One month online, zero incidents! This article explains Binance's C2C Select Zone.

- 核心观点:币安C2C严选专区强化资金安全保障。

- 关键要素:

- 严选区提供最高5万USDT冻结赔付。

- 商家需缴纳10万USDT高额保证金。

- 平台风控结合AI实时监测交易。

- 市场影响:提升用户信任,促进行业合规化。

- 时效性标注:中期影响。

"When my assets were frozen, I felt like the sky was falling. I'm an ordinary, law-abiding citizen, yet I was implicated in a case because of this incident," said Peter, a cryptocurrency enthusiast who experienced an asset freeze. The experience left him physically and mentally exhausted. He ran back and forth between the bank and the police station day and night, carrying printed bank statements, ID documents, and account verification documents. The fact that his account funds were involved in a criminal case caused him immense mental stress. Countless similar stories have played out in the cryptocurrency world. Some have had their lives severely impacted by unexpected freezes, while others have been so terrified that they dare not venture into the field again.

The C2C model of cryptocurrency is essentially a user-to-user exchange. While fiat currency circulates outside the platform through traditional financial channels like banks, digital assets are held in escrow by the platform, released only after the recipient confirms receipt. Some transactions even rely solely on trust between individuals. Because transacting parties are self-selected, their reliability and legality remain a mystery. Even on compliant platforms, it's difficult to completely prevent the flow of "dirty" funds within the channel. In extreme cases, this can lead to asset freezes and other consequences.

Faced with these thorny challenges, top platforms are leveraging risk control matrices and ongoing guarantees to optimize the trading experience. Binance C2C, as an industry leader, has consistently maintained a low freeze rate thanks to its massive trading volume and user base. Its merchant order completion rate remains high, and fraud and freeze rates are gradually decreasing. Dispute mediation and compensation guarantee mechanisms provide users with a safety net. Furthermore, the Shield Merchant and bulk trading areas within the C2C platform offer users a certain amount of freeze compensation, safeguarding the security of their funds. Since the launch of Shield Merchant three years ago, 70% of users have chosen to trade with Shield. These achievements are the result of the platform's in-depth deployment of black market detection, fund chain verification, and merchant onboarding.

Within this framework, Binance has embedded risk mitigation into the user journey. The Strictly Selected Zone also screens out higher-quality merchants from existing SHIELD merchants, giving users greater peace of mind. Users are continuously iterating on C2C, and based on the existing SHIELD merchants, a C2C Strictly Selected Zone has been launched. If a withdrawal from the C2C Strictly Selected Zone is subject to judicial freezing, 100% compensation will be provided, with a maximum limit of 50,000 USDT.

Next, this article will take you step by step to explore the secrets of Binance's C2C Select Zone and dismantle the layers of defense it has built for safe withdrawals:

The nightmare behind unsecured C2C: how do users fall into the trap step by step?

Sophia (a pseudonym) is a frequent visitor to the cryptocurrency community, having frequently deposited and withdrawn funds from the same ordinary C2C merchant. However, a recent, ordinary transaction led to a major setback. On Twitter, she saw an account with the same name as a regular merchant she frequently used on Binance C2C advertising a withdrawal, offering a more "affordable" price than the platform's merchants. She then added the "merchant" on Telegram for a private transaction. The merchant offered a higher selling price than the platform's listed price. Sophia dismissed the offer, having traded with the merchant many times before, and considered it a token of appreciation for her long-time customers. However, after the transaction, her bank account was still unfunded. When she contacted the "merchant," she discovered the TG account had been deleted.

At this point, Sophia's trading was completely halted. Not only had she transferred her U-coin, but she hadn't received the money either. She belatedly realized that these "merchants" advertising on other platforms, impersonating exchanges, had tricked her into trading at a higher price in order to defraud her of her money. Sophia quickly contacted Binance's P2P customer service for assistance. Although the transaction didn't take place on the Binance platform, and the scammers were impersonating Binance merchants, the team, adhering to the principle of "user first," dispatched a security specialist to follow up, advising the user to report the incident to the police and guiding them to collect as much relevant information as possible to provide evidence for police and bank prosecution.

Amy's (a pseudonym) tragedy escalated into a scam. She met an online lover who claimed to be an expert in cryptocurrency trading and a VIP user on the Binance platform. He told her that Binance offered VIP-specific financial products with promising annualized returns, requiring no manipulation. As a cryptocurrency novice and unfamiliar with the industry, Amy took his advice and offered to transfer her money to these products. However, her partner recently claimed that Binance had frozen her funds when she attempted to withdraw them, demanding their funds be released through financial transactions. He also asked her to add Binance customer service on WeChat for further communication. During this time, she continued to transfer funds to his bank account, only to be told that his account had been repeatedly frozen by the platform, making it impossible to withdraw the funds.

Amy felt very desperate and complained to "Binance" on the social platform. After seeing her request for help, the Binance team immediately arranged for a specialist to follow up. After investigation, it was found that Amy's "partner" account was real and had never been frozen. It had even had normal deposit and withdrawal operations recently. Therefore, it was determined that the user had been defrauded by a "pig killing scheme" and reminded the user to retain the evidence and report it to the police. Even the "big sister" personally stepped in to remind the user not to continue transferring money to the "partner" and not to trust the "Binance customer service" on WeChat, because the real Binance platform can only find customer service within the platform. In the end, Amy came to her senses and reported to the police. At the same time, the Binance platform also cooperated with the police investigation and froze her "partner's" account to help her recover the money.

Binance leads the industry in both trading volume and depth, and has particularly strict vetting standards for C2C merchants. Since the launch of Shield merchants, they have attracted 70% of user transactions. Consequently, many criminals have exploited this to impersonate Binance merchants and defraud them. Binance C2C reminds users not to trust advertisements claiming to be Binance merchants on other platforms. Transactions with Binance merchants should only be conducted through the Binance C2C platform.

If users encounter this type of scam impersonating a Binance merchant, they should immediately stop communicating with the scammer and block their contact information to prevent further misleading. If you encounter a scam, you can still call Binance C2C customer service for assistance at any time, so we can maximize our efforts to help protect the security of your assets.

Risk prevention and control are moved forward, and merchants are assured of settlement through merchant training

"When I first applied to become a certified Binance C2C merchant, I almost backed out," David admitted. The process for becoming a Binance C2C merchant was far more demanding than any other platform he'd ever encountered. They had to upload their ID and even provide proof of past trading history. Becoming a Shield merchant also required a hefty deposit. But it was this "rigor" that ultimately convinced him to choose Binance. "Although the review process was tedious, it gave me complete confidence in Binance's professionalism and robust security. After all, the stricter the rules, the more high-quality users gather, and the fewer potential risks."

Over the years, David, a C2C merchant, has repeatedly fallen prey to scams and even legal risks on other platforms. "I remember one time, there was a problem with the funds a buyer transferred, and after my U transfer was completed, my bank account was frozen. Not only did I lose thousands of dollars, but I was also summoned to the police station multiple times while trying to explain the situation and submit various documents. It was a huge waste of my time and energy," David recalls, still haunted by the memory. But since joining Binance C2C, such incidents have vanished. "Binance's risk control system is truly reliable," David exclaimed, praising the platform's backend, which monitors every C2C transaction in real time and intervenes immediately if any anomalies are detected. "Once, a buyer's remittance was frozen after it arrived. I was terrified of a repeat of the same problem, so I contacted the Binance C2C team, who temporarily froze the transaction for me. Once the freeze was automatically released, the platform released the loan. I no longer have to worry about buyers having problems with their funds."

David noted that Binance's recently launched Strictly Selected Zone is even more restrictive for merchants. Compared to the previous Shield merchants, the Strictly Selected Zone requires a 100,000 USDT margin. This is not only a guarantee for users, but also a constraint for merchants. He said: "Under this mechanism, our merchants will be more cautious about their reputation, because no merchant would be willing to joke with such a large amount of money as 100,000 USDT."

One of the main reasons for frozen cards during C2C withdrawals is often due to whether the funds exchanged between users and merchants are "clean." If the funds received by users or merchants are involved in a judicial case, the judicial authorities will notify the bank to freeze the funds.

Binance C2C addresses market pain points and has launched the "Binance C2C Certified Advertiser Management Regulations," which define action guidelines and restricted areas for merchants in C2C, covering payment and collection regulations, account changes, dispute mediation, and other aspects, so that merchants have rules to follow. Violators will face tiered penalties ranging from warnings to account bans and even permanent bans. At the same time, the platform's hosting and risk control measures are used to protect user interests.

Binance C2C's merchant screening process begins right from the application stage. First, through a series of rigorous account screening and risk management strategies, the system prioritizes eliminating high-risk applicants to ensure a clean background. For example, the application threshold requires a one-on-one video review by a dedicated person, which includes identity verification, order completion rate, trading volume, and other key indicators. Furthermore, a security deposit must be submitted, and the merchant's familiarity and compliance with the platform's rules must be confirmed. New applicants are subject to additional screening to prevent low-quality applicants from entering the market.

Overcoming these hurdles is just the beginning. Becoming a regular certified merchant means upgrading to a bulk or Shield merchant requires even stricter hurdles. Even after approval, merchants remain subject to ongoing risk control and strict oversight. Binance's C2C risk control team leverages multi-source data analysis to build dynamic models that track merchants throughout their entire transaction process, analyzing their behavior and transaction amounts in real time. By integrating big data and AI technology, they are able to identify potential risks even before transaction preparation. This systematic analysis of trading habits, funding flows, and account history pinpoints potential sources of trouble, minimizing risk exposure at the root.

Binance C2C not only requires merchants to adhere to strict entry and trading rules, but also regularly invites renowned legal professionals in the industry to provide legal training and assistance to all merchants, ensuring their understanding and implementation of these guidelines. "As ordinary merchants, our understanding of the law is relatively superficial. Often, what we consider to be commonplace operations may be problematic in the eyes of regulators," said Alex (a pseudonym), a Binance merchant. He stated, "Binance regularly invites legal professionals from the industry for training. This not only provides us with a broad understanding of various legal situations and cases involving C2C withdrawals, but also explains which actions fall within legal red lines and which are permitted. This not only helps us mitigate risks ourselves but also ensures the security of our users' funds. Binance truly demonstrates its commitment to every merchant and user."

"C2C Selected Zone" is launched, and Shield merchants usher in a comprehensive upgrade

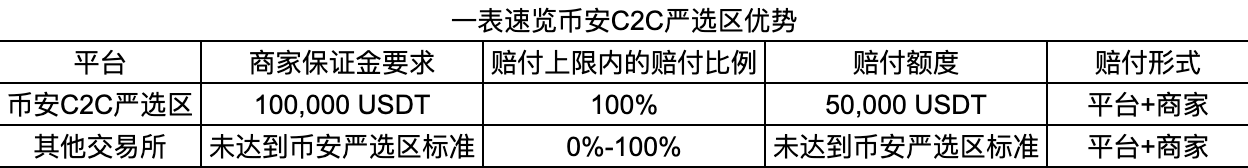

In order to further integrate risk hedging into the user experience and dispel users' concerns about card freezes during withdrawals, Binance's higher standards fully guarantee that users can receive full compensation from merchants when encountering freeze compensation scenarios. This fully demonstrates Binance's strict requirements for merchant thresholds and its determination and strength to ensure the safety of user funds. C2C has officially created a new "C2C Strictly Selected Zone" based on the Shield merchants. Simply put, if a user encounters a judicial freeze after trading with a merchant in the Binance C2C Strictly Selected Zone, they can obtain corresponding financial compensation in accordance with the platform rules: up to 100% compensation ratio, and a single compensation limit of up to 50,000 USDT. At the same time, merchants in the Strictly Selected Zone must pay a deposit of 100,000 USDT, which is the highest in the industry in terms of merchant deposit, compensation amount, and compensation limit.

The funds for compensation provided by Binance C2C are jointly borne by the platform and merchants, rather than relying solely on the merchant's deposit. This means that compensation is provided with an additional layer of insurance, and compensation can still be obtained even in the most extreme cases. This is the "user-first" principle that the Binance platform has always practiced, and it always considers issues from the user's perspective.

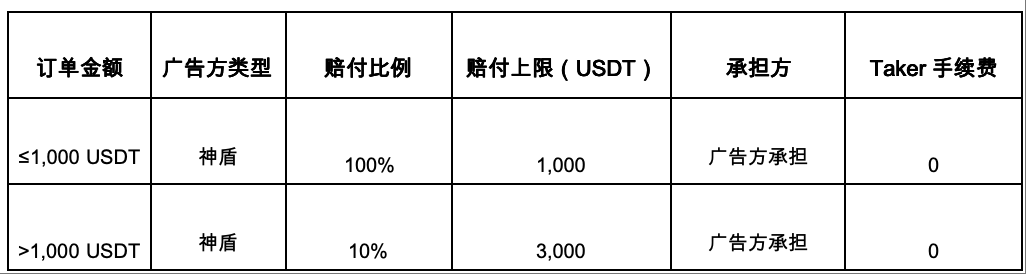

Not only in the strictly selected areas, even users who trade with SHIELD merchants can enjoy more comprehensive compensation protection after this upgrade. For amounts within 1,000 USDT, full compensation can be achieved, and for the part above 1,000 USDT, 10% compensation can be achieved, up to a maximum of 3,000 USDT. From now on, users can choose from a wide variety of compensation-guaranteed merchants on Binance C2C. In other words, in Binance's C2C transactions, more than 75% of merchants have compensation guarantees, and the coverage rate of compensation merchants exceeds other platforms in the industry.

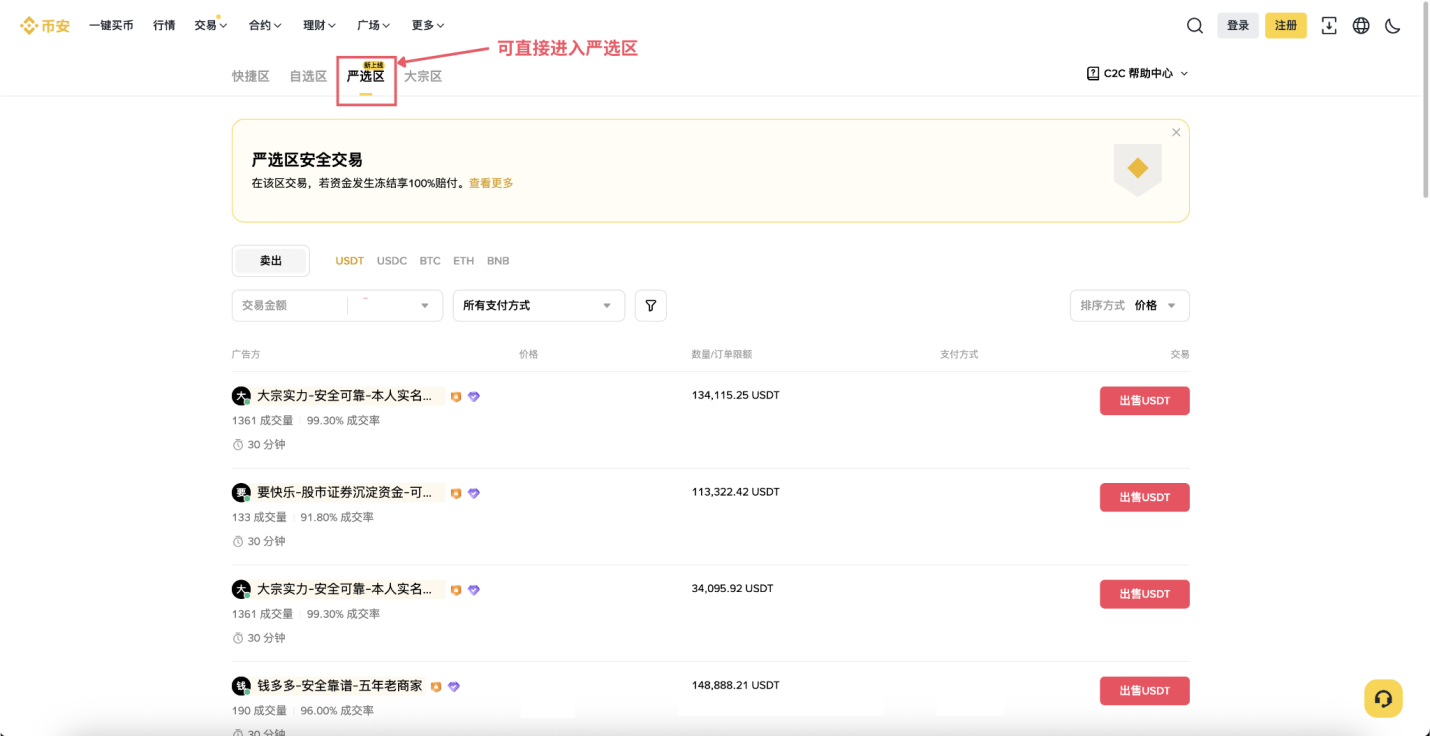

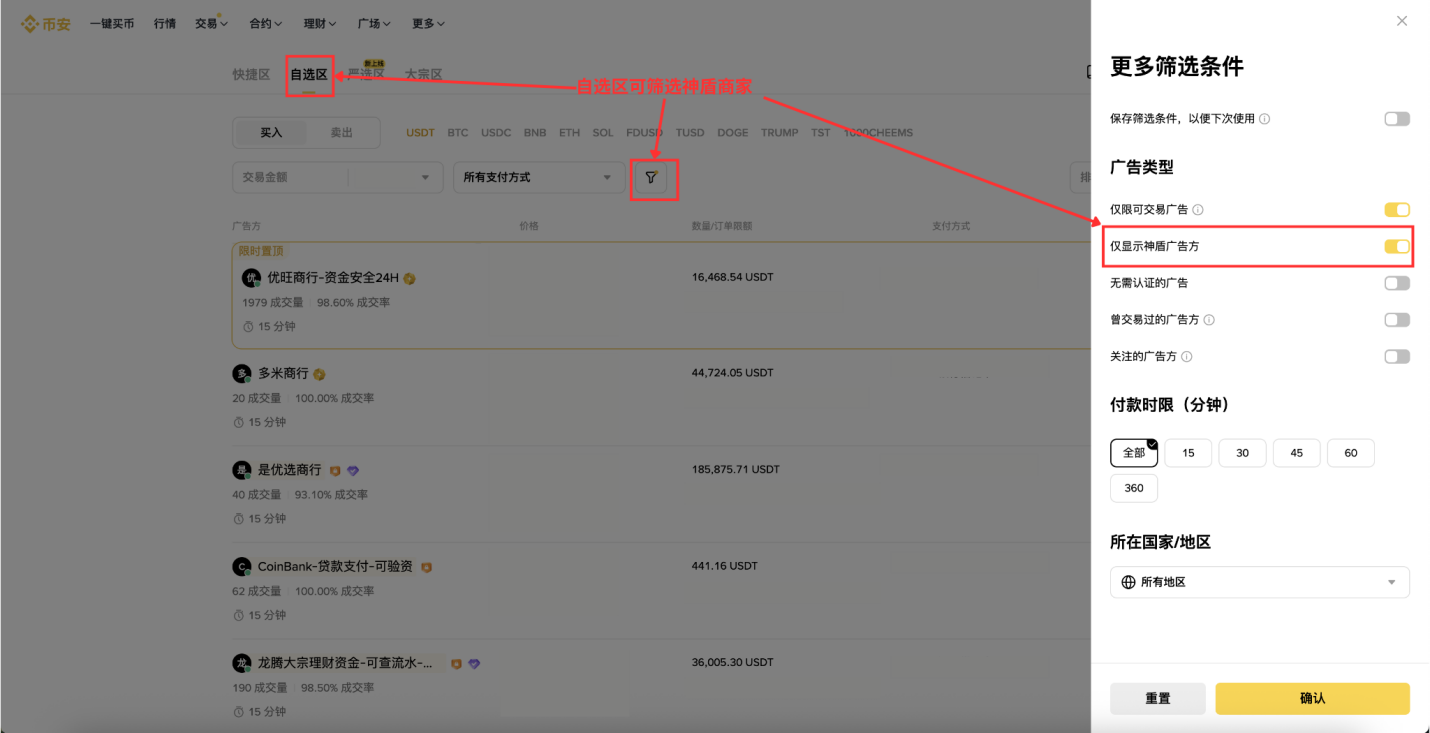

Furthermore, to facilitate user selection, Binance has created a separate "Strictly Selected" section within the C2C interface. Users wishing to trade directly with merchants in this section can simply click on it on the website or the new app, eliminating the need to filter merchants in the list. Even if users are trading outside of this section, they can still select the "Bulk" section or "Customized" section to find Shield merchants.

Even if merchants are placed in the strictly selected zone, Binance will continue to monitor them. For example, merchants are required to comply with the "compensation guarantee" service guidelines and are prohibited from using false promises to induce transactions. If a user complaint is verified to be the merchant's fault, the platform reserves the right to take measures such as deducting points, imposing fines, freezing accounts, and even revoking compensation eligibility, depending on the circumstances. Merchants who actively fulfill their compensation obligations and perform well will be rewarded with traffic allocation, exclusive rankings, and other incentives to provide higher-quality service.

Since Binance's C2C Select Zone launched a month ago, numerous users have withdrawn funds through it. The fact that it has operated with zero incidents in a month represents the ultimate protection for users and reflects the original purpose of the Select Zone: not to compensate users, but to provide them with a safer, more stable, and more reliable withdrawal experience. A platform with zero incidents is superior to thousands of platforms with incidents.

Binance also reminds users that they must adhere to the platform's risk management rules during transactions, such as verifying receiving account information and promptly confirming receipts, to avoid unnecessary disputes. If suspected fraud or fund anomalies occur, users should immediately contact customer service. The platform will assist and take strict measures against offending merchants, including compensation.

Linked with the risk control team, Binance C2C provides a 24/7 complaint channel and lock-up mechanism.

If the card is frozen, how can the user apply for compensation?

When a user finds that his account has been frozen, he should first contact the bank where he opened the account to confirm whether it is a judicial freeze and the duration of the freeze; if it is indeed a judicial freeze, the user needs to contact customer service to file a complaint and submit relevant materials, and the platform will review the application; after the review is passed, the merchant must complete the compensation within 30 working days after receiving the notification. If the compensation is not paid within the deadline, the platform will directly deduct the compensation from the merchant's deposit after receiving the user's complaint; if the merchant's deposit is forcibly deducted and is not replenished within 3 natural days, the platform will suspend its order publishing authority until the deposit is paid in full.

If a dispute arises between a user and a merchant, how will the platform handle it?

When user Alice was withdrawing money through a regular merchant C2C on Binance, her bank account was frozen after the merchant transferred the payment. "My first reaction was to contact the other party, but I couldn't get through at all," Alice recalled. "Although I have used regular merchants many times before, this time I was really worried that my money would be frozen and I would not be able to get it back." After realizing the anomaly, she immediately submitted the relevant transaction records and receipts through the Binance C2C complaint channel.

After receiving Alice's complaint, Binance C2C's customer service team quickly launched a review process. Through review, they found that the merchant had followed the standard operating procedures during the process. Users may actually face two situations: periodic risk control suspension of payment by the bank or temporary suspension of payment by the court. Therefore, the team reassured the user not to worry, but to communicate with the bank or local police to understand the specific situation.

During this period, the customer service team immediately informed the risk control department of the transaction, which conducted an in-depth analysis. Through comprehensive monitoring of chat logs with the user and a review of all previous transaction records and behaviors, it was ultimately determined that the merchant had engaged in no unusual behavior during the transaction. However, since the incident occurred, neither the user nor the platform was able to contact the merchant. Binance C2C, leveraging its custodial service mechanism, immediately locked and froze the funds to ensure the user's trading rights were not compromised. Binance C2C also arranged for security specialists to follow up on the user's situation, providing guidance on reporting the incident to the police and collecting information, including bank statements, to facilitate subsequent provision to the bank and police.

Recently, user Rachel registered on the platform and placed an order to purchase USDT. While transacting with a third advertiser, the advertiser quickly noticed the user's unusual activity and reported the situation to the platform. Upon receiving the alert, the platform immediately activated its risk control mechanism and conducted a comprehensive investigation of Xiao Guo's account, discovering significant risks associated with his withdrawal address. To prevent further losses, the platform immediately froze the relevant assets.

With the professional intervention and counseling of local police, Rachel gradually realized she had fallen prey to a "pig-killing" scam and proactively contacted the platform for assistance. Ultimately, through the coordinated efforts of the platform and the advertiser, the transaction was successfully refunded, helping Rachel recover her losses.

This incident not only demonstrates the effectiveness of the platform's risk control system and the advertisers' keen risk awareness, but also embodies the platform's service tenet of "users first, safety first." Going forward, the platform will continue to optimize its risk control mechanisms and collaborate with advertisers, users, and regulators to create a safer and more trustworthy trading environment.

The Binance C2C team stated: "We always prioritize user rights. We not only do everything we can to ensure user safety, but we also punish merchants who violate regulations. Even if users do not trade with merchants in the strictly selected or general zones, such as large-volume merchants or merchants with compensation mechanisms such as Shield, we will still handle the claims submitted to us regarding withdrawal disputes."

Binance C2C continues to strengthen and improve its risk control system. On the one hand, strict entry barriers ensure a thorough screening of merchants who process user withdrawals from the very beginning, comprehensively monitoring all merchant chat and transaction activity. On the other hand, Binance C2C actively encourages users to report suspicious activity and offers rewards to incentivize participation. Furthermore, Binance C2C provides risk warnings for merchants with lower transaction volumes, highlighting them for users to see. Regular safety education and legal education programs are also conducted to raise user awareness of risk prevention and provide legal education to merchants, ensuring they understand the legal red lines they should not cross.

24/7 service team and derivative product support

Binance's C2C business team, comprised of over 100 people across customer service, product development, and risk management, provides users with 24/7 support. Since its launch, it has expanded from a digital asset trading service on the exchange to a more comprehensive offering. As market demand diversifies, Binance C2C now supports stablecoins like USDT and USDC, as well as mainstream currencies like BTC, ETH, and BNB. C2C transactions can also be used to directly purchase currently popular alpha tokens, allowing users to fully participate in the ecosystem built by Binance and its wallet. Furthermore, a wide range of payment methods offers users greater flexibility, including bank transfers, bank cards, and other common payment methods.

The global financial landscape is undergoing significant change. With the entry of countries and institutions, digital assets are becoming increasingly integrated into people's daily lives. Binance has always upheld the principles of global compliance and user-first approach, continuously upgrading and improving its internal systems and mechanisms to provide secure, compliant, and stable digital asset services. Binance C2C further upholds this philosophy, ensuring the safety and user experience of both merchants and users through comprehensive protection mechanisms and strict standards, fostering a mutually beneficial ecosystem.

Disclaimer: Digital asset prices are subject to high market risk and volatility. The value of your investment may fluctuate, and you may lose your investment. You are solely responsible for your investment decisions, and Binance is not responsible for any resulting losses. Past performance is not a reliable indicator of future performance. You should only invest in products you are familiar with and understand the associated risks. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance, and consult an independent financial advisor before making any investment. This article should not be considered financial advice. For more information, please refer to Binance's Terms of Use and Risk Warning.