When stablecoins start building chains, does Ethereum still have a chance?

- 核心观点:稳定币发行方自建公链成新趋势。

- 关键要素:

- Circle推出Arc链,USDC作Gas。

- Stripe主导Tempo链,目标10万TPS。

- Plasma链公售超募7倍,融资3.7亿美元。

- 市场影响:重塑支付清算格局,挑战传统公链。

- 时效性标注:中期影响。

Original author: Biteye core contributor Viee

Original editor: Biteye core contributor Denise

For the past few years, stablecoins have been the quietest players in the crypto market, yet their presence continues to grow. Cross-border remittances, trade settlements, and regulatory compliance pilots...stablecoins remain an essential component of crypto capital flows.

This year, an even more significant change occurred: stablecoin issuers are no longer content to simply operate on-chain, but are beginning to build their own chains. In August, Circle announced the launch of Arc, followed shortly thereafter by the Stripe-led Tempo, which also released more details. The fact that these two giants, both deeply engaged in stablecoins, took this step almost simultaneously is intriguing.

Why do stablecoins need their own blockchain? In this seemingly business-centric market, do retail investors still have a chance? When stablecoins control their own financial flows, will general-purpose public chains like Ethereum and Solana still retain sufficient influence?

This article will explore four aspects:

1. What is a stablecoin public blockchain, and how does it differ from traditional public blockchains?

2. Comparison of design paths of representative projects;

3. Will stablecoin public chains threaten Ethereum?

4. Opportunities for ordinary users to enter the market.

Stablecoin public chain: a path closer to the "liquidation layer"

If public chains such as Ethereum and Solana focus on decentralized applications, then stablecoin public chains are closer to the settlement layer.

They have several distinctive features:

- Stablecoins are Gas: transaction fees are stable and predictable, and there is no need to hold additional volatile assets to pay for the "transit fee".

- Optimize payment and settlement: The goal is not "versatility" but "stable and easy to use".

- Built-in compliance module: facilitates connection with banks and payment institutions, reducing gray areas.

- Designed around the needs of "money": cross-currency settlement, foreign exchange matching, unified accounting units, and a clearing system that is closer to the real world.

In other words, the public stablecoin chain is more like a vertically integrated model, from issuance and liquidation to application, trying to control as many key links as possible. The cost is to bear the pressure of the initial cold start, but in the long run, it can gain economies of scale and voice.

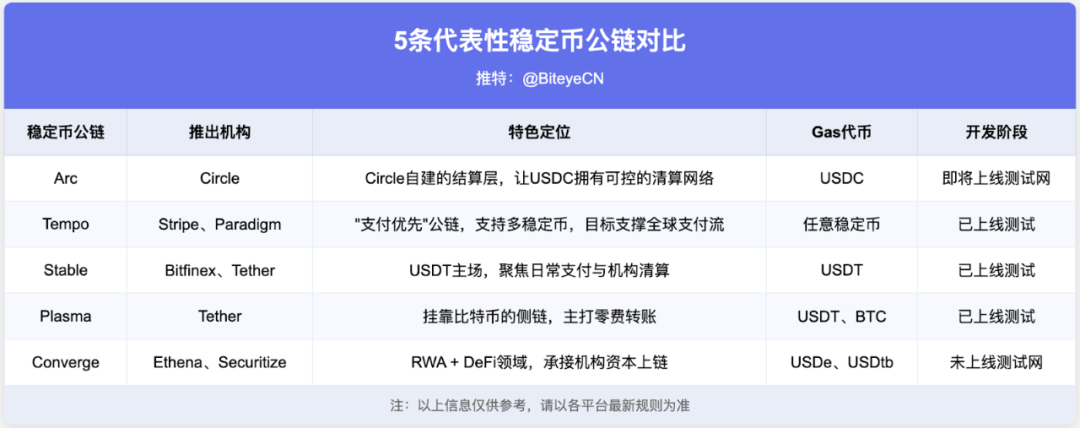

Different paths taken by 5 representative chains

1. Arc@arc: Circle’s first proprietary public blockchain

As the world's second-largest stablecoin issuer, Circle's launch of Arc is no surprise. While USDC has a massive market, its transaction fees are subject to volatility on Ethereum and other public blockchains. The emergence of Arc reflects Circle's ambition to build its own "settlement layer."

There are three core points in Arc's design:

- USDC as Gas: transparent fees and no exchange rate risk.

- Fast transactions and stable settlements: We promise to confirm transactions within 1 second, making it suitable for cross-border payments and large-value settlements.

- Optional privacy function: Provides necessary accounting privacy for enterprises or institutions while ensuring compliance.

This means that Arc is not only Circle’s technological attempt, but also a key step for it to become a financial infrastructure provider.

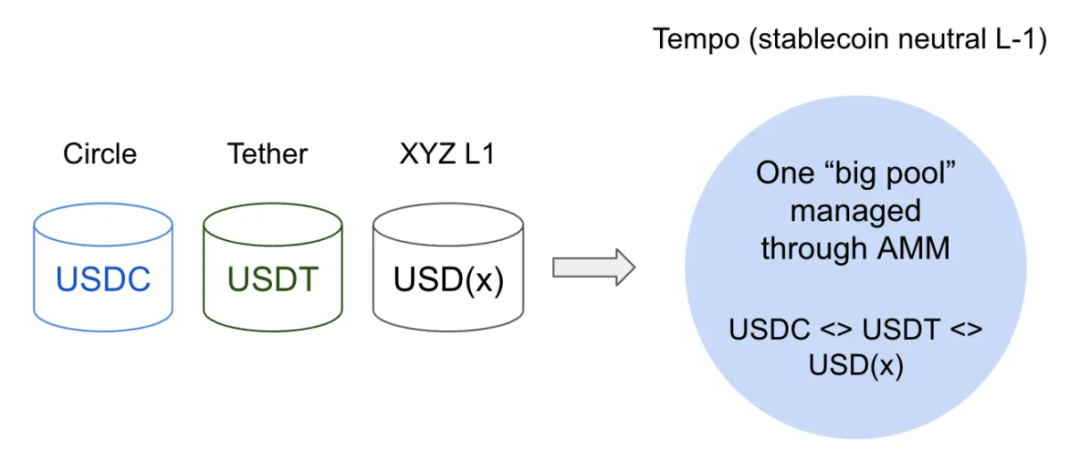

2. Tempo@tempo: A “payment-first” public chain

Tempo, co-incubated by Stripe and Paradigm, has a straightforward core strategy: as stablecoins go mainstream, a truly suitable payment infrastructure is needed. Traditional public blockchains struggle to support global settlement flows due to unstable fees, insufficient performance, or a too "crypto-native" experience. Tempo aims to fill this gap.

Therefore, Tempo has several distinctive features from its design:

- Any stablecoin can be used as Gas: stablecoin swaps are achieved through the built-in AMM.

- Low Fees & Predictable: Equipped with payment channels, notes, and whitelist functions, it is closer to the real payment system.

- Extreme performance: Targeting 100,000 TPS, sub-second confirmation, suitable for scenarios such as payroll, remittances, and micropayments.

- Compatible with EVM: Based on Reth architecture, the developer migration cost is low.

Its partners are also quite influential, including Visa, Deutsche Bank, Shopify, and OpenAI. This makes Tempo more like an open US dollar payment network than an appendage of a single stablecoin. If successfully implemented, it may even become the prototype of an "on-chain payroll system."

While Tempo prioritizes payments, its level of decentralization has sparked some discussion. Currently, Tempo's design focuses more on the attributes of a "consortium chain" rather than a "public chain," and its nodes are not fully open, resulting in a weaker level of decentralization.

3. Stable @stable: USDT’s home turf

Stable is a payment chain built specifically for USDT, supported by Bitfinex and USDT 0. Its goal is to make USDT flow more smoothly in daily financial activities.

In terms of design, Stable does several things:

- USDT native Gas: Transaction fees are paid directly with USDT, and point-to-point transfers are completely gas-free.

- Confirmation in seconds: taking into account both small-value payments and large-value fund flows.

- Enterprise-level features: including batch transfer aggregation and compliant privacy transfers.

- Consumer experience: The supporting wallet connects to bank cards and merchants for payment.

- Developer-friendly: compatible with EVM and provides a complete SDK

The keyword of Stable is implementation, and the focus is on how to make USDT more naturally integrated into daily scenarios such as cross-border remittances, merchant acquiring, and institutional clearing.

4. Plasma @PlasmaFDN: Bitcoin Sidechain

Unlike Stable, Plasma takes a different approach. As a Bitcoin sidechain, it relies on the security of BTC while focusing on stablecoin payments.

In terms of design, Plasma has the following main features:

- Bitcoin native bridge: BTC enters the EVM environment without custody and directly participates in the stablecoin ecosystem.

- USDT zero-fee transfer: The ability to complete USDT transfers for free is its biggest selling point.

- Custom Gas Tokens: Developers can choose to pay with stablecoins or eco-coins.

- Optional privacy function: suitable for salary payment and institutional liquidation.

- Compatible with EVM: Based on Reth architecture, the developer migration cost is low.

In July, Plasma officially launched its public sale, with the token $XPL. Ultimately, the total subscription amount exceeded $373 million, with over 7 times oversubscription. This market enthusiasm has already given it a shot in the arm.

5. Converge @convergeonchain: The convergence point of RWA and DeFi

The previous chains are essentially still centered around “stablecoin clearing and payment.” Converge’s ambition is different: its goal is to bring RWA and DeFi onto the same chain.

In terms of design logic, Converge has three key points:

- High performance: Block generation in 100 milliseconds, pushing performance to the limit in collaboration with Arbitrum and Celestia.

- Stablecoin native Gas: USDe and USDtb are used as transaction fees.

- Institutional-grade security: Backed by the ENA Network (CVN) for additional protection.

In short, Converge aims to solve the problem of "how to bring in large funds safely and efficiently." Its partners include familiar DeFi protocols such as Aave, Pendle, and Morpho, and it will also support the integration of RWA assets such as Securitize.

Different starting points, common direction

From Arc to Tempo, from Stable to Plasma to Converge, while their approaches differ, they all aim to address the same core problem: how can stablecoins truly integrate into everyday financial life? Arc and Stable focus on the controllability of their own assets, Tempo and Plasma prioritize multi-coin neutrality, and Converge targets institutions and RWAs. While the approaches differ, the shared goal is to ensure greater certainty in transfers, smoother liquidity, and more natural compliance.

Following this main line, we can generally see three trends in the future of stablecoin public chains:

- Compliance and institutionalization: Stablecoin public chains will focus more on settlement certainty and compliance interfaces in the future. Arc, Stable, etc. are striving to become clearing layers that banks and payment institutions can directly connect with.

- Challenges to traditional payments: Chains with a "multi-currency neutral" design, such as Tempo, pose an alternative pressure to Visa and Mastercard due to their low cost and global reach.

- Reshaping the market landscape: Currently, Circle and Tether account for nearly 90% of the stablecoin market share, and the market is almost a duopoly. However, "stablecoin neutral chains" such as Tempo are breaking the pattern, and the future may be towards multi-polar coexistence.

How will stablecoin chain building rewrite the public chain landscape?

When stablecoin issuers start building chains, the most intuitive question is whether they will impact general public chains such as Ethereum and Solana?

Stablecoin chains are naturally designed to facilitate money. They are indeed more suitable than the Ethereum mainnet or Solana for high-frequency, low-risk businesses like cross-border remittances and payroll. This could have a particularly direct impact on TRON. TRON's stablecoins primarily come from USDT, accounting for over 99%, and it is currently the largest public chain issuing USDT. However, if Tether's own stablecoin matures, TRON's primary competitive advantage will be weakened.

However, some argue that these "payment-only chains" aren't truly blockchains. This is because if they aim for complete decentralization, they inevitably face the influx of unrelated projects and tokens, leading to congestion and performance degradation. However, if they focus solely on payments, they're either minimalist, like Bitcoin, solely focused on transfers, or partially centralized, with nodes controlled by a small group of institutions. In other words, it's difficult to achieve both decentralization and efficient payments.

This also means that Ethereum and Solana are positioned very securely. The former has built a developer ecosystem based on its security and composable universal finance, while the latter has carved out a niche with its high performance and user experience. The ultimate competitive landscape is likely to be one where stablecoin chains take on deterministic settlement, while ETH/Solana retain open innovation.

Retail investors’ perspective: Where are the opportunities?

Frankly speaking, this round of opportunities is not friendly to the "direct returns" of retail investors. Compared with previous public chains, stablecoin public chains are more "business-oriented", involving payment, clearing, and custody systems.

But there are still several entry points worth paying attention to:

Participation in ecological incentives: The cold launch of a new chain is often accompanied by bounty programs, developer subsidies, transaction mining, etc. Similar activities may be launched in the future.

Node Staking: More technically proficient players can focus on node verification. For example, Converge requires staking ENA to participate.

Testnets: Many projects offer airdrops as rewards for early adopters, so consider testnets first. For example, ARC may launch a public testnet this fall, and the Stable, Plasma, and Tempo testnets are already live.

Long-term allocation: If you are optimistic about the "stablecoin public chain" narrative, you can consider longer-term investment, such as paying attention to related stocks such as Circle and Coinbase.

Plasma is particularly noteworthy. Its public sale in July saw its token, $XPL, oversubscribed seven times, totaling over $370 million. A subsequent airdrop, in partnership with Binance, sold out within an hour. Even in a more institutionally oriented sector, early retail investors still have the opportunity to reap the benefits.

Conclusion

Stablecoin public chains won't revolutionize the crypto market overnight. Changes will primarily occur behind the scenes, such as shorter clearing paths, more stable fees, and smoother regulatory interfaces.

On the surface, these may seem to lack a "sexy" narrative, but at the infrastructure level, they are gradually building the "water, electricity, and gas" of stablecoins. When we shift our perspective from "coin price" to "how money moves," the logic becomes clearer:

- Who can guarantee the certainty of settlement?

- Who can provide stable cross-currency liquidity?

- Who can open up the real payment scenario?

The stablecoin public chain is likely to be the most solid narrative of the next bull market. If there is a project that can truly deliver on these three things, it will not only be a "public chain" but may become the infrastructure of the next generation of crypto finance.