ArkStream Capital: A Guide to the Rebirth of Crypto VCs: Why It's Hard to Outperform BTC

- 核心观点:加密VC投资逻辑失效,回报全面下行。

- 关键要素:

- 77%项目无法发币上线。

- 上线币安项目回报仅2-5倍。

- 早期融资占比跌破50%。

- 市场影响:投资转向价值驱动,淘汰低效资本。

- 时效性标注:中期影响。

How long has it been since you last heard the term Web 3? From "Web 3" back to the "cryptocurrency" narrative, institutional investors in the cryptocurrency market are undergoing a dramatic reshuffle, and we're witnessing it all.

The result of this narrative reversal is that Bitcoin and Ethereum continue to reach new highs, while the altcoin season has yet to arrive. Holding onto cryptocurrencies in anticipation of a surge may be wishful thinking. The harsher reality is that starting in 2022, the overall decline in primary market investment returns is steadily impacting VC practitioners and investors who adhere to the "vintage investment theory." This article will systematically examine investment and financing data and market structure changes over the three years from the beginning of 2022 to the second quarter of 2025, uncovering the underlying reasons behind the dramatic shift from peak prosperity to shrinking returns in the primary cryptocurrency market.

We attempt to answer two core questions:

1. What difficulties are crypto VCs facing today?

2. Under the new cyclical logic, how should investment institutions participate in this market?

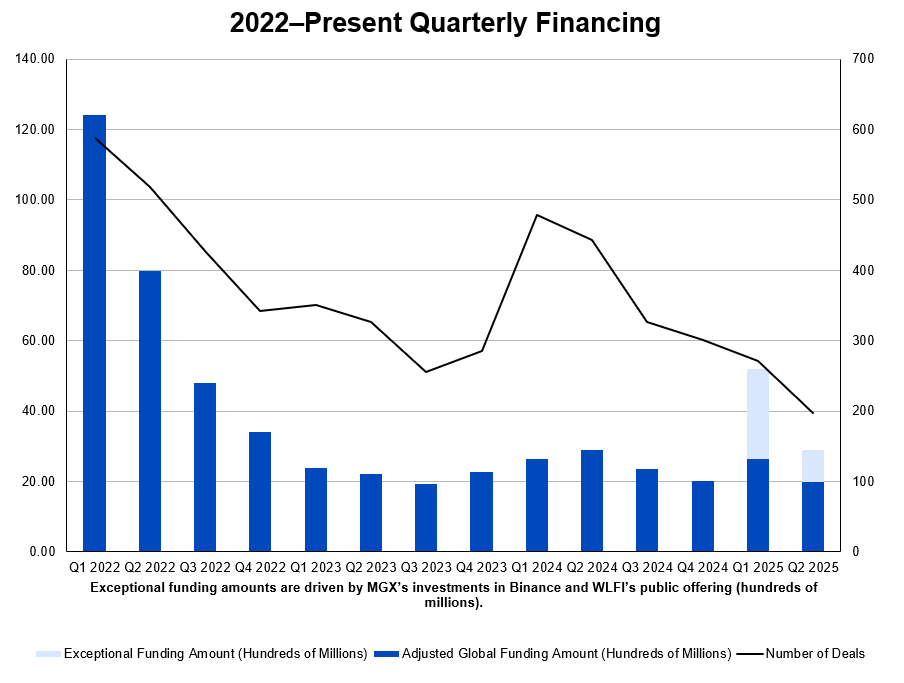

As a long-term participant in the primary market, ArkStream Capital has observed that since its peak in 2022, the market has experienced a sharp contraction in capital and a cooling of financing activity, reaching a low point in 2023. Although overall financing volume rebounded in Q1 2025, the increase was primarily concentrated in a few very large financing events. Excluding these outliers, market activity remains sluggish.

In parallel with this, there is a shift in venture capital strategies and preferences:

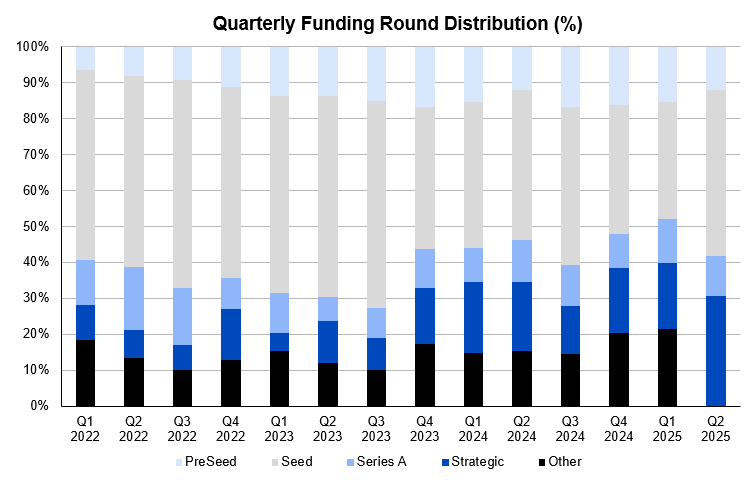

- Investment stages are shifting from early to late stages, and risk appetite is shrinking significantly. Data shows that the share of early-stage financing (Seed and PreSeed) remained above 60% from 2022 to the third quarter of 2023 (peaking at 72.78%), but has since begun to fluctuate and decline. By the first quarter of 2025, the proportion of early-stage financings fell below 50% for the first time since 2022, to 47.96% .

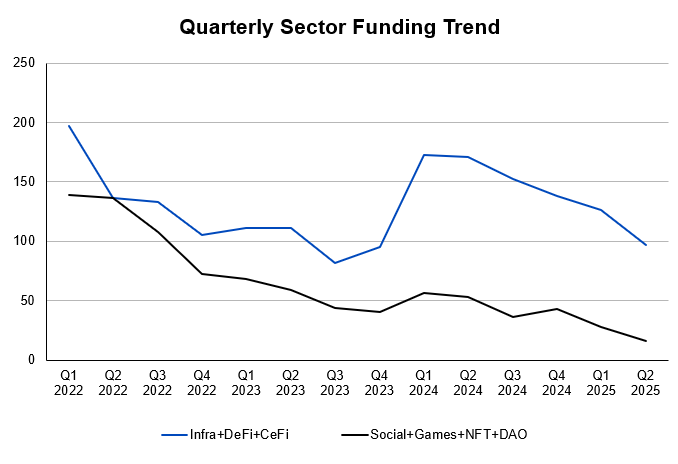

- The narrative is shifting from application-driven growth tracks like Social, NFT, and Gaming to areas emphasizing practicality and long-term value, such as DeFi, infrastructure, and RWA. Comparing Q2 2022 and Q2 2025, NFT/Games/Social funding rounds plummeted from 129 to 15. Meanwhile, Infrastructure/DeFi/CeFi accounted for 85.8% (97 of 113) of all funding rounds in Q2 2025, becoming the absolute core of the market.

- The "paper wealth" under the high FDV model is being falsified by the market: an analysis of 75 investments shows that market performance has plummeted from its peak, with 46 investments returning more than 10 times, to only 6 investments remaining; at the same time, the current valuations of 24 investments (32%) and 18 projects (42.85%) have fallen below private equity prices.

- Even Binance's "listing effect" is becoming ineffective, and "rising and falling" has become the new normal: data shows that although 25 projects still saw their first-day gains of more than 10 times in 2024, by 2025, the number of projects that fell below the issue price 7 days after listing had surged to 42, indicating that the model of relying solely on the endorsement of leading exchanges to drive valuations has failed.

- Although the cycle from financing to TGE is lengthening, this has not led to a higher success rate: data shows that among the more than 17,000 assets recorded by Coingecko, the transaction volume after the 1,500th ranking is almost zero. Even the failure rate of projects invested by top VCs such as Polychain Capital is as high as 26.72%.

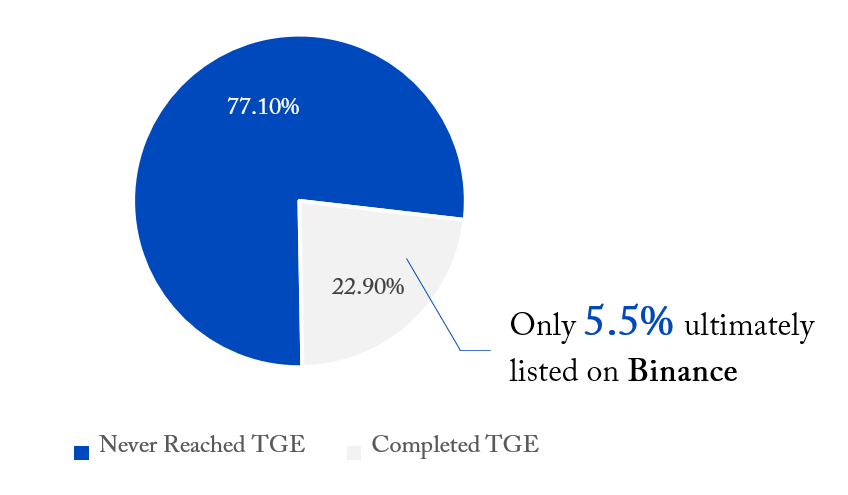

- The VC investment logic in the primary crypto market has failed: Data shows that, despite the harsh reality that 77% of projects fail to launch tokens, only 5.5% of top projects ultimately manage to list on Binance. However, the average return for these top projects is only 2-5x, far from enough to cover the other 94.5% of failed investments. It even falls short of the 4.3x return required by a simplified payback model, rendering the portfolio mathematically unprofitable.

Note: The relevant data analysis results are based on top crypto VC investment cases in Europe, the United States, and mainstream exchanges. The selected samples are representative but do not cover the entire industry. See below for details.

We believe this round of declining returns is not only a result of liquidity during the interest rate hike cycle, but also reflects the shift in the underlying paradigm of the primary crypto market: from valuation-driven to value-driven, from casting a wide net to prioritizing certainty, and from chasing narratives to betting on execution. Understanding and adapting to this paradigm shift may become a prerequisite for achieving excess returns in future cycles.

Overview of primary market data: Trends and cycle evolution

Overview of Global Crypto Primary Market Financing

Investment and financing data in the primary market is a measure of the market's willingness to pay for innovative ideas. Higher investment and financing figures indicate a greater willingness by venture capital to invest in the industry's future development. Whether it's the composable Lego of decentralized finance (DeFi), the Web 3 vision of "readable, writable, and ownable" data, or the continuous advancement of infrastructure in privacy protection, distributed storage, and scalability, all rely on the continued investment of venture capital in this market. Along with venture capital comes an influx of talent, and the prosperity of the primary market is often reflected in the steady flow of innovative and entrepreneurial talent within the industry.

This figure peaked in Q1 2022, with $12.4 billion raised across 588 deals. However, the market has since taken a sharp turn for the worse, entering a sustained downward cycle, with both total funding and activity declining. By Q4 2023, quarterly funding had fallen to $1.9 billion and deals to 255, reaching the bottom of the cycle. Despite a slight rebound in 2024, the overall market remains low.

Funding data for the first quarter of 2025 superficially showed signs of recovery: total quarterly funding rebounded to $5.2 billion, and the number of financings increased to 271. However, this "recovery" struggles to withstand detailed analysis. During the quarter, Abu Dhabi's sovereign fund MGX's strategic investment in Binance (approximately $2 billion) accounted for over 40% of the total, a single event-driven outlier. Furthermore, World Liberty Financial's $550 million ICO significantly inflated the overall data. Excluding these mega-rounds, the actual funding raised by crypto-native projects in the first quarter was only approximately $2.65 billion. The downward trend continued in the second quarter of 2025. Funding rounds for projects such as SharpLink, BitMine, Digital Asset, and World Liberty Financial warrant separate analysis and should not be considered the norm in the crypto venture capital market. Starting in Q1 2025, a clear divergence emerged between crypto-native venture capital and traditional finance. Crypto-native venture capital continued to shrink, while traditional finance rushed in and aggressively invested in the equity market. Behind this apparent growth lies the accelerating concentration of capital in lower-risk projects, and overall venture capital activity has yet to truly recover.

Figure: 2022–Present Quarterly Financing

Data source: RootData’s financing data dashboard

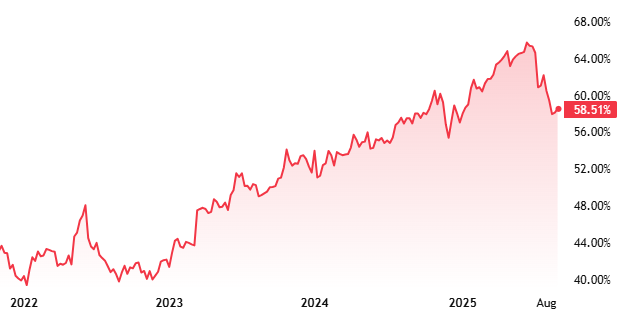

This downward trend is clearly negatively correlated with Bitcoin's market share. Bitcoin has experienced significant growth since the beginning of 2023, but primary market financing activity has not rebounded in tandem, breaking the previous cycle's pattern of rising BTC prices and increasing venture capital investment.

Figure: Bitcoin Market Dominance from 22 Years to Date

This means that the fluctuations in altcoin market sentiment are no longer solely driven by Bitcoin's price. On the contrary, as Bitcoin rises, market confidence in altcoins is steadily eroding. The 2022 decline reflected a macroeconomic retreat, while the 2023 low reflected a collapse of market confidence. The rebound in Q1 2025 was driven primarily by individual projects with strategic value or strong capital moats, signaling a new phase of "selective concentration" in the primary market. The era of "letting a hundred flowers bloom" is over, and the wave of the "Web 3" narrative is receding.

For VCs, this signals the end of the "cast a wide net" era, with a reassessment of certainty, strengthened fundamental screening, and exit path assessment becoming the new paradigm. Against the backdrop of declining overall returns and Bitcoin's rise but lack of capital, VCs can no longer rely on a natural upturn in a macro bull market. Instead, they should focus on technological barriers, business model resilience, and real user value to meet investors' higher demands for stable returns.

Analysis of investment activity of mainstream institutions

In an environment where the overall market is performing worse than expected, VCs still operating in the cryptocurrency market have had to switch their strategies in order to survive, from "all roads lead to Rome" to finding a fixed strategy with higher certainty.

First, investment round preferences are shifting from early-stage rounds to later-stage projects. In Q1 2025, the proportion of early-stage financing rounds fell below 50% for the first time since 2022. This shift indicates that, amidst increasing uncertainty about exit paths and the dominance of resources by leading projects, institutions are showing a significant increase in their preference for certainty, preferring to invest in mature projects with proven products and clear revenue streams . Meanwhile, the proportion of financing rounds at the PreSeed and Seed stages has declined. While this overall figure remains relatively healthy, demonstrating the continued vitality of early-stage entrepreneurship, the fundraising threshold has significantly increased.

Figure: Quarterly Funding Round Distribution (%)

Data source: Financing records collected by RootData, grouped and summarized by quarter and round

Secondly, investment track preferences are becoming more concentrated. Starting from Q1 2024, the proportion of financing projects in crypto-native non-financial application tracks such as Social, Games, NFT, and DAO fell below 50% for the first time, marking the decline of the "concept-driven" narrative. Instead, DeFi and infrastructure tracks have returned, which place more emphasis on the actual application value and sustainable revenue capacity of the protocol. Capital attention is shifting from To Consumer narratives to platform projects with To Business business models. At the same time, although the CeFi track has a low presence in the market narrative, the financing volume has always remained high, reflecting that its capital needs as a cash flow-intensive business are still recognized by capital.

Chart: Quarterly Sector Funding Trend

Data source: Financing data for each track collected by RootData

Another impact of the shift in investment preferences is that the paths available to entrepreneurs have been greatly reduced. If starting a business in the cryptocurrency industry used to be an open-ended exam, now it is like doing a "propositional essay", with only Infra, DeFi, and RWA as options. In the end, the competition depends on who can break out of the red ocean within the already mature business model.

For VCs, this trend means that the investment research system needs to closely follow changes in industry structure, dynamically reallocate time and resources, and give priority to supporting projects with deep value capture capabilities rather than short-term traffic-based themes.

Project life cycle and exit window analysis

Projects TGE and FDV

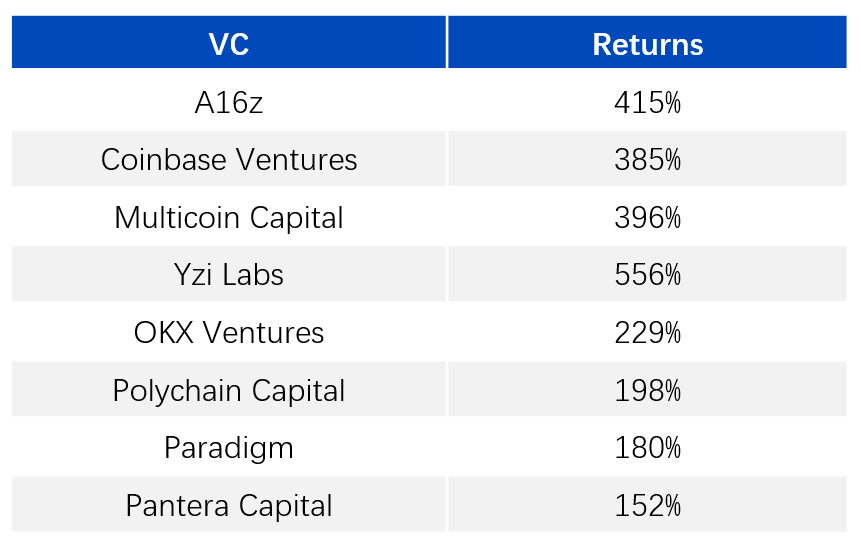

Project Data Description: This analysis uses top crypto VC investments from European and American exchanges as a sample, including a16z, Coinbase Ventures, Multicoin Capital, YZi Labs, OKX Ventures, Polychain Capital, Paradigm, and Pantera Capital. (Source data is available in the appendix tables: VC Investments, VC-Backed Listings on Binance: Spot Returns, and VC-Backed Listings on Binance: Spot Returns Pivot.)

Data screening criteria:

- Prioritize the number of investments: The same project may undergo multiple rounds of financing, and valuations across different rounds can vary significantly, directly impacting investment returns. Therefore, we consider different rounds of financing for the same project as separate investment numbers to more accurately reflect investment activity.

- Prioritizing Binance projects: As one of the world's largest exchanges, Binance offers extensive liquidity and market coverage. To more comprehensively reflect market performance, only projects listed on Binance for spot trading are selected as star projects.

- Data accuracy: Investments disclosed after token issuance are considered OTC (over-the-counter) transactions and are not included in the venture capital category to ensure the accuracy and consistency of data statistics.

- Exclusion of insufficient data dimensions: Projects that have not disclosed their investment amounts and valuations are not included in the statistical calculations due to insufficient data dimensions.

In the primary crypto market, a project's valuation system is a key variable influencing VC returns. In particular, the market performance of token prices after a Token Generation Event (TGE) has become a key indicator of exit efficiency. However, the crypto industry's fundraising approach of the past decade, based on project valuation or fully diluted valuation (FDV), is no longer effective in the current cycle. This results in investments that could have generated tens or even hundreds of times the paper return becoming negligible at the time of exit.

At the same time, whether it's traditional VC or crypto VC, project failure is the norm. For VCs, a few star projects that achieve high returns are enough to significantly boost overall returns. Therefore, the core metric for measuring VC performance isn't investment success rate, but rather whether they've capitalized on those star projects.

By analyzing the project's post-launch, opening FDV, highest FDV, and current FDV, and comparing the initial costs of investment institutions with public information, we further calculated the investment return performance of these institutions.

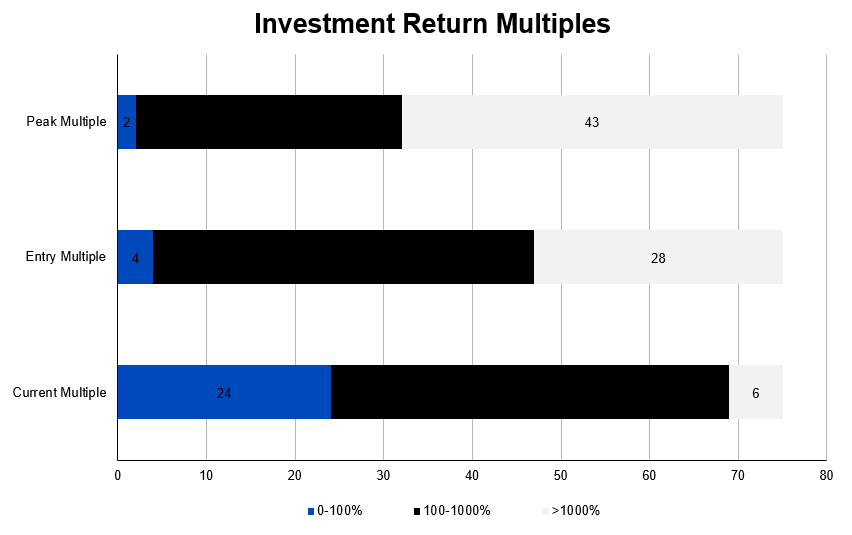

Figure: Investment Return Multiples

The above chart shows the post-coin offering market performance of mainstream VC-backed projects, highlighting the severity of the current investment return landscape. By calculating the ratios of opening FDV/private valuation, peak FDV/private valuation , and current FDV/private valuation , it is clear that a significant number of investment cases correspond to projects with current FDVs that are lower than, or even significantly lower than, their private valuations. Furthermore, the number of projects with excess returns at both opening and peak FDV/valuation has shown a sharp decline over time.

The statistical results show that among the 75 investment cases and 42 projects (see the appendix for detailed data):

- There were 71 projects/40 projects with opening FDV/private valuation exceeding 100%, of which 28 projects/18 projects had opening FDV returns exceeding 1000%;

- There were 73 projects/41 projects with the highest FDV/private equity valuation exceeding 100%, of which 46 projects/29 projects had the highest FDV return exceeding 1000%.

However, only six investments and four projects currently have a current FDV/private equity valuation exceeding 1000%, while 24 investments and 18 projects, representing 32% and 42.85% of the total, have a current FDV/private equity valuation below 100%. This means that nearly one-third of the investments and over 40% of the projects are currently failing to meet their valuation expectations at the private equity stage.

It’s worth noting that even though some star projects have listed on Binance, the exchange with the highest liquidity, their market performance still fails to match the high valuations achieved during their private placement phase. This phenomenon reflects the severe challenges posed by the current market environment to project valuations and highlights the downward pressure on investor returns.

Furthermore, the "1+3" lock-up period (one year, three years of linear unlocking) commonly implemented by leading exchanges limits the amount of funds investors can ultimately exit with. This further demonstrates that, despite some projects achieving high early market valuations, subsequent performance struggles to support investors' expected returns.

This "inflated book value" is particularly prevalent in the primary crypto market: projects often use high FDV pricing in early-stage funding rounds to secure better valuations and terms. However, once the tokens enter the TGE (Trading General Equity) circulation phase, insufficient market demand and the continuous unlocking of token supply often make it difficult to sustain the original valuation expectations, leading to a rapid price decline. Data shows that the actual circulating market value of many projects has even been lower than their private equity round entry valuations for extended periods, directly compressing VC exit multiples.

Essentially, high FDV often masks two core issues:

- "Book wealth" that lacks real market liquidity support is difficult to cash out in the secondary market;

- The token release plan was seriously out of sync with market demand, which led to a rapid buildup of selling pressure after the TGE, further suppressing prices.

For VCs, if FDV is still used as the core pricing anchor in primary market investments, it may significantly overestimate the achievable liquidity returns of the project and thus overestimate the book value of the investment portfolio.

Therefore, in the current market cycle, project valuations must return to fundamentals : the inherent closed-loop design of the token economics model, the dynamic balance of supply and demand, the cadence of lock-up releases, and the support of real buyer liquidity after the TGE. We believe that FDV should not be viewed as a "valuation ceiling," but rather as a "risk ceiling." A higher FDV indicates greater difficulty in cashing out and a higher risk of investment return discounts.

Shifting the focus from "high FDV paper premium" to "real realization of exitable circulating value" is a necessary evolution of VC investment methodology at the current stage.

Performance of projects listed on leading exchanges

In the primary crypto market, the listing of a leading exchange was once seen as a sign of project success and a window for VC exits. However, this "boosting effect" is clearly weakening.

An analysis of price fluctuations for projects listed on multiple exchanges between January 2022 and June 2025 reveals significant differences in performance across exchanges. However, a common trend is that the vast majority of projects experienced rapid price declines shortly after listing, sometimes even falling below their IPO price. This reflects the waning influence of exchanges on token prices.

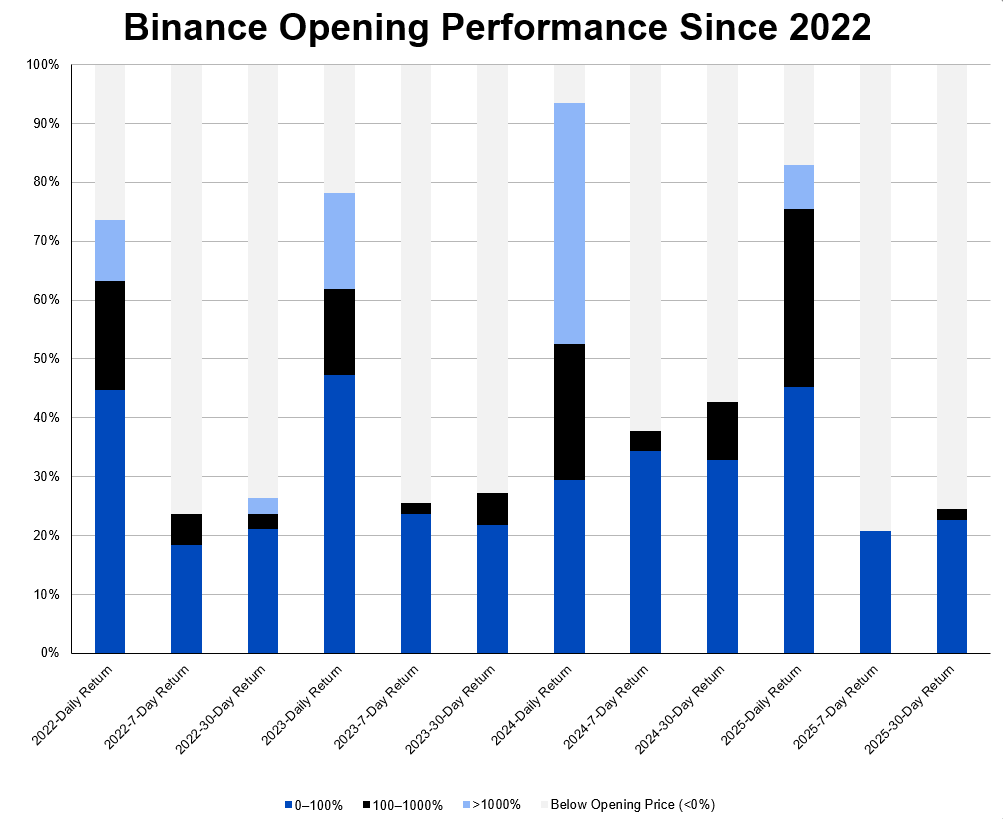

The chart below shows the price fluctuations of spot projects launched on the Binance platform from 2022 to Q2 2025.

Chart: Binance Opening Performance Since 2022

This "high-fly-lower" phenomenon is largely due to excessive pre-IPO incentives and an artificial liquidity boom. Some projects rapidly boost TVL and user interest through large-scale airdrops or "points mining," but this also introduces significant selling pressure during the initial TGEs. For example, the Berachain project this year saw a rapid decline in user retention after its TGE, leading to a significant drop in token price.

More importantly, it has become a continuous test of a project's market performance. In 2025, Binance adjusted its listing logic, launching the Alpha platform as an early demonstration channel and introducing a higher-standard tracking mechanism, focusing on evaluating the activity, liquidity quality, and price stability of listed projects. If a project fails to maintain real user growth and long-term narrative stickiness, even if it obtains a listing opportunity, it may be marginalized or even delisted. Exchange listing is no longer the "end point" of the project valuation cycle.

This trend means that the liquidity exit window in the primary market is shifting from being "node-driven" to being "process-driven." For VCs, this requires longer-term post-investment support and value capture logic. Projects must rely on solid product strength and market validation to continuously support the performance of tokens in the secondary market, rather than relying on a single event-driven "valuation realization." The model of relying solely on listing to create a short-term valuation recovery window is failing.

Financing to TGE Cycle and TGE Success Rate

Project Data Note: This analysis uses top crypto VC investments from European and American exchanges as a sample, including Coinbase Ventures, Multicoin Capital, YZi Labs, OKX Ventures, Polychain Capital, and Pantera Capital. (For source data, see the appendix table, VC Portfolio Failure & Non-Listing Rate.)

Data screening criteria:

- Prioritize the number of investments: The same project may undergo multiple rounds of financing, and valuations across different rounds can vary significantly, directly impacting investment returns. Therefore, we consider different rounds of financing for the same project as separate investment numbers to more accurately reflect investment activity.

- Prioritizing Binance projects: As one of the world's largest exchanges, Binance offers extensive liquidity and market coverage. To more comprehensively reflect market performance, only projects listed on Binance for spot trading are selected as star projects.

- Data accuracy: Investments disclosed after token issuance are considered OTC (over-the-counter) transactions and are not included in the venture capital category to ensure the accuracy and consistency of data statistics.

- Exclusion of insufficient data dimensions: Projects that have not disclosed their investment amounts and valuations are not included in the statistical calculations due to insufficient data dimensions.

Judging from the data presented in the previous paragraph, the ultimate performance of star projects is often disappointing. But what about the performance of the majority of other projects? Can they redeem themselves for the crypto VC industry? In this bottom-up industry, could the ultimate winners be those "potential stocks" that initially flew under the radar but only revealed their value over time? The answer is not optimistic. The greater possibility is that investors in these projects simply cannot find a suitable exit path.

In traditional venture capital, seed rounds typically take 6–12 months, while Series A rounds typically take 9–18 months. However, due to the flexibility of token financing mechanisms (such as the rapid deployment of ERC-20 and BEP-20), the crypto industry experienced an extreme model in its early days of completing fundraising within days and completing a TGE within weeks. However, with increasing regulatory pressure and a gradually cooling market, project developers are focusing more on product refinement and user growth, and the average time between fundraising and TGE for crypto projects has significantly lengthened.

While a longer cycle helps projects prepare better, it doesn't fundamentally improve project quality. Data shows that since 2021, Coingecko has recorded a total of 17,663 crypto assets. Of these, the trading volume of cryptocurrencies ranked below 1,500 by market capitalization has been nearly zero, indicating that many projects lack real value and sustainable vitality in the market.

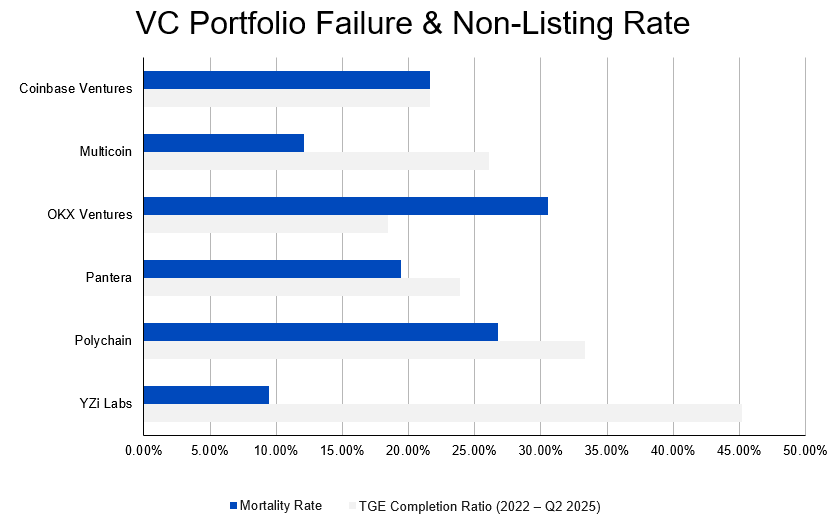

Even more worrying is the high failure rate not only among grassroots projects but also among institutionally backed projects. Data shows that by 2024, approximately 20.8% of VC-backed projects had ceased operations, and even top institutions were not immune. For example, the failure rate for projects backed by Coinbase Ventures reached 21.6%, while that of projects backed by Polychain Capital was as high as 26.72%. This phenomenon suggests that the current market's screening mechanisms for crypto projects still need further improvement, and the success rate of institutional investment needs to be improved urgently.

Figure: VC Portfolio Failure & Non-Listing Rate

Furthermore, despite a significant positive correlation between funding size and project survival rates, many star projects with funding exceeding $50 million have shut down. For example, Mintbase, which raised $13.5 million, MakersPlace, which raised $30 million, and Juno, which raised $21 million, have all ceased operations. This demonstrates that sufficient capital isn't a sufficient guarantee of project success; factors such as market environment, operational capabilities, and product competitiveness are equally crucial.

These changes have placed higher demands on VC investment strategies. The shift from the previous accelerated model of "TGE first, build later" to a more relaxed "polishing first, then IPO" approach means projects will need to undergo a longer validation period before going public. Investors, in turn, must more deeply assess a project's technical capabilities, team execution, and product-market fit to improve post-investment survival and exit feasibility.

Declining returns on primary market investments

Structural analysis of downward returns

The significant decline in investment returns in the primary cryptocurrency market is not only a result of liquidity fluctuations during the interest rate hike cycle, but also the result of a combination of structural factors. These changes have profoundly impacted market operations and posed new challenges to investment strategies.

Bitcoin's Siphon Effect and the Dilemma of Altcoins

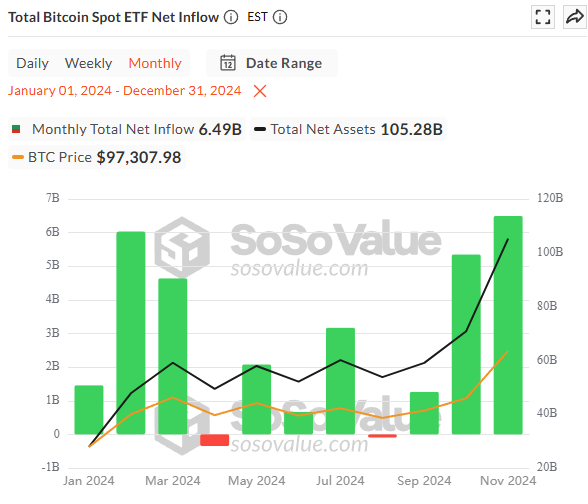

In recent years, the divergence in capital flows has become increasingly pronounced. Bitcoin's market capitalization dominance has climbed steadily from approximately 40% at the beginning of 2023, repeatedly exceeding 55% in 2024, becoming the absolute dominant source of market liquidity. Meanwhile, since its approval in January 2024, the US spot Bitcoin ETF has attracted over $100 billion in assets under management (AUM) and net inflows exceeding $30.7 billion.

Chart: Total net inflow of Bitcoin spot ETFs in 2024

In stark contrast, the primary cryptocurrency market is stagnant. Total funding for the entire year of 2024 is expected to be only $9.897 billion, significantly lower than the $28.6 billion raised in the same period of 2022. The past trend of "Bitcoin's rise is followed by an altcoin boom" has been broken, with funds now heavily concentrated in Bitcoin, while the altcoin market is suffering from a severe hemorrhage.

This phenomenon reflects the risk appetite of traditional financial institutions. ETFs, managed by institutions like BlackRock and Fidelity, primarily serve clients' needs for low-risk asset allocation. These funds view Bitcoin as "digital gold" rather than a gateway to "Web 3," and rarely flow into riskier altcoins and early-stage projects.

At the same time, the "Web 3" narrative is receding. Once-popular sectors like GameFi and SocialFi have lost their appeal due to broken economic models and user churn, and the market has begun to focus on Bitcoin, a proven store of value. This structural shift has made Bitcoin the primary destination for capital, while the altcoin market is struggling to support the massive supply of projects and valuations.

Contraction and concentration of track selection

The crypto market's investment preferences have shifted significantly, reflecting VCs' pursuit of certainty. In Q1 2025, the proportion of early-stage funding rounds fell below 50% for the first time, signaling a shift in institutional investors' preference for mature projects. This shift is driven by the fact that a staggering 68.75% of projects fail to launch, with some top-tier institutionally backed projects experiencing a failure rate approaching 80%. Exit challenges are forcing VCs to reassess capital efficiency, prioritizing projects with clear business models and strong moats.

Track selection is also becoming more concentrated. Starting from Q1 2024, "concept-driven" tracks such as Social, Games, and NFT will retreat, while DeFi and infrastructure tracks will return, and VCs will shift to emphasizing practical application value and sustainable income.

This trend has transformed the entrepreneurial landscape from an open-ended one to a task-based one. Only a few sectors, such as Infra, DeFi, and RWA, remain competitive, ultimately determining who can break through the competitive landscape. The concentration of market choice has not only exacerbated capital fragmentation but also compressed overall returns, contributing significantly to the decline in VC investment returns. VCs need to dynamically adjust their investment and research systems, focusing on deep value capture to address the market's demand for certainty.

High project failure rate and inefficient capital conversion

Although the lengthening market cycle has provided projects with more time to prepare, project quality has not fundamentally improved. Data shows that since 2022, among the 17,663 crypto assets recorded by Coingecko, the trading volume of a large number of currencies ranked after 1500 by market capitalization has been almost zero , reflecting that most projects lack real value and vitality.

Even more alarming is the high failure rate of projects backed by mainstream institutions. By 2024, approximately 20.8% of VC-backed projects had ceased operations . Top institutions like Coinbase Ventures and Polychain Capital had project failure rates of 21.6% and 26.72% , respectively. This suggests that superior capital and resources have not effectively reduced the risk of failure.

Even star projects with large financing scales cannot escape the fate of closure. For example, Mintbase, which received $13.5 million in financing, and MakersPlace, which received $30 million in financing, have both ceased operations.

This cycle has cleaned up the market with a high elimination rate, raising higher expectations for investors: shifting from "TGE first, build later" to "verification first, then IPO." Only by deeply exploring a project's technical implementation, team resilience, and market fit can we identify truly resilient projects under the dual pressures of capital and the cycle.

Listing a Coin Doesn’t Equal Success: Valuation Bubbles and Exit Dilemmas

Listing on a leading exchange was once a hallmark of crypto project success and investment exits, but this effect is fading. Data shows that 32.89% of investments and 42.85% of projects currently have FDVs below their private equity valuations . Furthermore, projects with a current FDV/private equity valuation ratio exceeding 1000% have now reached zero, reflecting the market's severe challenges with high FDV valuations.

Early projects created book premiums through high FDV financing, but token release plans were out of sync with market demand, leading to a buildup of selling pressure and a rapid price drop. Some projects, while using airdrops or incentive mechanisms to create a liquidity boom, struggled to maintain user retention and long-term narratives, ultimately causing token prices to collapse.

Furthermore, exchange listings have shifted from being a "valuation recovery point" to a "long-term performance test." Leading exchanges like Binance have tightened their listing standards, requiring projects to maintain real growth and price stability, threatening delisting. This has eroded the short-term valuation recovery window, making investment exits increasingly dependent on a project's long-term market performance.

This dilemma reveals the inherent risk of high FDV: it masks insufficient liquidity and imbalanced token economics, compressing investment returns. VCs need to return to fundamentals, focusing on closed-loop token economic design and real market demand. Only solid product strength and market validation can sustain a project's long-term value and prevent paper wealth from becoming an illusion of exit.

The oppression of the macro environment and the withdrawal of venture capital

Since March 2022, the Federal Reserve has continuously raised interest rates, pushing the federal funds rate to a high of 5.25%-5.50% within a year and a half. Simultaneously, the 10-year U.S. Treasury yield exceeded 4.5% in the second half of 2023, significantly increasing the appeal of risk-free assets and increasing the opportunity cost of investing in high-risk assets. During this period, risk appetite in the global capital market declined significantly, and financial support for high-risk sectors such as crypto projects was sharply reduced.

High interest rates have had a profound impact on crypto project valuations and investment returns. First, high interest rates increase the discount rate for future returns, meaning that crypto projects relying on long-term growth or token value will see their expected returns depreciate due to the increased discounting cost, directly compressing project valuations in the secondary market. Furthermore, with yields on risk-free assets (such as US Treasury bonds) exceeding 4.5%, investors are increasingly opting for low-risk, high-return assets and reducing their investment in high-risk crypto projects. This shift in capital flows has further weakened crypto startups' ability to raise capital, making it difficult for many projects to secure sufficient capital support. Furthermore, low valuations and reduced funding in the secondary market have made it difficult for investors to achieve high-return exits through the market. This shrinking return on investment not only impacts VC fund returns but also undermines market confidence in the crypto sector.

The life and death line of VC: Can “home run” returns cover huge losses?

Project Data Note: This analysis uses top crypto VC investments from European and American exchanges as a sample, including a16z, Coinbase Ventures, Multicoin Capital, YZi Labs, OKX Ventures, Polychain Capital, Paradigm, and Pantera Capital. (Source data is available in the appendix tables: VC Investments, VC-Backed Listings on Binance: Spot Returns, and VC-Backed Listings on Binance: Spot Returns Pivot.)

Data screening criteria:

- Prioritize the number of investments: The same project may undergo multiple rounds of financing, and valuations across different rounds can vary significantly, directly impacting investment returns. Therefore, we consider different rounds of financing for the same project as separate investment numbers to more accurately reflect investment activity.

- Prioritizing Binance projects: As one of the world's largest exchanges, Binance offers extensive liquidity and market coverage. To more comprehensively reflect market performance, only projects listed on Binance for spot trading are selected as star projects.

- Data accuracy: Investments disclosed after token issuance are considered OTC (over-the-counter) transactions and are not included in the venture capital category to ensure the accuracy and consistency of data statistics.

- Exclusion of insufficient data dimensions: Projects that have not disclosed their investment amounts and valuations are not included in the statistical calculations due to insufficient data dimensions.

In the venture capital world, a high failure rate is the norm. The success or failure of a VC fund doesn't depend on avoiding failures, but rather on whether its portfolio can produce one or two "home run" projects. These successful projects must generate returns of at least 10 times, or even more, to offset the losses of the numerous other projects that went to zero, ultimately achieving overall profitability for the fund.

In the current crypto market, a successful Binance spot listing has become the gold standard for measuring whether a project has truly "taken off." Therefore, the core question in evaluating primary market investment returns has shifted from "will the project fail?" to: What percentage of the portfolio of projects will ultimately be listed on Binance? Will the returns from these projects be sufficient to offset the substantial losses from those that fail to launch?

Let's take a look at the brutal funnel-like screening process of projects from investment to listing on Binance through a set of macro data, from the two dimensions of "number of investments" and "number of projects":

For example, a portfolio consisting of 1,026 investments, corresponding to 757 unique projects , shows the following overall performance:

Most investments are dormant (no TGE)

- Of all investments, 747 (72.8%), corresponding to 584 projects (77.1%), have failed to complete a TGE (token generation event and exchange listing). This means that over 70% of investments and projects remain on the books, not yet entering the public market, and face extremely high uncertainty.

A small number of successful "coin issuance" (completed TGE)

- Only 279 investments (27.2%), representing 173 projects (22.9%), successfully completed a TGE and entered the secondary market. This is the first step in providing an exit for early investors, but it still falls short of achieving success.

The final single-plank bridge (listing on Binance)

- At the top of the pyramid, there were only 76 investments, corresponding to 42 projects, that were successfully listed on Binance spot.

- This means that even among those projects that have successfully "issued tokens", only about a quarter (24.3% by number of projects and 27.2% by number of investments) can reach Binance, the top liquidity market.

- If we look at the starting point of the entire investment portfolio, the success rate is even more negligible:

- Calculated by the number of investments, only 7.4% of them will eventually be listed on Binance.

- Calculated based on the number of projects, the proportion that will eventually be listed on Binance is as low as 5.5%.

For any crypto fund, the probability of its investment being listed on Binance is only about 5.5%, which means that more than 94.5% of investment projects cannot bring top returns.

Now let’s examine how these 5.5% of “chosen ones” performed. Below is an estimate of the average return of projects invested by top institutions after they successfully listed on Binance Spot Markets:

It can be seen that even the world's top VCs, the average return multiples of their projects listed on Binance are generally between 2 times and 5 times, far from the "10 times" myth required to cover losses.

Let's do some math. Assuming a fund wants to break even, a very simplified model would be: if 77% of its projects go to zero, the remaining 23% would need to generate at least 4.3 times the average return (1 / 0.23 ≈ 4.3) to barely break even.

However, the reality is:

- The proportion of projects that can be listed on Binance is too low: only 5.5% of projects can achieve top-level liquidity.

- The returns from listing on Binance are not high enough: the average return of 2-5 times is far from enough to cover the losses of the other 95.5% of projects that fail. Not to mention the projects that are not listed on Binance and are only listed on ordinary exchanges, whose returns and liquidity are even worse.

The cruel reality is that even for the leading funds, looking at all the invested projects as a whole, the current Binance listing rate and the return multiples after listing are no longer able to cover the losses of a large number of other failed projects in their investment portfolios.

This ultimately leads to three major challenges that primary market investment institutions must confront: declining absolute returns, lower IPO multiples, and a drying up of liquidity. The entire industry's investment strategy is being forced to shift from a "wide-ranging, betting on hits" approach to a more in-depth assessment of a project's intrinsic value, team execution, and market fit.

Returning to the basics, when the tide of the "Web 3 revolution" recedes

The preceding article clearly reveals the market's "results": the overall decline in primary market returns and the failure of the 2017-2022 Crypto Vintage investment logic. However, to truly understand this dramatic shift, we must delve into the underlying "causes." We believe the current predicament facing crypto VCs isn't a simple cyclical adjustment, but rather a profound paradigm shift. The essence of this revolution is that, after a period of vigorous national exploration, the crypto industry is finally returning from the grand narrative of "Web 3" to its true core value: as a disruptive force in building the next generation of financial infrastructure.

The Wrong Skill Tree: The Bankruptcy of Web 3 Narratives and the End of Growth

For the past few years, the entire industry has been captivated by the dream of "Web 3." This vision depicts a decentralized, user-sovereign internet capable of competing with Web 2 giants. Within this narrative, the VC logic is simple and clear: find the next SocialFi, GameFi, or NFT platform capable of achieving exponential user growth, and capture a market worth hundreds of billions or even trillions of dollars through disruptive application-layer innovation.

However, this path ultimately proved to be the wrong one.

The End of Growth: The User Bottleneck of the Web 3 Narrative

Every disruptive application-layer story is premised on exponential user growth . However, the reality is that user growth in the crypto industry has reached a plateau. Complex wallet interactions, difficult private key management, and a lack of real-world application scenarios have prevented crypto applications from breaking out of niche markets and reaching the mainstream. When the myth of user growth is shattered, the high valuation model built upon it collapses. Once-hot sectors are now in tatters.

Value Mismatch: When “Revolution” Deviates from Core Advantages

The core advantage of blockchain technology lies in its financial attributes: efficient asset creation, permissionless global distribution, and programmable, automated interactions . Its essence is to transform production relations, particularly the production and circulation of financial assets. However, of most "Web 3" projects, less than 20% have truly targeted this core objective. The rest have attempted to use blockchain, a "financial hammer," to forcibly address "non-financial nails" like social networking and gaming. This mismatch in value has led to significant waste of resources and failed explorations. VCs have driven this grand social experiment, and while its results may not be entirely satisfactory, they are also extremely valuable—it has demonstrated with real money which paths are unviable.

Back to the core: The essence of the crypto industry is to build the next generation of financial infrastructure

If the door to Web 3 cannot lead to the future for the time being, then where is the real value export of the crypto industry? The answer is becoming increasingly clear: return to its technological origins and focus on building a new, efficient, and global financial infrastructure.

Unlike the Web 3 revolution, which seeks to "start from scratch," the goal of building financial infrastructure is more pragmatic and fundamental: it does not aim to create a virtual world detached from reality, but rather to use blockchain technology to provide a superior set of "tracks" and "traffic rules" for the flow of real-world assets and value.

This explains the trend observed in the data above:

- DeFi and the return of infrastructure: These are the new financial "rails" themselves, the cornerstones of value flow, and their importance is self-evident.

- The rise of RWA (real-world assets): This is the key to enabling real-world "goods" (such as bonds, real estate, and credit) to enter a new "track". It is the core of connecting virtual and reality and empowering the real economy with blockchain efficiency.

- CeFi (centralized finance)'s ability to sustain financing: As the "transfer station" and main entrance and exit between the old and new financial systems, its cash flow value is highly favored by capital when the market returns to rationality.

As the industry's development direction shifted from "Web 3 applications" to "financial infrastructure," the entire valuation system shifted accordingly. Previous valuation models that relied on vague narratives and user growth expectations were abandoned, replaced by a valuation framework more aligned with traditional infrastructure that emphasizes system stability, transaction efficiency, asset security, and sustainable business models . This is the fundamental reason for the current overall downward adjustment in the valuation system.

The change of participants: from "believers" to "rational people"

In the early stages of any emerging industry, it is dominated by endogenous, idealistic "believers." They are risk-takers, creators and disseminators of new narratives, and willing to pay for high-risk, high-return dreams.

However, with the approval of the Bitcoin ETF, the crypto industry is irreversibly moving from a niche geek circle to the mainstream financial market, and the structure of industry participants has undergone fundamental changes.

- The source of funding has changed: Traditional financial giants like BlackRock and Fidelity are entering the market with regulated funds. They aren't pursuing speculative myths with 100-fold returns, but rather prudent asset allocation. They view Bitcoin as "digital gold," not a ticket to Web 3.

- Investors' mindsets have changed: After experiencing a brutal bear market, investors have transformed from enthusiastic speculators to more cautious "rational people." They have begun to focus on the fundamentals of projects and assess their intrinsic value, rather than blindly chasing the next hot spot.

This transformation from "believer" to "rational person" is not an isolated case. It has a strikingly similar classic case in the history of Web 2 development: the Internet bubble around 2000.

At the peak of the bubble, market "believers" firmly believed that "whoever gets the eyeballs wins the world." They disregarded profits, paying only for click-through rates and grand narratives. A prime example of this is Pets.com. It boasted a disruptive story of selling pet supplies online and successfully went public. However, due to its complete disregard for high logistics costs and basic business logic, it quickly went bankrupt after burning through its investment. Pets.com's failure wasn't due to a flawed vision of the internet, but rather to the fervor of "believers" without the business core of a "rational person."

After the bubble burst, capital dried up, and the market returned to rationality. Investors' core question shifted from "How much is your user growth?" to the simplest " How do you make money? " It was in this market dominated by "rationalists" that the true giants emerged. Although Amazon's stock price plummeted, its asset-heavy moat of offline warehousing and logistics kept it afloat. Google, leveraging its clear and efficient profit model, AdWords, successfully went public in 2004, ushering in a new era.

The mirror of history clearly reflects the present : today's Web 3 projects that failed because their economic models could not be closed are like Pets.com yesterday; and the DeFi, infrastructure and RWA projects that are currently favored by capital again are just like Amazon and Google in the past. Their value is rooted in a sustainable and verifiable business logic, not just a beautiful story.

This shift in participants is essential for the industry to mature. When the market's dominant force shifts from "believers" to "rationalists," those overvalued bubbles built on faith and consensus will inevitably be squeezed out. Only projects that can provide real, measurable value will receive reasonable valuations and market recognition within this new value system.

In summary, the current predicament of the primary market represents a corrective shift in the industry's development path. It marks the end of an era—an era driven by grand narratives and boundless imagination—and the beginning of a new era—one dominated by real utility, sustainable business models, and rational capital . For VCs involved in this dynamic, understanding and adapting to this shift in underlying logic will be key to navigating the cycle and winning the future.

Transformation of investment logic under value reassessment

The market has declared, in the most brutal way possible, that a business model that relies solely on "listing on Binance" as an exit path is not investment, but gambling. As the liquidity premium in the secondary market disappears and the valuation bubble in the primary market bursts, the entire industry's value chain is undergoing a painful but necessary reassessment.

However, this is by no means a reason to be pessimistic and exit the market. On the contrary, this is a golden moment for top investors to recalibrate their approach and, with rigor and patience, capture true value. The goal is no longer to chase the next hot token, but to invest in and cultivate the " Stripe or Uber of the crypto world ."

From the perspective of VCs, in the post-AI era, the marginal impact of capital will decrease, and capital intensity will decline. The costs of previously supporting talent, expanding markets, and developing R&D will all decline with the advancement of AI. Therefore, the value of VCs is no longer simply investing money, but rather providing endorsements and advertising. This will lead to the demise of mid-tier and tail-end VCs that fail to proactively identify value gaps and simply follow the market by investing .

From “narrative-driven” to “business-driven”

In the past few years, VC investment has relied too much on "track narratives": ZK, Layer 2, GameFi, SocialFi, NFT... But most projects cannot prove themselves in terms of user retention and real revenue.

The core question of the future will no longer be “how many users do you have” but rather:

- Who are these users?

- Are they paying for real pain points?

- If the token rewards are cancelled, will they still stay?

Truly resilient projects often have stable on-chain transaction and fee income, and are driven by real demand rather than subsidies.

Case: Ethena

- The stable asset USDe was launched in 2024, and its circulation exceeded US$3 billion within six months, becoming one of the fastest-growing stablecoins;

- The core mechanism is the Delta-Neutral structure of hedging perpetual contracts, which steadily generates real yields over market cycles.

- Users include not only “thrifters” but also institutions, market makers, and hedge funds. Their fundamental needs are “hedging and stable returns” rather than short-term incentives.

- The revenue model is directly linked to the derivatives market. In 2024, the annualized return exceeded 20% at one point and gradually settled into protocol-layer cash flow.

This is the virtuous cycle of "user demand-real income-protocol value", and it is also the reason why Ethena can stand out in the highly competitive stablecoin market.

"Ballast" cash flow

More anti-cyclical cash flow protocols or applications will be needed in future investment portfolios.

- Compliance and security API services: Chainalysis' revenue exceeded $200M in 2022, and its valuation once reached $8.6B;

- Web 3 infrastructure SaaS: Alchemy, Infura, etc. charge subscription fees in US dollars. Their revenue is independent of the coin price and is extremely stable.

- Hybrid off-chain and on-chain valuation: refers to on-chain indicators such as TVL and protocol revenue, and also introduces traditional equity tools such as DCF and P/E.

This type of model provides a value anchor for investment and serves as the "ballast" of the portfolio.

Realization of the return curve

The return curve of crypto VC is shifting from a J-shaped curve of "a hundred times in two years" to a step curve of "ten times in eight years".

Future exit paths will be more diversified:

- Acquisition by a tech giant;

- Listed on a compliant STO platform;

- Mergers and acquisitions with traditional industries.

This means longer cycles and deeper patience.

The signal is clearer than ever

The current contraction in the primary market is merely a form of deleveraging after past unbridled growth. When the noise disappears, the signal becomes clearer than ever.

For serious investors, this means:

- Due diligence should focus on market size, unit economics, and product moat, just like top equity VCs.

- Post-investment efforts must truly empower, providing customers and channels, not just exchange resources.

Prospect track: the next round of investment opportunities in the crypto market

ArkStream Capital believes that the following three areas have long-term investment potential:

Stablecoins: The cornerstone of the next generation of global payments and settlements

The fundamental significance of stablecoins goes beyond simply providing anti-cyclical protection or cash flow. Rather, it liberates capital from the constraints of geopolitics, foreign exchange controls, and local financial systems , making capital universally accessible for the first time. Previously, US dollar assets were restricted from free circulation or even access in many countries. Stablecoins have changed all of this: acting as a "digital artery," they inject global capital into previously inaccessible regions and industries.

Cross-border e-commerce & game overseas expansion

- Pain points: Cross-border payments generally take 3-7 days to arrive, with fees of 3%-7%. Low credit card penetration leads to loss of paid conversions.

- Stablecoin changes: USDT/USDC T+0/minute-level clearing and settlement, global direct connection to wallets, significantly reducing fees and reconciliation costs.

- Market size: Cross-border e-commerce > $1 trillion/year (2023), estimated to be > $3.3 trillion in 2028; global games $184 billion (2023) - if only 10% of e-commerce + 5% of games use stablecoins, the potential annual on-chain traffic can reach $200 billion+.

Global Remittance & Remote Payroll

- Pain points: The average cost of traditional remittances is 6.39% (Q4 2023), with slow arrival and limited channels; LMIC annual remittances are $656 billion (2023).

- Stablecoin changes: 24/7 arrival, on-chain traceability, significantly lower costs than traditional MTOs, and convenient for batch payroll and micropayment automation.

- Market size: Global remittances are approximately $860 billion (2023); if 20% migrates to stablecoins, it will create an incremental on-chain settlement space of $170 billion/year.

Corporate liquidity in high inflation/capital control markets

- Pain points: Local currency depreciation and foreign exchange quotas squeeze operating cash flow, hindering cross-border raw material procurement and external payments.

- Stablecoin changes: Use stablecoins as dollar-denominated working capital, directly connect with overseas suppliers and contractors, and bypass inefficient/unstable channels.

- Market size: Nigeria recorded $59 billion in crypto transactions in July 2023–June 2024; in Q1 2024, small-value (< $1 million) stablecoin transfers reached nearly $3 billion, making stablecoins one of the mainstream uses.

DeFi Hedging & Global Derivatives Access

- Pain points: Small and medium-sized enterprises find it difficult to access foreign exchange/interest rate derivatives for hedging at low cost due to high barriers to entry and slow processes.

- Stablecoin changes: Use stablecoins as collateral for on-chain lending, forward/option hedging, and programmatic, composable risk control and financing.

- Market size: Global OTC foreign exchange is $7.5 trillion/day (2022); every 0.5% increase in on-chain penetration ≈ $37.5 billion/day in potential on-chain nominal transactions.

RWA: Making Traditional Assets Truly Programmable

Traditional financial assets, while vast, have long been constrained by geography, time, and clearing systems : government bonds can only be settled on business days, cross-border real estate investment procedures are cumbersome, supply chain bill approvals are lengthy, and private equity fund liquidity is virtually zero. Despite the vast amount of capital, it's been trapped in a "static reservoir."

The value of RWA lies in digitizing income and settlement rights, creating cash flows that can be automatically transferred and combined on-chain . Treasury bonds can be used as collateral, similar to stablecoins. Real estate rents can be automatically allocated. Supply chain financing can be instantly discounted. Private equity fund shares can access secondary liquidity. For investors, this is not just the digitization of a single asset, but a reshaping of global capital efficiency.

Treasury bonds/money market funds

- Pain points: High threshold and T+1/2 settlement slow down capital turnover.

- On-chain changes: Tokenized T-Bill/MMF, enabling 24/7 redemption and mortgage (BUIDL, BENJI).

- Market size: US money funds >$7 T; tokenized US Treasury bonds only $7.4 B (2025-09).

Real Estate and Private Equity

- Pain points: poor liquidity, long exit cycle, and complex cross-border investment.

- On-chain changes: Tokenization of properties/fund shares, on-chain distribution of rents and dividends, and introduction of secondary liquidity.

- Market size: Global real estate $287 T, private equity fund AUM $13 T+; less than $20 B on the chain.

Supply Chain Financing and Accounts Receivable

- Pain points: SMEs face difficulties in financing, and the global trade financing gap is $2.5 T.

- On-chain changes: Accounts receivable are tokenized, investors are directly connected to cash flow, and redemption is automatically executed by the contract.

- Market size: Supply chain finance $2.18 T; cumulative financing on the chain $10 B+.

Commodities and Stocks/ETFs

- Pain points: Cross-border transfers of gold and ETF shares face significant friction, and fractional share trading is restricted.

- On-chain changes: Physical gold, ETFs/stock shares are tokenized, enabling both settlement and collateralization.

- Market size: Gold token market capitalization ~$2 B; on-chain ETF/stock AUM >$100 M.

Crypto + AI: Let AI truly have the capabilities of an economic entity

For AI to become autonomous, it must be able to spend money, reconcile accounts, and verify deliveries on its own. The traditional financial system cannot achieve this: payments rely on manual account opening, cross-border settlements are slow, fee cycles are long, and call results are difficult to verify. Crypto networks, however, provide a complete "operating system":

- Currency layer: Stablecoins/deposit tokens are liquidated 24/7 globally, smart wallets allow agents to automatically spend the currency they hold, and streaming payments enable “pay-per-call”

- Contract layer: Fund custody, SLA and penalty clauses are written into the contract, and automatic refunds or fines will be imposed if the service does not meet the standards; strategic wallets can set limits and whitelists.

- Verification layer: TEE and zero-knowledge proof make computing power and reasoning results auditable, and payments are based on "proof" rather than "commitment."

When spendable money and verifiable work are connected to the same chain, agents are no longer just API callers; they can operate like businesses: using money to purchase computing power and data, exchanging deliverables for revenue, and accumulating cash flow and credit. This is the true meaning of "Crypto is the native currency of AI."

Agent Native Settlement and Treasury

- Pain points: Fragmentation of API billing and cross-border payments, manual reconciliation/invoicing/risk control, and inability to "settle while calling."

- On-chain changes: Agents use smart wallets to make streaming/micropayments (per token, per millisecond, per request); contracts host deposits and SLAs, with automatic refunds/fines for breaches; strategy wallets set daily limits/whitelists/session keys to control risk and permissions.

- Market size: GenAI's total spending is ~$202 B (estimated by 2028); if 5% is settled in real time via "Agent→On-chain", a native payment channel of $10 B/year will be formed.

Verifiable Computing and Inference Market (Compute & Inference)

- Pain points: Cloud bills are expensive and settled later, inference results and time series cannot be verified, and there is no automatic compensation for service failures/disconnections.

- On-chain changes: computing power providers staking → accept orders → issue certificates (TEE/zk/multi-party review) → settle according to certificates; failure to meet standards will result in slashing; prices are matched by the bidding pool, and **"payment proof** replaces "trust first, pay later".

- Market size: AI infrastructure spending ~$223 B (2028 estimate); 5% decentralized/verifiable channels ≈ $11 B in volume-based settlement.

Provenance & Licensing

- Pain points: The data sources for training/fine-tuning/inference are unclear, authorization is difficult to measure, and it is difficult for creators and companies to share profits continuously.

- On-chain changes: Data/models/materials are licensed on-chain and fingerprinted for traceability; each call automatically splits profits to addresses (creator, data DAO, annotator, model owner), and income is permanently bound to the source.

- Market size: Data brokerage ~$292 B (2025), creator economy ~$480 B (2027); connecting 5% to on-chain licensing and automatic profit sharing can form a billion-dollar continuous distribution channel.

Conclusion

In 2017, Crypto VC brought "venture capital and token financing" into the Crypto ecosystem. In 2024, the basic infrastructure and compliance channels were completed, and the first curve - the creation and circulation of assets and highways from 0 to 1 - came to an end.

We officially entered the second crypto curve in 2024. The focus isn't on creating a "hotter narrative," but rather on how to use crypto as a globally open, efficient, and verifiable financial highway to support real productivity: stablecoins enable cross-border capital flows, RWAs bring cash flow assets onto the blockchain, and crypto + AI connects funds directly with delivery. The true value of the industry is shifting from valuation narratives to the reconstruction of production relations.

For VCs, their role hasn't disappeared, but rather shifted to more pragmatic value creation. Capital needs to shift from "chasing hot spots" to "calculating the bottom line," helping entrepreneurs connect real needs, stable cash flows, and reusable financial primitives to the blockchain. Investors who adhere to fundamentals and execution will become the true value capturers in the next decade.

appendix

The investment, financing and return data involved in this article are detailed in the table below, which you are welcome to download .

References

https://cn.rootdata.com/

https://sosovalue.xyz/

https://defillama.com/

https://cryptorank.io/