Starting from HyperLiquid’s USDH becoming popular: Where is the fulcrum of DeFi stablecoins?

- 核心观点:DeFi协议稳定币成败关键在应用场景。

- 关键要素:

- 内生场景决定原始需求。

- 流动性深度保障价格稳定。

- 可组合性扩展价值网络。

- 市场影响:推动DeFi生态价值闭环竞争。

- 时效性标注:中期影响。

Recently, the bidding war for USDH issuance rights initiated by HyperLiquid has attracted players such as Circle, Paxos, and Frax Finance to compete openly. Some giants even offered $20 million in ecological incentives as bargaining chips. This storm not only demonstrates the huge allure of the DeFi protocol's native stablecoins, but also allows us to glimpse the stablecoin logic of the DeFi world.

We would like to take this opportunity to re-examine: What are DeFi protocol stablecoins? Why are they so popular? And as the issuance mechanism becomes increasingly mature, what are the real fulcrums that determine their success or failure?

Source: Paxos

1. Why are DeFi stablecoins so popular?

Before exploring this issue, we must face the fact that the stablecoin market is still dominated by stablecoins issued by centralized institutions (such as USDT and USDC). With strong compliance, liquidity, and first-mover advantage, they have become the most important bridge between the crypto world and the real world.

But at the same time, a force pursuing purer decentralization, censorship resistance and transparency has always been driving the development of DeFi native stablecoins. For a decentralized protocol with a daily trading volume of billions of dollars, the value of native stablecoins is self-evident.

It is not only the core pricing and settlement unit within the platform, which can greatly reduce dependence on external stablecoins, but also can lock the value of transactions, lending, clearing and other links firmly within its own ecosystem. Taking USDH to HyperLiquid as an example, its positioning is not simply to copy USDT, but to become the "heart" of the agreement - operating as a margin, pricing unit, and liquidity center.

This means that whoever can hold the right to issue USDH will occupy a crucial strategic position in the future landscape of HyperLiquid. This is the fundamental reason why the market responded quickly after HyperLiquid extended the olive branch. Even Paxos and PayPal did not hesitate to put out 20 million US dollars in ecological incentives as bargaining chips.

In other words, for DeFi protocols that are extremely dependent on liquidity, stablecoins are not just a "tool", but a "fulcrum" of on-chain economic activities covering transactions and value circulation. Whether it is DEX, Lending, derivatives protocols, or on-chain payment applications, stablecoins play a core role in the dollarized settlement layer.

Source: DeFi protocol stablecoin from imToken Web (web.token.im)

From the perspective of imToken, stablecoins are no longer a tool that can be summarized by a single narrative, but rather a multi-dimensional "asset complex" - different users and different needs will correspond to different stablecoin choices.

Within this classification, "DeFi protocol stablecoins" (DAI, GHO, crvUSD, FRAX, etc.) are a distinct category. Compared to centralized stablecoins, they emphasize decentralization and protocol autonomy. They rely on the protocol's inherent mechanism design and collateralized assets as anchors, striving to break away from reliance on a single institution. This is why, despite market fluctuations, numerous protocols continue to experiment.

2. The “Paradigm Struggle” Started by DAI

The evolution of DeFi protocol native stablecoins is essentially a paradigm battle centered on scenarios, mechanisms, and efficiency.

1. DAI (USDS) on MakerDAO (Sky)

As the originator of decentralized stablecoins, DAI launched by MakerDAO pioneered the paradigm of over-collateralized minting, allowing users to deposit ETH and other collateral into the vault to mint DAI, and has withstood the test of many extreme market conditions.

But what is less known is that DAI is also one of the first DeFi protocol stablecoins to embrace RWA (real-world assets). As early as 2022, MakerDAO began to try to enable asset initiators to convert real-world assets into tokens for loan financing, trying to find larger asset support and demand scenarios for DAI.

After the recent name change from MakerDAO to Sky and the launch of USDS as part of the final plan, MakerDAO plans to attract a different user group from DAI based on the new stablecoin and further expand its adoption from DeFi to off-chain scenarios.

2. Aave’s GHO

Interestingly, Aave, which is based on lending, is moving closer to MakerDAO and has launched GHO, a decentralized, collateral-backed, and US dollar-pegged DeFi native stablecoin.

It shares similar logic to DAI—it's an over-collateralized stablecoin minted using aTokens as collateral. Users can use Aave V 3 assets as collateral for over-collateralization. The only difference is that since all collateral is productive capital, it generates a certain amount of interest (aTokens), which is determined by lending demand.

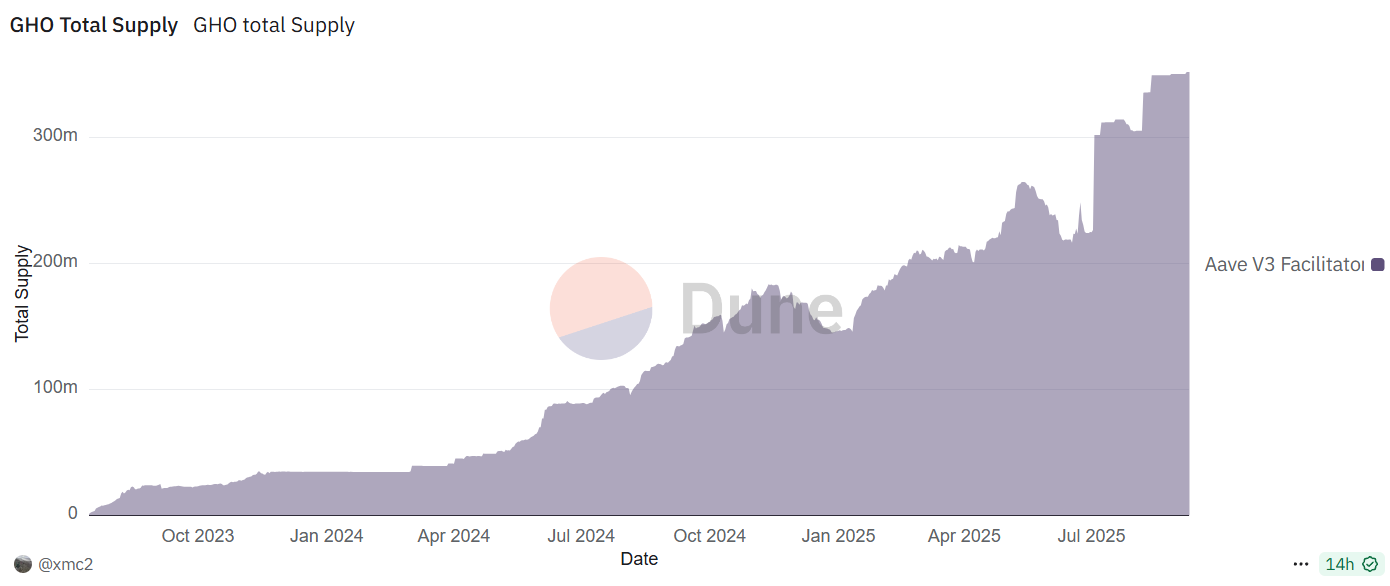

Source: Dune

From the perspective of experimental comparison, MakerDAO relies on the right to mint coins to expand its ecosystem, while Aave derives stablecoins from its mature lending scenarios. The two provide DeFi protocol stablecoin development templates under different paths.

As of the time of writing, the minting volume of GHO has exceeded 350 million pieces, and it has been in a basically steady growth trend in the past two years, with market recognition and user acceptance steadily increasing.

3. Curve’s crvUSD

Since its launch in 2023, crvUSD has supported a variety of mainstream assets as collateral, including sfrxETH, wstETH, WBTC, WETH, and ETH, and covers major LSD (liquidity staking) asset categories. Its unique LLAMMA liquidation mechanism also makes it easier for users to understand and use.

As of the time of writing, the number of crvUSD minted has exceeded 230 million. It is worth mentioning that wstETH alone accounts for about half of the total crvUSD minting volume, highlighting its deep binding and market advantages in the LSDfi field.

4. Frax Finance’s frxUSD

The story of Frax Finance is the most dramatic. During the 2022 stability crisis, Frax quickly adjusted its strategy and stabilized its position by increasing sufficient reserves to completely transform into a fully collateralized stablecoin.

A more critical step is that it has accurately entered the LSD track in the past two years, using its ecological product frxETH and the governance resources accumulated in its hands to create extremely attractive yields on platforms such as Curve, and successfully achieved the second growth curve.

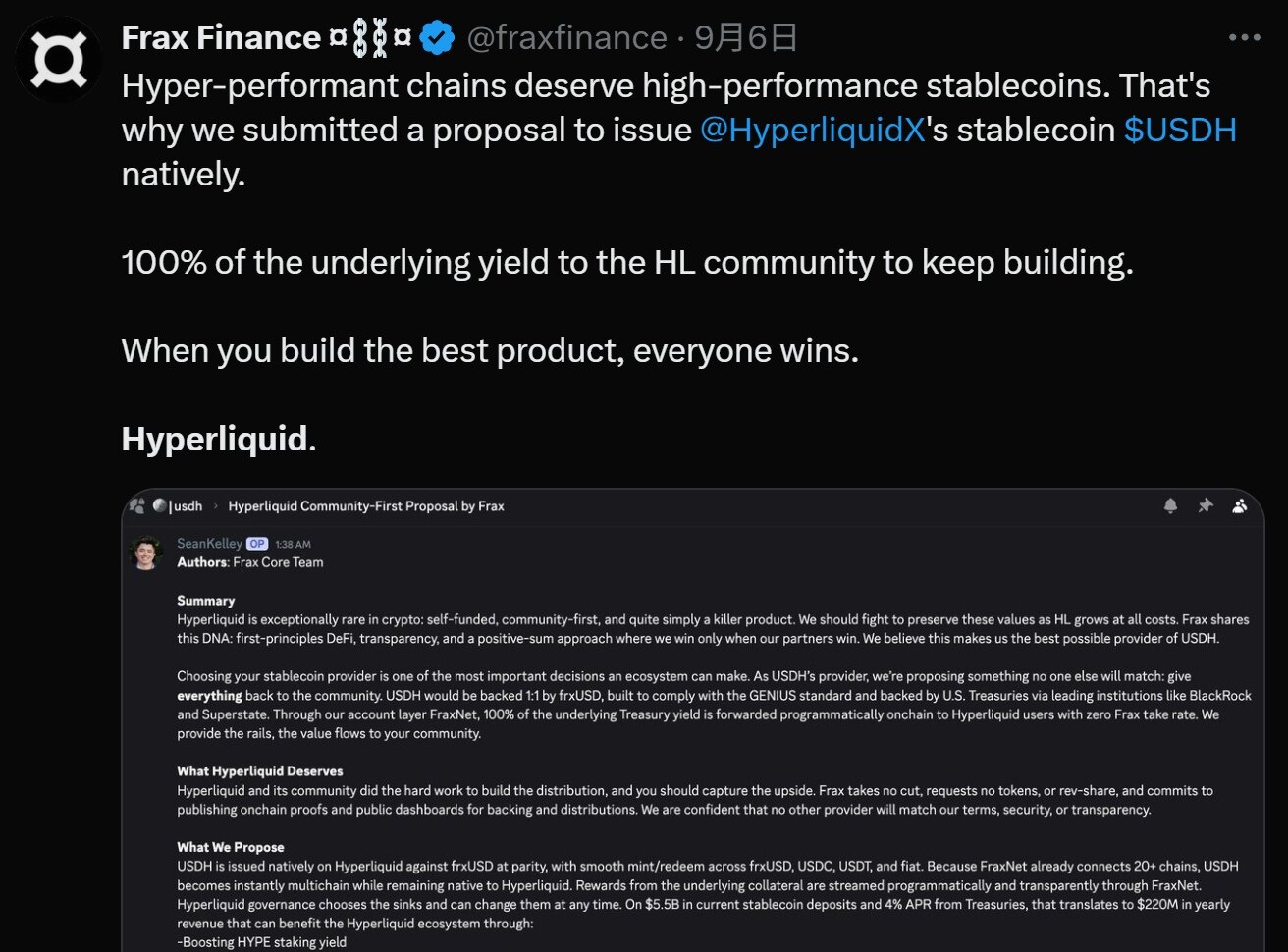

In the latest USDH bidding competition, Frax even put forward a "community first" proposal and planned to peg USDH with frxUSD at a 1:1 ratio. frxUSD is backed by BlackRock's yield-based BUIDL on-chain treasury bond fund. "100% of the underlying treasury bond income will be directly distributed to Hyperliquid users through an on-chain programmatic method, and Frax does not charge any fees."

3. From "issuance" to "transaction", what is the fulcrum?

From the above cases, we can see that, to a certain extent, stablecoins are the only way for DeFi protocols to move from "tools" to "systems."

In fact, as a narrative forgotten after the midsummer of 2020-2021, DeFi protocol stablecoins have been on a path of continuous evolution. From MakerDAO, Aave, Curve to today's HyperLiquid, we found that the focus of this war has quietly changed.

The key lies not in the ability to issue, but in the transaction and application scenarios. Put bluntly, whether it's overcollateralized or fully backed, issuing a stablecoin pegged to the US dollar is no longer a difficult task. The real challenges lie in "what can it be used for? Who will use it? Where can it circulate?"

As HyperLiquid emphasized when bidding for USDH issuance rights, serving the HyperLiquid ecosystem first and ensuring compliance is the key. This is the true fulcrum of DeFi stablecoins:

- First and foremost, there must be an endogenous scenario for the stablecoin to be widely deployed. This is also the stablecoin's "base." For example, for Aave, it's lending; for Curve, it's trading; and for HyperLiquid, it's derivatives trading (margin assets). It can be said that a strong endogenous scenario can provide the most original and loyal demand for stablecoins.

- Secondly, liquidity depth is crucial. After all, the lifeblood of a stablecoin lies in its trading pairs with other mainstream assets (such as ETH, WBTC) and other stablecoins (such as USDC, USDT). Having one or more deep liquidity pools is fundamental to maintaining price stability and meeting large-scale trading needs. This is why Curve remains a battleground for all stablecoins.

- Then there are composability and scalability. Whether a stablecoin can be easily integrated into other DeFi protocols as collateral, lending assets, or the underlying asset of yield aggregators determines the ceiling of its value network.

- Finally, there is the “icing on the cake” revenue drive – in the DeFi market, where stock-based trading is the norm, yield is the most effective way to attract liquidity, and stablecoins that “earn money for users” are more attractive.

In a nutshell, centralized stablecoins remain the underlying liquidity of DeFi. For all DeFi protocols, issuing native stablecoins is no longer a simple technical selection, but a strategic layout related to the closed loop of ecological value. Its real fulcrum has long shifted from "how to issue" to "how to make it traded and used frequently."

This also means that the DeFi stablecoins that will win in the future must be those "super assets" that can provide their holders with the most solid application scenarios, the deepest liquidity and the most sustainable returns, rather than just a "currency".