Why are so many people "watching" stablecoins, but it's so difficult to enter the market?

- 核心观点:稳定币成为加密与传统金融交汇热点。

- 关键要素:

- 市场规模年增近100%。

- 监管推动主流化合规发展。

- 机构巨头积极布局应用。

- 市场影响:加速金融数字化和跨境支付变革。

- 时效性标注:中期影响。

summary

Over the past decade, stablecoins have steadily moved from obscure experiments into the global financial spotlight. From the 2022 collapse of the algorithmic stablecoin TerraUSD (UST), which wiped out approximately $60 billion in market capitalization overnight, to the forced suspension of new issuance of the BUSD stablecoin by traditional giant Binance in 2023 due to regulatory pressure, to the high-profile debut of the USD 1 stablecoin, founded by the family of US President Trump, in early 2025—these landmark events demonstrate that stablecoins have become a hot topic at the intersection of the crypto world and traditional finance. Wall Street institutions, internet giants, and ordinary investors alike are closely monitoring the stablecoin market. However, despite the popularity of stablecoins, the barrier to entry is high, with technical and compliance challenges prohibiting many.

This article will analyze the driving forces and obstacles behind the current stablecoin craze from the perspectives of institutions, retail investors, and on-chain innovation, and explore why many people are eyeing stablecoins but have been unable to enter the market.

Table of contents

1. Why are stablecoins so popular?

- The market size is growing rapidly

- Policies promote the mainstreaming of the industry

- Popularity and cognitive gap

- Payment giants and financial institutions are actively participating in the market

2. How do global institutions deploy stablecoins?

- JD.com: Driven by cross-border payments

- JPMorgan Chase (JPM Coin): Corporate fund pool settlement

- PayPal (PYUSD): Consumer Applications

- Fintech companies (Stripe, Revolut, etc.): payment bridges

- Cross-border financial pilot: Public-private partnership

- Mainstream bank executives expressed support

3. People who want to join but don’t know where to start: obstacles and difficulties

- High technical threshold and expensive development costs

- Economic model design and liquidity problems

- Financing and liquidity support become increasingly difficult

- Compliance pressure and regulatory fog

- Insufficient credit endorsement makes it difficult to build trust

- User experience barriers and cumbersome entry operations

4. BenfChain × Stablecoin: One-click issuance + smooth experience

- Native one-click publishing

- Stablecoins for Gas Payment

- Ultimate User Experience (UX)

- Security and decentralization

5. Conclusion: Bixin Ventures’ Observations

1. Why are stablecoins so popular?

Stablecoins, as crypto assets anchored to fiat currencies, have become a bridge connecting traditional finance and the blockchain economy. Their popularity in recent years is reflected in several aspects:

The market size is growing rapidly

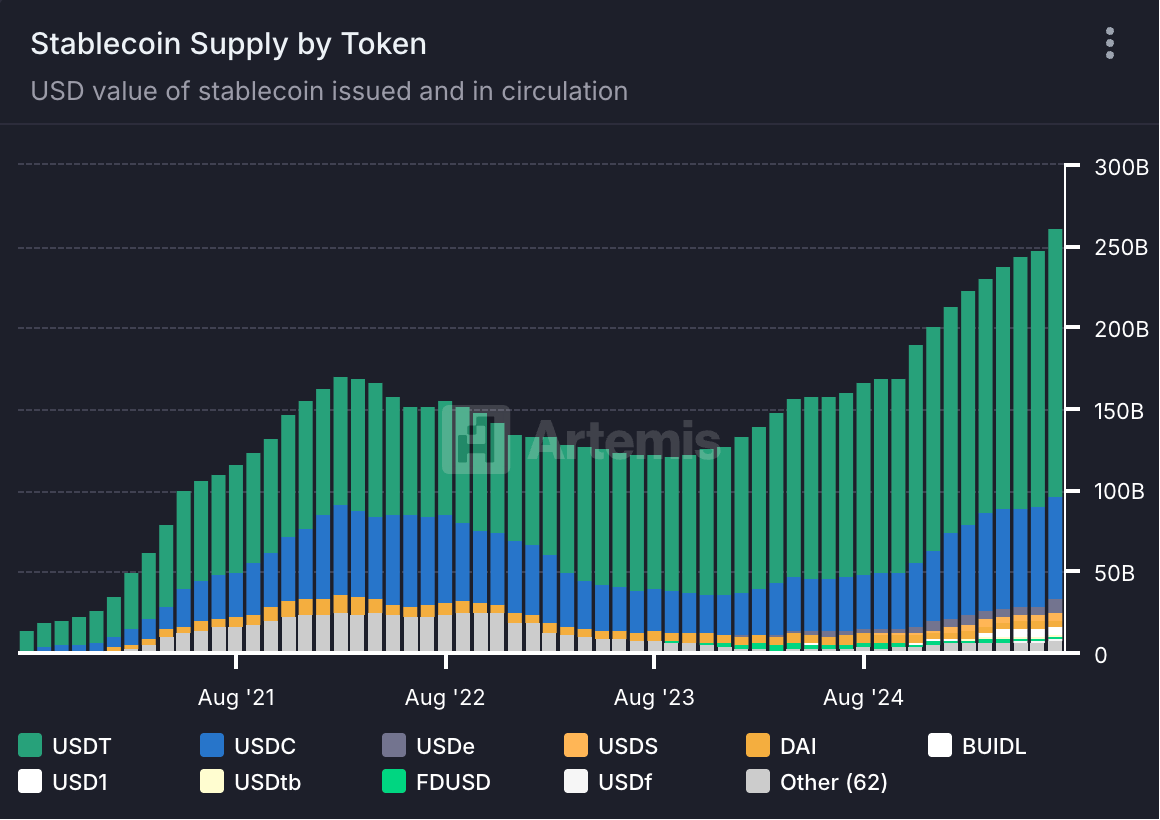

- Active Address Growth : The number of stablecoin users and transaction volume has exploded. The number of active stablecoin wallet addresses increased from 19.6 million in February 2024 to 41 million in August 2025, an annual increase of more than 100% (source: Artemis)

- Supply Growth : During the same period, the total global stablecoin supply climbed from approximately $138 billion to $275 billion , achieving a 99% year-on-year increase.

(Source: Artemis)

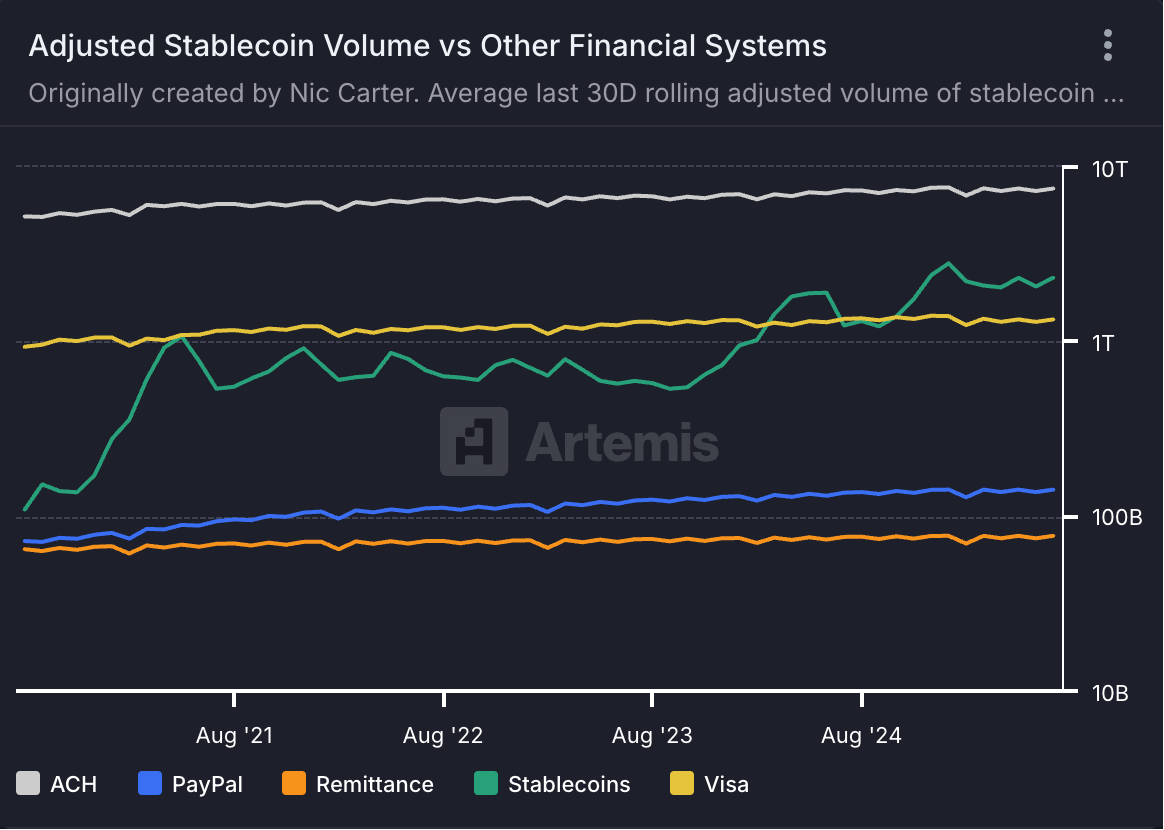

- Transaction volume surpasses payment giants : Since September 2024, the daily transaction volume of stablecoins has continued to exceed the transaction volume of the VISA channel, even reaching a peak of US$5.1 trillion at one point.

(Source: Artemis)

This series of data shows that the penetration and influence of stablecoins have increased significantly, whether in exchanges, DeFi or payment scenarios.

Policies promote the mainstreaming of the industry

The rapid follow-up of regulators in various countries has laid the foundation for the legal and compliant development of stablecoins.

- United States : In July 2025, the "Guidance and Establishment of a National Innovation Stablecoin in the United States Act (GENIUS Act)" was officially signed. The bill clearly stipulates that only federally insured depository institutions can issue payment stablecoins, and they must maintain 100% reserves, disclose monthly and undergo annual audits, and follow strict KYC/AML measures.

- Hong Kong : The Legislative Council passed the Stablecoin Ordinance in May 2025, requiring issuers to apply for a license from the Hong Kong Monetary Authority and meet requirements such as 1:1 full reserves of high-quality assets, a sound redemption mechanism and regular audits.

- Europe : The MiCA (EU Markets in Crypto-Assets) regulation was officially implemented at the end of 2024, bringing stablecoins under strict regulation and requiring issuers to meet strict standards such as capital adequacy, liquidity and transparent disclosure.

Major financial centers around the world have successively expressed their stance on stablecoins, and compliance is pushing stablecoins from the gray area to mainstream finance.

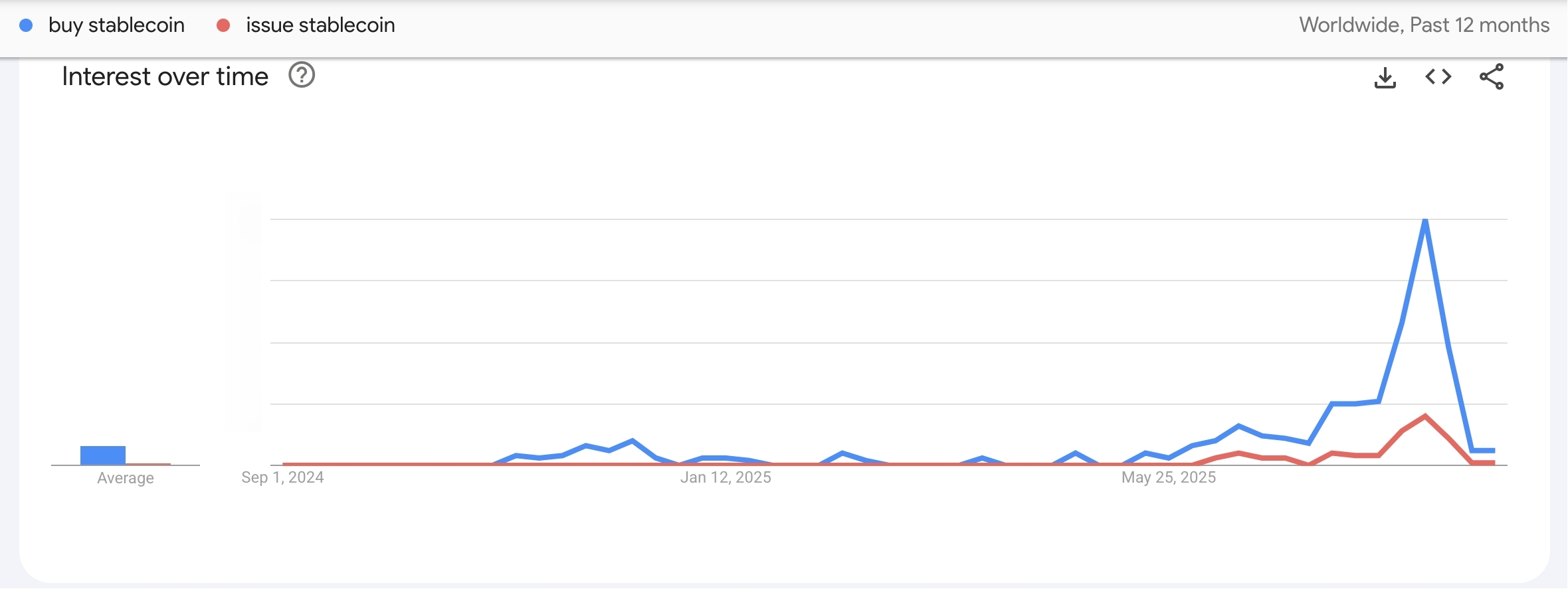

Popularity and cognitive gap

Search engine trends also reveal the public's strong interest in stablecoins. Over the past year, Google searches for keywords like "how to buy stablecoins" and "stablecoin returns" have skyrocketed, while queries for "how to issue a stablecoin" have been almost zero. This contrast suggests that while the public is highly interested in using stablecoins, their understanding of their creation remains limited. This combination of strong market demand and high supply barriers has further fueled calls within the industry for lower barriers to entry and innovative issuance methods.

(Google Trends search popularity comparison chart Source: Google)

Payment giants and financial institutions are actively participating in the market

Faced with the efficiency and low-cost advantages of stablecoins, traditional payment networks and internet finance platforms are rushing to test them, viewing them as an opportunity to upgrade the global payment system. A BIS (Bank for International Settlements) study shows that using stablecoins for cross-border payments can increase speed by two orders of magnitude and reduce costs by over 90% . This makes stablecoins a potential solution to address the pain points of slow and expensive cross-border remittances. In recent years, both Visa and Mastercard have announced plans to support stablecoin settlements. Visa has piloted accepting stablecoins like USDC in its global settlement network for the settlement of some card issuer funds, while Mastercard has launched an end-to-end stablecoin payment solution and plans to integrate compliant stablecoins into its merchant network. Payment service provider Stripe has offered content creators the option to use the USDC stablecoin as a payment option since 2022, enabling instant global micropayments. E-commerce platform Shopify has also partnered with companies to enable users to settle purchases with stablecoins. Notably, PayPal not only issued its own USD stablecoin, PYUSD, but also announced in 2025 that it would offer users who hold PYUSD an annualized 3.7% yield incentive to encourage them to hold and use the stablecoin in their PayPal and Venmo wallets . These initiatives reflect that traditional payment giants are viewing stablecoins as a crucial component of next-generation payment channels: on the one hand , they enable cross-border funds to arrive in seconds and at fees that are only one-tenth the cost of SWIFT wire transfers; on the other hand, they are leveraging stablecoins to unlock new growth in the crypto payment market. In short, from internet giants to bank payment networks, stablecoins are increasingly being viewed as the "financial infrastructure" of the digital age, significantly driving the industry's popularity.

In summary, a combination of factors, including rapidly expanding user base and transaction volume, a gradually clarifying regulatory environment, and surging public interest and the embrace of mainstream institutions, has made stablecoins one of the hottest topics in the crypto space. Behind this surge in popularity lies the immense potential of stablecoins, as value-anchored digital cash, to bridge tradition and innovation.

2. How do global institutions deploy stablecoins?

Stablecoins hold a promising future, and leading institutions are eager to enter the market through various strategies. From tech giants to Wall Street banks, many have launched their own stablecoin projects or partnered with them, aiming to gain a leading position in this new type of financial infrastructure.

The following are the layouts of several typical institutions:

JD Group - Cross-border payment driver

A subsidiary of JD.com Technology has entered the Hong Kong Monetary Authority's stablecoin sandbox and plans to issue "Jcoin," a Hong Kong dollar-pegged token, for use in cross-border trade and e-commerce payments. The goal is to significantly reduce cross-border payment costs and improve settlement efficiency, while also exploring the possibility of an offshore RMB stablecoin to promote RMB internationalization.

JPMorgan Chase (JPM Coin) - Enterprise Fund Pool Settlement

Launched in 2019, JPM Coin is primarily used for instant fund transfers between institutional clients. Based on the Quorum blockchain, it processes approximately $1-2 billion in daily transactions, becoming a crucial infrastructure for large-scale corporate liquidity management and cross-border clearing.

PayPal (PYUSD) - Consumer Applications

PayPal launched PYUSD in 2023, partnering with Paxos to issue a USD stablecoin. It has been integrated into PayPal and Venmo wallets. Starting in 2025, it will offer a 3.7% return on holdings, primarily targeting small and medium-sized merchants and freelancers for payment, settlement, and fund management.

Fintech companies (Stripe, Revolut, etc.) - payment bridges

Stripe offers USDC payment services for creators, and Revolut is developing a multi-currency stablecoin to reduce remittance and exchange costs. Both represent classic examples of emerging fintechs leveraging stablecoins to expand into the global payments market.

Cross-border Financial Pilot - Public-Private Partnership

The BIS-led mBridge and Project Agorá, as well as the Canton Network composed of investment banks and technology companies, are promoting central banks, commercial banks and financial institutions to jointly build an on-chain clearing network and explore the compliant application of stablecoins in cross-border payments and financial markets.

Mainstream bank executives expressed support

Major financial institutions have also shifted their stance on stablecoins from a wait-and-see approach to action. Several banks revealed their stablecoin plans during earnings calls: Citigroup stated it is exploring the possibility of issuing a "Citi Stablecoin," while Bank of America was also reportedly incubating a US dollar stablecoin internally for corporate client payments and settlements. JPMorgan Chase's CEO admitted that banks, driven by client demand, will enter the competition . Standard Chartered Bank not only joined the Hong Kong sandbox to test stablecoins, but also partnered with Singapore's StraitsX to provide custody and cash management services for its new stablecoins and US dollar stablecoins. Even asset management giant BlackRock has indirectly entered the stablecoin space through its stake in Circle and partnership with Coinbase. From banks to payments, e-commerce, and social media, various institutions are forming a converging force in the stablecoin market. Their entry not only brings substantial funding and a user base, but also empowers the stablecoin ecosystem in terms of compliance, security, and global networks. This is why stablecoins are currently developing so rapidly—with the backing of major players, stablecoins are moving from grassroots innovation to mainstream adoption .

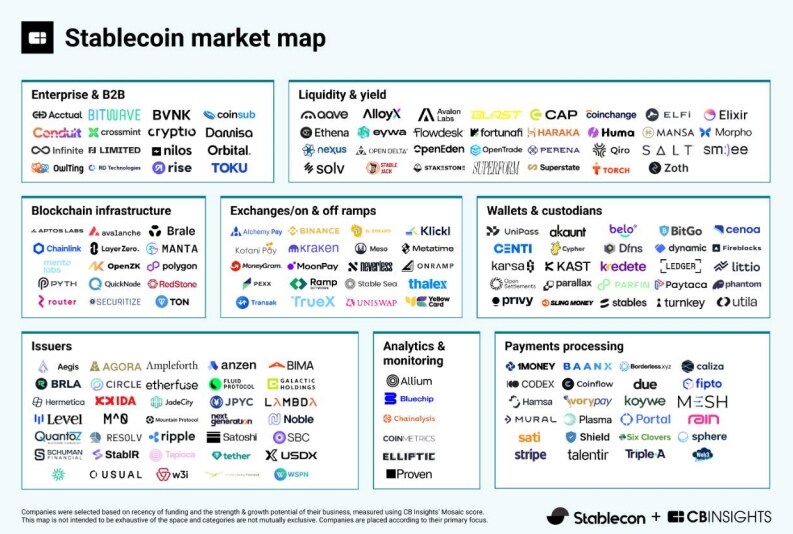

(Stablecoin Industry Chain Map Source: As shown in the figure)

3. People who want to join but don’t know where to start: obstacles and difficulties

While giants are making rapid progress in the stablecoin space, a large number of small and medium-sized players (individual developers, startups, small and medium-sized enterprises, and even traditional enterprises) face numerous barriers to entry. They see the opportunities and potential of stablecoins, but are often hindered by various barriers to entry.

Below we have sorted out several common obstacles that hinder these potential participants:

High technical threshold and expensive development costs

Building a stablecoin project is no easy task. First, blockchain development itself presents a significant barrier to entry for even the most average team, requiring proficiency in smart contracts, security auditing, and multi-chain interactions. According to blockchain development consulting firms, developing and deploying a stablecoin contract, supporting wallets, and a website backend from scratch can cost anywhere from $30,000 to $50,000, or as much as $500,000 , depending on team manpower, functional complexity, and compliance requirements. This represents a significant investment for small startups. Furthermore, security audits are essential, typically costing between $10,000 and $100,000 per audit. To protect against hacker attacks, many projects also require smart contract insurance, with annual premiums ranging from several thousand to tens of thousands of dollars. Conservatively, auditing and security investments often account for 20%-30% of a project's initial budget. This doesn't even include the ongoing need for code upgrades and iterations to adapt to new hacker tactics. These high initial financial and technical investments mean many ideas remain on paper. Despite their creativity and enthusiasm, many individuals or small teams are forced to abandon their plans when faced with budgets and technology stacks.

Economic model design and liquidity problems

The success of a stablecoin project hinges not only on programming but also on the underlying financial engineering . When issuing a pegged coin, a carefully designed collateral mechanism or algorithmic adjustment mechanism must be in place to ensure value stability. In the event of significant market volatility and large-scale user redemptions, the system needs to have contingency plans in place to avoid a death spiral. This requires small teams to develop economic models and stress-test to simulate various extreme scenarios to determine whether the stablecoin can maintain its peg. The collapse of Terra UST, for example, serves as a cautionary tale: an algorithmic stablecoin lacking asset backing collapsed instantly during a crisis of confidence, wiping out tens of billions of dollars in market value in just a few days. However, many startups often overlook the importance of modeling, focusing solely on achieving a 1:1 peg technically without delving into robustness at scale . A user in the crypto community aptly put it: " Writing code to issue a coin is technically easy... the challenge lies in scaling to billions of dollars and then redeeming every dollar. " In other words, a small team may be able to develop a functioning stablecoin contract, but it is likely to struggle to withstand the test of the real market. On the other hand, stablecoins often face a liquidity trap in their early stages: without sufficient capital to invest in market making and provide depth, they struggle to maintain their circulating value and exchange stability. But without anyone willing to provide liquidity, how can they secure funding? This chicken-and-egg dilemma renders the price and peg mechanisms of many small projects virtually useless in the absence of trading volume. Once a sell-off occurs, the stablecoin could suddenly deviate from its peg, leaving no room for regulation and leading to a collapse of its credibility.

Financing and liquidity support are becoming increasingly difficult

Stablecoin projects also face the commercial challenge of attracting investment. Unlike typical application startups, stablecoins are capital-intensive : not only do they burn through funds during the R&D phase, but they also require substantial reserves during operations to provide liquidity and handle redemptions. Consequently, small teams often seek venture capital (VC) investment or loans from market makers to expand their funding pools. However, the harsh reality is that most investment institutions are not interested in stablecoin startups. As analyst Anthony DeMartino points out, even if small projects offer attractive annualized interest rates of 40% , it is difficult to obtain market-making funds. Venture capitalists, focused on returns exceeding 10x , are unimpressed by mere interest rates of a few tens of percentage points. Market makers also face high capital costs, typically with an opportunity cost of around 20% for their own capital. Furthermore, considering the risk premium, few are willing to lend at a fixed rate to a stablecoin project with an uncertain future. He describes many such startups as "going into battle with toy knives," severely underequipped to challenge well-funded incumbent stablecoin giants. The results are predictable. Many founders are repeatedly asked during fundraising roadshows: "How big is your liquidity pool? Where is your community? Do you have enough marketing budget?" In the end, they often fail to provide convincing figures and are turned away. As one entrepreneur lamented at a forum, " Without capital for market making and marketing, without a user community and a strong team, the success rate is very low. " Lack of financing and insufficient revenue generation quickly lead small stablecoin projects into a vicious cycle: lack of funds, lack of users, inability to build credibility, and more lack of funds, ultimately forcing them to abandon their projects.

(Source: medium.com/@anthonydemartino)

Compliance pressure and regulatory fog

As mentioned earlier, major jurisdictions have successively introduced clear regulations on stablecoins. This presents another hurdle for small teams. The US requires stablecoin issuers to be regulated financial institutions, Europe requires registration of electronic money institutions and the fulfillment of capital requirements, and Hong Kong requires a license and statutory audits. Simply preparing compliance documents and procedures can be overwhelming for many developers. Obtaining a license is not only time-consuming and complex, but also extremely expensive. For example, establishing a regulated trust company in the US can easily require millions of dollars in capital and a team of specialized lawyers to handle the application. Applying for a stablecoin license in Hong Kong also requires meeting strict shareholder qualifications and risk management requirements. Some jurisdictions, such as Canada, even consider stablecoins to be securities, subjecting projects to onerous registration and disclosure obligations under securities laws. For small projects with limited budgets, they either risk launching online (which can easily lead to suspension or penalties) or simply abandon the process due to the lack of compliance. Regional regulatory differences also leave teams feeling overwhelmed. Targeting the US raises concerns about violating federal law; Southeast Asia lacks clear local regulations; and Europe, under MiCA, requires establishing an EU entity, auditing, and preparing a white paper—all tasks beyond the capabilities of typical startups in the short term. As a result, many ideas remain in the shadows, hesitant to bring them to market for fear of violating regulations as soon as they launch. The uncertainty surrounding compliance makes the average person feel like they're treading water in the stablecoin space, feeling overwhelmed and daunted.

Insufficient credit endorsement makes it difficult to build trust

As a value anchor, stablecoins require a high level of credibility. However, small teams often lack the backing they need to garner public trust. First, there's the team's background : many small project teams are anonymous or semi-anonymous, lacking established industry experience and the backing of large institutions. This makes it difficult for users to exchange real money for tokens issued by an unfamiliar team. Community forums often remind users to verify whether the project has a public corporate entity, who is the person in charge, whether it has been audited, and whether the codebase is active. Many small stablecoins, upon checking, lack team member profiles, have long-standing GitHub accounts, and frequently post on social media, naturally raising concerns among potential users. Transparency is also a concern: while mainstream stablecoins like USDC regularly disclose proof of reserve assets, small projects often struggle to afford audits. Even if they claim 1:1 reserves, users have no way to verify this. This creates a black box of trust : It's unclear whether the project is simply "printing money" and profiting from scams. Once suspicions arise, without a trusted third party to verify their innocence, small stablecoins are vulnerable to runs. It's fair to say that in the trust-based stablecoin space, new entrants are inherently at a disadvantage: without a brand, regulation, or significant financial backing, how can users trust your coins' consistent and stable redemption? This trust deficit leads many potential users to "wait and see" rather than act .

User experience barriers and cumbersome entry operations

Even after overcoming technical and funding challenges, small teams often overlook the importance of user experience . In the current multi-chain ecosystem, users often face numerous hurdles in using stablecoins. For example, to use a stablecoin on Ethereum, users must first own Ethereum's native ETH as gas; to use it on BSC, users must prepare BNB to pay transaction fees. New users are often confused: "I want to issue or use a stablecoin, but I'm asked to buy another coin first to pay for the transaction fee." Furthermore, the challenges of switching between chains, adding contract addresses, and calculating slippage fees make the process extremely unfriendly for non-expert users. The community has even created the hashtag #GasInUSD, reflecting users' strong desire to pay on-chain gas directly with USD stablecoins. Unfortunately, most public chains don't yet support this experience. Many small teams have launched new stablecoins without providing supporting wallets and user-friendly tools, forcing users to navigate multiple exchanges and bridges to obtain and use these tokens. This fragmented experience makes first-time users more likely to give up due to errors or frustration. For example, one team reflected on losing a significant number of potential users on their first day of launch, as many newcomers struggled to switch to the RPC network or experienced exchange failures due to excessive slippage, ultimately leaving the platform disappointed. The complex entry-level process effectively kept many ordinary users interested in stablecoins out of the market.

Taken together, these realities paint a portrait of many who are eager to jump into the stablecoin wave but haven't found a gateway: developers seeking innovation, entrepreneurs embracing new finance, small and medium-sized enterprises seeking to reduce costs and increase efficiency, and ordinary merchants eager to embrace digital asset payments. They see the opportunity in stablecoins , but struggle with a lack of funding, technology, regulatory compliance, trusted endorsements, and effective tools , forcing them to wait and see. Their thoughts may be: "The promise of stablecoins is alluring, and I don't want to miss out, but how do I get involved? Who can help me overcome the hurdles?" These pain points also lead to the next chapter: is there a solution that can pave the way for these hesitant individuals?

(Stablecoin issuance threshold diagram Source: self-made by the author)

4. BenfChain × Stablecoin: One-click issuance + smooth experience

From the perspective of investment and infrastructure development, lowering the barrier to entry for stablecoin issuance and use is key to future market expansion. We note that the BenFen Chain (BenFen Chain) attempts to address several of the most common pain points encountered by small and medium-sized teams and new users in its design:

Native one-click publishing

On the BenFen chain, any authorized user can issue their own stablecoin simply by filling out a form. The platform provides a user-friendly UI: users simply select the collateral type they wish to anchor (e.g., USD, gold, or other compliant assets), enter the desired issuance quantity, and click the "Mint" button to instantly generate the corresponding stablecoin token. The entire process requires no smart contract code, no complex protocol deployment, and no expensive audit fees. Technical risks are mitigated by BenFen's underlying Move smart contract security model. Contract templates have undergone rigorous audits and long-term operational verification, allowing issuers to enjoy out-of-the-box security without reinventing the wheel. BenFen has lowered the technical barrier to stablecoin issuance to near zero cost : development costs have been reduced from tens of thousands of dollars to tens of dollars in gas fees, and the timeline has been shortened from months to minutes. For projects lacking development teams, BenFen's one-click issuance tool is undoubtedly a game-changer. This means that merchants with cross-border payment needs and innovative startups can easily create their own stablecoins to serve specific communities or business scenarios without worrying about technical bottlenecks.

Stablecoins for Gas Payment

BenFen, deeply aware of the long-standing user experience issues with gas payments, has implemented an architectural breakthrough: allowing on-chain transaction fees to be paid directly with stablecoins . On BenFen, stablecoins are no longer simply a medium of exchange; they can also be used to pay for on-chain operations. For example, when transferring funds or invoking contracts on the BenFen chain, users can pay for gas directly with stablecoins like BUSD and BJPY, eliminating the need to hold the chain's native governance token. This design completely eliminates the hassle of new users having to purchase a large number of blockchain coins to pay for gas when using dApps. Even more conveniently, BenFen's average transaction fee is extremely low, at only approximately $0.05 , significantly lower than the $0.30–$0.50 gas costs on Ethereum/BSC. To optimize the new user experience, BenFen even supports gas agency payment: projects or third parties can sponsor transaction fees for users, eliminating the need for users to pay for gas when using selected applications. This series of improvements means that within the BenFen ecosystem, both newcomers to blockchain and veterans alike can enjoy the seamless "stablecoin as fuel" experience. Here, stablecoins truly become the universal value carrier on the chain—both transaction principal and network fuel. Users can bypass complex exchange procedures and directly use stablecoins to navigate various on-chain scenarios, just like spending dollars in internet applications.

Ultimate User Experience (UX)

To further lower the barrier to entry for Web 3 users, BenFen has also invested heavily in its wallet and payment experience, striving to be " as simple as traditional applications ." First, BenFen supports the zkLogin social login solution: users can register a blockchain wallet account with a single click using their phone number, email, or social media account, eliminating the need to memorize complex seed phrases or private keys. This greatly facilitates onboarding for average users and reduces asset losses caused by poor private key management. Secondly, for stablecoin payments, BenFen offers comprehensive social payment features : for example, mobile number transfers, friend red envelopes, and QR code payments are all supported through the BenPay app . Merchants can generate payment codes to accept stablecoin payments from customers, and users can send red envelopes and pay each other similarly to WeChat or PayPal, but the transfers are essentially completed on-chain. Furthermore, BenFen integrates a built-in cross-chain bridge, supporting the cross-chain exchange of major assets. Users can easily exchange USDT/USDC on Ethereum or Tron for stablecoins like BUSD on the BenFen chain. The entire operational process has been meticulously polished to be simple and intuitive: users don't need to understand any on-chain terminology; they can complete wallet creation, deposits, and transfers in just a few clicks. For developers, BenFen also provides a rich SDK, allowing them to easily build user-friendly front-end applications. In BenFen's view, stablecoins, as the "stable value" of digital currencies, deserve a user experience comparable to Web 2 to truly reach the masses.

Security and decentralization

While lowering the barrier to entry, BenFen maintains its commitment to security and decentralization. The underlying framework utilizes the Move smart contract language , whose resource types and linear logic inherently mitigate common vulnerabilities (such as reentrancy attacks) and provide strong type security for stablecoin contracts. Furthermore, BenFen combines a DAG and BFT consensus mechanism to build a high-performance blockchain, achieving a single-chain transaction throughput (TPS) of over 10,000 and confirmation times of less than 1 second. DAG parallel accounting ensures high throughput, while BFT consensus guarantees finality and fork resistance, resulting in an industry-leading network fault tolerance. In actual operation, BenFen's mainnet has achieved 99.99% availability since its launch, with no downtime or rollbacks due to consensus issues. This is crucial for stablecoin applications involving funds, ensuring users are assured of system reliability. Furthermore, BenFen supports flexible identity models to meet the needs of diverse scenarios: users can choose to participate in decentralized transactions using anonymous addresses or obtain regulated permissions after completing KYC, allowing them to access specific compliant applications or fiat deposit and withdrawal channels. At the network level, multiple authoritative institutions jointly maintain validation nodes to prevent malicious activity by a single party and safeguard the decentralization and censorship-resistant nature of the entire chain. In short, BenFen pursues stability —both in its commitment to the value of stablecoins and in the secure and robust operation of its systems. Through innovations in its underlying technical architecture, the BenFen chain creates a secure, efficient, and trustworthy environment for the issuance and use of stablecoins, lowering the barrier to entry without compromising trust.

Through the four key design aspects outlined above, BenFen Chain is committed to building a "stablecoin infrastructure accessible to everyone." Projects don't need programming expertise, vast capital, or complex on-chain operations. With legally compliant assets and a clear application scenario, BenFen can help them issue stablecoins with a single click and provide user-friendly payment and management tools. This undoubtedly opens a new window of opportunity for countless potential participants who were previously blocked. As BenFen's name, "Duty," implies, it's about being down-to-earth and returning to the essence of financial services—allowing more people to equally enjoy the benefits of stablecoins and blockchain innovation.

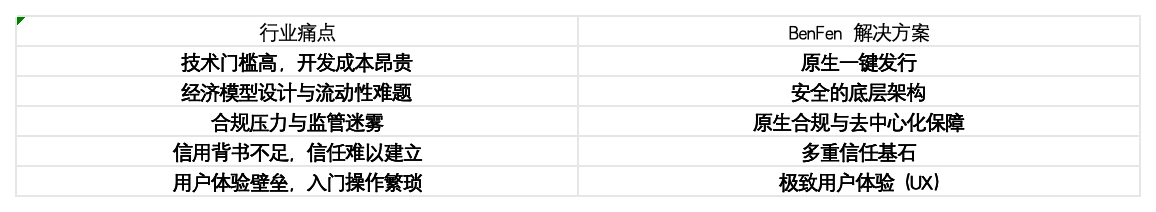

BenFen solutions and industry pain points correspondence table

5. Conclusion: Bixin Ventures’ Observations

As an investment institution that has long focused on blockchain infrastructure, Bixin Ventures' core judgment in the field of stablecoins is that compliance and ease of use will be the key variables driving the next wave of adoption .

Stablecoins have become a highly sought-after asset class for both institutional and retail investors, but the vast majority of potential participants still face multiple hurdles, including contract development, regulatory compliance, liquidity, and user experience. Projects like BenFen attempt to encapsulate these complexities at the underlying layer through technology and product design, making them accessible to smaller teams and regular users.

From our perspective:

- For developers , it means faster experimentation and iteration;

- For small and medium-sized enterprises , it provides a viable cross-border payment and settlement tool;

- For investors , it is an early exploration of the "popularization layer" of the stablecoin ecosystem.

We understand that the future of stablecoins will not be determined by a single project, but rather by compliance policies, institutional participation, and the evolution of infrastructure. BenFen's current role is to fill an overlooked gap, helping those who previously lack resources find a path into the world of stablecoins.

Therefore, we believe that attempts like BenFen deserve attention and continued observation. Whether it can become an important piece of the puzzle in the stablecoin ecosystem still needs market and time to verify.