC Chairman Paul Atkins gave a speech titled "Project Crypto" to the SEC's 4,000 employees. In that speech, he told everyone: We must move the US securities market to a blockchain. Think about what this means: it's a difficult and lengthy process involving a large number of stakeholders. There are obvious ones like the NYSE and NASDAQ, but there's also the DTCC, banks, publicly traded companies, brokerages, and more. It's essentially a complex and heterogeneous network of multiple stakeholders.

The opportunity I realized when I stepped into this role as Chairman of Ford Industries was that we could actually accelerate all of this. So, we're now deeply committed to building Ford Industries into the most blockchain-native public company in the world. I can't discuss the specifics yet, but broadly, this will involve both the capital markets side and the operational side. On the capital markets side, this means we intend to tokenize our stock. Once we tokenize our stock on Solana, we will handle dividends, equity governance (shareholder governance), stock splits, financing, and more, all on-chain. On the operational side, we hope to move core business operations to the blockchain as well.

This means on-chain transactions—which, incidentally, we've already done. The first thing we did after the settlement was to buy $1 million worth of SOL on the Dflow native chain. We contacted multiple Prop AMMs and bought this $1 million in SOL. I posted the TXID of this transaction on Twitter a few days ago. But it's not just about buying and selling SOL. We also want to run our entire business process, including payroll and supplier payments, on Solana, proving to the world that it's possible. This way, when the second, third, fourth, fifth, sixth, and tenth companies join, there's a viable path to follow.

Host: Wow, first of all, that's incredibly informative. Secondly, it's a clever example of "lead by example" marketing: just do it—others will eventually have to do it. Very cool. I did see that Dflow trade, and I also give a thumbs up to these Prop AMMs; they're really exciting new developments. Okay, that's a lot of content. I hope my quants have already edited this out.

Okay, Kyle, I have another question: You recently gave a talk at the All-In Summit—for such a large platform, I think it received relatively little attention. I'm guessing the video will be released soon. And you're currently in DC, or already in DC, talking to people. Compare how Solana is perceived in different circles in New York, San Francisco, and DC: How do they view us and crypto in general?

Kyle: You know the old picture of the blind men and the elephant? Different people touch different parts and think they are different things. I think the "internet capital market" is that elephant, and everyone sees it from different angles.

People on Wall Street see it as a trading system, and they generally like it; people in DC will say, oh, this thing is new and a little scary, I need you to help me understand it, maybe it will be less scary; people in San Francisco will say, man, this thing is cool, it's the intersection of distributed systems, cryptography, consensus, and so on.

Everyone has a perspective, and our job is to help them understand and engage. I'm in DC right now, meeting with some very important people to advance the encryption agenda in DC. We're working on the Clarity Act and several other things.

Host: Got it. I'd be disappointed if there weren't 50 different "elephant-stalk" tokens on-chain (laughs). Solana community, come on, give me an elephant, and tag me. You've said before that you'll deploy some capital into DeFi, but more broadly, run your business on Solana. Part of this is clearly a "Saylor strategy," where you're here to win, so you stockpile SOL. You mentioned a concept I found particularly interesting—which I've already stolen and tweeted—the M asset, or some other strategic M.

Kyle: I think it's inevitable. There are, I don't know, about 20 DATs operating online right now (give or take), and I wouldn't be surprised if there are 40 or 50 in the near future. But I don't think the market can support that many. So I think consolidation is inevitable, and the most logical acquirers will be other DATs.

Host: Very interesting. I just remembered a question I didn't ask: When you talk to regulators in DC, or even people in Europe and elsewhere, a common bias (especially back in January) was that Solana was all about memes. Obviously, you and I disagree: Solana has many other assets and a rich ecosystem. How would you respond to these people? Assuming they're asking in good faith, not like some Twitter troll, but simply someone who's not up to date, what would your takeaway be?

Kyle: I think you have to look at this through the lens of financial history. Look at the history of finance: as long as people think they can play games in the market to profit, they'll do it. This goes back hundreds of years to the days of commodity trading. The earliest US stock markets date back to the late 19th and early 20th centuries. They initially thrived, then suffered the Great Depression. After the economic crash, scammers tried to exploit the stock market. Our solution was a series of laws: the Securities Act of 1933, the Exchange Act of 1934, the Investment Company Act of 1940, the Commodity Exchange Act... These four pieces of legislation, even 90 years later, remain the cornerstone of the rules governing American capitalism and the financial system.

I emphasize this not to say that finance is bad, but to understand that intelligent but unethical people will always try to exploit the financial system for their own benefit. Therefore, it's up to regulators, self-regulatory organizations (like FINRA in the US), and good industry players like exchanges, banks, and brokerages to work together to establish a set of rules that encourage healthy market behavior. This is a never-ending game of cat and mouse: there's no logical end. Markets evolve, and so does this cat and mouse game. With the new paradigm of crypto, the game has changed, and people may be slower to adapt, but that's okay—everyone will adapt, and we'll ultimately end up with a net-improved system.

Host: Cool. Okay, I'd like to end with a little pep talk for the Solana bulls. But before that, let's cool things down a bit. We're clearly bulls on Solana. Honestly, you're probably even more bullish than I am, which is impressive. Putting aside our stance, what do you think Solana needs to improve most right now? You're also a VC, investing in projects and fixing the network's shortcomings. What are the areas you think need to be improved urgently?

Kyle: My top priority right now is tokenizing Ford Industries stock (our ticker symbol is FORD). People have been talking about stock tokenization for 10 years now. Ethereum is 10 years old, and people have been talking about it for almost 10 years now, but it still hasn't been meaningfully implemented.

Our good friend Galaxy tokenized their equity on Solana using Superstate a week or two ago; the scale is obviously still relatively small. I believe the most important task for the Solana community and ecosystem in the near term is to truly launch this initiative. We are currently tokenizing our own equity; we will then collaborate with ecosystem partners—wallets, market makers, and others—to ensure on-chain trading liquidity. Furthermore, we will collaborate with DeFi protocols to ensure that these equity can be used as valid collateral in various DeFi systems.

So we need to pull the entire chain together. Everything in finance requires collaboration from multiple parties, and they all need to be running at roughly the same time, moving forward in a coordinated and consistent manner. I'm fortunate to be in this position, with these connections, to try to coordinate all parties and truly get this off the ground.

Host: Okay. Finally, let's do some role-playing. Imagine you're on CNBC, and I'm a host who's a bit better looking than Jim Cramer (a famously bald CNBC host) and a bit less attractive than Andrew Ross Sorkin (laughs).

Kyle: You're definitely more entertaining, Mert, I agree.

Host: Great (laughs). Now you're on stage, and Tom is waiting backstage. You want to get him "on edge." You need to send a message to all the "boomers": Why will Solana continue to grow from here? Why Solana? What's your golden thirty seconds?

Kyle: I think the argument is simple: Ethereum was groundbreaking technology when it launched in 2015. Solana learned a lot from Ethereum, but they didn't iterate their system quickly enough. Today, Ethereum is over 10 years old (it just celebrated its 10th birthday a couple of months ago), and it still only handles about 20 transactions per second (TPS), fluctuating. This is clearly not enough to support global finance, payments, and more. This conclusion is a no-brainer. Solana isn't perfect yet, but at least Solana has a stronger credibility today to support 8 billion people participating in these internet capital markets. With the recent passage of the GENIUS Act (which we hope will drive global adoption of stablecoins), if you want to enable a billion people to use stablecoins, you have to do it on a chain that can support throughput and scalability.

Speaking of "Project Crypto" and the securities markets: Chairman Atkins wants this to happen. The Solana network currently processes approximately 10 billion transactions per day (give or take), and we're quite optimistic that this number will grow significantly in the coming months and years. If you look at the actual number of transactions settled daily on major stock exchanges around the world (NYSE, NASDAQ, London, Singapore, etc.), it's less than 10 billion. Of course, the total number of pending and canceled orders exceeds 10 billion, but actual daily trading volume is less than 10 billion. My point is to make it clear: we have the technical capabilities, and at least a reasonable claim, to be able to settle securities trading volumes not just in the United States, but globally. We still have a long way to go, but we're clearly not at 20 TPS. If you believe in the promise of crypto and the global internet capital market, you must have a scalable chain. Solana is the most performant and scalable chain available today—a fact that has been repeatedly proven across numerous metrics.

Host: Okay, our crew is already rushing to edit this segment (laughter). Kyle, thank you so much for coming. Best of luck to you in DC, and to Ford. For those of you who want to reach out to Kyle, remember to tweet him a bunch of long analogies, preferably without context, the less concise the better.

Kyle: Thanks for having me, Mert. Thank you, everyone. It's great to see you all. Bye.

Host: Well, thank you all for joining us. I hope you enjoyed this "Second episode, but first bald edition" Solana livestream. There will be many more to come. If you'd like to join in, please send me your suggestions. Thank you very much. Ah, I feel like I've been cut off the mic at the Grammys or the Oscars (laughs). Good night, bye, bye.