The crypto market is experiencing a major correction. Is the bull market retracing its course or has it already ended?

- 核心观点:市场回调是早期持有者获利了结的正常过程。

- 关键要素:

- OG持有者向交易所大量转移BTC。

- 市场杠杆率低,未破关键支撑。

- 比特币与风险资产相关性脱钩。

- 市场影响:短期震荡,长期为牛市蓄力。

- 时效性标注:短期影响。

Original author: Chloe, ChainCatcher

Just four days into November, the crypto market has already experienced a significant correction. Bitcoin has fallen nearly 13% in the past month, dropping from its previous high to around $104,000, with prices fluctuating repeatedly. ETH's trading price has fallen nearly 20% in the same period. Faced with this correction, market sentiment is generally anxious, with many questioning whether the bottom has been reached or if a full-blown bear market has begun. Is this correction a true top and subsequent decline, or is the market perhaps in the darkest hour before dawn?

ChainCatcher has compiled interpretations from industry experts, analysts, traders, and institutional investors from different perspectives. How do these various parties view this market correction?

Market OGs take large profits

In a report to CoinDesk, Enflux noted that liquidity is flowing out of cryptocurrencies and back into traditional finance, led by AI and fintech. Enflux stated that Wall Street is poised for another rally, driven by liquidity and infrastructure investment, while cryptocurrencies will continue to test where the true bottom is.

QCP Capital believes the recent pullback is largely unrelated to macroeconomic factors. Instead, Bitcoin's "veteran" holders are taking profits after a long rally, selling large amounts of BTC to exchanges like Kraken. On-chain data shows that approximately 405,000 BTC of long-term holdings have changed supply in the past month, but the price remains above the $100,000 mark. QCP stated, "The market absorbed traditional supply without breaking key support," noting that leverage remains low and funding rates are flat.

Renowned Wall Street market analyst Jordi Visser shares the same view: "The predicament is real, and frankly, the sentiment in the cryptocurrency market is currently very bad." However, Visser believes that Bitcoin is currently undergoing a "silent IPO."

He pointed out that the current price consolidation in the market is not a sign of failure, but a normal process for early holders to realize profits. Visser explained, "Galaxy Digital CEO Mike Novogratz disclosed in a recent earnings call that the company sold $9 billion worth of Bitcoin to a client, which represents an orderly exit by OGs."

This process is similar to the expiration of the lock-up period after a traditional IPO. Early investors did not panic sell, but rather systematically allocated their holdings. "They were very patient, waiting for this moment for many years." He believes that the decoupling of Bitcoin from risk assets proves this point. If the weakness is driven by macroeconomic factors, Bitcoin should fall along with risk assets, rather than diverging.

Bitcoin continues to follow the typical post-halving price action, with the price having the potential to break through.

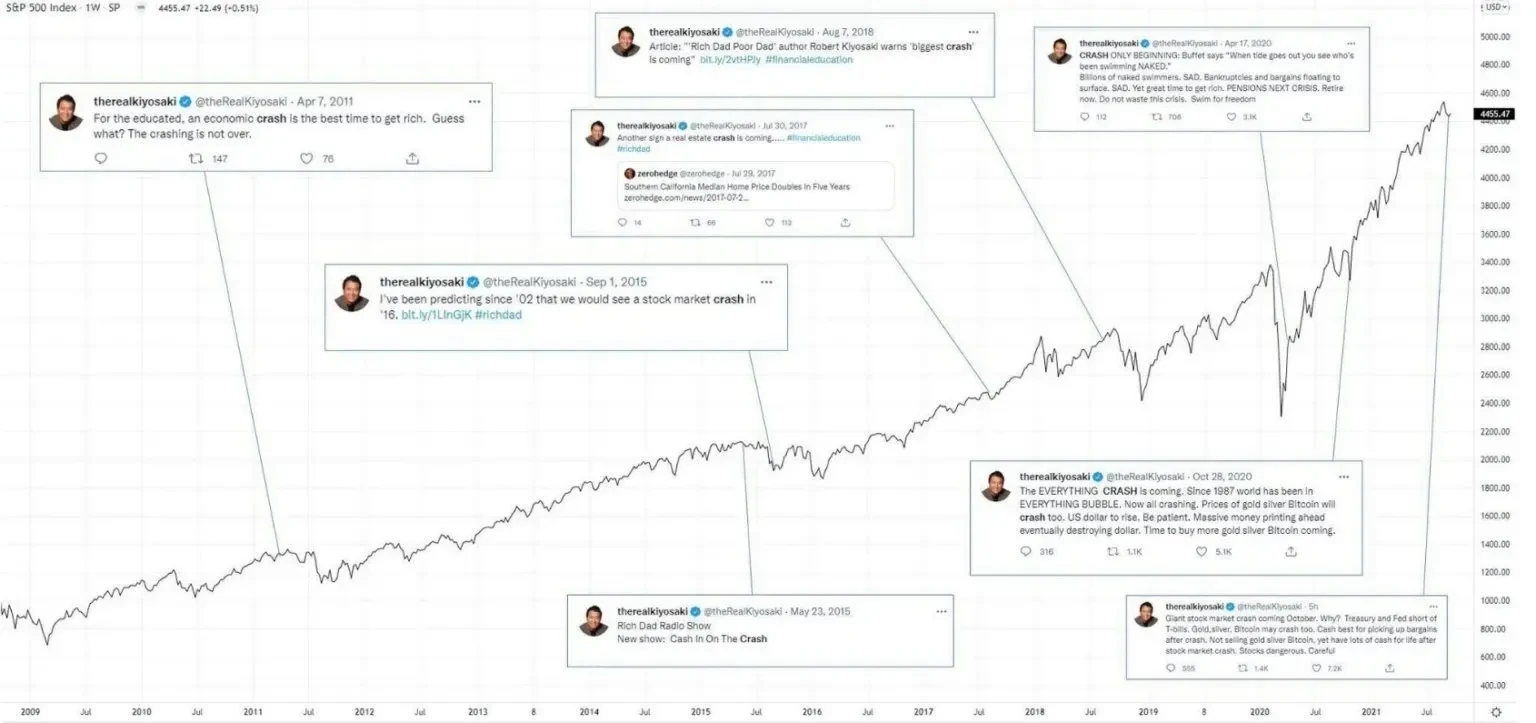

Robert Kiyosaki, author of "Rich Dad Poor Dad," has once again issued a crash warning: "A massive crash is beginning. Millions will be wiped out. Protect yourself. Silver, gold, Bitcoin, and Ethereum will protect you." However, he issued approximately 30 similar crash warnings between November 2024 and October 2025. Cryptonews quipped that while the market is indeed in a bad state, Robert's track record is also quite poor; historically, market movements have often contradicted his predictions.

StealthEx CEO Maria Carola believes that market risks remain high, but the market appears stronger than in previous cycles. However, she also warned that while the frequency of extreme flash crashes has decreased due to greater liquidity in the market now than in previous cycles, systemic risks such as major LPs withdrawing liquidity, unexpected macroeconomic events, or regulatory shocks could still trigger considerable volatility.

Cais Manai, co-founder and product lead of TEN Protocol, pointed out that Ethereum's recovery remains uncertain amid changing macroeconomic conditions. If the Federal Reserve leans dovish and risk appetite returns, we could see ETH quickly recover to $4,500, especially if ETF inflows remain healthy.

SynFutures CEO Rachel Lin offers a more optimistic assessment, suggesting that the October decline may be laying the groundwork for the next bull run. She believes such pullbacks often mark the midpoint of larger cycles. She anticipates November may see a period of "stability + cautious optimism," and if Bitcoin continues its typical post-halving pattern, a price of $120,000 to $150,000 by the end of 2025 is possible.

Traders' opinions: Will the end of the US government shutdown mark the dawn of a new era?

@CatoKt4 believes the core reason for the decline is that the market was "drained" again during the liquidity tightening phase. The main reason is that during the US government shutdown, the Treasury's General Account (TGA) could not release funds into the market normally. When the government was shut down, this pool only received funds and did not release them, resulting in a large amount of market liquidity being absorbed.

That evening, US Treasury bonds with maturities of 3 months and 6 months were auctioned, with a total auction size of $163 billion and an actual auction amount of $170.69 billion. After deducting the reinvestment amount from the Federal Reserve's SOMA account ($7.69 billion), this means that $163 billion was withdrawn from the financial market to purchase Treasury bonds. In normal times, a Treasury bond auction of this size would have a limited impact on risky assets, but in this special period of tightened liquidity, the withdrawal of $163 billion had a significant impact on the market.

In addition, hawkish comments from the Federal Reserve caused the probability of a December rate cut to drop from 69.8% to 67.5%, undermining market confidence in a rate cut.

@Trader_S18 cited the latest reports from Goldman Sachs and Citigroup, indicating that the government shutdown will end within two weeks. Goldman Sachs believes the shutdown is nearing its end and expects a funding agreement to be reached most likely around the second week of November. They suggested the following trading strategy for the next two weeks: before November 7th, watch whether BTC bottoms out in the 107k-111k range; if BTC breaks through and holds above 112k before November 12th, consider adding to positions for a rebound; if the government does reopen in mid-November, BTC may surge to the previous high of 124-126k.

Regarding this situation, he believes the impact of the government shutdown is no less than a hidden interest rate hike. Therefore, considering the extremely adverse external environment, the fact that the market has only fallen this much is quite remarkable. He urges users to hold on for another week or two until the US government reopens. Once the Treasury begins to deplete its massive TGA cash balance, up to $900 billion will flow back into the banking system, amounting to a hidden quantitative easing measure. At that point, better days will begin.

@TXMCtrades believes that when everyone in the market is calling a top, it actually proves that it hasn't peaked yet, because the real top usually appears when no one expects it and all coins are skyrocketing. This time, only a few major coins have risen, while others are still at low levels, indicating that market enthusiasm has not yet reached its peak, and the bull market may not be over yet.

@TraderNoah expressed both harsh criticism and cautious optimism regarding the entire crypto industry. He believes that after several years of performance, the market can withstand these "unacceptable facts." First, current prices are not cheap, even if some tokens have fallen by 80%, those underperforming assets deserve this because they are inherently worthless. Second, over 80% of the people in the industry are incompetent compared to those in other industries and will inevitably be naturally eliminated over time. Third, the overall performance of funds is poor. He emphasized that the crypto industry has historically been neglected because it is rife with speculation and immaturity.

Noah is optimistic about the future because the excessive behavior following the 2021 bull market (such as bubbles and low-quality projects) is finally being eliminated one by one. Although this will be painful in the short term and may even lead to the "death" of most market users, it is a necessary process for the industry to become successful and mature, and it is a painful transformation.

@CredibleCrypto firmly believes that the market will never peak at a mere 4 trillion market capitalization. "Since 2020, I have said many times that we will see at least 10 trillion in total market capitalization before the end of this cycle, and I still stand by this view. I will never sell anything when the market capitalization is 4 trillion."

@Ashcryptoreal emphasizes an optimistic outlook through historical comparisons. He recalls early November 2024, when Bitcoin plummeted from $71,000 to $66,000, leading many to believe the market was doomed. However, it surged 60% to $108,000 in just 45 days. During the same period, from November 4th to December 15th, ETH rose 75%, and the total market capitalization of other tokens surged 138%. Many smaller coins saw gains of 5-10 times in less than two months, demonstrating that the market can generate explosive parabolic returns in a short period. Now, in early November 2025, a similar decline is expected. He points out, "All the data is positive, including the Fed's December rate cut, the end of quantitative tightening (QT) on December 1st, the launch of quantitative easing (QE) (Fed buying Treasury bonds), the signing of the US-China trade agreement, gold prices reaching their peak, and US stocks hitting new highs."

He firmly believes that crypto prices are being manipulated and suppressed, and he does not accept the view that the crypto market is coming to an end given the abundance of global liquidity and the rise of other assets. Therefore, he chooses to hold his coins patiently and wait, even though the process is not easy, as investors in the crypto market are aware of the risks.

Finally, while interpretations of the reasons for this pullback vary—some attribute it to funds rotating into traditional markets, others to early holders taking profits, and still others to liquidity tightening caused by the government shutdown—what is certain is that the market is in a critical waiting period, including the reopening of the US government and a policy shift by the Federal Reserve. Furthermore, Bitcoin's fundamentals are undeniably stronger than ever. Historical data shows that Bitcoin's average return in the third quarter was still positive, reaching 6.05%. November has also been one of Bitcoin's strongest performing months in recent years, with an average increase of 42% over the past 12 years.

This shift from concentrated to dispersed holdings may be the transitional period Bitcoin needs to formally graduate from the experimental stage and become a long-term monetary asset.