Last night, tens of millions of dollars were betting on whether Trump could survive until the sun this morning.

- 核心观点:特朗普健康传闻短期扰动加密市场。

- 关键要素:

- Polymarket辞职概率仅1%。

- 特朗普政策支撑比特币涨至10.9万。

- 若离任政策或逆转引发抛售。

- 市场影响:短期波动风险,长期政策不确定性。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3)

On the afternoon of September 2, 2025, Eastern Time (early this morning Beijing Time), US President Donald Trump appeared in the Oval Office of the White House as scheduled and made a "major announcement" via live television. Although he appeared 49 minutes later than scheduled, he immediately dispelled rumors of being "critically ill" or "deceased."

The previous week, Trump had been absent from public events for several days , and photos of bruises on his hands and legs circulated widely on social media, sparking intense speculation about his health. At the end of August, Vice President Cyril Vance jokingly stated that he was ready to take over if Trump were to suffer an accident . Shortly thereafter, US officials added fuel to the fire: Trump was in good health and would play golf this morning. These two statements further fueled conspiracy theorists' enthusiasm, and the "golfing" theme became a meme to conceal the truth. On the other side of the world, onlookers were busy forwarding rumors on WeChat, such as "Trump's wife appeared at an Army hospital" and "Roads around an Army hospital have been closed."

Topics such as "Trump is Dead" quickly became trending searches on social media, and some people with wild imaginations even claimed that "his duties have been replaced by a stand-in" and "the AI in the live broadcast is quite realistic."

In the Google search term popularity ranking , the keyword "Trump resignation" search volume surged by 400% that day; other Trump-related keywords also reached their peak popularity around 2:00 before the event started.

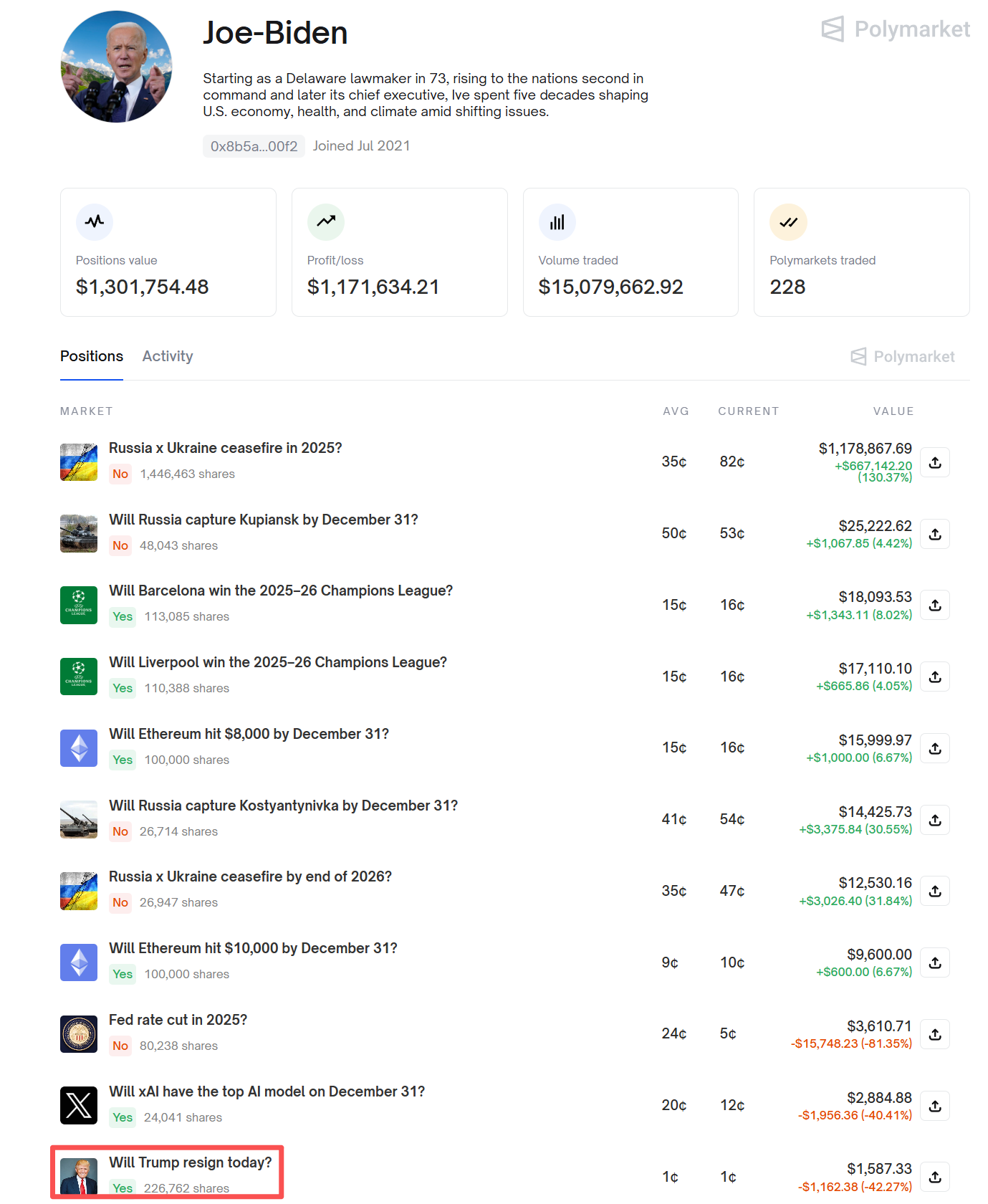

According to the prediction market Polymarket, the trading volume of "Trump resigns on the same day" contracts is close to 10 million US dollars, but the probability has always remained at a low level below 1%.

Let’s take a look at the nickname of the user who bought “Trump resigned today”

Trump's final speech focused on the tariff ruling and appeals. When asked by the media if he'd seen the death rumors, Trump bluntly replied, "Didn't see it."

Health controversy brews: How Trump's health affects market expectations

Trump's health has been a focus of attention since he entered politics. In 2025, at the age of 79, he returned to office, becoming the oldest incumbent president in U.S. history, and his physical and cognitive condition continues to spark controversy. According to the Wikipedia entry "Concerns About Donald Trump's Age and Health," discussions can be traced back to his first campaign in 2016, when his personal physician, Harold Bernstein, issued a statement declaring Trump "the healthiest presidential candidate ever." However, Bernstein later admitted that the letter was dictated by Trump himself. Furthermore, his father, Fred Trump, was diagnosed with Alzheimer's disease in 1991, fueling concerns about his potential risk of dementia.

As 2025 began, concerns about Trump's health intensified significantly. Between January and March, he repeatedly developed red spots and bruises on his hands, sparking intense speculation from the public and media. In April, the White House released its annual physical, revealing a weight of 224 pounds (102 kilograms) and a BMI of 27.6, placing him in the overweight range. Trump also took the Montreal Cognitive Assessment (MoCA), scoring a perfect 30 and declaring him in "excellent health."

Trump was found to have large bruises on the back of his hands during his meeting with South Korean President Lee Jae-myung

In July, the White House confirmed that Trump had been diagnosed with chronic venous insufficiency (CVI), a common vascular disease in the elderly that can cause leg swelling and recurring bruising. Dr. Sean Barbabella, the doctor who attended to the case, explained that the bruises on Trump's hands were related to his long-term aspirin use (for cardiovascular prevention) and frequent handshakes, and were not serious symptoms. However, in late August, photos of the incident leaked again; on August 30th, the hashtag #TrumpisDead became a top trending search, and rumors circulated online, including unconfirmed claims that Trump had only 6–8 months left to live and that he had been replaced by a body double.

The spread of these rumors is not without basis. During the 2024 campaign, Trump frequently made verbal gaffes, such as mistaking Nikki Haley for Nancy Pelosi and publicly stating that "World War II is about to start." In July 2024, The Conversation published commentary by psychologist Simon McCarthy-Jones, suggesting that Trump's narcissistic personality traits and low emotional stability may have made him more vulnerable to the psychological impact of the July assassination attempt .

Despite widespread online speculation, the White House has consistently denied that Trump has any serious health issues, even emphasizing that he "continues to win golf tournaments frequently." From August 30th to September 1st, the White House released photos of him playing golf at Trump National Golf Club in Sterling, Virginia, in an attempt to quell the rumors.

Trump walks with his granddaughter Kay Trump at the Trump National Golf Club in Sterling, Virginia, on the 30th local time.

From the perspective of the crypto market, since his re-election, the administration has introduced a series of crypto-friendly policies, including the signing of the GENIUS Act (a stablecoin regulatory framework), the repeal of the Biden-era SEC accounting standard SAB 121, and the establishment of a Bitcoin Strategic Reserve mechanism by executive order in March 2025. These measures are intended to boost market confidence and drive US Bitcoin miners' share of global computing power to 31.5%, leading to a rise in the price of Bitcoin from $80,000 at the end of 2024 to around $109,000.

Currently, the Trump family's involvement in the crypto industry is still deepening: the combined market value of its tokens TRUMP and MELANIA has exceeded US$1.5 billion, and the World Liberty Financial platform has also launched the WLFI token (officially circulated on September 1) and the US dollar-pegged stablecoin USD1.

“Worst-Case Scenario” Investment Strategy: How to Hedge Risks in the Event of Trump’s Potential Resignation?

At the same time, Polymarket contract data shows that the probability of "Trump ending his term in 2025 with an approval rating below 40%" is about 20%, reflecting that the market still has uncertainty about his long-term performance in office.

Assuming Trump's health continues to deteriorate, ultimately leading to his resignation or forced removal under the 25th Amendment (a 6% probability on Polymarket contracts), the crypto market will face significant uncertainty.

Trump's "crypto vision" has been implemented through a series of concrete policies, including banning central bank digital currencies (CBDCs), allowing 401(k) retirement accounts to invest in crypto assets, and signing the GENIUS Act (supporting the development of stablecoins). Furthermore, according to incomplete statistics, political donations from the crypto industry during the 2024 election reached tens of millions of dollars, becoming a key driving force behind his policy direction. These crypto trends have become a key pillar of the current bull market.

If Trump leaves office abruptly, some policies could be reversed, particularly the Bitcoin Strategic Reserve (which currently holds digital assets such as BTC and ETH, with a market capitalization exceeding $50 billion). If Vice President JD Vance maintains his crypto policies, market confidence could be restored. Conversely, if Democrats seize the opportunity to strengthen regulation (for example, by reopening the SEC's lawsuits against Coinbase and Ripple), there could be a risk of significant market capitalization losses.

Based on the risk exposure and market behavior characteristics at different stages of the event, the strategy can be developed in three steps: "short-term risk aversion - medium-term diversification - long-term layout":

Short-term strategy (1-3 months after the event): Prioritize risk aversion and lock in profits

- Reduce holdings of high-risk assets: The first choice is to sell meme tokens that are highly tied to Trump, such as TRUMP tokens, to avoid extreme volatility (after the assassination attempt in 2024, the unofficial TRUMP token on a certain chain once plummeted by more than 30%).

- Shift to stablecoins: Migrate positions to highly liquid stable assets such as USDC or USDT.

- Focus on prediction markets and derivatives: Use Polymarket to track the "Will Vance Continue Crypto Policy" contract.

- Allocate to traditional safe-haven assets: Increase exposure to gold ETFs (such as GLD). Bitcoin and gold have a historical correlation of approximately 0.4. If Trump leaves office and triggers political uncertainty, gold may rise.

Medium-term strategy (3-6 months): Capturing policy stabilization signals and technical rebounds

- Return to Core Assets: If Vance explicitly commits to continuing the reserve plan, the Bitcoin target price could be raised to $120,000. It is recommended to build positions in batches based on technical indicators (such as RSI < 30).

- Focus on Layer 2 and DeFi public chains: Prioritize chains such as Solana (SOL) and Cardano (ADA), which are less affected by policy changes. The TVL of the former has exceeded $100 billion, and a 10%–20% position is recommended.

- Use hedging tools: Hedge against market fluctuations through options or futures.

Long-term strategy (more than 6 months): Building a counter-cyclical asset portfolio

- Focus on crypto infrastructure stocks: US-listed mining companies such as Marathon Digital and Riot Platforms have benefited from favorable mining policies during Trump's presidency. Even after his departure, the 31.5% share of US computing power provides strong support, with an expected annualized return of approximately 20%.

- Embracing RWAs and stablecoins: As CBDC advancement has stalled, the space for private stablecoins and RWA tokenization has expanded rapidly, such as the BUIDL fund launched by BlackRock.

- Establish a risk monitoring system: It is recommended to set early warning lines. For example, when the probability of the "Trump being removed through the 25th Amendment" contract on Polymarket exceeds 10%, a 50% position reduction mechanism can be triggered to hedge against potential systemic shocks in advance.

Overall, the core principle of this strategy is to "assume the worst and prepare thoroughly." If Trump's health stabilizes, the crypto bull market is expected to continue; conversely, even a short-term market panic could create a valuable "gold mine."

Conclusion: Rational investment in low-probability events

Although Trump's health controversy continues to ferment, judging from Polymarket's pricing - the probability of "resigning on September 2nd" has always been less than 1%, and the probability of resigning throughout the year is only about 10% - the overall market sentiment remains rational.

Polymarket's probability of Trump resigning in 2025 is only about 10% (average)

The crypto market also stabilized. Considering the Trump family's deep involvement in the crypto industry and the strong policy momentum demonstrated since taking office, the likelihood of Trump voluntarily resigning or handing over power via the 25th Amendment in the short term remains extremely low .