BitMart Market Weekly Report (September 1-7)

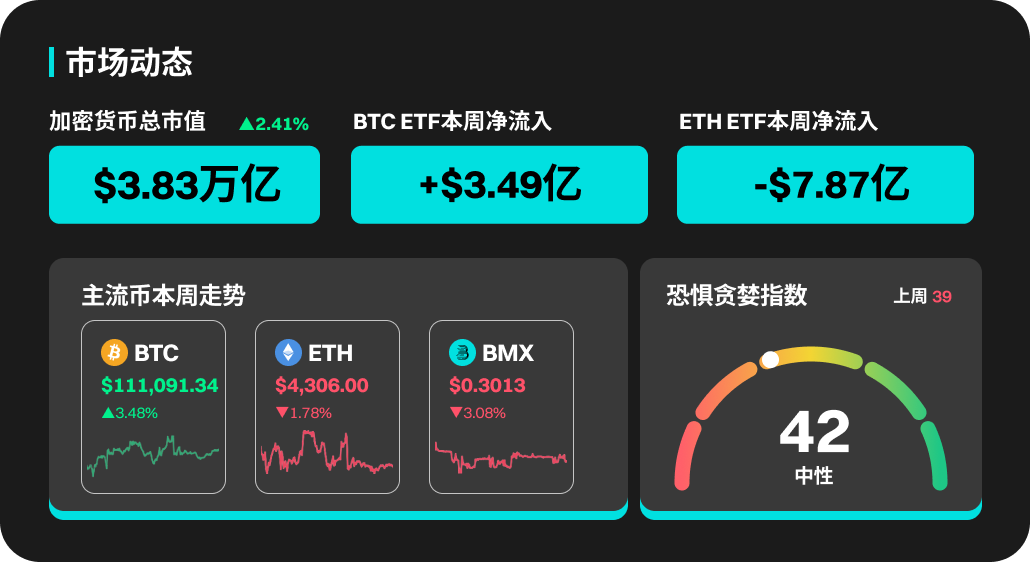

- Core view: The overall cryptocurrency market rose slightly, with BTC performing better than ETH.

- Key elements:

- The total market capitalization of cryptocurrencies rose 2.41% to 3.83 trillion.

- BTC ETFs saw a net inflow of $349 million and ETH saw a net outflow of $787 million.

- BTC's market share remained unchanged at 57.7%, while ETH fell to 13.5%.

- Market impact: The market awaits CPI data for short-term direction.

- Timeliness annotation: short-term impact.

According to BitMart's market report on September 8, the total market value of cryptocurrencies in the past week was 3.83 trillion, up 2.41% from the previous week.

Crypto market dynamics this week

Last week (September 1-7), BTC ETFs saw net inflows of $349 million. BTC remained within a narrow range of $107,000 to $113,000, with overall market volatility remaining relatively low. BTC's current market share is currently at 57.7%, roughly the same as last week. BTC's 11% retracement from its August all-time high is considered a normal decline. Last Friday's release of US non-farm payroll data, while further confirming expectations of a September interest rate cut, also fueled market concerns about a recession.

Last week, ETH ETFs saw a net outflow of $787 million, with net inflows on all trading days throughout the week. Despite this, ETH's market performance remained relatively stable, with no significant price drops. ETH's market share is currently reported at 13.5%, a slight decline from last week. The ETH/BTC exchange rate is currently at 0.0389, a significant drop of approximately 5% from last week, indicating that BTC outperformed ETH during this period. ETH is currently down 13% from its all-time high in August, as the market awaits the release of CPI data on September 11th.

This week's popular currencies

Among popular cryptocurrencies, MYX, WLD, HYPE, PENGU, and WLFI all performed well. MYX saw a 217.8% price increase this week, with a 24-hour trading volume of 3.15 million. WLD saw a 47.6% price increase, reaching a high of 1.28 USDT. HYPE and PENGU saw increases of 12.1% and 8.7%, respectively.

U.S. market and hot news

Last week, US stocks saw overall volatility and consolidation. The Dow Jones Industrial Average fell slightly by approximately 0.3%, the S&P 500 edged up 0.3%, and the Nasdaq performed relatively well, rising by approximately 1.1%. Weak non-farm payroll data boosted market expectations for a September rate cut by the Federal Reserve. Technology stocks, particularly the AI and semiconductor sectors, led the gains, while the energy sector came under pressure.

The US SEC plans to make a decision on the Bitwise Bitcoin and Ethereum ETF physical redemption application on September 8;

The US CPI data for August will be released at 8:30 pm on September 11;

SOL Strategies was approved to list on the Nasdaq on September 9 under the ticker symbol STKE;

Unlock popular sections and projects

Memecoin Section

The Memecoin sector saw strong activity last week, with a cumulative gain of approximately +10.6%. Dogecoin (DOGE) performed particularly well, rising +10.6%. With strong momentum and buoyant market sentiment, the Memecoin sector remains resilient in the short term if it continues to gain community support and attention.

Aptos (APT) will unlock approximately 11.31 million tokens at 6:00 PM Beijing time on September 11th, representing 2.20% of the current circulating supply and valued at approximately US$48 million.

Cheelee (CHEEL) will unlock approximately 20.81 million tokens at 8:00 am Beijing time on September 13, accounting for 3.13% of the current circulation and worth approximately US$56 million.

Risk Warning:

Use of BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve substantial risk of loss. Past, hypothetical, or simulated performance is not necessarily indicative of future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. You should carefully consider whether trading or holding digital currencies is appropriate for you based on your personal investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.