Hyperliquid Stablecoin Wars: An In-Depth Analysis of Ecosystem, Technology, Market, and Regulation

- 核心观点:Hyperliquid稳定币大战暴露平台风险。

- 关键要素:

- 平台历史安全漏洞未解决。

- 验证者中心化与预言机风险。

- 高收益模型加剧系统性风险。

- 市场影响:警示DeFi行业风险定价失衡。

- 时效性标注:中期影响。

Original author: Helios

summary

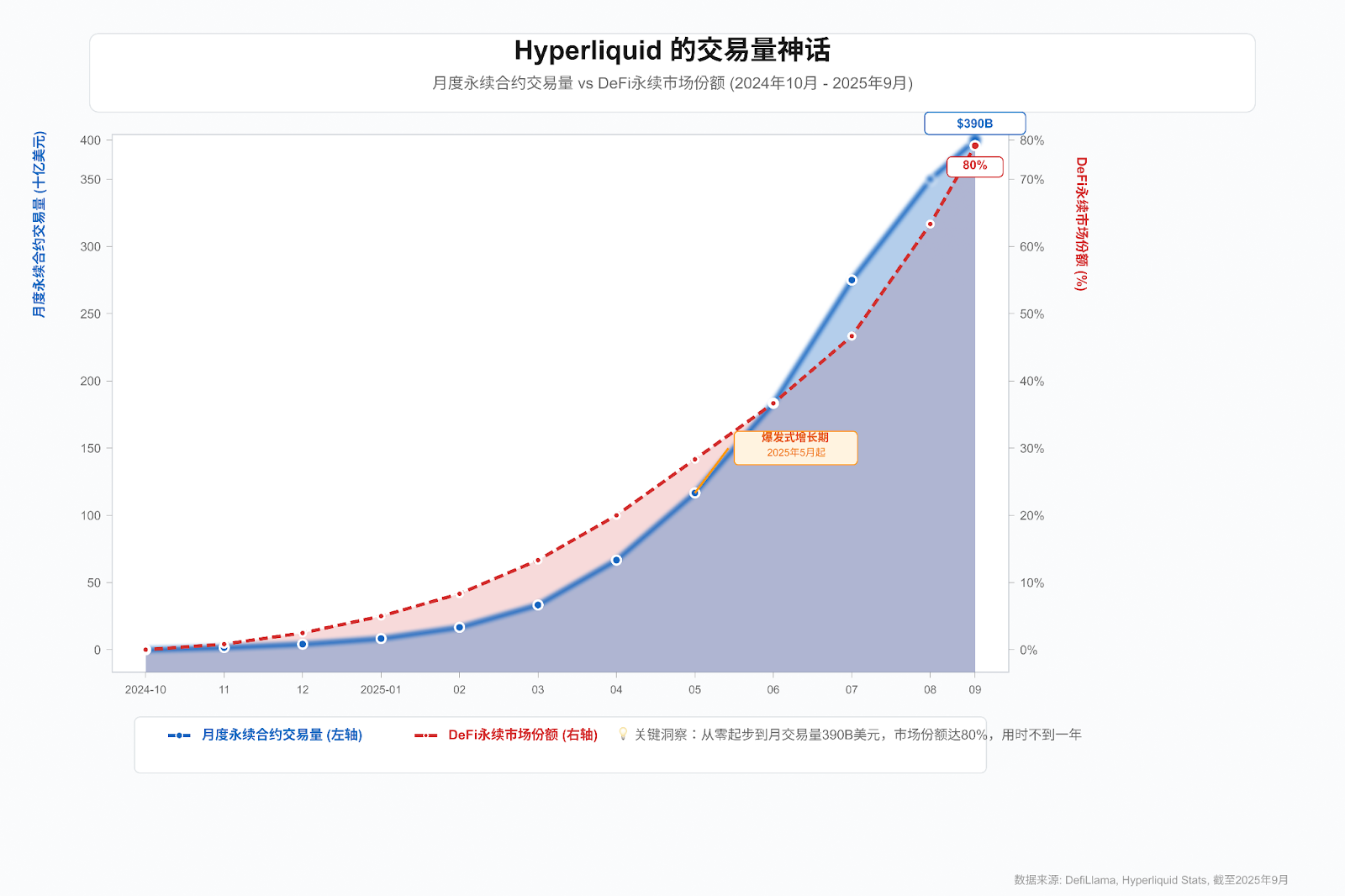

The Hyperliquid platform recently engaged in a "stablecoin war" over the right to issue USDH, attracting billions of dollars from industry giants such as Paxos, Frax, and Ethena, creating an unprecedented spectacle. This success is driven by Hyperliquid's $400 billion monthly trading volume and immense ecosystem appeal. However, amidst this wave of capital, a more serious issue has surfaced: the Hyperliquid platform's historically known security vulnerabilities, combined with its high-risk, high-return stablecoin model, are brewing a systemic risk that could jeopardize the entire ecosystem.

This report provides an in-depth analysis of this battle. We believe that the essence of this competition is not a simple commercial bidding, but a gamble between "compliance and stability" (represented by Paxos) and "high returns" (represented by Ethena). The core contradiction lies in that no matter which glamorous solution is chosen, USDH will be built on a historically impeccable technical foundation. The problems exposed by it, such as validator centralization and oracle manipulation (such as the XPL incident), are the "original sins" that cannot be avoided in any discussion.

This report argues that the USDH project's greatest challenge stems not from external market competition but from a deadly combination of internal platform risk and radical financial innovation. The outcome of this battle will not only determine the future of Hyperliquid but also serve as a decisive case study for the entire DeFi industry in how to price risk in the face of the allure of high growth.

Chapter 1: Introduction

1.1 The core role of stablecoins in the cryptoeconomy

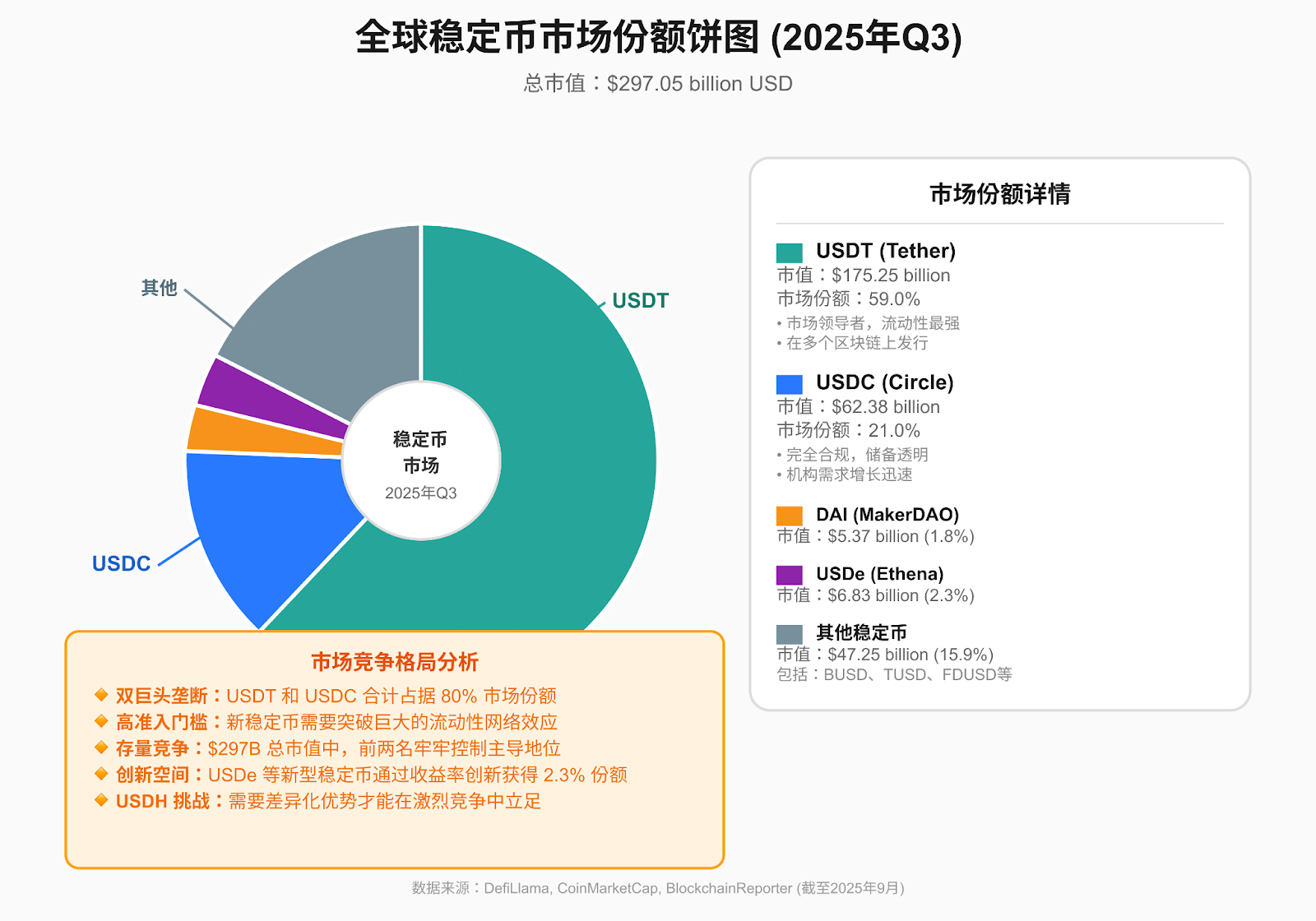

Stablecoins are cryptocurrencies whose value is anchored to a stable asset (usually fiat currency). They play a key role in the cryptoeconomy, bridging the fiat and digital asset worlds. Based on their collateral and mechanism, stablecoins can be categorized into three types: fiat-collateralized stablecoins (such as USDT and USDC), which are backed 1:1 by fiat reserves like the US dollar; crypto-collateralized stablecoins (such as DAI), which are issued by over-collateralizing crypto assets; and algorithmic stablecoins , which rely on algorithms and arbitrage mechanisms to maintain their peg and carry a higher risk profile. Stablecoins have become a core medium of exchange and store of value in the crypto market, playing an indispensable role in transaction settlement, decentralized finance (DeFi), and cross-border payments. As of mid-2025, the global market capitalization of stablecoins exceeded $250 billion.

1.2 Hyperliquid Platform

Hyperliquid is a vertically integrated, high-performance Layer-1 public blockchain and decentralized exchange (DEX) focused on on-chain derivatives trading. Its core advantage lies in its on-chain order book model, combined with its proprietary HyperBFT consensus mechanism . This enables processing of up to 200,000 orders per second and sub-second transaction confirmation latency, delivering performance and experience comparable to centralized exchanges. As of August 2025, Hyperliquid's perpetual contract monthly trading volume has approached $400 billion , firmly securing the top spot in the DeFi derivatives market. Its vision is to create a high-throughput, low-latency, and fully functional on-chain financial system.

1.3 The Origin of the Hyperliquid Stablecoin War

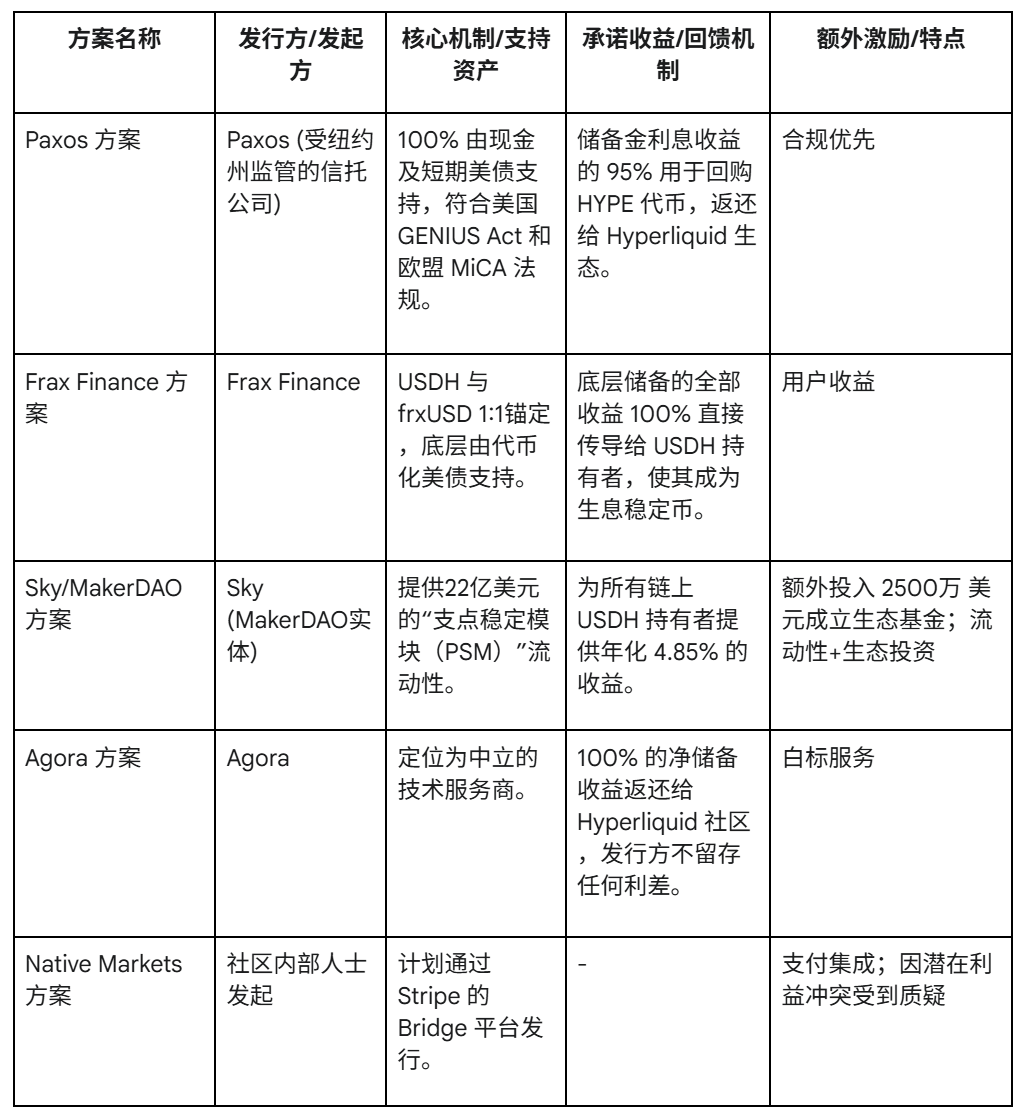

Hyperliquid has decided to launch its native stablecoin, USDH, aiming to reduce its reliance on external stablecoins (particularly USDC), strengthen its ecosystem autonomy, and share in the significant returns generated by its stablecoin reserve assets. Rather than issuing its own stablecoin, the platform opted for an open bidding process, inviting top global institutions to submit proposals. This move quickly sparked a stir in the industry, with six prominent organizations, including Paxos, Frax Finance, Sky (a MakerDAO entity), Agora, Native Markets , and Ethena Labs , entering the competition with distinctive designs and compelling offers. The core criterion for the bid was to maximize value for the Hyperliquid ecosystem. The winner will be determined by a vote of network validators on September 14, 2025.

This competition, which brings together leading players from both the centralized and decentralized sectors, has been dubbed the "Hyperliquid Stablecoin Wars" by the industry. However, it not only affects the future financial foundation of the Hyperliquid ecosystem, but more importantly, it puts Hyperliquid, a rapidly growing but relatively young platform, under extreme stress tests of its financial stability and security. The real challenge lies in whether the community and validators will ultimately favor short-term high returns or long-term security and stability—a choice that will directly collide with the platform's own technical risks.

Chapter 2: In-depth Analysis of Hyperliquid Stablecoin (USDH)

2.1 USDH Proposal: A Battle Between Wall Street and Crypto Maniacs

On the surface, USDH's six proposals represent a competition of business plans, but in reality, they represent a clash of two distinct development philosophies. On one side, the "Wall Street approach," exemplified by Paxos, emphasizes compliance, transparency, and regulatory friendliness, promising a secure but limited stablecoin. On the other, the "crypto-native approach," exemplified by Ethena, offers a highly alluring but potentially risky future through radical revenue-sharing models and substantial ecosystem incentives. The outcome of this clash will profoundly define the very essence of Hyperliquid's ecosystem.

The core of all proposals lies in how to manage USDH reserves and how to distribute the interest income generated. The main proposal mechanisms are as follows:

2.2 USDH’s Technical Architecture: A Double-Edged Sword of Efficiency and Risk

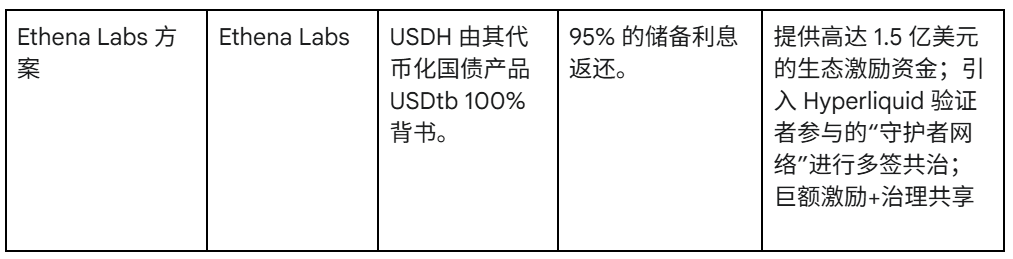

USDH will be natively issued on the Hyperliquid chain, fully leveraging its technological advantages:

- Unified State Architecture: The transaction layer (HyperCore) and the smart contract layer (HyperEVM) share the same state. USDH issuance, trading, and DeFi application interactions do not require cross-chain or cross-layer operations, fundamentally eliminating bridging risks and achieving atomic operations.

- HyperBFT high-performance consensus: provides sub-second transaction confirmation and extremely high throughput, ensuring that USDH transfer and transaction experience is as instant as internet payment.

- Dual-block architecture: By running 2-second "fast blocks" and 60-second "slow blocks" in parallel, it meets the needs of USDH high-frequency small payments and complex DeFi operations.

- Deep integration with ecological protocols: USDH will become the base currency for native applications such as HLP Vault (market making fund pool) and Hyperlend (lending protocol), building an internal value closed loop of "minting-trading-lending-payment".

In short, Hyperliquid's architecture is a delicate double-edged sword. Its unified state and high-performance consensus provide USDH with unparalleled efficiency and inherent advantages. However, this tight coupling also means "prosperity and decline are shared." Any underlying security or performance issues will have a catastrophic and unmitigated impact on USDH's stability and value.

2.3 Potential Risks of USDH: “Original Sin” That Cannot Be Ignored

Of all the risks USDH faces, the most fundamental and critical one stems from the Hyperliquid platform itself. These historically known, yet unresolved, vulnerabilities are the premise for assessing all other risks.

- Validator Centralization: Reports have indicated that the network was maintained by only a very small number of validator nodes in its early stages, posing a potential single point of failure and collusion risk. USDH issuance and governance are likely controlled by a small number of key players.

- Oracle Manipulation Incident (XPL Incident): Attackers previously compromised the HLP treasury by manipulating the price of low-liquidity tokens. This demonstrates that the platform's oracle mechanism is vulnerable to attack under extreme market conditions, a significant threat to any stablecoin that relies on price oracles, especially its liquidation mechanism.

- Security reputation incident (Lazarus Group suspicion): The platform once caused community panic and large-scale capital outflows due to wallet activity associated with the North Korean hacker group Lazarus Group. This demonstrates that the market's trust in the platform remains fragile, and any slight disturbance could trigger a run.

These “historical original sins” hover over the USDH project like ghosts, magnifying all other risks several times:

- Reserve management risk (increased platform risk): Even if the reserve is 100% secure, if the platform oracle can be manipulated, the liquidation mechanism may be attacked, thereby indirectly threatening the entire stablecoin system.

- Competitive risk (amplification of internal challenges): On a platform with a history of vulnerabilities, any rumors of poor operations of USDH will be exploited by competitors and quickly evolve into a crisis of trust.

- Regulatory risk (passive trigger): If a platform encounters a major incident due to security issues, it will inevitably attract strict scrutiny from regulators, and may even directly ban the relevant stablecoin business.

Chapter 3: Competition between Mainstream Stablecoins and USDH

3.1 Review of the Similarities and Differences of Mainstream Stablecoins (USDT, USDC, DAI)

- Similarities: Both are anchored to the US dollar, have a wide range of application scenarios, and meet the market demand for a stable value medium.

- Differences: There are significant differences in collateral mechanisms (centralized fiat currency vs. decentralized crypto assets), degree of centralization and supervision (company operations vs. DAO governance), and risk exposure (custodial risk vs. smart contract and collateral volatility risk).

3.2 USDH’s Position in the Existing Stablecoin Landscape

- Ecosystem native stablecoin: With Hyperliquid, a strong endogenous demand market, it has a cold start advantage.

- Compliance and institutional-friendly potential: By choosing a regulated entity such as Paxos as the issuer, it is expected to attract traditional institutional funds.

- Innovative revenue-sharing model: Returning reserve revenue to the community constitutes a dimensionality reduction attack on the traditional "issuer exclusively enjoys profits" model, which may lead to a new round of stablecoin innovation.

3.3 Competitive Landscape Faced by USDH

USDH faces market competition from mainstream stablecoins, fierce competition from bidders within Hyperliquid, and indirect competition from native stablecoins in other ecosystems. More importantly, the experiences of Aave's GHO and Curve's crvUSD serve as a stark warning: even launching a native stablecoin in a relatively mature and secure ecosystem is fraught with difficulties. USDH not only faces all these challenges, but also carries the unique historical risk of the Hyperliquid platform, making its path forward exceptionally arduous.

Chapter 4: Latest Development Trends and Regulatory Policies in the Stablecoin Market

4.1 Latest Development Trends in the Stablecoin Market

- The market size continues to grow and diversify: the total market value has exceeded US$250 billion, and new issuers (such as payment giant PayPal) and new types continue to emerge.

- Compliance and transparency have become core competitiveness: public disclosure of reserves and regular audits have become industry standards.

- Application scenarios are expanded and deepened: from transaction media to cross-border payments, retail settlements and on-chain asset tokenization.

- The rise of income-generating stablecoins: Represented by Ethena's USDe, sharing reserve income has become the key to attracting users.

- Potential interaction with CBDC: In the long run, private stablecoins and central bank digital currencies may form a complementary and coexisting relationship.

4.2 Stablecoin Regulatory Policy

- United States (GENIUS Act): Established a regulatory framework of "federal license + full high-quality reserves + prohibition of interest payments", incorporating stablecoins into the banking regulatory system.

- European Union (MiCA Regulation): It came into effect for stablecoins in June 2024, with detailed provisions on issuer qualifications, reserve management, consumer rights, etc.

- Global trends: Emphasis on reserve quality, consumer protection and anti-money laundering (AML/CFT), with clear regulatory convergence.

Chapter 5: Conclusion and Outlook

5.1 The Far-Reaching Significance of the Hyperliquid Stablecoin War

The true significance of this battle lies not in showcasing the prosperity of DeFi, but in revealing how risks are systematically underestimated amidst the hyper-growth frenzy of a bull market. It is a perfect example of the potential for conflict when an innovative financial model (a high-yield stablecoin) meets an underserved technology platform. Hyperliquid's choice will serve as a litmus test for the industry's future trade-off between growth and safety.

5.2 USDH Future Outlook and Final Winner Prediction

Final Winner Prediction and Key Variables

Given the crypto community's natural preference for high returns and the substantial incentives offered by the Ethena solution, we predict that Ethena Labs's solution is most likely to prevail. However, this also presents the highest risk. Ethena's aggressive model, combined with the historical fragility of the Hyperliquid platform, will create an extremely volatile pressure cooker. The ultimate winner will depend on two key variables:

- Can Hyperliquid come up with a strong and verifiable solution to USDH’s historical security issues before it goes online?

- Is the winning bidder (especially Ethena) willing to transfer some of its governance and risk control rights to a more decentralized and independent community supervisory body in an unalterable manner?

If the answer to both questions is no, then the future of USDH will be full of uncertainty.

5.3 Future Development Direction of Stablecoin Track

In the future, the stablecoin market will evolve towards diversification, compliance, innovation, and deep integration with traditional finance . Stablecoins will become smarter and more ubiquitous, gradually blurring the lines between them and traditional finance.

5.4 Recommendations

- To the Hyperliquid community: The platform's historical security vulnerabilities must be questioned as a top priority. When voting, don't be blinded by short-term gains, but require all candidates to submit detailed mitigation plans for platform-specific risks.

- For USDH issuers: They must acknowledge Hyperliquid's underlying risks and proactively establish additional risk reserves and contingency plans beyond the proposed commitments. Transparency should not be limited to reserves but also include real-time monitoring and reporting of the platform's security status.

- To regulators: They must recognize that oversight of such projects should extend beyond the issuer level to the underlying platforms on which they operate. Platform-level risks are a blind spot within the current regulatory framework.

- For market participants: It is important to understand that potential high returns always come with correspondingly high risks. When participating in USDH, it should be viewed as a high-risk financial experiment rather than a risk-free stable asset.

appendix

Glossary

- Hyperliquid: A new generation of high-performance Layer-1 public chain decentralized trading platform.

- USDH: Hyperliquid's planned native stablecoin.

- HYPE: Hyperliquid platform native token.

- HyperBFT: The customized Byzantine Fault Tolerant consensus protocol used by Hyperliquid.

- Unified State: Hyperliquid's core technical feature, eliminating cross-layer communication latency.

- GENIUS Act: The federal stablecoin bill passed by the United States in 2025.

- MiCA: EU Regulation on Markets in Crypto-Assets.

- GHO/crvUSD: Native stablecoins issued by Aave and Curve protocols respectively, which can be used as reference cases for USDH.

References

Hyperliquid official and technical documentation

Hyperliquid Docs:https://hyperliquid.gitbook.io/hyperliquid-docs

IQ.wiki: https://iq.wiki/wiki/hyperliquid

Halborn: https://www.halborn.com/blog/post/hyperliquid-smart-contract-security-audit

Hyperliquid Stablecoin Wars News Report

Background coverage of stablecoin issuers bidding for USDH: https://unchainedcrypto.com/stablecoin-issuers-enter-bidding-war-to-launch-hyperliquids-usdh/

Comparison of proposals from Paxos, Frax, Agora, and others: https://www.dlnews.com/articles/defi/paxos-frax-agora-and-native-markets-compete-to-build-usdh-stablecoin/

Details of Ethena Labs’ proposal, including its collaboration with BlackRock, can be found at: https://www.mitrade.com/au/insights/news/live-news/article-3-1109397-20250910

Platform historical risk event reports

Reports on the Lazarus Group hacker group's connection to Hyperliquid: https://bravenewcoin.com/insights/lazarus-group-linked-to-hyperliquid-exploit

Lazarus Group's Fund Movements on Hyperliquid and Platform Vulnerability Analysis: https://www.ccn.com/news/hyperliquid-exploited-lazarus-group-moves-funds-to-bybit/

Stablecoin Basics, Risks, and Trends

Stablecoin: https://en.wikipedia.org/wiki/Stablecoin

Definition, classification and basic principles of stablecoins: https://www.investopedia.com/terms/s/stablecoin.asp

Stablecoin General Risks and Rewards Analysis: https://www.chainalysis.com/blog/stablecoin-risks-rewards/

Deep Dive into Stablecoin Security Risks: https://www.certik.com/resources/blog/56 PjJG 1 U 0 JAGDB 4 iAn 9 f 2 ja-deep-dive-into-stablecoin-security-risks

Research on the Mechanism and Risks of Tokenized Treasury Bonds: https://www.jpmorgan.com/insights/en/research/institutional-investing/investment-insights/tokenized-treasuries

Analysis of the future development trends and application scenarios of stablecoins: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/what-is-the-future-of-stablecoins

Visa’s solutions and perspectives on stablecoin settlement: https://usa.visa.com/solutions/crypto/stablecoins.html

Comparison of mainstream and native stablecoins

Comparison of the three major stablecoins: USDT, USDC, and DAI: https://www.coinsdo.com/blog/usdt-vs-usdc-vs-dai-which-stablecoin-is-the-best

USDT vs. USDC comparison analysis: https://moonpay.com/learn/crypto/usdt-vs-usdc

Aave GHO native stablecoin case study: https://21shares.com/research/aave-and-gho-stablecoin

A deep dive into Curve’s crvUSD stablecoin: https://coinmarketcap.com/academy/article/a-deep-dive-into-curve-s-crvusd-stablecoin

Global regulatory policies

Official text of the US GENIUS Act: https://www.congress.gov/bill/118 th-congress/house-bill/4766

Legal interpretation of the US GENIUS Act: https://www.lathamwatkins.com/en/alerts/2024/09/us-house-passes-bipartisan-stablecoin-bill

EU MiCA Regulation Implementation Timeline and Guide: https://micapapers.com/guide/timeline/