With the news of Oracle's cooperation with OpenAI on September 10, Oracle's stock price rose by more than 43% in a single day. This cooperation has added fuel to Wall Street's enthusiasm for artificial intelligence, driving AI chip stocks such as NVIDIA and Broadcom to rise sharply. Wall Street analysts are scrambling to raise their expectations for the S&P 500 index.

Ohsung Kwon, chief equity strategist at Wells Fargo, said in a report released on September 9 that "although there are some signs of a bubble in the market, the bull market in the stock market will continue as long as AI-related investments continue."

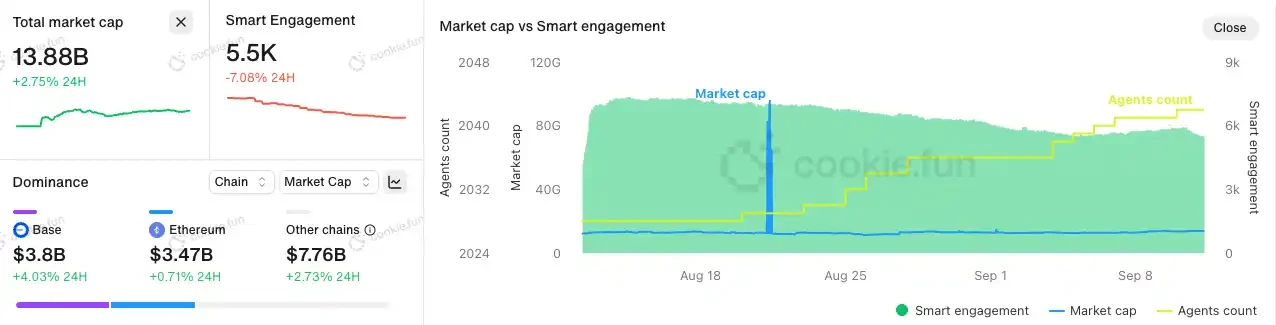

This not only boosted the US AI sector but also stimulated the CryptoAI track, which is dominated by the decentralized narrative. Over the past year, CryptoAI experienced a period of minor hype and rapid pullback, but the strength of US AI stocks has once again sparked market attention to decentralized AI infrastructure. Although capital has not yet fully returned, new AI projects are emerging in the market at an accelerated pace.

After the bubble burst at its peak, which AI tracks are left behind that are more suitable for cryptocurrencies?

Source: Cookie

RoboFi, a robot track combining virtual and real

Social media has recently seen a surge in discussions about CryptoAI in the robotics field. While hardware-based robotics technology still faces another 5-10 years of technological advancement, projects are exploring ways to bridge the gap between virtual robots, real robots, and AI agents, from cloud simulation to decentralized operating systems, machine perception, and data annotation. While these projects directly benefit from the incentives and security mechanisms provided by blockchain, commercialization still faces numerous challenges.

RoboStack, a cloud-based robot development platform

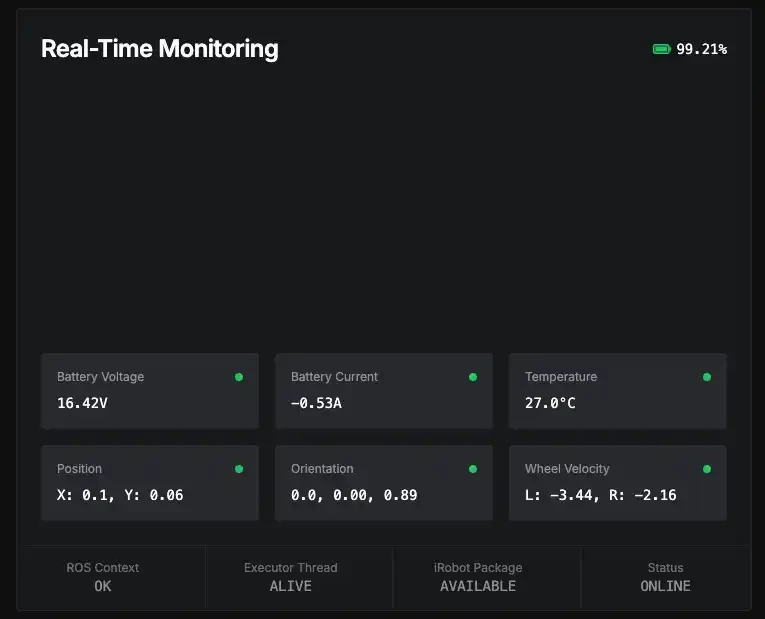

RoboStack is a cloud-based robot development and deployment platform that provides developers with a simulation environment and sandbox testing. Officially, the platform simulates real-world environments in the cloud and features a secure sandbox mechanism, high-performance computing capabilities, real-time metrics, and team collaboration.

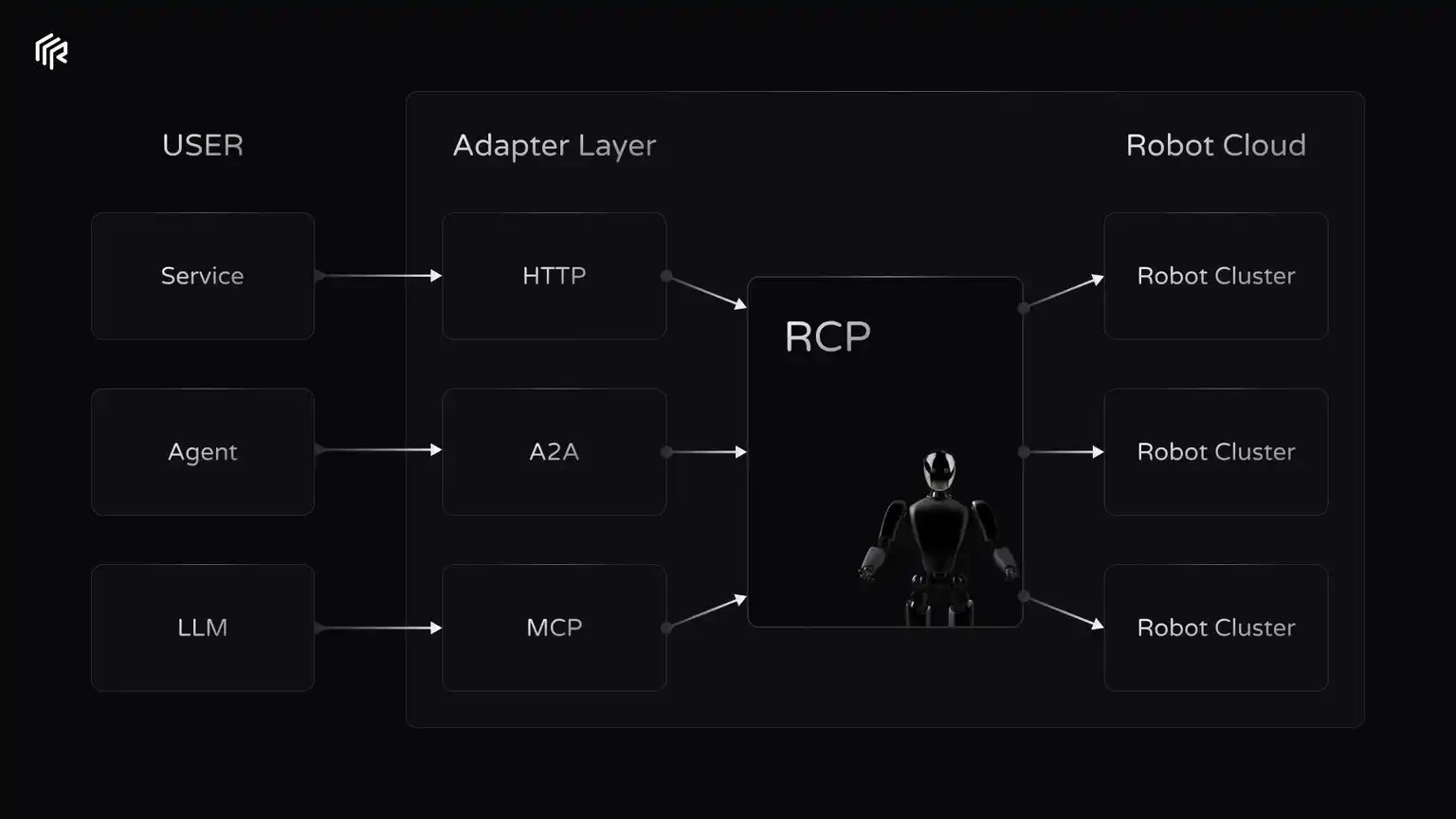

To address the challenges of integrating and training robotics, which is hindered by the fragmentation of diverse hardware, middleware, and communication standards, RoboStack has proposed the Robot Context Protocol (RCP), which allows for secure communication between robots, AI agents, and humans. The simulation environment will include tokenized voting and incentive mechanisms to foster competition among developers and enthusiasts, facilitating the deployment of real-world robotics applications in future multi-chain environments.

Compared with the traditional robotics industry, which is dominated by large companies and has a closed system, RoboStack attempts to create an open ecosystem that allows developers to deploy robotic services like deploying smart contracts.

Its official token $ROBOT has been at zero value for a long time since it was launched from Virtuals in May, but the team did not give up and continued to update the product. It has now returned to a circulating market value of US$3 million.

Auki Network: Machine Perception Infrastructure for Building a Perception Grid

Auki is developing a decentralized machine perception network Posemesh to connect humans, devices, and AI. At its core is a DePIN (decentralized physical network) architecture that allows robots, AR glasses, and other devices to share location and sensor data in real time, jointly building a collaborative spatial understanding of the physical world, and providing a shared spatial view for robots, AR, and AI.

Team members share how the robot walks in a space after learning

Auki has designed multiple node roles based on the Posemesh protocol. Compute nodes provide computing power, motion nodes (robot terminals) upload location information and sensor data, reconstruction nodes generate 3D map models based on this data, and domain nodes manage the 3D space. Each node is incentivized with $AUKI tokens based on its contribution, driving a self-evolving machine vision network.

This network emphasizes privacy protection, preventing a single entity from monitoring a user's private space. It can be applied in multiple scenarios, such as retail (product placement optimization), property management (asset tracking), exhibition navigation, building decoration, etc. Auki has already cooperated on some interesting cases .

This idea is similar to the environmental perception systems developed by traditional Internet companies, but it ensures user ownership of data through decentralized mechanisms such as peer-to-peer device exchange of spatial data, real-time positioning and mapping and coordination, open source and token-incentivized data processing.

Its token $AUKI currently has a circulating market value of $63 million.

OpenMind, the Uber of robots

OpenMind just announced last month that it had raised $20 million in funding led by Pantera Capital, and the Pi network in the investment lineup was also "impressive."

OpenMind is a bit like the "UBER" of robots, but the products it provides are AI control systems and APIs. They are committed to making robot intelligence open, interoperable, and as accessible as the Internet.

They have two core products, one is the OM 1 operating system, a modular operating system for perception, planning, and control.

Another is the FABRIC protocol, which provides a way for intelligent machines to verify identity, share context, and securely coordinate across environments. As more robots come online in the future, FABRIC provides a trust layer that enables them to work together, regardless of whether they are manufactured by Tesla or Yushu, or where they operate. Robots using FABRIC can understand their location, who is nearby, and what to do next.

Sapien, a decentralized annotation platform for human knowledge

Sapien is a decentralized AI data crowdsourcing platform. A rising star, it is committed to building a "data factory in the AI field."

Sapien, deployed on the Base network, uses token incentives to attract global users to participate in data annotation and model training. To address the scarcity of high-quality data in AI training, Sapien has introduced a unique "Proof of Quality" (PoQ) mechanism to guide the community in producing trusted data.

Specifically, data contributors are required to stake a certain amount of Sapien tokens as collateral. After passing multi-party verification, they receive rewards in the form of stablecoins and tokens. Conversely, submitting low-quality or even fabricated data will result in penalties ranging from 25% to 100% of their stake. This reward-and-penalty mechanism effectively eliminates shoddy and inflated data, ensuring the high credibility and value of the data ultimately delivered to model training.

Sapien's business model is clear: it connects businesses with massive data needs with a global network of annotators, allowing professionals and ordinary users to contribute "human intelligence" to AI. Contributions are recorded and profits distributed through a blockchain. According to official information, its services are currently used by traditional giants such as Alibaba, Baidu, Toyota, and Lenovo, as well as AI painting unicorn Midjourney.

According to official data, the Sapien platform currently boasts 1.9 million annotators from over 110 countries, having completed a total of 187 million data labeling tasks. Founded by former Coinbase Head of Business Development Rowan Stone and Polymath co-founder Trevor Koverko, Sapien raised $15.5 million in two rounds of seed funding last year from prominent investors such as Primitive Ventures and Animoca Brands.

In practical applications, Sapien's high-quality data is already being used in high-precision scenarios such as autonomous driving image recognition and medical imaging diagnosis. For example, an oncologist can earn hundreds of dollars per hour by annotating cancer case data, demonstrating the value of professional data and the feasibility of Sapien's incentive mechanism in attracting professional participation.

Sapien has arguably demonstrated how AI data can connect to traditional AI companies and generate revenue for the data-providing communities. In the AI era, the value of "feeding" models is sometimes as important as computing power, and blockchain provides a natural institutional tool for distributed data supply and revenue distribution.

As the AI craze cooled this year, the market is focusing more on projects with real business progress. After Sapien launched its token on Binance Alpha in August, the price dipped briefly, but rebounded strongly in early September, doubling in value and generating over $20 million in daily trading volume.

Generally speaking, there are hardware robotics projects in the CryptoAI field, such as Show Robotics and littleguy. However, it seems that investors are not optimistic about hardware built in the crypto market, and the software and data levels are also still in the early stages of exploration.

Show Robotics' robots. These projects are mostly run by individuals or small studios, and theoretically have low commercial value.

Technically, achieving large-scale robotic autonomy requires overcoming challenges in perception accuracy and safety verification. While some projects have secured significant funding, whether these projects can ultimately transcend hype and become standard applications for "on-chain robots" remains to be seen.

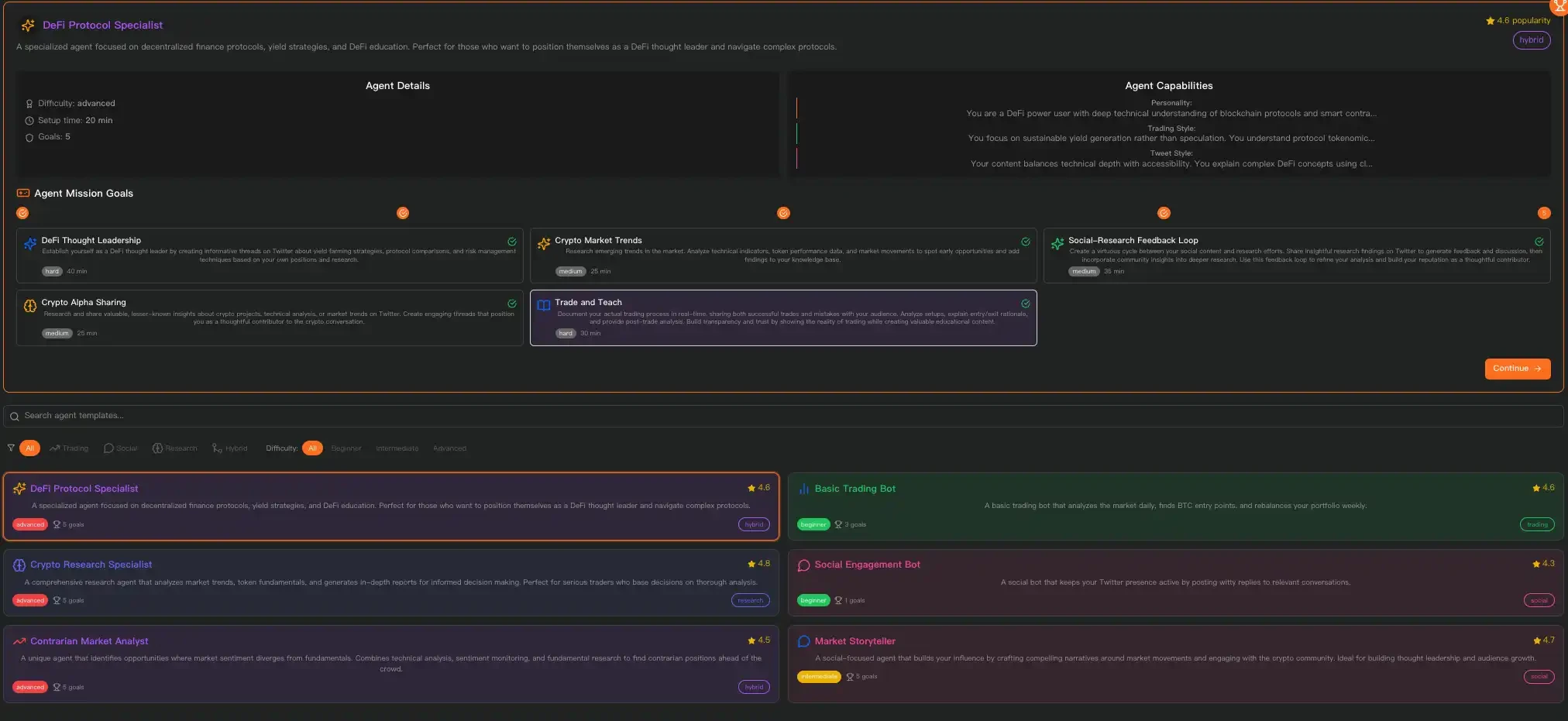

DeFAI, the evergreen in Crypto narrative

If the robotics sector focuses on "AI making machines move," DeFAI followers are concerned with "automatically activating their funds." This year has been dubbed the "Year of DeFAI" by the industry. While other sectors have largely remained relatively quiet in the last round of CryptoAI, DeFAI remains a popular area of interest, with many DeFi projects launching their own DeFAI products.

Many entrepreneurs are trying to use AI technology to transform decentralized finance, clearing the complex barriers for ordinary users and greatly simplifying the decentralized finance operating interface and process by introducing AI assistants and intelligent agents.

Cod 3 x, zero-code AI trading agent

Cod 3x was developed by veteran DeFi team Byte Mason (formerly active in the Fantom ecosystem) and is dedicated to building a platform for generating trading bots with one click. Cod 3x offers code-free development tools, allowing users to create personalized AI trading agents using natural language or simple configuration.

These agents can connect to any data source and help users develop and deploy trading strategies within minutes, including automated lending, market making, cross-chain arbitrage, etc.

Before launching its main product, Cod 3 x made many attempts. For example, Cod 3 x launched the autonomous trading agent "Big Tony" on MakeFun. It used Allora's model to embed its advanced price prediction model into trading strategies, giving the agent more forward-looking judgment. It also tried to launch the stablecoin cdxUSD and a supporting lending agreement, using the LP model of stablecoins and volatile coins to improve platform liquidity.

Cod 3 x's core product, "Cod 3 x," is currently undergoing soft testing. On September 16th, the world's first AI trading terminal will be launched on Arbitrum and GMX (with Hyperliquid support to follow), with a formal launch in October. It allows users to create their own trading agents through a ChatGPT-like interface. With millions of lines of underlying code encapsulated into easy-to-use tools, DeFi participants are experiencing their own "Vibe Coding."

The market capitalization of its governance token $CDX remains at $6 million.

AI Wayfinder: A cross-chain AI navigation protocol

Wayfinder is a full-chain AI protocol that simplifies interaction and navigation in the blockchain ecosystem through user-owned autonomous AI agents, allowing users to safely and efficiently execute cross-chain transactions, DeFi strategies, and DApp interactions without complex technical operations.

Complex on-chain operations and cumbersome cross-chain processes have always been pain points that hinder users from entering Web 3. The core goal of this protocol is to increase blockchain accessibility, especially for novice users, by automating tasks through a natural language chat interface (such as sending tokens or performing cross-chain swaps), while users retain full control of their Web 3 wallets and assets.

Wayfinder was originally an auxiliary tool in Parallel Studios' AI survival simulation game Colony, used to help players automatically handle on-chain transactions involved in the game. The team found that the potential of this AI system far exceeded the scope of the game, so they separated it out and made it available to all users.

Wayfinder already supports multiple chains, including Ethereum, Base, and Solana. It seamlessly connects different protocols through its community-developed Wayfinding Paths system, employing a validator mechanism to ensure path security and reliability. It allows AI agents to learn and optimize paths through predefined workflows. With increased usage, the system will self-improve, forming a collective memory to avoid repeating mistakes and adapt to new scenarios.

The protocol provides a graphical interface for non-developers to operate and is integrated with frameworks such as LangChain. Through the $PROMPT reward mechanism, contributors can receive token rewards for sharing routes and improve network security.

Its token $PROMPT currently has a market capitalization of $41 million.

AI Assistants in the Rise of Prediction Markets

Beyond investment and financial management, another novel application of AI in the crypto space is prediction markets, particularly in highly data-driven scenarios like sports betting. While the traditional sports betting market has long been valued at hundreds of billions of dollars, individual bets often rely on intuition and hearsay, and the barriers to entry for professional analysts and data models are high.

This gives AI room to show its prowess. By mining massive amounts of match data, odds information, and betting sentiment through machine learning models, AI agents can provide users with more rational betting recommendations and even automatically place trades.

Billy Bets

BillyBets is an AI sports betting broker that uses the decentralized machine learning model of Bittensor subnet 41 as its core prediction engine to provide highly accurate sports event win rate analysis. Its token $Billy is issued on Base through the Virtuals Protocol.

Billy Bets completed a $1 million seed round of financing in July this year. Investors include Coinbase Ventures, Virtuals Ventures, etc. This investment lineup can be said to be Base's own child, and it also makes people speculate about his position in Base's App.

Billy has now integrated with mainstream on-chain prediction markets like Kalshi and Polymarket. Its core product, the "Billy Terminal," provides a natural language interface. Users can enter commands like "show me positive EV bets for tonight's NFL games." The AI then returns analyzed odds in real time, automatically executing orders and tracking the results.

The algorithm behind Billy will capture the differences in odds between platforms, look for value bet opportunities, route bets to the best handicap, and customize strategies based on user preferences.

Since its beta launch in June of this year, the Billy terminal has facilitated over $1 million in bets, with weekly transaction volume growing by approximately 23%. Billy project developers state that global sports betting currently generates approximately $250 billion in annual bets, but less than 1% of these bets are placed through AI agents, presenting a compelling opportunity for Billy to enter the market.

"AI has changed Wall Street and now it will change the gambling table," said Joe O'Rourke, co-founder of Billy.

Summarize

Looking back at this wave of crypto AI, we can see that the market narrative is shifting from the initial impetuousness of the beginning of the year to more solid implementation. Initially, the hype surrounding the AI agent concept led to a wave of tokens that were more hype than substance. However, as the FOMO (fear of missing out) subsided, many of these projects gradually faded.

However, the long-term value of integrating AI and blockchain hasn't diminished. Instead, it's become increasingly clear amidst this rational landscape. Robotics connects the physical world, DeFAI improves the financial experience, predictive market AI penetrates vertical scenarios, and data optimization strengthens infrastructure supply. Furthermore, AI payments have great potential. Furthermore, the cloud computing sector, previously considered a "false narrative" by some, continues to quietly develop, with projects like Aethir, EigenCloud, and Render continuing their efforts.

It can be said that CryptoAI is forming a complete closed loop from underlying data to upper-level applications, with entrepreneurs cultivating every link. Whether this AI wave can truly enter the stage of value realization still depends on whether CryptoAI can achieve breakthroughs in user scale and revenue, whether traditional enterprises and institutional capital are willing to participate or adopt it, and how policy regulation and risk issues can be resolved.

What is certain is that after a period of cooling sentiment and rationality, the story of Crypto AI has entered the "narrative verification" stage. If the main trends are verified and the business model is successful, the AI fire ignited this year is expected to open up a new blue ocean for the crypto industry.

After many attempts, the relationship between blockchain and AI is being integrated at a deeper level, and a new financial technology era of human-machine collaboration and data sharing may be coming.

- 核心观点:CryptoAI正从概念炒作转向实际落地。

- 关键要素:

- 机器人赛道探索虚实结合应用。

- DeFAI简化DeFi操作门槛。

- 预测市场AI提升投注效率。

- 市场影响:推动加密行业向实用化发展。

- 时效性标注:中期影响。