In-depth analysis of Cango's Q2 financial report: Net loss of approximately US$300 million, why did the stock price rise?

- 核心观点:灿谷转型比特币矿企成功但现巨额会计亏损。

- 关键要素:

- 挖矿收入占比98%,达9.89亿元。

- 矿机减值致18亿账面亏损。

- 调整后EBITDA利润率达71%。

- 市场影响:凸显真实业务DAT模式受青睐。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Golem ( @web3_golem )

On September 5, Cango Inc., the world's second-largest Bitcoin mining company, released its Q2 2025 financial report (as of June 30). This is Cango Inc.'s first quarterly report after completing its strategic transformation from an Internet car company to a Bitcoin mining company, and it has attracted much attention from the outside world.

According to the financial report, Cangu's total revenue for the second quarter of 2025 was RMB 1 billion (US$139.8 million), of which RMB 989.4 million (US$138.1 million) came from Bitcoin mining, with a total of 1,404.4 bitcoins mined in the second quarter. Revenue from traditional auto trading was RMB 12.4 million (US$1.7 million). Judging by the revenue structure, Cangu's nine-month transformation has been successful.

However, Cangu still suffered an operating loss of RMB 1.3 billion (approximately US$180.4 million) in the second quarter of 2025, compared with an operating loss of RMB 13 million in the same period of 2024; its net loss in the second quarter of 2025 reached RMB 2.1 billion (approximately US$295.4 million), while its net profit in the same period of 2024 was RMB 86 million.

Although Cangu's revenue increased after the transformation, its operating losses continued to widen compared to the same period in 2024, even resulting in a significant net loss in accounting terms. Could it be that Cangu's transformation was all show and no substance, becoming another example of a Web 2 company's commercial failure in the crypto industry?

Growing pains during transformation

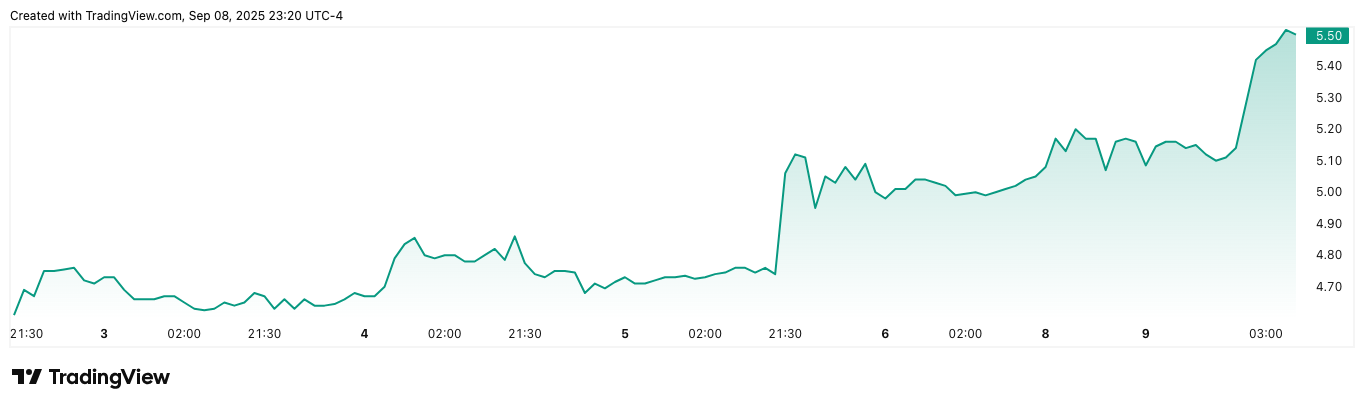

For listed companies, investor satisfaction with their financial reports and underlying operations is reflected in their stock price. On September 5th, when the US stock market opened, Canggu (NYSE: CANG) shares reached an intraday high of $5.12. This Monday, CANG continued its upward trend after the US market opened, closing at $5.50.

Cango's stock price performance after the release of its Q2 2025 financial report (as of September 9)

Judging from the stock price performance alone, investors believe that Cangu has delivered a satisfactory answer.

A careful look at the Q2 financial report reveals clues. In the second quarter of 2025, Cangu's total operating costs and expenses were 2.3 billion yuan (approximately US$320.3 million). Excluding normal equipment depreciation and human and administrative expenses, the largest cost came from the book loss caused by the impairment of mining machines (1.8 billion yuan).

In October 2024, Cangu chose to acquire 18 E/s mining machines through equity settlement, with the corresponding share price being approximately US$2 per ADS, for a total value of US$144 million. However, as of June 30, 2025, Cangu's share price had risen above US$4, resulting in a book loss of US$256.9 million (RMB 1.8 billion) based on the current fair value.

Therefore, this 1.8 billion RMB constitutes an "accounting loss." According to the equity acquisition agreement, the acquisition of 18 E/s mining rigs was a private placement for eight miners, not a public offering. Furthermore, shareholders were subject to a six-month lock-up period after the offering. Even though the share price has doubled, the shares cannot currently be sold on the secondary market.

Another factor contributing to the net loss in accounting terms was a one-time loss from the disposal of existing Chinese assets. During the divestiture of its existing automotive business, Cango originally sold all of its Chinese operations for a contract consideration of US$351.94 million. However, a third-party professional appraisal determined that the fair value of the related assets was lower than the original book value, resulting in a one-time impairment loss of US$82.58 million.

Clearly, Canggu's net loss in Q2 2025 wasn't due to poor mining performance, but rather to growing pains during its transformation. " We've traded temporary accounting fluctuations for sustainable competitive advantages—expanded economies of scale, a radically optimized cost structure, and a strategic focus on high-end computing. With this new foundation firmly established and a clear growth path, I have unprecedented confidence in Canggu's future," said Canggu CEO Paul Yu during the Q2 earnings call.

As of June 30, 2025, Cango's cash and cash equivalents reserves reached RMB 843.8 million (approximately US$117.8 million), an increase of approximately RMB 200 million from the RMB 660.1 million disclosed at the end of 2024. Despite the quarterly net loss, the ample cash reserves have given investors real confidence in Cango's continued business expansion.

After 9 months of transformation, Cangu has become a "growth beast"

Cangu's mining business revenue in the second quarter of 2025 was RMB 989 million (US$138.1 million), accounting for more than 98% of total revenue. After excluding the impairment losses of mining machines and one-time losses from the terminated Chinese business, the adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) in the second quarter was RMB 710.1 million (approximately US$99.1 million), compared with RMB 5.4 million in the same period of 2024, an increase of more than 130 times.

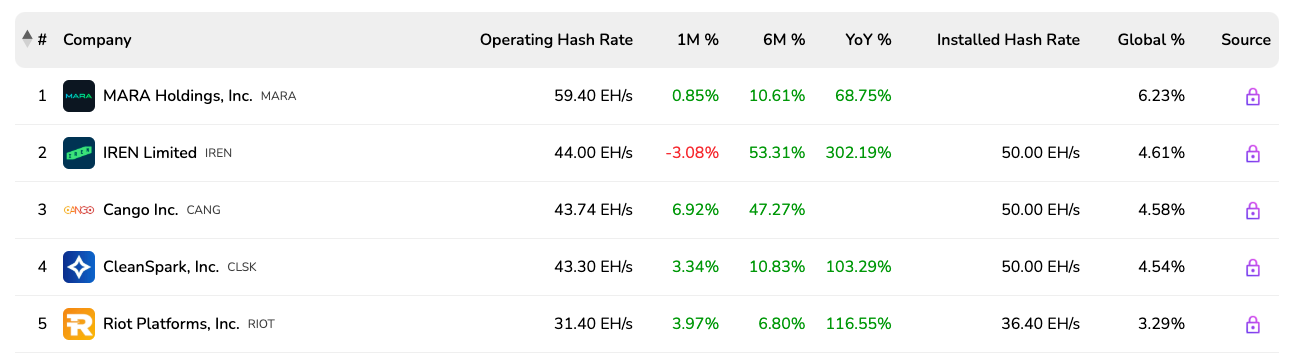

With an EBITDA margin of 71.01%, Canggu's strong potential for profitability has transformed it into a "growth beast." " In just nine months, we've become one of the world's largest Bitcoin miners ," CEO Paul Yu concluded during the Q2 earnings call. This isn't just Canggu boasting. According to BitcoinMiningStock , Canggu's hash rate has grown to 50 EH/s, making it one of the world's second-largest mining companies, accounting for 4.58% of global hash rate. Its actual operating hash rate is 43.74 EH/s, ranking third.

Bitcoin mining company computing power global ranking

In July, the commissioning of a 50 EH/s computing power unit led to a 44% increase in the company's Bitcoin production, reaching 650.5 BTC. Meanwhile, Cangu continues to expand its business, completing the acquisition of a 50-megawatt mining farm in Georgia, USA, in August. This acquisition will effectively reduce electricity procurement costs and improve operational stability.

DAT is cooling down, and the "Cangu Model" will be discovered.

Cangu is not only a Bitcoin mining company but also a new type of DAT (cryptocurrency treasury company). It implements a "mine and hold" strategy. While it doesn't generate open market demand for Bitcoin, it reduces selling pressure from the supply side. In the second quarter of 2025, Cangu mined a total of 1,404.4 Bitcoins, valued at over $158 million, at an average cost of $98,636 per coin. This means that Cangu "hoarded" 1,404.4 Bitcoins in the second quarter of 2025.

In 2025, the DAT concept began to gain popularity among US-listed companies. According to data from consulting firm Architect Partners, 154 US-listed companies have announced fundraising efforts to purchase cryptocurrencies since January of this year. However, on September 4th, a regulatory announcement from Nasdaq suddenly cooled the DAT craze. Nasdaq announced it was strengthening its scrutiny of publicly listed companies holding cryptocurrencies, focusing on companies attempting to inflate their stock prices by raising funds to purchase and hoard cryptocurrencies.

Although the specific measures have not yet been made public, the share prices of DAT concept stocks in the US immediately plunged. MSTR fell more than 5.3% on the day, MARA fell more than 3.5% on the day, RIOT fell more than 5.6% on the day, and SBET fell more than 10.1% on the day.

Nasdaq's move clearly aims to combat the phenomenon of crypto companies transitioning through US-listed shell companies and increase the difficulty of raising capital for existing crypto-backed companies. The popular DAT model of "hoarding cryptocurrencies, raising funds, hoarding more cryptocurrencies, and raising more funds" is likely to decline due to increased regulation. After the bubble bursts, new DATs that truly conduct compliant crypto business and accumulate cryptocurrency will see their value discovered.

Or perhaps, value discovery has already occurred, and Canggu represents a new type of DAT. Since September 4th, Canggu's (NYSE: CANG) stock price has continued to rise. Although it experienced a pullback on Tuesday, it still holds the top spot among all DAT concept stocks. Most DATs on the market are "shell companies," raising funds to purchase tokens and increase the value of each share of cryptocurrency. However, Canggu's fundraising is aimed at developing a real crypto business—improving its mining capabilities.

In terms of business, Cango adheres to an asset-light operation strategy centered on prioritizing the strategic purchase of used mining rigs, enabling rapid and cost-effective expansion and ramp-up of its computing power. On one hand, it achieves "computing power leverage" by expanding its computing power through financing methods such as Bitcoin-collateralized medium- and long-term loans; on the other hand, it optimizes capital utilization efficiency through reasonable debt in daily operations, achieving "operational leverage."

The amplifying effect of double leverage is better than direct financing to purchase Bitcoin. Cangu does not need to use the traditional DAT "additional stock issuance" method to cover the purchase of coins and operating expenses, avoiding the dilution of the original shareholders' equity and maximizing the benefits brought by the rise in Bitcoin prices.

One of the Canggu mines

Paul Yu, CEO of Cango, explained in the Q2 earnings call, "Our asset-light operating model gives us a unique advantage. By purchasing plug-and-play mining equipment, we can rapidly scale with minimal upfront investment, making it more cost-effective than our vertically integrated competitors. Our capital efficiency ensures excellent return on invested capital (ROCE) and maintains operational resilience through various market cycles, avoiding the burden of heavy equipment financing."

Cangu's model is also spreading to other mining companies, including American Bitcoin, a Bitcoin mining company in which the Trump family holds a stake. American Bitcoin also initially chose to accumulate Bitcoin at a low cost through mining, rather than directly raising funds to hoard Bitcoin, unlike traditional DATs. (Related reading: The Trump family raises another $1.5 billion: The business philosophy behind the Bitcoin mining company American Bitcoin )

Nasdaq's regulatory news may be a sign that while Bitcoin Treasury companies were a key innovation in this bull run for US crypto stocks, their outsized returns are shrinking. In the next phase of this bull run, these DATs with real crypto businesses will become the protagonists.

Looking for breakthroughs, the second growth curve begins to emerge

The competition in the Bitcoin mining industry is fierce, with electricity and equipment costs becoming the norm. To stand out, Hut8 even invited the son of the US President to launch American Bitcoin.

Although only nine months after its transformation, Cango has already grown into a leading mining company. According to the "corporate cycle theory" proposed by renowned British management scholar Charles Handy, leading companies in the industry must find a "second growth curve" if they want to avoid a "Nokia-style dilemma." After entering the first maturity stage, choosing new business objectives and building a new growth strategy are crucial to a company's success.

Cangu’s second growth curve has begun to show signs.

"This quarter's significant growth highlights the solid progress of our business transformation and its tangible positive impact on operations. With this solid foundation, we are well-positioned to further expand our Bitcoin mining business and drive future improvements in our energy and high-performance computing (HPC) capabilities ," said Michael Zhang, CFO of Cango, on the Q2 earnings call.

CEO Paul Yu elaborated on Cango's future plans in more detail during the conference call. In the short term, the company will fully utilize its existing 50 EH/s computing power and replicate the low-cost operating model of its Georgia mining farm to maximize value. In the medium term, the company plans to pilot renewable energy storage projects, striving to achieve near-zero-cost mining operations, while also retrofitting some facilities to support high-performance computing applications. The long-term goal is to build a dynamic computing platform, transitioning to an "energy + HPC" model, intelligently switching between Bitcoin mining and AI inference training in real time. This is expected to be implemented in the first half of 2026, maximizing the value of every kilowatt-hour of electricity.

Cangu's "Energy + HPC" strategy is different from traditional mining companies, which typically lease space and electricity to AI big-model companies. Instead, it focuses more on energy itself. This strategic positioning is expected to ensure Cangu's vitality even if the DAT concept cools and the mining industry falls into a downturn.